Notícias do Mercado

-

23:45

New Zealand: GDP q/q, Quarter II +0.7% (forecast +0.6%)

-

23:45

New Zealand: GDP y/y, Quarter II +3.9%

-

23:21

Currencies. Daily history for Sep 17'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2846 -0,88%

GBP/USD $1,6259 -0,07%

USD/CHF Chf0,9421 +1,03%

USD/JPY Y108,47 +1,25%

EUR/JPY Y139,32 +0,37%

GBP/JPY Y176,35 +1,17%

AUD/USD $0,8954 -1,45%

NZD/USD $0,8093 -1,22%

USD/CAD C$1,1015 +0,42%

-

23:00

Schedule for today,Thursday, Sep 18’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Bulletin

06:00 Switzerland Trade Balance August 3.98 2.56

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

08:00 United Kingdom Scottish Independence Vote

08:30 United Kingdom Retail Sales (MoM) August +0.1% +0.4%

08:30 United Kingdom Retail Sales (YoY) August +2.6%

10:00 United Kingdom CBI industrial order books balance September 11 9

12:30 Canada Foreign Securities Purchases June -1.07 2.47

12:30 U.S. Building Permits, mln August 1.06 Revised From 1.05 1.04

12:30 U.S. Housing Starts, mln August 1.09 1.04

12:30 U.S. Initial Jobless Claims September 315 312

12:45 U.S. Fed Chairman Janet Yellen Speaks

14:00 U.S. Philadelphia Fed Manufacturing Survey September 28.0 22.8

-

19:00

U.S.: FOMC QE Decision, 15 (forecast 15)

-

19:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

16:37

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies ahead of the Fed's interest rate decision

The U.S. dollar traded higher against the most major currencies ahead of the Fed's interest rate decision. Market participants expect the Fed will cut its asset purchase program by another $10 billion. Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

The U.S. consumer price index (CPI) declined 0.2% in August, missing expectations for a 0.1% rise, after a 0.1% increase in July.

On a yearly basis, the U.S. CPI decreased to 1.7% in August from 2.0% in July.

The U.S. consumer price index excluding food and energy was flat in August, missing expectations for a 0.2% increase, after a 0.1% gain in July.

On a yearly basis, the U.S. CPI excluding food and energy fell to 1.7% in August from 1.9% in July.

The NAHB housing market index jumped to 59 in September from 55 in August, exceeding expectations for a rise to 56.

The euro declined against the U.S. dollar. Eurostat said today consumer price inflation was revised up to an annual rate of 0.4% in August from a preliminary reading of 0.3%.

Eurozone's consumer price index excluding food, energy, alcohol, and tobacco costs increased 0.9% in August.

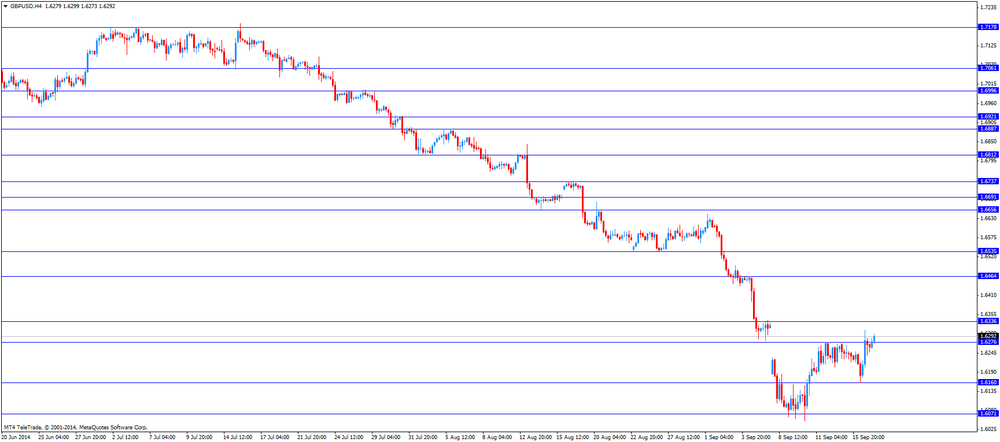

The British pound traded lower against the U.S. dollar. In the morning trading session, the pound increased against the greenback after the better-than-expected unemployment rate from the U.K. The unemployment rate in the U.K. fell to 6.2% in July from 6.4% in June, beating expectations for a decline to 6.3%. That was the lowest level since late 2008.

