Notícias do Mercado

-

23:31

Schedule for today, Tuesday, Nov 18’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Meeting's Minutes

08:25 Australia RBA's Governor Glenn Stevens Speech

09:30 United Kingdom Retail Price Index, m/m October +0.2% +0.1%

09:30 United Kingdom Retail prices, Y/Y October +2.3% +2.3%

09:30 United Kingdom RPI-X, Y/Y October +2.3%

09:30 United Kingdom Producer Price Index - Input (MoM) October -0.6% -1.4%

09:30 United Kingdom Producer Price Index - Input (YoY) October -7.4% -8.3%

09:30 United Kingdom Producer Price Index - Output (MoM) October -0.1% -0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) October -0.4% -0.2%

09:30 United Kingdom HICP, m/m October 0.0% +0.1%

09:30 United Kingdom HICP, Y/Y October +1.2% +1.2%

09:30 United Kingdom HICP ex EFAT, Y/Y October +1.5% +1.6%

10:00 Eurozone ZEW Economic Sentiment November 4.1 4.3

10:00 Germany ZEW Survey - Economic Sentiment November -3.6 0.9

13:30 U.S. PPI, m/m October -0.1% -0.1%

13:30 U.S. PPI, y/y October +1.6% +1.3%

13:30 U.S. PPI excluding food and energy, m/m October 0.0% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y October +1.6% +1.5%

15:00 U.S. NAHB Housing Market Index November 54 55

18:30 U.S. FOMC Member Narayana Kocherlakota

21:00 U.S. Net Long-term TIC Flows September 52.1 41.3

21:00 U.S. Total Net TIC Flows November 74.5

21:30 U.S. API Crude Oil Inventories November -1.5

23:30 Australia Leading Index October -0.1%

-

23:00

Australia: Conference Board Australia Leading Index, September -0.3%

-

16:44

Foreign exchange market. American session: the U.S. dollar mixed against the most major currencies after the weaker-than-expected U.S. industrial production and NY Fed Empire State manufacturing index

The U.S. dollar mixed against the most major currencies after the weaker-than-expected U.S. industrial production and NY Fed Empire State manufacturing index. The U.S. industrial production declined 0.1% in October, missing expectations for a 0.2% rise, after a 0.8% gain in September. September's figure was revised down from a 1.0% increase.

The Fed said that the decrease was driven by a fall in output of consumer goods and materials.

Capacity utilisation rate fell to 78.9% in October from 79.2% in September. September's figure was revised down from 79.3%. Analysts had expected a capacity utilisation rate of 79.3%.

The NY Fed Empire State manufacturing index increased to 10.16 in October from 6.2 in September. Analysts had expected the index to rise to 12.1.

The euro fell against the U.S. dollar due to comments by the European Central Bank President Mario Draghi. The European Central Bank (ECB) President Mario Draghi was testifying to the European Union's Parliament on Monday. He pointed out that the ECB could purchase government bonds.

Draghi noted that governments need to implement structural reforms.

Bundesbank said in its monthly report that Germany's economic growth was likely to remain weak in the next few months.

Eurozone's trade surplus widened to €17.7 billion in September from €15.4 billion in August, exceeding expectations for a rise to €16.2 billion. August's figure was revised down from a surplus of €15.8 billion.

The British pound traded slightly higher against the U.S. dollar. The Rightmove house price index for the U.K. declined 1.7% in November, after a 2.6% gain in October.

The Canadian dollar traded slightly lower against the U.S. dollar after the weaker-than-expected foreign securities purchases from Canada. Foreign securities purchases in Canada rose by C$4.37 billion in September, missing expectations for a gain of C$11.32 billion, after a C$10.29 increase in August. August's figure was revised up from a C$10.28 billion rise.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi increased against the greenback after the solid retail sales from New Zealand, but lost all its gains in the morning trading session. Retail sales in New Zealand rose 1.50% in the third quarter, after a 1.1% gain in the second quarter. The second quarter' figure was revised down from a 1.2% increase.

Retail sales excluding automobiles climbed 1.4% in the third quarter, after a 1.2% gain in the second quarter.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback despite weak new motor vehicle sales. New motor vehicle sales in Australia fell 1.6% in October, after a 2.9% rise in September.

The Japanese yen traded lower against the U.S. dollar. Japan's gross domestic product dropped by an annual rate of 1.6% in the third quarter, after a 7.3% fall in the previous quarter. Analysts had expected a 2.1% gain.

Investors speculate that Japan's Prime Minister Shinzo Abe will announce this week a delay in the sales-tax increase.

