Notícias do Mercado

-

20:00

Dow +1.35 16,169.32 +0.01% Nasdaq -12.69 4,057.37 -0.31% S&P -2.32 1,808.33 -0.13%

-

19:19

American focus : the euro fell slightly against the U.S. dollar

Rate of the euro traded in a range against the U.S. dollar, while demonstrating a slight decrease . Note that after adjusting Eurocurrency yesterday dollar growth caused by the decision to cut the Fed asset purchases by $ 10 billion to $ 75 billion a month , and an increase in the economic outlook for the United States . So , after a meeting of 17-18 December the Fed has reduced its quantitative easing program and kept the target range of the base interest rate of zero to 0.25 % per annum. Fed from January 2014 intends to reduce purchases of government bonds to $ 45 billion to $ 40 billion a month , mortgage-backed securities - from $ 40 billion to $ 35 billion a month . At the same time the Fed is ready to continue the reduction of future meetings , if justified its macroeconomic forecasts . The Federal Open Market Committee, stressed that the base rate will remain in the current range for a long time after the decline in the unemployment rate to less than 6.5% , especially in the case of continued low inflation .

As for economic data , today appreciable effect on the course of trading , they did not have .

The Canadian dollar rose sharply against the dollar , helped by the weak U.S. reports . The first is to provide data on the number of applications for unemployment benefits . In the Department of Labor reported that the number of people filing for first time applications for unemployment benefits rose by 10,000 and totaled a seasonally adjusted 379,000 in the week ended Dec. 14 , said Thursday . This is the highest level since March and well above 336,000 new claims economists expected . The number of applications from the previous week was revised up to 369,000 . New applications jumped by 74,000 in the past two weeks after moving to six-year lows in late November. The four-week moving average of claims, which smooths the volatile weekly data , rose by 13,250 to 343,500 .

Not pleased as data on the housing market. As it became known , existing home sales fell by 4.3% compared with the previous month to a seasonally adjusted annual rate of 4.90 million home sales fell 1.2 % compared with a year earlier, the first time in 29 months this index decreased compared to the same period last year. Economists had forecast a decline of 2.0% from October to November to an annual rate of 5.04 million .

The Swiss franc fell against the U.S. dollar, which has been associated with the release of unexpectedly weak data on Switzerland. As it became known , the trade surplus narrowed in November, Switzerland , contrary to expectations of improvement. The trade surplus fell to 2112 million Swiss francs from the downwardly revised 2282 million Swiss francs in October. Economists had forecast a surplus of 2.57 billion Swiss francs.

Exports rose for the second month in a row in real terms , after rising by 1.2 percent year on year , after growth of 0.3 percent in the previous month . Imports grew by 1.6 per cent per annum , after falling 2.7 percent in October. Jewelery exports hit a record high in November , while exports of chemicals and pharmaceuticals showed the biggest decline in two years.

-

18:21

European stock close

European stocks rallied the most in more than two months as the Federal Reserve’s decision to slow the pace of its stimulus boosted investor confidence that the U.S. economic recovery is on course.

The Stoxx Europe 600 Index rose 1.6 percent to 319.06 at 4:30 p.m. in London, for its biggest two-day gain since June. The gauge pared its losses since Nov. 28, when it hit its highest level since May 2008, to 1.9 percent.

The Fed said yesterday it will reduce its bond purchases to $75 billion a month from $85 billion in January, taking the first step toward unwinding the stimulus that Chairman Ben S. Bernanke put in place to help the economy recover from one of its worst recessions.

The U.S. central bank reiterated that it intends to hold its target interest rate near zero at least as long as unemployment exceeds 6.5 percent and the outlook for inflation is no higher than 2.5 percent. Twelve out of 17 Federal Open Market Committee participants predict the first increase in the main interest rate will come in 2015.

In Europe, finance ministers reached an agreement on how to deal with failing banks in the 17-nation euro area by pledging a 55 billion-euro ($75 billion) industry-financed fund for the next 10 years. They also backed an agency to make decisions on handling failing banks and when to share costs.

National benchmark indexes rose in all of the 18 western-European markets.

FTSE 100 6,584.7 +92.62 +1.43% CAC 40 4,177.03 +67.52 +1.64% DAX 9,335.74 +153.99 +1.68%

Saab surged 33 percent to 176.60 kronor, its highest price since May 2008. The Swedish maker of Gripen jets beat Boeing Co. and Dassault Aviation SA to win the contract to supply 36 jet fighters to Brazil. Celso Amorim, the South American country’s defense minister, said the government picked Saab over Boeing because of the performance and cost of its aircraft as well as Saab’s willingness to transfer technology. The deal is worth $4.5 billion through 2023.