The average earnings index including bonuses increased 0.6% in the three months to July, beating forecast of a 0.5% rise, after a 0.1% decline in the three months to June. June's figure was revised up from a 0.2% drop.

The average earnings index excluding bonuses climbed 0.7% in the three months to July, after a 0.7% gain in the three months to June. June's figure was revised up from a 0.6% increase.

Two members of Bank of England's Monetary Policy Committee, Ian McCafferty and Martin Weale, voted for the second consecutive month to raise interest rates to 0.75% from 0.5%.

Scotland's independence referendum on Thursday continued to weigh on the pound.

The Swiss franc traded lower against the U.S. dollar. Swiss ZEW Economic Sentiment Index declined to -7.7 in September from 2.5 in August. That was the first negative reading since January 2013.

The New Zealand dollar traded lower against the U.S dollar after the current account data from New Zealand. New Zealand's current account deficit was NZ$1.06 billion in the second quarter, down from a surplus of NZ$1.41 billion in the first quarter. Analysts had expected the current account deficit of NZ$1.04 billion.

The auction on Fonterra's GlobalDairyTrade platform showed dairy prices rose from a two-year low.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia.

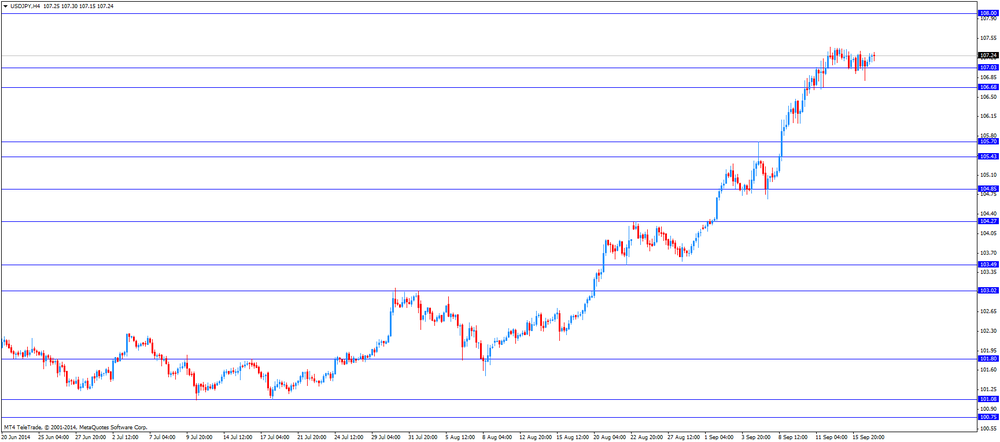

The Japanese yen dropped against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:30

U.S.: Crude Oil Inventories, September +3.7

-

15:00

U.S.: NAHB Housing Market Index, September 59 (forecast 56)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2900(E400mn), $1.2950(E329mn), $1.3000(E331mn), $1.3030(E227mn), $1.3050(E426mn)

USD/JPY Y106.75($300mn), Y107.00($100mn), Y107.25($200mn)

EUR/GBP: stg0.7940(E100mn), stg0.8020(E150mn)

EUR/CHF: Chf1.2090(E336mn), Chf1.2140(E568mn)

AUD/USD: $0.9000(A$833mn), $0.9100(A$1.7bn)

USD/CAD: C$1.0880($240mn), C$1.0980($535mn), C$1.1000($315mn), C$1.1030($350mn), C$1.1090-1.1100($660mn)

-

13:31

U.S.: CPI, Y/Y, August +1.7%

-

13:31

U.S.: CPI excluding food and energy, Y/Y, August +1.7%

-

13:30

U.S.: CPI, m/m , August -0.2% (forecast +0.1%)

-

13:30

U.S.: CPI excluding food and energy, m/m, August 0.0% (forecast +0.2%)

