Notícias do Mercado

-

19:20

American focus : the euro has increased markedly U.S. dollar

The euro exchange rate rose sharply against the dollar, while restoring all the previously lost positions , and updating the session high. Helped strengthen the euro currency data that showed pessimism among consumers of the 17 eurozone countries decreased significantly in December , exceeding with evaluation experts, and offsetting deterioration in the previous month. It became known from the latest data , which were presented to the European Commission.

According to the report , a preliminary index of consumer confidence rose to 13.6 points in December , compared with -15.4 points a month earlier. According to the average forecasts of experts, this indicator was improved to the level of -15.0 points.

It should be noted that these data were released today after a report showed that German consumers are more confident in December than expected, which is likely , and helped increase the total index for the euro area .

The latest report is likely to be welcomed by politicians of the European Central Bank, as it indicates that the current year to end on a positive note. Note that in the last months of data showed that unlike Germany, economic growth in France, Italy and Spain was not pleased that caused doubt in accelerating growth in the current quarter . Recall that in the second quarter of the eurozone economy grew by 0.3%.

The yen retreated from a 5- year high , and that was due to the general weakening of the dollar, even though a positive report on U.S. GDP . Experts note that the upward revision of GDP reinforced expectations that the Fed will continue rolling asset purchases in 2014. Key elements are the unemployment rate / p and employment without regard to the / x sector. However, today published a revised GDP is also important , as it reflects the strong growth in consumption, which may contribute to increased employment. Meanwhile, experts said that , despite the fact that today the dollar not strengthened , GDP data will contribute to the growth of the U.S. currency in the medium term .

The Canadian dollar rose against the U.S. dollar by restoring all the previously lost ground. The course of trade a considerable impact on U.S. GDP data , which caused the Canadian dollar to drop significantly , albeit briefly . Later, the market turned its attention to Canadian reports which, although lower than forecast, indicated a slight improvement . Note that one of the reports showed that annual inflation in Canada rose by less than 1% the second consecutive month in November , as higher energy costs and the vegetables were offset by lower prices for mortgage loans on household tools and prescription drugs . Overall consumer price index in November rose by 0.9 % compared with the previous year Growth was higher growth the previous month by 0.7 % , but below market expectations at 1.0% increase .

Core CPI , which excludes volatile components, such as some food and energy , rose 1.1 %, below market expectations of 1.2 % growth and the slowest annual growth rate in five months.

Meanwhile, other data showed that retail sales fell 0.1% in October compared with the previous month to 40.72 billion Canadian dollars ( $ 38,180 million). Market expectations were at the level of growth of 0.3%. In volume terms, sales in October rose 0.2 %. In annual terms retail sales rose 3.0%. Except for the automotive sector Canadian retail sales in October rose 0.4 % for the month and reached 31.21 billion Canadian dollars .

-

15:00

Eurozone: Consumer Confidence, December -13.6 (forecast -15.0)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y103.00, Y103.50, Y104.00, Y104.25, Y104.50, Y105.00

EUR/JPY Y142.75

EUR/USD $1.3600, $1.3635, $1.3650, $1.3700, $1.3775, $1.3780

GBP/USD $1.6200, $1.6300, $1.6350

EUR/GBP stg0.8405

USD/CHF Chf0.8875, Chf0.9020, Chf0.9110

EUR/CHF Chf1.2220, Chf1.2275

AUD/USD $0.8850, $0.8875, $0.8900, $0.9000, $0.9020

AUD/JPY Y92.75

NZD/USD $0.8075, $0.8195, $0.8300

USD/CAD C$1.0700, C$1.0775, C$1.0800

-

13:32

U.S.: PCE price index ex food, energy, q/q, Quarter III +1.4% (forecast +1.5%)

-

13:31

Canada: Consumer Price Index m / m, November 0.0% (forecast +0.2%)

-

13:31

Canada: Consumer price index, y/y, November +0.9% (forecast +1.0%)

-

13:31

Canada: Bank of Canada Consumer Price Index Core, m/m, November -0.1% (forecast +0.1%)

-

13:31

Canada: Bank of Canada Consumer Price Index Core, y/y, November +1.1% (forecast +1.2%)

-

13:31

U.S.: PCE price index, q/q, Quarter III +2.0% (forecast +1.4%)

-

13:30

Canada: Retail Sales, m/m, October -0.1% (forecast +0.3%)

-

13:30

Canada: Retail Sales ex Autos, m/m, October +0.4% (forecast 0.0%)

-

13:30

U.S.: GDP, q/q, Quarter III +4.1% (forecast +3.6%)