-

16:15

Update: European Central Bank (ECB) President Mario Draghi said purchase of government bonds is possible

The European Central Bank (ECB) President Mario Draghi was testifying to the European Union's Parliament on Monday. He said that Eurozone's economic growth has slowed over the summer months.

Draghi pointed out that the ECB could purchase government bonds.

The ECB president also said that the central bank needs "to remain alert to possible downside risks to our outlook for inflation".

Draghi noted that governments need to implement structural reforms. He said that Greece is starting to benefit from its economic reforms. The economy in Greece was the fastest-growing economy in the Eurozone in the third quarter. It rose by a quarterly rate of 0.7%.

-

15:52

Philadelphia Federal Reserve cut its U.S. economic growth forecast for the fourth quarter

The Philadelphia Federal Reserve released its quarterly survey on Monday. It lowered its fourth quarter forecast for the U.S. economic growth to 2.7% from the previous estimate of 3.1%.

The full-year growth forecast for 2014 was increased to 2.2% from the previous estimate of 2.1 percent due to an improved outlook for the labour market.

The Philadelphia Federal Reserve cut its first-quarter 2015 growth forecast to 2.8% from the estimate of 3.1% in August's survey.

Inflation is expected to be 1.7% in the fourth quarter, down from the previous estimate of 2.1.

-

15:24

European Central Bank President Mario Draghi reiterated the central bank is willing to add further stimulus measures if needed

The European Central Bank (ECB) President Mario Draghi was testifying to the European Union's Parliament on Monday. He reiterated that the ECB is willing to add further stimulus measures if needed.

Draghi noted that the ECB's credit-easing were working.

-

15:09

U.S. industrial production declined 0.1% in October

The Federal Reserve released its industrial production report on Monday. The U.S. industrial production declined 0.1% in October, missing expectations for a 0.2% rise, after a 0.8% gain in September. September's figure was revised down from a 1.0% increase.

The Fed said that the decrease was driven by a fall in output of consumer goods and materials.

Motor vehicle output declined 1.2% in October. That was the third consecutive decline.

Capacity utilisation rate fell to 78.9% in October from 79.2% in September. September's figure was revised down from 79.3%. Analysts had expected a capacity utilisation rate of 79.3%.

-

14:15

U.S.: Industrial Production (MoM), October +0.2% (forecast +0.2%)

-

14:15

U.S.: Capacity Utilization, October 78.9% (forecast 79.3%)

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E1.2bn), $1.2475-85(E786mn), $1.2485/90(E500mn), $1.2500(E1.1bn), $1.2515/25 (E350mn)

USD/JPY: Y114.60($559mn), Y114.75($200mn), Y115.00 ($359mn), Y116.00($320mn), Y116.75($444mn)

AUD/USD: $0.8650(A$341mn), $0.8700(A$270mn), $0.8750(A$200mn

USD/CAD: C$1.1305($900mn)

-

13:30

Canada: Foreign Securities Purchases, September 4.37 (forecast 11.32)

-

13:30

U.S.: NY Fed Empire State manufacturing index , October 10.16 (forecast 12.1)

-

13:09

Foreign exchange market. European session: the euro traded lower against the U.S. dollar ahead of the speech by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom Rightmove House Price Index (MoM) November +2.6% -1.7%

00:01 United Kingdom Rightmove House Price Index (YoY) November +7.6% +8.5%

00:30 Australia New Motor Vehicle Sales (MoM) October +2.9% +1.6%

00:30 Australia New Motor Vehicle Sales (YoY) October +0.8% -0.5%

10:00 Eurozone Trade Balance s.a. September 15.4 16.2 17.7

10:00 Germany Bundesbank Monthly Report

The U.S. dollar rose against the most major currencies ahead of the U.S. industrial production and NY Fed Empire State manufacturing index. The greenback increased against the most major currencies as Japan's preliminary gross domestic product declined in the third quarter. Japan's gross domestic product dropped by an annual rate of 1.6% in the third quarter, after a 7.3% fall in the previous quarter. Analysts had expected a 2.1% gain.

The U.S. industrial production is expected to rise 0.2% in October, after a 1.0% increase in September.

The NY Fed Empire State manufacturing index is expected to climb to 12.1 in October from 6.2 in September.

The euro traded lower against the U.S. dollar ahead of the speech by the European Central Bank President Mario Draghi. Eurozone's trade surplus widened to €17.7 billion in September from €15.4 billion in August, exceeding expectations for a rise to €16.2 billion. August's figure was revised down from a surplus of €15.8 billion.

The British pound fell against the U.S. dollar. The Rightmove house price index for the U.K. declined 1.7% in November, after a 2.6% gain in October.

