Notícias do Mercado

-

20:00

Dow +100.28 16,279.36 +0.62% Nasdaq +51.53 4,109.67 +1.27% S&P +13.13 1,822.73 +0.73%

-

19:20

American focus : the euro has increased markedly U.S. dollar

The euro exchange rate rose sharply against the dollar, while restoring all the previously lost positions , and updating the session high. Helped strengthen the euro currency data that showed pessimism among consumers of the 17 eurozone countries decreased significantly in December , exceeding with evaluation experts, and offsetting deterioration in the previous month. It became known from the latest data , which were presented to the European Commission.

According to the report , a preliminary index of consumer confidence rose to 13.6 points in December , compared with -15.4 points a month earlier. According to the average forecasts of experts, this indicator was improved to the level of -15.0 points.

It should be noted that these data were released today after a report showed that German consumers are more confident in December than expected, which is likely , and helped increase the total index for the euro area .

The latest report is likely to be welcomed by politicians of the European Central Bank, as it indicates that the current year to end on a positive note. Note that in the last months of data showed that unlike Germany, economic growth in France, Italy and Spain was not pleased that caused doubt in accelerating growth in the current quarter . Recall that in the second quarter of the eurozone economy grew by 0.3%.

The yen retreated from a 5- year high , and that was due to the general weakening of the dollar, even though a positive report on U.S. GDP . Experts note that the upward revision of GDP reinforced expectations that the Fed will continue rolling asset purchases in 2014. Key elements are the unemployment rate / p and employment without regard to the / x sector. However, today published a revised GDP is also important , as it reflects the strong growth in consumption, which may contribute to increased employment. Meanwhile, experts said that , despite the fact that today the dollar not strengthened , GDP data will contribute to the growth of the U.S. currency in the medium term .

The Canadian dollar rose against the U.S. dollar by restoring all the previously lost ground. The course of trade a considerable impact on U.S. GDP data , which caused the Canadian dollar to drop significantly , albeit briefly . Later, the market turned its attention to Canadian reports which, although lower than forecast, indicated a slight improvement . Note that one of the reports showed that annual inflation in Canada rose by less than 1% the second consecutive month in November , as higher energy costs and the vegetables were offset by lower prices for mortgage loans on household tools and prescription drugs . Overall consumer price index in November rose by 0.9 % compared with the previous year Growth was higher growth the previous month by 0.7 % , but below market expectations at 1.0% increase .

Core CPI , which excludes volatile components, such as some food and energy , rose 1.1 %, below market expectations of 1.2 % growth and the slowest annual growth rate in five months.

Meanwhile, other data showed that retail sales fell 0.1% in October compared with the previous month to 40.72 billion Canadian dollars ( $ 38,180 million). Market expectations were at the level of growth of 0.3%. In volume terms, sales in October rose 0.2 %. In annual terms retail sales rose 3.0%. Except for the automotive sector Canadian retail sales in October rose 0.4 % for the month and reached 31.21 billion Canadian dollars .

-

18:21

European stock close

European shares rose for a third day, heading for their biggest weekly jump since April, as insurers and banks rallied.

The Stoxx Europe 600 Index advanced 0.5 percent to 321.11 at 4:38 p.m. in London, bringing its increase for the week to 3.7 percent, after the Federal Reserve said it would start paring its record stimulus. Shares extended their rally today after a report showed the U.S. economy expanded in the third quarter at a faster rate than previously forecast.

The Stoxx 600 climbed 1.7 percent yesterday for its biggest two-day gain since June after the Federal Open Market Committee said Dec. 18 that it will lower monthly asset purchases to $75 billion from $85 billion. The central bank also said it will probably hold key interest rates within the current range of zero to 0.25 percent “well past the time that the unemployment rate declines below 6.5 percent,” according to its statement.

U.S. gross domestic product climbed at a 4.1 percent annualized rate in the quarter ended September, Commerce Department figures showed. That’s the strongest pace since the final three months of 2011 and up from a previous estimate of 3.6 percent. The median forecast of economists projected a 3.6 percent pace after 2.5 percent in the second quarter.

Data from Nuremberg-based GfK SE showed a gauge of German consumer confidence will climb to 7.6 in January from 7.4 this month, the highest reading since August 2007. A U.K. consumer sentiment index by GfK NOP Ltd. dropped 1 point in December from November to minus 13, the London-based research group said. The median forecast of economists called for a 1-point increase to minus 11.

