Notícias do Mercado

-

23:26

Currencies. Daily history for Sep 18'2014:

(pare/closed(GMT +2)/change, %)

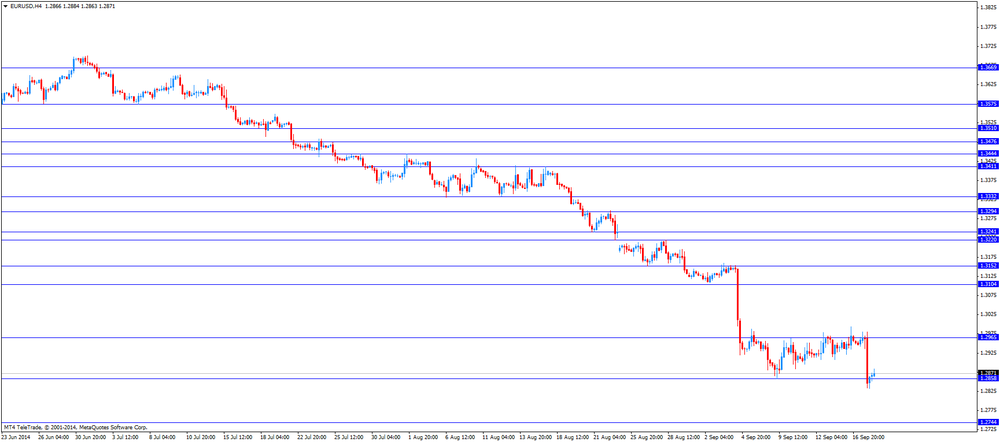

EUR/USD $1,2915 +0,53%

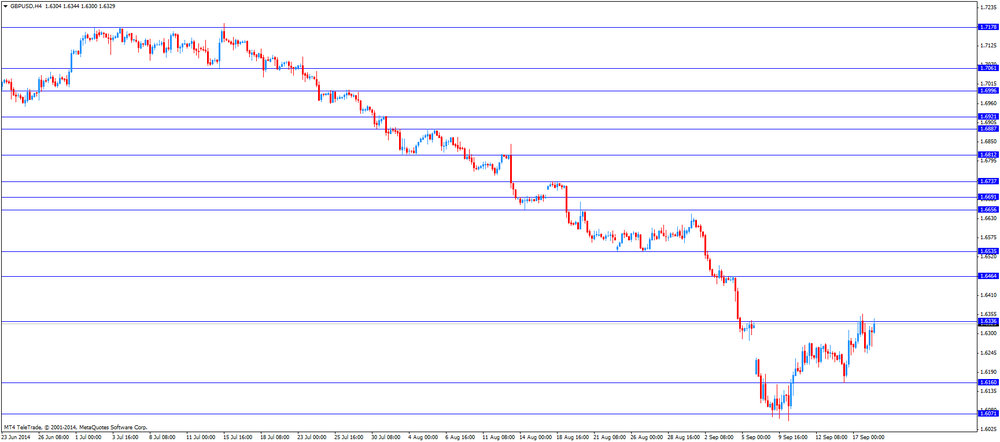

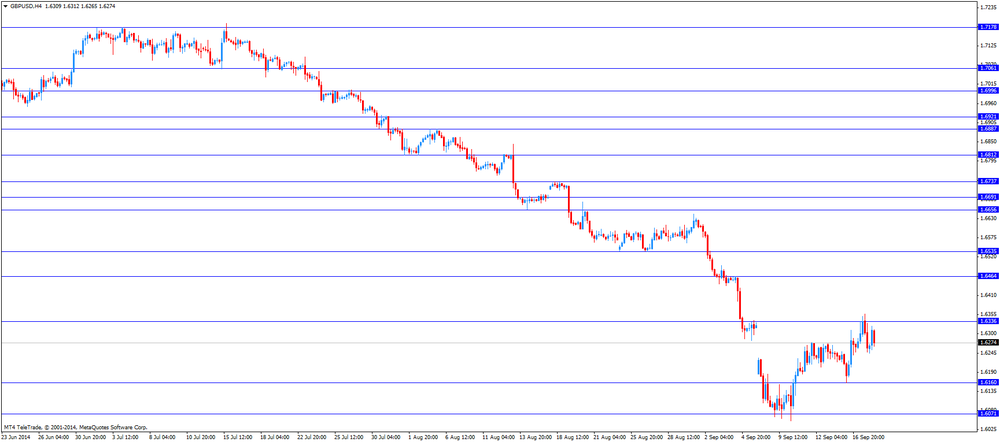

GBP/USD $1,6438 +1,09%

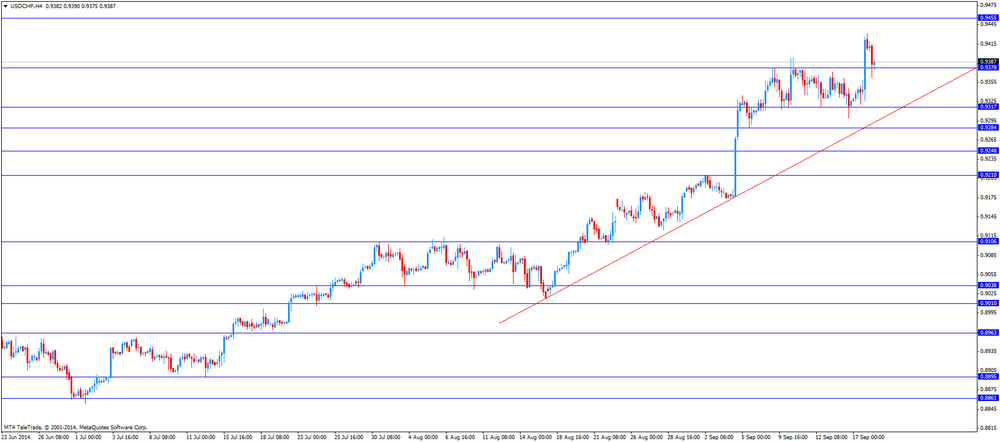

