Notícias do Mercado

-

23:56

Fed’s Evans: Need to make sure inflation pressures don't broaden further

“Need to make sure inflation pressures don't broaden further,” said Chicago Fed President Charles Evans on early Thursday in Asia.

more to come

-

23:55

USD/JPY meanders around 149.80s as the yen continues to weaken despite intervention looming

- USD/JPY oscillates around 149.80 as US Treasury yields rise, underpinning the US Dollar.

- The US housing market keeps deteriorating while the Federal Reserve pushes the pedal to the metal, ready to lift rates in November.

- Bank of Japan (BoJ) policymakers expressed that volatility surrounding the yen must reflect fundamentals,

The Japanese yen prolonged its agony against the US Dollar, printing a fresh 32-year low, as the USD/JPY reached a YTD high of 149.88 as market players tested the prospects of another intervention by the Bank of Japan (BoJ). As the Asian Pacific session begins, the USD/JPY is trading at 149.85, almost flat.

The Japanese yen weakened as US Treasury yields soared

Wall Street finished Wednesday’s session trading in the red. The Eurozone (EU), the UK, and Canada reported September’s inflation which remained stubbornly high, though the UK and Canada figures exceeded and were nearby estimates, while the EU’s inflation ticked lower vs. previous and foreseen figures, but by a minuscule margin. Given that backdrop, worldwide bond yields skyrocketed as expectations for further central bank tightening increased. Hence, the US 10-year T-bond yield rose by 12 bps, up at 4.138%, a tailwind for the USD/JPY.

In the meantime, US housing data revealed during the New York session still flashes the effect of the US Federal Reserve’s interest-rate hikes. Housing Starts for September were worse-than-expected, tumbling by 8.1% MoM vs. August’s 13.7% gain, as mortgage rates in the US keep climbing, reaching a 20-year high at 6.94%.

Aside from this, Japanese authorities continued their verbal interventions, led by the BoJ Governor Haruhiko Kuroda, who said that it is extremely important for the FX market moves to reflect fundamentals. Echoing his comments was his college, BoJ’s Adachi, who added that using monetary policy to respond to FX moves would increase uncertainty over the BoJ’s guidance.

On Thursday, the Japanese economic calendar will feature the Trade Balance, alongside Exports and Imports and Foreign investments. Meanwhile, the US economic docket will feature Initial Jobless Claims, Existing Home Sales, and the Philadelphia Fed Business Index.

USD/JPY Key Technical Levels

-

23:40

GBP/USD Price Analysis: Remains pressured towards 1.1130 support

- GBP/USD sellers poke three-week-old support line after reversing from multi-day-old resistance.

- Ascending trend line from late September, 21-DMA adds to the downside filters.

- Buyers need validation from 50-DMA to retake control.

- Steady oscillators, pullback from key hurdle favor sellers.

GBP/USD holds lower ground near 1.1220, fading the bounce off 1.1185 after a two-day downtrend. In doing so, the cable pair flirts with a short-term key support line during Thursday’s Asian session after taking a U-turn from the two-month-old resistance line earlier in the week.

In addition to the immediate support of 1.1220, an upward-sloping trend line from September 29, around 1.1155, will precede the 21-DMA level near 1.1130 to also challenge the short-term downside of the Cable pair.

It should, however, be noted that the quote’s weakness past 1.1130 will direct it toward the monthly low of 1.0923 which acts as the last defense of the GBP/USD buyers.

In a case where the Cable pair renews the monthly low, 1.0650 and the recently flashed record low of 1.0339 will be in focus.

Alternatively, a descending resistance line from late August, around 1.1345, restricts the GBP/USD pair’s nearby upside.

Following that, the 50-DMA level surrounding 1.1445 will challenge the buyers before directing them to the monthly high of 1.1495. Also acting as the upside filter is the 1.1500.

GBP/USD: Daily chart

Trend: Further weakness expected

-

23:35

USD/CAD Price Analysis: Bulls are worried that US yields are at extremes

- USD/CAD bulls depend on ongoing moves in the US yields embarking on critical long-term levels.

- The week's highs in USD/CAD are eyed for the remaining stretch of the week.

USD/CAD bears are back in town, although judging by the eagerness of the US dollar bulls, perhaps not for much longer. The following illustrates the potential trajectory for the US dollar and CAD vs the greenback:

USD/CAD M15 chart

The week's template shows that the highs are within reach yup near 1.1399 the figure. A series of peak formations on the downside while the price edges higher could lead to a significant bullish move for the remaining days of the week following the peak low that was put in at the start of the week near 1.3656.

The outcome will most probably depend on the path of the Us yields and the greenback though and the following illustrates the bullish bias for both:

DXY, daily chart

The greenback has been a laggard behind US yields which are making marks on weekly highs on Thursday, however, the momentum is solid and a break into deeper bullish territory could be on the cards as per the 2-year and 10-year chart respectively:

As seen, both are on the right side of the trendlines for continuations.

-

23:27

EUR/USD Price Analysis: Consolidation extends, nothing new under the sun

- The presence of hurdles around the upper portion of the triangle has escalated the consolidation phase.

- A rebound in risk-off impulse and declining 20-and 50-EMAs are supporting the greenback bulls.

- The RSI (14) has failed to sustain in the bullish range of 60.00-80.00.

The EUR/USD pair has turned sideways after dropping to near the immediate support of 0.9760 in the early Tokyo session. A rebound in the risk-off profile terminated the two-day winning spell. The asset witnessed a steep fall after multiple attempts of establishing an auction above the critical hurdle of 0.9850. Meanwhile, the US dollar index (DXY) has recovered the majority of its losses and has recaptured the resistance of 113.00.

On a four-hour scale, the major has continued its oscillation in a Symmetrical Triangle chart pattern after facing barricades at the downward-sloping trendline. The downward-sloping trendline of the above-mentioned chart pattern is placed from September 12 high at 1.0198 the upward-sloping trendline is plotted from September 28 low at 0.9536. An explosion of a neutral triangle results in wider ticks and heavy volume.

The asset has slipped below the 20-and 50-period Exponential Moving Averages (EMAs) at 0.9800 and 0.9785 respectively, which adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has failed to sustain longer above the bullish range of 60.00-80.00, which indicates a loss of upside momentum.

The shared currency bulls could lose their grip if the asset drops below October 13 low of 0.9632, which will drag the asset toward September 28 low at 0.9536. A breakdown of the September low will strengthen the greenback bulls further and will drag the asset toward the critical support of 0.9500.

For an upside move, the euro bulls need to push the asset above the round-level resistance of 0.9900, which will send the pair toward parity. A confident break above the parity will expose the asset bulls to hit September 20 high at 1.0050.

EUR/USD four-hour chart

-638018152048968977.png)

-

23:17

AUD/USD: On the back foot below 0.6300 ahead of Australia employment, PBOC

- AUD/USD holds lower ground after reversing from weekly high and snapping two-day uptrend.

- Risk-aversion, strong yields underpinned US dollar’s demand amid hawkish Fed bets.

- Geopolitical, covid fears surrounding China exert additional downside pressure.

- A corrective bounce can be witnessed on strong Aussie job numbers but bearish trend is likely to prevail.

AUD/USD remains depressed around 0.6270, despite the recent bounce off weekly low, as traders await the key Australia employment report during early Thursday. That said, the Aussie pair printed the first daily loss on turnaround Wednesday amid a risk-off mood. However, anxiety ahead of an important data set for Australia seems to chain the bears of late.

Market’s sentiment soured the previous day as UK-inspired risk-on mood faded after the strong inflation in the leading economies renewed fears of recession amid the central bankers’ aggressive stands despite economic slowdown fears. The price pressures in Britain, Eurozone and Canada were mostly nearly multi-month high and the core numbers, as well as services inflation, were firmer enough to push the central banks towards higher rates.

Also contributing to the risk-aversion wave were headlines concerning China. The dragon nation registered four-month high covid numbers while the US readiness to tie up with Taiwan to co-produce American weapons, per Nikkei, adds to the Sino-American tussles. Given the Aussie ties with Beijing, any negatives from the world’s second-largest economy weigh on Australia.

It’s worth noting that hawkish Fedspeak ignored mixed housing data from the US while Australia’s Westpac Leading Index also couldn’t impress the AUD/USD pair buyers.

While portraying the mood, the US Treasury yields refreshed a multi-year high and Wall Street closed in the red for the first time in three.

Moving on, Australia’s September month jobs report will precede the monetary policy meeting by the People’s Bank of China (PBOC) to entertain AUD/USD traders. Forecasts suggest that the headline Australia Employment Change to ease by 25K from 33.5K prior but the Unemployment Rate remains steady at 3.5%. Further, the PBOC is likely to keep its current monetary policy unchanged with the benchmark rate at 3.65%.

Given the downbeat forecasts from the Aussie jobs report, any positive surprises may help AUD/USD to reverse the previous day’s losses. However, the broad market fears could defend the bearish trend.

Also read: Australian Employment Preview: Near-term relief to the long-lasting pain

Technical analysis

A pullback from the 10-DMA, around 0.6285 by the press time, directs AUD/USD towards support line of the six-week-old bearish channel, close to 0.6060 at the latest.

-

23:00

EUR/JPY Price Analysis: Euro losses ground against the yen and drops below 146.50

- EUR/JPY edges slightly up as the Asian Pacific session begins.

- The Euro weakened due to an adverse market sentiment spurred by recession fears.

- Short term, the EUR/JPY could tumble towards 145.40 once it clears the 146.00 figure.