Amadeus rose 3.8 percent to 29.47 euros, its highest price since it listed its shares in April 2010. Group revenue will reach 3.16 billion euros in 2013, while adjusted earnings will be 1.40 euros per share, the company said late yesterday. The forecasts beat the average analyst estimates of 3.1 billion euros in sales and 1.39 euros in earnings per share. Amadeus will also increase its gross interim dividend to 30 euro cents.

Algeta advanced 1.4 percent to 358.60 kroner, its highest price since it sold shares to the public in 2007. Bayer said it will buy the Oslo-based drugmaker for about 17.6 billion kroner ($2.9 billion). Bayer will make the offer at 362 kroner per share. Algeta said last month it had received a preliminary offer from Bayer for 336 kroner.

Mediaset SpA jumped 16 percent to 3.37 euros, its biggest rally since its listing in 1996. Deutsche Bank AG analyst Laurie Davison wrote that a plan by the company and Mediaset Espana Comunicacion SA to spin off their pay-TV operations was aimed at bringing in a partner for that business. A stake sale in the new entity to Vivendi SA or Al-Jazeera could reduce the costs of soccer-broadcasting rights, the analyst wrote.

AstraZeneca Plc added 1 percent to 3,597 pence, the lowest price since March 2002. The drugmaker will pay as much as $4.3 billion to buy Bristol-Myers Squibb Co.’s share of their diabetes drugs joint venture. The purchase gives AstraZeneca sole control of treatments such as Onglyza and Forxiga.

-

17:00

European stock close: FTSE 100 6,584.7 +92.62 +1.43% CAC 40 4,177.03 +67.52 +1.64% DAX 9,335.74 +153.99 +1.68%

-

16:40

Oil: an overview of the market situation

Oil prices rose modestly today , rising above $ 110 per barrel (Brent) and $ 98 per barrel as the market ignored the decision by the U.S. Federal Reserve on the reduction of its program of monetary stimulus , and focused on the reduction in U.S. oil inventories . Oil prices have faced some obstacles early in the session after the dollar rose strongly on the decision of the Federal Reserve , but were able to grow at that time , as U.S. traders arrived at their jobs.

The only negative factor for oil were present data on the number of applications for unemployment benefits , but even they could not stop the rise in prices. As it became known , the number of people filing for first time applications for unemployment benefits rose a second consecutive week , becoming a potentially troubling sign for the labor market , which showed strengthening .

The number of initial claims for unemployment benefits , a measure of layoffs, increased by 10,000 and amounted to a seasonally adjusted 379,000 in the week ended December 14. This is the highest level since March and well above 336,000 new claims economists expected . Analyst Department of Labor said that there were no special factors influencing the latest figures , but he cautioned that the data on applications tend to be volatile during the festive season . The number of applications from the previous week was revised up to 369,000 . New applications jumped by 74,000 in the past two weeks after moving to six - year lows in late November.

The course of trade also continue to influence yesterday's data from the U.S. Department of Energy on wholesale inventories of raw materials in the country , which fell by 2.9 million barrels , while analysts expected a decline of 2.3 million barrels.

Cost January futures for U.S. light crude oil WTI (Light Sweet Crude Oil) grew by $ 0.72 - to $ 98.52 per barrel on the New York Mercantile Exchange.

January futures price for North Sea Brent crude oil mixture increased by $ 1.07 to $ 110.36 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices declined significantly today , while reaching its lowest level since July this year , given the fact that yesterday the Fed announced the decline in bond purchases , as a first step in the rejection of the super soft monetary policy. Note that earlier this policy helped the gold price rise to a record high , and it is up to $ 1,920 per ounce.

The Federal Reserve announced that will gradually collapse quantitative easing program from January 2014. This ministry said after a meeting of the Committee on the open market . The volume of the initial reduction of redemption will be $ 10 billion - to $ 75 billion from $ 85 billion the Fed motivates its decision strengthening the U.S. labor market . Measures to reduce the bond purchases will be taken further if the economic recovery continues.

We add that the expectation that the program will be reduced , the price of gold dropped by more than 25 percent this year , recording the biggest drop in more than 30 years.

