Notícias do Mercado

-

16:57

Foreign exchange market. American session: the Canadian dollar traded slightly higher against the U.S. dollar after the Bank of Canada's interest rate decision

The U.S. dollar traded higher against the most major currencies. The U.S. currency remained supported by yesterday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The U.S. producer price index rose 0.4% in June, exceeding expectations for a 0.2% increase, after a 0.2% decline in May.

On a yearly basis, producer prices climbed 1.9%, beating forecasts of a 1.8% rise, after a 2.0% gain in May.

Producer price index excluding food and energy climbed 0.2% in June, missing expectations for a 0.3% gain, after a 0.1 fall in May.

On a yearly basis, the PPI excluding food and energy gained 1.8%, exceeding expectations for a 1.7% rise, after 2.0% increase May.

Net foreign purchases of long-term securities rose to $19.4 billion in May, missing expectations for an increase to $27.4 billion, after net sales of $41.2 billion in April. April's figure was revised down from net sales of $24.2 billion.

Industrial production in the U.S. climbed 0.2% in June, missing forecasts of a 0.4% gain, after a 0.5% rise in May. May's figure was revised down from a 0.6% increase.

The NAHB housing market index increased to 53 in July from 49 in June, beating expectations for a rise to 51.

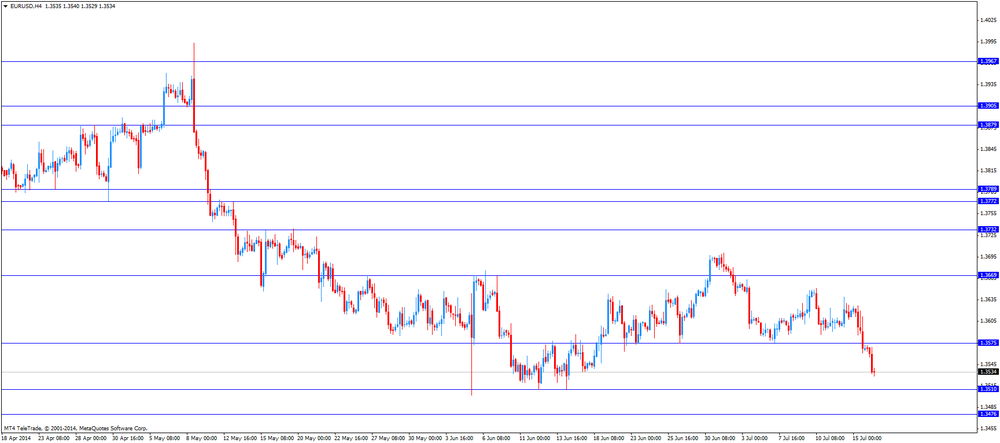

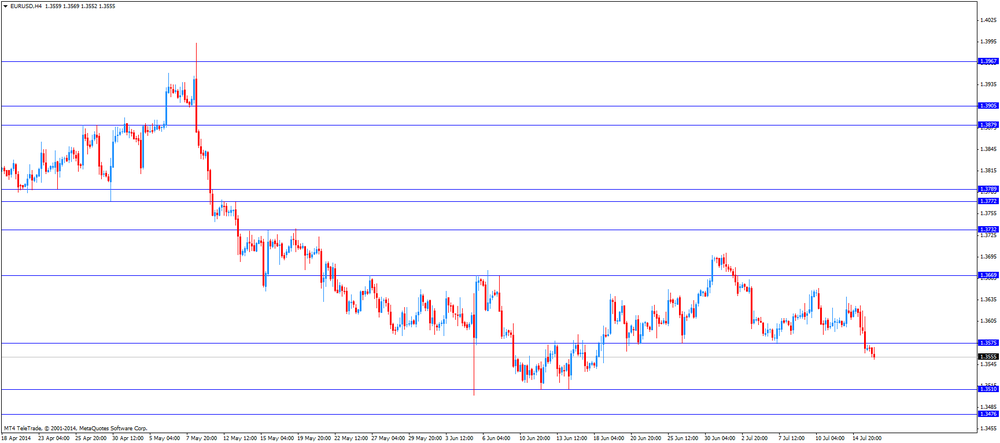

The euro traded lower against the U.S. dollar after the weaker-than-expected trade data from the Eurozone. Eurozone's trade balance surplus rose to €15.3 billion in May from €15.2 billion in April, missing expectations for an increase to €16.3 billion. April's figure was revised down from a surplus of €15.8 billion.