The EUR/JPY tumbled from weekly highs around 147.00, for fundamental reasons, like the Eurozone (EU) inflation report, with September’s CPI around 9.9% YoY, less than estimates but elevated. Also, expectations for further central bank tightening spurred concerns of a global recession as risk-perceived assets edged lower. Therefore, safe-haven peers, like the Japanese yen (JPY), appreciated against the Euro. At the time of writing, the EUR/JPY is trading at 146.44, almost flat, as the Asian session begins.

EUR/JPY Price Forecast

From a technical perspective, the EUR/JPY tested the YTD highs of 147.25 on Wednesday, though failure to hold the fort around the 147.00 figure exacerbated a drop towards the October 18 daily lows at 145.81. EUR/JPY traders should be aware that a bearish-harami candle chart pattern surfaced at the daily chart, warring downward action. Nevertheless, a break below October’s 18 daily low at 145.81 is needed to pave the way for further losses.

If that scenario plays out, the EUR/JPY first support would be the September 12 high-turned-support at 145.63. A breach of the latter will expose the 145.00 figure, followed by the October 5 swing high/support around 144.08.

EUR/JPY Daily Chart

Near term, the EUR/JPY hourly chart illustrates the cross as neutral biased, with prices sliding below the 20 and 50-Exponential Moving Averages (EMAs), with the former crossing below the latter, opening the door for further losses. Notably, a symmetrical triangle on a downtrend surfaced, meaning that EUR/JPY risks are skewed to the downside.

Hence, the EUR/JPY first support would be October’s 19 daily low at 146.07. Break below will expose the S1 daily pivot point at 145.90, followed by the 100-EMA at 145.70, ahead of the S2 daily pivot level at 145.40.

EUR/JPY Hourly Chart

-

22:58

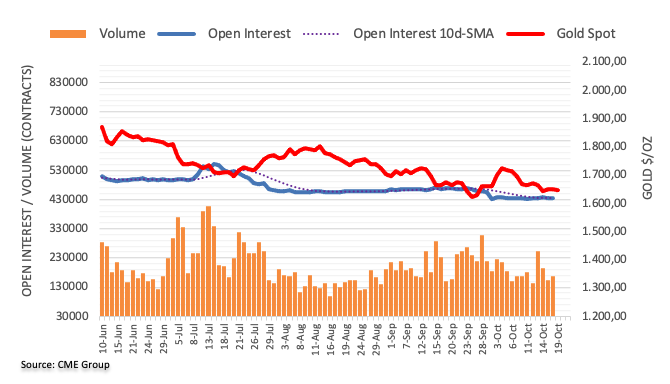

Gold Price Forecast: XAU/USD aims to test two-year low at around $1,610 as yields reaches sky

- Gold price may revisit two-year low at $1,614.85 as central banks are prepared for a fresh rate hike cycle.

- The 10-year US yields have printed a fresh 14-year high at 4.14%.

- A rebound in risk-off impulse has pushed the DXY to near 113.00.

Gold price (XAU/USD) has shifted its business below $1,630.00 after surrendering the cushion in the last New York session. The precious metal has witnessed a steep fall as yields sky-rocketed. The 10-year US Treasury yields refreshed its 14-year high at 4.14% in New York.

Returns on US government bonds approached the sky as odds remain firm for a fourth consecutive 75 basis point (bps) rate hike by the Federal Reserve (Fed). As per the CME FedWatch tool, the chances of a 75 bps rate hike announcement by the Fed in November stand at 94.5%. Price pressures in the global economy have not softened in response to the extent of rate hikes by the central banks.

The European Central Bank (ECB) is set to announce a bigger rate hike to curtain inflationary pressures next week. Also, a reclaim of double-digit inflation figures in the UK economy has bolstered the chances of the Bank of England (BOE)’s bumper rate hike announcement.

Meanwhile, the US dollar index (DXY) has reclaimed the critical resistance of 113.00 as the risk-on market mood has faded. S&P500 faced pressure after a two-day rally as investors shifted to long liquidation after making returns on value bets.

Gold technical analysis

On an hourly scale, gold prices have witnessed a steep fall after dropping below the 61.8% Fibo retracement (placed from a two-year low at $1,614.85 to October high at $1,729.58) at $1,659.00. The precious metal looks set to re-visit a two-year low at $1,614.85.

A declining 50-period Exponential Moving Average (EMA) at $1,643.66 indicates more weakness ahead.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which signals that the downside momentum has already been triggered.

