Notícias do Mercado

-

23:30

Australia: Leading Index, October 0.0%

-

23:00

Schedule for today, Wednesday, Nov 19’2014:

(time / country / index / period / previous value / forecast)

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m September -0.1% +1.2%

06:30 Japan BOJ Press Conference

09:00 Eurozone Current account, adjusted, bln September 18.9 21.3

09:30 United Kingdom Bank of England Minutes

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) November -30.7

13:30 U.S. Building Permits, mln October 1.018 1.040

13:30 U.S. Housing Starts, mln October 1.017 1.025

15:30 U.S. Crude Oil Inventories November -1.7

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter III -1.0% +0.3%

21:45 New Zealand PPI Output (QoQ) Quarter III -0.5% +0.2%

23:50 Japan Adjusted Merchandise Trade Balance, bln October -1070.14 -1020.00

-

21:01

U.S.: Total Net TIC Flows, November -55.6

-

21:00

U.S.: Net Long-term TIC Flows , September 164.3 (forecast 41.3)

-

16:24

Foreign exchange market. American session: the U.S. dollar mixed against the most major currencies after the better-than-expected U.S. producer price index and the NAHB housing market index

The U.S. dollar mixed against the most major currencies after the better-than-expected U.S. producer price index and the NAHB housing market index. The U.S. producer price index rose 0.2% in October, beating expectations for a 0.1% fall, after a 0.1% decrease in September.

On a yearly basis, the producer price index increased 1.5% in October, exceeding expectations for a 1.3% gain, after a 1.6% rise in September.

The increase was driven by higher prices for services and food. Wholesale prices excluding food and energy climbed 0.4% in October, while the cost of services inched 0.5%.

The producer price index excluding food and energy was up 0.4% in October, beating forecasts of a 0.1% increase, after the flat reading in September.

On a yearly basis, the producer price index excluding food and energy climbed 1.8% in October, exceeding expectations for a 1.5% increase, after a 1.6% gain in September.

The NAHB housing market index rose to 58.0 in November from 54.0 in October, exceeding expectations for a rise to 55.0.

The euro rose against the U.S. dollar. Germany's ZEW economic sentiment index increased 15.1 in November from -3.6 in October, exceeding expectations for a rise to 0.9.

Eurozone's ZEW economic sentiment index climbed to 11.0 in October from 4.1 in September, beating expectations for a gain to 4.3.

The British pound traded mixed against the U.S. dollar after the mixed economic data from the U.K. The U.K. consumer price index rose to an annual rate of 1.3% in October from 1.2% in September. Analysts had expected the consumer price inflation to remain unchanged at 1.2%.

Consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at 1.5% in October, missing expectations for an increase to 1.6%.

The Bank of England's inflation target is about 2%.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi increased against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after the minutes from November's Reserve Bank of Australia (RBA) monetary policy meeting. The RBA said that Australia's economy has grown at a moderate pace. The central bank added that gross domestic product growth will be below trend over 2014/15, but will pick up towards the end of 2016.

The RBA Governor Glenn Stevens said in today's speech that Australia's economy has spare capacity and interest rates are likely to stay at record lows for some time to support growth as inflation is contained.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

Japan's Prime Minister Shinzo Abe announced a delay in the sales-tax increase for 18 months on Tuesday, and called a snap election to take place next month.

-

16:10

November’s Reserve Bank of Australia monetary policy meeting: GDP growth will be below trend over 2014/15

The Reserve Bank of Australia (RBA) released its minutes from November's monetary policy meeting. The RBA said that Australia's economy has grown at a moderate pace. The central bank added that gross domestic product growth will be below trend over 2014/15, but will pick up towards the end of 2016.

The RBA noted that "very low interest rates continued to support activity in the housing market".

Australia's central bank pointed out that "the most prudent course was likely to be a period of stability in interest rates".

-

15:57

NAHB housing market index rose to 58.0 in November

The National Association of Home Builders (NAHB) released its housing market index for the U.S. today. The NAHB housing market index rose to 58.0 in November from 54.0 in October, exceeding expectations for a rise to 55.0.

