Notícias do Mercado

-

20:00

Dow +84.64 17,862.79 +0.48% Nasdaq +27.14 4,775.54 +0.57% S&P +13.9 2,075.13 +0.67%

-

16:44

Foreign exchange market. American session: the Canadian dollar decreased against the U.S. dollar after the mostly weaker-than-expected Canadian retail sales and consumer price index data

The U.S. dollar traded higher against the most major currencies. The greenback remained supported by Fed's interest rate decision released yesterday. The Fed kept its interest rate unchanged and said it will be "patient" before to raise its interest rate.

There will be released no major economic reports in the U.S. today.

The euro declined against the U.S. dollar. The Gfk German consumer confidence index increased to 9.0 in January from 8.7 in December, beating forecasts for a rise to 8.9.

Eurozone's adjusted current account surplus dropped to €20.5 billion in October from €32.0 billion in September. September's figure was revised up from a surplus of €30.0 billion. Analysts had expected a surplus of €27.8 billion.

The British pound fell against the U.S. dollar. The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance jumped to 61% in December from 27% in November, exceeding expectations for an increase to 30%. That was the highest level since January 1988.

The public sector net borrowing in the U.K. rose to £13.4 billion in November from £6.4 billion in October, beating expectations for a gain to £14.8 billion. October's figure was revised up from £7.1 billion.

The Canadian dollar decreased against the U.S. dollar after the mostly weaker-than-expected Canadian retail sales and consumer price index data. Canadian retail sales were flat in October, beating expectations for a 0.4% decline, after a 0.8% rise in September.

The decline in motor vehicle and parts sales weighed on retail sales.

Canadian retail sales excluding automobiles increased 0.2% in October, in line with expectations, after a flat reading in September.

Canadian consumer price inflation decreased 0.4% in November, missing expectations for a 0.2% decline, after a 0.1% gain in October.

On a yearly basis, the consumer price index fell to 2.0% November from 2.4% in October. Analysts had expected the index to decline 2.3%.

The consumer price index was driven by lower gasoline prices.

Canadian core consumer price index, which excludes some volatile goods, decreased 0.2% in November, missing expectations for a 0.1% rise, after a 0.3% increase in October.

On a yearly basis, core consumer price index in Canada declined to 2.1% in November from 2.3% in October, missing forecasts of a rise to 2.4%.

The Bank of Canada's inflation target is 2.0%.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback despite the mostly weak economic data from New Zealand. The ANZ business confidence index for New Zealand declined to 30.4 in December from 31.5 in November.

Credit card spending in New Zealand rose 5.2% in November, after a 6.8% gain in October. October's was revised up from a 6.7% increase.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen fell against the greenback after the Bank of Japan's (BoJ) interest rate decision. The BoJ kept its interest rate at 0.1% unchanged. The central bank will expand its monetary base at an annual pace of 80 trillion yen. The BoJ board voted by an 8-1 margin to hold off fresh stimulus measures.

The BoJ Governor Haruhiko Kuroda said at the press conference that the nation's economy is on track to reach the BoJ's 2% inflation target and the BoJ would do anything to achieve its target.

-

15:55

Bank of Japan Governor Haruhiko Kuroda: the nation’s economy is on track to reach the BoJ’s 2% inflation target

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its interest rate at 0.1% unchanged. The central bank will expand its monetary base at an annual pace of 80 trillion yen. The BoJ board voted by an 8-1 margin to hold off fresh stimulus measures.

The BoJ Governor Haruhiko Kuroda said at the press conference that Japan's economy continues to recover moderately. He added that the nation's economy is on track to reach the BoJ's 2% inflation target and the BoJ would do anything to achieve its target.

The BoJ said that "exports have shown signs of picking up", but "private consumption has remained resilient".

-

15:03

Canadian consumer price inflation dropped 0.4% in November

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation decreased 0.4% in November, missing expectations for a 0.2% decline, after a 0.1% gain in October.

