Notícias do Mercado

-

20:00

Dow +84.64 17,862.79 +0.48% Nasdaq +27.14 4,775.54 +0.57% S&P +13.9 2,075.13 +0.67%

-

17:11

European stocks close: stocks closed mixed

Stock indices closed mixed. Health care sector and Italian bank ratings cut by Standards and Poor's weighed on markets. Roche Holding AG shares dropped 6.1% after reporting disappointing results from a clinical trial.

Standards and Poor's lowered Italian bank ratings because the growth would be slower than expected.

The Gfk German consumer confidence index increased to 9.0 in January from 8.7 in December, beating forecasts for a rise to 8.9.

Eurozone's adjusted current account surplus dropped to €20.5 billion in October from €32.0 billion in September. September's figure was revised up from a surplus of €30.0 billion. Analysts had expected a surplus of €27.8 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,545.27 +79.27 +1.23 %

DAX 9,786.96 -24.10 -0.25 %

CAC 40 4,241.65 -7.84 -0.18 %

-

17:00

European stocks closed: FTSE 100 6,545.27 +79.27 +1.23% CAC 40 4,241.65 -7.84 -0.18% DAX 9,786.96 -24.10 -0.25%

-

16:44

Foreign exchange market. American session: the Canadian dollar decreased against the U.S. dollar after the mostly weaker-than-expected Canadian retail sales and consumer price index data

The U.S. dollar traded higher against the most major currencies. The greenback remained supported by Fed's interest rate decision released yesterday. The Fed kept its interest rate unchanged and said it will be "patient" before to raise its interest rate.

There will be released no major economic reports in the U.S. today.

The euro declined against the U.S. dollar. The Gfk German consumer confidence index increased to 9.0 in January from 8.7 in December, beating forecasts for a rise to 8.9.

Eurozone's adjusted current account surplus dropped to €20.5 billion in October from €32.0 billion in September. September's figure was revised up from a surplus of €30.0 billion. Analysts had expected a surplus of €27.8 billion.

The British pound fell against the U.S. dollar. The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance jumped to 61% in December from 27% in November, exceeding expectations for an increase to 30%. That was the highest level since January 1988.

The public sector net borrowing in the U.K. rose to £13.4 billion in November from £6.4 billion in October, beating expectations for a gain to £14.8 billion. October's figure was revised up from £7.1 billion.

The Canadian dollar decreased against the U.S. dollar after the mostly weaker-than-expected Canadian retail sales and consumer price index data. Canadian retail sales were flat in October, beating expectations for a 0.4% decline, after a 0.8% rise in September.

The decline in motor vehicle and parts sales weighed on retail sales.

Canadian retail sales excluding automobiles increased 0.2% in October, in line with expectations, after a flat reading in September.

Canadian consumer price inflation decreased 0.4% in November, missing expectations for a 0.2% decline, after a 0.1% gain in October.

On a yearly basis, the consumer price index fell to 2.0% November from 2.4% in October. Analysts had expected the index to decline 2.3%.

The consumer price index was driven by lower gasoline prices.

Canadian core consumer price index, which excludes some volatile goods, decreased 0.2% in November, missing expectations for a 0.1% rise, after a 0.3% increase in October.

On a yearly basis, core consumer price index in Canada declined to 2.1% in November from 2.3% in October, missing forecasts of a rise to 2.4%.

The Bank of Canada's inflation target is 2.0%.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback despite the mostly weak economic data from New Zealand. The ANZ business confidence index for New Zealand declined to 30.4 in December from 31.5 in November.

Credit card spending in New Zealand rose 5.2% in November, after a 6.8% gain in October. October's was revised up from a 6.7% increase.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia.

