Notícias do Mercado

-

23:58

AUD/JPY declines towards 94.00 ahead of Japan inflation data

- AUD/JPY is expected to drop to near 94.00 as the risk-off impulse has escalated.

- Japan’s headline and core CPI are seen higher at 3.1% and 2.0% respectively.

- The BOJ announced a bond-buying program worth $667 million.

The AUD/JPY pair has turned sideways in early Tokyo after a vertical downside move from above 95.00 in the New York session. The risk-off impulse heated further after escalating UK political crisis due to the resignation of new UK Prime Minister Liz Truss and soaring returns on US government bonds. In early Tokyo, the asset is oscillating in a narrow range of 94.17-94.38 as investors are awaiting the release of Japan’s National Consumer Price Index (CPI) data.

As per the consensus, the headline CPI will land higher at 3.1% vs. the prior release of 3.0%. While, the core CPI which excludes food and energy prices from the calculation, could accelerate to 2.0% against the former release of 1.6%.

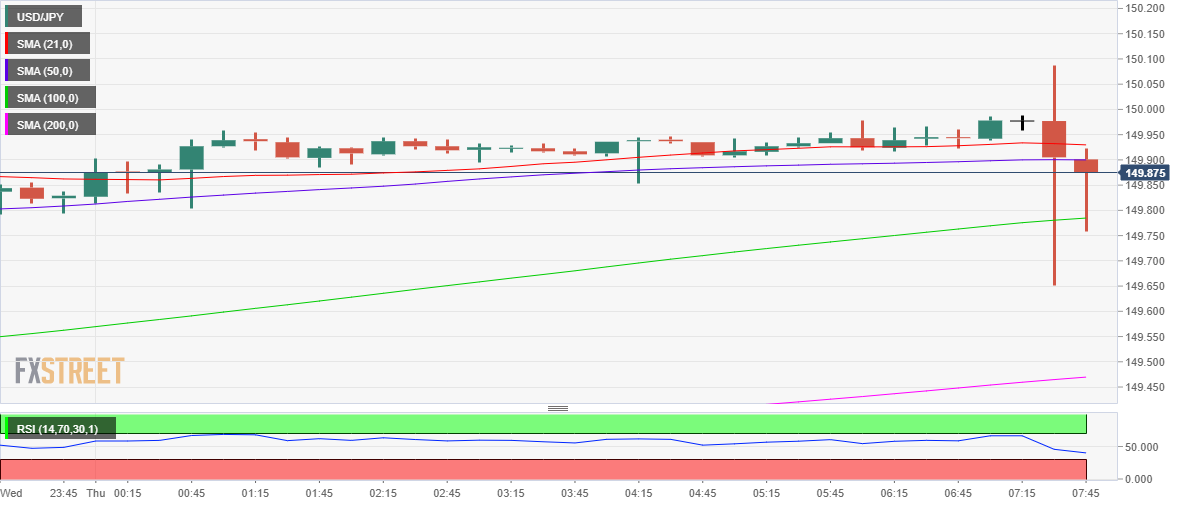

Suspicious commentary from Japan’s top currency diplomat Masato Kanda narrates that the vertical fall in the risk barometer could be an intervention action by the Bank of Japan (BOJ). On Thursday, Japan’s Kanda cited that he “will not comment on whether we are intervening now or have intervened today.” He further cited that, “Excessive and disorderly forex moves have a negative impact on the economy.” the economy is ready to take action in forex markets but will not comment on forex levels.

On Thursday, an emergency bond-buying program worth $667 million announced by the Bank of Japan (BOJ) triggered the risk of further weakness in the Japanese yen. The announcement followed commentary from Japan Prime Minister Fumio Kishida in which he cited the risk of weaker economic prospects due to external demand shocks.

On the Australian front, weaker job market data has impacted the aussie bulls. The Employment Change dropped sharply to 0.9k than the projections of 25k and the prior release of 33.5k. While the Unemployment Rate was released in line with the estimates and the former figure of 3.5%.

-

23:56

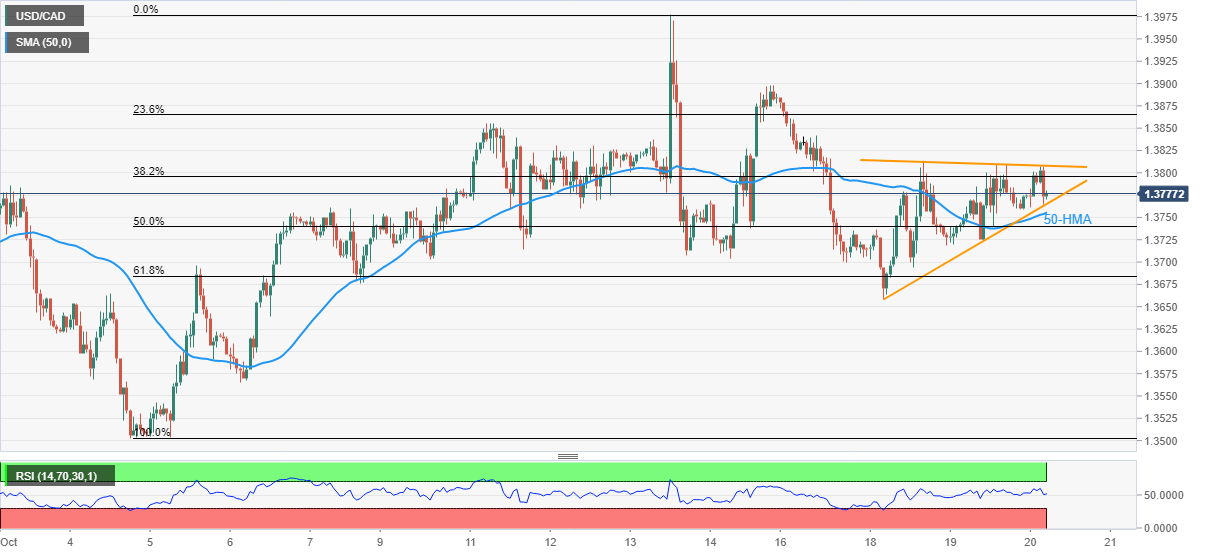

USD/CAD aims to regain 1.3800 as oil retreats, Canada Retail Sales eyed

- USD/CAD picks up bids to pare weekly losses.

- Oil prices reversed from one-week high as hopes of China demand, supply crunch wanes amid recession fears.

- Yields remain firmer around multi-year high, underpinning USD demand.

- Canada Retail Sales for August will be crucial amid a light calendar, risk catalysts are more important for clear directions.

USD/CAD licks its wounds during a quiet start to Friday’s trading in Asia, following the volatile day that refreshed the weekly low before reversing the move. Even so, the Loonie pair braces for the weekly loss.

The quote’s latest rebound could be linked to the market’s risk aversion, as well as softer prices of Canada’s main export item WTI crude oil. Additionally, the cautious mood ahead of Canada’s monthly Retail Sales for August also underpins the recovery moves.

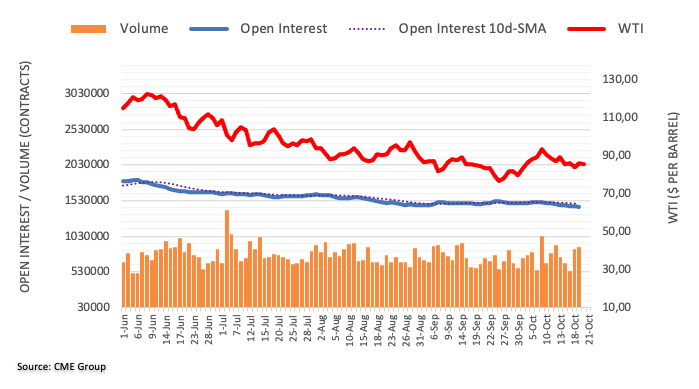

WTI crude oil remains pressured around $84.30, after a failed attempt to weekly gain due to the firmer US inventories and news surrounding China’s easing of quarantine rules. The reason could be linked to the growing fears of recession, which in turn underpin the US Treasury yield and the US dollar. “Recessions in the euro area and the UK are inevitable, as is a period of contraction in the US next year,” stated the Australia and New Zealand (ANZ) Banking Group in its latest report.

Elsewhere, a slump in Canada’s Employment Insurance Beneficiaries Change by 4.1% in August versus addition of 2.9% in the previous readings joined initial optimism to weigh on the USD/CAD prices before the risk-off mood recalled the buyers.

On the other hand, US Initial Jobless Claims eased to 214K for the week ended on October 07 versus 230K expected and a revised down 226K prior. Further, Philadelphia Fed Manufacturing Survey Index dropped to -8.7 for October versus the -5 market consensus and -9.9 previous reading. Additionally, US Existing Home Sales rose past 4.7M expected to 4.71M but eased below 4.78M prior. Recently, Federal Reserve Governor Lisa Cook mentioned that ongoing rate increases will be required.

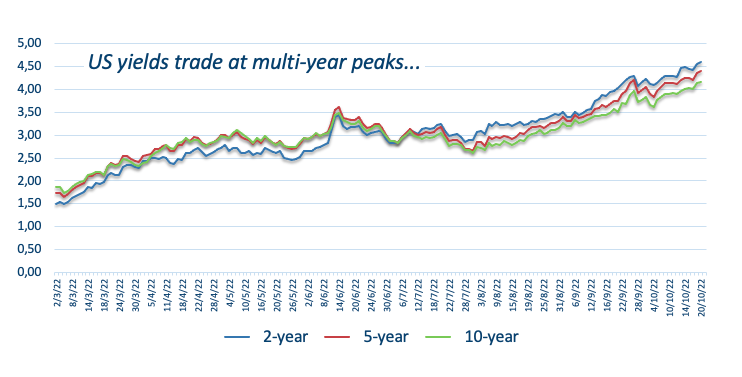

While portraying the mood, Wall Street closed in the red following an initially upbeat performance while the US 10-year Treasury yields rose to the highest since 2008.