A level above 50.0 is considered positive, below indicates a negative outlook.

The NAHB Chairman Kevin Kelly said that the increase was supported by growing confidence among consumers.

-

15:00

U.S.: NAHB Housing Market Index, November 58 (forecast 55)

-

14:43

U.S. producer price index rose 0.2% in October

The U.S. Commerce Department released the producer price index figures on Tuesday. The U.S. producer price index rose 0.2% in October, beating expectations for a 0.1% fall, after a 0.1% decrease in September.

On a yearly basis, the producer price index increased 1.5% in October, exceeding expectations for a 1.3% gain, after a 1.6% rise in September.

The increase was driven by higher prices for services and food. Wholesale prices excluding food and energy climbed 0.4% in October, while the cost of services inched 0.5%.

Prices for goods fell 0.4% last month. That was the biggest fall since April 2013.

Energy costs declined 3% in October. That was the biggest decline since March 2013.

The report showed that crude oil prices fell at a monthly rate of 9.8% in October.

The producer price index excluding food and energy was up 0.4% in October, beating forecasts of a 0.1% increase, after the flat reading in September.

On a yearly basis, the producer price index excluding food and energy climbed 1.8% in October, exceeding expectations for a 1.5% increase, after a 1.6% gain in September.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2375(E780mn), $1.2400(E523mn), $1.2450(E527mn), $1.2480-85(E878mn), $1.2495/00(E1.1bn), $1.2520(E380mn), $1.2535 (E505mn), $1.2560(E282mn), $1.2600(E$1.0bn)

USD/JPY: Y117.00($657mn), Y117.15($325mn)

AUD/USD: $0.8700(A$321mn)

EUR/CHF: Chf1.2050(E520mn)

AUD/NZD: $1.0800(A$250mn)

-

13:30

U.S.: PPI, m/m, October +0.2% (forecast -0.1%)

-

13:30

U.S.: PPI excluding food and energy, m/m, October +0.4% (forecast +0.1%)

-

13:30

U.S.: PPI, y/y, October +1.5% (forecast +1.3%)

-

13:30

U.S.: PPI excluding food and energy, Y/Y, October +1.8% (forecast +1.5%)

-

13:02

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the better-than-expected ZEW economic sentiment index from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Meeting's Minutes

08:25 Australia RBA's Governor Glenn Stevens Speech

09:30 United Kingdom Retail Price Index, m/m October +0.2% +0.1% 0.0%

09:30 United Kingdom Retail prices, Y/Y October +2.3% +2.3% +2.3%

09:30 United Kingdom RPI-X, Y/Y October +2.3% +2.4%

09:30 United Kingdom Producer Price Index - Input (MoM) October -0.6% -1.4% -1.5%

09:30 United Kingdom Producer Price Index - Input (YoY) October -7.4% -8.3% -8.4%

09:30 United Kingdom Producer Price Index - Output (MoM) October -0.1% -0.2% -0.3%

09:30 United Kingdom Producer Price Index - Output (YoY) October -0.4% -0.2% -0.5%

09:30 United Kingdom HICP, m/m October 0.0% +0.1% +0.1%

09:30 United Kingdom HICP, Y/Y October +1.2% +1.2% +1.3%

09:30 United Kingdom HICP ex EFAT, Y/Y October +1.5% +1.6% +1.5%

10:00 Eurozone ZEW Economic Sentiment November 4.1 4.3 11

10:00 Germany ZEW Survey - Economic Sentiment November -3.6 0.9 11.5

The U.S. dollar mixed to lower against the most major currencies ahead of the U.S. producer price index and the NAHB housing market index. The U.S. PPI is expected to decline 0.1% in October, after a 0.1% fall in September.

The NAHB housing market index is expected to climb to 55 in November from 54 in October.

The euro traded higher against the U.S. dollar after the better-than-expected ZEW economic sentiment index from the Eurozone. Germany's ZEW economic sentiment index increased 15.1 in November from -3.6 in October, exceeding expectations for a rise to 0.9.

Eurozone's ZEW economic sentiment index climbed to 11.0 in October from 4.1 in September, beating expectations for a gain to 4.3.

