Notícias do Mercado

-

19:21

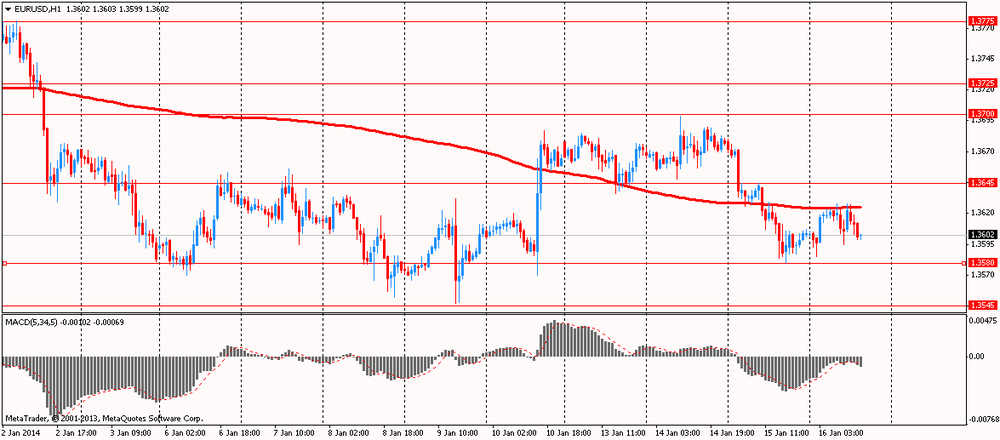

American focus : the euro fell slightly against the U.S. dollar

Euro fell against the dollar, losing the previously all that was associated with the release of U.S. data . As it became known , the growth of production in the region continued in January , according to a survey of business produced by the Federal Reserve Bank of Philadelphia. Activity indicators , new orders, deliveries , and employment is positive , that is evidence of the continuation of moderate growth . Evaluation indicators of future activity decreased , but continue to show optimism about economic growth in the next six months. The overall index of conditions in the industry from the Federal Reserve Bank of Philadelphia - the index of current activity - rose from a revised 6.4 in December to 9.4 . The index is in positive territory for eight consecutive months. The new orders index remained in positive territory, but fell from 12.9 to 5.1 , reflecting the slowdown in demand for industrial goods . Delivery index rose slightly to 12.1 . Labor market indicators have shown a slight improvement in December. Current employment index increased by 6 points from a revised December . The percentage of firms reporting a rise in the number of employees ( 23%), higher than the percentage of firms reporting employment growth in the last month ( 18%). Expectations for the next six months showed continued decline of optimism from highs reached in October, but optimism remains .

The index of future economic activity fell by 10 points, from a revised 44.8 in December to 34.4 . About 48 % of firms expect growth in activity over the next six months , 13% expect lower activity . Indices of future new orders and delivery remained at relatively high levels , but decreased by 7 and 9 points respectively.