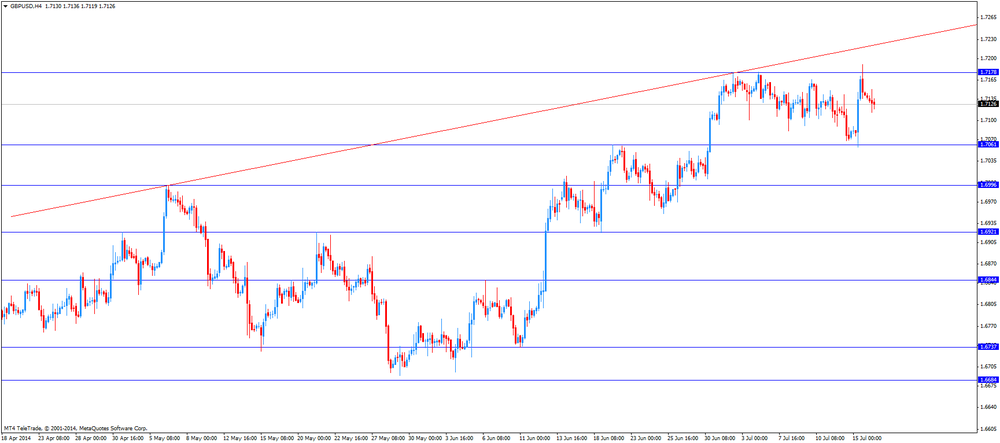

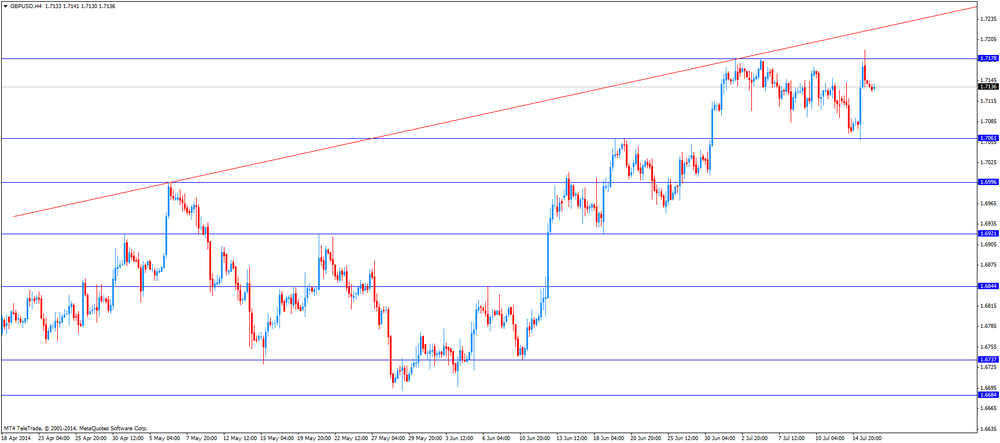

The British pound traded mixed against the U.S. dollar despite the better-than-expected labour market data from UK. The unemployment rate in the UK decreased to 6.5% in the three months to May, from 6.6% in the previous three months. That was the lowest level since October to December 2008.

Analysts had expected the unemployment rate to remain unchanged at 6.5%.

The number of people claiming unemployment benefit dropped by 36,300 in June, exceeding expectations for a decline by 27,100, after, after a fall by 27,400 in May.

These strong figures could mean that the Bank of England will hike its interest rate sooner than expected, perhaps before the end of the year.

But there is a problem. The growth in real wages remains weak. Average weekly earnings, excluding bonuses, increased by an annual 0.7% in the three months to May, after a 0.9% rise in the previous three months. That was the slowest growth since records began in 2001. Inflation over the same period was 1.6%.

Average weekly earnings, including bonuses, rose by an annual 0.3% in the three months to May, after a revised 0.8% rise in the previous three months.

The Swiss franc traded lower against the U.S. dollar after the weaker-than-expected ZEW/ Credit Suisse index for economic expectations. The ZEW/ Credit Suisse index for economic expectations in Switzerland declined to 0.1 in July from 4.8 in June.

