Notícias do Mercado

-

23:30

Currencies. Daily history for Dec 18’2014:

(pare/closed(GMT +2)/change, %)

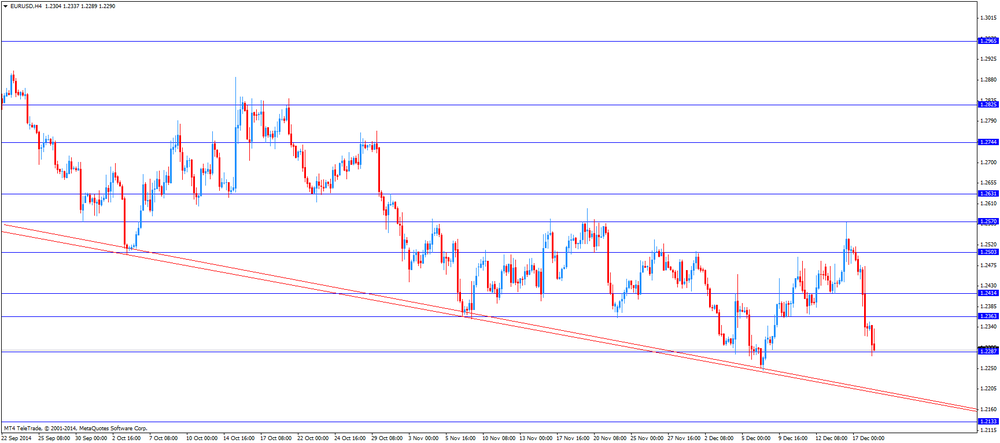

EUR/USD $1,2286 -0,45%

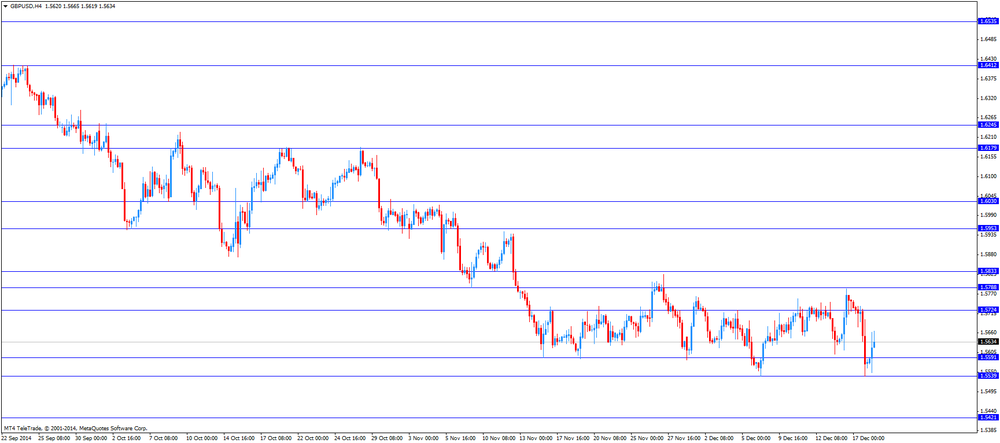

GBP/USD $1,5669 +0,61%

USD/CHF Chf0,9797 +0,70%

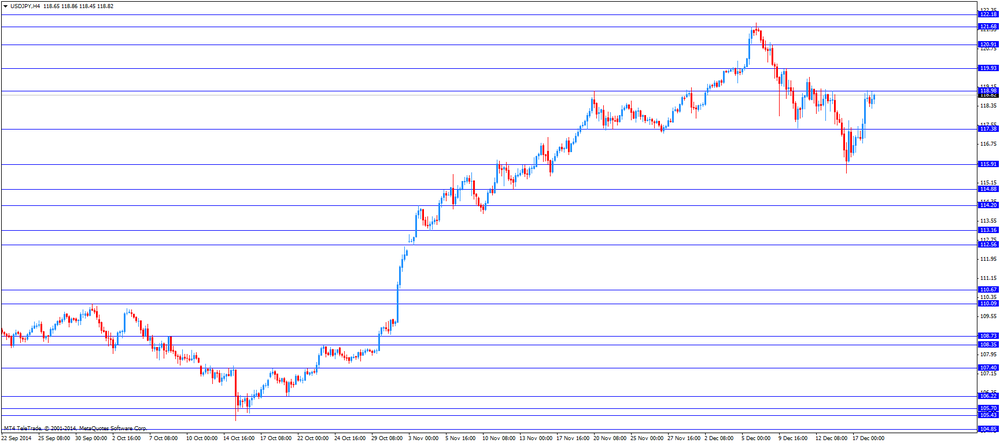

USD/JPY Y118,83 +0,15%

EUR/JPY Y145,99 -0,29%

GBP/JPY Y186,19 +0,78%

AUD/USD $0,8163 +0,53%

NZD/USD $0,7763 +0,77%

USD/CAD C$1,1574 -0,50%

-

23:02

Schedule for today, Friday, Dec 19’2014:

(time / country / index / period / previous value / forecast)

00:00 New Zealand ANZ Business Confidence December 31.5

00:05 United Kingdom Gfk Consumer Confidence December -2 -1

02:00 New Zealand Credit Card Spending November +6.7%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m October +1.0% +0.2%

06:30 Japan BOJ Press Conference

07:00 Germany Producer Price Index (MoM) November -0.2% -0.2%

07:00 Germany Producer Price Index (YoY) November -1.0% -1.1%

07:00 Germany Gfk Consumer Confidence Survey November 8.7 8.9

09:00 Eurozone Current account, adjusted, bln October 30.0 27.8

09:00 Eurozone EU Economic Summit

09:30 United Kingdom PSNB, bln November 7.1 14.8

11:00 United Kingdom CBI retail sales volume balance December 27 30

13:30 Canada Retail Sales, m/m October +0.8% -0.4%

13:30 Canada Retail Sales ex Autos, m/m October 0.0 +0.2%

13:30 Canada Consumer Price Index m / m November +0.1 -0.2

13:30 Canada Consumer price index, y/y November +2.4% +2.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m November +0.3% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November +2.3% +2.4%

-

16:43

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the mostly weaker-than-expected U.S. economic data

The U.S. dollar mixed against the most major currencies after the mostly weaker-than-expected U.S. economic data. The number of initial jobless claims in the week ending December 12 in the U.S. fell by 6,000 to 289,000 from 295,000 in the previous week. The previous week's figure was revised down from 294,000. Analysts had expected the number of initial jobless claims to climb to 297,000.

The Philadelphia Federal Reserve Bank released its manufacturing index dropped to 24.5 in December from 40.8 in November. Analysts had expected the index to decline to 26.3.

The U.S. preliminary services PMI declined to 53.6 in December from 56.2 in November, missing expectations for an increase to 57.1. This is the lowest level since February 2014.

The greenback remained supported by Fed's interest rate decision released yesterday. The Fed kept its interest rate unchanged and said it will be "patient" before to raise its interest rate.

The euro traded lower against the U.S. dollar. German Ifo business climate index rose to 105.5 in December from 104.7 in October, but missing expectations for a rise to 105.6.

The British pound traded higher against the U.S. dollar. Retail sales in the U.K. increased 1.6% in November, exceeding expectations for a 0.3% rise, after a 1.0% gain in October. That the highest increase since December 2013. October's figure was revised up from a 0.8% increase.

On a yearly basis, retail sales in the U.K. climbed 6.4% in November, beating expectations for a 4.5% rise, after a 4.6% increase in October. That was the highest rise since May 2004. October's figure was revised up from a 4.3% rise.

The increase was driven by strong Black Friday sales.

The Swiss franc traded lower against the U.S. dollar. The Swiss National Bank (SNB) has introduced a negative deposit rate to defend the exchange rate floor unchanged at 1.20 francs per euro. The SNB will charge 0.25% on sight deposits at the central bank. The new deposit rate will be imposed on January, 22.

Switzerland's trade surplus widened CHF3.87 billion in November from CHF3.23 billion in October, beating expectations for a decline to CHF 2.41 billion.

The State Secretariat for Economic Affairs (SECO) released its forecasts for Switzerland today. Seco still expects the economic growth of 1.8% in 2014, but lowered its forecast for 2015 to 2.1% from 2.4% due to a slowdown of the economic growth in the Eurozone.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback due after the gross domestic product (GDP) data from New Zealand. New Zealand's GDP rose 1.0% in the third quarter, exceeding expectations for a 0.7% increase, after a 0.7% gain in the second quarter.