The course also influenced today's trading data on the U.S. housing market . As it became known that sales of existing homes fell to the lowest level in nearly a year in November , becoming evidence that higher mortgage rates are forcing buyers wary of making purchases of real estate.

Sales of existing homes fell by 4.3% compared with the previous month to a seasonally adjusted annual rate of 4.90 million , said Thursday the National Association of Realtors. Home sales fell 1.2 % compared with a year earlier, the first time in 29 months, this figure fell compared with the same period last year. Economists had forecast a decline of 2.0% from October to November to an annual rate of 5.04 million .

Meanwhile , another report showed that investors continue to reduce positions in traded on the exchange funds gold. Withdrawal of assets amounted to 800 tons this year . The largest gold fund , SPDR Gold Shares, said Wednesday that its assets decreased by 4.2 tons .

The cost of the December gold futures on the COMEX today dropped to $ 1202.30 per ounce.

-

15:00

U.S.: Existing Home Sales , November 4.90 (forecast 5.04)

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, December 7.0 (forecast 10.3)

-

15:00

U.S.: Leading Indicators , November +0.8% (forecast +0.7%)

-

14:35

U.S. Stocks open: Dow 16,153.46 -14.51 -0.09%, Nasdaq 4,059.12 -10.94 -0.27%, S&P 1,806.81 -3.84 -0.21%

-

14:25

Before the bell: S&P futures -0.43%, Nasdaq futures -0.45%

U.S. stock-index futures fell, as data showed jobless claims unexpectedly rose last week.

Global markets:

Nikkei 15,859.22 +271.42 +1.74%

Hang Seng 22,888.75 -255.07 -1.10%

Shanghai Composite 2,127.79 -20.49 -0.95%

FTSE 6,550.55 +58.47 +0.90%

CAC 4,150.07 +40.56 +0.99%

DAX 9,272.54 +90.79 +0.99%

Crude oil $97.82 (+0.02%).

Gold $1200.70 (-2.78%).

-

13:30

U.S.: Initial Jobless Claims, December 379 (forecast 336)

-

13:15

European session: the euro fluctuated

06:45 Switzerland SECO Economic Forecasts Quarter I

07:00 Switzerland Trade Balance November 2.43 2.57 2.11

09:00 Eurozone Current account, adjusted, bln October 13.7 14.2 21.8

09:30 United Kingdom Retail Sales (MoM) November -0.9% Revised From -0.7% +0.3% +0.3%

09:30 United Kingdom Retail Sales (YoY) November +1.8% +2.2% +2.0%

The euro is trading sideways against the U.S. dollar, after adjusting dollar growth caused by yesterday's decision to cut the Fed asset purchases by $ 10 billion to $ 75 billion a month , and an increase in the economic outlook for the United States . So , after a meeting of 17-18 December the Fed has reduced its quantitative easing program and kept the target range of the base interest rate of zero to 0.25 % per annum. Fed from January 2014 intends to reduce purchases of government bonds to $ 45 billion to $ 40 billion a month , mortgage-backed securities - from $ 40 billion to $ 35 billion a month . At the same time the Fed is ready to continue the reduction of future meetings , if justified its macroeconomic forecasts . The Federal Open Market Committee, stressed that the base rate will remain in the current range for a long time after the decline in the unemployment rate to less than 6.5% , especially in the case of continued low inflation . The Fed also improved assessment of the U.S. economy, noting that it justifies the move to curtail QE, and raised its forecast for next year.

The euro rose slightly after the release of data on the balance of payments in the eurozone. Eurozone current account surplus rose to a seasonally adjusted 21.8 billion euros in October from 14.9 billion euros in September. The surplus on goods, services and income increased in October , while the deficit in current transfers declined from September .

The surplus on trade in goods rose to 17 billion euros from 13.7 billion euros in September. In turn, the surplus on services increased to 9.4 billion euros from 8.8 billion euros. In addition, profit rose to 4.7 billion euros from 2.6 billion euros. At the same time , current transfers showed a deficit of 9.4 billion euros, compared with a deficit of 10.2 billion euros a month ago.

On an unadjusted basis the current account surplus widened to 26.2 billion euros in October from 15.2 billion euros in September.

Pound also traded in a range against the U.S. currency on background data on retail sales in Britain. Sales , including automotive fuel rose 0.3 percent on a monthly measurement in November , recovering from a revised 0.9 percent drop in October. The result was in line with economists' expectations .

Excluding automotive fuel , sales increased by 0.4 percent on a monthly measurement in November. It was a little faster than the expected increase of 0.3 percent. In October, retail sales fell by a revised 0.7 percent.

