Notícias do Mercado

-

23:28

Currencies. Daily history for Oct 20'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2795 +0,27%

GBP/USD $1,6158 +0,41%

USD/CHF Chf0,9431 -0,30%

USD/JPY Y106,96 +0,07%

EUR/JPY Y136,85 +0,36%

GBP/JPY Y172,81 +0,47%

AUD/USD $0,8778 +0,40%

NZD/USD $0,7965 +0,63%

USD/CAD C$1,1288 +0,12%

-

23:01

Schedule for today, Tuesday, Oct 21’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Monetary Policy Statement

02:00 China Retail Sales y/y September +11.9% +11.8%

02:00 China Industrial Production y/y September +6.9% +7.5%

02:00 China Fixed Asset Investment September +16.5% +16.2%

02:00 China GDP y/y Quarter III +7.5% +7.2%

02:00 New Zealand Credit Card Spending September +4.2%

04:30 Japan All Industry Activity Index, m/m August -0.2% -0.3%

06:00 Switzerland Trade Balance September 1.33 Revised From 1.39 2.43

08:30 United Kingdom PSNB, bln September 10.9 9.3

08:55 Australia RBA Assist Gov Lowe Speaks

14:00 U.S. Existing Home Sales September 5.05 5.11

23:00 Australia Conference Board Australia Leading Index August +0.5%

23:30 Australia Leading Index September -0.1%

23:50 Japan Adjusted Merchandise Trade Balance, bln September -924.4 -910.0

-

16:37

Foreign exchange market. American session: the Canadian dollar traded lower against the U.S. dollar after the release of Canadian wholesale sales

The U.S. dollar traded mixed to lower against the most major currencies. The greenback remained supported by Friday's U.S. economic data. The Reuters/Michigan consumer sentiment index rose to 86.4 in October from 84.6 in September, beating forecasts of a decline to 84.3.

Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations.

The euro traded higher against the U.S. dollar. The European Central Bank has started buying covered bonds to stimulate the economy in the Eurozone.

Germany's Bundesbank said in its monthly bulletin that Germany's economy barely grew at in the third quarter and the outlook for the fourth quarter is cautious. Bundesbank noted that the economy in Germany was unlikely to enter recession.

German producer price index was flat in September, missing expectations for a 0.1% gain, after a 0.1% decline in August.

On a yearly basis, German producer price index fell 1.0% in September, in line with expectations, after a 0.8% drop in August.

Eurozone's current account surplus declined to 18.9 billion euros in August from a surplus of 21.6 billion euros in July, missing expectations for a current account surplus of 21.3 billion euros. July's figure was revised up from a surplus of EUR18.7 billion.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the release of Canadian wholesale sales. Wholesale sales in Canada climbed 0.2% in August, in line with expectations, after a 0.2% decline in July. July's figure was revised up from a 0.3% drop.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

The Aussie was supported by news from China. A Chinese government official said the China's central bank is planning to inject about 200 billion yuan into some lenders.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen decreased against the greenback on Government Pension Investment Fund (GPIF) report. The Nikkei newspaper said that Japan's Government Pension Investment Fund will raise its target for foreign bonds and shares to around 30% from 23%.

Comments by the Bank of Japan Governor Haruhiko Kuroda also weighed on yen. He said on Monday that Japan's economy "will continue to recover moderately as a trend". Kuroda added that the annual inflation rate is expected to remain at around 1.25% "for some time".

-

15:28

Reserve Bank of Australia Assistant Governor Christopher Kent: “monetary policy is currently configured to support growth in demand”

The Reserve Bank of Australia Assistant Governor Christopher Kent said t the Leading Age Services Australia National Congress in Adelaide on Monday that "monetary policy is currently configured to support growth in demand". He added that that inflation is expected to remain within its 2% to 3% target.

Kent focused more on the challenges and opportunities of an ageing population.