-

13:15

European session: the euro rose

07:00 Germany Producer Price Index (MoM) November -0.2% 0.0% -0.1%

07:00 Germany Producer Price Index (YoY) November -0.7% -0.8% -0.8%

07:00 Germany Gfk Consumer Confidence Survey January 7.4 7.4 7.6

07:30 Japan BOJ Press Conference

09:30 United Kingdom Current account, bln Quarter III -6.1 Revised From -13.0 -13.8 -20.7

09:30 United Kingdom PSNB, bln November 7.4 Revised From 6.4 6.6 14.8

09:30 United Kingdom GDP, q/q (Finally) Quarter III +0.8% +0.8% +0.8%

09:30 United Kingdom GDP, y/y (Finally) Quarter III +1.5% +1.5% +1.9%

The euro shows a slight increase against the U.S. dollar in anticipation of the U.S. GDP . Support for the single currency was partially data research group GfK, according to which the German consumer confidence index rose to its highest level in more than six years in January. Expected consumer confidence index for January rose to 7.6 from 7.4 in December. Economists expected the index to remain at the level of December . As reported in the survey report GfK, the value in January was the highest since August 2007 . "Consumer climate is preparing for a good start in the new year ," they added .

German economic expectations rose for the fourth month in a row in December. Corresponding indicator was 23.3 points , adding 3 points from November . Indicator , which measures consumers' income expectations fell in December after recording significant gains in the previous month . Index fell 5.7 points to 39.5 points. However, the reduction is relatively small as compared with an increase of 12 points in November. and

Another report showed that the German producer price index fell by 0.8 percent year on year in November after falling 0.7 percent in October . Result is consistent with economists' expectations . In monthly terms, the producer price index fell 0.1 percent in November . Economists had expected prices to remain unchanged compared with the previous month .

The euro rose slightly against the dollar, despite the downgrade of EU rating agency Standard & Poor's from AAA to AA +. The agency cited the " weakening of the interaction " and new complications in the negotiations on the budget.

Pound traded steadily against the U.S. currency against the background of the final GDP data for Britain. The UK economy expanded by 0.8 percent in the quarterly measurement in the third quarter , coinciding with the second assessment , published on November 27. Nevertheless, the statistical agency with increased slightly revised the GDP for the second quarter and showed 0.8 percent expansion compared with the previous reporting an increase of 0.7 percent. GDP grew by 1.9 percent year on year in the third quarter , according to the ONS. This result is improved compared with 1.5 percent growth , which was reported in the second assessment .

Slight pressure on the pound had data from GfK, according to which the index measuring consumer confidence in the UK fell for the third month in a row in December. Index fell to -13 points , giving analysts, who expected to improve to -11 after the index reached -12 in November. Among the individual components of the survey, the economic outlook fell to -4 s -1 in the previous month . Major component purchases fell to -17 from -13 the previous month. At the same time, GfK noted that all these figures were significantly higher than a year ago , when the overall index fell to -29 points. Prospects component was -31 points in December 2012 , but a component of large purchases made -27 points.

The yen fell against most major currencies after the Bank of Japan left unchanged targets expansion of the monetary base in the range of 60 trillion yen ( $ 581 billion ) to 70 trillion yen per year. " Inflation expectations are rising , increasing core consumer prices of about 1 %," - said in a statement the Bank of Japan released after the meeting. Last month, the central bank said that CPI « varied in the range of 0.5 % -1.0 %."

EUR / USD: during the European session, the pair rose to $ 1.3663 and retreated

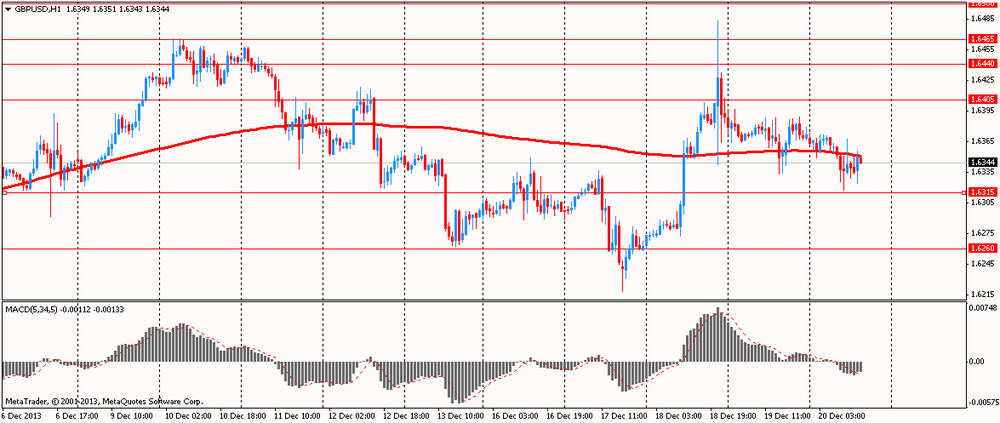

GBP / USD: during the European session, the pair traded in the range of $ 1.6317 - $ 1.6367