The Canadian dollar traded lower against the U.S. dollar ahead of foreign securities purchases from Canada. Foreign securities purchases in Canada are expected to rise by C$11.32 billion in September, after a C$10.28 increase in August.

EUR/USD: the currency pair fell to $1.2481

GBP/USD: the currency pair declined to $1.5618

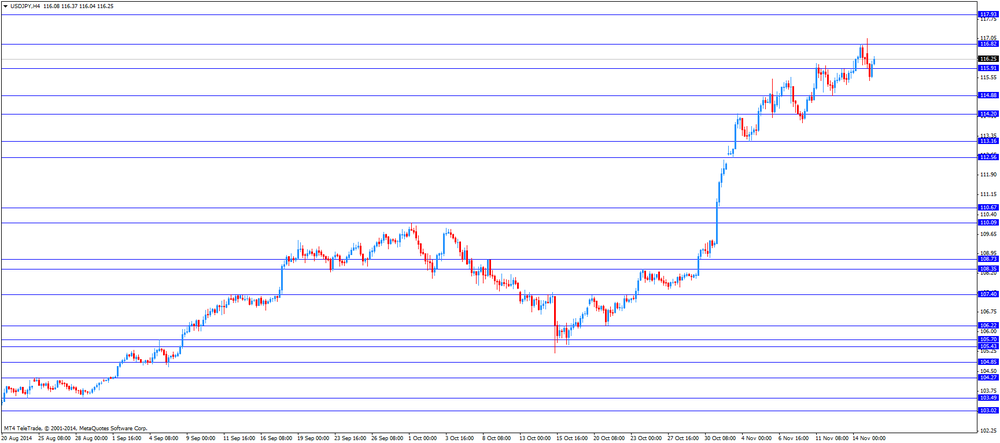

USD/JPY: the currency pair climbed to Y116.37

The most important news that are expected (GMT0):

13:30 Canada Foreign Securities Purchases September 10.28 11.32

13:30 U.S. NY Fed Empire State manufacturing index October 6.2 12.1

14:00 Eurozone ECB President Mario Draghi Speaks

14:15 U.S. Industrial Production (MoM) October +1.0% +0.2%

14:15 U.S. Capacity Utilization October 79.3% 79.3%

-

12:50

Orders

EUR/USD

Offers $1.2650, $1.2600/05, $1.2580, $1.2525/30

Bids $1.2480, $1.2450, $1.2420/00

GBP/USD

Offers $1.5780/85, $1.5745/50, $1.5700, $1.5665/70

Bids $1.5620/00, $1.5580, $1.5550, $1.5525/20, $1.5500

AUD/USD

Offers $0.8900, $0.8850, $0.8820, $0.8800

Bids $0.8700, $0.8650, $0.8620/00, $0.8550

EUR/JPY

Offers Y147.00, Y146.80, Y145.80/00, Y145.50

Bids Y144.55/50, Y144.20/00, Y143.55/50

USD/JPY

Offers Y117.50, Y117.25, Y116.50

Bids Y115.85/80, Y115.10/00, Y114.50

EUR/GBP

Offers stg0.8100, stg0.8066, stg0.8020

Bids stg0.7950, stg0.7900, stg0.7885/75, stg0.7860/50

-

10:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E1.2bn), $1.2475-85(E786mn), $1.2485/90(E500mn), $1.2500(E1.1bn), $1.2515/25 (E350mn)

USD/JPY: Y114.60($559mn), Y114.75($200mn), Y115.00 ($359mn), Y116.00($320mn), Y116.75($444mn)

AUD/USD: $0.8650(A$341mn), $0.8700(A$270mn), $0.8750(A$200mn

USD/CAD: C$1.1305($900mn)

-

10:02

Eurozone: Trade Balance s.a., September 17.7 (forecast 16.2)

-

09:25

Press Review: Kiwi in Mid-to-High 70s Sustainable for New Zealand

BLOOMBERG

English Says Kiwi in Mid-to-High 70s Sustainable for New Zealand

New Zealand Finance Minister Bill English said a U.S.-kiwi exchange rate in the "mid-to-high 70s" is sustainable for the economy as he seeks steady growth and moderate business cycles.

"We have that opportunity ahead of us over the next three or four years of 3 percent growth," English said in an interview with Bloomberg TV from the Group of 20 summit in Brisbane yesterday.

BLOOMBERG

Ruble Less Respected Than Rand as Volatility Hits Record

Russia's ruble is the most volatile relative to other currencies in at least nine years, hurting the country's already battered economy as the unprecedented price swings drive investors away.

