Notícias do Mercado

-

23:36

Commodities. Daily history for Oct 20'2014:

(raw materials / closing price /% change)

Light Crude 82.72 +0.01%

Gold 1,247.10 +0.19%

-

23:32

Stocks. Daily history for Oct 20'2014:

(index / closing price / change items /% change)

Nikkei 225 15,111.23 +578.72 +3.98%

Hang Seng 23,070.26 +47.05 +0.20%

Shanghai Composite 2,356.73 +15.54 +0.66%

FTSE 100 6,267.07 -43.22 -0.68%

CAC 40 3,991.24 -41.94 -1.04%

Xetra DAX 8,717.76 -132.51 -1.50%

S&P 500 1,904.01 +17.25 +0.91%

NASDAQ Composite 4,316.07 +57.64 +1.35%

Dow Jones 16,399.67 +19.26 +0.12%

-

23:28

Currencies. Daily history for Oct 20'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2795 +0,27%

GBP/USD $1,6158 +0,41%

USD/CHF Chf0,9431 -0,30%

USD/JPY Y106,96 +0,07%

EUR/JPY Y136,85 +0,36%

GBP/JPY Y172,81 +0,47%

AUD/USD $0,8778 +0,40%

NZD/USD $0,7965 +0,63%

USD/CAD C$1,1288 +0,12%

-

23:01

Schedule for today, Tuesday, Oct 21’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Monetary Policy Statement

02:00 China Retail Sales y/y September +11.9% +11.8%

02:00 China Industrial Production y/y September +6.9% +7.5%

02:00 China Fixed Asset Investment September +16.5% +16.2%

02:00 China GDP y/y Quarter III +7.5% +7.2%

02:00 New Zealand Credit Card Spending September +4.2%

04:30 Japan All Industry Activity Index, m/m August -0.2% -0.3%

06:00 Switzerland Trade Balance September 1.33 Revised From 1.39 2.43

08:30 United Kingdom PSNB, bln September 10.9 9.3

08:55 Australia RBA Assist Gov Lowe Speaks

14:00 U.S. Existing Home Sales September 5.05 5.11

23:00 Australia Conference Board Australia Leading Index August +0.5%

23:30 Australia Leading Index September -0.1%

23:50 Japan Adjusted Merchandise Trade Balance, bln September -924.4 -910.0

-

20:00

Dow -31.5 16,348.91 -0.19% Nasdaq +30.36 4,288.80 +0.71% S&P +7.76 1,894.52 +0.41%

-

17:00

European stocks close: FTSE 100 6,267.07 -43.22 -0.68% CAC 40 3,991.24 -41.94 -1.04% DAX 8,717.76 -132.51 -1.50%

-

17:00

European stocks close: stocks closed lower on disappointing corporate earnings

Stock indices closed lower on disappointing corporate earnings.

Germany's Bundesbank said in its monthly bulletin that Germany's economy barely grew at in the third quarter and the outlook for the fourth quarter is cautious. Bundesbank noted that the economy in Germany was unlikely to enter recession.

German producer price index was flat in September, missing expectations for a 0.1% gain, after a 0.1% decline in August.

On a yearly basis, German producer price index fell 1.0% in September, in line with expectations, after a 0.8% drop in August.

Eurozone's current account surplus declined to 18.9 billion euros in August from a surplus of 21.6 billion euros in July, missing expectations for a current account surplus of 21.3 billion euros. July's figure was revised up from a surplus of EUR18.7 billion.

Royal Philips NV shares decreased 3.4% after missing third-quarter sales and profit analysts' estimates.

SAP SE shares fell 5.7% after the company lowered its full-year earnings forecast.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,267.07 -43.22 -0.68%

DAX 8,717.76 -132.51 -1.50%

CAC 40 3,991.24 -41.94 -1.04%

-

16:40

Oil: an overview of the market situation

The cost of oil futures declined substantially, as market participants remain concerned about the prospects of the global economy and its impact on the demand for raw materials. Pressure on prices also have a speculation that the Organization of Petroleum Exporting Countries will not cut production to support oil prices. Recall November 27 oil ministers of the OPEC countries have planned a meeting in Vienna in which intend to consider the advisability of adjusting the current production at the level of 30 million barrels per day at the beginning of 2015.