National benchmark indexes rose in 16 of the 18 western-European markets.

FTSE 100 6,606.58 +21.88 +0.33% CAC 40 4,193.77 +16.74 +0.40% DAX 9,400.18 +64.44 +0.69%

Carnival advanced 3.3 percent to 2,389 pence. Credit Suisse raised its rating to outperform from neutral and Natixis increased it to neutral from reduce. The world’s largest cruise operator posted fourth-quarter profit that beat analysts’ estimates yesterday.

German healthcare provider Rhoen Klinikum AG jumped 5.2 percent to 21.43 euros, its highest price since June 2012. Shareholder B Braun Melsungen AG withdrew its lawsuit against Rhoen-Klinikum’s sale of 43 clinics and other assets to Fresenius SE’s Helios unit, according to a statement.

Telenet Group Holding NV rose 2.9 percent to 42.12 euros after Goldman Sachs Group Inc. upgraded the stock to buy from neutral, citing growth prospects.

BAE retreated 4.5 percent to 422.1 pence. Europe’s largest defense company said yesterday that the United Arab Emirates stopped talks to buy its Eurofighter Typhoon, just weeks after Prime Minister David Cameron lobbied for them in Dubai. Negotiations with Saudi Arabia over pricing are also dragging out, delaying BAE’s efforts to beef up its export business.

Lundin Petroleum AB lost 7.8 percent to 121.20 kronor after Norway said the Swedish oil explorer drilled a dry well.

-

17:00

European stock close: FTSE 100 6,606.58 +21.88 +0.33% CAC 40 4,193.77 +16.74 +0.40% DAX 9,400.18 +64.44 +0.69%

-

16:41

Oil: an overview of the market situation

Oil prices have risen significantly today , rising at the same time above $ 111 per barrel (Brent) $ 98 per barrel (WTI), and is now directed to its weekly gain , which is associated with a positive outlook for fuel demand in the U.S. and a decrease in Libyan supplies. We add that the oil prices are also rising in the background of that presented earlier this week, a report showed that U.S. crude stocks fell , while the decision to the U.S. Federal Reserve to start reducing bond-buying program has supported the view that the U.S. economy is on the road to recovery.

U.S. crude WTI c beginning of the week up 2.5 percent, while prices for Brent demonstrate weekly gain at 2 percent.

It should be noted that support prices were surprisingly strong U.S. data . According to the report , U.S. GDP grew in the third quarter by 4.1 % year on year , showing the highest since the fourth quarter 2011 preliminary estimate of GDP growth in the third quarter was at 3.6 %. The median estimate of GDP growth economists was also at the level of 3.6%. Growth stocks accounts for about one-third of GDP growth in the third quarter, which shows the company's confidence in the prospects for demand. Growth in retail sales in October and November, the Fed confirmed assessment that the economy is growing . Growth in market share increased estimate of household assets , as house prices rise . Along with the increasing number of employees, and lower unemployment , consumption seems to have become grow. Consumer spending rose by 2% , compared to 1.4% according to preliminary estimates . Cost of services led to GDP growth of 0.32% in the third quarter . In addition to increased health care costs, increased spending on leisure . Spending on nondurable goods rose 2.9 %.

Prices were also supported by the ongoing supply problem in Libya where crude oil exports fell to 110,000 barrels per day, with more than 1 million barrels per day in July.

Cost February on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 99.04 a barrel on the New York Mercantile Exchange.

February futures price for North Sea Brent crude oil mixture increased by $ 1.22 to $ 111.27 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold futures rose today, but , nevertheless, remain near six-month lows on the news that the Federal Reserve will begin to reduce the amount of its program to stimulate the economy in the next month , which will put pressure on the precious metal. Now gold prices could recover above $ 1,200 per ounce, which was broken during yesterday's trading .

Meanwhile, we add that the attention of the market also attracted U.S. GDP data . It is learned that the U.S. economy grew stronger pace of 4.1 % in the third quarter. Growth was stronger than previously estimated , as new data showed that consumer spending accelerated in the summer.