The Canadian dollar traded slightly higher against the U.S. dollar after the Bank of Canada's interest rate decision. The BoC kept unchanged its interest rate at 1.00%. Canada's central bank said consumer inflation increased sooner than expected, caused by higher energy and import prices. The BoC added that it is is neutral with respect to the timing and direction of the next change to the interest rate.

Canadian manufacturing shipments gained 1.6% in May, beating forecasts of 0.4% rise, after a 0.2% decline in April. April' s figure was revised down from a 0.1% decrease.

The New Zealand dollar dropped against the U.S dollar due to the weaker-than-expected inflation data from New Zealand and yesterday's comments by the Fed Chair Janet Yellen, but later recovered a part of its losses. New Zealand's consumer price index increased 0.3% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the previous quarter.

On a yearly basis, the consumer price index in New Zealand rose 1.6% in the second quarter, after a 1.5% increase in the previous quarter.

The Australian dollar declined against the U.S. dollar due to yesterday's comments by the Fed Chair Janet Yellen, but later recovered a part of its losses. The leading index for Australia released by Westpac and the Melbourne Institute climbed 0.1% in June, after a 0.1% rise in the previous month.

Some better-than-expected economic data from China hadn't any positive impact on the Australian and New Zealand dollar. China's gross domestic product rose 7.5% in the second quarter, exceeding expectations for a 7.4% increase, after a 7.4% in the previous quarter.

Industrial production in China climbed 9.2% in June, beating forecasts for a 9.0% rise, after a 8.8% gain in May.

Fixed asset investment in China rose 17.3% in June period, exceeding expectations for a 17.2% gain, after a 17.2% increase in May.

Retail sales in China gained 12.4% in June, after 12.5% rise in May.

The Japanese yen traded mixed against the U.S. dollar dollar due to yesterday's comments by the Fed Chair Janet Yellen. The Bank of Japan (BoJ) said in its monthly report on Wednesday that Japan's economy has continued to recover moderately. The BoJ also said that Japan's output gap was 0.6% in January-March, turning positive for the first time since Q2 2008.

-

16:37

Bank of Canada kept its interest rate unchanged at 1.00%

The Bank of Canada (BoC) released its interest rate decision today:

- The BoC kept its interest rate unchanged at 1.00%;

- Consumer inflation increased to around 2%, sooner than expected;

- Core inflation also increased but remains below 2%;

- The pace of inflation has been caused by higher energy and import prices;

- The central bank lowered its GDP growth forecasts to 2.2 and 2.4 per cent, this year and next;

- The BoC expects Canada's economy to return to full capacity full capacity around mid-2016;

- The central bank is neutral with respect to the timing and direction of the next change to the interest rate.

- The BoC kept its interest rate unchanged at 1.00%;

-

15:30

U.S.: Crude Oil Inventories, July -7.5

-

15:17

U.S. producer prices increased higher than expected in June

The U.S. Labor Department released producer prices on Wednesday. The U.S. producer price index rose 0.4% in June, exceeding expectations for a 0.2% increase, after a 0.2% decline in May.

On a yearly basis, producer prices climbed 1.9%, beating forecasts of a 1.8% rise, after a 2.0% gain in May.

Food prices dropped 0.2%. That was a second straight month decline. Gasoline prices rose 6.4%. That was the largest increase since September 2012.

Producer price index excluding food and energy climbed 0.2% in June, missing expectations for a 0.3% gain, after a 0.1 fall in May.

On a yearly basis, the PPI excluding food and energy gained 1.8%, exceeding expectations for a 1.7% rise, after 2.0% increase May.

-

15:00

Canada: Bank of Canada Rate, 1.00% (forecast 1.00%)

-

15:00

U.S.: NAHB Housing Market Index, July 53 (forecast 51)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3570, $1.3600, $1.3620/30

USD/JPY Y101.00, Y101.30, Y101.80/90

AUD/USD $0.9350, $0.9395

GBP/USD $1.7025, $1.7050, $1.7075, $1.7100/05

EUR/GBP Stg0.7915

USD/CAD C$1.0700, C$1.0725/30

NZD/USD $0.8660

EUR/CHF Chf1.2125

-

14:15

U.S.: Industrial Production (MoM), June +0.2% (forecast +0.4%)