Moving on, risk catalysts will be important to watch for fresh impulse ahead of Canada’s Retail Sales for August, expected 0.2% MoM versus -2.5% prior, which in turn could weigh on the USD/CAD prices if other things remain positive to the Loonie buyers. Also important will be the Fedspeak and the bond market moves.

Technical analysis

USD/CAD pair’s recovery from the 21-day EMA, around 1.3670 by the press time, needs validation from the 1.3800 level to convince buyers.

-

23:33

GBP/USD Price Analysis: At a make or a break around 1.1200

- The cable is on the verge of an explosion of the symmetrical triangle.

- Resignation from novel UK Prime Minister Liz Truss underpinned the risk-aversion theme.

- The 20-EMA is acting as a major barricade for the pound bulls.

The GBP/USD pair is struggling to surpass the immediate hurdle of 1.1240 in the early Tokyo session. The pound bulls witnessed a steep fall from 1.1336 on Thursday as the risk appetite of investors was trimmed led by soaring yields and UK political crisis after novel UK Leader Liz Truss resigned.

The returns on 10-year US government bonds skyrocketed amid a dismal market mood as the market participants are considering the 75 basis points (bps) rate hike by the Federal Reserve (Fed), a certainty now. Apart from that, soaring yields also supported the greenback in vaporizing early gains and ending the New York session with negligible losses of around 113.00.

On a four-hour scale, the cable is on the verge of exploding the symmetrical triangle chart pattern. The downward-sloping trendline of the above-mentioned chart pattern is placed from September 13 high at 1.1738 while the upward-sloping trendline is plotted from September 26 low at 1.0339. An explosion of volatility contraction pattern results in wider ticks and heavy volume.

The 200-period Exponential Moving Average (EMA) at 1.1300 is acting as a major barricade for the counter.

Meanwhile, the Relative Strength Index (RSI) has shifted into the 40.00-60.00 range, which signals a consolidation ahead.

Going forward, an upside break of Monday’s high at 1.1440 will drive the cable towards September 14 high at 1.1590, followed by September 13 high at 1.1738.

On the flip side, a drop below the 50-EMA at 1.1200 will drag the asset toward the psychological support of 1.1000. If cable surrenders the psychological support, it will expose to more downside towards October 12 low at 1.0924.

GBP/USD four-hour chart

-

23:31

NZD/USD ignores upbeat New Zealand trade data around 0.5680 amid dicey markets

- NZD/USD remains sidelined following a pullback from the weekly top.

- New Zealand’s Trade Balance improved in September, Exports grew as well but Imports eased.

- Upbeat mood initially favored Kiwi pair before dragging it on the recession woes.

- RBNZ, Fed both are likely to announce 75 bps rate hike but the rush to risk-safety put USD ahead.

NZD/USD pays little heed to New Zealand’s (NZ) trade data for September amid the early hours of Friday’s Asian session. That said, the Kiwi pair seesaws around 0.5680 after retreating from the weekly high near 0.5745. Even so, the quote is likely bracing for the strongest week since early August.

NZ Trade Balance improved to $-11.95B YoY in September versus $-13.19B expected and $-12.5B prior (revised from $-12.2B). Further, Imports eased to $7.64B from $7.92B prior while Exports rose to $6.03B compared to 5.29B previous readings. Overall, the Pacific nation’s trade numbers were positive enough to favor the NZD/USD bulls but could not.

The reason could be linked to the shift in the market’s mood, mainly due to the fears of recession and higher rates, which in turn propelled the Treasury bond yields and the US dollar.

That said, mostly firmer US data and hawkish Fedspeak also favored the greenback to pare recent losses even as the initial optimism weighed on the quote.

US Initial Jobless Claims eased to 214K for the week ended on October 07 versus 230K expected and a revised down 226K prior. Further, Philadelphia Fed Manufacturing Survey Index dropped to -8.7 for October versus the -5 market consensus and -9.9 previous reading. Additionally, US Existing Home Sales rose past 4.7M expected to 4.71M but eased below 4.78M prior.

Recently, Federal Reserve Governor Lisa Cook mentioned that ongoing rate increases will be required.

It’s worth noting that China’s debate on reducing quarantine time for international visitors seemed to have favored the Kiwi pair buyers earlier on Thursday.

Moving on, a lack of major data/events could keep the NZD/USD on a dicey floor but the risk catalysts will be crucial to watch for clear directions. Also to keep in mind that the NZD/USD downside appears limited due to the hawkish bias over the Reserve Bank of New Zealand’s (RBNZ) next move.

Technical analysis

The first daily closing beyond the 21-DMA in two months join a weekly support line to keep the NZD/USD buyers hopeful unless the quote breaks 0.5640 level. The recovery moves, however, need validation from monthly high of 0.5815.

-

23:19

GBP/JPY Price Analysis: Seesaws around 168.60, as BoJ’s intervention, lurks

- GBP/JPY clings to gains as the Asian session begins, following Thursday’s 200 pip volatile session, on speculation of BoJ’s FX intervention.

- Short term, the GBP/JPY might test 170.00 but needs to clear 169.73; otherwise, a fall to the weekly lows below 167 is on the cards.

The GBP/JPY seesawed within a large range on Thursday on what looks like an intervention in the FX markets by Japanese authorities after hitting a daily low/high of 167.42-169.73, respectively, for a total of 220 pips difference between Thursday’s price extremes. At the time of writing, the GBP/JPY is trading at 168.60, down by a minimal 0.02%, as the Asian Pacific session begins.

GBP/JPY Price Forecast

The daily chart delineates the GBP/JPY remains upward biased. However, Thursday’s candlestick engulfed the price action of Tuesday and Wednesday’s sessions, though with a smaller-than-expected body, meaning that buying and selling pressure is at equilibrium. The Relative Strength Index (RSI) at 62.85 is almost flat, despite lying a bullish territory, while the 20-day Exponential Moving Average (ËMA) at 163.27 crossed above the 50-day EMA, eyeing the 100-day EMA lying at 163.54, which, once surpassed, could spark another leg-up in the pair. Key resistance levels lie at 169.00, followed by October 20 cycle high at 169.73, closely followed by 170.00.

In the near term, the GBP/JPY one-hour time frame depicts the pair consolidating. The hourly EMAs, namely the 20, 50, and 100, are almost flat below the current exchange rate, with the 200-EMA lying at 165.73. The RSI in the hourly chart is at 53.86, in bullish territory, validating the neutral to upward bias, though a break above Thursday’s high at 169.73 is needed to pave the way for further gains and will expose key resistance levels like the 170.00 figure, and 171.00.

On the flip side, the GBP/JPY needs to break below 168.43 to retest the weekly low at 166.95, though it would face some hurdles on the way south. The first support would be the S1 daily pivot at 167.45, followed by the 167.00 figure, ahead of 166.95.

GBP/JPY Key Technical Levels

-

23:13

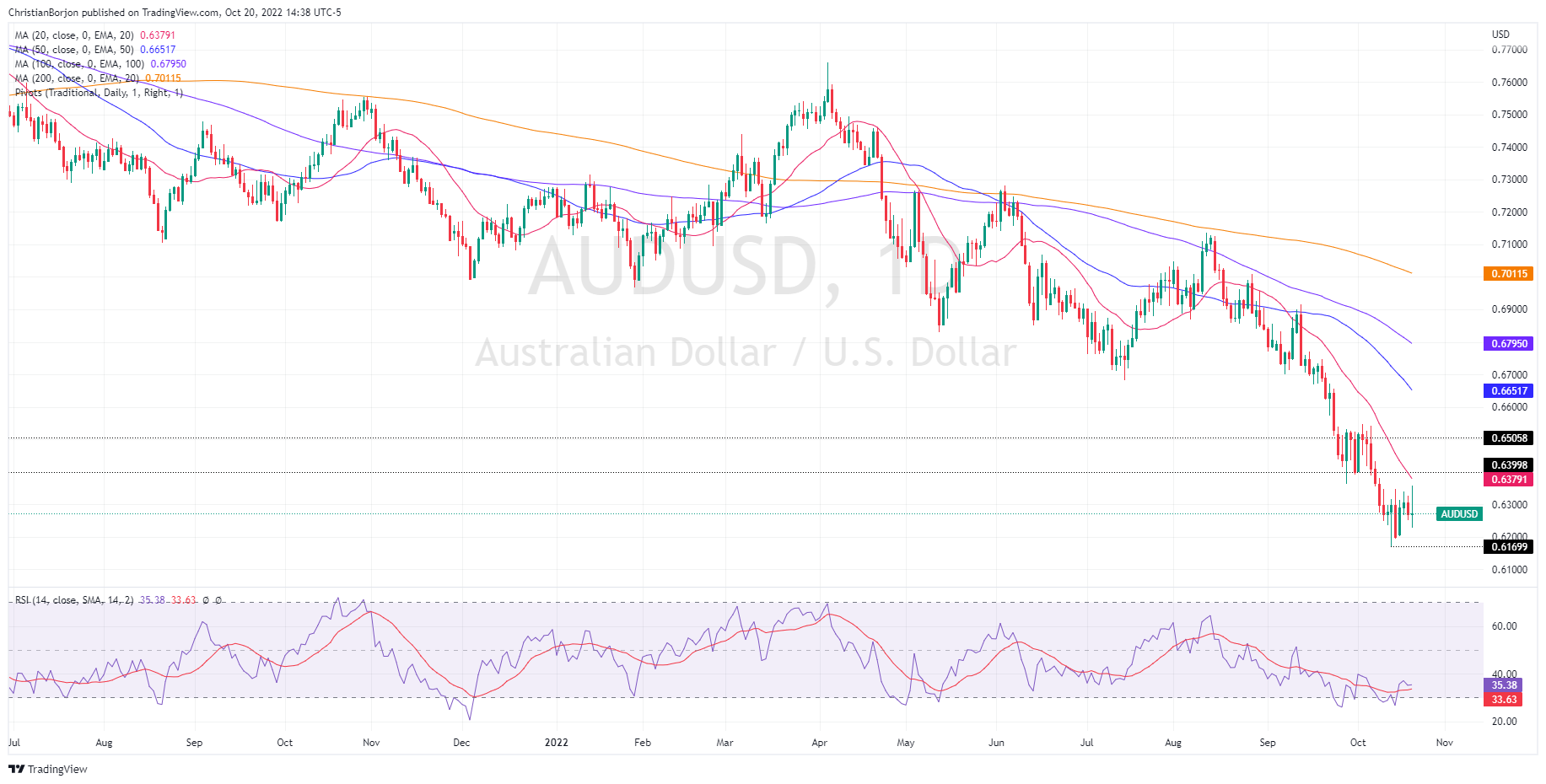

AUD/USD steadies below 0.6300, yields, central banks in focus

- AUD/USD remains sidelined after a volatile day that refreshed weekly top before retreating.