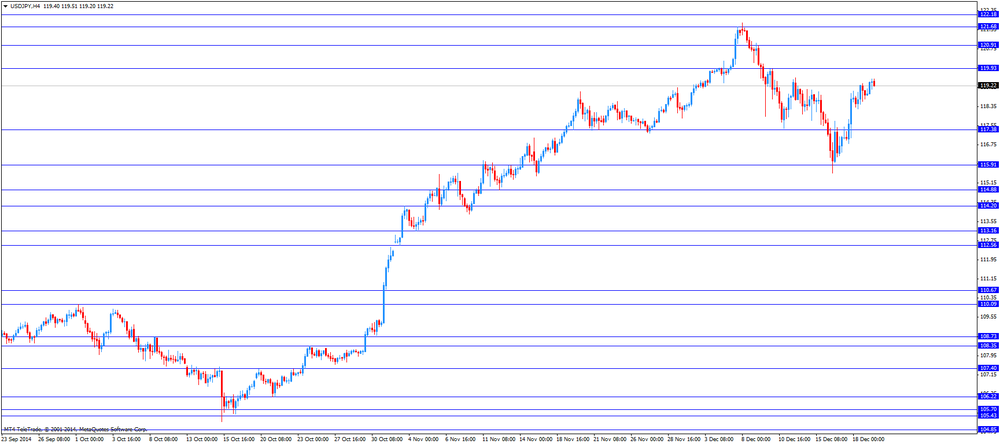

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen fell against the greenback after the Bank of Japan's (BoJ) interest rate decision. The BoJ kept its interest rate at 0.1% unchanged. The central bank will expand its monetary base at an annual pace of 80 trillion yen. The BoJ board voted by an 8-1 margin to hold off fresh stimulus measures.

The BoJ Governor Haruhiko Kuroda said at the press conference that the nation's economy is on track to reach the BoJ's 2% inflation target and the BoJ would do anything to achieve its target.

-

16:40

Oil: a review of the market situation

Oil prices rose moderately, rising above $ 60 per barrel (Brent), and depart from the 5.5-year low, as investors try to balance position by the end of the year after a six-month decline in prices.

But despite the rise in price of oil is now on the way to his fourth consecutive weekly decline, due to OPEC's decision to abandon production cuts, despite the huge global reserves. Prices for Brent and WTI fell almost doubled since June, and many investors expect further fall if production decreases or the demand will not grow.

"After a long and a sharp drop in oil prices in recent days, there has been interest in buying, but selling pressure is maintained," - said the expert Newedge Japan Ken Hasegawa. Many oil companies have announced plans to cut costs in the coming year, as lower oil prices made some projects uneconomical. "But at the moment there is no significant production decline, and the balance of supply and demand does not change, so that prices may fall further," - said Hasegawa.

Little influenced by data from the American Petroleum Institute (API), which showed that oil production in the US for the first time in 28 years last month exceeded 9 million barrels per day. US rocked in November 9.06 million barrels of oil per day - 15% more than last year, and a daily maximum value in March 1986. For November, the highest rate since 1973. The growth of oil production in the United States contributed shale boom. US refineries processed a record 16.3 million for November. Barrels per day. Gasoline production increased by 0.6% to a record 9.54 million for November. Bpd.

Meanwhile, earlier today, Iraqi MP Haitham al-Dzhiburi said that Iraq will stop new investments in oil projects if oil prices fall to $ 50 per barrel. Iraq's draft budget for 2015 based on an average oil price of $ 70 per barrel.

Cost of January futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 55.80 dollars per barrel on the New York Mercantile Exchange.

January futures price for North Sea petroleum mix of Brent rose $ 0.74 to $ 60.55 a barrel on the London Stock Exchange ICE Futures Europe.

-

16:20

Gold: a review of the market situation

The value of gold has hardly changed today, stabilized slightly below the level of $ 1,200, which is associated with the strengthening of the US dollar and expectations of higher interest rates in the United States. Recall, on Wednesday the Fed has indicated that it may raise interest rates next year, replacing the intention to keep them close to zero level "extended period" of time for a promise to show "patience" before making a decision to raise the cost of borrowing.

Gold, which does not bring interest income, it is possible hardly compete with other assets yielding interest, when interest rates rise. In addition, higher interest rates are likely to have support for the US dollar, which also have a negative impact on the situation of dollar-denominated metal.

"The market is now seeking to move away from the $ 1,200. The positions are evenly distributed, so the further it will set the direction of the news in early January," - said the expert Saxo Bank Ole Hansen.

Meanwhile, Commerzbank analyst Carsten Fritsch said: "it was surprising that gold has not dropped after the Fed meeting, given the strength of the dollar. We expect that the price of the precious metal will be under some pressure in the first half of the year, and perhaps will drop to about $ 1,100 per ounce in the second quarter due to the impact of higher interest rates, falling inflation expectations, lower oil prices and economic weakness outside the US. "

It is worth emphasizing, the dollar rose 0.4 percent compared with a basket of major currencies, while the yen fell on expectations of further stimulus next year to support the Japanese inflation.

