Notícias do Mercado

-

20:00

Dow -65.89 16,416.05 -0.40% Nasdaq +1.6 4,216.48 +0.04% S&P -4.55 1,843.83 -0.25%

-

19:21

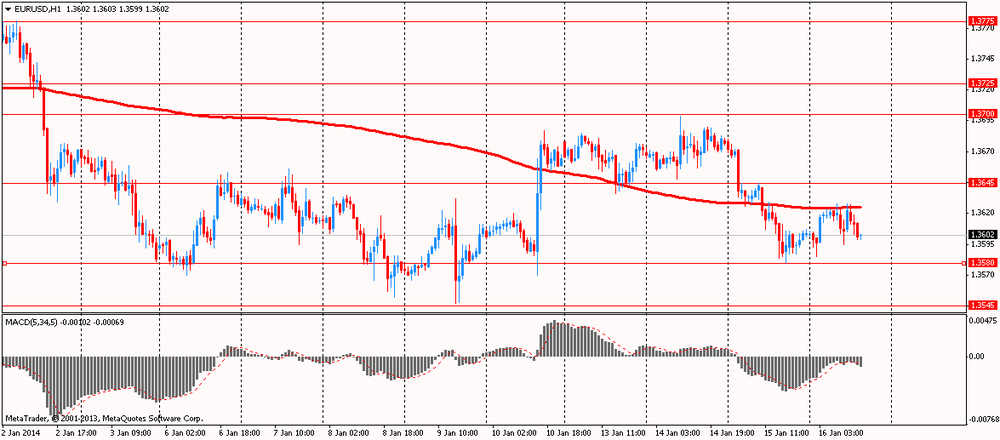

American focus : the euro fell slightly against the U.S. dollar

Euro fell against the dollar, losing the previously all that was associated with the release of U.S. data . As it became known , the growth of production in the region continued in January , according to a survey of business produced by the Federal Reserve Bank of Philadelphia. Activity indicators , new orders, deliveries , and employment is positive , that is evidence of the continuation of moderate growth . Evaluation indicators of future activity decreased , but continue to show optimism about economic growth in the next six months. The overall index of conditions in the industry from the Federal Reserve Bank of Philadelphia - the index of current activity - rose from a revised 6.4 in December to 9.4 . The index is in positive territory for eight consecutive months. The new orders index remained in positive territory, but fell from 12.9 to 5.1 , reflecting the slowdown in demand for industrial goods . Delivery index rose slightly to 12.1 . Labor market indicators have shown a slight improvement in December. Current employment index increased by 6 points from a revised December . The percentage of firms reporting a rise in the number of employees ( 23%), higher than the percentage of firms reporting employment growth in the last month ( 18%). Expectations for the next six months showed continued decline of optimism from highs reached in October, but optimism remains .

The index of future economic activity fell by 10 points, from a revised 44.8 in December to 34.4 . About 48 % of firms expect growth in activity over the next six months , 13% expect lower activity . Indices of future new orders and delivery remained at relatively high levels , but decreased by 7 and 9 points respectively.