- Risk sentiment sours following an initial optimism, yields dribble around multi-year high.

- Australia reported downbeat job numbers for September, firmer Q3 NAB Business Confidence.

- Fears of recession propel yields, DXY while China’s covid headlines battled the bears.

AUD/USD treads water around 0.6280 during early Friday morning in Asia, after marking notable activity the previous day. The Aussie pair refreshed its weekly top initially on Thursday amid cautious optimism in the market. However, fears of recession unearthed afterward and triggered the quote’s pullback. Even so, the quote is up for posting the first weekly gain in six.

Be it upbeat prints of Australia’s quarter National Australia Bank’s (NAB) Business Confidence or China’s debate on reducing quarantine time for international visitors, AUD/USD had some positives to renew the weekly top. However, the political jitters in the UK joined downbeat Aussie Employment Change for September to weigh on the quote.

Australia’s headline Employment Change rose 0.9K versus 25K expected and 33.5K prior while the Unemployment Rate and Participation Rate matched market forecasts of printing 3.5% and 66.6% figures respectively. On the other hand, National Australia Bank's (NAB) quarterly Business Confidence figures rose to 9 versus 5 expected and 7 prior and restrict the AUD/USD pair’s immediate downside.

Also, mixed US statistics and upbeat Treasury yields seem to keep the US dollar on the bull’s radar despite the latest pullback that teases the greenback gauge’s firmer weekly loss in three.

US Initial Jobless Claims eased to 214K for the week ended on October 07 versus 230K expected and a revised down 226K prior. Further, Philadelphia Fed Manufacturing Survey Index dropped to -8.7 for October versus the -5 market consensus and -9.9 previous reading. Additionally, US Existing Home Sales rose past 4.7M expected to 4.71M but eased below 4.78M prior.

Elsewhere, Wall Street closed in the red following initially upbeat performance while the US 10-year Treasury yields rose to the highest since 2008.

Despite the mixed data and recently cautious optimism, the fears of high inflation pushing policymakers towards more/heavier rate hikes challenge the AUD/USD buyers. That said, risk catalysts are likely to be important for clear directions amid a light calendar ahead of the US session.

Technical analysis

AUD/USD is up for challenging the six-week-old bearish channel, backed by a weekly support line and upbeat MACD signals. However, sustained trading beyond 0.6305 is necessary to convince the buyers.

-

23:05

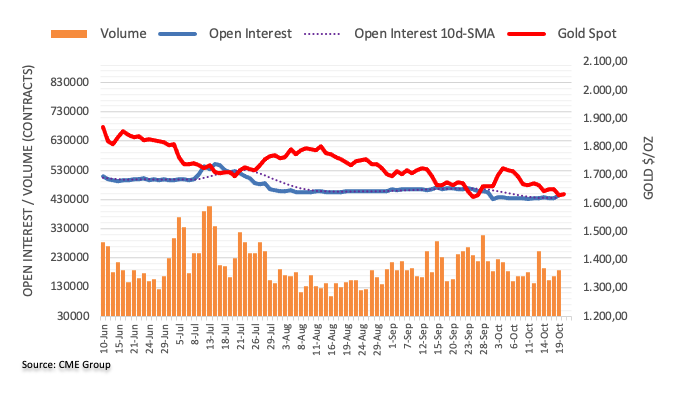

Gold Price Forecast: XAU/USD eyes a revisit to a two-year low below $1,620, yields extend rally

- Gold price has resumed its downside journey after the pullback move faded.

- The precious metal failed to extend the rebound move as the risk-off impulse rebounded.

- The 10-year US yields have soared further to 4.23% as a bigger rate hike by the Fed looks certain.

Gold price (XAU/USD) has witnessed a steep fall after the termination of the pullback move at around $1,646.00. The precious metal has resumed its downside journey and is revisiting the two-year low at $1,614.85. Cat got gold prices tongue as the market impulse turned risk-averse again after S&P500 surrendered their gains in the New York session.

Meanwhile, returns on US government bonds have reached the rooftop as odds for a fourth consecutive 75 basis point (bps) rate hike by the Federal Reserve (Fed) has heated further. The 10-year benchmark US Treasury yields have soared to 4.23%.

Fed Beige Book, released this week, cited that inflationary pressures are here to stay led by rising input prices. This has strengthened the need of tightening monetary policy further. As per the CME FedWtch tool, the probability of a 75 bps rate hike announcement is stable above 95%.

Firmer yields fetched strength for the US dollar index (DXY) after it dropped below 112.20 when market sentiment was bewildered. The DXY has recaptured the critical hurdle of 113.00.

Gold technical analysis

On an hourly scale, the gold prices are declining towards the two-year placed at $1,614.85, recorded on 28 September 2022. The 100-period Exponential Moving Average (EMA) at $1,645.63 acted as a major barricade for the counter.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, and a shift into the bearish range of 20.00-40.00will trigger the downside momentum

Gold hourly chart

-

22:45

New Zealand Imports down to $7.64B in September from previous $7.93B

-

22:45

New Zealand Exports up to $6.03B in September from previous $5.48B

-

22:45

New Zealand Trade Balance NZD (MoM) above forecasts ($-2205M) in September: Actual ($-1615M)

-

22:45

New Zealand Trade Balance NZD (YoY) came in at $-11.95B, above forecasts ($-13.19B) in September

-

22:00

South Korea Producer Price Index Growth (YoY) above expectations (7.4%) in September: Actual (8%)

-

22:00

South Korea Producer Price Index Growth (MoM) below forecasts (0.4%) in September: Actual (0.2%)

-

21:39

EUR/USD is carving out the risk of an imminent downside breakout, US yields rocket to the moon (and back?)

- EUR/USD bears pressing into key support territory.

- US dollar bulls are mindful of the risk of BoJ intervention ahead of the next Fed meeting.

EUR/USD is up into the close on Wall Street by some 0.12% as the US dollar lags the soaring US yield environment and despite markets pricing in the Federal Reserve's terminal rate of around 5%. Risk sentiment has been fickle this week, playing into the hands of the euro bulls at times of risk-on. Earnings season and UK politics have been a drive in that regard, but the focus will now turn to the central banks again, which is the US dollar's playing field, casting a dark cloud over stocks and high beta currencies, such as the euro for the week ahead.

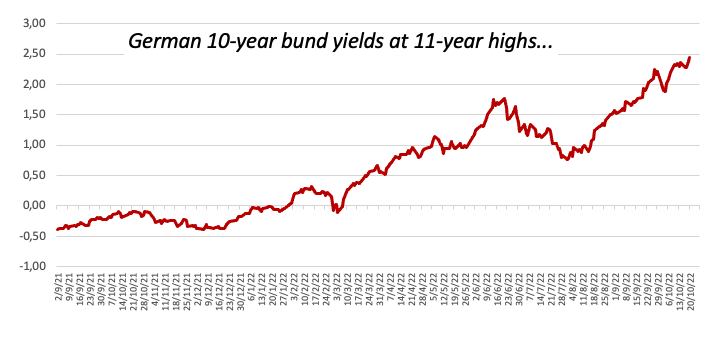

In trade on Thursday, the US dollar found some relief on the comments from Federal Reserve Bank of Philadelphia President Patrick Harker who said the central bank is not done with raising its short-term rate target amid very high levels of inflation. His most hawkish of remarks sent yields to fresh cycle highs, the strongest in a decade. He said the Fed has made disappointing progress at lower inflation and added that inflation in 2023 would fall to around 4% and 2.5% in 2024, which is still well above the 2%. as such risk sold off, yield and the greenback rallied weighing on the euro in the latter part of the US morning trade. Bond yields rose, with the US 2-year note last seen paying 4.593%, up 0.75%, after reaching to the highest since 2008 at 4.614%. The US dollar weakened, with the DXY index last seen down 0.15 points to 112.85 having moved between a low of 112.16 and 113.09.

As for events on the week and today's session, a spate of mixed quarterly corporate results and economic indicators provided some evidence of an economic slowdown, but a dip in jobless claims showed the Fed's aggressive campaign of interest rate hikes has had little effect on the tight US labour market. Financial markets have now fully priced in yet another 75 basis point interest rate hike from the Federal Reserve when it meets next month, according to CME's FedWatch tool, and there is where the euro bulls' hard work could come undone as per the technical analysis below.

EUR/USD technical analysis, H4, H1 & daily chart

The price is under pressure within a coil and is testing the outer rims of the triangle to the downside, pressured by rising US yields and the US dollar:

(US 2-year yields at a decade high).

The US dollar, as per the DXY index could be on the verge of another surge to catch up with soaring US yields, which does not bode well for the euro:

The confluence of the bullish flag pattern and W-formation, with the correction, supported the neckline meeting a 50% mean reversion and trendline likely give fuel for the bulls.