Gold hourly chart

-

21:18

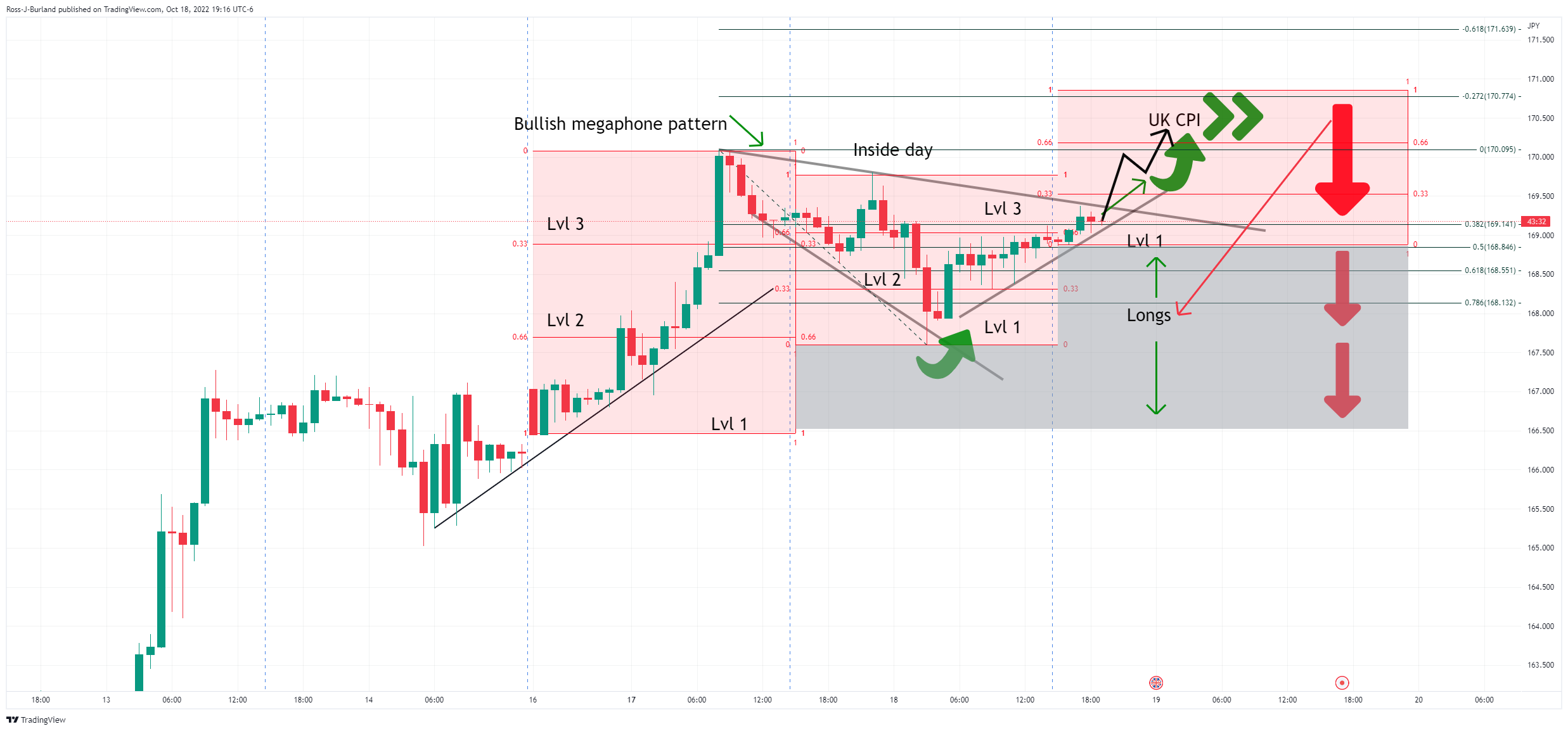

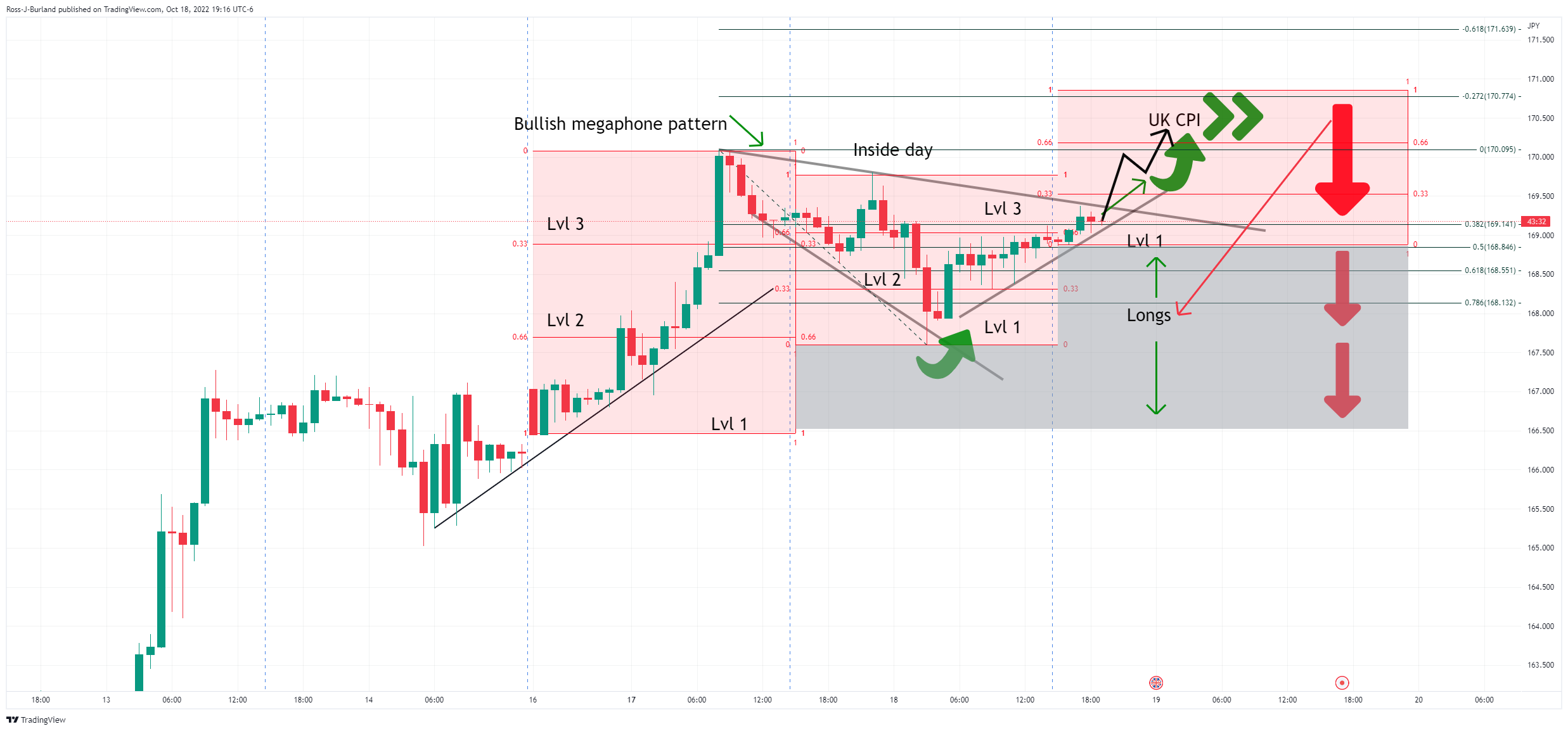

GBP/JPY Price Analysis: Another inside day could spell disaster for the bulls

- GBP/JPY remains on the backside of the counter-trendline.

- Bears are lurking and eager to pounce and bullish advancements into the resistance.

GBP/JPY was another inside day on Wednesday which makes for a coiled market that could be about to spring before the week is out. The following is an illustration of such a scenario that could play out over Thursday:

GBP/JPY prior analysis, H1 charts

It was illustrated that the market was an inside day and that there were prospects of a bullish megaphone breakout to the upside if the trendline broke. Instead, the doom and gloom around UK politics and the economy has sunk the pound across the board. There has been a move lower into levels 1 and 2 long positions from the prior day as follows:

GBP/JPY H1 chart update

While on the backside of the counter trendline, if the 167.50s hold, there could be a move up into the highs for the day to test the commitments of the bears prior to the capitulation of the bulls for a significant sell-off into the rising trend as illustrated in the chart above. 166.43, 165.02 and 162.32 are all key levels on the way down a cascade of market orders.

-

21:09

NZD/USD’s reversal from 0.5730 highs finds support at 0.5650

- The kiwi remains steady above 0.5650 after its reversal at 0.5730.

- The greenback appreciates as risk appetite fades.

- NZD/USD's broader outlook remains bearish – Credit Suisse.

The New Zealand dollar has trimmed some of the previous two days’ gains on Wednesday, weighed by a strong US recovery and a sourer market mood. Downside attempts, however, have been contained at 0.5650 so far.

The kiwi suffers against a stronger US dollar

The risk appetite observed at the start of the week waned on Wednesday, which has favored the US dollar on the back of its safe-haven status. The world’s major stock indexes have posted moderate gains following a two-day rally at the start of the week.

Furthermore, US Treasury bonds have pushed higher, with the benchmark 14-year note trading above 4% for the first time in 14 years. This, coupled with market hopes of another aggressive rate hike by the Fed in November, has increased the attractiveness of the USD.

NZD/USD’s broader outlook remains bearish – Credit Suisse

Analysts at Credit Suisse see the pair biased lower with the current upside correction limited at 0.5798/5813: “Whilst both daily RSI and MACD are holding bullish divergences, which suggests that the recovery will extend for now, our broader outlook remains outright bearish and we thus see this development only as a correction (…) “Whilst we expect a better near-term ceiling to be found at the 0.5798/5813 level, above here would see scope to test the falling 55-day average at 0.5978.”

Technical levels to watch

-

21:02

Fed's Bullard: Have to react if inflation doesn't fall as expected

Federal Reserve Bank of St. Louis President James Bullard left open the possibility that the central bank would raise interest rates by 75 basis points at each of its next two meetings in November and December while saying that he won't predate what rate move he backs at the December FOMC meeting.

The Fed hiked rates by 75 basis points for the third straight meeting last month, to a target range of 3% to 3.25%. The US central bank is expected to lift rates by another 75 basis points when it meets on November 1-2, with an additional 50 or 75 basis point increase also likely in December.

Key quotes

Have to react if inflation doesn't fall as expected.

Won't predate what rate move he backs at the December FOMC meeting.

In 2023, if inflation starts to decline meaningfully, Fed can stay where it is at higher rate level.

First have to get to right rate level, then move to data dependency.

Sees the possibility of good inflation dynamics in 2023.

Des not appear to be a lot of financial stress now in the US economy.

Not clear that equity pricing should be the main metric of financial liquidity.

US is still in a low productivity growth regime.

He thinks US GDP will be revised higher for first half of the year at some point but too late to be useful for monetary policy.

Big negative productivity number for the first half of 2022 is 'questionable'.

US GDP probably was really flat in the first half of the year, not negative, third quarter looks to be positive.

Fed in great shape on the employment side of the mandate, a great time to 'nip inflation in the bud.

Fed shouldn't react to declines in the stock market.Inflation expectations are looking good now, at least based on tips markets.

US dollar update

As for the US dollar bounced, it has from two-week lows on Wednesday with a rise in US Treasury yields that made 14-year highs as investors maintained expectations that the Federal Reserve will continue to aggressively raise rates.

The DXY index has recovered on Wednesday as follows:

DXY daily chart

The W-formation's neckline is holding up as support and the DXY index has started to recover from a 50% mean reversion.

-

20:59

Forex Today: Inflation revolves at record highs, triggers run to safety

What you need to take care of on Thursday, October 20:

A souring market mood benefited the American Dollar on Wednesday, which extended its latest advance against its major rivals.

The day rotated around fresh inflation reports that reminded market players of the high risk of an upcoming global recession. The European Union published the second estimate of the September Consumer Price Index, which was downwardly revised to 9.9% YoY, barely below the 10% previously estimated. Core inflation was confirmed at 4.8%.

The United Kingdom also released the September annual CPI, which surged by 10.1% YoY, higher than the previous 9.9% and also above the 10% expected, a fresh multi-decade high. The reading, which excludes volatile food and energy prices, rose by 6.5% in the year to September, surpassing the previous 6.3%.

Finally, the Canadian CPI contracted in September, up 6.9% YoY from 7.0% in August. The Bank of Canada's core CPI, however, unexpectedly climbed to 6.0%.

Stubbornly high inflation revived recession-related concerns, as most central banks from around the globe are focused on taking it down, regardless of their actions' negative effects on economic growth. Persistent price pressures hint at continued aggressive quantitative tightening.

Meanwhile, the US Federal Reserve’s Beige Book showed that pessimism increased amid weakening demand and as price growth remained elevated, further fueling markets’ concerns.

European and American indexes closed in the red, reflecting market concerns. Government bond yields, on the other hand, surged, with the US 10-year Treasury note yield reaching to 4.13% and the 2-year note yield peaking at 4.55%.

The EUR/USD pair finished the day around 0.9770, while GBP/USD settled at 1.1215. The AUD/USD is currently trading at 0.6260, while USD/CAD is marginally higher, at 1.3770. The USD/JPY pair trades at a fresh multi-year high, not far from the 150.00 threshold.

Gold came under strong selling pressure and currently changes hands at $1,629. Crude oil prices, on the other hand, managed to recover some ground, and WTI is now at $84.30 a barrel.

The upcoming Asian session will bring the Australian monthly employment report.

Polkadot beats Ethereum, Solana and Bitcoin in terms of development activity

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:37

GBP/USD finds support at 1.1185 and ticks up to 1.1200 area

- The pound attempts to consolidate losses in the 1.1200 area.

- Investors scale down hopes of aggressive BoE tightening despite hot CPI data.

- GBP/USD's decline could extend below 1.10 – ING.

The pound seems to be attempting to set a bottom at 1.1185 after its reversal from 1.1445 highs earlier this week. The pair dropped for the second consecutive day on Wednesday, weighed by negative inflation data and political uncertainty in the UK.

Sterling dives further following hot CPI figures

Consumer inflation accelerated beyond expectations in September, the annual CPI increased to 10.1% from 9.9% in the previous month, against market expectations of a 10.0% reading. The market, however, has scaled down hopes of an aggressive BoE rate hike to fight inflation on the back of the looming recession risks, which has hit GBP demand.

Furthermore, the turmoil in the UK government, with the ruling Tory party plotting to replace the recently elected Prime Minister Liz Truss after her tax cut fiasco is adding negative pressure on the pair.

On the other end, the sourer market mood has favored the safe-haven US dollar, which surged higher on Wednesday, underpinned by hopes of aggressive monetary tightening by the Fed and higher US bond yields.

