Notícias do Mercado

-

16:50

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the release of the U.S. economic data

The U.S. dollar traded higher against the most major currencies after the release of the U.S. economic data. The initial jobless claims in the U.S. climbed by 28,000 to 326,000, from 298,000 in the previous week. Analysts had expected an increase of jobless claims by 12,000 to 310,000.

U.S. flash manufacturing purchasing managers' index rose to 56.2 in May, from 55.4 in April. Analysts had forecasted a gain to 55.6.

Sales of existing homes in the U.S. climbed to 1.3% in April to an annual rate of 4.65 million units, missing expectations of a 2.2% gain to 4.68 million. That was the first increase in 2014.

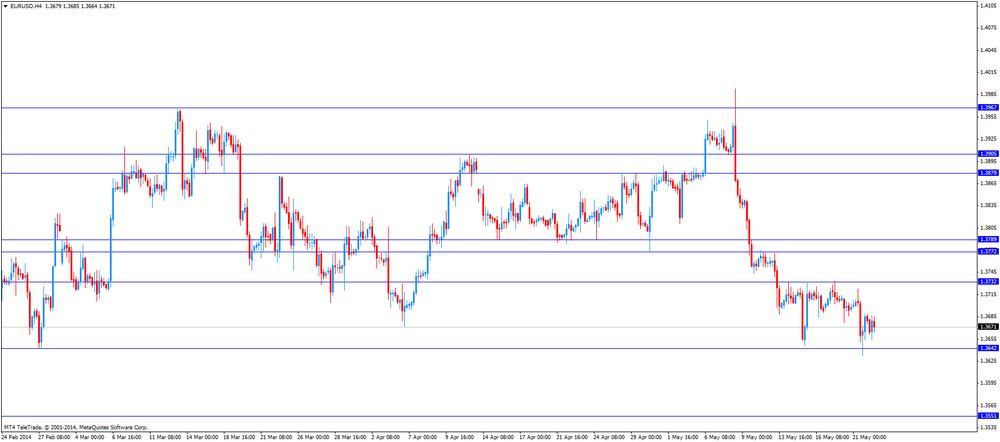

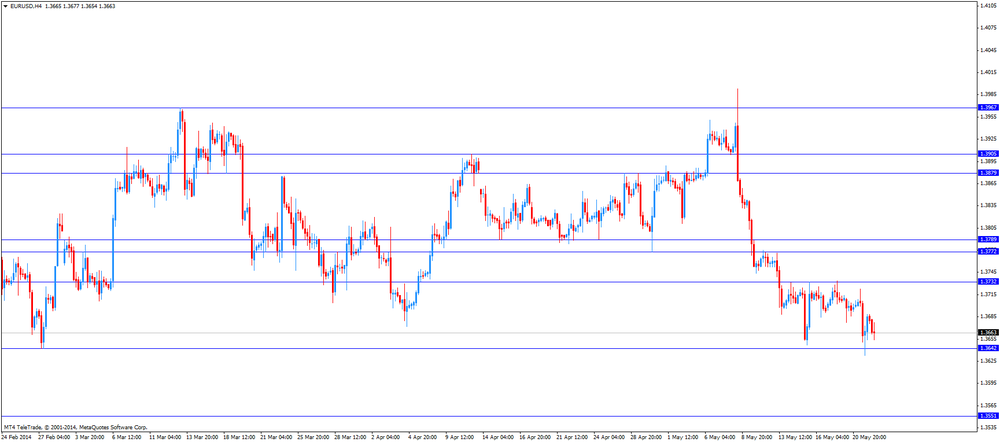

The euro decreased against the U.S. dollar. Eurozone’s flash manufacturing purchasing managers' index fell to 52.5 in May, from 53.4 in April. That was the slowest growth in six months. Analysts had expected a decrease to 53.2.

Eurozone’s flash services purchasing managers' index climbed to 53.5 in May, from 53.1 in April. That was the fastest pace in almost three years. Analysts had forecasted a decrease to 53.0.

France's flash manufacturing purchasing managers' index decreased to 49.3 in May, from 51.2 in April. Analysts had expected a decline to 51.1.

France's flash services purchasing managers' index decreased to 49.2 in May, from 50.4 in April. Analysts had forecasted a fall to 50.3.