On a yearly basis, the consumer price index fell to 2.0% November from 2.4% in October. Analysts had expected the index to decline 2.3%.

The consumer price index was driven by lower gasoline prices.

Canadian core consumer price index, which excludes some volatile goods, decreased 0.2% in November, missing expectations for a 0.1% rise, after a 0.3% increase in October.

On a yearly basis, core consumer price index in Canada declined to 2.1% in November from 2.3% in October, missing forecasts of a rise to 2.4%.

The Bank of Canada's inflation target is 2.0%.

-

14:09

Canadian retail sales were flat in October

Statistics Canada released retail sales data on Friday. Canadian retail sales were flat in October, beating expectations for a 0.4% decline, after a 0.8% rise in September.

The decline in motor vehicle and parts sales weighed on retail sales. Motor vehicle and parts sales fell 0.6% in October, building material and garden supply sales increased 2.0%, while electronics and appliance sales rose 3.2%.

Gasoline station sales dropped 1.1%.

Canadian retail sales excluding automobiles increased 0.2% in October, in line with expectations, after a flat reading in September.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E1.5bn), $1.2250-60(E3.1bn), $1.2300(E9.8bn), $1.2350(E6.0bn)

USD/JPY: Y117.00($4.8bn), Y118.50($1.3bn), Y119.00($2.3bn), Y119.50($1.2bn), Y120.00($6.6bn)

GBP/USD: $1.5550(stg300mn), $1.5600(stg335mn), $1.5700(stg1.0bn)

EUR/GBP: stg0.7750(E300mn), stg0.7865-75(E400mn), stg0.7915(E350mn)

USD/CHF: Chf0.9750($877mn), Chf0.9800($525mn), Chf0.9900($1.9bn)

AUD/USD: $0.8185(A$1.4bn), $0.8200(A$1.1bn), $0.8255(A$1.4bn)

NZD/USD: $0.7600(NZ$1.7bn), $0.7750(NZ$450mn), $0.7770(NZ$280mn)

USD/CAD: C$1.1500($775mn), C$1.1600($1.1bn), C$1.1650($437mn), C$1.1700($480mn)

-

13:31

Canada: Bank of Canada Consumer Price Index Core, m/m, November -0.2% (forecast +0.1%)

-

13:31

Canada: Bank of Canada Consumer Price Index Core, y/y, November +2.1% (forecast +2.4%)

-

13:30

Canada: Retail Sales, m/m, October 0.0% (forecast -0.4%)

-

13:30

Canada: Retail Sales ex Autos, m/m, October +0.2% (forecast +0.2%)

-

13:30

Canada: Consumer Price Index m / m, November -0.4% (forecast -0.2)

-

13:30

Canada: Consumer price index, y/y, November +2.0% (forecast +2.3%)

-

13:10

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar despite the better-than-expected data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand ANZ Business Confidence December 31.5 30.4

00:05 United Kingdom Gfk Consumer Confidence December -2 -1 -4

02:00 New Zealand Credit Card Spending November +6.7% +5.2%

03:00 Japan Bank of Japan Monetary Base Target 275 275 275

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m October +1.0% +0.2% -0.1%

06:30 Japan BOJ Press Conference

07:00 Germany Producer Price Index (MoM) November -0.2% -0.2% 0.0%

07:00 Germany Producer Price Index (YoY) November -1.0% -1.1% -0.9%

07:00 Germany Gfk Consumer Confidence Survey January 8.7 8.9 9.0

09:00 Eurozone Current account, adjusted, bln October 32.0 Revised From 30.0 27.8 20.5

09:00 Eurozone EU Economic Summit

09:30 United Kingdom PSNB, bln November 6.4 Revised From 7.1 14.8 13.4

11:00 United Kingdom CBI retail sales volume balance December 27 30 61

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by Fed's interest rate decision released yesterday. The Fed kept its interest rate unchanged and said it will be "patient" before to raise its interest rate.

