Notícias do Mercado

-

23:31

Currencies. Daily history for Dec 15’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2436 -0,14%

GBP/USD $1,5636 -0,52%

USD/CHF Chf0,9654 +0,13%

USD/JPY Y117,81 -0,70%

EUR/JPY Y146,50 -0,86%

GBP/JPY Y184,2 -1,23%

AUD/USD $0,8210 -0,51%

NZD/USD $0,7743 -0,40%

USD/CAD C$1,1670 +0,86%

-

23:00

Schedule for today, Tuesday, Dec 16’2014:

(time / country / index / period / previous value / forecast)

00:15 Australia RBA Assist Gov Debelle Speaks

00:30 Australia RBA Meeting's Minutes

01:35 Japan Manufacturing PMI (Preliminary) December 52.0 52.3

01:45 China HSBC Manufacturing PMI (Preliminary) December 50.0 49.8

07:00 United Kingdom Bank Stress Test Results

07:00 United Kingdom BOE Financial Stability Report

07:00 United Kingdom Publication of the Systemic Risk Survey

07:58 France Manufacturing PMI (Preliminary) December 48.4 48.7

07:58 France Services PMI (Preliminary) December 47.9 48.6

08:28 Germany Manufacturing PMI (Preliminary) December 49.5 50.4

08:28 Germany Services PMI (Preliminary) December 52.1 52.6

08:58 Eurozone Manufacturing PMI (Preliminary) December 50.1 50.5

08:58 Eurozone Services PMI (Preliminary) December 51.1 51.6

09:00 United Kingdom BOE Gov Mark Carney Speaks

09:30 United Kingdom Retail Price Index, m/m November 0.0% +0.1%

09:30 United Kingdom Retail prices, Y/Y November +2.3% +2.3%

09:30 United Kingdom RPI-X, Y/Y November +2.4%

09:30 United Kingdom Producer Price Index - Input (MoM) November -1.5% -1.1%

09:30 United Kingdom Producer Price Index - Input (YoY) November -8.4% -8.3%

09:30 United Kingdom Producer Price Index - Output (MoM) November -0.3% -0.3%

09:30 United Kingdom Producer Price Index - Output (YoY) November -0.5% -0.2%

09:30 United Kingdom HICP, m/m November +0.1% +0.1%

09:30 United Kingdom HICP, Y/Y November +1.3% +1.2%

09:30 United Kingdom HICP ex EFAT, Y/Y November +1.5% +1.5%

10:00 Eurozone ZEW Economic Sentiment December 11.0 20.1

10:00 Eurozone Trade Balance s.a. October 17.7 18.2

10:00 Germany ZEW Survey - Economic Sentiment December 11.5 19.8

10:45 United Kingdom BOE Gov Mark Carney Speaks

13:30 Canada Manufacturing Shipments (MoM) October +2.1% -0.4%

13:30 Canada Foreign Securities Purchases October 4.37 5.21

13:30 U.S. Housing Starts, mln November 1009 1025

13:30 U.S. Building Permits, mln November 1080 1050

14:45 U.S. Manufacturing PMI (Preliminary) December 54.8 56.1

21:30 U.S. API Crude Oil Inventories December +4.4

21:45 New Zealand Current Account Quarter III -1.07 -5.32

23:30 Australia Leading Index November 0.0%

23:50 Japan Adjusted Merchandise Trade Balance, bln November -977.5 -990.0

-

21:00

U.S.: Net Long-term TIC Flows , October -1.4 (forecast 72.8)

-

21:00

U.S.: Total Net TIC Flows, October +178.4

-

16:42

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data. The U.S. industrial production increased 1.3% in November, exceeding expectations for a 0.8% rise, after a 0.1% gain in October. That was the highest rise since May 2010. October's figure was revised up from a 0.1% decrease.

The increase was driven by bigger output of consumer goods and business equipment.

The NAHB housing market index fell to 57.0 in December from 58.0 in November, missing expectations for a rise to 59.0.

The NY Fed Empire State manufacturing index dropped to -3.6 in November from 10.2 in October. That was the first negative reading since January 2013. Analysts had expected the index to rise to 12.1.

The decline was driven by a fall in orders and shipments.