Meanwhile, a bearish scenario on the hourly chart could be as follows:

We have seen three pushes into the topside of the coil and a subsequent blow-off into longs with perhaps more of a long squeeze to play out before a correction. This will put the 0.9780/75 under pressure which guards the 0.9750 support block and 0.97 the figure below there. in doing so, the bears will be in control below the triangle with lower lows on their radar:

However, risks to the bearish thesis may lie in the hands of the Bank of Japan as the threat of intervention, by selling the US dollar and buying the yen, guarding the 150.00s area. This could have widespread ripple effects in the forex markets, potentially stripping the greenback of such a move as outlined above, at least for the while the market is impacted by intervention:

If the market decides to front run such a risk, considering no trader wants to be offside by 500 pips on actual intervention, as what happened on 22 September during the BoJ's bid for the yen (resulting in a 90 pip rally in the euro and a sharp drop in US yields), a 100 pip move to 149.00 could evolve in the near term, ahead of the Federal Reserve November 1/2.

-

21:11

USD/CHF steady above 1.0000, with upside attempts capped at 1.0065/75

- The dollar consolidates right below long-term highs at 1.0075.

- A pullback in risk appetite has favored the USD.

- Upside moves remain capped by a key resistance area of 1.0065/75.

The US dollar remains steady above parity levels on Thursday, at a short distance to the 1.0075 three-year high. The pair’s reversal from 1.0065 has been supported at 0.9995 and the pair appreciated again during the US session to reach the 1.0050 area.

The USD picks up as risk appetite fades

The greenback depreciated across the board earlier today as UK Prime minister Liz Truss’s resignation triggered a risk-on sentiment. Optimism, however, has been short-lived and the US dollar regained lost ground later on.

The upcoming Federal Reserve monetary policy meeting, which is expected to deliver a fourth consecutive 0.75% rate hike continues underpinning the US dollar.

Furthermore, US macroeconomic data has been moderately positive. Initial jobless claims increased below expectations on the week of October 14th, while existing home sales declined less than expected.

USD/CHF limited below a key resistance area at 1.0065/75

The pair is moving now right below an important resistance area at 1.0065/75 (October 13, 14 highs). Confirmation above that level would set the pair at three-year highs, aiming for the May 20 2019 high at 1.0120 ahead of April 25 2019 high at 1.0225.

On the downside, initial support lies at 0.9920 (Oct .18 low and the 100-period SMA in the four-hour chart) below here 0.9780 (Oct. 4 and 6 lows) and 0.9740 (Sept. 30 low).

Technical levels to know

-

21:01

Forex Today: Soaring yields saved the greenback

What you need to take care of on Friday, October 21:

The American Dollar started Thursday on the back foot but trimmed intraday losses and finished the day little changed against most major rivals. The greenback eased at the beginning of the day on the back of stable US Treasury yields and firmer equities. Wall Street rallied ahead of the opening following solid earning reports, but US indexes finished the day in the red as bond yields soared to their highest since 2008.

The yield on the 10-year US Treasury note picked at 4.23%, while the 2-year note yield hit 4.62%, as inflation and recession made it to the top of investors’ concerns.

It is worth noting that the Türkiye Central Bank slashed interest rates by 150 bps for the third consecutive month, with the main rate now at 10.5%, despite annual inflation surpassing 80%.

Another risk-off factor came from the United Kingdom. Prime Minister Liz Truss resigned after 44 days in office, after failing to order the financial system, but instead triggering more chaos. The 1922 Committee announced they would start the Conservative Party's leadership on Monday, October 24.

The EUR/USD pair trades around 0.9770, while GBP/USD settled at 1.1210, trimming early gains. The AUD/USD pair met sellers around a fresh weekly high of 0.6355 and finished the day unchanged, around 0.6260, while USD/CAD settled at 1.3780.

The USD/JPY pair hit a multi-decade high of 150.28, slowly grinding higher. Market players are cautious as BOJ’s intervention seems imminent.

Gold nears the weekly high, now trading at around $1,626 a troy ounce after trading as high as $1,645. Crude oil prices are stable, with WTI now at $84.80 a barrel.

Bitcoin price will fall to these levels if bulls continue evading support

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:40

USD/CAD turns positive on the day and approaches 1.3800

- The US dollar bounces from 1.3685 and returns to 1.3775.

- The Canadian dollar loses ground as oil prices dip.

- USD/CAD to continue appreciating towards 1.40 – MUFG.

The US dollar has bounced up strongly after hitting session lows at 1.3685 earlier on Thursday. The pair firmed up as risk appetite triggered by UK PM Liz Truss’s resignation faded, turning positive on daily charts and reaching the 1.3775 area so far.

The Canadian dollar weakens as oil prices retreat

Crude oil prices, which had rallied earlier today, underpinning the commodity-linked loonie are losing ground on Thursday’s US afternoon trading. The WTI oil has retreated nearly 3% to prices below $85.00.

Furthermore, the market has shifted the focus to the upcoming Federal Reserve’s monetary policy meeting, after Truss’s resignation effect ebbed. The Fed is expected to hike rates by 0.75% for the fourth consecutive time in November, which is acting as a tailwind for the US dollar.

On the macroeconomic front, US data has been fairly positive on Thursday. Initial jobless claims increased below expectations on the week of October 14th, while existing home sales declined less than expected.

USD/CAD expected to move towards 1.40 – MUFG

Currency analysts at MUFG see the risk skewed to the upside, with the pair aiming to 1.40: “The BoC is expected to bring an earlier end to their rate hike cycle than the Fed, reflecting in part expectations that Canada’s economy will prove more sensitive to rate hikes than the US economy given household debt is much more elevated in Canada (…) We expect USD/CAD to keep moving up closer to 1.4000.”

Technical levels to watch

-

20:39

AUD/USD oscillates around 0.6260s on mixed US data, post-Fed hawkish commentary

- AUD/USD is registering minimal gains amidst a risk-on impulse.

- Fed officials to keep increasing rates, amidst mixed US economic data reported.

- Australia’s employment figures justified the RBA’s ¼ increase to the OCR.

The AUD/USD advances in the North American session, though below its daily high reached at the London fix, of 0.6356, amid the Fed’s hawkish commentary and a risk-on impulse, which kept the greenback pressured, as shown by the US Dollar Index (DXY). At the time of writing, the AUD/USD is trading at 0.6276, up 0.13%.

On Thursday. Fed officials continue to express worries about high inflation in the US. Given the scenario of CPI hitting 8% in September and the tightness of the labor market, Philadelphia’s Fed Patrick Harker and Fed board member Lisa Cook commented that the Fed would need to keep increasing rates. Harker commented that he is “disappointed of the lack of progress curtailing inflation,” while he added that he expects rates to be above 4% in 2023.

Aside from this, a tranche of US economic data gave mixed signals to market participants, given that the Fed has hiked 300 bps in the year. The US Department of Labor reported that last week’s claims for unemployment rose by just 214K, less than estimates, reflecting the labor market resilience. In the meantime, US Existing Home Sales slid for the eighth consecutive month, as higher mortgage rates, around 7% sparked by the Federal Reserve’s monetary stance, had cooled down the housing market.

Aside from this, Australia’s job data in September disappointed, as the economy added just 900 workers to the economy, well below the 25K estimated, and trailed the August jump of 36K. Australia’s jobs data miss justified the Reserve Bank of Australia’s (RBA) minuscule rate hike early in October as the bank slowed its tightening pace. In the same report, the Unemployment Rate stood steady at 3.5%.

Given that backdrop, the Federal Reserve tightening cycle will leave the greenback on the front foot against the Australian dollar. Money market futures expect the Federal funds rate (FFR) to peak around 5%, while the RBA Overnight Cash Rate (OCR) will hit 4%. Therefore, the interest rate differential, and the safe-haven status of the US Dollar, will keep the AUD/USD downward pressured.

AUD/USD Price Forecast

The AUD/USD downtrend remains intact, despite jumping off the daily lows. Worth noting that the AUD/USD registered fresh weekly highs around 0.6356, but Fed hawkish commentary, and elevated US bond yields, were headwinds for the AUD/USD. However, with the Relative Strength Index (RSI) reaching higher lows, contrarily to AUD/USD’s price action, a positive divergence surfaced, the spark for the earlier gains. Unless buyers keep the major from registering a negative day, a re-test of the 0.6300 figure is on the cards.

-

20:00

Argentina Trade Balance (MoM) came in at $414M, below expectations ($960M) in September

-

19:59

Gold Price Forecast: XAU/USD bears eye the cycle lows for end of week

- Gold bears could come under pressure into the closing sessions of the week.

- The US dollar has lagged behind the rise in yields but is making a comeback from a confluence of key daily support.

The gold price has moved back to a flat position on the day to print around $1,629.25 at the time of writing having travelled between a low of $1,622.54 and $1,628.93 thus far, reversing two losing sessions as the US dollar eased.

There has been a disparity in the price of the US dollar and US yields which may come back to bite the gold bugs before the week is out, however. Federal Reserve Bank of Philadelphia President Patrick Harker said Thursday the central bank is not done with raising its short-term rate target amid very high levels of inflation. His most hawkish of comments sent yields to fresh cycle highs, the strongest in a decade. He said the Fed has made disappointing progress at lower inflation and added that inflation in 2023 would fall to around 4% and 2.5% in 2024, which is still well above the 2%. as such risk sold off, yield and the greenback rallied weighing on the price of gold.

Bond yields rose, with the US 2-year note last seen paying 4.593%,0.75%after reaching to the highest since 2008 at 4.614%:

Meanwhile, the US dollar weakened, with the DXY index last seen down 0.15 points to 112.85 having moved between a low of 112.16 and 113.09.