There will be released no major economic reports in the U.S. today.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. The Gfk German consumer confidence index increased to 9.0 in January from 8.7 in December, beating forecasts for a rise to 8.9.

Eurozone's adjusted current account surplus dropped to €20.5 billion in October from €32.0 billion in September. September's figure was revised up from a surplus of €30.0 billion. Analysts had expected a surplus of €27.8 billion.

The British pound traded mixed against the U.S. dollar despite the better-than-expected data from the U.K. The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance jumped to 61% in December from 27% in November, exceeding expectations for an increase to 30%. That was the highest level since January 1988.

The public sector net borrowing in the U.K. rose to £13.4 billion in November from £6.4 billion in October, beating expectations for a gain to £14.8 billion. October's figure was revised up from £7.1 billion.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian retail sales and consumer price index data. Canadian retail sales are expected to decrease 0.4% in October, after 0.8% rise in September.

Canadian retail sales excluding automobiles are expected to rise 0.2% in October, after a flat reading in September.

The consumer price index in Canada is expected to decline to an annual rate of 2.3% in November from 2.4% in October.

The core consumer price index in Canada is expected to rise to an annual rate of 2.4% in November from 2.3% in October.

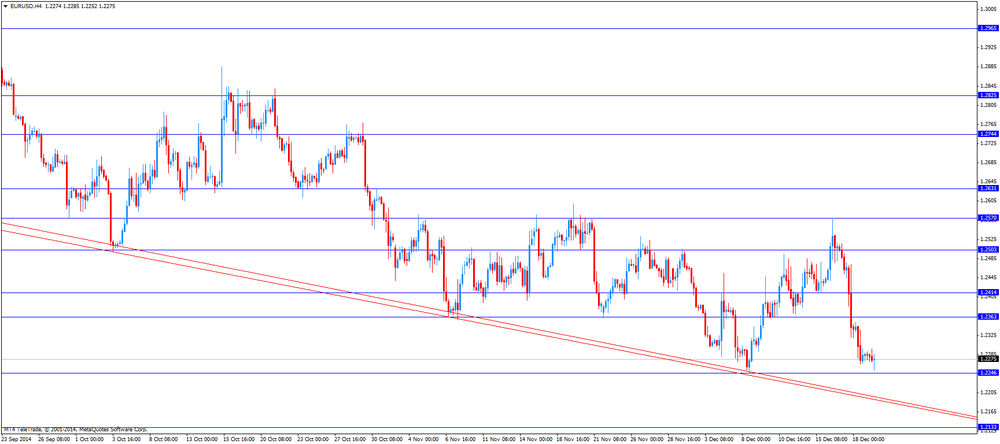

EUR/USD: the currency pair traded mixed

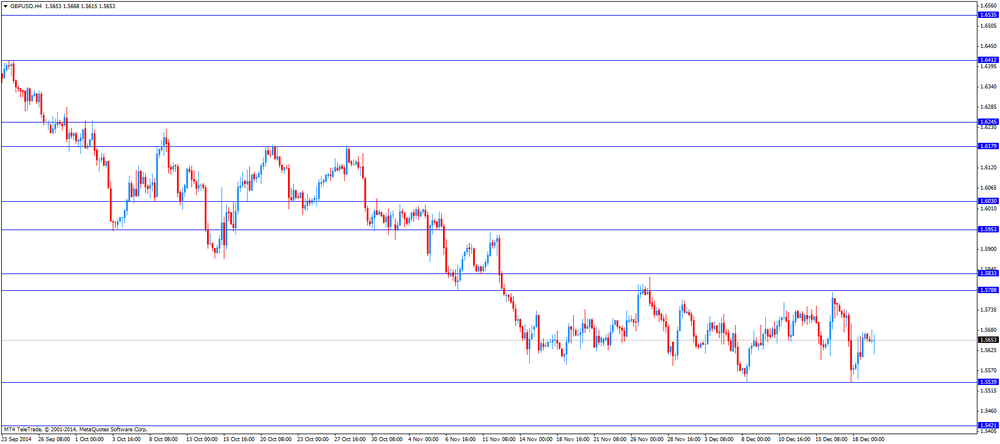

GBP/USD: the currency pair traded mixed

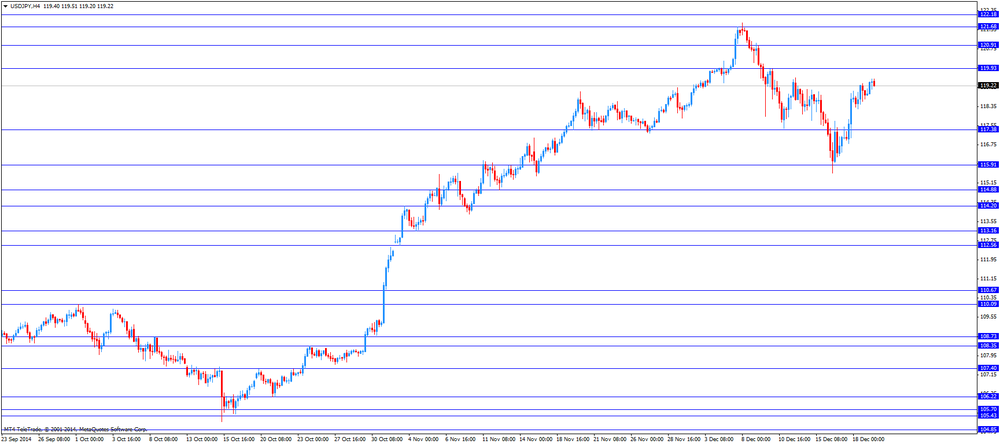