In annualized retail sales including automotive fuel , increased by 2 percent in November compared to expectations of 2.2 percent growth . Excluding fuel , sales increased by 2.3 per cent per annum, which is slower than the increase of 2.4 percent , which was expected .

The yen lost some positions recruited against the dollar today after the beginning of the two-day meeting of the Bank of Japan. According to the median forecast of economists on the basis of a two-day meeting, which ends on December 20 , the Bank of Japan decides to keep the volume to stimulate the economy of the country at the same level . However, they expect quantitative easing program in Japan in 2014.

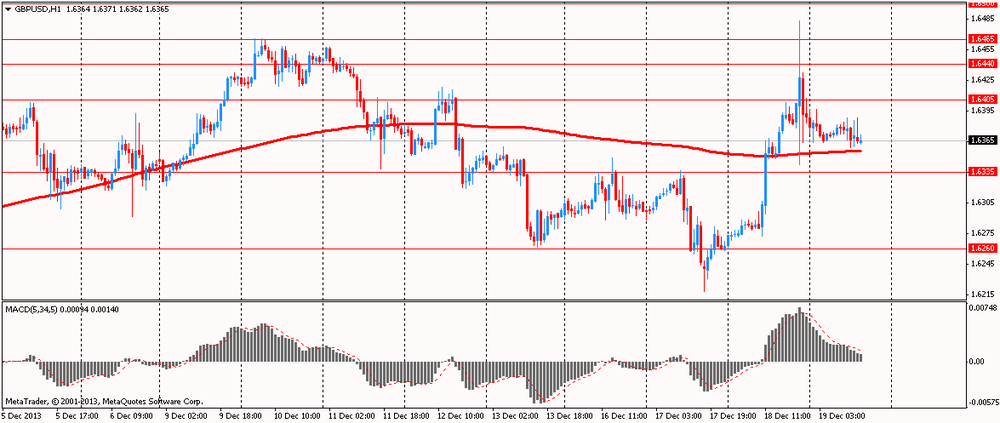

EUR / USD: during the European session, the pair rose to $ 1.3691 and retreated

GBP / USD: during the European session, the pair traded in a narrow range of $ 1.6359 - $ 1.6388

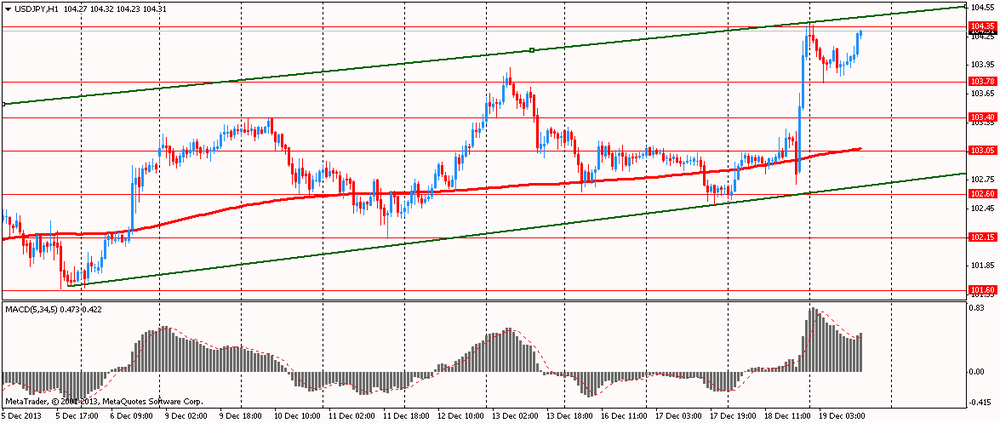

USD / JPY: during the European session, the pair rose to Y104.31

U.S. at 13:30 GMT publish number of initial claims for unemployment insurance , the number of repeated applications for unemployment benefits in the 15:00 GMT - Sales in the secondary housing market in November , the Fed's manufacturing index for December - Philadelphia .