-

13:55

Japan's Government Pension Investment Fund will raise its target for local shares, for foreign bonds and shares

The Nikkei newspaper said that Japan's Government Pension Investment Fund will raise its target for foreign bonds and shares to around 30% from 23%. The Government Pension Investment Fund will raise its target for local shares to around 25% from 12%, the Nikkei newspaper also said.

-

13:30

Canada: Wholesale Sales, m/m, August +0.2% (forecast +0.2%)

-

13:29

Bank of Japan Governor Haruhiko Kuroda: the annual inflation rate is expected to remain at around 1.25% "for some time"

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a meeting of the BoJ's regional branch managers on Monday that Japan's economy "will continue to recover moderately as a trend". Kuroda added that the annual inflation rate is expected to remain at around 1.25% "for some time".

He reiterated that the BoJ will continue with its quantitative and qualitative easing to achieve the 2% inflation target.

-

13:01

Foreign exchange market. European session: the euro traded slightly higher against the U.S. dollar

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Producer Price Index (MoM) September -0.1% +0.1% 0.0%

06:00 Germany Producer Price Index (YoY) September -0.8% -1.0% -1.0%

08:00 Eurozone Current account, adjusted, bln August 21.6 Revised From 18.7 21.3 18.9

10:00 Germany Bundesbank Monthly Report

The U.S. dollar traded mixed to lower against the most major currencies. The greenback remained supported by Friday's U.S. economic data. The Reuters/Michigan consumer sentiment index rose to 86.4 in October from 84.6 in September, beating forecasts of a decline to 84.3.

Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations.

The euro traded slightly higher against the U.S. dollar. The European Central Bank has started buying covered bonds to stimulate the economy in the Eurozone.

German producer price index was flat in September, missing expectations for a 0.1% gain, after a 0.1% decline in August.

On a yearly basis, German producer price index fell 1.0% in September, in line with expectations, after a 0.8% drop in August.

Eurozone's current account surplus declined to 18.9 billion euros in August from a surplus of 21.6 billion euros in July, missing expectations for a current account surplus of 21.3 billion euros. July's figure was revised up from a surplus of EUR18.7 billion.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded slightly higher against the U.S. dollar ahead the Canadian wholesale sales. Wholesale sales in Canada are expected to climb 0.2% in August, after a 0.3% decline in July.