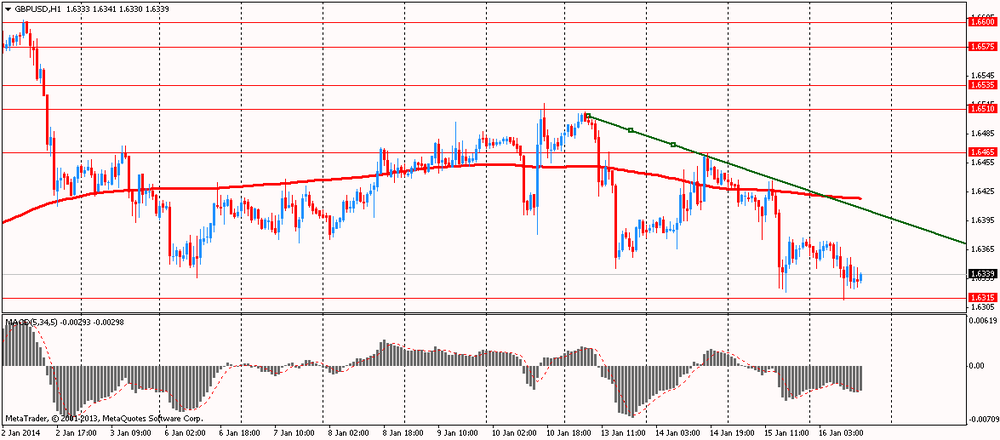

Pound fell slightly against the U.S. dollar , as data showed that expectations regarding the future growth of British housing prices have increased again last month, which was due to the lack of new homes on the market . It became known from the last survey, which was published today by the Royal Institution of Chartered Surveyors (RICS). RICS experts said that 61 percent of respondents predict that home prices will rise over the next three months, compared with 59 percent in November. We add that the last result was the highest since September 1999. The survey also showed house prices rose in every region of Great Britain in the last month . Nevertheless , the main house price balance fell to 56 % in December from 58% in November. Many experts predicted that the value of this index will rise to the level of 59%. It is worth noting that it was the first decline in the index over the past four months. Economists also said the UK housing market was underpinned by falling unemployment , low interest rates and government programs to make mortgages cheaper and easier to obtain .

It should be noted that the head of the Bank of England Governor Mark Carney said Wednesday that, according to forecasts , the British housing prices will continue to grow vigorously until the middle of next year.

-

18:20

European stock close

European stocks were little changed near a six-year high as Citigroup Inc. made a bullish case for investing in mining companies and as initial jobless claims in the U.S. fell to a six-week low.

The Stoxx Europe 600 Index slipped 0.2 percent to 333.97 at 4:30 p.m. in London. The benchmark climbed yesterday to its highest level since January 2008 as the World Bank raised its forecast for global economic growth. The measure has added 1.7 percent in January, after rallying 17 percent in 2013.

National benchmarks fell in 13 of the 18 western European markets.

FTSE 100 6,815.42 -4.44 -0.07% CAC 40 4,319.27 -12.80 -0.30% DAX 9,717.71 -16.10 -0.17%

A U.S. Labor Department report showed that first-time jobless claims decreased by 2,000 to 326,000 in the week ended Jan. 11, from a revised 328,000 in the previous week. That was the lowest since the week ended Nov. 29.

Commodity producers, as a group, posted the best performance in the Stoxx 600 after Citigroup Inc. turned bullish on European miners for the first time in three years.

“Our move reflects better bottom-up fundamentals, particularly from the major miners,” analysts including Heath R. Jansen wrote in a note. “We would rather be too early than too late in making this call.”

Rio Tinto gained 2.6 percent to 3,339 pence. The world’s second-largest mining company cut cash costs by more than $2 billion and halved exploration spending to $948 million last year, beating the targets set by Chief Executive Officer Sam Walsh. Fourth-quarter iron-ore output climbed 7 percent from a year earlier, in line with estimates.

BHP Billiton Ltd. increased 3.9 percent to 1,860.5, pence for the biggest gain since October. Citigroup upgraded its rating on the company to buy from neutral. The brokerage said BHP is trading at a discount to some valuation measures, may deliver 35 percent cumulative growth by the end of the decade, could deliver cost savings and may continue to sell assets.

United Utilities (UU/) advanced 4.8 percent to 690.5 pence. Morgan Stanley upgraded the U.K.’s largest publicly traded water supplier to overweight, a rating similar to buy, from equal weight. The brokerage said the company trades at the lowest premium to its regulatory capital value compared with rivals. RCV is an accounting norm developed by the U.K. Water Services Regulation Authority for setting price limits.

Ladbrokes Plc (LAD) rose 1.6 percent to 175.8 pence. The U.K. operator of 2,100 betting outlets said that 2013 operating profit will be in the middle of analysts’ estimated range of 129.8 million pounds to 151 million pounds and consistent with the forecast the company gave in November.

Richemont (CFR) dropped 2 percent to 87 Swiss francs. The owner of the Cartier brand said revenue in the October-December period rose 2.8 percent to 2.94 billion euros. Analysts in a Bloomberg survey had expected sales of 3.05 billion euros.