GBP/USD: A return below 1.10 is on the cards – ING

FX analysts at ING see the pair depreciating lower, probably below 1.1000: “We still struggle to see a return to 1.15+ levels in cable, as a combination of political instability, risks of a deeper recession and smaller rate hikes by the BoE along the path of fiscal rigour – along with a strong dollar - may more than offset the benefits of quieter debt-related concerns (…) It’s too early to dismiss a return to sub-1.10 levels.”

Technical levels to watch

-

20:34

EUR/GBP Price Analysis: Subdued around 0.8710s, as a bearish-harami surfaces

- EUR/GBP oscillates around 0.8710s, courtesy of a risk-off impulse, bolstering the Euro.

- The cross-currency pair remains trapped within the 20/50-day Exponential Moving Averages (EMAs).

- A bearish-harami is forming in the EUR/GBP daily chart, warranting further downside.

The Euro prolonged its gains against the Pound Sterling amidst a volatile trading session that witnessed both currencies featuring reports that inflation in the Eurozone and the UK remains higher, meaning that further central bank actions are needed to control stubbornly elevated inflation. From a technical point of view, the EUR/GBP is trading above its opening price by 0.16%, hoovering around 0.8710s, trapped between the 20 and the 50-day Exponential Moving Averages (EMAs).

EUR/GBP Price Forecast

The EUR/GBP daily chart illustrates the pair as neutral-to-upward biased, though contained within last Tuesday’s price action (0.8633-0.8731). If the EUR/GBP breaks the October 18 high of 0.8731, that could pave the way for further gains, exposing the 20-day EMA at 0.8775. Otherwise, a bearish-harami candle pattern would emerge, warranting downside action in the pair. If that scenario plays out, EUR/GBP’s key support areas lie at the 50-day EMA at 0.8656, followed by the confluence of the October 17 low and the 50-day EMA around 0.8656/57.

EUR/GBP Daily Chart

Short term, the EUR/GBP one-hour chart portrays the pair as neutral, consolidated in the 0.8700-0.8723 area. On top, the 200-EMA at 0.8723 would be a difficult hurdle to surpass. Once cleared, it could send the EUR/GBP towards the R1 daily pivot at 0.8745, followed by the R2 pivot point at 0.8787, ahead of the 0.8800 figure.

On the flip side, the EUR/GBP failure to crack 0.8731, the weekly high, would exacerbate a fall toward fresh weekly lows. Hence, the EUR/GBP first support will be the 20-EMA at 0.8702, followed by the confluence of the daily pivot and the 50-EMA at 0.8690. Break below will expose the 100-EMA at 0.8673, followed by the S1 pivot level at 0.8650.

EUR/GBP Hourly Chart

-

19:50

USD/CHF’s recovery extends to session highs past 1.0000

- The US dollar regains lost ground and returns above parity.

- Fed tightening hopes, and higher US yields are underpinning the USD.

- USD/CHF is at a key resistance area of 1.0065/75.

The US dollar is going through a solid recovery against the Swiss franc on Wednesday. The pair has retraced all the ground lost on the previous two days and is testing levels above parity after having reached session highs at 1.0065.

USD, boosted by a sourer market mood and Fed tightening hopes

The positive market mood seen over the past two days waned on Wednesday, which has increased US dollar demand, on the back of its safe-haven status. European stock markets closed with moderate losses, while in the US, the Dow Jones dips 0.5%, the S&P Index trades 0.8% lower and the Nasdaq drops about 1%.

US Treasury bonds have also pushed higher on Wednesday, with the benchmark 10-year yield trading above 4%. Market hopes of another aggressive rate hike by the Federal Reserve after November’s meeting have buoyed US yields, dragging the USD up with them.

USD/CHF reaches a key resistance area at 1.0065/75

The pair has reached an important resistance area at 1.0065/75 (October 13, 14 highs) which, so far remains capping upside attempts. Confirmation above that level would set the pair at three-year highs, aiming for May 20, 2019, high at 1.0120 ahead of April 25, 2019, high at 1.0225.

On the downside, initial support lies at 0.9920 (Oct .18 low and the 100-period SMA in the four-hour chart) below here 0.9780 (Oct. 4 and 6 lows) and 0.9740 (Sept. 30 low).

Technical levels to watch

-

19:48

EUR/USD drops below 0.9800, trimming its weekly gains

- EUR/USD tumbled to the 20-day Exponential Moving Average (EMA), which could pave the way for further losses.

- Eurozone inflation rising, the economy weakening, and the ECB hiking rates paint a gloomy scenario for the bloc.

- EUR/USD Price Forecast: Failure to crack 0.9900 exposed the major to selling pressure.

EUR/USD snaps two days of gains, tumbles below 0.9800, after Eurozone (EU) inflation remained elevated, while the US housing market continues to feel the “pain” of higher interest rates, which would continue to increase, as reiterated by Fed speakers. At the time of writing, the EUR/USD is trading at 0.9770, down by 0.88%, after reaching a daily high of 0.9872.

The Euro tumbles on high EU inflation as stagflation looms

September’s inflation in the Euro area jumped by 1.2% MoM and 9.9% YoY, increasing the likelihood of a third straight 75 bps interest-rate hike by the European Central Bank (ECB). A slew of policymakers had justified the case of a ¾ percent lift to the bank rate, even though during the last week, the International Monetary Fund (IMF) foresaw a recession in Germany and Italy in 2023.

Given the backdrop of mixed sentiment in the Euro area, as shown by October’s ZEW survey, hinting at a recession, the EUR/USD appreciated. Factors like overall US Dollar weakness, and a stable UK bond market, sparked a relief rally on risk-perceived assets.

Aside from this, US economic data, namely the US Housing Starts for September, shrank by 8,1% MoM, due to the US Federal Reserve’s aggressive monetary policy tightening, with rates about to hit the 4% threshold, as speculations of another big-size rate hike mounted.

Hawkish Fed rhetoric continues

Aside from this, Minnesota Fed President Neil Kashkari said that inflation is too high while saying that the Federal funds rate (FFR) needs to get to the 4.5-4.75% to tackle inflation. He added that the Fed would need to continue its restrictive policy if inflation remains high.

EUR/USD Price Forecast

The EUR/USD refrained from testing the top-trendline of a descending channel drawn from February 2022, around the 0.9900 figure, exposing the Euro to selling pressure. Factors like fundamentals and the Relative Strength Index (RSI) crossing to bearish territory and about to pierce its 7-day RSI’s SMA would pave the way for further losses. Therefore, key resistance levels would be tested, like the October 13 swing low of 0.9631, followed by the YTD low at 0.9536.

-

19:35

UK's PM Truss may have lost another: MPs claim Tory Chief Whip has gone (on rumors)

There are rumours that the Tory Chief Whip Wendy Morton, has resigned.

This is yet to be confirmed, but if it is true, this will be the second resignation of the day. Suella Braverman has resigned as interior minister after just 43 days in the role, citing a breach of rules as well as concerns over the direction of the government.

More to come...

-

19:11

Fed Beige Book: Forecasts became more pessimistic as concerns about weakening demand grew

The Federal Reserve's Beige Book has been released that states that price growth remained elevated with some easing was noted across several districts

Here is an extract from the report:

Overall Economic

''Activity National economic activity expanded modestly on net since the previous report; however, conditions varied across industries and Districts. Four Districts noted flat activity and two cited declines, with slowing or weak demand attributed to higher interest rates, inflation, and supply disruptions. Retail spending was relatively flat, reflecting lower discretionary spending, and auto dealers noted sustained sluggishness in sales stemming from limited inventories, high vehicle prices, and rising interest rates. Travel and tourist activity rose strongly, boosted by continued strength in leisure activity and a pickup in business travel. Manufacturing activity held steady or expanded in most Districts in part due to easing in supply chain disruptions, though there were a few reports of output declines. Demand for nonfinancial services rose. Activity in transportation services was mixed, as port activity increased strongly whereas reports of trucking and freight demand were mixed. Rising mortgage rates and elevated house prices further weakened single-family starts and sales, but helped buoy apartment leasing and rents, which generally remained high. Commercial real estate slowed in both construction and sales amid supply shortages and elevated construction and borrowing costs, and there were scattered reports of declining property prices. Industrial leasing remained robust, while office demand was tepid. Bankers in most reporting Districts cited declines in loan volumes, partly a result of shrinking residential real estate lending. Energy activity expanded moderately, whereas agriculture reports were mixed, as drought conditions and high input costs remained a challenge. Outlooks grew more pessimistic amidst growing concerns about weakening demand.

Labor Markets

Employment continued to rise at a modest to moderate pace in most Districts. Several Districts reported a cooling in labor demand, with some noting that businesses were hesitant to add to payrolls amid increased concerns of an economic downturn. There were also scattered mentions of hiring freezes. Overall labor market conditions remained tight, though half of Districts noted some easing of hiring and/or retention difficulties. Competition for workers has led to some labor poaching by competitors or competing industries able to offer higher pay. Wage growth remained widespread, though an easing was reported in several Districts. Some businesses said elevated inflation and higher costs of living were pushing wages up, coupled with upward pressure from labor market tightness. Contacts expect wage growth to continue as higher pay remains essential for retaining talent in the current environment.

Prices

Price growth remained elevated, though some easing was noted across several Districts. Significant input price increases were reported in a variety of industries, though some declines in commodity, fuel, and freight costs were noted. Growth in selling prices was mixed, with stronger increases reported by some Districts and a moderation seen in others. Some contacts noted solid pricing power over the past six weeks, while others said cost passthrough was becoming more difficult as customers push back. Looking ahead, expectations were for price increases to generally moderate.

