Notícias do Mercado

-

19:20

American focus : the euro fell sharply against the U.S. dollar

The dollar has risen considerably against the euro, which was associated with the release of U.S. data packet . As it became known , bookmarks new homes have retained high rates in December , which is a sign that the housing market can overcome the effects of higher interest rates . Bookmark new homes in the U.S. fell by 9.8 % last month and reached a seasonally adjusted annual rate of 999,000 , the Ministry of Commerce said on Friday . But this figure was significantly higher summer levels and almost coincided with the forecast of economists at 1 million bookmarks in December. Nojabrskie rates were revised to 1.11 million from the previous estimate of 1.09 million, which is the strongest level in more than five years. In December, the number of building permits indicator of future construction, fell 3.0% to 986,000 units. Permits also fell in November. For all of 2013 the volume of new housing construction rose by 18.3% over the previous year to 923,400 . It was the strongest year since 2007 , the year before the recession began . Building Permits rose 17.5 % from 2012 to 974,700 , it is also the strongest level since 2007.

Meanwhile , another report showed that industrial production , which measures output in the manufacturing sector , the municipal sector and the mining sector increased by a seasonally adjusted 0.3 % last month compared with November . During 2013 , total production increased by 3.7%. Capacity utilization rose 0.1 percentage points to a level of 79.2% . Figures differed slightly with forecasts . Economists had expected industrial production to grow at 0.4 % in December, and the utilization rate is 79.2% . The November growth was revised down slightly to 1.0% . Utilization rate was revised up to 79.1 %.

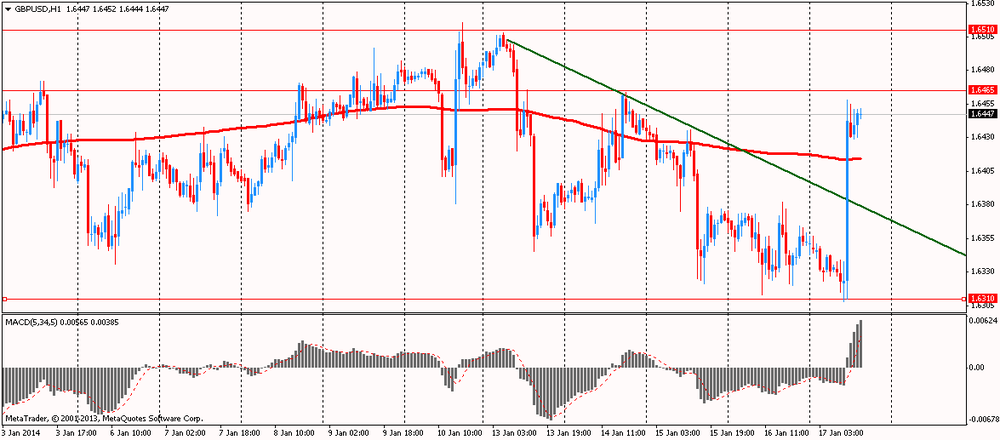

Pound rose sharply against the dollar, though it has lost some of the previously captured positions . On the dynamics of trade affected by strong retail sales data . It is learned that retail sales in the UK rose in December , with the annual growth rate was the fastest in more than nine years. Sales far exceeded analysts 'expectations and pointed to consumers' desire to spend money on as the British economy recovers. According to the data , retail sales in December rose by 5.3% compared with the same period last year. This is the highest annual growth rate since October 2004 . Compared with the previous month sales rose 2.6% , and it was the strongest monthly increase since February 2010, the Bureau of Statistics reported . Retail sales growth exceeded analysts' expectations. Economists were to grow sales in December was only 0.5 % compared to November and 2.5% compared to December 2012 . Excluding automotive fuel retail sales rose by 2.8 percent on a monthly measurement of December , beating the consensus increase by 0.3 percent . Annualised sales recorded an increase of 6.1 percent , which is much faster than expected growth of 3.2 percent . These data indicate a strong growth of the British economy in the 4th quarter of last year , after rising by 3.2% year on year in Q3.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, January 80.4 (forecast 83.4)

-

14:15

U.S.: Industrial Production (MoM), December +0.3% (forecast +0.4%)

-

14:15

U.S.: Capacity Utilization, December 79.2% (forecast 79.2%)

-

13:30

U.S.: Housing Starts, mln, December 0.999 (forecast 1.000)

-

13:30

U.S.: Building Permits, mln, December 0.986 (forecast 1.020)

-

13:15

European session: the pound rose

08:15 Switzerland Producer & Import Prices, m/m December +0.3% +0.5% 0.0%

08:15 Switzerland Producer & Import Prices, y/y December -0.4% -0.5% -0.4%

09:30 United Kingdom Retail Sales (MoM) December +0.3% +0.5% +2.6%

09:30 United Kingdom Retail Sales (YoY) December +1.8% Revised From +2.0% +2.5% +5.3%

10:00 Eurozone Construction Output, m/m November -1.1% Revised From -1.2% -0.6%

10:00 Eurozone Construction Output, y/y November -2.3% Revised From -2.4% -1.7%

The euro declines against the U.S. dollar against the background data on the reduction of construction in the eurozone. As shown by statistical office Eurostat, the volume of construction in the Eurozone fell for the third month in a row in November.