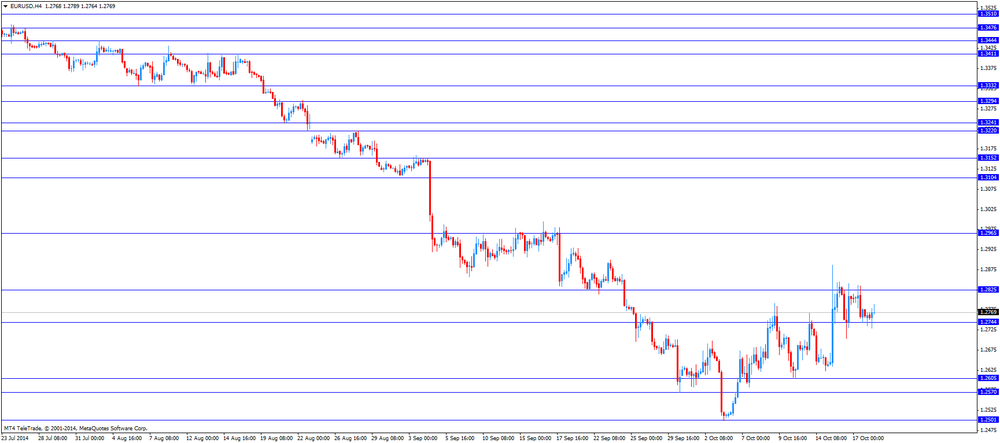

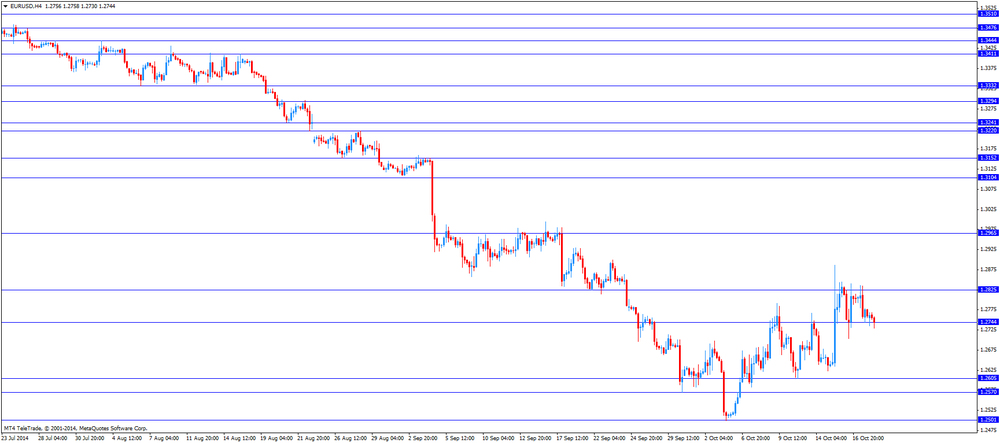

EUR/USD: the currency pair rose to 1.2789

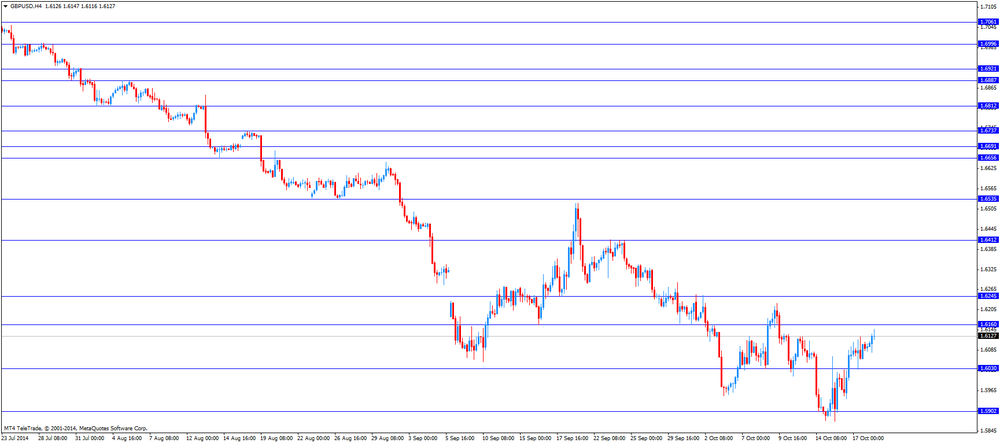

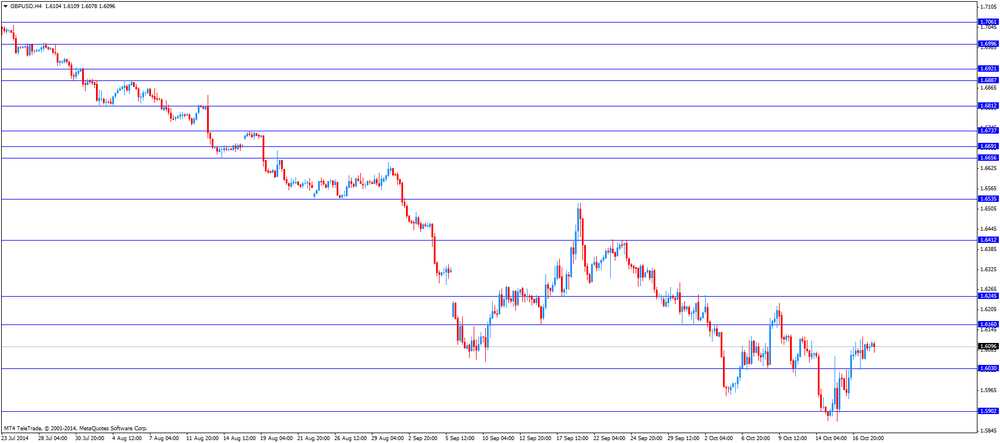

GBP/USD: the currency pair increased to $1.6147

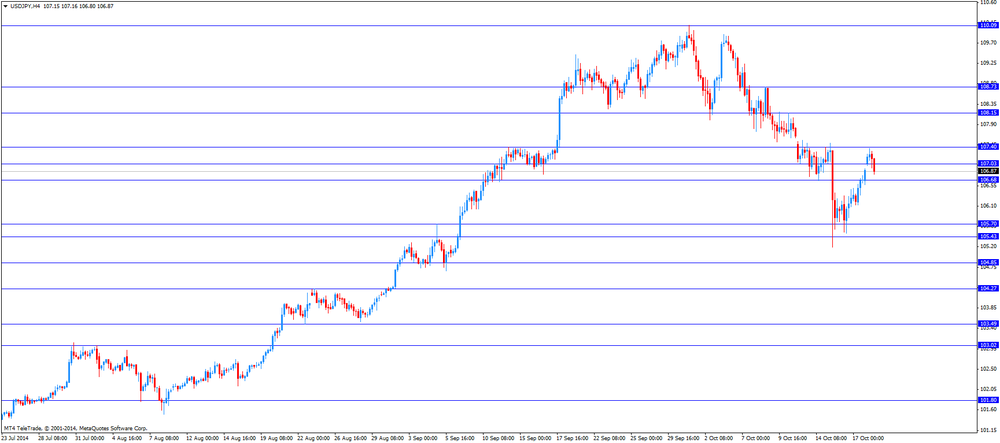

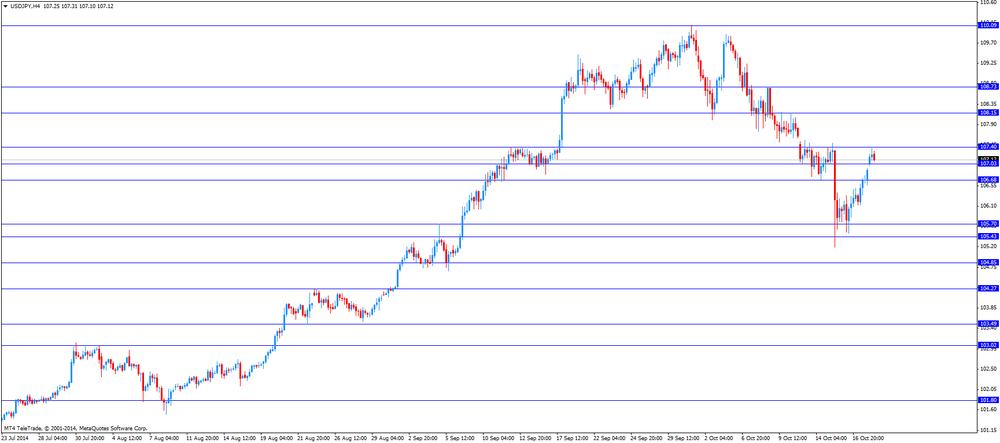

USD/JPY: the currency pair fell to Y106.80

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m August -0.3% +0.2%

21:45 New Zealand Visitor Arrivals September -3.0%

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD: $1.2550(E1.12bn), $1.2580(E271mn), $1.2680(E304mn), $1.2700(E203mn), $1.2725(E597mn) $1.2750-55(E530mn), $1.2775(E542mn), $1.2790-800(E450mn), $1.2850(E460mn)

USD/JPY: Y105.50($667mn), Y106.25($2.5bn), Y106.75($1.37bn), Y107.20($400mn), Y107.50($503mn)