Carrefour slid 4.1 percent to 27.15 euros. The retailer said total revenue fell 1.5 percent to 22.2 billion euros, in line with the average of four analysts’ estimates.

Royal Ahold NV lost 2.4 percent to 12.85 euros. The biggest Dutch retailer posted fourth-quarter revenue of 7.47 billion euros, missing the median projection of 7.57 billion euros.

-

17:00

European stock close: FTSE 100 6,815.42 -4.44 -0.07% CAC 40 4,319.27 -12.80 -0.30% DAX 9,717.71 -16.10 -0.17%

-

16:40

Oil: an overview of the market situation

Oil prices are mixed , though with a slight modification. On the dynamics of trade affect expectations increasing supplies from the Middle East and North Africa, which outweighed the news about a noticeable drop in U.S. oil inventories .

Today, as it became known that the Organization of Petroleum Exporting Countries (OPEC) kept its forecast for global oil demand in 2014 at 90.91 million barrels per day , which is 1.2 % higher than in 2013 , said the cartel. OPEC has maintained its forecast for global oil demand this year at 90.9 million b / d

By the end of 2013 , global demand for OPEC oil estimated at 89.86 million b / d (an increase of 1 % compared to 2012 ) .

Forecast oil production countries on OPEC for 2014 increased by 70 thousand b / d - up to 55.38 million b / d (up by 1.27 million b / d relative to 2013). The main growth will provide the United States, Canada, Brazil and Sudan , while in Norway and Mexico is expected to reduce production . Demand for OPEC oil this year is expected to reach 29.6 million b / d to 0.4 million b / d below the level of 2013. In December last year , OPEC cut oil production by 20 thousand b / d compared with November - to 29.44 million b / d . In the beginning of December, OPEC kept oil production quotas at 30 million b / d .

At the same time, investors continue to monitor developments in Iran and is ranked fifth in the world in oil production. Earlier Thursday, Iranian Foreign Minister Mohammad Javad Zarif said that Tehran expects to reach an agreement with the OPEC oil production quotas that Iran was able to get right to produce raw materials as part of its volume.

" The sanctions restricting trade in oil from Iran, has not yet taken off < ... > In the future, we may see a slight increase in Iran's oil exports to countries such as India, China , South Africa, South Korea and Japan . However, shipments will be limited to U.S. pressure and quotas on imports of Iranian oil , "- said an analyst at Natixis SA Abhishek Deshpande .

It should also be noted that the mixed dynamics in the prices of oil futures transactions is largely due to a technical correction . On the eve of the price of oil futures have risen markedly influenced by data on further reductions in U.S. commercial crude oil inventories . Today , market participants with the beginning of the next trading day record profits , resulting a day earlier.

February futures price of U.S. light crude oil WTI (Light Sweet Crude Oil) dropped to $ 93.92 per barrel.

February futures price for North Sea Brent crude oil mixture rose $ 0.13 to $ 107.01 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices rose slightly after a government report that inflation in the U.S. rose , increasing the appeal of the precious metal as a hedge against inflation.

As it became known , U.S. consumer prices increased slightly last month, but the overall level of inflation remains weak while the Federal Reserve decided to cut its bond purchasing program . Consumer Price Index, which measures how much Americans pay for goods and services , rose a seasonally adjusted 0.3% in December compared with the previous month . Base prices , which exclude volatile food and energy , rose only 0.1%. Compared with a year earlier , overall consumer prices rose by 1.5%, while core prices rose 1.7%. Annual inflation target is 2% Fed . Economists forecast that prices in general will rise by 0.3%, while core prices will rise by 0.1 % in November. Energy prices showed a monthly increase , while gasoline prices rose by 3.1%.

" The need for gold as a safe asset no longer dominates the market : the U.S. economy is showing signs of improvement , the EU is putting in place plans for the economy and fears somewhat subsided crisis " - analysts Heraeus Metals,

It is worth noting that the markets are closely watching the data in an attempt to understand whether the U.S. Federal Reserve have enough evidence of economic recovery to continue to reduce its bond purchases even more in 2014.