Department of Commerce previously reported on the annual growth rate of 3.6 % in July-September . A new estimate on Friday showed that gross domestic product , the sum of all goods and services produced in the economy grew at the fastest pace since the fourth quarter of 2011, and became the second fastest rise since the beginning in mid-2009 . Economists had forecast a revised third-quarter growth rate of 3.6%.

In addition, it was reported that the world's largest reserves of gold exchange-traded fund secured (ETF) SPDR Gold Trust on Thursday declined by 3.9 tonnes to 808.72 tonnes - its lowest level in nearly five years. Outflow for the year of the eight largest " gold " ETF world totaled 720 tons, as investors prefer stocks.

Demand in the physical market grew only slightly at lower prices because consumers expect that gold prices will drop even more.

Studies show that experts expect a reduction in demand for the metal. Manufacture of jewelery will fall significantly in the near future that will provoke the proposed reduction of gold bullion purchases by 50%.

The cost of the December gold futures on the COMEX today rose to $ 1200.40 per ounce.

-

15:00

Eurozone: Consumer Confidence, December -13.6 (forecast -15.0)

-

14:34

U.S. Stocks open: Dow 16,180.36 +1.28 +0.01%, Nasdaq 4,066.44 +8.30 +0.20%, S&P 1,811.29 +1.69 +0.09%

-

14:25

Before the bell: S&P futures +0.19%, Nasdaq futures +0.29%

U.S. stock futures rose, as data showing faster-than-estimated growth boosted confidence in the world’s largest economy.

Global markets

Nikkei 15,870.42 +11.20 +0.07%

Hang Seng 22,812.18 -76.57 -0.33%

Shanghai Composite 2,084.79 -43.00 -2.02%

FTSE 6,601.34 +16.64 +0.25%

CAC 4,181.09 +4.06 +0.10%

DAX 9,382.73 +46.99 +0.50%

Crude oil $98.63 (+0.85%).

Gold $1191.60 (-0.17%).

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y103.00, Y103.50, Y104.00, Y104.25, Y104.50, Y105.00

EUR/JPY Y142.75

EUR/USD $1.3600, $1.3635, $1.3650, $1.3700, $1.3775, $1.3780

GBP/USD $1.6200, $1.6300, $1.6350

EUR/GBP stg0.8405

USD/CHF Chf0.8875, Chf0.9020, Chf0.9110

EUR/CHF Chf1.2220, Chf1.2275

AUD/USD $0.8850, $0.8875, $0.8900, $0.9000, $0.9020

AUD/JPY Y92.75

NZD/USD $0.8075, $0.8195, $0.8300

USD/CAD C$1.0700, C$1.0775, C$1.0800

-

13:32

U.S.: PCE price index ex food, energy, q/q, Quarter III +1.4% (forecast +1.5%)

-

13:31

Canada: Consumer Price Index m / m, November 0.0% (forecast +0.2%)

-

13:31

Canada: Consumer price index, y/y, November +0.9% (forecast +1.0%)

-

13:31

Canada: Bank of Canada Consumer Price Index Core, m/m, November -0.1% (forecast +0.1%)

-

13:31

Canada: Bank of Canada Consumer Price Index Core, y/y, November +1.1% (forecast +1.2%)

-

13:31

U.S.: PCE price index, q/q, Quarter III +2.0% (forecast +1.4%)

-

13:30

U.S.: GDP, q/q, Quarter III +4.1% (forecast +3.6%)

-

13:30

Canada: Retail Sales, m/m, October -0.1% (forecast +0.3%)

-

13:30

Canada: Retail Sales ex Autos, m/m, October +0.4% (forecast 0.0%)

-

13:15

European session: the euro rose

07:00 Germany Producer Price Index (MoM) November -0.2% 0.0% -0.1%

07:00 Germany Producer Price Index (YoY) November -0.7% -0.8% -0.8%

07:00 Germany Gfk Consumer Confidence Survey January 7.4 7.4 7.6

07:30 Japan BOJ Press Conference

09:30 United Kingdom Current account, bln Quarter III -6.1 Revised From -13.0 -13.8 -20.7

09:30 United Kingdom PSNB, bln November 7.4 Revised From 6.4 6.6 14.8

09:30 United Kingdom GDP, q/q (Finally) Quarter III +0.8% +0.8% +0.8%

09:30 United Kingdom GDP, y/y (Finally) Quarter III +1.5% +1.5% +1.9%

The euro shows a slight increase against the U.S. dollar in anticipation of the U.S. GDP . Support for the single currency was partially data research group GfK, according to which the German consumer confidence index rose to its highest level in more than six years in January. Expected consumer confidence index for January rose to 7.6 from 7.4 in December. Economists expected the index to remain at the level of December . As reported in the survey report GfK, the value in January was the highest since August 2007 . "Consumer climate is preparing for a good start in the new year ," they added .