The euro traded mixed against the U.S. dollar. Germany's Bundesbank released its monthly report. Bundesbank said that if oil prices continue to decline, it will cut its inflation forecast for 2015 by 0.4%. Bundesbank expects inflation of 1.1% in 2015.

The British pound fell against the U.S. dollar despite the better-than-expected industrial order books balance. The CBI industrial order books balance climbed to +5% in December from +3% in November. That was the highest level since August. Analysts expected the CBI industrial order books balance to remain unchanged at +3%.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's producer and import prices declined 0.7% in November, missing forecasts of a 0.2% rise, after a 0.1% fall in October.

On a yearly basis, producer and import prices decreased 1.6% in November, after a 1.1% drop in October.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports.

The Australian dollar mixed against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against the greenback after the Australian outlook report and new motor vehicle sales data for Australia. Australia's government said that the budget deficit will be A$40.4 billion in the fiscal year ending June 30, 2015, down from May's estimate of A$29.8 billion.

The unemployment rate in Australia is expected to be 6.5% by mid 2015, up from May's estimate of 6.25%.

Australia's new motor vehicle sales declined 0.6% in November, after a 1.6% drop in October.

The Japanese yen rose against the U.S. dollar due to risk aversion. Japan's Tankan manufacturing index decline to 12 in the fourth quarter from 13 in the third quarter.

Japan's Tankan non-manufacturing index rose to 16 in the fourth quarter from 13 in the third quarter.

-

16:07

NY Fed Empire State manufacturing index: the first negative reading since January 2013

The New York Federal Reserve released its survey on Monday. The NY Fed Empire State manufacturing index dropped to -3.6 in November from 10.2 in October. That was the first negative reading since January 2013.

Analysts had expected the index to rise to 12.1.

The decline was driven by a fall in orders and shipments.

-

15:37

NAHB housing market index declined to 57.0 in December

The National Association of Home Builders (NAHB) released its housing market index for the U.S. today. The NAHB housing market index fell to 57.0 in December from 58.0 in November, missing expectations for a rise to 59.0.

A level above 50.0 is considered positive, below indicates a negative outlook.

The NAHB Chairman Kevin Kelly said that businesses of builders have improved. He added that the NAHB expects builders to remain confident next year.

-

15:00

U.S.: NAHB Housing Market Index, December 57 (forecast 59)

-

14:57

U.S. industrial production rose 1.3% in November

The Federal Reserve released its industrial production report on Monday. The U.S. industrial production increased 1.3% in November, exceeding expectations for a 0.8% rise, after a 0.1% gain in October. That was the highest rise since May 2010. October's figure was revised up from a 0.1% decrease.

The increase was driven by bigger output of consumer goods and business equipment. The output of consumer goods was up 2.5% in November, the largest increase since August 1998.

Motor vehicle output surged 5.1% in November, the highest increase since July.

Business equipment production climbed 1.2%.

Capacity utilisation rate climbed to 80.1% in November from 77.6% in October, the highest since March 2008. October's figure was revised up from 78.9%.

Analysts had expected a capacity utilisation rate of 79.4%.

-

14:15

U.S.: Industrial Production (MoM), November +1.3% (forecast +0.8%)

-

14:15

U.S.: Capacity Utilization, November 80.1% (forecast 79.4%)

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E1.2bn), $1.2400(E1.5bn), $1.2450(E730mn), $1.2500(E3.0bn)

USD/JPY: Y117.50($754mn), Y118.80($1.0bn), Y120.00($665mn), Y121.00($1.1bn)

GBP/USD: $1.6000(stg304mn)

EUR/GBP: stg0.7875

USD/CHF: Chf0.9635-40($315mn)

AUD/USD: $0.8275

AUD/JPY: Y100.00(A$510mn)

USD/CAD: C$1.1500($352mn), C$1.1600($352mn), C$1.1700 ($512mn)

-

13:30

U.S.: NY Fed Empire State manufacturing index , November -3.6 (forecast 12.1)

-

13:03

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom Rightmove House Price Index (MoM) December -1.7% -3.3%

00:01 United Kingdom Rightmove House Price Index (YoY) December +8.5% +7.0%

00:30 Australia New Motor Vehicle Sales (MoM) November -1.6% -0.6%

00:30 Australia New Motor Vehicle Sales (YoY) November -0.5% -3.8%

08:15 Switzerland Producer & Import Prices, m/m November -0.1% +0.2% -0.7%

08:15 Switzerland Producer & Import Prices, y/y November -1.1% -1.6%

11:00 United Kingdom CBI industrial order books balance December 3 3 5

11:00 Germany Bundesbank Monthly Report

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The U.S. industrial production is expected to rise 0.8% in November, after a 0.1% decrease in October.