-

12:59

Orders

EUR/USD

Offers $1.3850, $1.3830/35, $1.3815/20, $1.3800/05, $1.3770/80, $1.3750, $1.3730, $1.3700/10

Bids $1.3650, $1.3600

GBP/USD

Offers $1.6500, $1.6400/10

Bids $1.6355/50, $1.6325/15, $1.6295/90, $1.6280/75, $1.6250/40

AUD/USD

Offers $0.8980/90, $0.8950, $0.8910, $0.8900

Bids $0.8825/20, $0.8800, $0.8750, $0.8700

EUR/JPY

Offers Y143.50, Y143.00, Y142.55/60

Bids Y141.80/60, Y141.50, Y141.25/20, Y141.00

USD/JPY

Offers Y105.00, Y104.50

Bids Y103.65/60, Y103.50, Y103.10/00, Y102.60/50

EUR/GBP

Offers stg0.8500, stg0.8475/80, stg0.8467, stg0.8435/40, stg0.8420, stg0.8390/405

Bids stg0.8330/20, stg0.8300/290, stg0.8260/50, stg0.8220

-

11:31

European stocks rallied

European stocks rallied after the Federal Reserve’s decision to slow the pace of its bond purchases boosted investor confidence in the U.S. economic recovery. U.S. index futures slipped after equities jumped to a record in New York, while Asian shares pared gains.

The U.S. central bank said it plans to cut its monthly bond purchases to $75 billion from $85 billion, taking its first step toward unwinding the monetary stimulus that Chairman Ben S. Bernanke put in place to help the economy recover from one of its worst recessions. The Fed’s purchases will be divided between $40 billion in Treasuries and $35 billion in mortgage bonds starting in January, Bernanke said after concluding a two-day policy meeting.

The central bank reiterated that it will probably hold its target interest rate near zero at least as long as unemployment exceeds 6.5 percent and the outlook for inflation is no higher than 2.5 percent. A majority of Federal Open Market Committee participants, or 12 out of 17, predict the first increase in the main interest rate in 2015.

Saab surged 23 percent to 163.10 kronor. The Swedish maker of Gripen jets beat Boeing Co. and Dassault Aviation SA to win the contract to supply 36 jet fighters to South America’s largest economy.

Amadeus rose 1.5 percent to 28.80 euros. Group revenue will be 3.16 billion euros ($4.4 billion) in 2013, while adjusted earnings will be 1.40 euros per share, the company said in a statement late yesterday. That compared with the average analyst estimate of 3.1 billion euros in sales and 1.39 euros in earnings per share for this year. Amadeus will also increase its gross interim dividend to 30 euro cents.

Algeta advanced 1.6 percent to 359.20 kroner, its highest price since it sold shares to the public in 2007. Bayer will begin an offer to buy Algeta shares at 362 kroner each, the Leverkusen, Germany-based company said. Algeta said last month it had received a preliminary offer from Bayer for 336 kroner.

FTSE 100 6,557.14 +65.06 +1.00%

CAC 40 4,167.46 +57.95 +1.41%

DAX 9,314.5 +132.75 +1.45%

-

10:23

Option expiries for today's 1400GMT cut

USDJPY Y102.50, Y102.85, Y103.00, Y103.50, Y103.70

EUR/USD $1.3500, $1.3530, $1.3540, $1.3670, $1.3770, $1.3780, $1.3800, $1.3865

GBP/USD $1.6150, $1.6400

EUR/GBP stg0.8500

AUD/USD $0.8710, $0.8900, $0.8950, $0.8500

-

09:59

Asia Pacific stocks close

Asian stocks rose after the Federal Reserve expressed enough confidence in the U.S. labor market to taper asset purchases while promising to hold interest rates close to zero. Shares in China and Hong Kong fell on concern higher funding costs will hurt growth.

Nikkei 225 15,859.22 +271.42 +1.74%

S&P/ASX 200 5,202.23 +106.13 +2.08%

Shanghai Composite 2,127.79 -20.49 -0.95%

Fast Retailing Co., Asia’s biggest apparel chain, climbed 4.5 percent, pushing Japan’s Nikkei 225 Stock Average to its highest close since 2007 as the yen touched a five-year low to the dollar.

Fanuc Corp., a maker of factory robotics, rose 4.1 percent to a record in Tokyo.

Caltex Australia Ltd. surged 13 percent as the petroleum refiner said profit may climb to A$340 million ($300 million).

Hang Lung Properties Ltd., a Hong Kong developer that invests in mainland malls, fell 3.6 percent.