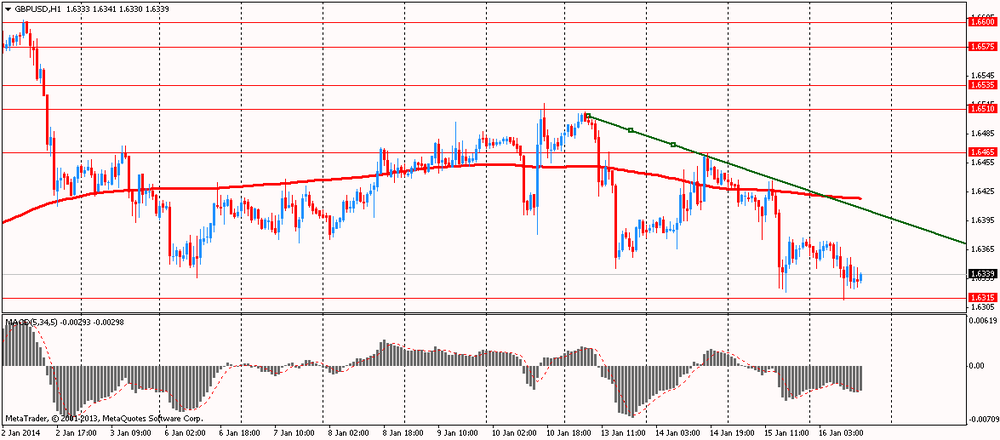

Pound fell slightly against the U.S. dollar , as data showed that expectations regarding the future growth of British housing prices have increased again last month, which was due to the lack of new homes on the market . It became known from the last survey, which was published today by the Royal Institution of Chartered Surveyors (RICS). RICS experts said that 61 percent of respondents predict that home prices will rise over the next three months, compared with 59 percent in November. We add that the last result was the highest since September 1999. The survey also showed house prices rose in every region of Great Britain in the last month . Nevertheless , the main house price balance fell to 56 % in December from 58% in November. Many experts predicted that the value of this index will rise to the level of 59%. It is worth noting that it was the first decline in the index over the past four months. Economists also said the UK housing market was underpinned by falling unemployment , low interest rates and government programs to make mortgages cheaper and easier to obtain .

It should be noted that the head of the Bank of England Governor Mark Carney said Wednesday that, according to forecasts , the British housing prices will continue to grow vigorously until the middle of next year.

-

15:00

U.S.: NAHB Housing Market Index, January 56 (forecast 58)

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, January 9.4 (forecast 8.8)

-

14:01

U.S.: Total Net TIC Flows, November -16.6

-

14:00

U.S.: Net Long-term TIC Flows , November -29.3 (forecast 42.3)

-

13:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3450, $1.3500, $1.3525, $1.3575, $1.3600, $1.3650, $1.3750

USD/JPY Y103.00, Y104.00, Y104.50

USD/CHF Chf0.9100

AUD/USD $0.8750, $0.8800, $0.8900

USD/CAD C$1.0825, C$1.0925

-

13:31

U.S.: CPI, Y/Y, December +1.5% (forecast +1.4%)

-

13:31

U.S.: CPI excluding food and energy, Y/Y, December +1.7% (forecast +1.7%)

-

13:30

U.S.: Initial Jobless Claims, January 326 (forecast 327)

-

13:30

Canada: Foreign Securities Purchases, November 8.7 (forecast 7.21)

-

13:30

U.S.: CPI, m/m , December +0.3% (forecast +0.3%)

-

13:30

U.S.: CPI excluding food and energy, m/m, December +0.1% (forecast +0.1%)

-

13:15

European session: the euro stabilized

The euro is trading sideways against the U.S. dollar on the background of how the final data on inflation in the euro area in line with the preliminary estimates.

Annual inflation in the 17 countries of the eurozone declined in December , bringing inflation was still below the European Central Bank's target level. Eurostat on Thursday confirmed its preliminary assessment of the dynamics of prices in December , published last week. According to the report , the consumer price index (CPI) in December rose by 0.3 % compared to November and 0.8% compared to December 2012 .

The data indicate a weakening of annual inflation compared with November , when it stood at 0.9 % , and this figure was still below the target level , the ECB near 2.0%.

Eurostat also confirmed that the increase in core consumer price index (Core CPI), which excludes volatile food prices and energy prices, slowed to 0.7 %, showing the lowest growth since the beginning of such statistics in 2001.

Today was a monthly report published by the ECB. In its January newsletter Governing Council of the ECB have to maintain rates at current or lower level for a long period of time. Authorities said that accommodative monetary policy rate will be maintained long as need be.

Risks to the economic outlook of the eurozone are still bearish . Global uncertainty coupled with rising commodity prices , weak domestic demand, export growth and insufficient efforts of EU Member States , undertaken in the course of reform , may adversely affect the economic recovery of the region.

In addition, the Governing Council pointed to improvements in European financial institutions and stressed the need to consolidate the banking system evrobloka with a view to strengthening .

The dollar index close to four-month high , as investors believe that the U.S. economy is strong enough to survive without loss possible reduction incentives Fed . Economic activity in all regions of the U.S. grew in December, " moderate " pace due to an increase in consumer spending in the festive season , the improvement in the labor market and recovery of industrial production , released Wednesday shows a regional overview of the Fed.