Market participants are also monitoring the situation in the physical gold market. Importers in India for the first time in five months, offering gold at a discount to the price of $ 2 in London, indicating that excess metal on the market. Experts note that the demand in India is likely to fall significantly in December after the rapid supply growth in the previous three months.

Little impact also continues to yesterday's unexpected decision of the central bank of Switzerland set a negative rate next year. Swiss National Bank announced that, starting from 22 January 2015, the interest rate on deposits "overnight" will be 0.25%. This measure is aimed at weakening the Swiss franc and prevent deflation. Negative interest rates are likely to make Swiss investors move from cash to gold.

The cost of the December gold futures on the COMEX today rose by $ 3.0 to 1196.60 dollars per ounce.

-

15:55

Bank of Japan Governor Haruhiko Kuroda: the nation’s economy is on track to reach the BoJ’s 2% inflation target

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its interest rate at 0.1% unchanged. The central bank will expand its monetary base at an annual pace of 80 trillion yen. The BoJ board voted by an 8-1 margin to hold off fresh stimulus measures.

The BoJ Governor Haruhiko Kuroda said at the press conference that Japan's economy continues to recover moderately. He added that the nation's economy is on track to reach the BoJ's 2% inflation target and the BoJ would do anything to achieve its target.

The BoJ said that "exports have shown signs of picking up", but "private consumption has remained resilient".

-

15:03

Canadian consumer price inflation dropped 0.4% in November

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation decreased 0.4% in November, missing expectations for a 0.2% decline, after a 0.1% gain in October.

On a yearly basis, the consumer price index fell to 2.0% November from 2.4% in October. Analysts had expected the index to decline 2.3%.

The consumer price index was driven by lower gasoline prices.

Canadian core consumer price index, which excludes some volatile goods, decreased 0.2% in November, missing expectations for a 0.1% rise, after a 0.3% increase in October.

On a yearly basis, core consumer price index in Canada declined to 2.1% in November from 2.3% in October, missing forecasts of a rise to 2.4%.

The Bank of Canada's inflation target is 2.0%.

-

14:36

U.S. Stocks open: Dow 17,799.27 +21.12 +0.12%, Nasdaq 4,746.32 -2.08 -0.04%, S&P 2,063.62 +2.39 +0.12%

-

14:25

Before the bell: S&P futures +0.01%, Nasdaq futures +0.21%

U.S. equity-index futures climbed and crude advanced amid efforts by central banks to support growth.

Global markets:

Nikkei 17,621.4 +411.35 +2.39%

Hang Seng 23,116.63 +284.42 +1.25%

Shanghai Composite 3,109.69 +52.17 +1.71%

FTSE 6,488.38 +22.38 +0.35%

CAC 4,216.37 -33.12 -0.78%

DAX 9,719.99 -91.07 -0.93%

Crude oil $57.73 (+2.21%)

Gold $1197.50 (+0.23%)

-

14:09

Canadian retail sales were flat in October

Statistics Canada released retail sales data on Friday. Canadian retail sales were flat in October, beating expectations for a 0.4% decline, after a 0.8% rise in September.

The decline in motor vehicle and parts sales weighed on retail sales. Motor vehicle and parts sales fell 0.6% in October, building material and garden supply sales increased 2.0%, while electronics and appliance sales rose 3.2%.

Gasoline station sales dropped 1.1%.

Canadian retail sales excluding automobiles increased 0.2% in October, in line with expectations, after a flat reading in September.

-

14:06

DOW components before the bell

(company / ticker / price / change, % / volume)

Boeing Co

BA

125.69

+0.02%

0.3K

The Coca-Cola Co

KO

42.40

+0.02%

0.2K

Pfizer Inc

PFE

31.98

+0.03%

0,5K

Caterpillar Inc

CAT

91.75

+0.07%

1.9K

Travelers Companies Inc

TRV

106.05

+0.09%

1.0K

JPMorgan Chase and Co

JPM

61.61

+0.21%

34.8K

Procter & Gamble Co

PG

92.24

+0.26%

1.1K

AT&T Inc

T

33.60

+0.27%

4.2K

Chevron Corp

CVX

109.32

+0.27%

2.8K

Verizon Communications Inc

VZ

47.18

+0.28%

2.4K

Microsoft Corp

MSFT

47.66

+0.29%

16.8K

McDonald's Corp

MCD

93.95

+0.30%

1.0K

Wal-Mart Stores Inc

WMT

86.20

+0.30%

0.1K

General Electric Co

GE

25.22

+0.32%

20.5K

Merck & Co Inc

MRK

59.18

+0.34%

5.3K

Cisco Systems Inc

CSCO

27.75

+0.36%

3.0K

Home Depot Inc

HD

101.05

+0.38%

7.5K

Goldman Sachs

GS

192.40

+0.41%

0.3K

Intel Corp

INTC

37.17

+0.41%

4.3K

American Express Co

AXP

93.60

+0.46%

0.6K

Walt Disney Co

DIS

93.12

+0.55%

0.1K

E. I. du Pont de Nemours and Co

DD

72.68

+0.62%

0.2K

International Business Machines Co...