The NAHB housing market index is expected to climb to 59 in December from 58 in November.

The greenback remained supported by Friday's better-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index. The index rose to 93.8 in December from a final reading of 88.8 in November, exceeding expectations for an increase to 89.6. That was the highest level since January 2007.

The euro traded higher against the U.S. dollar. Germany's Bundesbank released its monthly report. Bundesbank said that if oil prices continue to decline, it will cut its inflation forecast for 2015 by 0.4%. Bundesbank expects inflation of 1.1% in 2015.

The British pound fell against the U.S. dollar despite the better-than-expected industrial order books balance. The CBI industrial order books balance climbed to +5% in December from +3% in November. That was the highest level since August. Analysts expected the CBI industrial order books balance to remain unchanged at +3%.

The Swiss franc traded lower against the U.S. dollar. Switzerland's producer and import prices declined 0.7% in November, missing forecasts of a 0.2% rise, after a 0.1% fall in October.

On a yearly basis, producer and import prices decreased 1.6% in November, after a 1.1% drop in October.

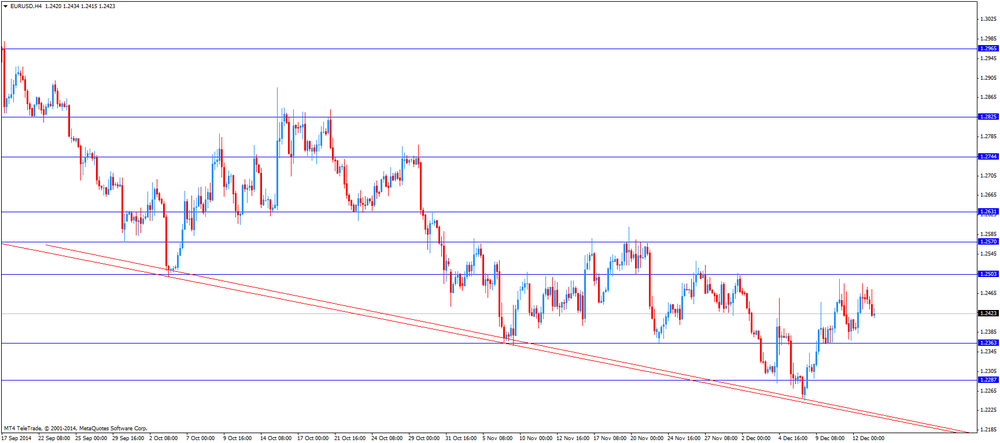

EUR/USD: the currency pair fell to $1.2415

GBP/USD: the currency pair decreased to $1.5658

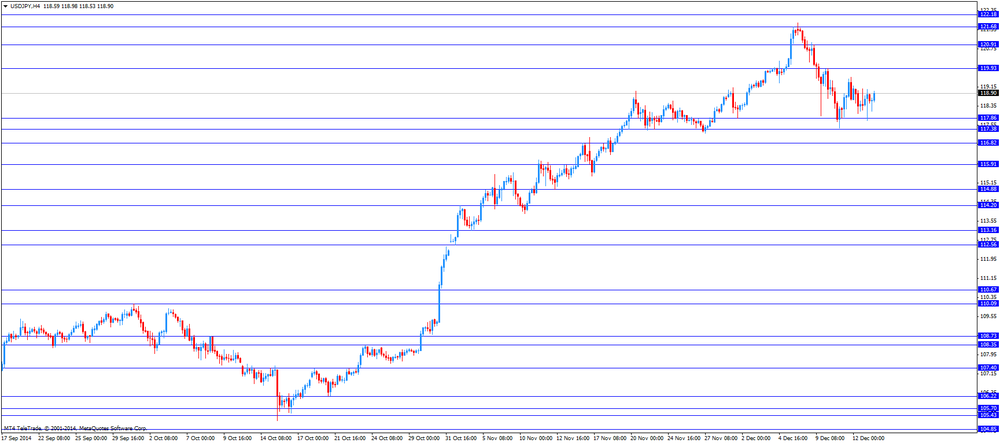

USD/JPY: the currency pair rose to Y118.98

The most important news that are expected (GMT0):