One-month implied volatility on the ruble, which reflects traders' expectations for future swings in the exchange rate, reached 33 percent on Nov. 10, almost double that of Brazil's real, the second-most volatile among 41 major currencies tracked by Bloomberg.

REUTERS

Oil price drop could have perverse braking effect on economy

A falling oil price could hamper rather than aid economic recovery as lower export revenues for energy producers will mean fewer petrodollars propping up markets and keeping a lid on the cost of capital.

Research by BNP Paribas published this week found energy exporting countries are set to pull more money out of world markets than they put in for the first time in almost two decades.

Source: http://www.reuters.com/article/2014/11/07/global-economy-petrodollars-idUSL6N0SX4Q820141107

-

07:35

Foreign exchange market. Asian session: U.S. dollar trading lower in Asian Trade against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom Rightmove House Price Index (MoM) November +2.6% -1.7%

00:01 United Kingdom Rightmove House Price Index (YoY) November +7.6% +8.5%

00:30 Australia New Motor Vehicle Sales (MoM) October +2.9% +1.6%

00:30 Australia New Motor Vehicle Sales (YoY) October +0.8% -0.5%

The U.S. dollar traded weaker against its peers during Asian Trade. The greenback is trading flat against the euro after Friday's losses. The preliminary University of Michigan's consumer sentiment index published on Friday rose to 89.4 beating forecasts predicting 87.5 and data showing that U.S. inflation expectations fell.

The Australian dollar is currently trading flat against the U.S. dollar after recovering from early losses followed by gains in Friday's trading.

The kiwi is trading higher against the U.S. dollar after a volatile trading session on Friday and comments by Reserve Bank of New Zealand Governor Graeme Wheeler earlier in the week that the exchange rate is "unjustified" and "further increases in short term interest rates may be required".

The Japanese yen currently trading at USD115.67 recovered against the greenback after hitting a new seven-year low at USD 117.05. Preliminary data on the Japanese GDP showed that Japan unexpectedly fell into recession and the Nikkei declined. Preliminary GDP for the third quarter declined -1.5% compared with a forecast of +2.1% after losing -7.3% in the previous quarter reinforcing speculations that Prime Minister Abe will postpone a sales tax hike.

EUR/USD: the euro is trading flat against the U.S. dollar

USD/JPY: the U.S. dollar traded weaker against the Japanese yen after new seven-year highs

GPB/USD: The British pound traded stronger against the U.S. dollar

The most important news that are expected (GMT0):

10:00 Eurozone Trade Balance s.a. September 15.8 16.2

10:00 Germany Bundesbank Monthly Report

13:30 Canada Foreign Securities Purchases September 10.28 11.32

13:30 U.S. NY Fed Empire State manufacturing index October 6.2 12.1

14:00 Eurozone ECB President Mario Draghi Speaks

14:15 U.S. Industrial Production (MoM) October +1.0% +0.2%

14:15 U.S. Capacity Utilization October 79.3% 79.3%

23:00 Australia Conference Board Australia Leading Index September -0.2%

-

06:16

Options levels on monday, November 17, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2671 (4952)

$1.2618 (3595)

$1.2582 (580)

Price at time of writing this review: $ 1.2542

Support levels (open interest**, contracts):

$1.2489 (3636)

$1.2436 (2906)

$1.2380 (3377)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 99716 contracts, with the maximum number of contracts with strike pric $1,3000 (5307);

- Overall open interest on the PUT options with the expiration date December, 5 is 103587 contracts, with the maximum number of contracts with strike price $1,2500 (6415);

- The ratio of PUT/CALL was 1.04 versus 1.06 from the previous trading day according to data from November, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.6002 (1997)

$1.5903 (658)

$1.5806 (460)

Price at time of writing this review: $1.5717

Support levels (open interest**, contracts):

$1.5592 (1190)

$1.5495 (878)

$1.5397 (949)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 37314 contracts, with the maximum number of contracts with strike price $1,6000 (1997);

- Overall open interest on the PUT options with the expiration date December, 5 is 39638 contracts, with the maximum number of contracts with strike price $1,5900 (2341);

- The ratio of PUT/CALL was 1.06 versus 1.06 from the previous trading day according to data from November, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:31

Australia: New Motor Vehicle Sales (MoM) , October +1.6%

-

00:31

Australia: New Motor Vehicle Sales (YoY) , October -0.5%

-

00:01

United Kingdom: Rightmove House Price Index (YoY), November +8.5%

-

00:00

United Kingdom: Rightmove House Price Index (MoM), November -1.7%

-