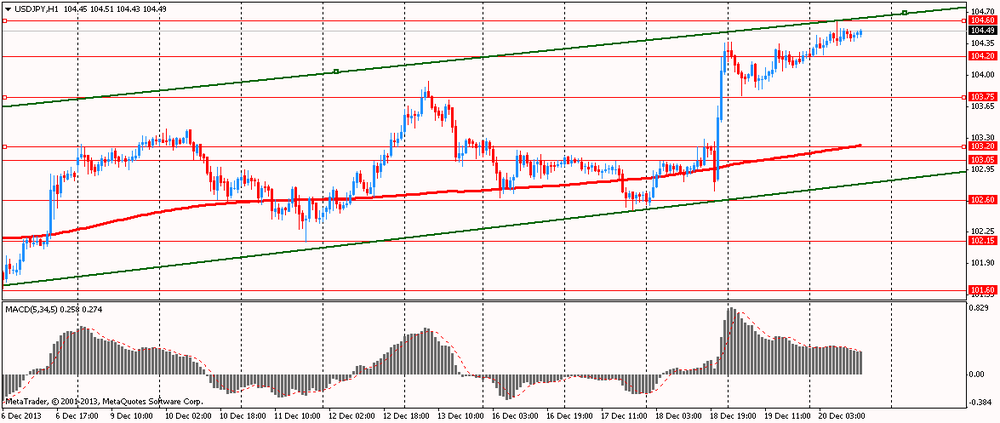

USD / JPY: during the European session, the pair rose to Y104.60

At 13:30 GMT , Canada will release the consumer price index , core consumer price index from the Bank of Canada in November , retail sales volume change , the change in retail sales excluding auto sales for October. At 13:30 GMT the United States will in the final data on the change in GDP , personal consumption expenditures index , the main index of personal consumption expenditures for the 3rd quarter . At 15:00 GMT Eurozone release indicator of consumer confidence for December.

-

13:00

Orders

EUR/USD

Offers $1.3770/80, $1.3750, $1.3730, $1.3700/10

Bids $1.3600, $1.3590, $1.3580/75

GBP/USD

Offers $1.6500, $1.6450, $1.6410, $1.6390/400

Bids $1.6320/15, $1.6300, $1.6295/90, $1.6280/75, $1.6250/40

AUD/USD

Offers $0.8980/90, $0.8950, $0.8920, $0.8900/10, $0.8885/90

Bids $0.8825/20, $0.8800, $0.8750

EUR/JPY

Offers Y144.20, Y144.00, Y143.50, Y143.00

Bids Y142.20, Y142.05/00, Y141.80/60, Y141.50, Y141.25/20

USD/JPY

Offers Y106.00, Y105.00

Bids Y104.00, Y103.80/75, Y103.65/60

EUR/GBP

Offers stg0.8467, stg0.8435/40, stg0.8415/20, stg0.8400, stg0.8380/85

Bids stg0.8330/20, stg0.8300/290, stg0.8260/50

-

10:25

Option expiries for today's 1400GMT cut

USD/JPY Y103.00, Y103.50, Y104.00, Y104.25, Y104.50, Y105.00

EUR/JPY Y142.75

EUR/USD $1.3600, $1.3635, $1.3650, $1.3700, $1.3775, $1.3780

GBP/USD $1.6200, $1.6300, $1.6350

EUR/GBP stg0.8405

USD/CHF Chf0.8875, Chf0.9020, Chf0.9110

EUR/CHF Chf1.2220, Chf1.2275

AUD/USD $0.8850, $0.8875, $0.8900, $0.9000, $0.9020

AUD/JPY Y92.75

NZD/USD $0.8075, $0.8195, $0.8300

USD/CAD C$1.0700, C$1.0775, C$1.0800

-

09:31

United Kingdom: PSNB, bln, November 14.8 (forecast 6.6)

-

09:30

United Kingdom: Current account, bln , Quarter III -20.7 (forecast -13.8)

-

09:30

United Kingdom: GDP, q/q, Quarter III +0.8% (forecast +0.8%)

-

09:30

United Kingdom: GDP, y/y, Quarter III +1.9% (forecast +1.5%)