13:30 U.S. NY Fed Empire State manufacturing index November 10.2 12.1

14:15 U.S. Industrial Production (MoM) November -0.1% +0.8%

14:15 U.S. Capacity Utilization November 78.9% 79.4%

15:00 U.S. NAHB Housing Market Index December 58 59

21:00 U.S. Net Long-term TIC Flows October 164.3 72.8

21:00 U.S. Total Net TIC Flows October -55.6

-

13:00

Orders

EUR/USD

Offers $1.2500

Bids $1.2355/50

GBP/USD

Offers $1.5850, $1.5800, $1.5780/85, $1.5760/65

Bids $1.5610/00, $1.5520

AUD/USD

Offers $0.8390/00, $0.8375/80, $0.8350, $0.8300

Bids $0.8220, $0.8200, $0.8180, $0.8150

EUR/JPY

Offers Y149.50, Y149.00, Y148.50, Y147.80/00

Bids Y147.00, Y146.85/80, Y146.50, Y146.00

USD/JPY

Offers Y119.50/60, Y119.25, Y119.00

Bids Y118.00, Y117.50

EUR/GBP

Offers stg0.8020, stg0.8000, stg0.7980

Bids stg0.7800

-

12:43

CBI industrial order books balance jumped to +3% in December

The Confederation of British Industry (CBI) released its industrial order books balance. The CBI industrial order books balance climbed to +5% in December from +3% in November. That was the highest level since August.

Analysts expected the CBI industrial order books balance to remain unchanged at +3%.

The CBI's director for economics Rain Newton-Smith said that export products have improved and the growth of output is expected.

-

11:00

United Kingdom: CBI industrial order books balance, December 5 (forecast 3)

-

10:25

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E1.2bn), $1.2400(E1.5bn), $1.2450(E730mn), $1.2500(E3.0bn)

USD/JPY: Y117.50($754mn), Y118.80($1.0bn), Y120.00($665mn), Y121.00($1.1bn)

GBP/USD: $1.6000(stg304mn)

EUR/GBP: stg0.7875

USD/CHF: Chf0.9635-40($315mn)

AUD/USD: $0.8275

AUD/JPY: Y100.00(A$510mn)

USD/CAD: C$1.1500($352mn), C$1.1600($352mn), C$1.1700 ($512mn)

-

09:20

Press Review: Abe coalition secures big Japan election win with record low turnout

REUTERS

Abe coalition secures big Japan election win with record low turnout

TOKYO, Dec 15 (Reuters) - Japanese Prime Minister Shinzo Abe, brushing aside suggestions that a low turnout tarnished his coalition's election win, vowed on Monday to stick to his reflationary economic policies, tackle painful structural reforms and pursue his muscular security stance.

But doubts persist as to whether Abe, who now has a shot to become a rare long-lasting leader in Japan, can engineer sustainable growth with his "Abenomics" recipe of hyper-easy monetary policy, government spending and promises of deregulation.

Source: http://www.reuters.com/article/2014/12/15/japan-election-idUSL3N0TY0D220141215

BLOOMBERG

Draghi's QE Battle Almost Won as Economists See Action

The battle over whether to start quantitative easing in the euro region is all but won, economists say.

More than 90 percent of respondents in Bloomberg's monthly survey predict the Bank will begin large-scale buying of government bonds next year, up from 57 percent last month. An announcement will most likely come in the first quarter, with any decision taken against the objections of some policy makers, the poll of 55 economists showed.

Source: http://www.bloomberg.com/news/2014-12-15/draghi-s-qe-battle-almost-won-as-economists-see-action.html

BLOOMBERG

Hedge Funds' Bullish Gold Bets Defy Goldman Outlook: Commodities

Hedge Funds are the most bullish on gold since August, defying Goldman Sachs Group Inc.'s prediction that the rally in prices will fade.

The net-long position in New York futures and options climbed for a fourth week, the longest stretch of increases since July, government data show. Futures jumped 2.7 percent last week, the most since June, as a plunge in global equities erased about $2 trillion from the value of stocks.