IBM

157.68

0.00%

3.0K

Johnson & Johnson

JNJ

106.80

-0.01%

1.1K

Exxon Mobil Corp

XOM

91.01

-0.16%

11.8K

Nike

NKE

95.10

-2.04%

32.0K

-

13:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Freeport-McMoRan (FCX) target lowered to $35 from 42 at Cowen

Twitter (TWTR) initiated at Perform Oppenheimer, target $36

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E1.5bn), $1.2250-60(E3.1bn), $1.2300(E9.8bn), $1.2350(E6.0bn)

USD/JPY: Y117.00($4.8bn), Y118.50($1.3bn), Y119.00($2.3bn), Y119.50($1.2bn), Y120.00($6.6bn)

GBP/USD: $1.5550(stg300mn), $1.5600(stg335mn), $1.5700(stg1.0bn)

EUR/GBP: stg0.7750(E300mn), stg0.7865-75(E400mn), stg0.7915(E350mn)

USD/CHF: Chf0.9750($877mn), Chf0.9800($525mn), Chf0.9900($1.9bn)

AUD/USD: $0.8185(A$1.4bn), $0.8200(A$1.1bn), $0.8255(A$1.4bn)

NZD/USD: $0.7600(NZ$1.7bn), $0.7750(NZ$450mn), $0.7770(NZ$280mn)

USD/CAD: C$1.1500($775mn), C$1.1600($1.1bn), C$1.1650($437mn), C$1.1700($480mn)

-

13:31

Canada: Bank of Canada Consumer Price Index Core, m/m, November -0.2% (forecast +0.1%)

-

13:31

Canada: Bank of Canada Consumer Price Index Core, y/y, November +2.1% (forecast +2.4%)

-

13:30

Canada: Retail Sales, m/m, October 0.0% (forecast -0.4%)

-

13:30

Canada: Retail Sales ex Autos, m/m, October +0.2% (forecast +0.2%)

-

13:30

Canada: Consumer Price Index m / m, November -0.4% (forecast -0.2)

-

13:30

Canada: Consumer price index, y/y, November +2.0% (forecast +2.3%)

-

13:10

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar despite the better-than-expected data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand ANZ Business Confidence December 31.5 30.4

00:05 United Kingdom Gfk Consumer Confidence December -2 -1 -4

02:00 New Zealand Credit Card Spending November +6.7% +5.2%

03:00 Japan Bank of Japan Monetary Base Target 275 275 275

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m October +1.0% +0.2% -0.1%

06:30 Japan BOJ Press Conference

07:00 Germany Producer Price Index (MoM) November -0.2% -0.2% 0.0%

07:00 Germany Producer Price Index (YoY) November -1.0% -1.1% -0.9%

07:00 Germany Gfk Consumer Confidence Survey January 8.7 8.9 9.0

09:00 Eurozone Current account, adjusted, bln October 32.0 Revised From 30.0 27.8 20.5

09:00 Eurozone EU Economic Summit

09:30 United Kingdom PSNB, bln November 6.4 Revised From 7.1 14.8 13.4

11:00 United Kingdom CBI retail sales volume balance December 27 30 61

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by Fed's interest rate decision released yesterday. The Fed kept its interest rate unchanged and said it will be "patient" before to raise its interest rate.

There will be released no major economic reports in the U.S. today.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. The Gfk German consumer confidence index increased to 9.0 in January from 8.7 in December, beating forecasts for a rise to 8.9.

Eurozone's adjusted current account surplus dropped to €20.5 billion in October from €32.0 billion in September. September's figure was revised up from a surplus of €30.0 billion. Analysts had expected a surplus of €27.8 billion.

The British pound traded mixed against the U.S. dollar despite the better-than-expected data from the U.K. The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance jumped to 61% in December from 27% in November, exceeding expectations for an increase to 30%. That was the highest level since January 1988.