-

14:15

U.S.: Capacity Utilization, June 79.1% (forecast 79.4%)

-

14:01

U.S.: Total Net TIC Flows, May 35.5

-

14:00

U.S.: Net Long-term TIC Flows , May 19.4 (forecast 27.4)

-

13:31

Canada: Manufacturing Shipments (MoM), May +1.6% (forecast +0.4%)

-

13:30

U.S.: PPI, m/m, June +0.4% (forecast +0.2%)

-

13:30

U.S.: PPI excluding food and energy, m/m, June +0.1% (forecast +0.3%)

-

13:30

U.S.: PPI, y/y, June +1.9% (forecast +1.8%)

-

13:30

U.S.: PPI excluding food and energy, Y/Y, June +1.8% (forecast +1.7%)

-

13:03

Foreign exchange market. European session: the Swiss franc dropped against the U.S. dollar after the weaker-than-expected ZEW/ Credit Suisse index for economic expectations

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index May +0.1% +0.1%

02:00 China Retail Sales y/y June +12.5% +12.4%

02:00 China Industrial Production y/y June +8.8% +9.0% +9.2%

02:00 China Fixed Asset Investment June +17.2% +17.2% +17.3%

02:00 China GDP y/y Quarter II +7.4% +7.4% +7.5%

05:00 Japan BoJ monthly economic report July

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9% +0.7%

08:30 United Kingdom Average Earnings, 3m/y May +0.7% +0.7% +0.3%

08:30 United Kingdom Claimant count June -27.4 -27.1 -36.3

08:30 United Kingdom Claimant Count Rate June 3.2% 3.2% 3.1%

08:30 United Kingdom ILO Unemployment Rate May 6.6% 6.6% 6.5%

09:00 Eurozone Trade Balance s.a. May 15.8 16.3 15.3

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 4.8 0.1

The U.S. dollar traded higher against the most major currencies. The U.S. currency remained supported by yesterday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The Fed Chair Yellen will testifiy before the House Financial Services Committee today.

The euro fell against the U.S. dollar after the weaker-than-expected trade data from the Eurozone. Eurozone's trade balance surplus rose to €15.3 billion in May from €15.2 billion in April, missing expectations for an increase to €16.3 billion. April's figure was revised down from a surplus of €15.8 billion.

The British pound traded lower against the U.S. dollar despite the better-than-expected labour market data from UK. The unemployment rate in the UK decreased to 6.5% in the three months to May, from 6.6% in the previous three months. That was the lowest level since October to December 2008.

Analysts had expected the unemployment rate to remain unchanged at 6.5%.

The number of people claiming unemployment benefit dropped by 36,300 in June, exceeding expectations for a decline by 27,100, after, after a fall by 27,400 in May.

These strong figures could mean that the Bank of England will hike its interest rate sooner than expected, perhaps before the end of the year.

But there is a problem. The growth in real wages remains weak. Average weekly earnings, excluding bonuses, increased by an annual 0.7% in the three months to May, after a 0.9% rise in the previous three months. That was the slowest growth since records began in 2001. Inflation over the same period was 1.6%.

Average weekly earnings, including bonuses, rose by an annual 0.3% in the three months to May, after a revised 0.8% rise in the previous three months.

The Swiss franc dropped against the U.S. dollar after the weaker-than-expected ZEW/ Credit Suisse index for economic expectations. The ZEW/ Credit Suisse index for economic expectations in Switzerland declined to 0.1 in July from 4.8 in June.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Bank of Canada's interest rate decision. Analysts expect the BoC will keep unchanged its interest rate at 1.00%.

