Notícias do Mercado

-

13:41

Option expiries for today's 1400GMT cut

USD/JPY Y103.30, Y103.50, Y103.80, Y105.20, Y106.50

EUR/USD $1.3430, $1.3500, $1.3590, $1.3600, $1.3620, $1.3650, $1.3660, $1.3670, $1.3700

GBP/USD $1.6290, $1.6340, $1.6360, $1.6465

USD/CHF Chf0.9060, Chf0.9125

EUR/CHF Chf1.2360

-

13:21

European session: the euro rose

07:00 Germany Producer Price Index (MoM) December -0.1% +0.2% +0.1%

07:00 Germany Producer Price Index (YoY) December -0.8% -0.6% -0.5%

Moderate growth rate of the euro against the U.S. dollar on the background data on producer prices in Germany. Recent data from the Statistical Office Destatis showed that producer prices in Germany fell again last month, while fixing the fifth consecutive monthly decline .

According to the report , producer prices fell in December by 0.5 percent compared to the same period last year. Recall also that in the month of November , prices have fallen more significantly , namely by 0.8 percent . Also, add that, according to the average forecast of experts for this indicator was down by 0.6 per cent per annum. The cost of energy and intermediate goods decreased by 1.8 percent and 1.1 percent , respectively. Meanwhile , consumer prices rose by 1.5 percent , while prices for durable goods rose 1.1 percent . Capital goods prices rose 0.7 percent .

In Statistical Bureau also reported that in a monthly basis, producer prices rose in December by 0.1 percent , fully offsetting a decline of 0.1 percent, which was recorded in the month of November.

In addition, the data showed that in 2013, the producer price index for industrial products fell slightly - by 0.1 per cent per annum. Recall that the results of 2012 , the index rose by 1.6 percent.

The yen rose against most major currencies following the collapse of the Asian stock markets on data about the weakening economic growth in China , increasing its attractiveness as a safe-haven currency . China's GDP grew by 7.7 % compared with a year earlier and 1.8% compared with the previous quarter , said today the National Bureau of Statistics in Beijing. "The pace of growth is clearly weaker " - said Dariusz Kowalczyk , senior economist and strategist at Credit Agricole CIB in Hong Kong. Growth was the same as in 2012 . According to a survey conducted last month , this year the economy will grow by 7.4% , ie, the slowest pace since 1990.

Today, U.S. markets will be closed due to holiday in memory of the leader of the civil rights movement of Martin Luther King .

EUR / USD: during the European session, the pair rose to $ 1.3566

GBP / USD: during the European session, the pair rose to $ 1.6452 and retreated

USD / JPY: during the European session, the pair rose to Y104.26 and stepped

At 21:45 GMT New Zealand will release the consumer price index for the 4th quarter .