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m October +0.8% -0.4%

13:30 Canada Retail Sales ex Autos, m/m October 0.0 +0.2%

13:30 Canada Consumer Price Index m / m November +0.1 -0.2

13:30 Canada Consumer price index, y/y November +2.4% +2.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m November +0.3% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November +2.3% +2.4%

-

13:00

Orders

EUR/USD

Offers $1.2380, $1.2340-50

Bids $1.2200

GBP/USD

Offers $1.5800, $1.5785, $1.5750-53

Bids $1.5625/20, $1.5605/00

AUD/USD

Offers $0.8300, $0.8250, $0.8200

Bids $0.8100, $0.8050, $0.8000

EUR/JPY

Offers Y148.50, Y148.00, Y147.50, Y146.80/00

Bids Y146.00, Y145.50, Y145.00

USD/JPY

Offers Y121.20, Y121.00, Y120.50, Y120.00, Y119.50

Bids Y119.00, Y118.50, Y118.00

EUR/GBP

Offers stg0.7975/80, stg0.7950/55, stg0.7900, stg0.7880/85

Bids stg0.7800

-

12:43

CBI retail sales balance rose to 61% in December, the highest since 1988

The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance jumped to 61% in December from 27% in November, exceeding expectations for an increase to 30%. That was the highest level since January 1988.

The increase was largely driven by "Black Friday" price cuts.

-

11:00

United Kingdom: CBI retail sales volume balance, December 61 (forecast 30)

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E1.5bn), $1.2250-60(E3.1bn), $1.2300(E9.8bn), $1.2350(E6.0bn)

USD/JPY: Y117.00($4.8bn), Y118.50($1.3bn), Y119.00($2.3bn), Y119.50($1.2bn), Y120.00($6.6bn)

GBP/USD: $1.5550(stg300mn), $1.5600(stg335mn), $1.5700(stg1.0bn)

EUR/GBP: stg0.7750(E300mn), stg0.7865-75(E400mn), stg0.7915(E350mn)

USD/CHF: Chf0.9750($877mn), Chf0.9800($525mn), Chf0.9900($1.9bn)