Recall that the Fed announced its first QE reduction of $ 10 billion ( to $ 75 billion ) in December , citing an improving economy .

Support investors' appetite for risky assets and yesterday's report from the Federal Reserve , which is known as the "Beige Book" . It was said that the U.S. economy continued to grow at a moderate pace since the end of November until the end of 2013.

Cost February gold futures on the COMEX today rose to $ 1241.90 per ounce.

-

15:00

U.S.: NAHB Housing Market Index, January 56 (forecast 58)

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, January 9.4 (forecast 8.8)

-

14:36

U.S. Stocks open: Dow 16,450.92 -31.02 -0.19%, Nasdaq 4,210.36 -4.52 -0.11%, S&P 1,845.85 -2.53 -0.14%

-

14:24

Before the bell: S&P futures -0.21%, Nasdaq futures -0.07%

U.S. stock futures fell, as Best Buy Co. tumbled and investors scrutinized earnings at companies from Goldman Sachs Group Inc. to Citigroup Inc.

Global markets:

Nikkei 15,747.2 -61.53 -0.39%

Hang Seng 22,986.41 +84.41 +0.37%

Shanghai Composite 2,023.7 +0.35 +0.02%

FTSE 6,825.8 +5.94 +0.09%

CAC 4,323.32 -8.75 -0.20%

DAX 9,719.09 -14.72 -0.15%

Crude oil $93.91 (-0.28%)

Gold $1240.40 (+0.17%).

-

14:01

U.S.: Total Net TIC Flows, November -16.6

-

14:00

U.S.: Net Long-term TIC Flows , November -29.3 (forecast 42.3)

-

13:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3450, $1.3500, $1.3525, $1.3575, $1.3600, $1.3650, $1.3750

USD/JPY Y103.00, Y104.00, Y104.50

USD/CHF Chf0.9100

AUD/USD $0.8750, $0.8800, $0.8900

USD/CAD C$1.0825, C$1.0925

-

13:31

U.S.: CPI, Y/Y, December +1.5% (forecast +1.4%)

-

13:31

U.S.: CPI excluding food and energy, Y/Y, December +1.7% (forecast +1.7%)

-

13:30

U.S.: Initial Jobless Claims, January 326 (forecast 327)

-

13:30

Canada: Foreign Securities Purchases, November 8.7 (forecast 7.21)

-

13:30

U.S.: CPI, m/m , December +0.3% (forecast +0.3%)

-

13:30

U.S.: CPI excluding food and energy, m/m, December +0.1% (forecast +0.1%)

-

13:15

European session: the euro stabilized

The euro is trading sideways against the U.S. dollar on the background of how the final data on inflation in the euro area in line with the preliminary estimates.

Annual inflation in the 17 countries of the eurozone declined in December , bringing inflation was still below the European Central Bank's target level. Eurostat on Thursday confirmed its preliminary assessment of the dynamics of prices in December , published last week. According to the report , the consumer price index (CPI) in December rose by 0.3 % compared to November and 0.8% compared to December 2012 .

The data indicate a weakening of annual inflation compared with November , when it stood at 0.9 % , and this figure was still below the target level , the ECB near 2.0%.

Eurostat also confirmed that the increase in core consumer price index (Core CPI), which excludes volatile food prices and energy prices, slowed to 0.7 %, showing the lowest growth since the beginning of such statistics in 2001.

Today was a monthly report published by the ECB. In its January newsletter Governing Council of the ECB have to maintain rates at current or lower level for a long period of time. Authorities said that accommodative monetary policy rate will be maintained long as need be.

Risks to the economic outlook of the eurozone are still bearish . Global uncertainty coupled with rising commodity prices , weak domestic demand, export growth and insufficient efforts of EU Member States , undertaken in the course of reform , may adversely affect the economic recovery of the region.

In addition, the Governing Council pointed to improvements in European financial institutions and stressed the need to consolidate the banking system evrobloka with a view to strengthening .

The dollar index close to four-month high , as investors believe that the U.S. economy is strong enough to survive without loss possible reduction incentives Fed . Economic activity in all regions of the U.S. grew in December, " moderate " pace due to an increase in consumer spending in the festive season , the improvement in the labor market and recovery of industrial production , released Wednesday shows a regional overview of the Fed.