USD/CHF Chf0,9340 -0,87%

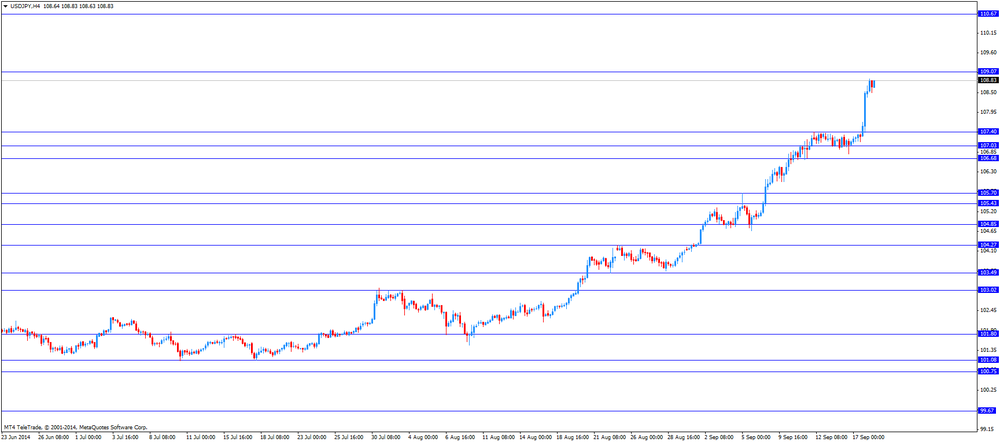

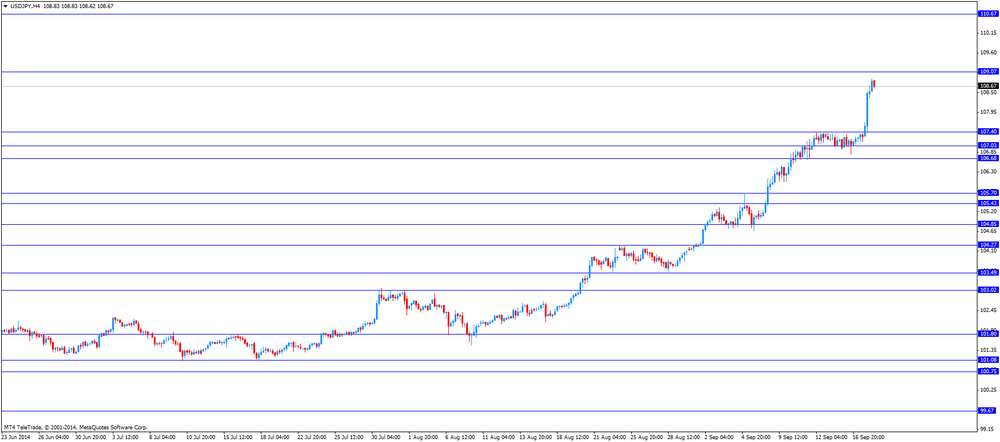

USD/JPY Y108,76 +0,27%

EUR/JPY Y140,47 +0,82%

GBP/JPY Y178,81 +1,38%

AUD/USD $0,8983 +0,32%

NZD/USD $0,8161 +0,83%

USD/CAD C$1,0938 -0,70%

-

23:00

Schedule for today, Friday, Sep 18’2014:

(time / country / index / period / previous value / forecast)

03:00 New Zealand Credit Card Spending August +4.5%

04:30 Japan All Industry Activity Index, m/m July -0.4% +0.4%

06:00 Germany Producer Price Index (MoM) August -0.1% -0.1%

06:00 Germany Producer Price Index (YoY) August -0.8%

08:00 Eurozone Current account, adjusted, bln July 13.1 14.3

12:30 Canada Wholesale Sales, m/m July +0.6% +0.8%

12:30 Canada Consumer Price Index m / m August -0.2% -0.1%

12:30 Canada Consumer price index, y/y August +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m August -0.1% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August +1.7%

14:00 U.S. Leading Indicators August +0.9% +0.4%

-

16:35

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. economic data. The U.S. housing starts in August dropped by 14.4% to a seasonally adjusted annual rate of 956,000 units from 1.117 million units in July, missing expectations for a decline to 1.040 million. July's figure was revised up from 1.093 million units.

The number of building permits in August fell by 5.6% to 998,000 units from 1.057 million units in July. July's figure was revised up from 1.052 million units. Analysts expected building permits to decrease to 1.040 million units.

Philadelphia Fed manufacturing index declined to 22.5 in September from 28.0 in August, missing forecasts of the fall to 22.8.

The number of initial jobless claims in the U.S. in the week ending September 13 dropped by 36,000 to 280,000. The previous week's figure was revised to 316,000 from 315.000.

Yesterday's results of the Fed's monetary policy meeting weighed on the greenback. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The euro traded higher against the U.S. dollar. The European Central Bank said today it allotted €82.6 billion in its new Targeted Long Term Refinancing Operation (TLTRO). Analysts had expected €174 billion.

The British pound traded higher against the U.S. dollar. The Scotland's independence referendum weighed on the pound.

The U.K. retail sales increased 0.4% in August, in line with expectations, after a flat reading in July. July's figure was revised down from a 0.1% rise.

On a yearly basis, retail sales in the U.K. climbed 3.9% in August, after a 2.5% gain in July. July's figure was revised down from a 2.6% increase.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance dropped to -4% in September from +11% in August, missing expectations for a decrease to +9%.

The Swiss franc rose against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

Switzerland's central bank said "will continue to enforce the minimum exchange rate with the utmost determination".

The Canadian dollar traded higher against the U.S. dollar after the better-than-forecasted foreign securities purchases from Canada. Foreign securities purchases in Canada climbed by C$5.30 billion in July, exceeding expectations for a rise of C$2.47 billion, after a C$1.08 billion rise in June. June's figure was revised down from - C$1.07 billion.

The New Zealand dollar traded higher against the U.S dollar. The better-than-expected gross domestic product (GDP) from New Zealand supported the kiwi. New Zealand's GDP rose 0.7% in the second quarter, exceeding expectations for a 0.6% increase, after a 1.0% gain in the first quarter.

On a yearly basis, New Zealand's GDP climbed by 3.9% in the second quarter, after a 3.8% rise in the first quarter.

The Australian dollar traded higher against the U.S. dollar. The Fed's interest rate decision weighed on the Aussie.

The Reserve Bank of Australia (RBA) released its bulletin today. The RBA said spare capacity in the Australian labour market has risen over the past few years.

The Japanese yen traded mixed against the U.S. dollar. Japan' trade deficit declined to ¥948.5 billion in August from ¥1,023.8 billion, beating expectations for a decline to a deficit of ¥990.0 billion.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda on Thursday reiterated the central bank will adjust its monetary policy if needed to reach the 2% inflation target. He believes that Japan can reach a 2% inflation target at around fiscal 2015 to March 2016.

Mr. Kuroda also said that he is optimistic on a recovery of Japan's exports.