"It is unlikely that the recent recovery in prices will continue until such time as we get the exact content by OPEC to cut production", - the expert said Carsten Fritsch Commerzbank. He and several other analysts do not exclude a further decline in oil prices. "Testing in the range of 75-80 dollars per barrel can occur on the current or next week," - says economist ABN Amro Bank in Amsterdam Hans van Kleef.

It is worth emphasizing that the world's reserves are way ahead of demand in recent months. Earlier report showed that oil production in the OPEC reached in September two-year high of 31 million barrels per day, due to increased production volumes in Iraq and Libya.

Market participants are preparing for tomorrow's publication of a number of economic indicators in China, which will give a clue as to the strength of the economic recovery and future course. Recent economic performance of China noted that the recovery remains uncertain and may require further monetary stimulus.

Little support prices have reported that an Iranian president Hassan Rouhani gave an indication of the Ministry of Oil to use "diplomatic means" to prevent a further fall in prices. "This news once again emphasizes that oil producers are concerned about the decline in share price, - the analyst said CMC Markets Michael Hughes. - None of the major countries, OPEC, will not be able to survive long periods without serious consequences, during which oil will cost less than $ 85 per barrel. "

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 81.10 a barrel on the New York Mercantile Exchange (NYMEX).

Price of December futures for North Sea Brent crude oil mixture fell $ 1.58 to $ 84.84 a barrel on the London exchange ICE Futures Europe.

-

16:37

Foreign exchange market. American session: the Canadian dollar traded lower against the U.S. dollar after the release of Canadian wholesale sales

The U.S. dollar traded mixed to lower against the most major currencies. The greenback remained supported by Friday's U.S. economic data. The Reuters/Michigan consumer sentiment index rose to 86.4 in October from 84.6 in September, beating forecasts of a decline to 84.3.

Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations.

The euro traded higher against the U.S. dollar. The European Central Bank has started buying covered bonds to stimulate the economy in the Eurozone.

Germany's Bundesbank said in its monthly bulletin that Germany's economy barely grew at in the third quarter and the outlook for the fourth quarter is cautious. Bundesbank noted that the economy in Germany was unlikely to enter recession.

German producer price index was flat in September, missing expectations for a 0.1% gain, after a 0.1% decline in August.

On a yearly basis, German producer price index fell 1.0% in September, in line with expectations, after a 0.8% drop in August.

Eurozone's current account surplus declined to 18.9 billion euros in August from a surplus of 21.6 billion euros in July, missing expectations for a current account surplus of 21.3 billion euros. July's figure was revised up from a surplus of EUR18.7 billion.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the release of Canadian wholesale sales. Wholesale sales in Canada climbed 0.2% in August, in line with expectations, after a 0.2% decline in July. July's figure was revised up from a 0.3% drop.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

The Aussie was supported by news from China. A Chinese government official said the China's central bank is planning to inject about 200 billion yuan into some lenders.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen decreased against the greenback on Government Pension Investment Fund (GPIF) report. The Nikkei newspaper said that Japan's Government Pension Investment Fund will raise its target for foreign bonds and shares to around 30% from 23%.

Comments by the Bank of Japan Governor Haruhiko Kuroda also weighed on yen. He said on Monday that Japan's economy "will continue to recover moderately as a trend". Kuroda added that the annual inflation rate is expected to remain at around 1.25% "for some time".

-

16:20

Gold: an overview of the market situation

Gold prices rose markedly today, breaking a series of two-day decline, as the decline in the European stock market has heightened interest in the metal as an alternative asset. Gold has also received support from the dollar index falling 0.15% - to the level of 85.19. A weak dollar tends to increase the demand for gold, as it increases the appeal of the precious metal as an alternative asset and makes dollar-denominated commodities cheaper for buyers in other currencies.

"We think that gold will meet strong resistance at $ 1,250, and the level of support in the near future will be $ 1.220-1.225", - said the dealer MKS Group Sam Laughlin, adding that prices could fall to $ 1,200 with the improvement in the global economy.

The rise in prices is also associated with speculation that a weaker-than-expected growth in the global economy and its impact on the economy of the United States could force the Federal Reserve to delay raising interest rates.

Investors also await the publication of a series of Chinese economic indicators that prompt relative strength of the economic recovery and the future path of monetary policy. Tomorrow China will release data on GDP growth in the third quarter, as well as reports on industrial production, retail sales and investment in fixed assets in September. It is expected that the economy grew by 7.2%, after +7.5% in the 2nd quarter.