AUD/USD: $0.8185(A$1.4bn), $0.8200(A$1.1bn), $0.8255(A$1.4bn)

NZD/USD: $0.7600(NZ$1.7bn), $0.7750(NZ$450mn), $0.7770(NZ$280mn)

USD/CAD: C$1.1500($775mn), C$1.1600($1.1bn), C$1.1650($437mn), C$1.1700($480mn)

-

09:30

United Kingdom: PSNB, bln, November 14.1 (forecast 14.8)

-

09:18

Press Review: Ruble firms as government steps up verbal support

REUTERS

Ruble firms as government steps up verbal support(Reuters) - Russia's ruble strengthened on Friday after Finance Minister Anton Siluanov confirmed his ministry had sold foreign currency and on expectations that exporters will step up dollar sales.

At 0815 GMT (03:15 a.m. EST), the ruble was around 2.7 percent stronger against the dollar at 59.85 RUBUTSTN=MCX and gained 2.7 percent to trade at 73.65 versus the euro EURRUBTN=MCX.

The ruble's recovery is in contrast to intense selling pressure earlier this week, when the ruble at one stage had fallen about 20 percent against the dollar on the day before rising again, threatening the relative financial stability on which President Vladimir Putin has built his popularity.

Source: http://www.reuters.com/article/2014/12/19/us-russia-crisis-markets-idUSKBN0JX0OS20141219

Businessweek

The Relentless Production of Shale Oil Is Breaking OPEC's Neck

The world's biggest oil companies faced ruin in the summer of 1931. Crude prices had plummeted. Wildcatters were selling oil from the bonanza East Texas field for a nickel a barrel, cheaper than a bowl of chili. On Aug. 17, Governor Ross Sterling declared a state of insurrection in four counties and sent 1,100 National Guard troops to shut down the fields and bring order to the market. A month later the Railroad Commission of Texas handed out strict production quotas.

BLOOMBERG

Yellen's Inflation Lessons: Targets Matter, Oil Shocks Dissipate

Janet Yellen isn't likely to change monetary policy because of transitory influences on prices coming from abroad. She's also not inclined to tolerate a long period of above-target inflation as a way of making up for years of little change in living costs.

Those are among the insights the Fed chair offered investors at her press conference this week.

For Yellen, these issues are now critical. Inflation has been below the Fed's 2 percent target for 30 months and, with a 45 percent decline in oil prices this year, will remain below it for several more months. Fed officials are wary of inflation remaining too low because it can become a drag on growth.

BLOOMBERG

Russia Forcing SNB Hand Drains Arsenal to Fight ECB StimulusJanet

The Swiss National Bank's resort to negative interest rates leaves President Thomas Jordan wielding a weaker hand when the European Central Bank ramps up stimulus.

Swiss central bank officials are now bracing for a month of currency speculation as the Russian crisis simmers on and a potential ECB quantitative easing decision on Jan. 22 threatens further pressure on the franc. While the SNB can toughen its response, any further action will probably lack the shock factor unleashed with yesterday's deployment of a charge on deposits.

-

09:03

Eurozone: Current account, adjusted, bln , October 20.5 (forecast 27.8)

-

07:30

Foreign exchange market. Asian session: U.S. dollar trading mixed

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand ANZ Business Confidence December 31.5 30.4

00:05 United Kingdom Gfk Consumer Confidence December -2 -1 -4

02:00 New Zealand Credit Card Spending November +6.7% +5.2%

03:00 Japan Bank of Japan Monetary Base Target 275 275 275

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m October +1.0% +0.2% -0.1%

06:30 Japan BOJ Press Conference

07:00 Germany Producer Price Index (MoM) November -0.2% -0.2% 0.0%

07:00 Germany Producer Price Index (YoY) November -1.0% -1.1% -0.9%

07:00 Germany Gfk Consumer Confidence Survey November 8.7 8.9 9.0

The greenback traded stronger to mixed against its major peers in Asian trade after the FED's policy meeting as FED Chair Janet Yellen stated that rates are going to be raised next year once economic parameters were met - finally removing the "considerable time" from the minutes. She further said "the committee considers it unlikely to begin normalization process for at least the next couple of meetings". The U.S. dollar traded slightly lower against the euro, stronger against the British pound and the Japanese Yen and weaker against New Zealand's and Australia's dollar after positive data from China.