The public sector net borrowing in the U.K. rose to £13.4 billion in November from £6.4 billion in October, beating expectations for a gain to £14.8 billion. October's figure was revised up from £7.1 billion.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian retail sales and consumer price index data. Canadian retail sales are expected to decrease 0.4% in October, after 0.8% rise in September.

Canadian retail sales excluding automobiles are expected to rise 0.2% in October, after a flat reading in September.

The consumer price index in Canada is expected to decline to an annual rate of 2.3% in November from 2.4% in October.

The core consumer price index in Canada is expected to rise to an annual rate of 2.4% in November from 2.3% in October.

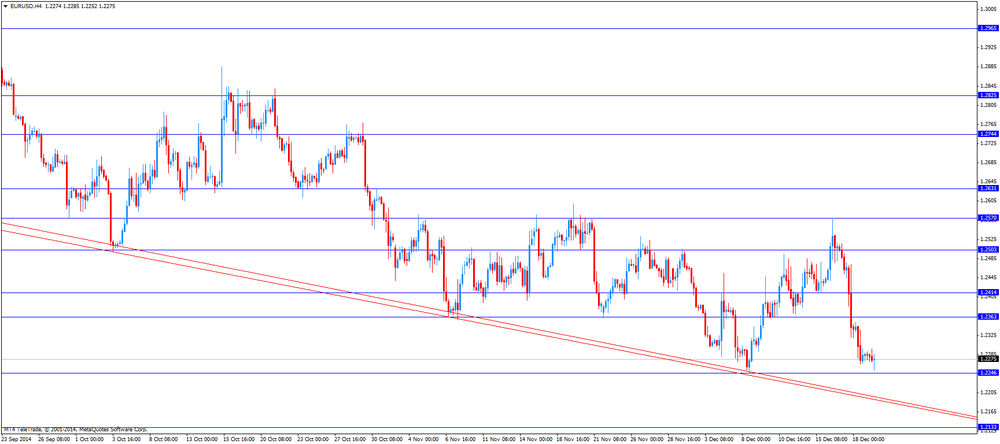

EUR/USD: the currency pair traded mixed

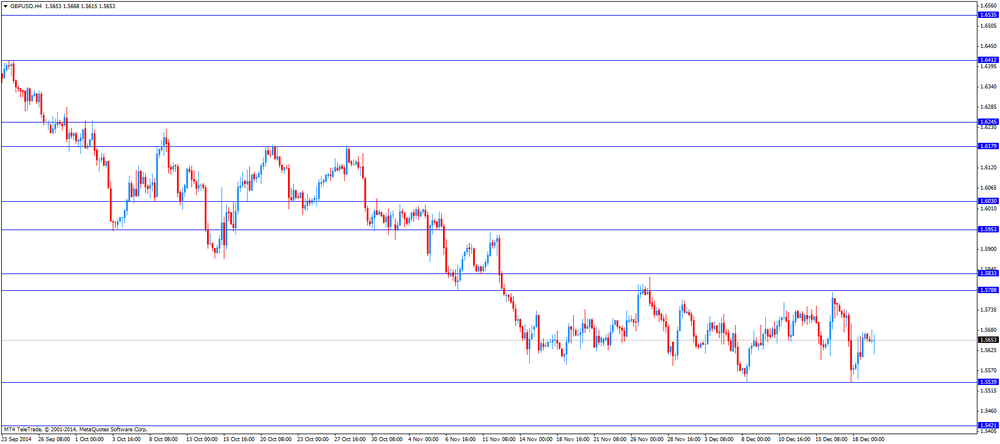

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m October +0.8% -0.4%

13:30 Canada Retail Sales ex Autos, m/m October 0.0 +0.2%

13:30 Canada Consumer Price Index m / m November +0.1 -0.2

13:30 Canada Consumer price index, y/y November +2.4% +2.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m November +0.3% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November +2.3% +2.4%

-

13:00

Orders

EUR/USD

Offers $1.2380, $1.2340-50

Bids $1.2200

GBP/USD

Offers $1.5800, $1.5785, $1.5750-53

Bids $1.5625/20, $1.5605/00

AUD/USD

Offers $0.8300, $0.8250, $0.8200

Bids $0.8100, $0.8050, $0.8000

EUR/JPY

Offers Y148.50, Y148.00, Y147.50, Y146.80/00

Bids Y146.00, Y145.50, Y145.00

USD/JPY

Offers Y121.20, Y121.00, Y120.50, Y120.00, Y119.50

Bids Y119.00, Y118.50, Y118.00

EUR/GBP

Offers stg0.7975/80, stg0.7950/55, stg0.7900, stg0.7880/85

Bids stg0.7800

-

12:43

CBI retail sales balance rose to 61% in December, the highest since 1988

The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance jumped to 61% in December from 27% in November, exceeding expectations for an increase to 30%. That was the highest level since January 1988.