About the Beige Book

The Beige Book is a Federal Reserve System publication about current economic conditions across the 12 Federal Reserve Districts. It characterizes regional economic conditions and prospects based on a variety of mostly qualitative information, gathered directly from each District’s sources. Reports are published eight times per year.''

-

19:00

AUD/USD extends decline from 0.6330 high to 0.6250 area

- The aussie retreats from 0.6330 and reaches 0.6250 low.

- The greenback rallies on Fed tightening hopes and higher US yields.

- AUD/USD might revisit 2020 lows at 0.5506 – Credit Suisse.

The Australian dollar is giving away previous gains on Wednesday, weighed by a stronger US dollar in a deteriorated market mood. The pair has pulled back from Tuesday’s high at 0.6330, returning to the mid-range of 0.6200.

The USD appreciates as risk appetite ebbs

The positive risk sentiment seen over the last two days faded on Wednesday. The major stock markets are going through moderate declines, which is undermining demand for the risk-sensitive Australian dollar.

The greenback is going through a strong recovery, fuelled by hopes of another aggressive Fed rate hike in November. In this backdrop, US Treasury bonds have pushed higher, with the benchmark 10-year note jumping to levels above 4% for the first time since the 2008 financial crash.

Besides, the Reserve Bank of Australia’s decision to slow down the pace of monetary tightening has increased negative pressure on the Australian Dollar.

AUD/USD could revisit 2020 low at 0.5506 – Credit Suisse

FX analysts at Credit Suisse maintain their negative outlook on the pair and warn about further decline to 0.5506: “AUD/USD maintains its medium-term downtrend and (…) we continue to look for further sustained downside (…) We expect a fall to the 78.6% retracement of the 2020/21 uptrend and the low from April 2020 at 0.6041/5978 initially. Whilst we would stay wary of another pause here, a convincing break lower would be seen to open the door for a move all the way to 0.5506 – the low of 2020.”

Technical levels to watch

-

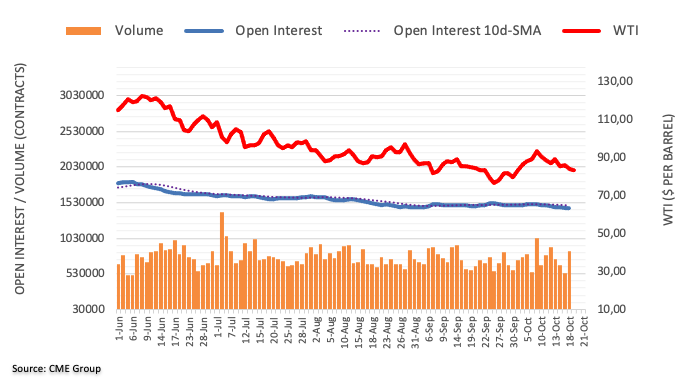

18:44

US President Joe Biden: US is to sell 15 mln bbls of crude oil from the SPR

US President Joe Biden said the US will sell 15 million barrels of crude oil from the SPR from the nation's Strategic Petroleum Reserve (SPR) by the year's end and detailed a strategy to refill the stockpile when prices drop, Reuters reported.

''Biden's plan is intended to add enough supply to prevent oil price spikes that could hurt consumers and businesses, in the wake of a decision by OPEC+ oil-producing nations, let by Saudi Arabia, to cut oil production ahead of U.S. midterm elections. Biden and his Democrats could lose control of one or both houses of Congress in November voting.''

Key notes

- Could also make extra oil available for sale if needed.

- To refill SPR when us oil prices are at or below $72/bbl’.

- Biden urges oil companies to increase US production and investment and offer consumers appropriate prices.

- Biden US needs to pass permitting reform bill.

- Biden says timing of SPR release is not politically motivated.

WTI Update

The price of oil moved higher early on Wednesday ahead of an expected release of additional US strategic supplies to counter OPEC+ cuts as supply remains tight and US oil inventories fell last week.

Spot West Texas Intermediate crude is up 2.90% at the time of writing and close to the highs of the day at $86.19bbls.

-

18:38

Fed's Kashkari: Yet to see evidence core inflation has peaked

Minneapolis Fed President Neel Kashkari is participating in a public Q&A session as part of a weekly series hosted by Travelers. Travelers Institute President Joan Woodward moderates the session.

He said its possible headline inflation has peaked but he is yet to see evidence of that.

Key quotes

He is seeing little evidence of the labour market softening.

Says surging mortgage costs have a 'profound' impact on the housing sector.

''Still working hard to achieve a soft landing.

Mixed signals make it hard to get a firm read on economy.

Some data points to slower consumer spending.

Hasn't seen evidence core inflation has peaked.

Fed committed to getting inflation back to 2%.

Open to discussing inflation target level once price pressures back to 2%.

Some evidence points to improving supply chains.Possible headline inflation has peaked.

It takes a year or so for fed rate changes to work through economy,

Risk of undershooting on rate hikes is bigger than overdoing it,

Favors rate hikes until core inflation start to cool,

Best guess is that the Fed can pause on rate hikes sometime next year,

Fairly confident stagflation won't occur.''US dollar update

As for the US dollar bounced, it has from two-week lows on Wednesday with a rise in US Treasury yields that made 14-year highs as investors maintained expectations that the Federal Reserve will continue to aggressively raise rates.

The greenback also hit a 32-year peak against the yen and approached the 150 level where some traders think the Ministry of Finance and Bank of Japan might intervene in the tumbling currency.

The Fed expected is expected to lift rates by another 75 basis points when it meets on November 1-2, with an additional 50 basis points or 75 basis points also increase likely in December.

DXY daily chart

The W-formation's neckline is holding up as support and the DXY index has started to recover from a 50% mean reversion.

-

18:27

Silver Price Forecast: XAG/USD drops due to heightened global inflation as bond yields rise

- Silver extends its losses below $19.00 as rising inflation justifies the need for higher interest rates.

- Global bond yields climb, led by US Treasury yields, a headwind for silver.

- US 10-year TIPS, a proxy for real yields, surpasses the 1.70% threshold.

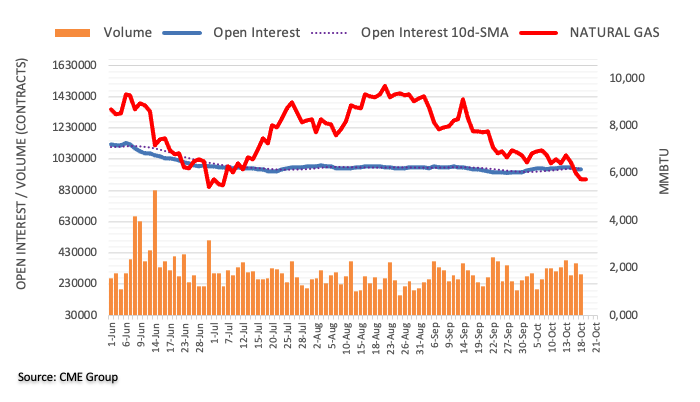

Silver price slid for the first time in the week following the release of UK, EU, and Canada inflation data, which remained stubbornly high, sparking a jump in global bond yields, a headwind for the precious metals segment, namely silver and gold. At the time of writing, the XAG/USD is trading at $18,42, below its opening price.

Inflation is the name of the game

In the European session, the Eurozone (EU) and the UK reported inflation, which remained stubbornly high, with the EU’s HICP for September jumping by 9.9% YoY, a tick lower than August’s reading, while UK CPI rose 10.1% YoY. Given the backdrop, market players are betting that the European Central Bank (ECB) and the Bank of England (BoE) would need to tighten further, probably 75 bps each, as they try to tame inflation.

Also, Canada added to the mix before Wall Street opened, with September’s inflation steadily hanging to the previous month’s readings, except for the core Consumer Price Index (CPI) on its monthly/annual readings, exceeding estimates by a tick.

Bond yields rally, pressuring precious metals

Worldwide bond yields jumped on data, with the US 10-year T-bond yield extending its gains above the 4.10% threshold, a headwind for silver, which appreciates as nominal and real yields fall. Speaking about the latter, the US 10-year TIPS bond rate, a proxy for real yields, keeps going north at 1.716%, up by ten bps.

Consequently, the greenback is printing gains. The US Dollar Index, a gauge of the buck’s value against a basket of peers, is back above the 113.00 figure, gaining close to 1%, propelled by US T-bond yields.

Elsewhere, the Minnesota Fed President Neil Kashkari reiterated that inflation is too high. Kashkari added that If the Federal funds rate (FFR) hits 4.5-4.75% and inflation remains high, he does not see the case for pausing interest-rate increases.

Silver (XAG/USD) Price Forecast

XAG/USD remains downward biased, although it recovered some ground and hurdled the $19.00 mark last Friday. Nevertheless, higher US bond yields mean a stronger US Dollar, so buyers could not hold to gains above $19.00 a troy ounce. Therefore, XAG/USD dropped below October’s 17 low of $18.55, opening the door for a test of the week’s low at $18.23. Once cleared, the next support would be the MTD low of $18.09.

-

18:25

UK Politics: Dramas and more resignation letters

In recent trade, there has been news that Suella Braverman has resigned as interior minister after just 43 days in the role, citing a breach of rules as well as concerns over the direction of the government:

In the resignation letter posted to Twitter, she said, “It is with the greatest regret that I am choosing to tender my resignation.”

The political shake-up is just one of a number of themes weighing on the pound at a hugely turbulent time for the government, with Truss under intense pressure to resign after a budget on September 23 set of turmoil in financial markets.

On Friday, Truss fired her finance minister, Kwasi Kwarteng, over the incident.

GBP/USD update

Meanwhile, the pound is down 1% on the day and has dropped from a high of 1.1357 to a low of 1.1184 so far and the markets expect sterling to remain under pressure amid an outlook for rising inflation and a recession in Britain.