It should be emphasized that many experts are increasingly put on the rise in gold prices. In the week before October 14 the number of net long positions increased by 12 thousand. Contracts to 42.2 thousand., Which is the highest level for the last five weeks. Meanwhile, the world's largest reserves of the gold-exchange trading fund SPDR Gold Trust rose last week by 1.5 tons, registering the first weekly inflow since early September. Experts note the duration of this trend will depend on the dynamics of the dollar and the situation on the stock markets. In addition, it is unclear how strong is the demand for physical gold in India this week, according to this, it is likely that prices will drop a bit.

The cost of the December gold futures on the COMEX today rose to 1244.40 dollars per ounce.

-

15:28

Reserve Bank of Australia Assistant Governor Christopher Kent: “monetary policy is currently configured to support growth in demand”

The Reserve Bank of Australia Assistant Governor Christopher Kent said t the Leading Age Services Australia National Congress in Adelaide on Monday that "monetary policy is currently configured to support growth in demand". He added that that inflation is expected to remain within its 2% to 3% target.

Kent focused more on the challenges and opportunities of an ageing population.

-

14:35

U.S. Stocks open: Dow 16,380.41 +263.17 +1.63%, Nasdaq 4,258.44 +41.05 +0.97%, S&P 1,886.76 +24.00 +1.29%

-

14:08

Before the bell: S&P futures -0.20%, Nasdaq futures -0.05%

U.S. stock-index futures fell as International Business Machines Corp. cut its earnings outlook.

Global markets:

Nikkei 15,111.23 +578.72 +3.98%

Hang Seng 23,070.26 +47.05 +0.20%

Shanghai Composite 2,356.73 +15.54 +0.66%

FTSE 6,257.52 -52.77 -0.84%

CAC 3,981.63 -51.55 -1.28%

DAX 8,727.83 -122.44 -1.38%

Crude oil $82.80 (+0.07%)

Gold $1246.30 (+0.59%)

-

14:05

DOW components before the bell

(company / ticker / price / change, % / volume)

3M Co

MMM

137.50

+0.07%

0.1K

Johnson & Johnson

JNJ

98.82

+0.12%

33.3K

Verizon Communications Inc

VZ

48.14

+0.15%

1.4K

Goldman Sachs

GS

177.45

+0.31%

4.3K

Caterpillar Inc

CAT

95.35

+0.32%

1.4K

Pfizer Inc

PFE

27.92

+0.32%

5.9K

E. I. du Pont de Nemours and Co

DD

67.21

+0.34%

0.9K

United Technologies Corp

UTX

101.97

+0.43%

0.1K

JPMorgan Chase and Co

JPM

56.47

+0.48%

1.3K

Merck & Co Inc

MRK

54.32

+0.56%

1.4K

General Electric Co

GE

24.98

+0.64%

17.0K

Walt Disney Co

DIS

84.44

+0.73%

1.3K

American Express Co

AXP

83.21

+0.76%

1.5K

Home Depot Inc

HD

90.94

+0.78%

8.0K

Chevron Corp

CVX

111.80

0.00%

2.5K

Boeing Co

BA

123.23

-0.01%

0.2K

Procter & Gamble Co

PG

83.26

-0.01%

10.9K

Visa

V

205.92

-0.04%

4.9K

McDonald's Corp

MCD

91.00

-0.04%

2.6K

AT&T Inc

T

34.04

-0.12%

3.8K

The Coca-Cola Co

KO

42.79

-0.21%

2.9K

Exxon Mobil Corp

XOM

91.00

-0.23%

4.5K

Nike

NKE

86.86

-0.37%

0.3K

Microsoft Corp

MSFT

43.33

-0.69%

18.1K

Intel Corp

INTC

31.10

-0.89%

11.8K

International Business Machines Co...

IBM

169.33

-6.99%

398.8K

-

13:55

Japan's Government Pension Investment Fund will raise its target for local shares, for foreign bonds and shares

The Nikkei newspaper said that Japan's Government Pension Investment Fund will raise its target for foreign bonds and shares to around 30% from 23%. The Government Pension Investment Fund will raise its target for local shares to around 25% from 12%, the Nikkei newspaper also said.