The increase was largely driven by "Black Friday" price cuts.

-

12:00

European stock markets mid-session: European indices decline after recent rally

European indices reversed early gains after moving up for four days supported by U.S. indices after the FED statement and good U.S. employment data. Today Italian Banks were downgraded by S&P, weighing on the markets. The energy sector was under pressure again as oil prices further decline. Earlier in the session markets found support in a better-than-expected Gfk Consumer Confidence Survey.

In today's session the FTSE 100 index added +0.30% supported by better-than expected CBI Reatil Sales quoted at 6,485.40 points, France's CAC 40 lost -0.72% trading at 4,218.75. Germany's DAX 30 is currently trading -0.71% at 9,741.44 points.

-

11:25

Oil: Brent holds below USD60

Brent crude and West Texas Intermediate are trading higher today after volatile trading on Thursday. Recent sell offs to five-year lows were judged excessive by market participants. Yesterday Saudi Arabia's oil minister reiterated that it would be difficult for Saudi Arabia and the OPEC alone to reduce the volume of production and added that the market is experiencing temporary difficulties, mainly due to the weakening global economy. U.S. oil producers continue to produce on record levels fighting for market shares.

Brent Crude added +1.16%, currently trading at USD59.96 a barrel. Crude hit a low at USD58.50 this week. West Texas Intermediate rose +1.33% currently quoted at USD54.83.

-

11:00

United Kingdom: CBI retail sales volume balance, December 61 (forecast 30)

-

11:00

Gold trading little changed below USD1,200

Gold prices trade steady around USD1200 after the FED statement being "patient" with rising rates and the positive outlook on the U.S. economy. A broadly stronger U.S. dollar after better-than-expected data on Initial jobless Claims and low oil prices weigh on gold. Rallying stock markets put further pressure on the metal.The precious metal is currently quoted at USD1,197.40 or -0,02% a troy ounce.

GOLD currently trading at USD1,197.40

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E1.5bn), $1.2250-60(E3.1bn), $1.2300(E9.8bn), $1.2350(E6.0bn)

USD/JPY: Y117.00($4.8bn), Y118.50($1.3bn), Y119.00($2.3bn), Y119.50($1.2bn), Y120.00($6.6bn)

GBP/USD: $1.5550(stg300mn), $1.5600(stg335mn), $1.5700(stg1.0bn)

EUR/GBP: stg0.7750(E300mn), stg0.7865-75(E400mn), stg0.7915(E350mn)

USD/CHF: Chf0.9750($877mn), Chf0.9800($525mn), Chf0.9900($1.9bn)

AUD/USD: $0.8185(A$1.4bn), $0.8200(A$1.1bn), $0.8255(A$1.4bn)

NZD/USD: $0.7600(NZ$1.7bn), $0.7750(NZ$450mn), $0.7770(NZ$280mn)

USD/CAD: C$1.1500($775mn), C$1.1600($1.1bn), C$1.1650($437mn), C$1.1700($480mn)

-

09:30

United Kingdom: PSNB, bln, November 14.1 (forecast 14.8)

-

09:18

Press Review: Ruble firms as government steps up verbal support

REUTERS

Ruble firms as government steps up verbal support(Reuters) - Russia's ruble strengthened on Friday after Finance Minister Anton Siluanov confirmed his ministry had sold foreign currency and on expectations that exporters will step up dollar sales.

At 0815 GMT (03:15 a.m. EST), the ruble was around 2.7 percent stronger against the dollar at 59.85 RUBUTSTN=MCX and gained 2.7 percent to trade at 73.65 versus the euro EURRUBTN=MCX.

The ruble's recovery is in contrast to intense selling pressure earlier this week, when the ruble at one stage had fallen about 20 percent against the dollar on the day before rising again, threatening the relative financial stability on which President Vladimir Putin has built his popularity.