-

08:15

Switzerland: Producer & Import Prices, m/m, November -0.7% (forecast +0.2%)

-

08:15

Switzerland: Producer & Import Prices, y/y, November -1.6%

-

07:30

Foreign exchange market. Asian session: the greenback trading steady to weaker

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom Rightmove House Price Index (MoM) December -1.7% -3.3%

00:01 United Kingdom Rightmove House Price Index (YoY) December +8.5% +7.0%

00:30 Australia New Motor Vehicle Sales (MoM) November -1.6% -0.6%

00:30 Australia New Motor Vehicle Sales (YoY) November -0.5% -3.8%

The greenback traded mixed to weaker against its major peers after its recent gains. Markets await data on the Industrial Production, Capcity Utilisation and the NAHB Housing Market index later in the day and the FED's interest rate decision on Wednesday.

The Australian dollar recovered from early losses trading at the lowest since June 2010 after commodities slumped and a hostage situation in a café in Sydney's financial district where a black flag with Arabic writing was placed in a window. New Motor Vehicle Sales in November declined -0.6%, with a reading for October of -1.6%. Data for the whole year showed a decline of -3.8%.

New Zealand's dollar further declined after its recent rally against the U.S. dollar. Markets are looking forward to the release of the GDP data on Wednesday.

The Japanese yen rose against in the U.S. dollar after Prime Minister Shinzo Abe led his ruling coalitition to a landslide victory at this weekend's snap elections securing a two-third majority of the lower house of parliament now controlling 325 of the 475 seats. The outcome of the elections backs up Prime Minister Abe's "Abenomics", his structural reforms and monetary and fiscal stimulus which are likely to weigh on the yen in the long term. Yesterday BoJ Tankan. Manufacturing Index declined from 13 to a reading of 12 whereas the BoJ Tankan. Non-Manufacturing Index climbed from 13 to 16 giving a mixed picture.

EUR/USD: the euro added against the greenback

USD/JPY: the U.S. dollar traded weaker against the yen

GPB/USD: The British pound traded stronger against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Producer & Import Prices, m/m November -0.1% +0.2%

08:15 Switzerland Producer & Import Prices, y/y November -1.1%

11:00 United Kingdom CBI industrial order books balance December 3 3

11:00 Germany Bundesbank Monthly Report

13:30 U.S. NY Fed Empire State manufacturing index November 10.2 12.1

14:15 U.S. Industrial Production (MoM) November -0.1% +0.8%

14:15 U.S. Capacity Utilization November 78.9% 79.4%

15:00 U.S. NAHB Housing Market Index December 58 59

21:00 U.S. Net Long-term TIC Flows October 164.3 72.8

21:00 U.S. Total Net TIC Flows October -55.6

-

06:16

Options levels on monday, December 15, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2575 (3240)

$1.2534 (1746)

$1.2506 (356)

Price at time of writing this review: $ 1.2442

Support levels (open interest**, contracts):

$1.2398 (762)

$1.2359 (1631)

$1.2334 (1954)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 48563 contracts, with the maximum number of contracts with strike price $1,2500 (7175);

- Overall open interest on the PUT options with the expiration date January, 9 is 55248 contracts, with the maximum number of contracts with strike price $1,2000 (7761);

- The ratio of PUT/CALL was 1.14 versus 1.14 from the previous trading day according to data from December, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.6002 (1915)

$1.5904 (1635)

$1.5807 (1562)

Price at time of writing this review: $1.5725

Support levels (open interest**, contracts):

$1.5689 (1333)

$1.5593 (1011)

$1.5495 (963)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 18307 contracts, with the maximum number of contracts with strike price $1,5850 (2012);

- Overall open interest on the PUT options with the expiration date January, 9 is 17670 contracts, with the maximum number of contracts with strike price $1,5200 (1699);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from December, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:33

Australia: New Motor Vehicle Sales (YoY) , November -3.8%

-

00:32

Australia: New Motor Vehicle Sales (MoM) , November -0.6%

-

00:05

United Kingdom: Rightmove House Price Index (YoY), December +7.0%

-

00:01

United Kingdom: Rightmove House Price Index (MoM), December -3.3%

-