Also today will be presented employment figures in the United States . According to the median forecast of economists , the number of new applications for unemployment benefits last week reduced to 327 thousand little later will be published Philadelphia Fed manufacturing index , which this month could grow to 8.8 from a revised 6.4 in December.

The Australian dollar fell to its lowest level since August 2010 against the U.S. dollar and to the eight year low against the New Zealand dollar after the publication of a negative report on employment in Australia. According to the National Bureau of Statistics , the number of jobs in the country in December fell by 22.6 thousand , while economists had expected growth of 10 thousand for the year Australia's economy lost 67.5 thousand jobs , which was the worst figure since 1992 .

EUR / USD: during the European session, the pair traded in the range of $ 1.3595 - $ 1.3628

GBP / USD: during the European session, the pair fell to $ 1.6313

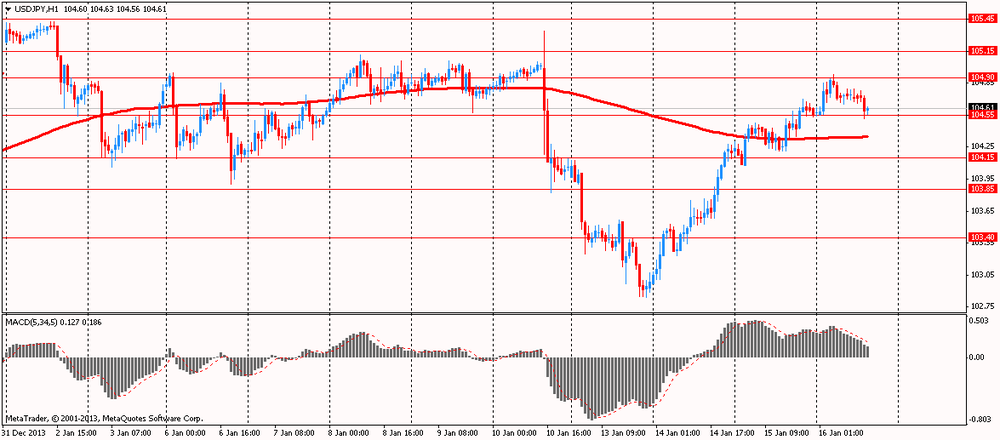

USD / JPY: during the European session, the pair fell to Y104.52

At 13:30 GMT , Canada will release the volume of transactions with foreign securities in November. At 13:30 GMT the United States will come in the consumer price index , consumer price index excluding prices for food and energy , consumer price index ( not seasonally adjusted ) , the main consumer price index for December. At 14:00 GMT , Canada will release the change in sales in the secondary housing market in December. In the U.S. at 14:00 GMT will net purchases of long-term U.S. securities by foreign investors , total net purchases of U.S. securities by foreign investors in November in 15:00 GMT - Fed manufacturing index Philadelphia housing market index for January of NAHB .

-

10:27

Option expiries for today's 1400GMT cut

EUR/USD $1.3450, $1.3500, $1.3525, $1.3575, $1.3600, $1.3650, $1.3750

USD/JPY Y103.00, Y104.00, Y104.50

USD/CHF Chf0.9100

AUD/USD $0.8750, $0.8800, $0.8900

USD/CAD C$1.0825, C$1.0925

-

10:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, December +0.7% (forecast +0.7%)

-

10:00

Eurozone: Harmonized CPI, December +0.3% (forecast +0.3%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, December +0.8% (forecast +0.8%)

-

07:18

Asian session: The Dollar Spot Index headed for its highest

00:00 Australia Consumer Inflation Expectation January +2.1%

00:01 United Kingdom RICS House Price Balance December 58% 59% 56%

00:30 Australia Unemployment rate December 5.8% 5.8% 5.8%

00:30 Australia Changing the number of employed December 21.0 10.3 -22.6

The Dollar Spot Index headed for its highest in more than four months before a U.S. report economists forecast will show applications for jobless benefits declined last week. Initial jobless claims in the U.S. probably fell to 328,000 in the period ended Jan. 11, the fewest since November, according to the median estimate of economists surveyed by Bloomberg News before the Labor Department report today. Economists in a separate Bloomberg poll estimate the Federal Reserve Bank of Philadelphia’s general economic index rose to 8.7 this month from a revised 6.4 in December.