The Bank of England is expected to increase rates by 75 basis points rather than 100 bps at its November meeting following Wednesday's Consumer Price Index inflation data. The UK Office for National Statistics has reported the headline Consumer Price Index (CPI) at 10.1%, higher than the expectations of 10% and the prior release of 9.9%. Also, the core CPI has escalated to 6.5% than the projections of 6.4% and the former figure of 6.3%.

GBP/USD H1 chart

-

18:12

Gold Price Forecast: XAU/USD dives to fresh three-week lows below $1,630

- Gold accelerates its decline and hits fresh three-week lows below $1,630.

- The USD rallies on Fed tightening hopes and higher US yields.

- XAU/USD focusing on $1.614 or lower – Credit Suisse.

Gold futures accelerated their downtrend on Wednesday to reach fresh three-week lows right below $1,630. The yellow metal dives nearly 1.5% so far today on the back of a strong USD recovery as risk appetite waned.

Fed tightening hopes and higher bond yields boost the USD

After the moderate decline of the previous two days, the dollar is going through a solid recovery on Wednesday. The USD has bounced back amid a sourer market mood and the rebound on US Treasury bond yields. The benchmark 10-year bond yield has jumped to 4.12%, its highest level since the 2007 crisis

Beyond that, the investors have shifted their focus to the Federal Reserve’s monetary policy meeting due on November 1 and 2. With the market anticipating another 75 basis point hike, the aggressive tightening cycle of the US central bank is acting as a tailwind for the USD.

The USD has regained most of the ground lost over the previous two days. The US Dollar Index bounced up from levels right below 112.00 and has rallied beyond 1% on the day, returning to the 113.00 area at the time of writing.

XAU/USD: Next support is $1,614 – Credit Suisse

Analysts at Credit Suisse point out that gold futures have activated a double top, which anticipates further declines: “Gold below $1,691/76 has reinforced its existing large ‘double top’. Hence, with a top in place, we expect gold to come under renewed pressure. We note that the next support is seen at $1,614, then $1,560, and eventually $1,451/40.”

Technical levels to watch

-

18:05

United States 20-Year Bond Auction increased to 4.395% from previous 3.82%

-

17:30

Bank of Canada should be set for another 75 bps increase next week – CIBC

Data released on Wednesday showed the annual inflation rate in Canada eased less-than-expected from 7.0% to 6.9%. Analysts at CIBC now believe the Bank of Canada (BoC) will need to with a 75 basis points rate hike next week, against the 50 bps previously anticipated.

Key Quotes:

“There will be some long faces at the Bank of Canada this morning as inflation cooled less than expected. Unadjusted headline CPI increased 0.1% in September, with the annual rate easing only one tick to 6.9% (consensus -0.1%, 6.7% y/y). This is the third consecutive deceleration in headline CPI driven mainly by the fall in gasoline prices.”

“Given that those prices have since reversed, the next month could see headline inflation temporarily heading in the wrong direction again. But that is not the main focus for the Bank of Canada, who is paying closer attention to core inflation. CPI excluding food and energy rose by 0.4% seasonally adjusted on the month, faster than last month, and at a pace that's too high to be consistent with the 2% target.”

“The Bank of Canada has clearly not slayed the inflation dragon yet and is therefore set for another large rate hike next week. The pace of growth in seasonally adjusted inflation excluding food and energy picked up by more than expected this month and is too high for comfort. As such, we now believe the Bank will need to go with a 75 bps hike next week rather than the 50 bps we previously anticipated. The Bank might then be left with a last 25 bps in December if growth numbers support it.”

-

17:29

WTI moving sideways, with upside attempts capped below $84.50

- WTI prices tick up above $84, bulls remain capped at $84.50.

- Fears of a global recession and lower Chinese demand hurt crude prices.

- US commercial oil stocks declined unexpectedly.

WTI futures are trading without clear direction on Wednesday, despite the unexpected decline in US oil inventories. The West Texas Intermediate retreated to session lows at 82.60 earlier today, before attempting to pare losses, although recovery attempts remained capped below 84.50.

Oil prices suffer amid global recession fears

Crude prices have depreciated about 10% over the last two weeks amid a combination of increasingly negative global economic perspectives and fears of a decline on Chinese demand.

The Chinese Government has delayed the release of key indicators scheduled to be published this week, including the third quarter’s GDP, which was due on Wednesday. This decision has been taken negatively by the market and has increased doubts about China’s economic momentum and its potential impact on oil demand.

Furthermore, US President Joe Biden has confirmed his commitment to keep releasing crude from the country’s oil reserves, which has increased negative pressure on prices.

Against this backdrop, the unexpected decline in US commercial oil inventories has been unable to push crude prices higher. The EIA reported earlier on Wednesday a 1.725M decline in inventories in the week of October 14 against market expectations of a 1.38M increase.

Technical levels to watch

-

17:26

USD/CAD holds onto daily gains near 1.3800

- US dollar up across the board on Wednesday on higher US yields.

- Canada: Inflation above expectations in September.

- USD/CAD up for the second day in a row, rebound from the 20-day SMA.

The USD/CAD printed a fresh daily high during the American session at 1.3808 and then pulled back to 1.3770. It is hovering slightly below 1.3800, on its way to the second daily gain in a row supported by a stronger US dollar across the board.

Canadian inflation numbers disappoint

Canadian CPI rose 0.1% in September and the annual rate eased from 7.0% to 6.9%, against market expectations of a 6.8% reading. “After some respite in August, price growth picked up in September. Economists were expecting gasoline prices to fall but did not foresee the dramatic jump in food prices”, noted analysts at the National Bank of Canada. They are seeing “significant divergences in core inflation between Canada and the US over the past 3 months, as it has moderated substantially on this side of the border. In both cases, the global slowdown, less acute supply chain issues and lower transportation costs should translate into weak goods inflation prints going into 2023”.

The loonie rose modestly after the numbers but not enough to push USD/CAD to the downside. The pair is rising after avoiding on Tuesday a daily close below the 20-day Simple Moving Average, currently at 1.3710.

On the upside, if the pair holds above 1.3800 it could gain momentum for a test of the next resistance area at 1.3830. On the flip side, a daily close below 1.3700 should open the doors to more losses.

Technical levels

-

17:08

GBP/USD trips down below 1.1250 post-UK hot CPI, pressures the BoE

- GBP/USD failed to cling to the 1.1300 figure on concerns that the BoE would hike less than estimated.

- UK Inflation rose to fresh 4-decade highs above 10%, exerting pressure on the Bank of England.

- The US housing market continued to deteriorate amidst the Federal Reserve’s tight monetary policy.

The British Pound slides to fresh two-day lows below 1.1300 against the US Dollar after UK inflation extended to double digits, to a new 40-year high, while United States (US) housing data extends its decline due to Federal Reserve (Fed) aggressive policy. The GBP/USD is trading at 1.1220 at the time of writing after hitting a daily high at 1.1358.

Heightened UK Inflation pressures the BoE to act amid the ongoing economic slowdown

Early during the European session, the UK Office for National Statistics (ONS) revealed the Consumer Price Index (CPI) for September rose by 10.1% YoY, above estimates, and higher than August’s 9.9%, cementing the case for further tightening by the Bank of England (BoE). Also, core CPI jumped from 6.3% YoY vs. 6.4% foreseen.

The GBP/USD tumbled below 1.1300 on the news after political turmoil in the country, linked to the new Prime Minister’s tax-cut plan, witnessed the sacking of Finance Minister Kwarteng, replaced by Jeremy Hunt, who scrapped Liz Truss’s budget. Meanwhile, market participants anticipate that the BoE will hike 75 bps rather than 100 as the UK economy further deteriorates.

Fed’s aggression weighing on the US housing market

Across the pond, US Housing Starts for September declined by 8.1% MoM after August’s data surprisingly grew by 13.70%. The housing market continues to bear the brunt of the Fed interest-rate increases, as the US central bank embarked on a mission to bring inflation towards its 2% target, despite tipping the US economy into a recession.

On Tuesday, Minnesota Fed President Neil Kashkari reiterated that inflation is too high, and he does not see the case for pausing interest-rate increases. Kashkari added that if the Federal funds rate (FFR) hits 4.5-4.75% and inflation remains high, the Fed would need to continue its restrictive policy.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against six currencies, is up by almost 0.80% at 112.778, underpinned by US Treasury bond yields, with the 10-year benchmark note yielding 4.098%, gaining eight bps.

GBP/USD Price Analysis

The GBP/USD extended its losses, below October’s 18 low, putting in play a fall towards Monday’s 1.1208 daily low, which, once cleared, could send the Pound Sterling toward the 20-day Exponential Moving Average (EMA) at 1.1127. If it gives way, the GBP/USD next stop would be the 1.1100 figure, followed by the October 12 1.0923 cycle low.

-

17:00

Russia Producer Price Index (YoY): 3.8% (September)

-

17:00

Russia Producer Price Index (MoM): -0.8% (September) vs -1%

-

16:40

USD/JPY approaching 150.00 with BoJ intervention eyed

- The dollar continues marching higher and reaches the 149.70 area.

- Investors hold their breath for a potential BoJ intervention at 150.00

- USD/JPY's rally could reach 160.00 – Nordea.

The greenback resumed the upside on Wednesday and appreciates for the 11th consecutive day, with the pair reaching session highs at 149.70 so far, approaching the psychological 150.00 level, which according to some market sources, might trigger an intervention by the Bank of Japan.

All eyes are on a potential BoJ intervention

With the Japanese yen declining across the board, the USD/JPY has surged about 30% since march, to reach 32-year highs. The US dollar is now moving well above the 145.00 level, which triggered the first BoJ intervention since 1998 in September.