EUR/JPY: Y136.00(E778mn)

GBP/USD: $1.6000(stg933mn), $1.6190-1.6200(stg328mn)

EUR/GBP: Stg0.7915(E136mn), stg0.8040(E120mn)

AUD/USD: $0.8600(A$1.8bn), $0.8700(A$131mn), $0.8800(A$338mn), $0.8850(A$1.0bn)

NZD/USD: $0.7900(NZ$146mn), $0.7935(NZ$200mn), $0.7950(NZ402mn), $0.8000(NZ$978mn)

USD/CAD: C$1.1135($260mn), C$1.1260($190mn), C$1.1280($120mn)

-

10:10

Foreign exchange market. Asian session: the Japanese yen fell against the U.S. dollar on Government Pension Investment Fund (GPIF) report

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Producer Price Index (MoM) September -0.1% +0.1% 0.0%

06:00 Germany Producer Price Index (YoY) September -0.8% -1.0% -1.0%

08:00 Eurozone Current account, adjusted, bln August 21.6 Revised From 18.7 21.3 18.9

The U.S. dollar traded mixed against the most major currencies. The greenback was supported by Friday's U.S. economic data. The Reuters/Michigan consumer sentiment index rose to 86.4 in October from 84.6 in September, beating forecasts of a decline to 84.3.

Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

The Aussie was supported by news from China. A Chinese government official said the China's central bank is planning to inject about 200 billion yuan into some lenders.

The Japanese yen fell against the U.S. dollar on Government Pension Investment Fund (GPIF) report. The Nikkei newspaper said that Japan's Government Pension Investment Fund will raise its target for foreign bonds and shares to around 30% from 23%.

Comments by the Bank of Japan Governor Haruhiko Kuroda also weighed on yen. He said on Monday that Japan's economy "will continue to recover moderately as a trend". Kuroda added that the annual inflation rate is expected to remain at around 1.25% "for some time".

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.6111

USD/JPY: the currency pair fell to Y107.38

The most important news that are expected (GMT0):

10:00 Germany Bundesbank Monthly Report

12:30 Canada Wholesale Sales, m/m August -0.3% +0.2%

21:45 New Zealand Visitor Arrivals September -3.0%

-

09:01

Eurozone: Current account, adjusted, bln , August 18.9 (forecast 21.3)

-

07:00

Germany: Producer Price Index (MoM), September 0.0% (forecast +0.1%)

-

07:00

Germany: Producer Price Index (YoY), September -1.0% (forecast -1.0%)

-

06:17

Options levels on monday, October 20, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2893 (3024)

$1.2849 (4202)

$1.2809 (1660)

Price at time of writing this review: $ 1.2758

Support levels (open interest**, contracts):

$1.2707 (1133)

$1.2659 (2124)

$1.2595 (2276)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 54545 contracts, with the maximum number of contracts with strike pric $1,2900 (6607);

- Overall open interest on the PUT options with the expiration date November, 7 is 57540 contracts, with the maximum number of contracts with strike price $1,2600 (6454);

- The ratio of PUT/CALL was 1.00 versus 1.04 from the previous trading day according to data from October, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.6402 (1485)

$1.6304 (1703)

$1.6207 (1977)

Price at time of writing this review: $1.6109

Support levels (open interest**, contracts):

$1.5993 (2155)

$1.5896 (1341)

$1.5797 (1490)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 26219 contracts, with the maximum number of contracts with strike price $1,6200 (1977);

- Overall open interest on the PUT options with the expiration date November, 7 is 31766 contracts, with the maximum number of contracts with strike price $1,5400 (2398);

- The ratio of PUT/CALL was 1.21 versus 1.22 from the previous trading day according to data from October, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:03

United Kingdom: Rightmove House Price Index (YoY), October +7.6%

-

00:01

United Kingdom: Rightmove House Price Index (MoM), October +2.6%

-