-

13:42

Upgrades and downgrades before the market open

Upgrades:

Freeport-McMoRan (FCX) upgraded to Neutral from Sell at Citigroup

American Express (AXP) upgraded to Buy from Hold at Sandler O'Neill

Downgrades:

Other:

-

13:30

Canada: Wholesale Sales, m/m, August +0.2% (forecast +0.2%)

-

13:29

Bank of Japan Governor Haruhiko Kuroda: the annual inflation rate is expected to remain at around 1.25% "for some time"

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a meeting of the BoJ's regional branch managers on Monday that Japan's economy "will continue to recover moderately as a trend". Kuroda added that the annual inflation rate is expected to remain at around 1.25% "for some time".

He reiterated that the BoJ will continue with its quantitative and qualitative easing to achieve the 2% inflation target.

-

13:01

Foreign exchange market. European session: the euro traded slightly higher against the U.S. dollar

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Producer Price Index (MoM) September -0.1% +0.1% 0.0%

06:00 Germany Producer Price Index (YoY) September -0.8% -1.0% -1.0%

08:00 Eurozone Current account, adjusted, bln August 21.6 Revised From 18.7 21.3 18.9

10:00 Germany Bundesbank Monthly Report

The U.S. dollar traded mixed to lower against the most major currencies. The greenback remained supported by Friday's U.S. economic data. The Reuters/Michigan consumer sentiment index rose to 86.4 in October from 84.6 in September, beating forecasts of a decline to 84.3.

Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations.

The euro traded slightly higher against the U.S. dollar. The European Central Bank has started buying covered bonds to stimulate the economy in the Eurozone.

German producer price index was flat in September, missing expectations for a 0.1% gain, after a 0.1% decline in August.

On a yearly basis, German producer price index fell 1.0% in September, in line with expectations, after a 0.8% drop in August.

Eurozone's current account surplus declined to 18.9 billion euros in August from a surplus of 21.6 billion euros in July, missing expectations for a current account surplus of 21.3 billion euros. July's figure was revised up from a surplus of EUR18.7 billion.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded slightly higher against the U.S. dollar ahead the Canadian wholesale sales. Wholesale sales in Canada are expected to climb 0.2% in August, after a 0.3% decline in July.