-

13:30

U.S.: Current account, bln, Quarter II -99 (forecast -114)

-

13:05

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the consumer inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:45 New Zealand Current Account Quarter II 1.41 -1.04 -1.06

10:30 United Kingdom Average Earnings, 3m/y July -0.2% +0.5% +0.6%

10:30 United Kingdom Average earnings ex bonuses, 3 m/y July +0.6% +0.7%

10:30 United Kingdom Claimant count August -37.4 Revised From -33.6 -29.7 -37.2

10:30 United Kingdom Claimant Count Rate August 3.0% 2.9%

10:30 United Kingdom ILO Unemployment Rate July 6.4% 6.3% 6.2%

10:30 United Kingdom Bank of England Minutes

11:00 Eurozone Harmonized CPI August -0.7% +0.1%

11:00 Eurozone Harmonized CPI ex EFAT, Y/Y August +0.8% +0.9%

11:00 Eurozone Harmonized CPI, Y/Y (Finally) August +0.3% +0.3% +0.4%

11:00 Switzerland Credit Suisse ZEW Survey (Expectations) September 2.5 -7.7

The U.S. dollar traded mixed against the most major currencies ahead of the Fed's interest rate decision. Market participants expect the Fed will cut its asset purchase program by another $10 billion. Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

The U.S. consumer price index is expected to rise 0.1% in August, after a 0.1% increase in July.

The U.S. consumer price index excluding food and energy is expected to climb 0.2% in August, after a 0.1% gain in July.

The NAHB housing market index is expected to increase to 56 in September from 55 in August.

The euro traded mixed against the U.S. dollar after the consumer inflation data from the Eurozone. Eurostat said today consumer price inflation was revised up to an annual rate of 0.4% in August from a preliminary reading of 0.3%.

Eurozone's consumer price index excluding food, energy, alcohol, and tobacco costs increased 0.9% in August.

The British pound traded higher against the U.S. dollar after the better-than-expected unemployment rate from the U.K. The unemployment rate in the U.K. fell to 6.2% in July from 6.4% in June, beating expectations for a decline to 6.3%. That was the lowest level since late 2008.

The average earnings index including bonuses increased 0.6% in the three months to July, beating forecast of a 0.5% rise, after a 0.1% decline in the three months to June. June's figure was revised up from a 0.2% drop.

The average earnings index excluding bonuses climbed 0.7% in the three months to July, after a 0.7% gain in the three months to June. June's figure was revised up from a 0.6% increase.

Two members of Bank of England's Monetary Policy Committee, Ian McCafferty and Martin Weale, voted for the second consecutive month to raise interest rates to 0.75% from 0.5%.

Scotland's independence referendum on Thursday continued to weigh on the pound.

The Swiss franc traded mixed against the U.S. dollar. Swiss ZEW Economic Sentiment Index declined to -7.7 in September from 2.5 in August. That was the first negative reading since January 2013.