The Australian dollar further recovered from a four year low after China revised up the size of its economy. Chinese GDP rose by 3.4% in 2013. Market participants still expect more economic stimulus from the PBoC. China is Australia's most important trading partner.

New Zealand's dollar traded positive against the greenback currently quoted at USD0.7785. Visitor arrivals for November rose by +7.7% compared to +3.3% in October. The ANZ Business Confidence declined to 30.4 from a previous reading of 31.5. Credit Card Spending rose at a slower pace reading +5.2% compared to +6.7% in October.

The Japanese yen continued to decline versus the U.S. dollar for a third consecutive day as the Bank of Japan maintains its stimulus and continues its monetary policy. Japan's Monetary Base Target was unchanged at an annual pace of 80 trillion yen as were the benchmark interest rates at 0.10%. The All industry Activity Index declined by -0.1% in October versus an increase of +1.0% in September. Analysts expected the index to be +0.2%.

EUR/USD: the euro added gains against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Current account, adjusted, bln October 30.0 27.8

09:00 Eurozone EU Economic Summit

09:30 United Kingdom PSNB, bln November 7.1 14.8

11:00 United Kingdom CBI retail sales volume balance December 27 30

13:30 Canada Retail Sales, m/m October +0.8% -0.4%

13:30 Canada Retail Sales ex Autos, m/m October 0.0 +0.2%

13:30 Canada Consumer Price Index m / m November +0.1 -0.2

13:30 Canada Consumer price index, y/y November +2.4% +2.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m November +0.3% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November +2.3% +2.4%

-

07:00

Germany: Producer Price Index (MoM), November 0.0% (forecast -0.2%)

-

07:00

Germany: Producer Price Index (YoY), November -0.9% (forecast -1.1%)

-

07:00

Germany: Gfk Consumer Confidence Survey, November 9.0 (forecast 8.9)

-

05:31

Options levels on friday, December 19, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2387 (695)

$1.2353 (295)

$1.2322 (183)

Price at time of writing this review: $ 1.2280

Support levels (open interest**, contracts):

$1.2245 (2158)

$1.2208 (3572)

$1.2183 (7244)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 51688 contracts, with the maximum number of contracts with strike price $1,2500 (6506);

- Overall open interest on the PUT options with the expiration date January, 9 is 61104 contracts, with the maximum number of contracts with strike price $1,2000 (7317);

- The ratio of PUT/CALL was 1.18 versus 1.13 from the previous trading day according to data from December, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (1836)

$1.5805 (2110)

$1.5709 (2394)

Price at time of writing this review: $1.5656

Support levels (open interest**, contracts):

$1.5592 (981)

$1.5495 (1204)

$1.5397 (900)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 23533 contracts, with the maximum number of contracts with strike price $1,5850 (4094);

- Overall open interest on the PUT options with the expiration date January, 9 is 18455 contracts, with the maximum number of contracts with strike price $1,5550 (1949);

- The ratio of PUT/CALL was 0.78 versus 0.79 from the previous trading day according to data from December, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:35

Japan: All Industry Activity Index, m/m, October -0.1% (forecast +0.2%)

-

03:56

Japan: BoJ Interest Rate Decision, 0.10% (forecast 0.10%)

-

03:55

Japan: Bank of Japan Monetary Base Target, 275 (forecast 275)

-

02:01

New Zealand: Credit Card Spending, November +5.2%

-

00:05

United Kingdom: Gfk Consumer Confidence, December -4 (forecast -1)

-

00:00

New Zealand: ANZ Business Confidence, December 30.4

-