German economic expectations rose for the fourth month in a row in December. Corresponding indicator was 23.3 points , adding 3 points from November . Indicator , which measures consumers' income expectations fell in December after recording significant gains in the previous month . Index fell 5.7 points to 39.5 points. However, the reduction is relatively small as compared with an increase of 12 points in November. and

Another report showed that the German producer price index fell by 0.8 percent year on year in November after falling 0.7 percent in October . Result is consistent with economists' expectations . In monthly terms, the producer price index fell 0.1 percent in November . Economists had expected prices to remain unchanged compared with the previous month .

The euro rose slightly against the dollar, despite the downgrade of EU rating agency Standard & Poor's from AAA to AA +. The agency cited the " weakening of the interaction " and new complications in the negotiations on the budget.

Pound traded steadily against the U.S. currency against the background of the final GDP data for Britain. The UK economy expanded by 0.8 percent in the quarterly measurement in the third quarter , coinciding with the second assessment , published on November 27. Nevertheless, the statistical agency with increased slightly revised the GDP for the second quarter and showed 0.8 percent expansion compared with the previous reporting an increase of 0.7 percent. GDP grew by 1.9 percent year on year in the third quarter , according to the ONS. This result is improved compared with 1.5 percent growth , which was reported in the second assessment .

Slight pressure on the pound had data from GfK, according to which the index measuring consumer confidence in the UK fell for the third month in a row in December. Index fell to -13 points , giving analysts, who expected to improve to -11 after the index reached -12 in November. Among the individual components of the survey, the economic outlook fell to -4 s -1 in the previous month . Major component purchases fell to -17 from -13 the previous month. At the same time, GfK noted that all these figures were significantly higher than a year ago , when the overall index fell to -29 points. Prospects component was -31 points in December 2012 , but a component of large purchases made -27 points.

The yen fell against most major currencies after the Bank of Japan left unchanged targets expansion of the monetary base in the range of 60 trillion yen ( $ 581 billion ) to 70 trillion yen per year. " Inflation expectations are rising , increasing core consumer prices of about 1 %," - said in a statement the Bank of Japan released after the meeting. Last month, the central bank said that CPI « varied in the range of 0.5 % -1.0 %."

EUR / USD: during the European session, the pair rose to $ 1.3663 and retreated

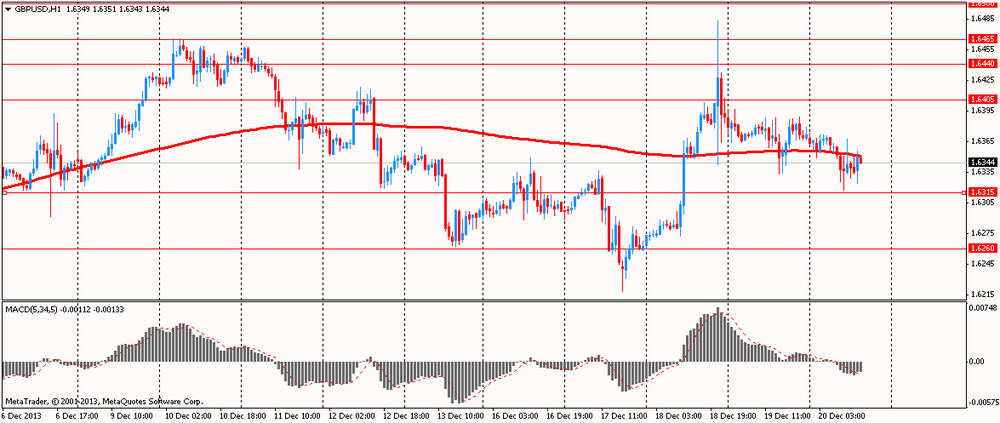

GBP / USD: during the European session, the pair traded in the range of $ 1.6317 - $ 1.6367