The British pound traded mixed against the U.S. dollar after the mixed economic data from the U.K. The U.K. consumer price index rose to an annual rate of 1.3% in October from 1.2% in September. Analysts had expected the consumer price inflation to remain unchanged at 1.2%.

Consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at 1.5% in October, missing expectations for an increase to 1.6%.

The Bank of England's inflation target is about 2%.

EUR/USD: the currency pair rose to $1.2539

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 U.S. PPI, m/m October -0.1% -0.1%

13:30 U.S. PPI, y/y October +1.6% +1.3%

13:30 U.S. PPI excluding food and energy, m/m October 0.0% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y October +1.6% +1.5%

15:00 U.S. NAHB Housing Market Index November 54 55

18:30 U.S. FOMC Member Narayana Kocherlakota

21:00 U.S. Net Long-term TIC Flows September 52.1 41.3

21:00 U.S. Total Net TIC Flows November 74.5

-

12:50

Orders

EUR/USD

Offers $1.2650, $1.2600/05, $1.2580, $1.2550

Bids $1.2400

GBP/USD

Offers $1.5745/50, $1.5700

Bids $1.5620/00, $1.5580, $1.5550, $1.5525/20

AUD/USD

Offers $0.8900, $0.8850, $0.8820, $0.8800, $0.8760/80, $0.8750

Bids $0.8650, $0.8620/00, $0.8550

EUR/JPY

Offers Y148.00, Y147.50, Y147.00, Y146.80, Y146.45/50

Bids Y145.50, Y145.00, Y144.55/50

USD/JPY

Offers Y118.50, Y118.00, Y117.50, Y117.25

Bids Y116.00, Y115.85/80, Y115.10/00

EUR/GBP

Offers stg0.8100, stg0.8066, stg0.8020

Bids stg0.7950, stg0.7910/00, stg0.7885/75, stg0.7860/50

-

10:55

Reserve Bank of Australia Governor Glenn Stevens: interest rates are likely to stay low

Reserve Bank of Australia Governor Glenn Stevens said in today's speech that Australia's economy has spare capacity and interest rates are likely to stay at record lows for some time to support growth as inflation is contained. He is not worried about fast growing home prices as higher prices are spurring a needed revival in home-building.

-

10:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2375(E780mn), $1.2400(E523mn), $1.2450(E527mn), $1.2480-85(E878mn), $1.2495/00(E1.1bn), $1.2520(E380mn), $1.2535 (E505mn), $1.2560(E282mn), $1.2600(E$1.0bn)

USD/JPY: Y117.00($657mn), Y117.15($325mn)

AUD/USD: $0.8700(A$321mn)

EUR/CHF: Chf1.2050(E520mn)

AUD/NZD: $1.0800(A$250mn)

-

10:20

Reuters: Japan PM - Sales tax rise to be delayed until April 2017

-

10:17

ZEW sentiment improves in November

ZEW Survey - Economic Sentiment improved in November from -3.6 last month to +11.5 beating forecasts by 10.6 being at the highest for four months. Eurozone Economic Sentiment improved from 4.1 to 11, analysts predicted the index to climb to 4.3 easing negative sentiment over Eurozones and Germanys economic outlook. European stock markets continue to rise.

-

10:00

Germany: ZEW Survey - Economic Sentiment, November 11.5 (forecast 0.9)

-

10:00

Eurozone: ZEW Economic Sentiment, November 11 (forecast 4.3)

-

09:32

United Kingdom: Retail Price Index, m/m, October 0.0% (forecast +0.1%)

-

09:32

United Kingdom: Retail prices, Y/Y, October +2.3% (forecast +2.3%)

-

09:31

United Kingdom: HICP ex EFAT, Y/Y, October +1.5% (forecast +1.6%)

-

09:31

United Kingdom: Producer Price Index - Input (MoM), October -1.5% (forecast -1.4%)

-

09:31

United Kingdom: Producer Price Index - Input (YoY) , October -8.4% (forecast -8.3%)