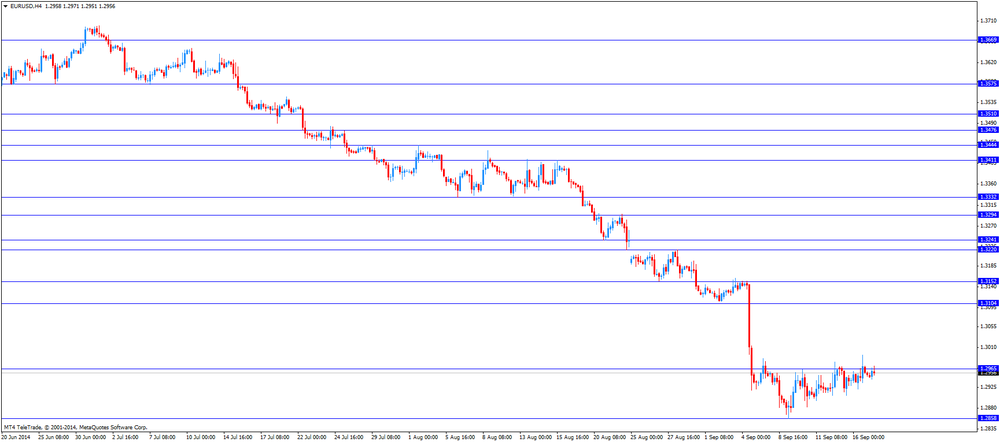

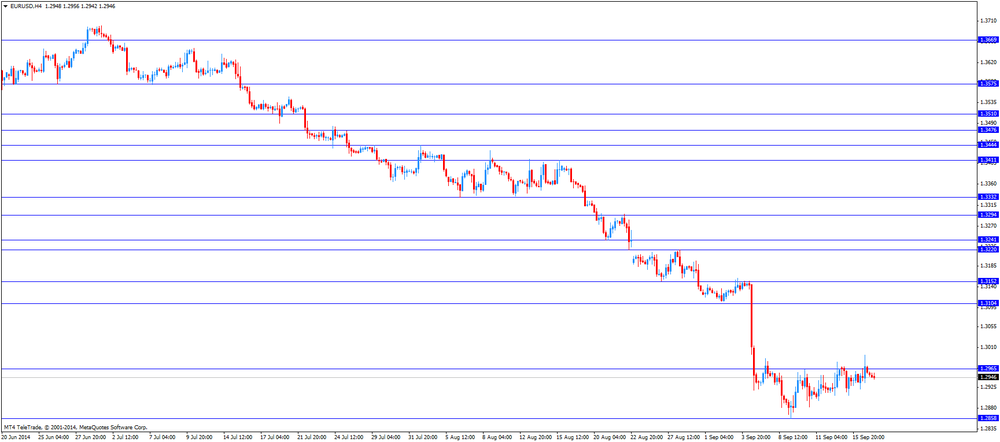

EUR/USD: the currency pair traded mixed

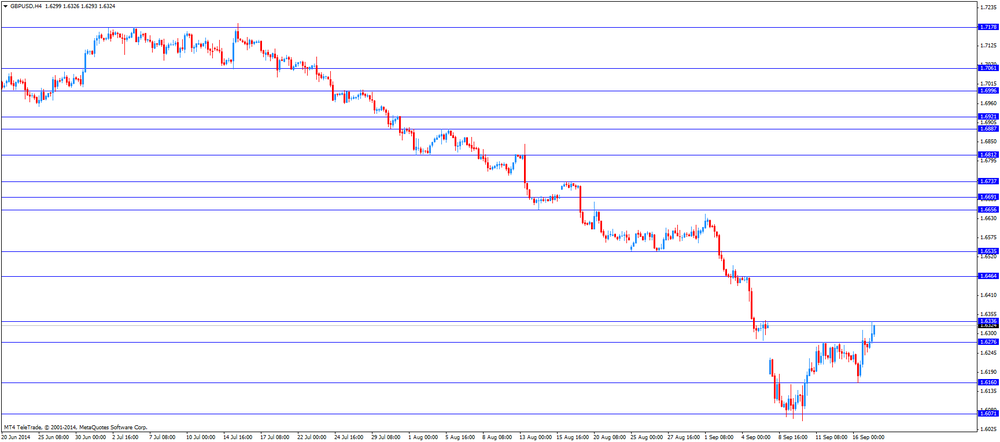

GBP/USD: the currency pair rose to $1.6335

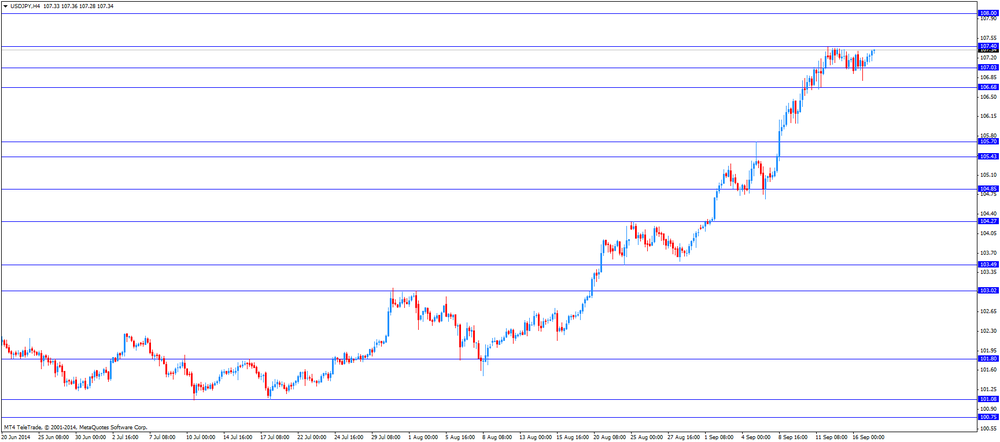

USD/JPY: the currency pair increased to Y107.36

The most important news that are expected (GMT0):

14:30 U.S. Current account, bln Quarter II -111 -114

14:30 U.S. CPI, m/m August +0.1% +0.1%

14:30 U.S. CPI, Y/Y August +2.0%

14:30 U.S. CPI excluding food and energy, m/m August +0.1% +0.2%

14:30 U.S. CPI excluding food and energy, Y/Y August +1.9%

16:00 U.S. NAHB Housing Market Index September 55 56

20:00 U.S. FOMC Economic Projections

20:00 U.S. FOMC Statement

20:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

20:00 U.S. FOMC QE Decision 25 15

20:30 U.S. Federal Reserve Press Conference

-

13:00

Orders

EUR/USD

Offers $1.3070, $1.3050, $1.3000

Bids $1.2900, $1.2880, $1.2860/50, $1.2800

GBP/USD

Offers $1.6500, $1.6465, $1.6400, $1.6340/50,

Bids 1.6160, $1.6125/20, $1.6100, $1.6050

AUD/USD

Offers $0.9250/60, $0.9220, $0.9110

Bids 0.8980, $0.8900, $$0.8800

EUR/JPY

Offers Y140.00, Y139.50, Y139.20

Bids Y138.30, Y138.00, Y138.50

USD/JPY

Offers Y108.00, Y107.40-50

Bids Y106.70/65, Y106.50, Y106.05/95, Y105.50, Y105.20

EUR/GBP

Offers stg0.8100, stg0.8000/10, stg0.7970

Bids stg0.7920, stg0.7900, stg0.7890

-

11:29

Eurozone’s consumer price inflation was revised up to 0.4% in August