Germany's manufacturing purchasing managers' index I slid to 52.9 in May, from 54.1 in April. Analysts had expected a decline to 54.0.

Germany's services purchasing managers' index gained to 56.4 in May, from 54.7 in April. Analysts had forecasted a rise to 54.8.

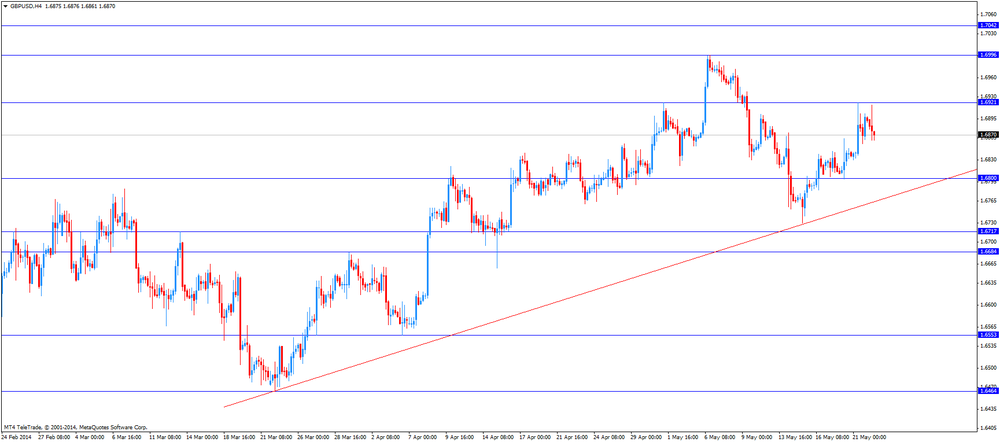

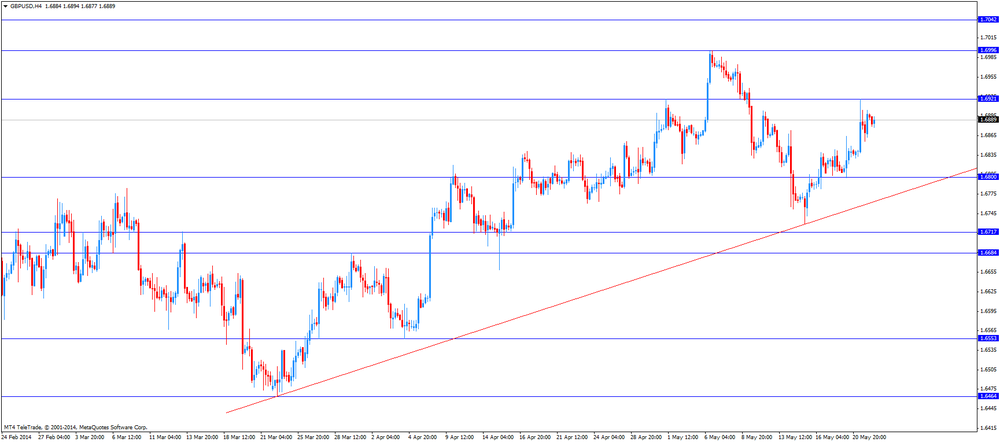

The British pound declined against the U.S. dollar after the U.K. gross domestic product. U.K. gross domestic product increased 0.8% in the first quarter (Q4 2013: +0.8%). Analysts had expected this figure.

On a yearly basis, U.K. gross domestic product climbed 3.1% in the first quarter (Q4 2013: +3.1%). Analysts had expected this growth.

U.K. business investment rose by 2.7% in the first quarter, from a 2.4% gain in the previous quarter. That was the highest pace since the first quarter of 2013.

On a yearly basis, U.K. business investment climbed 8.7% in the first quarter, unchanged from the previous quarter figure.

The Confederation of British Industry released the British factory orders. The Confederation of British Industry's (CBI) total order book balance was 0 in May, up from -1 in April. Analysts had expected +4.

The Canadian dollar rose against the U.S. dollar. The retail sales in Canada decreased 0.1% in March, from a 0.5% rise in February. Analysts had expected a 0.2% gain.