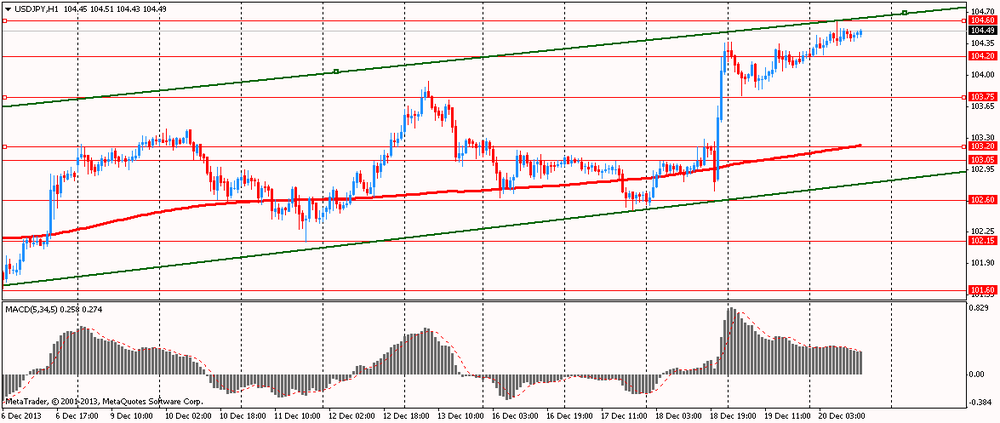

USD / JPY: during the European session, the pair rose to Y104.60

At 13:30 GMT , Canada will release the consumer price index , core consumer price index from the Bank of Canada in November , retail sales volume change , the change in retail sales excluding auto sales for October. At 13:30 GMT the United States will in the final data on the change in GDP , personal consumption expenditures index , the main index of personal consumption expenditures for the 3rd quarter . At 15:00 GMT Eurozone release indicator of consumer confidence for December.

-

13:00

Orders

EUR/USD

Offers $1.3770/80, $1.3750, $1.3730, $1.3700/10

Bids $1.3600, $1.3590, $1.3580/75

GBP/USD

Offers $1.6500, $1.6450, $1.6410, $1.6390/400

Bids $1.6320/15, $1.6300, $1.6295/90, $1.6280/75, $1.6250/40

AUD/USD

Offers $0.8980/90, $0.8950, $0.8920, $0.8900/10, $0.8885/90

Bids $0.8825/20, $0.8800, $0.8750

EUR/JPY

Offers Y144.20, Y144.00, Y143.50, Y143.00

Bids Y142.20, Y142.05/00, Y141.80/60, Y141.50, Y141.25/20

USD/JPY

Offers Y106.00, Y105.00

Bids Y104.00, Y103.80/75, Y103.65/60

EUR/GBP

Offers stg0.8467, stg0.8435/40, stg0.8415/20, stg0.8400, stg0.8380/85

Bids stg0.8330/20, stg0.8300/290, stg0.8260/50

-

11:30

European shares advanced for a second day

European shares advanced for a second day, heading for their biggest weekly jump since April, after the U.S. Federal Reserve said it would slow the pace of its bond buying. U.S. stock-index futures rose and Asian shares were little changed.

The Fed’s Open Market Committee said Dec. 18 that it will lower monthly asset purchases to $75 billion from $85 billion. The central bank also said it will probably hold key interest rates within the current range of zero to 0.25 percent “well past the time that the unemployment rate declines below 6.5 percent,” according to their statement.

In Germany, data from Nuremberg-based GfK SE showed a gauge of consumer confidence in Europe’s largest economy will climb to 7.6 in January from 7.4 this month, the highest reading since August 2007. A U.K. consumer sentiment index by GfK NOP Ltd. dropped 1 point in December from November to minus 13, the London-based research group said. The median forecast of 24 economists in a Bloomberg News survey was for a 1-point increase to minus 11.

The European Union lost its top credit rating from Standard & Poor’s, which cut its long-term rating to AA+ from AAA, citing weaker creditworthiness.

Telenet rose 2.6 percent to 41.98 euros. Goldman Sachs raised its rating on the stock to buy from neutral, citing growth prospects.

Financial companies and banks in the Stoxx 600 posted the biggest gains as a group. Italy’s Banca Monte dei Paschi di Siena SpA rallied 4.8 percent and Deutsche Boerse AG climbed 2.3 percent.