US Treasury yields picked up on Wednesday, with the market shifting its focus towards the Federal Reserve’s monetary policy meeting, due on November 1 and 2. The bank is widely expected to increase the Federal Funds Rate by 75 basis points for the fourth consecutive time, which has provided a fresh boost to the USD after having traded without clear direction over the last two days.

Monetary policy divergence is the main reason behind yen's weakness. The Bank of Japan is lagging behind all the major central banks, already in a monetary tightening cycle, which is crushing demand on the yen.

USD/JPY could reach 160.00 – Nordea

FX analysts at Nordea Bank observe more upside potential on the pair and point out a potential 160.00 target: “With a continued worsening of rate differentials, we see USD/JPY trading as high as 160 at times, even with the intervention from the Japanese government (…) What will stop the weakening of the JPY is a shift in monetary policy from the Bank of Japan or a 180-degree shift from all other G10 central banks.

Technical levels to watch

-

16:35

UK: Suella Braverman departs as home secretary – The Guardian

Suella Braverman is understood to have departed as UK Secretary of State for the Home Department, reported The Guardian. According to them, UK PM Liz Truss “cleared her diary and called off a planned visit amid desperate attempts to save her premiership”.

Braverman was eliminated in the second round of the Conservative Party leadership election after Boris Johnson’s resignation. She then supported Liz Truss and was appointed Home Secretary on September 6.

The Guardian reports that a former Transport secretary, Grant Shapps could replace Braverman. He backed Rishi Sunak in the Tory race.

-

16:16

Colombia Trade Balance: $-2168M (August) vs previous $-494M

-

16:13

BoE’s Cunliffe: LDI episode is mostly behind us

The Bank of England (BoE) Deputy Governor Jon Cunliffe said on Wednesday that recent market tensions regarding LDI are “mostly behind us”. He mentioned financial markets have to adjust to government fiscal policies and the market panic was caused by politicians.

Regarding LDIs (Liability Driven Investment), Cunliffe said they have got to the point where on average they could absorb an increase of 200 basis points in yields. He said they do not run stress tests on LDIs.

According to the BoE policymaker, there needs to be more coordination between security regulators and central banks.

Market reaction

The pound remains steady on Wednesday after volatile days. GBP/USD is hovering around 1.1255, down near 70 pips amid a stronger US dollar across the board.

-

15:51

Brent Crude Oil to suffer further weakness, potentially to the March 2021 low at $60.27 – Credit Suisse

Brent Crude Oil is back below key averages. Strategists at Credit Suisse expect further weakness from here.

Only a solid rise back above $93.78/102.57 would improve the technical picture

“Brent Crude Oil is back below key averages and we expect further weakness towards the 50% retracement of the whole 2020/2022 upmove at $77.56. If this level would break as well, we then identify next support levels at $65.72, December 2021 low and then $63.02, the 61.8% retracement, where we would expect a more sustainable consolidation/countermove to be established. Nevertheless, below would open the door for the March 2021 low at $60.27.”

“Only a solid rise back above the crucial intersection of the 55 and 200-day averages, currently seen at $93.78/102.57, would improve the technical picture again, which is not our base case.”

-

15:49

EIA: US Commercial crude oil inventories decline by 1.72M, against expectations of a 1.38M increase

The weekly report from the US Energy Information Administration (EIA) showed a decline in crude oil inventories of 1.725M against expectations of an increase by 1.38M during the week ending October 14. Cushing crude oil inventories rose by 583K and gasoline inventories by declined by 114K.

Key takeaways:

- US crude oil refinery inputs averaged 15.6 million barrels per day during the week ending October 14, 2022 which was 132,000 barrels per day less than the previous week’s average.

- Refineries operated at 89.5% of their operable capacity last week. Gasoline production increased last week, averaging 9.4 million barrels per day. Distillate fuel production increased last week, averaging 5.0 million barrels per day.

- US commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.7 million barrels from the previous week. At 437.4 million barrels, U.S. crude oil inventories are about 2% below the five year average for this time of year

Market reaction

Crude oil prices remained steady after the report, holding onto to modest daily gains. The West Texas Intermediate (WTI – cash) rose to test the daily high around $83.40 and then pulled back toward $82.50.

- US crude oil refinery inputs averaged 15.6 million barrels per day during the week ending October 14, 2022 which was 132,000 barrels per day less than the previous week’s average.

-

15:30

United States EIA Crude Oil Stocks Change came in at -1.725M below forecasts (1.38M) in October 14

-

15:01

S&P 500 Index can see a base and a deeper recovery on a break above 3807/10 – Credit Suisse

S&P 500 above 3687/77 can keep the immediate risk higher for a test of 3807/10. Nonetheless, a break above the latter is needed to see a base established, analysts at Credit Suisse report.

Move below 3687 to suggest more choppy sideways phase

“Support at 3687/77 holding can see the immediate risk stay higher for strength back to 3763 and then the current October high and 38.2% retracement of the August/October fall at 3807/10. Beyond here is needed to mark a near-term base though and a more concerted recovery for a test of the 630-day average, currently at 3947.”

“Below 3687 can instead raise the likelihood we are set to see a more choppy sideways phase and a retest of the 200-week average at 3606/04.”

-

14:56

AUD/USD keeps the red below 0.6300, focus shifts to Australian jobs report on Thursday

- AUD/USD comes under renewed selling pressure on Wednesday amid resurgent USD demand.

- Aggressive Fed rate hike bets, surging US bond yields, the risk-off impulse lifts the greenback.

- Bears, however, remain on the sidelines ahead of the key Australian jobs report on Thursday.

The AUD/USD pair fails to capitalize on its modest recovery gains recorded over the past two trading sessions and meets with a fresh supply on Wednesday. The pair maintains its offered tone through the early North American session and is currently placed near the daily low, around the 0.6280-0.6275 region.

The US dollar makes a solid comeback in the wake of a breakout rally in the US Treasury bond yields and turns out to be a key factor exerting downward pressure on the AUD/USD pair. In fact, the benchmark 10-year Treasury note hits its highest level since 2008 and the yield on the rate-sensitive 2-year US government bond rallies to a new 15-year peak amid hawkish Fed expectations.

The markets seem convinced that the US central bank will stick to its aggressive policy tightening path to tame inflation and have been pricing in another supersized 75 bps rate hike in November. This, in turn, remains supportive of elevated US Treasury bond yields. This, along with the risk-off impulse, lifts the safe-haven buck and weighs on the risk-sensitive Australian dollar.

The market sentiment remains fragile amid growing worries about the economic headwinds stemming from rapidly rising borrowing costs, geopolitical risks and China's strict zero-COVID policy. The anti-risk flow is evident from a fresh leg down in the equity markets. This, to a larger extent, overshadows mixed US housing market data and does little to dent the intraday USD bullish move.

Apart from this, the Reserve Bank of Australia's (RBA) decision to slow the pace of policy tightening earlier this month suggests that the path of least resistance for the AUD/USD pair is to the downside. Hence, a subsequent slide back below the 0.6200 round-figure mark, towards challenging the YTD low near the 0.6170 region touched last week, looks like a distinct possibility.

That said, traders seem reluctant to place placing aggressive bearish bets and prefer to wait for the monthly employment details from Australia, due for release during the Asian session on Thursday. In the meantime, the USD price dynamics will continue to influence the AUD/USD pair, which, along with the broader risk sentiment, should allow traders to grab short-term opportunities.

Technical levels to watch

-

14:45

USD/CAD to top 1.40 again in the coming weeks – TDS

In the opinion of economists at TD Securities, dips into and below 1.37 in USD/CAD should be faded and a return to a 1.40 handle is likely.

There is zero reasons to like the loonie

“We see strong markers of support and dips in USD/CAD should be shallow. Dips into 1.36/37 should be strongly faded.”

“We look for the pair to top 1.40 again in the coming weeks.”

“To get CAD to strengthen will need to see a relaxation of positive USD catalysts primarily through a Fed pivot and a series of moderation in month-on-month US core CPI. Neither is happening near-term.”

-

14:28

EUR/USD Price Analysis: A deeper correction could revisit 0.9631

- EUR/USD fades the recent advance and breaks below 0.9800.

- The October low near 0.9630 comes next on the downside.

EUR/USD reverses the uptick to the 0.9870/80 band and comes under pressure below the 0.9800 support on Wednesday.

The inability of the pair to surpass the area of weekly highs near 0.9880 in the very near term could lure extra selling pressure in and pave the way for a probable test of the October low at 0.9631 (October 13).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0553.

EUR/USD daily chart

-

14:25

AUD/USD could suffer a substantial drop to the 2020 low at 0.5506 – Credit Suisse

AUD/USD maintains its core downtrend, with scope of reaching the 2020 low at 0.5506, analysts at Credit Suisse report.

Current pause may stay in place for now

“AUD/USD maintains its medium-term downtrend and though the current pause may stay in place for now, we continue to look for further sustained downside.”

“We expect a fall to the 78.6% retracement of the 2020/21 uptrend and the low from April 2020 at 0.6041/5978 initially. Whilst we would stay wary of another pause here, a convincing break lower would be seen to open the door for a move all the way to 0.5506 – the low of 2020.”

-

14:15

Gold Price Forecast: XAU/USD hits three-week low amid surging bond yields, stronger USD

- A combination of factors drags gold to a fresh three-week low on Wednesday.

- Hawkish Fed expectations, rising US bond yields, stronger USD exert pressure.

- The risk-off impulse could lend some support and help limit any further losses.

Gold continues losing ground through the early North American session and hits a fresh three-week low, around the $1,630 area in the last hour. The downtick is exclusively sponsored by a strong pickup in demand for the US dollar, which tends to weigh on the dollar-denominated commodity.