The Canadian retail sales excluding automobile sales climbed 0.1% in March, from a 0.6% increase in February. Analysts had forecasted a 0.5% rise.

The New Zealand dollar traded lower against the U.S. dollar. The Reserve Bank of New Zealand reported its annual inflation expectations increased to 2.4% in the first quarter, from 2.3% in the previous quarter.

The kiwi was also supported by the better-than-expected Chinese economic data. China’s HSBC manufacturing index (preliminary) climbed to 49.7 in May, up from 48.1 in April. Analysts had expected an increase to 48.4.

The Australian dollar increased against the U.S. dollar after the release of inflation expectations in Australia and Chinese manufacturing data, but later lost its gains. The inflation expectation for the next 12 months rose to 4.4% in April, from 4.2% in March. March’s figure was revised up from +2.4%.

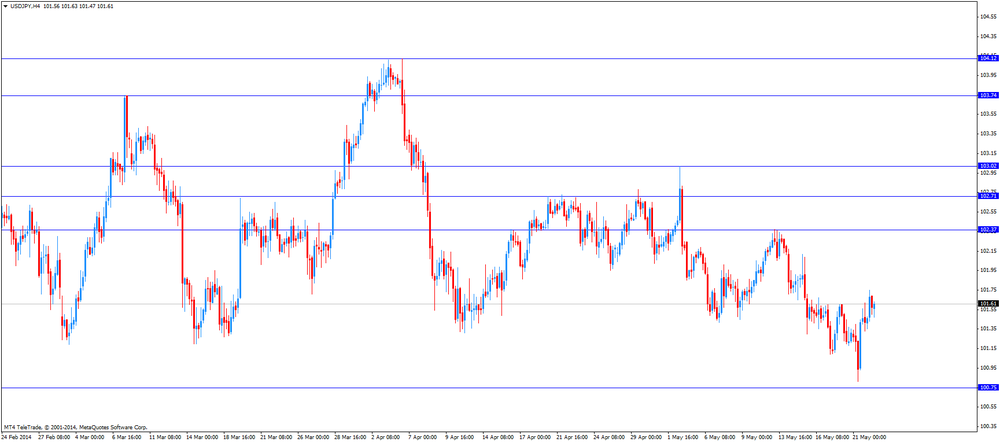

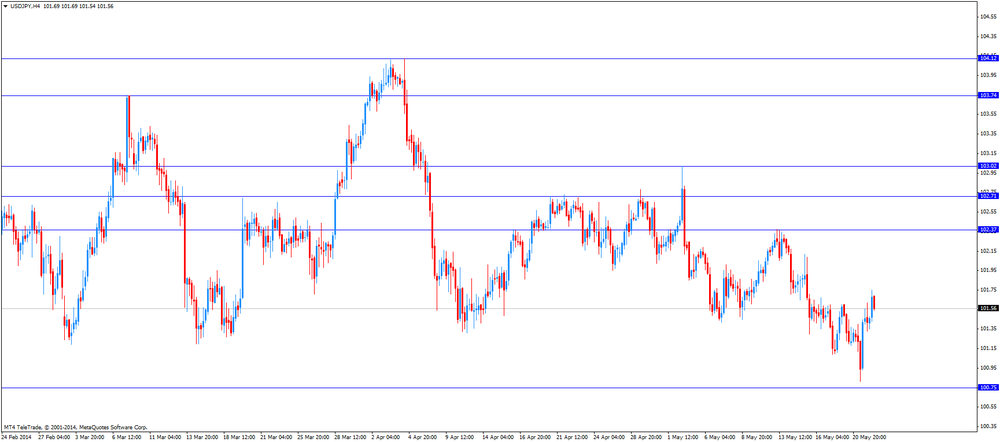

The Japanese yen traded lower against the U.S. dollar. The decreasing demand for safe-haven currency had a negative impact on the yen. No economic data was published in Japan.

-

16:24

Existing home sales in the U.S. rose in April

The National Association of Realtors released the U.S. existing home sales today. Sales of existing homes in the U.S. climbed to 1.3% in April to an annual rate of 4.65 million units, missing expectations of a 2.2% gain to 4.68 million. That was the first increase in 2014.

Chief economist at the National Association of Realtors Lawrence Yun said he is optimistic about the development of existing home sales.