Carnival Corp. advanced 3.1 percent to 2,384 pence. Credit Suisse Group AG and Natixis SA raised their ratings on the shares after the world’s largest cruise operator posted fourth-quarter profit that beat analysts’ estimates yesterday.

BAE retreated 4.9 percent to 420.3 pence. Europe’s largest defense company said yesterday that the United Arab Emirates stopped talks to buy its Eurofighter Typhoon, just weeks after Prime Minister David Cameron personally lobbied for them in Dubai. Negotiations with Saudi Arabia over pricing are also dragging out, delaying BAE’s efforts to beef up its export business.

FTSE 100 6,584.86 +0.16 0.00%

CAC 40 4,169.6 -7.43 -0.18%

DAX 9,366.43 +30.69 +0.33%

-

10:25

Option expiries for today's 1400GMT cut

USD/JPY Y103.00, Y103.50, Y104.00, Y104.25, Y104.50, Y105.00

EUR/JPY Y142.75

EUR/USD $1.3600, $1.3635, $1.3650, $1.3700, $1.3775, $1.3780

GBP/USD $1.6200, $1.6300, $1.6350

EUR/GBP stg0.8405

USD/CHF Chf0.8875, Chf0.9020, Chf0.9110

EUR/CHF Chf1.2220, Chf1.2275

AUD/USD $0.8850, $0.8875, $0.8900, $0.9000, $0.9020

AUD/JPY Y92.75

NZD/USD $0.8075, $0.8195, $0.8300

USD/CAD C$1.0700, C$1.0775, C$1.0800

-

10:03

Asia Pacific stocks close

Asia’s benchmark stock index fell for the first time in four days as Chinese shares slid on concern funding costs for lenders will remain high even after the central bank injected liquidity. Japan’s Nikkei 225 Stock Average rose as the yen reached a five-year low.

Nikkei 225 15,870.42 +11.20 +0.07%

Hang Seng 22,812.18 -76.57 -0.33%

S&P/ASX 200 5,265.22 +62.99 +1.21%

Shanghai Composite 2,084.79 -43.00 -2.02%

Ping An Insurance Co., China’s second-largest insurer, declined 4.6 percent to lead declines on the Hang Seng Index.

Mazda Motor Corp., a Japanese carmaker that gets 73 percent of sales abroad, climbed 3.5 percent.

Telstra Corp. rose 1.8 percent, pushing Australia’s benchmark index to the biggest weekly gain in almost eight months, after agreeing to sell its Hong Kong mobile phone business.

-

09:31

United Kingdom: PSNB, bln, November 14.8 (forecast 6.6)

-

09:30

United Kingdom: Current account, bln , Quarter III -20.7 (forecast -13.8)

-

09:30

United Kingdom: GDP, q/q, Quarter III +0.8% (forecast +0.8%)

-

09:30

United Kingdom: GDP, y/y, Quarter III +1.9% (forecast +1.5%)

-

08:59

FTSE 100 6,593.03 +8.33 +0.13%, CAC 40 4,177.09 +0.06 0.00%, Xetra DAX 9,362.45 +26.71 +0.29%

-

07:41

European bourses are initially seen trading higher Friday: the FTSE up 13, the DAX up 24, the CAC up 13.

-

07:18

Asian session: The Bloomberg U.S. Dollar Index touched its highest level in two weeks

00:01 United Kingdom BOE Quarterly Bulletin Quarter IV

00:05 United Kingdom Gfk Consumer Confidence December -12 -11 -13

02:00 New Zealand Credit Card Spending November -0.8% +3.5%

03:30 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:30 Japan Bank of Japan Monetary Base Target 270 270 270

03:30 Japan BoJ Monetary Policy Statement

The U.S. Dollar Index touched its highest level in two weeks amid prospects the Federal Reserve will continue to dial back monthly bond buying after announcing a $10 billion cut. U.S. gross domestic product rose at a 3.6 percent annual rate in the third quarter, the strongest since the first quarter of 2010, a Commerce Department report today will confirm, according to the median estimate in a Bloomberg News survey. A report Dec. 23 will show personal income and spending accelerated in November, separate polls forecast.