-

15:55

Federal Reserve Chair Janet Yellen: lower-income families in America are "extraordinarily vulnerable"

The Federal Reserve Chair Janet Yellen said today lower-income families in America are "extraordinarily vulnerable". She added Yellen that the Fed must help Americans build assets.

Yellen said nothing about the Fed's monetary policy.

-

15:10

U.S. housing starts dropped in August

The U.S. Commerce Department released the housing market data today. The U.S. housing starts in August dropped by 14.4% to a seasonally adjusted annual rate of 956,000 units from 1.117 million units in July, missing expectations for a decline to 1.040 million. July's figure was revised up from 1.093 million units.

The fall was driven mostly by a 31.7% decline in construction of multifamily units. Construction of multifamily units is a volatile segment.

The number of building permits in August fell by 5.6% to 998,000 units from 1.057 million units in July. July's figure was revised up from 1.052 million units. Analysts expected building permits to decrease to 1.040 million units.

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, September 22.5 (forecast 22.8)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2800(E230mn), $1.2850(E1.87bn), $1.2900(E967mn), $1.2950(E369mn), $1.3000(E1.1bn), $1.3025-30(E618mn), $1.3050(E767mn)

USD/JPY Y107.00($1.1bn), Y107.50($320mn), Y108.00($490mn)

GBP/USD: $1.6200(stg181mn), $1.6300(stg110mn), $1.6350(stg150mn), $1.6400(stg624mn)

EUR/GBP: stg0.7875(E150mn), stg0.7940(E120mn), stg0.7975(E150mn), stg0.8000(E200mn)

USD/CHF: Chf0.9150($515mn), Chf0.9350(E420mn)

EUR/CHF: Chf1.2090(E191mn), Chf1.2150(E128mn)

AUD/USD: $0.8900(A$748mn), $0.8950(A$249mn), $0.9000(A$587mn), $0.9050(A$401mn), $0.9100(A$1.0bn), $0.9200(A$1.1bn)

NZD/USD: $0.8200(NZ$145mn), $0.8300(NZ$208mn)

USD/CAD: C$1.0900($492mn), C$1.0940($200mn), C$1.1000($456mn), C$1.1050($320mn)

-

14:03

Federal Reserve kept its interest rate unchanged

The Federal Reserve released the results of its monetary policy meeting yesterday. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The Fed raised its estimates for interest rate. The U.S. central bank said interest rate will be 3.75% at the end of 2017.

The Fed Chair Janet Yellen said at the press conference yesterday that the labour market has not recovered fully and inflation has been below the Fed's 2% target.

-

13:31

U.S.: Building Permits, mln, August 1.00 (forecast 1.04)

-

13:30

U.S.: Initial Jobless Claims, September 280 (forecast 312)

-

13:30

U.S.: Housing Starts, mln, August 0.96 (forecast 1.04)

-

13:30

Swiss National Bank kept its interest rate unchanged

The Swiss National Bank's (SNB) released its interest rate decision today. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

Switzerland's central bank said "will continue to enforce the minimum exchange rate with the utmost determination".

"It is prepared to purchase foreign currency in unlimited quantities, and if necessary, it will take further measures immediately", the SNB.

The central bank kept its 2014 outlook for inflation unchanged at 0.1%. The projection for 2015 inflation was cut to 0.2% from 0.3%. Inflation in 2016 is expected to be 0.5%.

"The risk of deflation has increased again," the central bank said.

The SNB lowered its GDP forecast for 2014 to 1.5% from 2% in June.

The Swiss National Bank Chairman Thomas Jordan said that the central bank has not ruled out the introduction of negative interest rates.

-

13:30

Canada: Foreign Securities Purchases, June 5.30 (forecast 2.47)

-

13:05

Foreign exchange market. European session: the Swiss franc rose against the U.S. dollar after the Swiss National Bank’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Bulletin

06:00 Switzerland Trade Balance August 3.98 2.56 1.39

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

08:00 United Kingdom Scottish Independence Vote

08:30 United Kingdom Retail Sales (MoM) August +0.1% +0.4% +0.4%

08:30 United Kingdom Retail Sales (YoY) August +2.5% Revised From +2.6% +3.9%

09:15 Eurozone Targeted LTRO 174 82.6

10:00 United Kingdom CBI industrial order books balance September 11 9 -4

The U.S. dollar traded mixed to lower against the most major currencies ahead of the speech of the Fed Chair Janet Yellen and the U.S. economic data.