Total construction fell by 0.6 percent on a monthly measurement after falling 1.1 percent in October , which was revised from 1.2 percent fall , originally dubbed . Building construction decreased by 1.1 percent , while civil engineering grew by 1 percent.

In the 28 countries of the EU construction output fell 1.1 percent in the month , after falling 0.3 percent in the previous month . Volume of construction fell for the third month in a row.

The biggest monthly decline was observed in the Czech Republic , Romania and the UK . The highest growth was recorded in Slovenia, Poland and Hungary.

In annual terms in the eurozone construction volume decreased by 1.7 percent in November , after falling 2.3 percent in October , revised from 2.4 percent fall . In the 28 countries of the EU construction volume decreased by 1.6 percent after a 1 percent decline in October , which was revised to a drop by 0.8 percent.

The British pound rose sharply on the back of strong retail sales data . Retail sales in the UK rose in December , with the annual growth rate was the fastest in more than nine years. Sales far exceeded analysts 'expectations and pointed to consumers' desire to spend money on as the British economy recovers.

According to the data , retail sales in December rose by 5.3% compared with the same period last year. This is the highest annual growth rate since October 2004 . Compared with the previous month sales rose 2.6% , and it was the strongest monthly increase since February 2010, the Bureau of Statistics reported .

Retail sales growth exceeded analysts' expectations. Economists were to grow sales in December was only 0.5 % compared to November and 2.5% compared to December 2012 .

Excluding automotive fuel retail sales rose by 2.8 percent on a monthly measurement of December , beating the consensus increase by 0.3 percent . Annualised sales recorded an increase of 6.1 percent , which is much faster than expected growth of 3.2 percent .

These data indicate a strong growth of the British economy in the 4th quarter of last year , after rising by 3.2% year on year in Q3 .

EUR / USD: during the European session, the pair fell to $ 1.3586

GBP / USD: during the European session, the pair rose to $ 1.6458

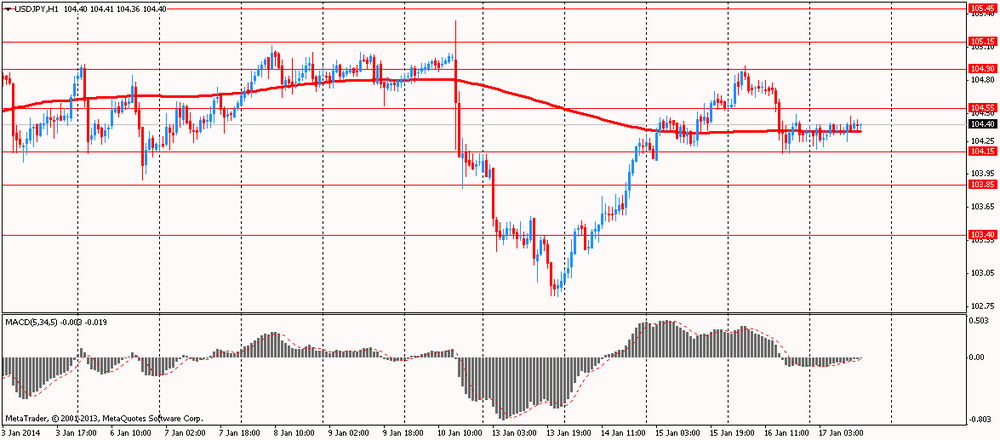

USD / JPY: during the European session, the pair rose to Y104.48

In the U.S. at 13:30 GMT will volume of building permits issued , the number of Housing Starts for December, in 14:15 GMT - the capacity utilization rate , the change in volume of industrial production for December, in the 14:55 GMT - consumer sentiment index from the University of Michigan in January to 15:00 GMT - the vacancy rate and labor turnover from the Bureau of Labor Statistics for November.