The index, however, remains in a bullish trend, near term and long term. The confluence of the bullish flag pattern and W-formation, with the correction, supported the neckline meeting a 50% mean reversion and trendline likely give fuel for the bulls to play catch up with US yields, weighing on gold's outlook for the remaining session of the week.

It's been a particularly troubling time in markets this week, with UK politics a major driver of volatility, feeding into the doom loop for gold prices at times of risk-off. However, the bearish themes could well intensify for the yellow metal as jumbo rate hikes are around the corner. As analysts at ANZ Bank explained, ''with the Truss soap opera over, global investors can now refocus on upcoming central bank meetings.'' The war on inflation will be firmly on the minds of investors as we head into these meetings, and in this context, gold will likely continue to struggle given inflation's increasing persistence.

''For the time being, we have found that US wage growth trends are validating near-term household inflation expectations, but appear to have settled at levels that would sustain a CPI inflation rate of 5-6% going forward, far removed from the 2.5% rate consistent with the Fed's inflation target,'' analysts at TD Securities said.

''In turn, don't count on investors to grow their appetite in the yellow metal. Physical demand for bullion has remained elevated, but seasonal considerations suggest that this tailwind could soon fade following India's festive season.''

Gold technical analysis

At the start of the week, within the pre-open market analysis on gold, Chart of the Week, Gold Price: Halloween comes early, XAU/USD back below critical bearish structure $,1670, the downside was marked as the path of least resistance as follows:

Gold, pre-open analysis October 16

Gold update, daily chart

As illustrated, that path continues to play out with the $1,614 lows potentially just a session or two, or three, away. Beyond there, we have the 2020 $1,570s clocked as the midpoint of the March 2020 range:

-

19:55

GBP/USD rejected at 1.1330 retreats to 1.1220 as Truss’s withdrawal enthusiasm ebbs

- The pound rally fails at 1.1330 and the pair returns to 1.1220.

- Investors scale back BoE hike hopes after Truss's demise.

- GBP/USD likely to reach 1.10 – ING.

The pound has given away most of the ground taken after the announcement of Prime Minister Truss's resignation and remains practically unchanged on the daily chart.

The pair rallied to session highs at 1.1330 with the market celebrating the departure of Truss’s controversial government, to lose steam shortly afterward and return to the lower ranges of 1.1200.

The market scales back BoE hike hopes

The U-turn on the tax cuts plan and finally the Prime Minister’s demise has prompted investors to scale down hopes of an aggressive BoE rate hike in November. MPC member Broadbent affirmed earlier on Thursday that the bank will respond to Britain’s tax and spending policies, in a hint that interest rates might not rise as much as expected.

Truss came to power with an economics program that roiled financial markets in September, triggering a sharp sell-off on the British pound that forced the Bank of England to step in with a bond-buying program.

The tax-cuts fiasco divided the Tory party and caused the resignation of two of her ministers in less than six weeks, hurting the country’s credibility

GBP/USD could dive to 1.10 – ING

FX analysts at ING see the current downtrend likely to extend towards 1.1000: “Political infighting and the uncertainty of policy continue to demand a risk premium for sterling, where GBP/USD could easily slip back to the bottom end of its wide 1.10-1.15 range.”

Technical levels to watch

-

19:16

Silver Price Forecast: XAG/USD climbs above $18.60 amid a soft US Dollar, high US bond yields

- Silver price capitalizes on US Dollar weakness, despite US bond yields hurdling the 4% threshold.

- Fed officials continued reiterating that inflation is too high, that rates need to be restrictive, and may peak close to 5% in 2023.

- Silver Price Forecast (XAG/USD): An ongoing upside correction is on the cards and may test the 50-day EMA around $19.15.

Silver price bounces off weekly lows around $18.20s and climbs to the $18.70 area amidst elevated US Treasury yields. The US Dollar could not capitalize on the hawkish rhetoric of Philadelphia’s Fed Patrick Harker, while US economic data was mixed.

Silver climbs despite Fed’s hawkish commentary and mixed US data

Philadelphia Fed President Patrick Harker said that the Fed would continue to hike rates “for a while” and expected the Federal funds rate (FFR) to be “well above 4%” by the end of the year. Of late, the Federal Reserve Governor Lisa Cook said that to curb high inflation, it would require to continue to tighten monetary conditions and then keep them “for some time.”

Given that the Federal Reserve’s measures had already impacted segments of the economy, some are lagging, like the labor market. The US Department of Labor reported that unemployment claims for the last week rose by just 214K less than the 228K foreseen by analysts. At the same time, the Philadelphia Fed reported business conditions for the area contracted by 8.7, more than estimates but less than September’s 9.9 fall.

Later, the US housing market prolonged its deterioration as September’s Existing Home Sales shrank by 1.5%, to 4.71 million houses, vs. estimates of a 2.14% contraction.

In the meantime, the US Dollar Index, a gauge of the buck’s value against a basket of peers, is trimming some earlier losses, down by just 0.05% at 112.849, a headwind for XAG/USD. US bond yields continue to rise, with the 10-year rate extending its gains by eight bps, hitting 4.215%, its highest level since 1990.

Silver Price Forecast

XAG/USD is downward biased, despite the ongoing bounce from weekly lows, around $18.20s. Even though the Relative Strength Index (RSI) is about to cross over its 7-day RSI Simple Moving Average (SMA), which would be a bullish signal, it would mean an upside correction to the ongoing trend. Therefore, XAG/USD might test the 50-day Exponential Moving Average (EMA) around $19.15 before resuming its downtrend.

-

19:03

EUR/GBP returns above 0.8700 with the pound losing momentum

- The euro bounces up at 0.8675 lows and returns above 0.8700.

- The pound loses steam after having rallied following Truss's resignation.

- EUR/GBP remains neutral while below 0.8750.

The euro is paring losses with the British pound retreating from session highs as the dust from UK PM Liz Truss's resignation settles. The pair found support at 0.8675 to reach 0.8715 at the moment of writing.

Prime Minister Truss’ withdrawal boosts the pound

The market welcomed the announcement of Prime Minister Liz Truss’s resignation earlier today, which sent the pound surging against its main peers and pushed world stocks to session highs.

Sterling’s rally, however, has been short-lived. The ongoing political uncertainty in the UK, with a Tory leadership election scheduled for next week, is keeping GBP bulls in check.

Furthermore, the market has scaled down hopes of an aggressive BoE rate hike at November’s MPC meeting. BoE member Broadbent affirmed on Thursday that the bank will respond to Britain’s tax and spending policies, but has not given any further information about the next monetary policy decision.

EUR/GBP: In a consolidative mood while below 0.8750

From a longer-term perspective, the pair remains trading sideways within recent ranges. On the upside, the pair should extend beyond 0.8750, where the 100 and 200-period SMA on the four-hour chart meet, before aiming for the October 12 high at 0.8865.

On the downside, immediate support lies at 0.8675 (October 19 low). Below here, the next potential targets could be at 0.8565 (September 6 low) and 0.8390/00 (August 8, 17, and 24 lows).

Technical levels to watch

-

18:43

Fed's Cook: Ongoing rate increases will be required

Federal Reserve Governor Lisa Cook crossed the wries in recent trade and was reported to have that inflation remains unacceptably high and interest rates will need to keep rising to get it under control.

“Inflation is too high, it must come down and we will keep at it until the job is done,” she said Thursday during opening remarks at a panel discussion with business and community leaders in Spartanburg, South Carolina. “This likely will require ongoing rate hikes and then keeping policy restrictive for some time.” She noted ongoing rate increases will be required.

US dollar update

Meanwhile, the US dollar index weakened below the 113 mark on Thursday to a low of 112.16 before recently picking up to a recent high of 112.80.

Meanwhile, earlier this session, the dollar traded at its highest level against the Japanese yen in more than 30 years, crossing the 150.00 psychological level.

-

18:13

The UK Conservative Party's leadership election will be held on Monday 24th

The 1922 committee announced that the first ballot of MPs in the Conservative Party's leadership election will be held on Monday 24th, between 3:30 PM and 5:30 PM UK time.

Candidates competing to become Britain's next prime minister will need the backing of 100 Conservative Party lawmakers to get on the ballot on Monday, organisers said.

If two candidates emerge, they will go to an online vote of members of the wider Conservative Party, with the winner declared by next Friday.

Candidates competing to become Britain's next prime minister will need the backing of 100 Conservative Party lawmakers to get on the ballot on Monday, organisers said.

If two candidates emerge, they will go to an online vote of members of the wider Conservative Party.

GBP/USD update

The British pound fell to a low of 1.1171 on Thursday, after Liz Truss announced she was resigning as British Prime Minister while investors rushed for safety amid concerns over fiscal uncertainty in Britain and prospects of aggressive US Federal Reserve interest rate hikes.

At the time of writing, GBP/USD is trading at 1.1227 and is 0.1% higher amid market volatility.

On the macro front, Britain's annual rate of consumer price inflation inched up to 10.1% last month, returning to a 40-year high and beating market forecasts, while the core rate hit an all-time high of 6.5%. The Bank of England is seen stepping up its interest rate hiking campaign next month to combat inflation, despite ongoing recession risks.

-

18:11

NZD/USD’s bulls are capped at 0.5740, returns to 0.5700 area

- The New Zealand dollar fails at 0.5740 and reruns to 0.5700.

- The kiwi trims losses as risk appetite fades.

- NZD/USD: Upside attempts to be capped below 0.5755 – UOB.

The New Zealand dollar is struggling to find acceptance above 0.5700 as the pair’s rebound from 0.5620 was capped at 0.5740 on Thursday’s US trading session. The pair remains positive on the daily chart although bullish momentum seems to have faded.

The kiwi appreciated on risk appetite

The negative price action observed during Thursday’s Asian session gave way to a solid recovery as the market sentiment improved during the European session. The positive reaction to the news of UK Prime Minister Liz Truss's resignation has weighed on the safe-haven USD, pushing the pair to levels past 0.5700.