Source: http://www.reuters.com/article/2014/12/19/us-russia-crisis-markets-idUSKBN0JX0OS20141219

Businessweek

The Relentless Production of Shale Oil Is Breaking OPEC's Neck

The world's biggest oil companies faced ruin in the summer of 1931. Crude prices had plummeted. Wildcatters were selling oil from the bonanza East Texas field for a nickel a barrel, cheaper than a bowl of chili. On Aug. 17, Governor Ross Sterling declared a state of insurrection in four counties and sent 1,100 National Guard troops to shut down the fields and bring order to the market. A month later the Railroad Commission of Texas handed out strict production quotas.

BLOOMBERG

Yellen's Inflation Lessons: Targets Matter, Oil Shocks Dissipate

Janet Yellen isn't likely to change monetary policy because of transitory influences on prices coming from abroad. She's also not inclined to tolerate a long period of above-target inflation as a way of making up for years of little change in living costs.

Those are among the insights the Fed chair offered investors at her press conference this week.

For Yellen, these issues are now critical. Inflation has been below the Fed's 2 percent target for 30 months and, with a 45 percent decline in oil prices this year, will remain below it for several more months. Fed officials are wary of inflation remaining too low because it can become a drag on growth.

BLOOMBERG

Russia Forcing SNB Hand Drains Arsenal to Fight ECB StimulusJanet

The Swiss National Bank's resort to negative interest rates leaves President Thomas Jordan wielding a weaker hand when the European Central Bank ramps up stimulus.

Swiss central bank officials are now bracing for a month of currency speculation as the Russian crisis simmers on and a potential ECB quantitative easing decision on Jan. 22 threatens further pressure on the franc. While the SNB can toughen its response, any further action will probably lack the shock factor unleashed with yesterday's deployment of a charge on deposits.

-

09:03

Eurozone: Current account, adjusted, bln , October 20.5 (forecast 27.8)

-

09:00

European Stocks. First hour: Indices continue climb for a fourth day

European indices continued to rise for a fourth day amid a global rally during early trading tracking strong gains on the Wall Street where the Dow Jones posted its biggest daily gains in three years. Stocks were supported by a better-than expected German Gfk Consumer Confidence Survey. The index rose to a six-month high of 9.0 from 8.7 in the previous month. Analysts had expected Consumer Confidence to be at 8.9 for November. The Producer Price index stabilized with a reading of 0.0% compared to forecasts of -0.2%. Equities remained supported after the FED's decision on Wednesday to be "patient" before hiking interest rates, making it unlikely seeing an raise before the FED's April meeting. Markets await Eurozone's Current account, the outcome of E.U.'s economic summit, U.K.'s PSNB and CBI Retail Sales Volume.

The FTSE 100 index is currently trading +0.73% quoted at 6,513.27 points supported by strong gains in the financial sector, Germany's DAX 30 added +0.58% trading at 9,868.65. France's CAC 40 rose by +0.78%, currently trading at 4,282.46 points.

-

08:00

Global Stocks: Wall Street rallies

U.S. markets were rallying on Thursday again after the FED's statement. The DOW JONES added +2.43% closing at 17,778.15 points, the S&P 500 rallied +2.40 with a final quote of 2,061.23. Upbeat data on Initial Jobless Claims showed 289,000 people filing for jobless benefits. 6,000 less than previously and below expectations of 297,000 new applications. The Philadelphia Fed Manufacturing Survey being below estimates at 24.5 compared to 26.3 and 40.8 in October could not harm the bullish sentiment. It was the Wall Street's biggest two-day advance since 2011.

Hong Kong's Hang Seng added +1.35% to 23,140.34. China's Shanghai Composite closed at 3,109.69 points, a gain of +1.71% after very volatile trading. China revised up the size of its economy. Chinese GDP rose by 3.4% in 2013. Market participants still expect more economic stimulus from the PBoC.

Japan's Nikkei added +2.39% closing at 17,261.40 after the BoJ's decision to leave interest rates at the current level, continuing the stimulus program and giving a brighter view of the economy.