Also today will be presented employment figures in the United States . According to the median forecast of economists , the number of new applications for unemployment benefits last week reduced to 327 thousand little later will be published Philadelphia Fed manufacturing index , which this month could grow to 8.8 from a revised 6.4 in December.

The Australian dollar fell to its lowest level since August 2010 against the U.S. dollar and to the eight year low against the New Zealand dollar after the publication of a negative report on employment in Australia. According to the National Bureau of Statistics , the number of jobs in the country in December fell by 22.6 thousand , while economists had expected growth of 10 thousand for the year Australia's economy lost 67.5 thousand jobs , which was the worst figure since 1992 .

EUR / USD: during the European session, the pair traded in the range of $ 1.3595 - $ 1.3628

GBP / USD: during the European session, the pair fell to $ 1.6313

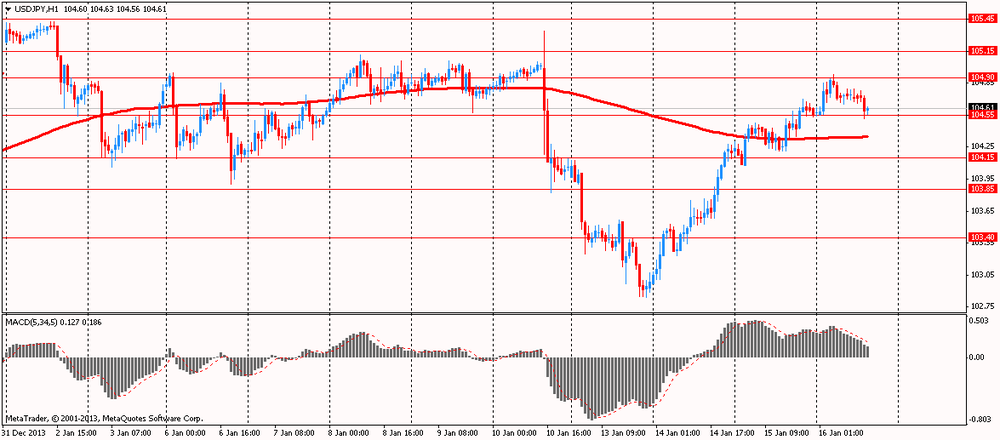

USD / JPY: during the European session, the pair fell to Y104.52

At 13:30 GMT , Canada will release the volume of transactions with foreign securities in November. At 13:30 GMT the United States will come in the consumer price index , consumer price index excluding prices for food and energy , consumer price index ( not seasonally adjusted ) , the main consumer price index for December. At 14:00 GMT , Canada will release the change in sales in the secondary housing market in December. In the U.S. at 14:00 GMT will net purchases of long-term U.S. securities by foreign investors , total net purchases of U.S. securities by foreign investors in November in 15:00 GMT - Fed manufacturing index Philadelphia housing market index for January of NAHB .

-

11:30

European stocks were little changed

European stocks were little changed, after rallying yesterday to a six-year high, as investors weighed corporate earnings and awaited data on American jobless claims. U.S. index futures and Asian shares were little changed.

The Stoxx Europe 600 Index slipped 0.1 percent to 334.14 at 9:53 a.m. in London. The benchmark climbed yesterday to its highest level since January 2008 as the World Bank raised its forecast for global economic growth. The measure has added 1.8 percent in January, after rallying 17 percent in 2013. Standard & Poor’s 500 Index futures and the MSCI Asia Pacific Index fell less than 0.1 percent today.

Richemont dropped 1.9 percent to 87.05 Swiss francs. The owner of the Cartier brand said revenue in the October-December period rose 2.8 percent to 2.94 billion euros. Analysts in a Bloomberg survey had expected sales of 3.05 billion euros.

Carrefour slid 3 percent to 27.44 euros. The retailer said total French sales, excluding petrol, rose 2.2 percent on a comparable basis in the fourth quarter. Total revenue fell 1.5 percent to 22.2 billion euros, in line with the average of four analysts’ estimates.