On a yearly basis, New Zealand's GDP climbed by 3.2% in the third quarter, missing expectations for a 3.3% gain, after a 3.2% rise in the second quarter. The second quarter's figure was revised down from a 3.9% rise.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded slightly higher against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:55

U.S. preliminary services PMI declined to 53.6 in December

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. The U.S. preliminary services PMI declined to 53.6 in December from 56.2 in November, missing expectations for an increase to 57.1. This is the lowest level since February 2014.

The decline was driven by slower employment and new business growth.

A reading above 50 indicates expansion in economic activity, below 50 indicates stagnation.

-

15:43

Philadelphia Federal Reserve Bank’s manufacturing index dropped to 24.5 in December

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to 24.5 in December from 40.8 in November.

Analysts had expected the index to decline to 26.3.

The survey said a pace of expansion was slowing, but there is still general optimism.

A reading above zero indicates expansion.

-

15:33

Swiss National Bank has introduced a negative deposit rate

The Swiss National Bank (SNB) has introduced a negative deposit rate to defend the exchange rate floor unchanged at 1.20 francs per euro. The SNB will charge 0.25% on sight deposits at the central bank. The new deposit rate will be imposed on January, 22.

The recent turmoil in global markets (falling oil prices and the Russian crisis) pushed the Swiss franc higher due to increased demand for safe-haven assets.

-

15:13

Federal Reserve will be "patient" before to raise its interest rate

The Federal Reserve released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged. The central bank changed its guidance language. It said that it will be "patient" before to raise its interest rate.

For the past six months, the Fed said that interest rates would remain unchanged for a "considerable time" after the end of bond-buying programme. The central bank maintained this phrase, but added that it can start to hike its interest rate sooner than expected. Improving inflation and employment are necessary for interest rate hike, the Fed pointed out.

The Fed Chair Janet Yellen said at the press conference that the Fed's position has not changed despite different views when to raise interest rates. Yellen noted that the Fed was unlikely to hike its interest rates for the "next couple of meetings".

The central bank said that the economy is expanding at a moderate pace and household and business spending were increasing moderately.

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, December 24.5 (forecast 26.3)

-

15:00

U.S.: Leading Indicators , November +0.6% (forecast +0.6%)

-

14:45

U.S.: Services PMI, December 53.6 (forecast 57.1)

-

14:18

Switzerland lowered its economic growth forecast for 2015

The State Secretariat for Economic Affairs (SECO) released its forecasts for Switzerland today. Seco still expects the economic growth of 1.8% in 2014, but lowered its forecast for 2015 to 2.1% from 2.4% due to a slowdown of the economic growth in the Eurozone.

Seco forecasted the growth of 2.4% in 2016.

Unemployment rate is expected to fall to 3.2% this year, to 3% in 2015 and to 2.8% in 2016.

Seco warned that the sluggish recovery in Europe could have a negative impact on the economic growth in Switzerland.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E2.7bn), $1.2400(E2.0bn), $1.2430(E500mn), $1.2450(E572mn), $1.2500-05(E1.3bn), $1.2525(E1.0bn), $1.2600(E1.7bn)

USD/JPY: Y116.50($1.0bn), Y117.00($1.2bn), Y117.65($1.5bn), Y117.85-118.00($1.8bn)

EUR/JPY: Y147.50(E750mn)

EUR/GBP: stg0.7850(E770mn), stg0.7905(E400mn)

EUR/CHF: Chf1.2010(E350mn)

NZD/USD: $0.7720(NZ$250mn)

-

13:30

U.S.: Initial Jobless Claims, December 289 (forecast 297)

-

13:04

Foreign exchange market. European session: the British pound rose against the U.S. dollar after the better-than-expected retail sales from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Bulletin

06:45 Switzerland SECO Economic Forecasts

07:00 Switzerland Trade Balance November 3.23 2.41 3.87

09:00 Eurozone EU Economic Summit

09:00 Germany IFO - Business Climate December 104.7 105.6 105.5

09:00 Germany IFO - Current Assessment December 110.0 110.3 110.0

09:00 Germany IFO - Expectations December 99.7 100.9 101.1

09:30 United Kingdom Retail Sales (MoM) November +0.8% +0.3% +1.6%

09:30 United Kingdom Retail Sales (YoY) November +4.3% +4.5% +6.4%

The U.S. dollar mixed against the most major currencies ahead of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to increase by 3,000 to 297,000.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to drop to 26.3 in December from 40.8 in November.