Eurostat said today consumer price inflation was revised up to an annual rate of 0.4% in August from a preliminary reading of 0.3%. But consumer price inflation remains at the lowest level since Oct 2009.

Eurozone's consumer price index excluding food, energy, alcohol, and tobacco costs increased 0.9% in August.

-

10:57

Bank of England's Monetary Policy Committee minutes: two members voted for the second consecutive month to raise interest rates

The Bank of England's Monetary Policy Committee (MPC) released its latest minutes today. Two members, Ian McCafferty and Martin Weale, voted for the second consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

-

10:47

U.K. unemployment reached the lowest level since late 2008

The U.K. Office for National Statistics released its labour market data. The unemployment rate in the U.K. fell to 6.2% in July from 6.4% in June, beating expectations for a decline to 6.3%. That was the lowest level since late 2008.

The claimant count declined by 37,200 people in August, exceeding expectations for a drop of 29,700 people, after a decrease of 37,400 people in July. July's figure was revised up from a fall of 33,600 people.

The average earnings index including bonuses increased 0.6% in the three months to July, beating forecast of a 0.5% rise, after a 0.1% decline in the three months to June. June's figure was revised up from a 0.2% drop.

The average earnings index excluding bonuses climbed 0.7% in the three months to July, after a 0.7% gain in the three months to June. June's figure was revised up from a 0.6% increase.