The median home price gained 5.2% in April to $201,700 from the same period a year earlier.

The Federal Reserve expressed concern that the slow pace of the housing recovery is a risk for the broader economy's continued improvement.

-

15:00

U.S.: Existing Home Sales , April 4.65 (forecast 4.71)

-

15:00

U.S.: Leading Indicators , April +0.4% (forecast +0.4%)

-

14:48

Federal Reserve’s April minutes: the Fed will keep reducing its asset purchase program

The Federal Reserve released its April minutes on Wednesday:

- The Fed

will keep reducing its asset purchase program;

- The Fed see

the slow improvement in the economy and doesn’t see inflation pressure;

- The Federal

Reserve Board of Governors agreed at their April meeting to consider a mix of

tools to normalize monetary policy, but interest rate hikes aren't planned yet.

- The Fed

will keep reducing its asset purchase program;

-

14:45

U.S.: Manufacturing PMI, May 56.2 (forecast 55.6)

-

13:30

U.S.: Initial Jobless Claims, May 326 (forecast 312)

-

13:30

Canada: Retail Sales, m/m, March -0.1% (forecast +0.2%)

-

13:30

Canada: Retail Sales ex Autos, m/m, March +0.1% (forecast +0.5%)

-

13:11

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the economic data in the Eurozone

Economic calendar (GMT0):

01:00 Australia Consumer Inflation Expectation May +4.2% +4.4%

01:45 China HSBC Manufacturing PMI (Preliminary) May 48.1 48.4 49.7

03:00 New Zealand Expected Annual Inflation 2y from now Quarter I +2.3% +2.4%

06:58 France Manufacturing PMI (Preliminary) May 51.2 51.1 49.3

06:58 France Services PMI (Preliminary) May 50.4 50.3 49.2

07:28 Germany Manufacturing PMI (Preliminary) May 54.1 54.0 52.9

07:28 Germany Services PMI (Preliminary) May 54.7 54.8 56.4

07:58 Eurozone Manufacturing PMI (Preliminary) May 53.4 53.2 52.5

07:58 Eurozone Services PMI (Preliminary) May 53.1 53.0 53.5

08:30 United Kingdom Business Investment, q/q Quarter I +2.4% +2.3% +2.7%

08:30 United Kingdom Business Investment, y/y Quarter I +8.7% +8.7%

08:30 United Kingdom PSNB, bln April 4.9 3.6 9.63

08:30 United Kingdom GDP, q/q Quarter I +0.8% +0.8% +0.8%

08:30 United Kingdom GDP, y/y Quarter I +3.1% +3.1% +3.1%

09:00 Eurozone European Parliamentary Elections

10:00 United Kingdom CBI industrial order books balance May -1 4 -1

The U.S. dollar traded higher against the most major currencies amid the release of the U.S. economic data. The initial jobless claims in the U.S. should increase to 312,000, from 297,000 in the previous week. U.S. flash manufacturing purchasing managers' index should increase to 55.6 in May, from 55.4 in April. The existing home sales in the U.S. should rise to 4.71 million units in April, from 4.59 million units in March.

The euro traded mixed against the U.S. dollar after the release of the economic data in the Eurozone. Eurozone’s flash manufacturing purchasing managers' index fell to 52.5 in May, from 53.4 in April. That was the slowest growth in six months. Analysts had expected a decrease to 53.2.

Eurozone’s flash services purchasing managers' index climbed to 53.5 in May, from 53.1 in April. That was the fastest pace in almost three years. Analysts had forecasted a decrease to 53.0.

France's flash manufacturing purchasing managers' index decreased to 49.3 in May, from 51.2 in April. Analysts had expected a decline to 51.1.

France's flash services purchasing managers' index decreased to 49.2 in May, from 50.4 in April. Analysts had forecasted a fall to 50.3.

Germany's manufacturing purchasing managers' index I slid to 52.9 in May, from 54.1 in April. Analysts had expected a decline to 54.0.

Germany's services purchasing managers' index gained to 56.4 in May, from 54.7 in April. Analysts had forecasted a rise to 54.8.

The British pound declined against the U.S. dollar after the U.K. gross domestic product. U.K. gross domestic product increased 0.8% in the first quarter (Q4 2013: +0.8%). Analysts had expected this figure.