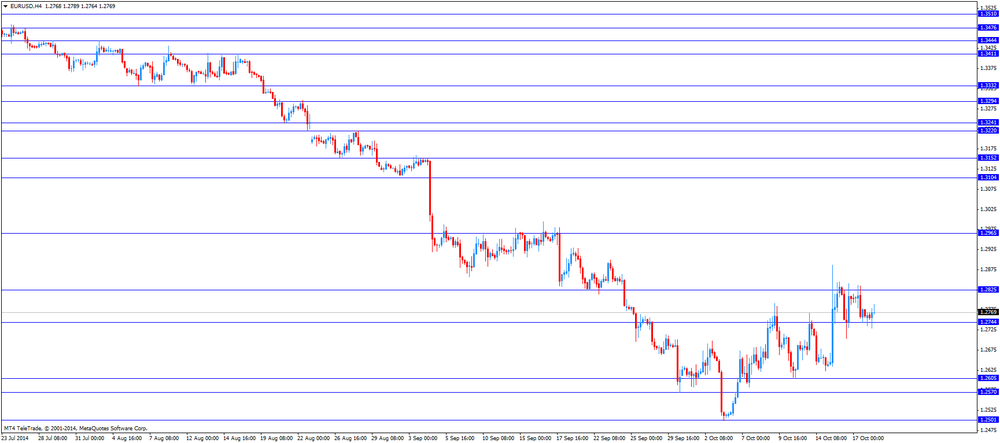

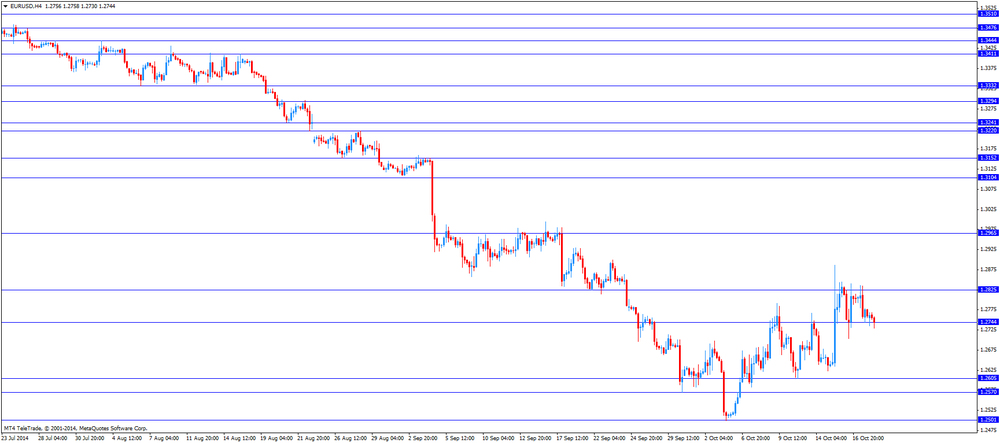

EUR/USD: the currency pair rose to 1.2789

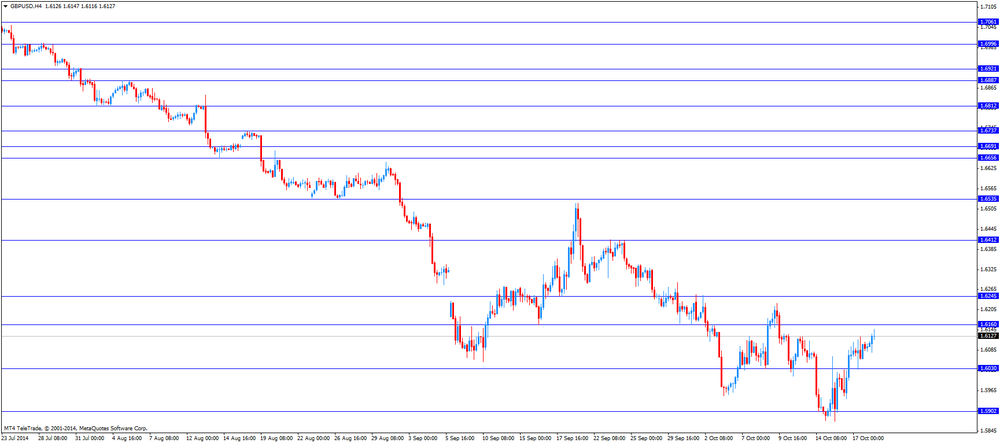

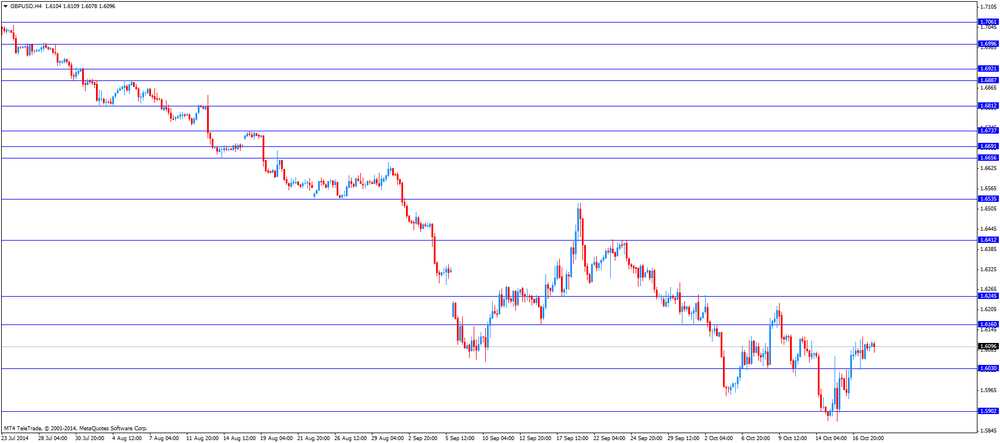

GBP/USD: the currency pair increased to $1.6147

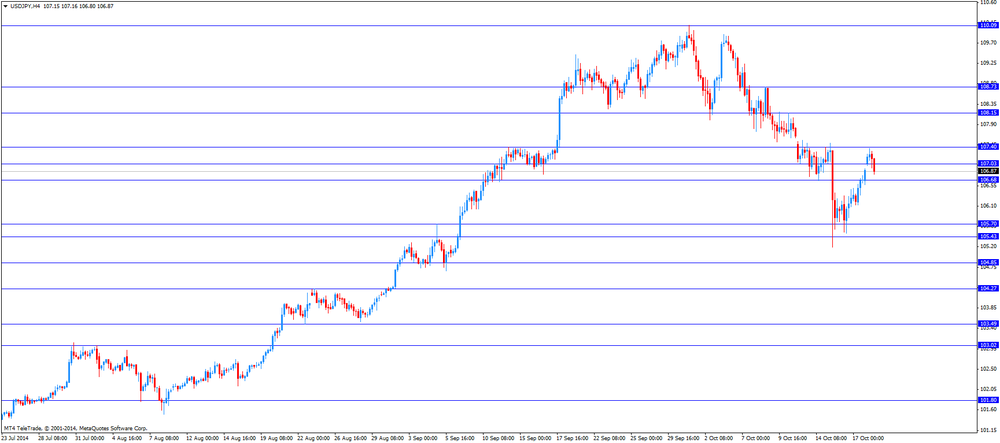

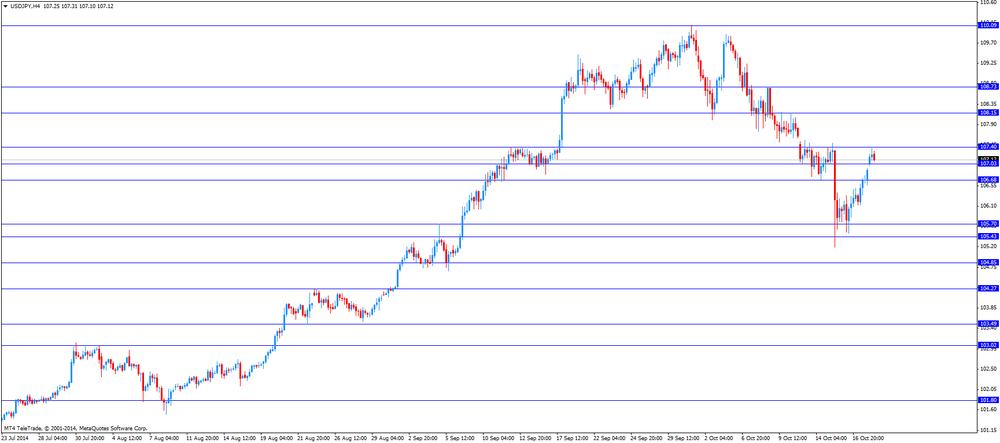

USD/JPY: the currency pair fell to Y106.80

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m August -0.3% +0.2%

21:45 New Zealand Visitor Arrivals September -3.0%

-

12:02

European stock markets mid session: stocks traded lower on disappointing corporate earnings

Stock indices traded lower on the weaker-than-expected corporate earnings.

German producer price index was flat in September, missing expectations for a 0.1% gain, after a 0.1% decline in August.

On a yearly basis, German producer price index fell 1.0% in September, in line with expectations, after a 0.8% drop in August.

Eurozone's current account surplus declined to 18.9 billion euros in August from a surplus of 21.6 billion euros in July, missing expectations for a current account surplus of 21.3 billion euros. July's figure was revised up from a surplus of EUR18.7 billion.

Royal Philips NV shares decreased 3.3% after missing third-quarter sales and profit analysts' estimates.

SAP SE shares fell 4.4% after the company lowered its full-year earnings forecast.

Current figures:

Name Price Change Change %

FTSE 100 6,260.78 -49.51 -0.78 %

DAX 8,756.25 -94.02 -1.06 %

CAC 40 3,999.27 -33.91 -0.84 %

-

10:47

Asian Stocks close: stocks closed higher following Friday’s gains on Wall Street

Asian stock indices closed higher following Friday's gains on Wall Street. Stocks were supported by Friday's strong U.S. economic data. The Reuters/Michigan consumer sentiment index rose to 86.4 in October from 84.6 in September, beating forecasts of a decline to 84.3.

Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations.

Japanese stocks advanced on Government Pension Investment Fund (GPIF) report. The Nikkei newspaper said that Japan's Government Pension Investment Fund will raise its target for local shares to around 25% from 12%.

NEC Corp. shares climbed 6.5% on a report the company's half-year operating profit will rise.

Toyota Motor Corp. shares rose 5.2% on a weaker yen.