The greenback was supported by Fed's interest rate decision released yesterday. The Fed kept its interest rate unchanged and said it will be "patient" before to raise its interest rate.

The euro traded lower against the U.S. dollar after the weaker-than-expected Ifo figures from Germany. German Ifo business climate index rose to 105.5 in December from 104.7 in October, but missing expectations for a rise to 105.6.

The British pound rose against the U.S. dollar after the better-than-expected retail sales from the U.K. Retail sales in the U.K. increased 1.6% in November, exceeding expectations for a 0.3% rise, after a 1.0% gain in October. That the highest increase since December 2013. October's figure was revised up from a 0.8% increase.

On a yearly basis, retail sales in the U.K. climbed 6.4% in November, beating expectations for a 4.5% rise, after a 4.6% increase in October. That was the highest rise since May 2004. October's figure was revised up from a 4.3% rise.

The increase was driven by strong Black Friday sales.

The Swiss franc traded lower against the U.S. dollar. Switzerland's trade surplus widened CHF3.87 billion in November from CHF3.23 billion in October, beating expectations for a decline to CHF 2.41 billion.

The State Secretariat for Economic Affairs (SECO) released its forecasts for Switzerland today. Seco still expects the economic growth of 1.8% in 2014, but lowered its forecast for 2015 to 2.1% from 2.4% due to a slowdown of the economic growth in the Eurozone.

EUR/USD: the currency pair traded fell to $1.2277

GBP/USD: the currency pair climbed to $1.5665

USD/JPY: the currency pair increased to Y118.96

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims December 294 297

15:00 U.S. Philadelphia Fed Manufacturing Survey December 40.8 26.3

-

13:00

Orders

EUR/USD

Offers $1.2380

Bids $1.2200

GBP/USD

Offers $1.5800, $1.5785

Bids $1.5520, $1.5500, $1.5480

AUD/USD

Offers $0.8350, $0.8300, $0.8250

Bids $0.8155/50, $0.8100, $0.8050, $0.8000

EUR/JPY

Offers Y148.00, Y147.50, Y146.80/00, Y146.50

Bids Y145.50, Y145.00, Y144.50

USD/JPY

Offers Y120.00, Y119.50, Y119.20, Y118.80

Bids Y118.00, Y117.50, Y117.00

EUR/GBP

Offers stg0.8020, stg0.7975/80, stg0.7950/55

Bids stg0.7800

-

12:19

UK retail sales increased 1.6% in November, the highest increase since December 2013

The Office for National Statistics released the retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 1.6% in November, exceeding expectations for a 0.3% rise, after a 1.0% gain in October. That the highest increase since December 2013. October's figure was revised up from a 0.8% increase.

On a yearly basis, retail sales in the U.K. climbed 6.4% in November, beating expectations for a 4.5% rise, after a 4.6% increase in October. That was the highest rise since May 2004. October's figure was revised up from a 4.3% rise.

The increase was driven by strong Black Friday sales. Electrical goods sales surged 32% from a year earlier, while sales at department stores jumped 15%.

Online sales rose at an annual rate of 12.9%.

-

10:18

Option expiries for today's 10:00 ET NY cut

-

09:30

United Kingdom: Retail Sales (MoM), November +1.6% (forecast +0.3%)

-

09:30

United Kingdom: Retail Sales (YoY) , November +6.4% (forecast +4.5%)

-

09:20

Press Review: Swiss franc hits two-year low as SNB cuts rates to negative

REUTERS

Swiss franc hits two-year low as SNB cuts rates to negative

(Reuters) - The Swiss franc hit its lowest against the dollar in more than two years, and touched a two-month trough against the euro, on Thursday after the Swiss National Bank said it would introduce negative interest rates.

In a brief statement, the SNB said it would impose an interest rate of -0.25 percent on sight deposit account balances of over 10 million Swiss francs as it seeks to discourage safe-haven buying of francs.

Source: http://www.reuters.com/article/2014/12/18/us-markets-forex-idUSKBN0JV04120141218

BLOOMBERG

PBOC Offers Loans to Banks as Money Rate Jumps Most in 11 Months

China's central bank offered short-term loans to commercial lenders as the benchmark money-market rate jumped the most in 11 months.