-

13:01

Orders

EUR/USD

Offers $1.3650, $1.3620/25, $1.3600, $1.3564-68

Bids $1.3505/00, $1.3480, $1.3460/50, $1.3436

GBP/USD

Offers $1.6520, $1.6508-18, $1.6500, $1.6465-70, $1.6452

Bids $1.6396, $1.6385/80, $1.6370, $1.6320, $1.6309

AUD/USD

Offers $0.8940/50, $0.8900, $0.8860/70, $0.8850, $0.8825/30

Bids $0.8780/75, $0.8750, $0.8720, $0.8700, $0.8685/80

EUR/JPY

Offers Y142.40/50, Y141.95/00, Y141.88, Y141.45/50, Y141.38

Bids Y140.80/60, Y140.35/33, Y140.20, Y140.00, Y139.50

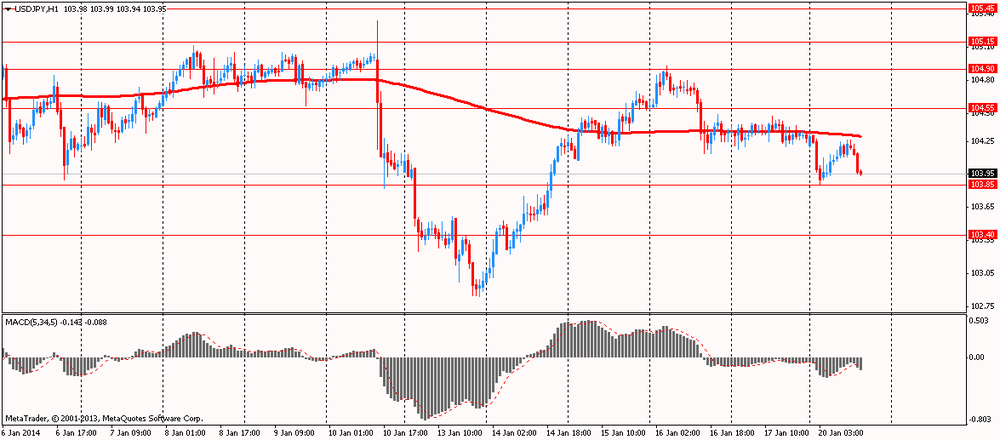

USD/JPY

Offers Y105.25/30, Y105.15, Y105.00, Y104.80, Y104.48/55

Bids Y103.85/80, Y103.50, Y103.20, Y103.00

EUR/GBP

Offers stg0.8370/80, stg0.8340-50, stg0.8320, stg0.8300, stg0.8250

Bids stg0.82335, stg0.8230, stg0.8220, stg0.8205/00, stg0.8160

-

10:30

Option expiries for today's 1400GMT cut

USD/JPY Y103.30, Y103.50, Y103.80, Y105.20, Y106.50

EUR/USD $1.3430, $1.3500, $1.3590, $1.3600, $1.3620, $1.3650, $1.3660, $1.3670, $1.3700

GBP/USD $1.6290, $1.6340, $1.6360, $1.6465

USD/CHF Chf0.9060, Chf0.9125

EUR/CHF Chf1.2360

-

07:26

Asian session: The dollar touched its strongest since November

02:00 China Retail Sales y/y December +13.7% +13.6% +13.6%

02:00 China Industrial Production y/y December +10.0% +9.8% +9.7%

02:00 China Fixed Asset Investment December +19.9% +19.9% +19.6%

02:00 China NBS Press Conference

02:00 China GDP y/y Quarter IV +7.8% +7.6% +7.7%

04:30 Japan Industrial Production (MoM) (Finally) November +0.1% +0.1% -0.1%

04:30 Japan Industrial Production (YoY) (Finally) November +5.0% +5.0% +4.8%

The dollar touched its strongest since November versus the euro amid speculation the Federal Reserve will continue reducing stimulus as the U.S. economy improves.

The Bloomberg Dollar Spot Index held a four-month high after a Citigroup Inc. gauge showed last week that economic data were surpassing expectations by the most in almost two years.

The yen rose against all its major peers as a decline in Asian stocks boosted its allure as a haven.

The Australian dollar rallied from its lowest in more than three years after China’s economic growth beat economists’ forecasts. Gross domestic product in China, the world’s second-largest economy and Australia’s biggest trading partner, slowed to 7.7 percent in the fourth quarter from a year earlier. Economists polled by Bloomberg predicted 7.6 percent growth.

New Zealand’s dollar fell after an earthquake struck the North Island.

U.S. markets will be closed today for a holiday commemorating civil rights leader Martin Luther King Jr.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3505-40

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6395-25

USD / JPY: on Asian session the pair fell to Y103.85

There is a very quiet calendar Monday, with limited European data and the US markets closed for the national Martin Luther King holiday. Monday's calendar kicks off at 0700GMT, with the release of German December PPI data set to be published. Analysts are looking for a reading of "flat" on month, and down 0.6% on year - a pick-up from the -0.8% in November. Spanish data set for release at 0800GMT includes the release of the November industrial orders and services survey. At 0900GMT, Italian November industrial sales and orders data will be published. Orders are seen flat on month, up 1.5% on year. French President Hollande as set to put his domestic woes to the side for a few hours,as he visits The Netherlands. In the afternoon, Belgian consumer confidence datawill be released at 1400GMT. -

07:01

Germany: Producer Price Index (MoM), December +0.1% (forecast +0.2%)

-

07:00

Germany: Producer Price Index (YoY), December -0.5% (forecast -0.6%)

-

06:04

Schedule for today, Monday, Jan 20’2013:

02:00 China Retail Sales y/y December +13.7% +13.6% +13.6%

02:00 China Industrial Production y/y December +10.0% +9.8% +9.7%

02:00 China Fixed Asset Investment December +19.9% +19.9% +19.6%

02:00 China NBS Press Conference

02:00 China GDP y/y Quarter IV +7.8% +7.6% +7.7%

04:30 Japan Industrial Production (MoM) (Finally) November +0.1% +0.1% -0.1%

04:30 Japan Industrial Production (YoY) (Finally) November +5.0% +5.0% +4.8%

07:00 Germany Producer Price Index (MoM) December -0.1% +0.2%

07:00 Germany Producer Price Index (YoY) December -0.8% -0.6%

11:00 Germany Bundesbank Monthly Report January

13:30 U.S. Bank holiday

21:45 New Zealand CPI, q/q Quarter IV +0.9% 0.0%

21:45 New Zealand CPI, y/y Quarter IV +1.4% +1.5%

22:45 New Zealand REINZ Housing Price Index, m/m December +1.2%

-