Housing starts in the U.S. are expected to decline to 1.040 million units in August from 1.090 million units in July.

The number of building permits is expected to decline to 1.040 million units in August from 1.060 million in July.

The number of initial jobless claims in the U.S. is expected to decline by 3,000 to 312,000.

Yesterday's results of the Fed's monetary policy meeting weighed on the greenback. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The euro traded mixed against the U.S. dollar. The European Central Bank said today it allotted €82.6 billion in its new Targeted Long Term Refinancing Operation (TLTRO). Analysts had expected €174 billion.

The British pound traded higher against the U.S. dollar. The Scotland's independence referendum weighed on the pound.

The U.K. retail sales increased 0.4% in August, in line with expectations, after a flat reading in July. July's figure was revised down from a 0.1% rise.

On a yearly basis, retail sales in the U.K. climbed 3.9% in August, after a 2.5% gain in July. July's figure was revised down from a 2.6% increase.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance dropped to -4% in September from +11% in August, missing expectations for a decrease to +9%.

The Swiss franc rose against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

Switzerland's central bank said "will continue to enforce the minimum exchange rate with the utmost determination".

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.6344

USD/JPY: the currency pair traded mixed

USD/CHF: the currency pair declined to CHF0.9362

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases June -1.07 2.47

12:30 U.S. Building Permits, mln August 1.06 Revised From 1.05 1.04

12:30 U.S. Housing Starts, mln August 1.09 1.04

12:30 U.S. Initial Jobless Claims September 315 312

12:45 U.S. Fed Chairman Janet Yellen Speaks

14:00 U.S. Philadelphia Fed Manufacturing Survey September 28.0 22.8

-

13:00

Orders

EUR/USD

Offers $1.3070, $1.3050, $1.3000, $1.3230/25

Bids $1.2835, $1.2800, $1.2755

GBP/USD

Offers $1.6500, $1.6465, $1.6400, $1.6360

Bids 1.6200, 1.6160, $1.6125/20, $1.6100, $1.6050

AUD/USD

Offers $0.9250/60, $0.9220, $0.9110/00, $0.9050

Bids 0.8920, $0.8900, $$0.8800

EUR/JPY

Offers Y141.60, Y141.00, Y140.40

Bids Y139.20, Y139.00, Y138.45, Y138.15

USD/JPY

Offers Y110.00, Y109.00

BidsY107,40, Y106.70/65, Y106.50, Y106.05/95, Y105.50, Y105.20

EUR/GBP

Offers stg0.8100, stg0.8000/10, stg0.7950

Bids stg0.7880, stg0.7800

-

11:25

Bank of Japan Governor Haruhiko Kuroda believes that Japan can reach a 2% inflation target at around fiscal 2015 to March 2016

The Bank of Japan (BoJ) Governor Haruhiko Kuroda on Thursday reiterated the central bank will adjust its monetary policy if needed to reach the 2% inflation target. He believes that Japan can reach a 2% inflation target at around fiscal 2015 to March 2016.

Mr. Kuroda also said that he is optimistic on a recovery of Japan's exports.

The BoJ governor repeated the country's economy is expected to recover moderately and private consumption has remained resilient as a trend.

-

11:00

United Kingdom: CBI industrial order books balance, September -4 (forecast 9)

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD: $1.2800(E230mn), $1.2850(E1.87bn), $1.2900(E967mn), $1.2950(E369mn), $1.3000(E1.1bn), $1.3025-30(E618mn), $1.3050(E767mn)

USD/JPY Y107.00($1.1bn), Y107.50($320mn), Y108.00($490mn)

GBP/USD: $1.6200(stg181mn), $1.6300(stg110mn), $1.6350(stg150mn), $1.6400(stg624mn)

EUR/GBP: stg0.7875(E150mn), stg0.7940(E120mn), stg0.7975(E150mn), stg0.8000(E200mn)

USD/CHF: Chf0.9150($515mn), Chf0.9350(E420mn)

EUR/CHF: Chf1.2090(E191mn), Chf1.2150(E128mn)

AUD/USD: $0.8900(A$748mn), $0.8950(A$249mn), $0.9000(A$587mn), $0.9050(A$401mn), $0.9100(A$1.0bn), $0.9200(A$1.1bn)

NZD/USD: $0.8200(NZ$145mn), $0.8300(NZ$208mn)