Indexes on the close:

Nikkei 225 15,111.23 +578.72 +3.98 %

Hang Seng 23,070.26 +47.05 +0.20 %

Shanghai Composite 2,356.73 +15.54 +0.66 %

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD: $1.2550(E1.12bn), $1.2580(E271mn), $1.2680(E304mn), $1.2700(E203mn), $1.2725(E597mn) $1.2750-55(E530mn), $1.2775(E542mn), $1.2790-800(E450mn), $1.2850(E460mn)

USD/JPY: Y105.50($667mn), Y106.25($2.5bn), Y106.75($1.37bn), Y107.20($400mn), Y107.50($503mn)

EUR/JPY: Y136.00(E778mn)

GBP/USD: $1.6000(stg933mn), $1.6190-1.6200(stg328mn)

EUR/GBP: Stg0.7915(E136mn), stg0.8040(E120mn)

AUD/USD: $0.8600(A$1.8bn), $0.8700(A$131mn), $0.8800(A$338mn), $0.8850(A$1.0bn)

NZD/USD: $0.7900(NZ$146mn), $0.7935(NZ$200mn), $0.7950(NZ402mn), $0.8000(NZ$978mn)

USD/CAD: C$1.1135($260mn), C$1.1260($190mn), C$1.1280($120mn)

-

10:10

Foreign exchange market. Asian session: the Japanese yen fell against the U.S. dollar on Government Pension Investment Fund (GPIF) report

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Producer Price Index (MoM) September -0.1% +0.1% 0.0%

06:00 Germany Producer Price Index (YoY) September -0.8% -1.0% -1.0%

08:00 Eurozone Current account, adjusted, bln August 21.6 Revised From 18.7 21.3 18.9

The U.S. dollar traded mixed against the most major currencies. The greenback was supported by Friday's U.S. economic data. The Reuters/Michigan consumer sentiment index rose to 86.4 in October from 84.6 in September, beating forecasts of a decline to 84.3.

Housing starts in the U.S. climbed 6.3% to 1.017 million annualized rate in September from a 957,000 pace in August, in line with expectations.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

The Aussie was supported by news from China. A Chinese government official said the China's central bank is planning to inject about 200 billion yuan into some lenders.

The Japanese yen fell against the U.S. dollar on Government Pension Investment Fund (GPIF) report. The Nikkei newspaper said that Japan's Government Pension Investment Fund will raise its target for foreign bonds and shares to around 30% from 23%.

Comments by the Bank of Japan Governor Haruhiko Kuroda also weighed on yen. He said on Monday that Japan's economy "will continue to recover moderately as a trend". Kuroda added that the annual inflation rate is expected to remain at around 1.25% "for some time".

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.6111

USD/JPY: the currency pair fell to Y107.38

The most important news that are expected (GMT0):

10:00 Germany Bundesbank Monthly Report

12:30 Canada Wholesale Sales, m/m August -0.3% +0.2%

21:45 New Zealand Visitor Arrivals September -3.0%

-

09:01

Eurozone: Current account, adjusted, bln , August 18.9 (forecast 21.3)

-

07:00

Germany: Producer Price Index (MoM), September 0.0% (forecast +0.1%)

-

07:00

Germany: Producer Price Index (YoY), September -1.0% (forecast -1.0%)

-

06:17

Options levels on monday, October 20, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2893 (3024)

$1.2849 (4202)

$1.2809 (1660)

Price at time of writing this review: $ 1.2758

Support levels (open interest**, contracts):

$1.2707 (1133)

$1.2659 (2124)

$1.2595 (2276)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 54545 contracts, with the maximum number of contracts with strike pric $1,2900 (6607);

- Overall open interest on the PUT options with the expiration date November, 7 is 57540 contracts, with the maximum number of contracts with strike price $1,2600 (6454);

- The ratio of PUT/CALL was 1.00 versus 1.04 from the previous trading day according to data from October, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.6402 (1485)

$1.6304 (1703)

$1.6207 (1977)

Price at time of writing this review: $1.6109

Support levels (open interest**, contracts):

$1.5993 (2155)

$1.5896 (1341)

$1.5797 (1490)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 26219 contracts, with the maximum number of contracts with strike price $1,6200 (1977);

- Overall open interest on the PUT options with the expiration date November, 7 is 31766 contracts, with the maximum number of contracts with strike price $1,5400 (2398);

- The ratio of PUT/CALL was 1.21 versus 1.22 from the previous trading day according to data from October, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:00

Nikkei 225 15,027.39 +494.88 +3.41%, Hang Seng 23,253.87 +230.66 +1.00%, S&P/ASX 200 5,320 +48.28 +0.92%, Shanghai Composite 2,343.01 +1.83 +0.08%

-

00:03

United Kingdom: Rightmove House Price Index (YoY), October +7.6%

-

00:01

United Kingdom: Rightmove House Price Index (MoM), October +2.6%

-