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD: $1.2900(E400mn), $1.2950(E329mn), $1.3000(E331mn), $1.3030(E227mn), $1.3050(E426mn)

USD/JPY Y106.75($300mn), Y107.00($100mn), Y107.25($200mn)

EUR/GBP: stg0.7940(E100mn), stg0.8020(E150mn)

EUR/CHF: Chf1.2090(E336mn), Chf1.2140(E568mn)

AUD/USD: $0.9000(A$833mn), $0.9100(A$1.7bn)

USD/CAD: C$1.0880($240mn), C$1.0980($535mn), C$1.1000($315mn), C$1.1030($350mn), C$1.1090-1.1100($660mn)

-

10:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, August +0.9%

-

10:00

Switzerland: Credit Suisse ZEW Survey (Expectations), September -7.7

-

10:00

Eurozone: Harmonized CPI, Y/Y, August +0.4% (forecast +0.3%)

-

10:00

Eurozone: Harmonized CPI, August +0.1%

-

09:45

Foreign exchange market. Asian session: the New Zealand dollar traded lower against the U.S dollar after the current account data from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:45 New Zealand Current Account Quarter II 1.41 -1.04 -1.06

10:30 United Kingdom Average Earnings, 3m/y July -0.2% +0.5% +0.6%

10:30 United Kingdom Average earnings ex bonuses, 3 m/y July +0.6% +0.7%

10:30 United Kingdom Claimant count August -37.4 Revised From -33.6 -29.7 -37.2

10:30 United Kingdom Claimant Count Rate August 3.0% 2.9%

10:30 United Kingdom ILO Unemployment Rate July 6.4% 6.3% 6.2%

10:30 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision today.

Market participants expect the Fed will cut its asset purchase program by another $10 billion.

The New Zealand dollar traded lower against the U.S dollar after the current account data from New Zealand. New Zealand's current account deficit was NZ$1.06 billion in the second quarter, down from a surplus of NZ$1.41 billion in the first quarter. Analysts had expected the current account deficit of NZ$1.04 billion.

The auction on Fonterra's GlobalDairyTrade platform showed dairy prices rose from a two-year low.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

11:00 Eurozone Harmonized CPI, Y/Y (Finally) August +0.3% +0.3%

14:30 U.S. Current account, bln Quarter II -111 -114

14:30 U.S. CPI, m/m August +0.1% +0.1%

14:30 U.S. CPI, Y/Y August +2.0%

14:30 U.S. CPI excluding food and energy, m/m August +0.1% +0.2%

14:30 U.S. CPI excluding food and energy, Y/Y August +1.9%

16:00 U.S. NAHB Housing Market Index September 55 56

20:00 U.S. FOMC Economic Projections

20:00 U.S. FOMC Statement

20:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

20:00 U.S. FOMC QE Decision 25 15

20:30 U.S. Federal Reserve Press Conference

-

09:31

United Kingdom: Average Earnings, 3m/y , July +0.6% (forecast +0.5%)

-

09:31

United Kingdom: Average earnings ex bonuses, 3 m/y, July +0.7%

-

09:30

United Kingdom: Claimant count , August -37.2 (forecast -29.7)

-

09:30

United Kingdom: Claimant Count Rate, August 2.9%

-

09:30

United Kingdom: ILO Unemployment Rate, July 6.2% (forecast 6.3%)

-

06:19

Options levels on wednesday, September 17, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3069 (4612)

$1.3020 (434)

$1.2987 (160)

Price at time of writing this review: $ 1.2950

Support levels (open interest**, contracts):

$1.2898 (4787)

$1.2876 (7027)

$1.2853 (3902)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 49070 contracts, with the maximum number of contracts with strike price $1,3000 (4612);

- Overall open interest on the PUT options with the expiration date October, 3 is 55185 contracts, with the maximum number of contracts with strike price $1,3000 (7027);

- The ratio of PUT/CALL was 1.13 versus 1.17 from the previous trading day according to data from September, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.6504 (2184)

$1.6407 (1295)

$1.6312 (1485)

Price at time of writing this review: $1.6280

Support levels (open interest**, contracts):

$1.6184 (1381)

$1.6087 (3005)

$1.5990 (1896)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 26553 contracts, with the maximum number of contracts with strike price $1,6500 (2184);

- Overall open interest on the PUT options with the expiration date October, 3 is 36257 contracts, with the maximum number of contracts with strike price $1,6300 (4559);

- The ratio of PUT/CALL was 1.37 versus 1.38 from the previous trading day according to data from September, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-