USD/CAD: C$1.0900($492mn), C$1.0940($200mn), C$1.1000($456mn), C$1.1050($320mn)

-

10:14

Foreign exchange market. Asian session: the New Zealand dollar traded higher against the U.S dollar after the better-than-expected gross domestic product from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Bulletin

06:00 Switzerland Trade Balance August 3.98 2.56 1.39

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

08:00 United Kingdom Scottish Independence Vote

08:30 United Kingdom Retail Sales (MoM) August +0.1% +0.4% +0.4%

08:30 United Kingdom Retail Sales (YoY) August +2.5% Revised From +2.6% +3.9%

The U.S. dollar traded lower against the most major currencies. In the yesterday's evening trading session, the greenback rose significantly against the most major currencies. The U.S. dollar was supported by the results of the Fed's monetary policy meeting. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The New Zealand dollar traded higher against the U.S dollar after the better-than-expected gross domestic product (GDP) from New Zealand. New Zealand's GDP rose 0.7% in the second quarter, exceeding expectations for a 0.6% increase, after a 1.0% gain in the first quarter.

On a yearly basis, New Zealand's GDP climbed by 3.9% in the second quarter, after a 3.8% rise in the first quarter.

The Australian dollar traded slightly higher against the U.S. dollar. The Fed's interest rate decision weighed on the Aussie.

The Reserve Bank of Australia (RBA) released its bulletin today. The RBA said spare capacity in the Australian labour market has risen over the past few years.

The Japanese yen declined against the U.S. dollar despite the better-than-expected data from Japan. Japan' trade deficit declined to ¥948.5 billion in August from ¥1,023.8 billion, beating expectations for a decline to a deficit of ¥990.0 billion.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda on Thursday reiterated the central bank will adjust its monetary policy if needed to reach the 2% inflation target. He believes that Japan can reach a 2% inflation target at around fiscal 2015 to March 2016.

Mr. Kuroda also said that he is optimistic on a recovery of Japan's exports.

EUR/USD: the currency pair rose to $1.2873

GBP/USD: the currency pair increased to $1.6322

USD/JPY: the currency pair climbed to Y108.87

The most important news that are expected (GMT0):

09:15 Eurozone Targeted LTRO 174

10:00 United Kingdom CBI industrial order books balance September 11 9

12:30 Canada Foreign Securities Purchases June -1.07 2.47

12:30 U.S. Building Permits, mln August 1.06 Revised From 1.05 1.04

12:30 U.S. Housing Starts, mln August 1.09 1.04

12:30 U.S. Initial Jobless Claims September 315 312

12:45 U.S. Fed Chairman Janet Yellen Speaks

14:00 U.S. Philadelphia Fed Manufacturing Survey September 28.0 22.8

-

09:30

United Kingdom: Retail Sales (MoM), August +0.4% (forecast +0.4%)

-

09:30

United Kingdom: Retail Sales (YoY) , August +3.9%

-

08:30

Switzerland: SNB Interest Rate Decision, 0.25% (forecast 0.25%)

-

07:02

Switzerland: Trade Balance, August 1.39 (forecast 2.56)

-

06:28

Options levels on thursday, September 18, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2993 (442)

$1.2960 (165)

$1.2935 (34)

Price at time of writing this review: $ 1.2956

Support levels (open interest**, contracts):

$1.2832 (3121)

$1.2801 (2471)

$1.2765 (4530)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 50640 contracts, with the maximum number of contracts with strike price $1,3000 (4958);

- Overall open interest on the PUT options with the expiration date October, 3 is 55553 contracts, with the maximum number of contracts with strike price $1,3000 (6669);

- The ratio of PUT/CALL was 1.10 versus 1.13 from the previous trading day according to data from September, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.6505 (3083)

$1.6409 (1565)

$1.6315 (1576)

Price at time of writing this review: $1.6264

Support levels (open interest**, contracts):

$1.6187 (1493)

$1.6090 (3350)

$1.5992 (2258)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 29898 contracts, with the maximum number of contracts with strike price $1,6500 (3083);

- Overall open interest on the PUT options with the expiration date October, 3 is 39529 contracts, with the maximum number of contracts with strike price $1,6300 (4736);

- The ratio of PUT/CALL was 1.32 versus 1.37 from the previous trading day according to data from September, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:50

Japan: Adjusted Merchandise Trade Balance, bln, August -924,2 (forecast -990.0)

-