EUR/USD: the currency pair declined to $1.3529

GBP/USD: the currency pair decreased to $1.7113

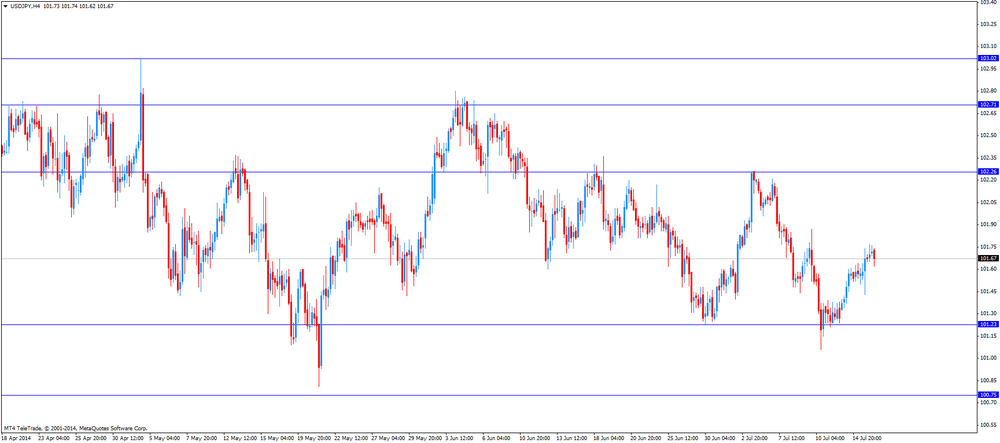

USD/JPY: the currency pair climbed to Y101.79

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) May -0.1% +0.4%

12:30 U.S. PPI, m/m June -0.2% +0.2%

12:30 U.S. PPI, y/y June +2.0% +1.8%

12:30 U.S. PPI excluding food and energy, m/m June -0.1% +0.3%

12:30 U.S. PPI excluding food and energy, Y/Y June +2.0% +1.7%

13:00 U.S. Net Long-term TIC Flows May -24.2 27.4

13:00 U.S. Total Net TIC Flows May 136.8

13:15 U.S. Industrial Production (MoM) June +0.6% +0.4%

13:15 U.S. Capacity Utilization June 79.1% 79.4%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Federal Reserve Chair Janet Yellen Testifies

14:00 U.S. NAHB Housing Market Index July 49 51

15:15 Canada BOC Press Conference

16:00 U.S. FOMC Member Richard Fisher Speaks

18:00 U.S. Fed's Beige Book July

-

13:00

Orders

EUR/USD

Offers $1.3640, $1.3590/600

Bids $1.3520, $1.3500, $1.3485/80

GBP/USD

Offers $1.7200

Bids $1.7055, $1.7040/30

AUD/USD

Offers $0.9450, $0.9420, $0.9400

Bids $0.9320, $0.9300, $0.9250

EUR/JPY

Offers Y138.80, Y138.50, Y138.20, Y137.95/00

Bids Y137.50, Y137.20, Y137.00, Y136.50

USD/JPY

Offers Y102.20, Y102.00, Y101.80

Bids Y101.50, Y101.20, Y101.00, Y100.80

EUR/GBP

Offers stg0.8000, stg0.7980/85

Bids stg0.7890, stg0.7880, stg0.7850

-

11:12

UK unemployment is at the lowest level since 2008

The Office for National Statistics in the UK released the labour market data. The unemployment rate in the UK decreased to 6.5% in the three months to May, from 6.6% in the previous three months. That was the lowest level since October to December 2008.

Analysts had expected the unemployment rate to remain unchanged at 6.5%.

The number of people claiming unemployment benefit dropped by 36,300 in June, exceeding expectations for a decline by 27,100, after, after a fall by 27,400 in May.

These strong figures could mean that the Bank of England will hike its interest rate sooner than expected, perhaps before the end of the year.

But there is a problem. The growth in real wages remains weak. Average weekly earnings, excluding bonuses, increased by an annual 0.7% in the three months to May, after a 0.9% rise in the previous three months. That was the slowest growth since records began in 2001. Inflation over the same period was 1.6%.

Average weekly earnings, including bonuses, rose by an annual 0.3% in the three months to May, after a revised 0.8% rise in the previous three months.

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3570, $1.3600, $1.3620/30

USD/JPY Y101.00, Y101.30, Y101.80/90

AUD/USD $0.9350, $0.9395

GBP/USD $1.7025, $1.7050, $1.7075, $1.7100/05

EUR/GBP Stg0.7915

USD/CAD C$1.0700, C$1.0725/30

NZD/USD NZ$0.8660

EUR/CHF Chf1.2125

-

10:17

Foreign exchange market. Asian session: the New Zealand dollar dropped against the U.S dollar due to the weaker-than-expected inflation data from New Zealand and yesterday’s comments by the Fed Chair Janet Yellen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index May +0.1% +0.1%