Atlanta Fed President Dennis Lockhart, who doesn’t vote on monetary policy this year, said yesterday he expects inflation that’s been “too low” will accelerate toward the Fed’s 2 percent target. Chairman Ben S. Bernanke speaks today.

Data from Australia showed employers unexpectedly cut jobs, sending the nation’s currency to its weakest since August 2010 versus the greenback and an eight-year low against its New Zealand counterpart. In Australia, jobs decreased by 22,600 last month, following November’s revised 15,400 gain, the statistics bureau said today. That compares with a 10,000 increase predicted by economists. The unemployment rate held at 5.8 percent, the highest in four years. Bets that the Reserve Bank of Australia will lower its record-low benchmark rate by July rose to 43 percent from 24 percent yesterday, swaps data compiled by Bloomberg show.

EUR / USD: during the Asian session, the pair rose to $ 1.3625

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6345-75

USD / JPY: during the Asian session, the pair rose to Y104.95

There is a heavy calendar Thursday, with a slew of data on both sides of the Atlantic. The European calendar will kick off at 0700GMT, when the EMU December ACEA car registrations numbers are released. At 0700GMT, German December final HICP numbers will also cross the wires. At 0730GMT, the French December Bank of France retail trade index will be published. The ECB monthly bulletin will be published at 0900GMT, with the statement expected to reflect ECB President Draghi's statement ahead of last Thursday's press conference. The final December EMU final HICP data will be released at 1000GMT and is expected to come inline with the preliminary 0.8% y/y and the 0.7% core. ECB speakers kick off at 1000GMT, when Governing Council member Jens Weidmann speaks on "Economic Outlook for 2014", in Berlin. At 1245GMT, ECB Governing Council member Luis Linde will attend a working luncheon with the members of the AED, in Madrid.

-

07:01

Germany: CPI, m/m, December +0.4% (forecast +0.4%)

-

07:01

Germany: CPI, y/y , December +1.4% (forecast +1.4%)

-

06:22

Currencies. Daily history for Jan 15'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3604 -0,54%

GBP/USD $1,6369 -0,42%

USD/CHF Chf0,9084 +0,67%

USD/JPY Y104,55 +0,33%

EUR/JPY Y142,23 -0,22%

GBP/JPY Y171,13 -0,09%

AUD/USD $0,8914 -0,57%

NZD/USD $0,8337 -0,52%

USD/CAD C$1,0933 -0,11%

-

06:04

Schedule for today, Thursday, Jan 16’2013:

00:00 Australia Consumer Inflation Expectation January +2.1%

00:01 United Kingdom RICS House Price Balance December 58% 59%

00:30 Australia Unemployment rate December 5.8% 5.8%

00:30 Australia Changing the number of employed December 21.0 10.3

07:00 Germany CPI, m/m (Finally) December +0.4% +0.4%

07:00 Germany CPI, y/y (Finally) December +1.4% +1.4%

09:00 Eurozone ECB Monthly Report January

10:00 Eurozone Harmonized CPI December -0.1% +0.3%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December +0.8% +0.8%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y December +0.7% +0.7%

13:30 Canada Foreign Securities Purchases November 4.41 7.21

13:30 U.S. Initial Jobless Claims January 330 327

13:30 U.S. CPI, m/m December 0.0% +0.3%

13:30 U.S. CPI, Y/Y December +1.2% +1.4%

13:30 U.S. CPI excluding food and energy, m/m December +0.2% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y December +1.7% +1.7%

14:00 U.S. Net Long-term TIC Flows November 35.4 42.3

14:00 U.S. Total Net TIC Flows November 194.9

15:00 U.S. Philadelphia Fed Manufacturing Survey January 7.0 8.8

15:00 U.S. NAHB Housing Market Index January 58 58

16:10 U.S. Fed Chairman Bernanke Speaks

17:00 Switzerland SNB Chairman Jordan Speaks

-