-

09:31

United Kingdom: Producer Price Index - Output (MoM), October -0.3% (forecast -0.2%)

-

09:31

United Kingdom: Producer Price Index - Output (YoY) , October -0.5% (forecast -0.2%)

-

09:30

United Kingdom: HICP, m/m, October +0.1% (forecast +0.1%)

-

09:30

United Kingdom: HICP, Y/Y, October +1.3% (forecast +1.2%)

-

09:20

Press Review: Australian exports to China still face hurdles after hyped trade deal

BLOOMBERG

Abe $1 Trillion Gift to Stock Market Shields Recession Gloom

Shinzo Abe has helped make investors in Japanese stocks $1 trillion richer over the last two years, and many are betting he will make them even richer.

Abe, Japan's prime minister, is moving to safeguard his political future at the same time government data show the economy unexpectedly sank into a recession last quarter. He is expected to call a snap election for next month to build support for postponing a sales tax increase by 18 months, people familiar with the situation said.

INVESTING.COM

Australian exports to China still face hurdles after hyped trade deal

A trade deal signed with great fanfare between China and Australia has been touted as a major step towards Australia shifting its economy from a "mining boom" to a "dining boom," but the reality is likely to be more sobering.

Australia is looking to replace its reliance on exports of minerals such as coal and iron ore as mining investment wanes and demand begins to dwindle. The government would prefer to expand its food and agricultural exports to capitalize on a rapidly growing Asian middle class.

REUTERS

Japan can't print people: James Saft

Japan's attempts, through Abenomics, to beat back against the tide of demographics may be proving futile.

Japan has lapsed into its fourth recession since 2008, with its economy contracting at a 1.6 percent annual clip in the third quarter, frustrating hopes that the Abenomics cocktail of fiscal and economic stimulus topped up with deregulation would be enough.

Source: http://www.reuters.com/article/2014/11/18/markets-saft-idUSL2N0T42SJ20141118

-

07:30

Foreign exchange market. Asian session: U.S. dollar trading stronger against euro and yen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia RBA Meeting's Minutes

The U.S. dollar traded stronger against its peers during Asian Trade although data from the world's largest economy published yesterday showed Industrial Production (MoM) declined by -0.1% after a forecast of +0.2%, Capacity Utilization dipped to 78.9% in October with a forecast of 79.3% and the NY Fed Empire State manufacturing index declined to 10.16 below forecasts of 12.1. The greenback traded stronger against the euro after the Bundesbank announced in its monthly report that the outlook for economic growth is stays weak in the months to come.

The Australian dollar is currently trading slightly higher against the U.S. dollar. Market participants awaiting RBA's Governor Glenn Stevens Speech scheduled for 08:25 GMT at CEDA annual dinner in Melbourne.

The New Zealand dollar rose against the U.S. dollar. Markets are focusing on the upcoming Fonterra Cooperative Group Global Dairy Trade auction overnight to see if prices are stabilizing.