In fact, the USD Index, which measures the greenback's performance against a basket of currencies, has now recovered a major part of its weekly losses amid rising bets for aggressive rate hikes by the Fed. The US central bank remains committed to bringing inflation under control and is expected to deliver another supersized 75 bps rate increase at the next policy meeting in November.

Hawkish Fed expectations trigger a fresh leg up in the US Treasury bond yields and continue to act as a tailwind for the buck. In fact, the yield on the rate-sensitive 2-year US government bond rallies to a new 15-year peak and the benchmark 10-year Treasury note hit its highest level since 2008. This is seen as another factor driving flows away from the non-yielding gold.

The USD maintains its strong bid tone and seems rather unaffected by mixed US housing market data. This, along with rising bets for a jumbo rate hike by the European Central Bank and the Bank of England, suggests that the path of least resistance for the XAU/USD is to the downside. Hence, a slide back towards the YTD low, around the $1,615 area, remains a distinct possibility.

That said, a turnaround in the global risk sentiment - as depicted by a generally weaker tone around the equity markets, could lend support to the safe-haven gold. That said, any attempted recovery might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

Technical levels to watch

-

13:49

USD Index Price Analysis: Further upside seen above 114.00

- DXY reclaims part of the ground lost and advances to 2-day highs.

- The surpass of the 114.00 region could pave the way for extra gains.

DXY sets aside two daily pullbacks in a row and extends further the recent breakout of the 112.00 barrier on Wednesday.

So far, the index looks poised to keep navigating within a 112.00-114.00 range at least until the next FOMC event. In case bulls break above the 114.00 region, gains could then accelerate to the 2022 peak near 114.80.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 8-month support line near 108.10.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 103.52.

-

13:33

Canada: Annual CPI eases to 6.9% in September vs. 6.8% expected

- Inflation in Canada falls at a slightly slower-than-expected pace.

- USD/CAD trims a part of its intraday gains in reaction to the data.

Inflation in Canada, as measured by the Consumer Price Index (CPI), fell to 6.9% in September from 7.0% in August, data published by Statistics Canada showed this Wednesday. This reading is slightly better than the market expectation of 6.8%.

The Bank of Canada's (BOC) Core CPI, which excludes volatile food and energy prices, unexpectedly climbed to 6.0% on a yearly basis from 5.8% in August, again beating estimates for a reading of 5.6%.

Market reaction

The initial market reaction, however, is limited amid a goodish pickup in the US dollar demand, which continues to act as a tailwind for the USD/CAD pair.

-

13:31

Canada Consumer Price Index (YoY) above forecasts (6.8%) in September: Actual (6.9%)

-

13:31

Canada Industrial Product Price (MoM) registered at 0.1% above expectations (-2%) in September

-

13:31

Canada Consumer Price Index - Core (MoM) climbed from previous 0.2% to 0.4% in September

-

13:31

Canada BoC Consumer Price Index Core (YoY) above forecasts (5.6%) in September: Actual (6%)

-

13:31

Canada Raw Material Price Index came in at -3.2% below forecasts (0%) in September

-

13:30

United States Building Permits (MoM) registered at 1.564M above expectations (1.53M) in September

-

13:30

Canada BoC Consumer Price Index Core (MoM) meets forecasts (0.4%) in September

-

13:30

United States Building Permits Change: 1.4% (September) vs -10%

-

13:30

Canada Consumer Price Index (MoM) above expectations (0%) in September: Actual (0.1%)

-

13:30

United States Housing Starts Change dipped from previous 12.2% to -8.1% in September

-

13:30

United States Housing Starts (MoM) registered at 1.439M, below expectations (1.475M) in September

-

13:15

EUR/JPY Price Analysis: Upside momentum looks unchanged

- EUR/JPY comes under pressure after printing new cycle highs.

- Further up aligns the December 2014 top at 149.78.

EUR/JPY returns to the negative territory after six consecutive sessions closing with gains.

Considering the current price action in the cross, the door still looks open to extra upside. That said, the immediate target now emerges at the December 2014 peak at 149.78 (December 8).

In the short term the upside momentum is expected to persist while above the October lows near 141.00.

In the longer run, while above the key 200-day SMA at 136.68, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

-

13:12

Gold Price Forecast: XAU/USD to come under renewed pressure, next support at $1,614 – Credit Suisse

Gold has reinforced its “double top.” Strategists at Credit Suisse expect the yellow metal to suffer further weakness.

Only a convincing weekly close above $1,712 would ease the pressure

“Gold below $1,691/76 has reinforced its existing large ‘double top’. Hence, with a top in place, we expect gold to come under renewed pressure. We note that the next support is seen at $1,614, then $1,560 and eventually $1,451/40.”

“Only a convincing weekly close above the 55-day average at $1,712 would ease the pressure on the precious metal, with next resistance then seen at the even more important 200-day average, currently at $1,817, which we would expect to cap at the very latest.”

-

12:40

USD/JPY: Strength to extend to test the 149.78 high of 2014 – Credit Suisse

The rally in USD/JPY has gained further strong momentum. Economists at Credit Suisse believe that the pair has potential to test the 149.78 high of 2014.

Support is seen at 144.85/24

“Although we are wary of a potential top in USD/JPY around 150-153, we look for the rally here to extend further still.

“Resistance is seen initially at 147.23/27, above which can see resistance next at 148.43/45 and potentially back to the 149.78 high of 2014. We would look for this to prove a tougher barrier if tested.”

“Support is seen at 146.54/40 initially, with a break below 146.23 needed to see a setback into the 144.85/24 zone, which we look to try and hold.”

-

12:15

USD/CAD: Break below 1.3650 to inspire a deeper drop – Scotiabank

USD/CAD’s sharp appreciation through September is showing signs of flattening out. In the view of economists at Scotiabank, the pair needs to break below the 1.3650 mark to sustain further losses.

More choppy range trading in the short run

“Price action is choppy and daily/weekly trend signals are showing some signs of weakening; intraday (1 and 6-hour) DMI oscillator measures have turned decidedly flat. These signals suggest more, choppy range trading in the short run at least.”

“We note that last week’s spike high at 1.3972 was followed by the formation of a bearish key reversal signal (new cycle high, lower close) on the daily chart.”

“USD-bearish price signals are not prompting a significant reaction at this point and the longer run DMIs indicate a lot of residual upside momentum remains in this market. Still, we note the bearish reversal signal came at a sensitive point (near the 1.40 level) and that high has not been challenged again so far.”

“More obvious USD weakness (we think below 1.3650) is needed to inspire a deeper drop at this point.”

-

12:00

South Africa Retail Sales (YoY) registered at 2%, below expectations (4.2%) in August

-

12:00

United States MBA Mortgage Applications: -4.5% (October 14) vs previous -2%

-

11:59

When is the Canadian consumer inflation (CPI report) and how could it affect USD/CAD?

Canada CPI Overview

Statistics Canada will release the consumer inflation figures for September later during the early North American session on Wednesday, at 12:30 GMT. The headline CPI is expected to remain flat during the reported month as compared to a 0.3% fall in July. The yearly rate, meanwhile, is expected to ease from 7.0% to 6.8% in September. More importantly, the Bank of Canada's Core CPI, which excludes volatile food and energy prices, is estimated to rise by 0.4% MoM in September and came in at 5.6% on a yearly basis, down from 5.8% in August.

Analysts at Citibank offer their take on the upcoming macro data and write: “We expect a modest -0.1% MoM decline in September CPI, with the YoY measures moderating further to 6.6%. Most important will be the trend in core inflation measures after the first signs of a pullback in August. Continued moderation in core CPI measures would be consistent with leading survey indicators that suggest further easing into year-end. These will be key for BoC’s decision in October. We expect a further easing in inflation data to support a shift to a 50 bps pace of hikes by the BoC in October.”

How Could it Affect USD/CAD?

Ahead of the key release, a goodish pickup in the US dollar demand assists the USD/CAD pair to gain some positive traction on Wednesday. That said, an intraday bounce in crude oil prices underpins the commodity-linked loonie and acts as a headwind for the major. A softer-than-expected Canadian CPI print should allow the major to build on the overnight recovery move from over a one-week low.

Conversely, a stronger reading could provide a modest lift to the domestic currency, though the immediate market reaction is more likely to remain limited. The prospects for more aggressive rate hikes by the Federal Reserve, along with looming recession risks, should continue to benefit the safe-haven buck and act as a tailwind for the USD/CAD pair. This, in turn, suggests that the path of least resistance for spot prices is to the upside.

Key Notes

• Canadian CPI Preview: Forecasts from seven major banks, signs of easing price pressures?

• USD/CAD clings to gains above mid-1.3700s, lacks follow-through ahead of Canadian CPI

• USD/CAD: Next potential objectives located at 1.4040 and 1.4210 – SocGen

About Canadian CPI

The Consumer Price Index (CPI) released by Statistics Canada is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of CAD is dragged down by inflation. The Bank of Canada aims at an inflation range (1%-3%). Generally speaking, a high reading is seen as anticipatory of a rate hike and is positive (or bullish) for the CAD.

-

11:56

NZD/USD: 0.5798/5813 to hold current correction to avoid a stronger upmove towards 0.5978 – Credit Suisse

NZD/USD is seeing a minor recovery, which economists at Credit Suisse look to be held at 0.5798/5813.

Move below 0.5510 needed to turn near-term risk back lower

“Whilst both daily RSI and MACD are holding bullish divergences, which suggests that the recovery will extend for now, our broader outlook remains outright bearish and we thus see this development only as a correction prior to an eventual move lower.”