Royal Ahold NV fell 3.8 percent to 12.67 euros. The biggest Dutch retailer posted fourth-quarter revenue of 7.47 billion euros, missing the median projection of 7.57 billion euros.

Rio Tinto gained 1.6 percent to 3,306 pence. The world’s second-largest mining company cut cash costs by more than $2 billion and halved exploration spending across the range of commodities to $948 million last year, beating the targets set by Chief Executive Officer Sam Walsh. Fourth-quarter iron-ore output climbed 7 percent from a year earlier to 55.5 million metric tons, in-line with the 55.7 million-ton median estimate of analysts.

FTSE 100 6,822.19 +2.33 +0.03%

CAC 40 4,325.2 -6.87 -0.16%

DAX 9,733.03 -0.78 -0.01%

-

10:27

Option expiries for today's 1400GMT cut

EUR/USD $1.3450, $1.3500, $1.3525, $1.3575, $1.3600, $1.3650, $1.3750

USD/JPY Y103.00, Y104.00, Y104.50

USD/CHF Chf0.9100

AUD/USD $0.8750, $0.8800, $0.8900

USD/CAD C$1.0825, C$1.0925

-

10:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, December +0.7% (forecast +0.7%)

-

10:00

Eurozone: Harmonized CPI, December +0.3% (forecast +0.3%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, December +0.8% (forecast +0.8%)

-

09:42

Asia Pacific stocks close

Asian stocks fell, with the regional benchmark index poised to drop for a fourth day, as a report showed U.S. service industries expanded less than expected and raw-material shares led declines.

Nikkei 225 15,814.37 -94.51 -0.59%

S&P/ASX 200 5,316.99 -7.89 -0.15%

Shanghai Composite 2,044.44 -1.27 -0.06%

Sinopec Shanghai Petrochemical Co., an oil processor, slumped 5.9 percent, leading material shares lower.

Oversea-Chinese Banking Corp., Southeast Asia’s second-biggest lender, fell 0.8 percent in Singapore amid concern it may pay too much to take over Hong Kong’s Wing Hang Bank Ltd.

Li & Fung Ltd., the world’s largest supplier of clothes and toys to retailers, gained 8.5 percent in Hong Kong as the company called its 2013 performance “solid.”

-

08:37

FTSE 100 6,821.08 +1.22 +0.02%, CAC 40 4,333.42 +1.35 +0.03%, Xetra DAX 9,743.9 +10.09 +0.10%

-

07:45

European bourses are initially seen trading higher Thursday: the FTSE is seen up 12, while the DAX is called up 29 and the CAC up 9.

-

07:18

Asian session: The Dollar Spot Index headed for its highest

00:00 Australia Consumer Inflation Expectation January +2.1%

00:01 United Kingdom RICS House Price Balance December 58% 59% 56%

00:30 Australia Unemployment rate December 5.8% 5.8% 5.8%

00:30 Australia Changing the number of employed December 21.0 10.3 -22.6

The Dollar Spot Index headed for its highest in more than four months before a U.S. report economists forecast will show applications for jobless benefits declined last week. Initial jobless claims in the U.S. probably fell to 328,000 in the period ended Jan. 11, the fewest since November, according to the median estimate of economists surveyed by Bloomberg News before the Labor Department report today. Economists in a separate Bloomberg poll estimate the Federal Reserve Bank of Philadelphia’s general economic index rose to 8.7 this month from a revised 6.4 in December.

Atlanta Fed President Dennis Lockhart, who doesn’t vote on monetary policy this year, said yesterday he expects inflation that’s been “too low” will accelerate toward the Fed’s 2 percent target. Chairman Ben S. Bernanke speaks today.

Data from Australia showed employers unexpectedly cut jobs, sending the nation’s currency to its weakest since August 2010 versus the greenback and an eight-year low against its New Zealand counterpart. In Australia, jobs decreased by 22,600 last month, following November’s revised 15,400 gain, the statistics bureau said today. That compares with a 10,000 increase predicted by economists. The unemployment rate held at 5.8 percent, the highest in four years. Bets that the Reserve Bank of Australia will lower its record-low benchmark rate by July rose to 43 percent from 24 percent yesterday, swaps data compiled by Bloomberg show.