-

07:30

Foreign exchange market. Asian session: U.S. dollar trading mixed

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand ANZ Business Confidence December 31.5 30.4

00:05 United Kingdom Gfk Consumer Confidence December -2 -1 -4

02:00 New Zealand Credit Card Spending November +6.7% +5.2%

03:00 Japan Bank of Japan Monetary Base Target 275 275 275

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m October +1.0% +0.2% -0.1%

06:30 Japan BOJ Press Conference

07:00 Germany Producer Price Index (MoM) November -0.2% -0.2% 0.0%

07:00 Germany Producer Price Index (YoY) November -1.0% -1.1% -0.9%

07:00 Germany Gfk Consumer Confidence Survey November 8.7 8.9 9.0

The greenback traded stronger to mixed against its major peers in Asian trade after the FED's policy meeting as FED Chair Janet Yellen stated that rates are going to be raised next year once economic parameters were met - finally removing the "considerable time" from the minutes. She further said "the committee considers it unlikely to begin normalization process for at least the next couple of meetings". The U.S. dollar traded slightly lower against the euro, stronger against the British pound and the Japanese Yen and weaker against New Zealand's and Australia's dollar after positive data from China.

The Australian dollar further recovered from a four year low after China revised up the size of its economy. Chinese GDP rose by 3.4% in 2013. Market participants still expect more economic stimulus from the PBoC. China is Australia's most important trading partner.

New Zealand's dollar traded positive against the greenback currently quoted at USD0.7785. Visitor arrivals for November rose by +7.7% compared to +3.3% in October. The ANZ Business Confidence declined to 30.4 from a previous reading of 31.5. Credit Card Spending rose at a slower pace reading +5.2% compared to +6.7% in October.

The Japanese yen continued to decline versus the U.S. dollar for a third consecutive day as the Bank of Japan maintains its stimulus and continues its monetary policy. Japan's Monetary Base Target was unchanged at an annual pace of 80 trillion yen as were the benchmark interest rates at 0.10%. The All industry Activity Index declined by -0.1% in October versus an increase of +1.0% in September. Analysts expected the index to be +0.2%.

EUR/USD: the euro added gains against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Current account, adjusted, bln October 30.0 27.8

09:00 Eurozone EU Economic Summit

09:30 United Kingdom PSNB, bln November 7.1 14.8

11:00 United Kingdom CBI retail sales volume balance December 27 30

13:30 Canada Retail Sales, m/m October +0.8% -0.4%

13:30 Canada Retail Sales ex Autos, m/m October 0.0 +0.2%

13:30 Canada Consumer Price Index m / m November +0.1 -0.2

13:30 Canada Consumer price index, y/y November +2.4% +2.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m November +0.3% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November +2.3% +2.4%

-

07:00

Germany: Producer Price Index (MoM), November 0.0% (forecast -0.2%)

-

07:00

Germany: Producer Price Index (YoY), November -0.9% (forecast -1.1%)

-

07:00

Germany: Gfk Consumer Confidence Survey, November 9.0 (forecast 8.9)

-

05:31

Options levels on friday, December 19, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2387 (695)

$1.2353 (295)

$1.2322 (183)

Price at time of writing this review: $ 1.2280

Support levels (open interest**, contracts):

$1.2245 (2158)

$1.2208 (3572)

$1.2183 (7244)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 51688 contracts, with the maximum number of contracts with strike price $1,2500 (6506);

- Overall open interest on the PUT options with the expiration date January, 9 is 61104 contracts, with the maximum number of contracts with strike price $1,2000 (7317);

- The ratio of PUT/CALL was 1.18 versus 1.13 from the previous trading day according to data from December, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (1836)

$1.5805 (2110)

$1.5709 (2394)

Price at time of writing this review: $1.5656

Support levels (open interest**, contracts):

$1.5592 (981)

$1.5495 (1204)

$1.5397 (900)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 23533 contracts, with the maximum number of contracts with strike price $1,5850 (4094);

- Overall open interest on the PUT options with the expiration date January, 9 is 18455 contracts, with the maximum number of contracts with strike price $1,5550 (1949);

- The ratio of PUT/CALL was 0.78 versus 0.79 from the previous trading day according to data from December, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:35

Japan: All Industry Activity Index, m/m, October -0.1% (forecast +0.2%)

-

03:56

Japan: BoJ Interest Rate Decision, 0.10% (forecast 0.10%)

-

03:55

Japan: Bank of Japan Monetary Base Target, 275 (forecast 275)

-

02:01

New Zealand: Credit Card Spending, November +5.2%

-

02:01

Nikkei 225 17,516.88 +306.83 +1.78%, Hang Seng 23,130.04 +297.83 +1.30%, Shanghai Composite 3,044.25 -13.27 -0.43%

-

00:05

United Kingdom: Gfk Consumer Confidence, December -4 (forecast -1)

-

00:00

New Zealand: ANZ Business Confidence, December 30.4

-