The euro fell a third day to its lowest since Dec. 6 as traders speculated the European Central Bank will need to loosen monetary conditions to support the region’s fragile recovery. ECB President Mario Draghi said Dec. 16 low there are risks from long periods of low inflation and policy makers have tools to address this, including “several other instruments on the liquidity front.”

The yen held declines against most major peers after the Bank of Japan retained its plan to add 60 trillion yen ($575 billion) to 70 trillion yen a year to the monetary base. BOJ policy makers, led by Governor Haruhiko Kuroda, said following a two-day policy meeting that they will continue easing until 2 percent annual inflation is stable. The BOJ will examine the risks and make policy adjustments as needed, according to a statement. Most economists surveyed by Bloomberg News anticipate the central bank will escalate its stimulus after the national sales tax is raised in April.

EUR / USD: during the Asian session the pair fell to $ 1.3630

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6350-70

USD / JPY: during the Asian session, the pair rose to Y104.60

UK public borrowing data and the Q3 GDP third reading due at 0930GMT, ahead of BOE Haldane speaking at 1100GMT, provides the morning's interest. Sterling retains an underlying buoyant tone with most expecting the pound to make further gains versus the euro. -

07:01

Germany: Producer Price Index (YoY), November -0.8% (forecast -0.8%)

-

07:00

Germany: Gfk Consumer Confidence Survey, January 7.6 (forecast 7.4)

-

07:00

Germany: Producer Price Index (MoM), November -0.1% (forecast 0.0%)

-

06:22

Commodities. Daily history for Dec 19’2013:

Gold $1,196.1 -40.00 -3.24%

Oil $98.63 +0.83 +0.85%

-

06:22

Stocks. Daily history for Dec 19’2013:

Nikkei 225 15,859.22 +271.42 +1.74%

S&P/ASX 200 5,202.23 +106.13 +2.08%

Shanghai Composite 2,127.79 -20.49 -0.95%

FTSE 100 6,584.7 +92.62 +1.43%

CAC 40 4,177.03 +67.52 +1.64%

DAX 9,335.74 +153.99 +1.68%

Dow +11.05 16,179.02 +0.07%

Nasdaq -11.92 4,058.14 -0.29%

S&P -1.05 1,809.60 -0.06%

-

06:21

Currencies. Daily history for Dec 19'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3660 -0,18%

GBP/USD $1,6371 -0,11%

USD/CHF Chf0,8976 +0,43%

USD/JPY Y104,23 -0,03%

EUR/JPY Y142,39 -0,21%

GBP/JPY Y170,60 -0,15%

AUD/USD $0,8865 +0,07%

NZD/USD $0,8190 -0,56%

USD/CAD C$1,0662 -0,36%

-

06:02

Schedule for today, Friday, Dec 20’2013:

00:01 United Kingdom BOE Quarterly Bulletin Quarter IV

00:05 United Kingdom Gfk Consumer Confidence December -12 -11

02:00 New Zealand Credit Card Spending November -0.8%

03:30 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:30 Japan Bank of Japan Monetary Base Target 270 270

03:30 Japan BoJ Monetary Policy Statement

07:00 Germany Producer Price Index (MoM) November -0.2% 0.0%

07:00 Germany Producer Price Index (YoY) November -0.7% -0.8%

07:00 Germany Gfk Consumer Confidence Survey January 7.4 7.4

07:30 Japan BOJ Press Conference

09:30 United Kingdom Current account, bln Quarter III -13.0 -13.8

09:30 United Kingdom PSNB, bln November 6.4 6.6

09:30 United Kingdom GDP, q/q (Finally) Quarter III +0.8% +0.8%

09:30 United Kingdom GDP, y/y (Finally) Quarter III +1.5% +1.5%

13:30 Canada Retail Sales, m/m October +1.0% +0.3%

13:30 Canada Retail Sales ex Autos, m/m October 0.0% 0.0%

13:30 Canada Consumer Price Index m / m November -0.2% +0.2%

13:30 Canada Consumer price index, y/y November +0.7% +1.0%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m November +0.2% +0.1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November +1.2% +1.2%

13:30 U.S. PCE price index, q/q Quarter III +1.4% +1.4%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +1.5% +1.5%

13:30 U.S. GDP, q/q (Finally) Quarter III +3.6% +3.6%

15:00 Eurozone Consumer Confidence December -15.4 -15.0

15:00 U.S. Fed Chairman Nomination Vote

-