-

07:18

Asian session: The Bloomberg U.S. Dollar Index touched its highest level in two weeks

00:01 United Kingdom BOE Quarterly Bulletin Quarter IV

00:05 United Kingdom Gfk Consumer Confidence December -12 -11 -13

02:00 New Zealand Credit Card Spending November -0.8% +3.5%

03:30 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:30 Japan Bank of Japan Monetary Base Target 270 270 270

03:30 Japan BoJ Monetary Policy Statement

The U.S. Dollar Index touched its highest level in two weeks amid prospects the Federal Reserve will continue to dial back monthly bond buying after announcing a $10 billion cut. U.S. gross domestic product rose at a 3.6 percent annual rate in the third quarter, the strongest since the first quarter of 2010, a Commerce Department report today will confirm, according to the median estimate in a Bloomberg News survey. A report Dec. 23 will show personal income and spending accelerated in November, separate polls forecast.

The euro fell a third day to its lowest since Dec. 6 as traders speculated the European Central Bank will need to loosen monetary conditions to support the region’s fragile recovery. ECB President Mario Draghi said Dec. 16 low there are risks from long periods of low inflation and policy makers have tools to address this, including “several other instruments on the liquidity front.”

The yen held declines against most major peers after the Bank of Japan retained its plan to add 60 trillion yen ($575 billion) to 70 trillion yen a year to the monetary base. BOJ policy makers, led by Governor Haruhiko Kuroda, said following a two-day policy meeting that they will continue easing until 2 percent annual inflation is stable. The BOJ will examine the risks and make policy adjustments as needed, according to a statement. Most economists surveyed by Bloomberg News anticipate the central bank will escalate its stimulus after the national sales tax is raised in April.

EUR / USD: during the Asian session the pair fell to $ 1.3630

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6350-70

USD / JPY: during the Asian session, the pair rose to Y104.60

UK public borrowing data and the Q3 GDP third reading due at 0930GMT, ahead of BOE Haldane speaking at 1100GMT, provides the morning's interest. Sterling retains an underlying buoyant tone with most expecting the pound to make further gains versus the euro. -

07:01

Germany: Producer Price Index (YoY), November -0.8% (forecast -0.8%)

-

07:00

Germany: Gfk Consumer Confidence Survey, January 7.6 (forecast 7.4)

-

07:00

Germany: Producer Price Index (MoM), November -0.1% (forecast 0.0%)

-

06:21

Currencies. Daily history for Dec 19'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3660 -0,18%

GBP/USD $1,6371 -0,11%

USD/CHF Chf0,8976 +0,43%

USD/JPY Y104,23 -0,03%

EUR/JPY Y142,39 -0,21%

GBP/JPY Y170,60 -0,15%

AUD/USD $0,8865 +0,07%

NZD/USD $0,8190 -0,56%

USD/CAD C$1,0662 -0,36%

-

06:02

Schedule for today, Friday, Dec 20’2013:

00:01 United Kingdom BOE Quarterly Bulletin Quarter IV

00:05 United Kingdom Gfk Consumer Confidence December -12 -11

02:00 New Zealand Credit Card Spending November -0.8%

03:30 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:30 Japan Bank of Japan Monetary Base Target 270 270

03:30 Japan BoJ Monetary Policy Statement

07:00 Germany Producer Price Index (MoM) November -0.2% 0.0%

07:00 Germany Producer Price Index (YoY) November -0.7% -0.8%

07:00 Germany Gfk Consumer Confidence Survey January 7.4 7.4

07:30 Japan BOJ Press Conference

09:30 United Kingdom Current account, bln Quarter III -13.0 -13.8

09:30 United Kingdom PSNB, bln November 6.4 6.6

09:30 United Kingdom GDP, q/q (Finally) Quarter III +0.8% +0.8%

09:30 United Kingdom GDP, y/y (Finally) Quarter III +1.5% +1.5%

13:30 Canada Retail Sales, m/m October +1.0% +0.3%

13:30 Canada Retail Sales ex Autos, m/m October 0.0% 0.0%

13:30 Canada Consumer Price Index m / m November -0.2% +0.2%

13:30 Canada Consumer price index, y/y November +0.7% +1.0%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m November +0.2% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November +1.2% +1.2%

13:30 U.S. PCE price index, q/q Quarter III +1.4% +1.4%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +1.5% +1.5%

13:30 U.S. GDP, q/q (Finally) Quarter III +3.6% +3.6%

15:00 Eurozone Consumer Confidence December -15.4 -15.0

15:00 U.S. Fed Chairman Nomination Vote

-