Risk trade, however, has weakened through the US session as the enthusiasm about Truss's departure fades and the market acknowledges the ongoing political uncertainty in the UK. Equity markets have retreated from session highs and the USD regains lost ground, sending the sentiment-linked kiwi back to previous ranges.

NZD/USD seen limited below 0.5750 – UOB

Analysts at UOB are skeptical about a relevant NZD recovery in the near-term: “We highlighted yesterday that NZD ‘could rise above 0.5725 but a sustained advance above this level still appears unlikely (…) Our update from two days ago (18 Oct, spot at 0.5675) still stands. As highlighted, NZD appears to have moved into a consolidation phase and is likely to trade between 0.5570 and 0.5755 for the time being.”

Technical levels to watch

-

17:49

USD/JPY oscillates around 149.90 after testing 150.00, though fears of BoJ’s intervention loom

- USD/JPY edges up during the New York session, following a test of the 150.00 figure, as BoJ intervention lurks.

- Japanese authorities, namely the Bank of Japan and the Finance Ministry, continued to express worries about the yen’s weakness.

- Mixed US economic data would not deter the Federal Reserve from hiking in the last two meetings of 2022.

The USD/JPY marched firmly after hitting the 150.00 mark for the first time in 32 years but retraced below the figure, at around 149.90s, at the time of writing, as market players weighed on a possible “stealth” intervention by Japanese authorities, even though the Bank of Japan’s loose monetary policy, and the Fed’s aggression, justifies higher exchange rates in the major, meaning a weaker Japanese yen, and a strong American Dolar.

Traders are testing Japanese authorities

During the Asian session, Japanese authorities ramped up their verbal intervention in the markets as the USD/JPY surpassed the 150.00 figure. Additionally, the 10-year JGB’s yield shot through the upper band imposed by the BoJ, above 0.25%, propelling the central bank to buy $667 million in government debt to put a lid on the 10-year JGB yield rise.

US economic indicators flashed mixed signals on Fed’s aggressive policy

Aside from this, the US Department of Labor revealed that claims for unemployment for the week ending on October 15 rose by 214K less than the 228K estimated by the street’s economists, flashing the labor market tightness. At the same time, the Philadelphia Fed reported its Business Conditions Index for October, which came at -8.7, below the -5.0 forecasts, but better than September’s -9.9 number.

In the meantime, the US housing market prolonged its deterioration as September’s Existing Home Sales shrank by 1.5%, to 4.71 million houses, vs. estimates of a 2.14% contraction.

Given the backdrop, Fed’s aggressive monetary policy continues to deliver mixed shocks. Even though is already known that housing and construction are the first segments of the economy to feel the shocks, the labor market lags sharply. Meanwhile, a slew of Fed speakers led by St. Louis Fed President James Bullard, Minnesota’s Neil Kashkari, and Chicago Fed Charles Evans, reiterated the Fed needs to continue front-loading through the remainder of 2022 and could shift towards gradual increases in 2023.

Therefore, due to central bank divergence between the BoJ and the Federal Reserve, further upside pressure in the USD/JPY is expected. However, FX verbal interventions would likely keep the pair advancing steadily without spectacular waves above 150.00, as the next key resistance lies around 151.65.

USD/JPY Price Forecast

The USD/JPY daily chart confirms the pair as upward biased, though Japanese verbal intervention might refrain traders from opening fresh bets against the Japanese yen (JPY) fall. Nevertheless, if the USD/JPY continues to advance steadily, the next key resistance areas lie at July’s 1990 swing high at 151.65, followed by the June 1990 pivot high at 155.80.

-

17:29

Fed's Harker sees interest rate “well above 4 percent by the end of the year”

Philadelphia Fed President Patrick Harker said on Thursday they are not done with raising its short-term interest rate target amid very high levels of inflation, as reported by Reuters. He added the Fed will find space “next year to pause the tightening process”. According to him, the interest rate will be above 4% by the end of 2022.

Additional takeaways

“We have also raised the federal funds rate 300 basis points since the start of 2022. That means the Fed is actively trying to slow the economy. But we are going to keep raising rates for a while.”

“Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4 percent by the end of the year.”

“The Fed is actively trying to slow the economy.”

“”We are going to keep raising rates for a while.”

“Sometime next year, we are going to stop hiking rates. At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work. It will take a while for the higher cost of capital to work its way through the economy.”

“Inflation will come down, but it will take some time to get to our target. I expect PCE inflation to come in at around 6 percent in 2022, around 4 percent next year, and 2.5 percent in 2024.”

Market reaction

After a decline following the beginning of the American session, the US Dollar trimmed losses. The DXY bottomed at 112.16 and as of writing, trades at 112.62, down by 0.25% for the day.

-

17:20

EUR/JPY resumes the upside to retest 147.25 resistance area

- The euro appreciates again on Thursday to test seven-year highs at 147.25.

- Yen weakness has boosted speculation of BoJ intervention.

- Monetary policy divergence is crushing yen demand.

The euro is crawling higher again on Thursday after the previous day’s reversal, and the pair has regained lost ground to retest the resistance area at 147.25 on the US morning session.

The yen remains weak with all eyes on the BoJ

The battered Japanese currency maintains its negative tone across the board. The USD/JPY crossed the psychological 150.00 mark earlier on Thursday, reaching its highest level in 32 years and boosting speculation of a potential intervention by the Bank of Japan to curb JPY weakness.

The Japanese authorities reiterated their commitment to defend the yen's stability on Thursday. Masato Kanda, a top currency diplomat assured that the Japanese Government is ready to take action “as excessive volatility becomes increasingly unacceptable.”

In the long run, however, the yen remains under pressure on the back of the monetary policy divergence between the BoJ and the rest of the major world central banks, especially the US Federal Reserve.The Fed is widely expected to increase rates by 0.75% for the fourth consecutive time in November and, according to a recent poll by Reuters, the ECB might also approve a 75-basis-points hike next week. In this scenario, the Japanese central bank's ultra-expansive policy is crushing demand for the Japanese currency.

Technical levels to watch

-

17:03

UK: New PM could be known by Monday, Johnson likely to run in Tory leadership race

UK PM Liz Truss resigned on Thursday, becoming the shortest-serving prime minister in history. Attention is now set on the Tory leadership race.

The election at the Conservative Party is likely to take place Friday, Saturday and Sunday, according to The Telegraph. In the event of having an outright winner, the new PM could be known by Monday. Graham Brady, the leader of the 1922 Committee, expects a new prime minister to be announced by October 28. More details about the race will be presented during the day.

Potential candidates for Tory leadership include former PM Boris Johnson, Rishi Sunak, Penny Mordaunt, Sajid Javid, Kemi Badenoch, Ben Wallace, Kit Malthouse, and Grant Shapps. On the contrary, James Cleverly ruled out making a bid.

-

16:57

United States 4-Week Bill Auction climbed from previous 3.25% to 3.43%

-

16:49

WTI pulls back to $86.00 area from session highs above $87.00

- WTI prices appreciate for the second consecutive day to reach an $87.10 high.

- Sanctions on Russian oil and lower reserves are buoying petrol prices.

- China is considering relaxing COVID-19 lockdowns.

WTI futures are trading higher for the second consecutive day on Thursday, to shrug off the last two weeks’ negative trend. The US benchmark oil has extended its recovery from Tuesday’s lows at $82.15 to session highs at $87.10 before retreating to the $86.00 area.

Sanctions on Russia and lower supplies boost oil prices

A European ban on Russian crude oil that will come into effect in December, amid a new set of sanctions for the Ukrainian war, is pushing prices higher as the eurozone leaders struggle to find alternative providers ahead of the winter.

US official data has revealed that the country’s Strategic Petroleum reserves fell last week to their lowest level since 1984. These figures have offset the announcement of US President Joe Biden’s plan to sell 15 million barrels from the strategic reserves to tame crude prices.

Beyond that, the EIA reported a 1.725M decline in crude oil inventories in the week of October 14, against market expectations of a 1.38M increase, which has contributed to push prices higher.

Besides, news that China, the world’s larger importer, is considering shortening the COVID-19 quarantine for visitors has eased market concerns about a decline in demand thus adding bullish pressure on prices.

Technical levels to watch

-

16:33

GBP/USD rises further above 1.1300 boosted by Truss’s resignation and weaker USD

- Liz Truss resigns as Prime Minister after 45 days.

- Pound up across the board, among top performers of the American session.

- GBP/USD up more than a hundred pips on Thursday.

The GBP/USD printed a fresh daily high during the American session at 1.1335, boosted by a rebound of the pound following PM Liz Truss's resignation and a weaker US dollar.

Truss and USD down, risk appetite and GBP up

The greenback is falling across the board as Wall Street posts gains with main indexes up around 1%. The DXY is under 112.30, down by 0.55% even as US yields move rise.

The pound strengthened following the resignation of Liz Truss as Prime Minister after only 45 days. The new PM will emerge from a new leadership election at the Conservative Party next week.

Market participants reduced their bets on Bank of England interest rate hikes. They now see a less aggressive BoE. Now attention will turn to the potential successors that could include Rishi Sunak and Boris Johnson.

The GBP/USD ran to 1.1305 initially, following the announcement and more recently printed a fresh daily high at 1.1336, amid a decline of the dollar. It is hovering around 1.1300. EUR/GBP is modestly lower for the day, trading under 0.8700 while GBP/JPY is up approaching 170.00.

Technical levels

-

16:31

USD/CAD tumbles below 1.3700 on broad US Dollar weakness, on mixed US economic data

- US Initial Jobless Claims flashed the tight labor market, while Existing Home Sales continued to fall, feeling the shocks of the Fed’s policy.

- Higher-than-expected inflation in Canada keeps investors reassessing another large-size rate hike by the Bank of Canada.