02:00 China Retail Sales y/y June +12.5% +12.4%

02:00 China Industrial Production y/y June +8.8% +9.0% +9.2%

02:00 China Fixed Asset Investment June +17.2% +17.2% +17.3%

02:00 China GDP y/y Quarter II +7.4% +7.4% +7.5%

05:00 Japan BoJ monthly economic report July

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9% +0.7%

08:30 United Kingdom Average Earnings, 3m/y May +0.7% +0.7% +0.3%

08:30 United Kingdom Claimant count June -27.4 -27.1 -36.3

08:30 United Kingdom Claimant Count Rate June 3.2% 3.2% 3.1%

08:30 United Kingdom ILO Unemployment Rate May 6.6% 6.6% 6.5%

09:00 Eurozone Trade Balance s.a. May 15.8 16.3 15.3

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 4.8 0.1

The U.S. dollar traded higher against the most major currencies due to yesterday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The Fed Chair Yellen will testifiy before the House Financial Services Committee today.

The New Zealand dollar dropped against the U.S dollar due to the weaker-than-expected inflation data from New Zealand and yesterday's comments by the Fed Chair Janet Yellen. New Zealand's consumer price index increased 0.3% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the previous quarter.

On a yearly basis, the consumer price index in New Zealand rose 1.6% in the second quarter, after a 1.5% increase in the previous quarter.

The Australian dollar declined against the U.S. dollar due to yesterday's comments by the Fed Chair Janet Yellen. The leading index for Australia released by Westpac and the Melbourne Institute climbed 0.1% in June, after a 0.1% rise in the previous month.

Some better-than-expected economic data from China hadn't any positive impact on the Australian and New Zealand dollar. China's gross domestic product rose 7.5% in the second quarter, exceeding expectations for a 7.4% increase, after a 7.4% in the previous quarter.

Industrial production in China climbed 9.2% in June, beating forecasts for a 9.0% rise, after a 8.8% gain in May.

Fixed asset investment in China rose 17.3% in June period, exceeding expectations for a 17.2% gain, after a 17.2% increase in May.

Retail sales in China gained 12.4% in June, after 12.5% rise in May.

The Japanese yen traded lower against the U.S. dollar dollar due to yesterday's comments by the Fed Chair Janet Yellen. The Bank of Japan (BoJ) said in its monthly report on Wednesday that Japan's economy has continued to recover moderately. The BoJ also said that Japan's output gap was 0.6% in January-March, turning positive for the first time since Q2 2008.

EUR/USD: the currency pair declined to $1.3560

GBP/USD: the currency pair decreased to $1.7135

USD/JPY: the currency pair rose to Y101.80

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) May -0.1% +0.4%

12:30 U.S. PPI, m/m June -0.2% +0.2%

12:30 U.S. PPI, y/y June +2.0% +1.8%

12:30 U.S. PPI excluding food and energy, m/m June -0.1% +0.3%

12:30 U.S. PPI excluding food and energy, Y/Y June +2.0% +1.7%

13:00 U.S. Net Long-term TIC Flows May -24.2 27.4

13:00 U.S. Total Net TIC Flows May 136.8

13:15 U.S. Industrial Production (MoM) June +0.6% +0.4%

13:15 U.S. Capacity Utilization June 79.1% 79.4%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Federal Reserve Chair Janet Yellen Testifies

14:00 U.S. NAHB Housing Market Index July 49 51

15:15 Canada BOC Press Conference

16:00 U.S. FOMC Member Richard Fisher Speaks

18:00 U.S. Fed's Beige Book July

-

10:00

Switzerland: Credit Suisse ZEW Survey (Expectations), July 0.1

-

10:00

Eurozone: Trade Balance s.a., May 15.3 (forecast 16.3)

-

09:31

United Kingdom: ILO Unemployment Rate, May 6.5% (forecast 6.6%)

-

09:31

United Kingdom: Claimant Count Rate, June 3.1% (forecast 3.2%)

-

09:31

United Kingdom: Average earnings ex bonuses, 3 m/y, May +0.7%

-

09:31

United Kingdom: Average Earnings, 3m/y , May +0.3% (forecast +0.7%)

-

09:30

United Kingdom: Claimant count , June -36.3 (forecast -27.1)