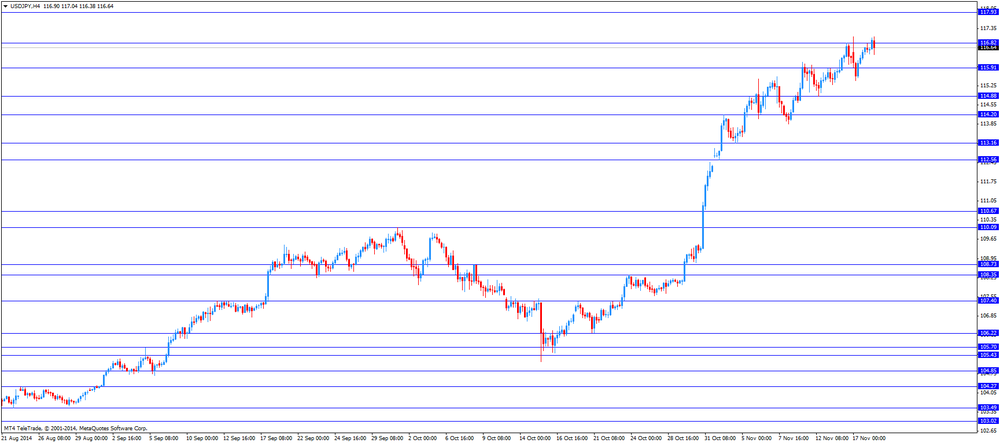

The Japanese yen currently trading at USD116.6 close to a new seven-year low against the greenback. As preliminary data on the Japanese GDP showed that Japan unexpectedly fell into recession the Nikkei delined by almost 3%. Preliminary GDP for the third quarter declined --1.6% compared with a forecast of +2.1% after losing -7.3% in the previous quarter reinforcing speculations that Prime Minister Abe will announce to postpone a planned sales tax hike as today.

EUR/USD: the euro lost against the greenback

USD/JPY: the U.S. dollar traded stronger against the Japanese yen at close to seven-year highs

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

08:25 Australia RBA's Governor Glenn Stevens Speech

09:30 United Kingdom Retail Price Index, m/m October +0.2% +0.1%

09:30 United Kingdom Retail prices, Y/Y October +2.3% +2.3%

09:30 United Kingdom RPI-X, Y/Y October +2.3%

09:30 United Kingdom Producer Price Index - Input (MoM) October -0.6% -1.4%

09:30 United Kingdom Producer Price Index - Input (YoY) October -7.4% -8.3%

09:30 United Kingdom Producer Price Index - Output (MoM) October -0.1% -0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) October -0.4% -0.2%

09:30 United Kingdom HICP, m/m October 0.0% +0.1%

09:30 United Kingdom HICP, Y/Y October +1.2% +1.2%

09:30 United Kingdom HICP ex EFAT, Y/Y October +1.5% +1.6%

10:00 Eurozone ZEW Economic Sentiment November 4.1 4.3

10:00 Germany ZEW Survey - Economic Sentiment November -3.6 0.9

13:30 U.S. PPI, m/m October -0.1% -0.1%

13:30 U.S. PPI, y/y October +1.6% +1.3%

13:30 U.S. PPI excluding food and energy, m/m October 0.0% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y October +1.6% +1.5%

15:00 U.S. NAHB Housing Market Index November 54 55

18:30 U.S. FOMC Member Narayana Kocherlakota

21:00 U.S. Net Long-term TIC Flows September 52.1 41.3

21:00 U.S. Total Net TIC Flows November 74.5

21:30 U.S. API Crude Oil Inventories November -1.5

23:30 Australia Leading Index October -0.1%

-

06:23

Options levels on tuesday, November 18, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2671 (4952)

$1.2618 (3595)

$1.2559 (191)

Price at time of writing this review: $ 1.2471

Support levels (open interest**, contracts):

$1.2436 (2906)

$1.2380 (3377)

$1.2346 (5511)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 99716 contracts, with the maximum number of contracts with strike pric $1,3000 (5307);

- Overall open interest on the PUT options with the expiration date December, 5 is 103587 contracts, with the maximum number of contracts with strike price $1,2500 (6415);

- The ratio of PUT/CALL was 1.04 versus 1.06 from the previous trading day according to data from November, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (658)

$1.5806 (460)

$1.5715 (916)

Price at time of writing this review: $1.5651

Support levels (open interest**, contracts):

$1.5592 (1190)

$1.5495 (878)

$1.5397 (949)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 37314 contracts, with the maximum number of contracts with strike price $1,6000 (1997);

- Overall open interest on the PUT options with the expiration date December, 5 is 39638 contracts, with the maximum number of contracts with strike price $1,5900 (2341);

- The ratio of PUT/CALL was 1.06 versus 1.06 from the previous trading day according to data from November, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:00

Currencies. Daily history for Nov 17’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2449 -0,62%

GBP/USD $1,5639 -0,20%

USD/CHF Chf0,9647 +0,61%

USD/JPY Y116,64 +0,31%

EUR/JPY Y145,21 -0,30%

GBP/JPY Y182,41 +0,12%

AUD/USD $0,8707 -0,57%

NZD/USD $0,7909 -0,03%

USD/CAD C$1,1309 +0,30%

-