The amount of money made available by the People's Bank of China wasn't clear, according to people familiar with the matter. Policy makers are adding funds to the financial system to address a cash crunch as subscriptions for the biggest new share sales of the year lock up funds. Twelve initial public offerings from today through Dec. 25 will draw orders of as much as 3 trillion yuan ($483 billion), Shenyin & Wanguo Securities Co. estimated.

BLOOMBERG

Greece Fails to Gather Support to Elect New President

Greece moved a step closer to early elections after Prime Minister Antonis Samaras failed to gather enough support for his nominee in a parliamentary vote for a new head of state.

In voting in Athens yesterday, 160 lawmakers in Greece's 300-seat chamber backed Samaras's candidate for the presidency, Stavros Dimas, short of the 200 votes required in the first of three attempts this month. Samaras has 155 lawmakers in his governing coalition and failure to rally enough support for Dimas will lead to the dissolution of parliament.

Source: http://www.bloomberg.com/news/2014-12-17/greece-fails-to-gather-support-to-elect-new-president.html

-

09:00

Germany: IFO - Business Climate, December 105.5 (forecast 105.6)

-

09:00

Germany: IFO - Current Assessment , December 110.0 (forecast 110.3)

-

09:00

Germany: IFO - Expectations , December 101.1 (forecast 100.9)

-

07:30

Foreign exchange market. Asian session: U.S. dollar stronger after FED policy meeting

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia RBA Bulletin

06:45 Switzerland SECO Economic Forecasts

07:00 Switzerland Trade Balance November 3.23 2.41 3.87

The greenback traded stronger to mixed against its major peers in Asian trade after the FED's policy meeting ended yesterday as FED Chair Janet Yellen stated that rates are going to be raised next year once economic parameters were met - finally removing the "considerable time" from the minutes. She further said "the committee considers it unlikely to begin normalization process for at least the next couple of meetings". The U.S. dollar extended its gains against the euro, the British pound and the Japanese Yen.

The Australian dollar recovered slightly from a four year low after yesterday's slump.

New Zealand's dollar traded positive to stable against the greenback currently quoted at USD0.7707. The GDP on a quarterly basis beat expectations by +0.3% with a reading of +1.0%. Yearly GDP in the third quarter decreased from +3.9% to +3.2%, missing forecasts by 0.1%.

The Japanese yen continued to decline versus the U.S. dollar after the currency hit a monthly high on Tuesday fuelled by fears over falling oil prices and Russia's economic crisis.

EUR/USD: the euro lost against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone EU Economic Summit

09:00 Germany IFO - Business Climate December 104.7 105.6

09:00 Germany IFO - Current Assessment December 110.0 110.3

09:00 Germany IFO - Expectations December 99.7 100.9

09:30 United Kingdom Retail Sales (MoM) November +0.8% +0.3%

09:30 United Kingdom Retail Sales (YoY) November +4.3% +4.5%

13:30 U.S. Initial Jobless Claims December 294 297

14:45 U.S. Services PMI (Preliminary) December 56.2 57.1

15:00 U.S. Leading Indicators November +0.9% +0.6%

15:00 U.S. Philadelphia Fed Manufacturing Survey December 40.8 26.3

21:45 New Zealand Visitor Arrivals November +3.3%

-

07:00

Switzerland: Trade Balance, November 3.87 (forecast 2.41)

-

06:28

Options levels on thursday, December 18, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2452 (1773)

$1.2410 (346)

$1.2381 (245)

Price at time of writing this review: $ 1.2337

Support levels (open interest**, contracts):

$1.2306 (810)

$1.2278 (2109)

$1.2235 (3684)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 51390 contracts, with the maximum number of contracts with strike price $1,2500 (6745);

- Overall open interest on the PUT options with the expiration date January, 9 is 58168 contracts, with the maximum number of contracts with strike price $1,2000 (7336);

- The ratio of PUT/CALL was 1.13 versus 1.16 from the previous trading day according to data from December, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.5802 (1955)

$1.5704 (2729)

$1.5608 (711)

Price at time of writing this review: $1.5585

Support levels (open interest**, contracts):

$1.5491 (1074)

$1.5394 (938)

$1.5297 (1172)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 23056 contracts, with the maximum number of contracts with strike price $1,5850 (4100);

- Overall open interest on the PUT options with the expiration date January, 9 is 18196 contracts, with the maximum number of contracts with strike price $1,5550 (1898);

- The ratio of PUT/CALL was 0.79 versus 0.79 from the previous trading day according to data from December, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-