- USD/CAD tumbled below 1.3700 after hitting a daily high of 1.3806.

The USD/CAD plunged from around 1.3800 as the US Dollar losses against most G8 currencies, despite high US Treasury yields and expectations of the Fed hiking rates by a larger size at November’s meeting. Also, a risk-on mood spurred by China’s cutting quarantine for arrivals was cheered by investors as US equities are trading with gains. At the time of writing, the USD/CAD is trading at 1.3695.

The US Dollar weakened as claims for unemployment dropped

In the Asian session, wires reported that China could ease quarantines for arrivals from 10 to 7 days. That said, risk-perceived assets edged higher on the headline, as shown by global equities advancing. Aside from this, US economic data revealed before Wall Street opened reported that US Initial Jobless Claims for the last week dropped unexpectedly to 214K, less than the 231.5K estimated. Given the Federal Reserve hikes more than 300 bps to the Federal funds rate to the 3.25% area, the labor market is still showing resilience, as shown by the report. It should be noted that September’s Unemployment Rate ticked lower, meaning the Fed job is not done.

Of late, US Existing Home Sales fell 1.5%, less than the 2.4% contraction estimated, though it has been the eighth month in a row, as elevated mortgage rates and higher prices keep prospective buyers at bay.

Canada’s inflation topped estimates; TD Securities foresees a 75 bps hike by the BoC

On the Canadian front, Wednesday’s September inflation report surprised the upside, jumping 6.9% YoY, above estimates of 6.7%, so market participants ratchet up expectations for the Bank of Canada’s additional rate hikes, with a 75 bps lift for the next meeting fully priced in. Following the report, the USD/CAD trimmed some of its gains. However, throughout Thursday’s session, positioning ahead of the BoC’s meeting in the next week underpinned the Loonie, with the USD/CAD tumbling more to the 20-DMA.

Analysts at TD Securities changed their view and expected the BoC to lift rates by 75 bps. They noted, “The Bank has grown increasingly concerned with the inflation backdrop and potential for long-term inflation expectations to become unanchored, and this data does not provide any evidence that inflation has turned. This should tip the scales to a 75bp move next week.”

USD/CAD Key Technical Levels

-

15:59

GBP/USD: Retest of 1.0550/1.0520 could follow failure to hold 1.0920 – SocGen

In the view of economists at Société Générale, the GBP/USD pair could suffer a substantil drop on a break under the 1.0920 mark.

Break of the resistance zone at 1.1495/1.1550 essential for extension in bounce

“Daily RSI is near the upper end of bearish territory denoting a cross above zone of 1.1495/1.1550 is essential for extension in bounce. Failure can lead to continuation in downtrend.”

“In case recent pivot low at 1.0920 gets violated, there could be a risk of next leg of downtrend towards 1.0550/1.0520 and September levels of 1.0350.”

-

15:44

S&P 500 Index: Break above 3810/40 to open up September high of 4120 – SocGen

S&P 500 has staged a sharp rebound. The index could extend its move higher on a break above the 3810/40 area, economists at Société Générale report.

Defense of 3585 essential to avert deeper fall

“Holding above the 3585 mark, a short-term bounce can’t be ruled out.”

“It would be interesting to see if the index can form a base and reclaim the recent high near 3810/3840. If this break materializes, an extended up-move could take shape towards 4000 and September high of 4120.”

-

15:39

US: Existing Home Sales decline by 1.5% in September

- Existing Home Sales in the US declined slightly less than expected in September

- US Dollar under pressure amid risk appetite.

Existing Home Sales in the US declined for the eighth straight month in September, after posting a 1.5% slide to a seasonally adjusted annual rate of 4.71 million, above the 4.70 million of market consensus. Sales were down 23.8% on a yearly basis, the National Association of Realtors (NAR) reported on Thursday.

“The median existing-home sales price increased to $384,800, up 8.4% from one year ago,” noted NAR in its publication. “The median existing-home sales price increased to $384,800, up 8.4% from one year ago.

Market reaction

The US dollar is falling on Thursday, amid risk appetite. The DXY drops by 0.53% an trades near daily lows at 112.30.

-

15:30

United States EIA Natural Gas Storage Change registered at 111B above expectations (105B) in October 14

-

15:00

United States Existing Home Sales (MoM) came in at 4.71M, above expectations (4.7M) in September

-

15:00

United States Existing Home Sales Change (MoM) declined to -1.5% in September from previous -0.4%

-

14:53

EUR/USD: Retest of 0.9535 low could follow failure to reclaim parity – SocGen

EUR/USD downtrend has undergone a pause recently. Looking ahead, economists at Société Générale expect the world’s most popular currency pair to resume its decline toward 0.9535.

Break below 0.9535 to open up next projections at 0.9200/0.9150

“The high formed earlier in October at 1.0000 is near-term resistance. Failure to cross this would mean persistence in the downtrend.”

“The pair is expected to head lower towards the recent low of 0.9535. A break below can extend the decline towards 0.9380 and next projections at 0.9200/0.9150.”

-

14:52

AUD/USD sticks to modest intraday gains, around 0.6300 mark amid weaker USD

- AUD/USD stages a solid intraday bounce amid the emergence of fresh selling around the USD.

- A stable risk tone weighs on the safe-haven greenback and benefits the risk-sensitive aussie.

- Elevated US bond yields, recession fears should limit losses for the USD and cap the major.

The AUD/USD pair rallies over 100 pips from a three-day low touched earlier this Thursday and hits a fresh daily high, around the 0.6330 area, during the early North American session. The pair, however, retreats a few pips and is currently placed near the 0.6300 round-figure mark, still up around 0.50% for the day.

As investors look past the mixed Australian employment details, the emergence of fresh US dollar selling turns out to be a key factor offering support to the AUD/USD pair. A modest recovery in the risk sentiment - as depicted by a mildly positive tone around the equity markets - undermines the safe-haven buck and benefits the risk-sensitive aussie.

The intraday USD selling remains unabated following the release of the weaker Philly Fed Manufacturing Index, which remains in the contraction territory for the second successive month in October. This, to a larger extent, overshadows an unexpected fall in the US Initial Jobless Claims and does little to impress the USD bulls or provide any impetus.

That said, growing worries about a deeper global economic downturn should keep a lid on any optimistic move. Apart from this, elevated US Treasury bond yields, bolstered by firming expectations for a more aggressive policy tightening by the Fed, should act as a tailwind for the greenback. This, in turn, warrants some caution for the AUD/USD bulls.

Apart from this, the Reserve Bank of Australia's (RBA) decision to slow the pace of policy tightening earlier this month suggests that the path of least resistance for the AUD/USD pair is to the downside. Hence, it will be prudent to wait for strong follow-through buying before confirming that spot prices have bottomed out and positioning for further gains.

Technical levels to watch

-

14:36

EUR/USD Price Analysis: Selling pressure alleviated above 0.9960

- EUR/USD reclaims part of the ground lost on Wednesday’s decline.

- The 8-month resistance line caps the upside near 0.9960.

EUR/USD regains some composure and trades close to the 0.9800 neighbourhood on Thursday.

In case of the continuation of the rebound, the pair faces an interim hurdle at the 55-day SMA, today 0.9941, ahead of the more relevant 8-month resistance line around 0.9960. The surpass of the latter is needed to mitigate the downside pressure and spark a more lasting/serious recovery to, initially, the October peak at 0.9999 (October 4).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0544.

EUR/USD daily chart

-

14:32

Gold Price Forecast: XAU/USD to struggle amid hawkish Fedspeak – TDS

Gold has flirted with three-week lows near $1,620 earlier in the day. Hawkish Federal Reserve expectations after US inflation data came in hotter-than-expected last month are set to continue weighing on the yellow metal, strategists at TD Securities report.

Gold positions continue to unwind

“Gold positions continue to unwind, with ETF holdings reduced by over 400K ounces in the last session, the largest one day decline since March of last year.”

“Hawkish Fedspeak continues to push forward the narrative that we are set for a persistently hawkish central bank regime. In this context, gold prices are unlikely to rise with a deteriorating growth outlook until the Fed makes progress in the war on inflation.”

“Physical demand for bullion has remained elevated, but seasonal considerations suggest that this tailwind could soon fade following India's festive season.”

-

14:17

USD Index: Scope for a deeper downtrend on a break below 110/109.30 – SocGen

The US Dollar Index (DXY) uptrend has paused. Nevertheless, only a break under the 110/109.30 region could open up further losses, economists at Société Générale report.

50-DMA at 110/109.30 is short-term support

“Steep ascending trend line and 50-DMA near 110.00/109.30 is first layer of support near-term.”

“The uptrend could resume once a break above recent lower high at 113.90 materializes. Beyond 113.90, next potential hurdles are located at 117 and 2001 high of 121/122.”

“It is worth noting that monthly RSI is at its best levels since 2015 denoting an overstretched move. This doesn’t signal a reversal, however, a consolidation is not ruled out. Only if 50-DMA near 110/109.30 gets violated would there be a risk of a deeper downtrend.”

-

14:14

GBP/USD trims a part of intraday gains, struggles to find acceptance above 1.1300 mark

- GBP/USD catches fresh bids on Thursday and is supported by a combination of factors.

- The UK PM Liz Truss’ resignation ends the political crisis and boost the British pound.

- Signs of stability in the financial markets weigh on the USD and remain supportive.

- Hawkish Fed expectations act as a tailwind for the USD losses and cap the upside.

The GBP/USD pair gains strong intraday positive traction and rallies over 130 pips from the weekly low touched earlier this Thursday, though struggles to find acceptance above the 1.1300 mark. The pair quickly retreats to the 1.1255-1.1250 region, still up nearly 0.50% for the day.