-

13:00

Orders

EUR/USD

Offers $1.3720/30, $1.3680/710, $1.3650

Bids $1.3580, $1.3555/45, $1.3525/20, $1.3500/490

GBP/USD

Offers $1.6605, $1.6540/50, $1.6520, $1.6500

Bids $1.6400, $1.6380

AUD/USD

Offers $0.8940/50, $0.8900, $0.8860/65, $0.8850, $0.8825/30

Bids $0.8770, $0.8750, $0.8720, $0.8700

EUR/JPY

Offers Y143.00, Y142.80, Y142.40/50, Y142.15/20

Bids Y141.50, Y141.20/00, Y140.50, Y140.20

USD/JPY

Offers Y105.25/30, Y105.00, Y104.80

Bids Y104.00, Y103.80, Y103.50

EUR/GBP

Offers stg0.8400/05, stg0.8370/80, stg0.8340-50, stg0.8320, stg0.8300

Bids stg0.8255/50, stg0.8220, stg0.8205/00, stg0.8160

-

10:31

Option expiries for today's 1400GMT cut

USD/JPY Y103.00, Y103.25, Y103.95, Y104.00, Y104.15, Y104.50, Y104.75, Y105.00, Y105.50, Y106.00

EUR/USD $1.3500/10, $1.3530, $1.3570, $1.3600, $1.3615, $1.3650, $1.3725, $1.3770/75, $1.3800

AUD/USD $0.8700, $0.8750, $0.8850

EUR/GBP stg0.8265/70, stg0.8320, stg0.8400

USD/CAD Cad1.0750, Cad1.0925

GBP/USD $1.6300, $1.6360, $1.6475

EUR/CHF Chf1.2275, Chf1.2320, Chf1.2350

USD/CHF Chf0.9000, Chf0.9030/35, Chf0.9100, Chf0.9130, Chf0.9200

EUR/JPY Y141.00, Y141.25, Y142.50

NZD/USD NZ$0.8325

AUD/JPY Y91.45

-

10:00

Eurozone: Construction Output, m/m, November -0.6%

-

10:00

Eurozone: Construction Output, y/y, November -1.7%

-

09:30

United Kingdom: Retail Sales (MoM), December +2.6% (forecast +0.5%)

-

09:30

United Kingdom: Retail Sales (YoY) , December +5.3% (forecast +2.5%)

-

08:15

Switzerland: Producer & Import Prices, m/m, December 0.0% (forecast +0.5%)

-

08:15

Switzerland: Producer & Import Prices, y/y, December -0.4% (forecast -0.5%)

-

07:07

Asian session: The dollar was set for its biggest weekly advance

05:00 Japan Consumer Confidence December 42.5 43.4 41.3

The dollar was set for its biggest weekly advance against major peers in two months before Federal Reserve Bank of Richmond President Jeffrey Lacker speaks today. Lacker, who doesn’t vote on monetary policy this year, said on Jan. 10 that he “would expect a similar reduction in pace to be discussed at the upcoming meeting.”

The greenback rose versus most of its 16 main counterparts as U.S. data on retail sales, New York manufacturing and initial jobless claims released this week all beat economists estimates, bolstering bets the Fed will continue to reduce monetary stimulus. Jobless claims decreased by 2,000 to 326,000 in the week ended Jan. 11, a Labor Department report showed yesterday in Washington. The median forecast of economists surveyed by Bloomberg News called for 328,000. The Federal Open Market Committee will reduce purchases by $10 billion at each meeting to end the program this year, according to the median forecasts of economists in a Bloomberg survey. It next meets Jan. 28-29.

The yen’s losses were limited versus the greenback after U.S. Treasury Secretary Jacob J. Lew said Japan can’t rely on the exchange rate for economic advantage.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3605-20

GBP / USD: during the Asian session the pair fell to $ 1.6320

USD / JPY: on Asian session the pair traded in the range of Y104.20-40

There is only limited UK data as the December retail sales data are released. Analysts note that it is virtually impossible for National Statistics to seasonally adjust data at this time of year, in part due to changes in discounting patterns year-to-year, and the December numbers will need to be viewed alongside January's to give a fuller picture of spending over the Christmas and New Year period. The BRC/KPMG December retail sales monitor shows sales growth slipped to 1.8% in on the year in December, which was the lowest level since December last year, with the exception of April 2013 when sales were weak due to a trading day lost to Easter compared to April 2012. The data raise questions as to whether household consumption will be able to provide as much of a boost to Q4 GDP as it did in Q3 when it contributed 0.5 percentage points to overall quarterly growth of 0.8%. Analysts are looking for UK Dec total retail sales to fall 0.7% on month and rise 1.8% on year.

-

06:29

Currencies. Daily history for Jan 16'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3619 +0,11%

GBP/USD $1,6352 -0,10%

USD/CHF Chf0,9047 -0,41%

USD/JPY Y104,34 -0,20%

EUR/JPY Y142,10 -0,09%

GBP/JPY Y170,61 -0,30%

AUD/USD $0,8891 -0,26%

NZD/USD $0,8353 +0,19%

USD/CAD C$1,0928 -0,05%

-

06:08