-

06:30

Options levels on wednesday, July 16, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3648 (2866)

$1.3624 (632)

$1.3694 (77)

Price at time of writing this review: $ 1.3559

Support levels (open interest**, contracts):

$1.3542 (4005)

$1.3497 (2624)

$1.3464 (7848)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 24722 contracts, with the maximum number of contracts with strike price $1,3800 (3700);

- Overall open interest on the PUT options with the expiration date August, 8 is 33597 contracts, with the maximum number of contracts with strike price $1,3500 (7848);

- The ratio of PUT/CALL was 1.36 versus 1.35 from the previous trading day according to data from July, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.7401 (1015)

$1.7303 (1277)

$1.7206 (1454)

Price at time of writing this review: $1.7123

Support levels (open interest**, contracts):

$1.7093 (2021)

$1.6996 (2276)

$1.6898 (1995)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15929 contracts, with the maximum number of contracts with strike price $1,7250 (2196);

- Overall open interest on the PUT options with the expiration date August, 8 is 21684 contracts, with the maximum number of contracts with strike price $1,7000 (2276);

- The ratio of PUT/CALL was 1.36 versus 1.33 from the previous trading day according to data from Jule, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:02

China: Industrial Production y/y, June +9,2% (forecast +9.0%)

-

03:01

China: Retail Sales y/y, June +12.4%

-

03:01

China: Fixed Asset Investment, June +17.3% (forecast +17.2%)

-

03:00

China: GDP y/y, Quarter II +7.5% (forecast +7.4%)

-

01:30

Australia: Leading Index, May +0.1%

-

01:25

Currencies. Daily history for Jule 15'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3567 -0,39%

GBP/USD $1,7141 +0,32%

USD/CHF Chf0,8956 +0,42%

USD/JPY Y101,68 +0,14%

EUR/JPY Y137,95 -0,25%

GBP/JPY Y174,28 +0,48%

AUD/USD $0,9367 -0,26%

NZD/USD $0,8761 -0,48%

USD/CAD C$1,0755 +0,42%

-

01:01

Schedule for today, Wednesday, Jule 16’2014:

(time / country / index / period / previous value / forecast)

01:45 New Zealand CPI, q/q Quarter II +0.3% +0.5%

01:45 New Zealand CPI, y/y Quarter II +1.5%

03:30 Australia Leading Index May +0.1%

05:00 China Retail Sales y/y June +12.5% +12.5%

05:00 China Industrial Production y/y June +8.8% +9.0%

05:00 China Fixed Asset Investment June +17.2% +17.2%

05:00 China GDP y/y Quarter II +7.4% +7.4%

08:00 Japan BoJ monthly economic report July

11:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9%

11:30 United Kingdom Average Earnings, 3m/y May +0.7% +0.7%

11:30 United Kingdom Claimant count June -27.4 -27.1

11:30 United Kingdom Claimant Count Rate June 3.2% 3.2%

11:30 United Kingdom ILO Unemployment Rate May 6.6% 6.6%

12:00 Eurozone Trade Balance s.a. May 15.8 16.3

12:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 4.8

15:30 Canada Manufacturing Shipments (MoM) May -0.1% +0.4%

15:30 U.S. PPI, m/m June -0.2% +0.2%

15:30 U.S. PPI, y/y June +2.0% +1.8%

15:30 U.S. PPI excluding food and energy, m/m June -0.1% +0.3%

15:30 U.S. PPI excluding food and energy, Y/Y June +2.0% +1.7%

16:00 U.S. Net Long-term TIC Flows May -24.2 27.4

16:00 U.S. Total Net TIC Flows May 136.8

16:15 U.S. Industrial Production (MoM) June +0.6% +0.4%

16:15 U.S. Capacity Utilization June 79.1% 79.4%

17:00 Canada Bank of Canada Rate 1.00% 1.00%

17:00 Canada Bank of Canada Monetary Policy Report

17:00 Canada BOC Rate Statement

17:00 U.S. Federal Reserve Chair Janet Yellen Testifies

17:00 U.S. NAHB Housing Market Index July 49 51

17:30 U.S. Crude Oil Inventories July -2.4

18:15 Canada BOC Press Conference

19:00 U.S. FOMC Member Richard Fisher Speaks

21:00 U.S. Fed's Beige Book July

-