The British pound strengthens after Liz Truss resigned as Prime Minister of the UK, marking an end of a chaotic chapter that led to the recent chaos in the financial markets. There will be a new leadership contest within a week and Truss will stay as Prime Minister until that is complete. Apart from the UK political developments, a weaker US dollar is seen as another factor offering support to the GBP/USD pair.

Signs of stability in the equity markets fail to assist the safe-haven greenback to capitalize on the previous day's strong move up. The USD bulls remain on the defensive following the disappointing release of the Philly Fed Manufacturing Index, which remains in contraction territory for the second straight month and came in at -8.7 for October. This overshadows an unexpected fall in the US weekly Jobless Claims.

That said, elevated US Treasury bond yields, bolstered by hawkish Fed expectations, act as a tailwind for the greenback. Apart from this, looming recession risks hold back traders from placing aggressive bullish bets around the GBP/USD pair. Nevertheless, spot prices, for now, seem to have snapped a two-day losing streak, though remain below a downward sloping trend-line extending September monthly swing high.

Technical levels to watch

-

14:06

USD Index Price Analysis: Another visit to 114.00 remains in store

- DXY comes under pressure and revisits the 112.30 zone.

- The resumption of the upside still targets 114.00 and above.

DXY partially fades Wednesday’s strong advance after the index failed to extend the bounce further north of the low-113.00s on Thursday.

The index, in the meantime, looks poised to keep navigating within a 112.00-114.00 range at least until the next FOMC event. In case bulls break above the 114.00 region, gains could then accelerate to the 2022 peak near 114.80.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 8-month support line near 108.20.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 103.61.

DXY daily chart

-

14:04

Risks seen to the downside for the pound in the coming weeks – Crédit Agricole

GBP/USD remains vulnerable around 1.12. Economists at Crédit Agricole keep the bearish bias intact around the British pound.

Bank of England to disappoint market rate hike expectations

“We think that for the GBP to extend its recent gains, we need to see a further retreat of UK sovereign credit risks.”

“We further continue to see the risks to the downside for the currency in the coming weeks. This is because the announced and future fiscal austerity measures will increase the UK recession risks but dampen some of the inflation pressures given the government’s support for household energy bills.”

“We think that the BoE will disappoint market rate hike expectations in the coming months. In addition, the UK external imbalances are expected to deteriorate further and add to the pressure on the GBP.”

-

14:00

Russia Central Bank Reserves $ dipped from previous $548.7B to $544.4B

-

13:41

Breaking: UK Politics: PM Truss says she will resign

The recently-elected UK Prime Minister Liz Truss makes a statement this Thursday and says that she will resign.

Truss will remain in place until a new leader is chosen and the leadership election will be completed in the next week.

Given that the markets have been anticipating the UK PM's resignation, the announcement does little to influence the British pound or provide any meaningful impetus to the GBP/USD pair, which has now eased a bit from the daily high touched in the last hour.

-

13:38

US: Weekly Initial Jobless Claims fall to 214K vs. a rise to 230K expected

- Initial Jobless Claims in the US fell by12K in the week ending October 14.

- US Dollar Index remains depressed near the daily low after the release.

There were 214,000 initial jobless claims in the week ending October 14, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print follows the previous week's downward revised reading of 226,000 and beats market expectations for a rise to 230,000.

Further details of the publication revealed that the 4-week moving average was 212,250, an increase of 1,250 from the previous week's downwardly revised reading of 211,000.

Market reaction

The US dollar bulls seem rather unimpressed by the data amid a modest recovery in the risk sentiment. This, along with a goodish pickup in demand for the British pound, keeps the USD depressed near the daily low.

-

13:33

EUR/JPY Price Analysis: Next on the upside comes 149.80

- EUR/JPY resumes the upside and challenges the 2022 high.

- The continuation of the uptrend could extend to the 149.80 region.

EUR/JPY leaves behind Wednesday’s negative price action and retakes the area beyond 147.00 the figure, closer to the 2022 peak.

Considering the current price action in the cross, the door still looks open to extra upside. That said, the immediate target now emerges at the December 2014 high at 149.78 (December 8).

In the short term the upside momentum is expected to persist while above the October lows near 141.00.

In the longer run, while above the key 200-day SMA at 136.76, the constructive outlook for the cross should remain unchanged.

EUR/USD daily chart

-

13:32

US: Philadelphia Fed Manufacturing Index comes in at -8.7 for October vs. -5 expected

- Philadelphia Fed Manufacturing Index remains in negative territory for the second straight month.

- The USD maintains its offered tone and flirts with the daily low following the latest US macro data.

The Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity remains in contraction territory for the second successive month in October. The gauge came in at -8.7 for the reported month as compared to -9.9 in September, missing estimates pointing to a reading of -5.

Market reaction

The US Dollar Index maintains its offered tone and is currently flirting with the daily low. A modest recovery in the global risk sentiment - as depicted by a positive tone around the equity markets - continues to undermine the safe-haven greenback.

-

13:31

Canada Employment Insurance Beneficiaries Change (MoM) declined to -4.1% in August from previous 2.9%

-

13:30

United States Philadelphia Fed Manufacturing Survey registered at -8.7, below expectations (-5) in October

-

13:30

United States Continuing Jobless Claims above expectations (1.375M) in October 7: Actual (1.385M)

-

13:30

United States Initial Jobless Claims registered at 214K, below expectations (230K) in October 14

-

13:30

United States Initial Jobless Claims 4-week average: 212.25K (October 14) vs 211.5K

-

13:29

UK PM Truss to make a statement at 1330 GMT

According to the latest headlines floating on the wires, the UK conservative lawmaker Jill Mortimer was quoted saying that they have submitted a letter of no confidence in Prime Minister Liz Truss.

This comes amid reports that the 1922 Committee is co-ordinating optics to help soften the blow for the Prime Minister.

Next on tap is a statement by the UK PM Truss at 1330 GMT.

Market Reaction:

The British pound strengthens a bit in reaction to the news, lifting the GBP/USD to a fresh daily high, around the 1.1275-1.1280 region in the last hour.

-

13:11

Gold Price Forecast: XAU/USD may steady, but a rally could be a long way off – HSBC

Gold prices have come down considerably from their year-to-date highs. Strategists at HSBC expect the yellow metal to be mostly on the defensive to early 2023, before gaining ground later next year.

A pause in US rate rises in 2023 may allow gold to have a modest bounce

“The Fed is likely to continue to deliver rate hikes before taking a pause after the February 2023 meeting. If US rates keep rising until next February 2023, gold may be subject to further downward pressure. A subsequent pause in rate hikes may allow gold to rally, but a lack of rate cuts would likely limit potential gains.”

“While the financial climate has turned decisively against gold, elevated geopolitical risks, higher oil prices and general firm underlying physical demand for gold may be cushioning gold’s declines.”

“A firmer USD will help keep gold on the defensive into 2023, but limits to USD strength may offer gold an opportunity to increase later in 2023.”

-

12:31

USD/IDR to grind higher toward next resistance at 15,832 – TDS

Bank Indonesia (BI) hiked rates by 50 bps as expected. Nonetheless, economists at TD Securities expect the USD/IDR to advance nicely toward the 15,832 resistance.

Another 50 bps hike cannot be discounted if IDR weakens aggressively

“BI hiked by another 50 bps, bringing the 7-day reverse repo rate to 4.75%. BI Governor Warjiyo noted that the hike was a ‘front-loaded, pre-emptive and forward-looking step to lower inflation expectations that are too high or overshooting’. However, we think the policy path ahead leans more on the pace of IDR depreciation given BI's historical focus on FX. Further, Warjiyo commented that the Bank wants to control the IDR to prevent imported inflation.”

“We see a gradual move for USD/IDR higher towards its next technical resistance level at 15,832 (76.4% Fib level over 5 yr-window).”

“BI likely won't tolerate any sharp one-sided moves in IDR and another 50 bps hike cannot be discounted if IDR weakens aggressively against the USD and compared to its regional peers.”

-

12:24

USD/TRY: Upside remains capped by 18.60 despite CBRT rate cut

- USD/TRY stays pretty much unchanged around 18.59.

- The CBRT cut rates by 150 bps, more than expected.

- Single digit interest rate could be a couple of meetings away.

USD/TRY remains directionless just below the 18.60 region for yet another session on Thursday.

USD/TRY apathetic post-CBRT

USD/TRY keeps exchanging gains with losses, always within the broader range bound theme and below the 18.60 region for the time being.

Thursday’s price action appears as no exception despite the Turkish central bank (CBRT) reduced the One-Week Repo Rate by 150 bps at its event, more than the full-point raise estimated by the broad consensus.

Indeed, the CBRT walked (President Erdogan’s) talk and kept the easing cycle well and sound in October, leaving at the same time the door open to a similar move at the next meeting, which could be the end of the ongoing cycle, as per the bank’s statement.

No big news from the statement, as it emphasizes the stronger job creation in Türkiye vs. peer economies, while weakening foreign demand could ring some alarms in the near term. The stronger than expected performance of tourism revenue continued to collaborate with the improvement of the current account.

What to look for around TRY

USD/TRY keeps navigating the area of all-time highs near 18.60, paying little to nil attention to the latest CBRT interest rate decision.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in the last three months), real interest rates remain entrenched well in negative territory and the omnipresent political pressure to keep the CBRT biased towards a low-interest-rates policy.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth via transforming the current account deficit into surplus, always following a lower-interest-rate recipe.

Key events in Türkiye this week: CBRT Interest Rate Decision (Thursday) – Consumer Confidence (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.07% at 18.5950 and faces the next hurdle at 18.5980 (all-time high October 11) followed by 19.00 (round level). On the downside, a break below 18.2560 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

-

12:12

UK PM Spokesman: PM Truss will lead the Conservative Party into next election

UK PM Liz Truss's spokesman said in a statement on Thursday, “PM Truss will lead the Conservative Party into the next election.”

Additional takeaways

Public wants the government to deliver on its priorities.