-

09:30

United Kingdom: Retail Sales (MoM), November +0.3% (forecast +0.3%)

-

09:30

United Kingdom: Retail Sales (YoY) , November +2.0% (forecast +2.2%)

-

09:19

FTSE 100 6,553.16 +61.08 +0.94%, CAC 40 4,145.75 +36.24 +0.88%, DAX 9,277.3 +95.55 +1.04

-

09:00

Eurozone: Current account, adjusted, bln , October 21.8 (forecast 14.2)

-

07:40

European stocks are initially seen trading sharply higher Thursday: the FTSE up 68, the DAX up 83, the CAC up 41

-

07:21

Asian session: The dollar climbed

00:30 Australia RBA Bulletin Quarter IV

04:30 Japan All Industry Activity Index, m/m October +0.4% -0.2% -0.2%

The dollar climbed against most of 16 major counterparts after the Federal Reserve decided to slow stimulus that’s seen to have debased the U.S. currency, reinforcing prospects the world’s largest economy is improving. The Federal Open Market Committee yesterday announced a plan to cut monthly bond purchases to $75 billion from $85 billion, taking its first step toward unwinding the unprecedented stimulus that Chairman Ben S. Bernanke put in place to help the economy recover from the worst recession since the 1930s.

The Fed reinforced assurances the benchmark rate is likely to stay low “well past the time that the unemployment rate declines below 6.5 percent, especially if projected inflation continues to run below” policy makers’ 2 percent goal. The central bank has kept the target for the federal-funds rate at a range of zero to 0.25 percent since 2008.

The yen rebounded against the dollar after its biggest slump in more than four months. The Bank of Japan policy makers start a two-day meeting today. BOJ officials see significant scope to increase government-bond purchases from 7 trillion yen ($67 billion) a month if needed to achieve their 2 percent inflation target, according to people familiar with the discussions. The BOJ monetary policy statement is due tomorrow.

The euro fell before European Union leaders meet today to discuss a planned banking union. In Europe, finance ministers backed an agency to handle failing banks and pledged to create an industry-financed resolution fund over the next 10 years. This is the “final building block of the whole banking union,” Dutch Finance Minister Jeroen Dijsselbloem told reporters before the summit in Brussels today.

EUR / USD: during the Asian session the pair fell to $ 1.3650

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6360-95

USD / JPY: on Asian session the pair fell to Y103.75

US data to the fore as further tapering data dependent. Weekly jobless claims, Phila Fad and existing home sales later. UK retail sales at 0930GMT in focus next ahead of US weekly claims, Phila Fed and housing data this afternoon. -

07:00

Switzerland: Trade Balance, November 2.11 (forecast 2.57)

-

06:22

Commodities. Daily history for Dec 18’2013:

Gold $1,223.6 -7.60 -0.62%

Oil $97.58 +0.36 +0.37%

-

06:21

Stocks. Daily history for Dec 18’2013:

Nikkei 225 15,587.8 +309.17 +2.02%

Hang Seng 23,171.88 +102.65 +0.44%

S&P/ASX 200 5,096.1 -7.09 -0.14%

Shanghai Composite 2,148.29 -2.79 -0.13%

FTSE 100 6,492.08 +5.89 +0.09%

CAC 40 4,109.51 +40.87 +1.00%

DAX 9,181.75 +96.63 +1.06%

Dow +293.22 16,168.48 +1.85%

Nasdaq +46.38 4,070.06 +1.15%

S&P +29.75 1,810.75 +1.67%

-

06:21

Currencies. Daily history for Dec 18'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3685 -0,60%

GBP/USD $1,6389 +0,77%

USD/CHF Chf0,8937 +1,00%

USD/JPY Y104,26 +1,53%

EUR/JPY Y142,69 +0,95%

GBP/JPY Y170,86 +2,29%

AUD/USD $0,8859 -0,43%

NZD/USD $0,8236 -0,41%

USD/CAD C$1,0700 +0,89%

-

06:01

Schedule for today, Thursday, Dec 19’2013:

00:30 Australia RBA Bulletin Quarter IV

04:30 Japan All Industry Activity Index, m/m October +0.4% -0.2%

06:45 Switzerland SECO Economic Forecasts Quarter I

07:00 Switzerland Trade Balance November 2.43 2.57

09:00 Eurozone Current account, adjusted, bln October 13.7 14.2

09:30 United Kingdom Retail Sales (MoM) November -0.7% +0.3%

09:30 United Kingdom Retail Sales (YoY) November +1.8% +2.2%

13:30 U.S. Initial Jobless Claims December 368 336

15:00 U.S. Leading Indicators November +0.2% +0.7%

15:00 U.S. Existing Home Sales November 5.12 5.04

15:00 U.S. Philadelphia Fed Manufacturing Survey December 6.5 10.3

-