EUR / USD: during the Asian session, the pair rose to $ 1.3625

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6345-75

USD / JPY: during the Asian session, the pair rose to Y104.95

There is a heavy calendar Thursday, with a slew of data on both sides of the Atlantic. The European calendar will kick off at 0700GMT, when the EMU December ACEA car registrations numbers are released. At 0700GMT, German December final HICP numbers will also cross the wires. At 0730GMT, the French December Bank of France retail trade index will be published. The ECB monthly bulletin will be published at 0900GMT, with the statement expected to reflect ECB President Draghi's statement ahead of last Thursday's press conference. The final December EMU final HICP data will be released at 1000GMT and is expected to come inline with the preliminary 0.8% y/y and the 0.7% core. ECB speakers kick off at 1000GMT, when Governing Council member Jens Weidmann speaks on "Economic Outlook for 2014", in Berlin. At 1245GMT, ECB Governing Council member Luis Linde will attend a working luncheon with the members of the AED, in Madrid.

-

07:01

Germany: CPI, m/m, December +0.4% (forecast +0.4%)

-

07:01

Germany: CPI, y/y , December +1.4% (forecast +1.4%)

-

06:22

Commodities. Daily history for Jan 15’2013:

Gold $1,239.20 -$6.20 -0.50%

Oil $94.38 +$1.79 +1.93%

-

06:22

Stocks. Daily history for Jan 15’2013:

Nikkei 225 15,808.73 +386.33 +2.50%

Hang Seng 22,902 +110.72 +0.49%

S&P/ASX 200 5,245.43 +33.38 +0.64%

Shanghai Composite 2,023.35 -3.49 -0.17%

FTSE 100 6,819.86 +53.00 +0.78%

CAC 40 4,332.07 +57.87 +1.35%

DAX 9,733.81 +193.30 +2.03%

Dow +109.17 16,483.03 +0.67%

Nasdaq +31.86 4,214.88 +0.76%

S&P +9.53 1,848.41 +0.52%

-

06:22

Currencies. Daily history for Jan 15'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3604 -0,54%

GBP/USD $1,6369 -0,42%

USD/CHF Chf0,9084 +0,67%

USD/JPY Y104,55 +0,33%

EUR/JPY Y142,23 -0,22%

GBP/JPY Y171,13 -0,09%

AUD/USD $0,8914 -0,57%

NZD/USD $0,8337 -0,52%

USD/CAD C$1,0933 -0,11%

-

06:04

Schedule for today, Thursday, Jan 16’2013:

00:00 Australia Consumer Inflation Expectation January +2.1%

00:01 United Kingdom RICS House Price Balance December 58% 59%

00:30 Australia Unemployment rate December 5.8% 5.8%

00:30 Australia Changing the number of employed December 21.0 10.3

07:00 Germany CPI, m/m (Finally) December +0.4% +0.4%

07:00 Germany CPI, y/y (Finally) December +1.4% +1.4%

09:00 Eurozone ECB Monthly Report January

10:00 Eurozone Harmonized CPI December -0.1% +0.3%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December +0.8% +0.8%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y December +0.7% +0.7%

13:30 Canada Foreign Securities Purchases November 4.41 7.21

13:30 U.S. Initial Jobless Claims January 330 327

13:30 U.S. CPI, m/m December 0.0% +0.3%

13:30 U.S. CPI, Y/Y December +1.2% +1.4%

13:30 U.S. CPI excluding food and energy, m/m December +0.2% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y December +1.7% +1.7%

14:00 U.S. Net Long-term TIC Flows November 35.4 42.3

14:00 U.S. Total Net TIC Flows November 194.9

15:00 U.S. Philadelphia Fed Manufacturing Survey January 7.0 8.8

15:00 U.S. NAHB Housing Market Index January 58 58

16:10 U.S. Fed Chairman Bernanke Speaks

17:00 Switzerland SNB Chairman Jordan Speaks

-