On a yearly basis, U.K. gross domestic product climbed 3.1% in the first quarter (Q4 2013: +3.1%). Analysts had expected this growth.

U.K. business investment rose by 2.7% in the first quarter, from a 2.4% gain in the previous quarter. That was the highest pace since the first quarter of 2013.

On a yearly basis, U.K. business investment climbed 8.7% in the first quarter, unchanged from the previous quarter figure.

The Confederation of British Industry released the British factory orders. The Confederation of British Industry's (CBI) total order book balance was 0 in May, up from -1 in April. Analysts had expected +4.

The Canadian dollar traded little changed against the U.S. dollar ahead of the release of the Canadian retail sales. The retail sales in Canada should increase 0.2% in March, from a 0.5% rise in February. The Canadian retail sales excluding autos should climb 0.5% in March, from a 0.6% increase in February.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.6861

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m March +0.5% +0.2%

12:30 Canada Retail Sales ex Autos, m/m March +0.6% +0.5%

12:30 U.S. Initial Jobless Claims May 297 312

13:43 U.S. Manufacturing PMI (Preliminary) May 55.4 55.6

14:00 U.S. Existing Home Sales April 4.59 4.71

-

13:00

Orders

EUR/USD

Offers $1.3770/80, $1.3750, $1.3730/35, $1.3695/700

Bids $1.3600, $1.3550

GBP/USD

Offers $1.7000, $1.6950, $1.6925/35

Bids $1.6855-45, $1.6831

AUD/USD

Offers $0.9400, $0.9375/80, $0.9345/50, $0.9300, $0.9280

Bids $0.9220, $0.9150

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.50, Y139.20

Bids Y138.50, Y138.00, Y137.50

USD/JPY

Offers Y102.70/80, Y102.50, Y102.00, Y101.80

Bids Y101.05/00, Y100.80, Y100.50

EUR/GBP

Offers stg0.8215-25, stg0.8195/205, stg0.8160/65, stg0.8120-30

Bids stg0.8050, stg0.8035/30, stg0.8005/000

-

11:00

United Kingdom: CBI industrial order books balance, May -1 (forecast 4)

-

10:59

U.K. gross domestic product grows as expected

The Office for National Statistics released the U.K. gross domestic product (GDP) figures. U.K. gross domestic product increased 0.8% in the first quarter (Q4 2013: +0.8%). Analysts had expected this figure.

On a yearly basis, U.K. gross domestic product climbed 3.1% in the first quarter (Q4 2013: +3.1%). Analysts had expected this growth.

U.K. business investment rose by 2.7% in the first quarter, from a 2.4% gain in the previous quarter. That was the highest pace since the first quarter of 2013.

On a yearly basis, U.K. business investment climbed 8.7% in the first quarter, unchanged from the previous quarter figure.

U.K. public sector net borrowing excluding one-off payments related to Royal Mail's pension plan and cash transfers from the Bank of England was £11.5 billion in April. The amount increased nearly 2% from April last year.

-

10:26

Option expiries for today's 1400GMT cut

EUR/USD $1.3625, $1.3650, $1.3700, $1.3715

USD/JPY Y101.00, Y101.25, Y101.40

GBP/USD $1.6850, $1.7000

EUR/GBP stg0.8050, stg0.8100

AUD/USD $0.9200, $0.9225, $0.9260

USD/CAD C$1.0900

-

10:00

Foreign exchange market. Asian session: the Australian and New Zealand dollar traded higher against the U.S. dollar due to the better-than-expected Chinese manufacturing data

Economic calendar (GMT0):

01:00 Australia Consumer Inflation Expectation May +4.2% +4.4%

01:45 China HSBC Manufacturing PMI (Preliminary) May 48.1 48.4 49.7

03:00 New Zealand Expected Annual Inflation 2y from now Quarter I +2.3% +2.4%

06:58 France Manufacturing PMI (Preliminary) May 51.2 51.1 49.3

06:58 France Services PMI (Preliminary) May 50.4 50.3 49.2

07:28 Germany Manufacturing PMI (Preliminary) May 54.1 54.0 52.9

07:28 Germany Services PMI (Preliminary) May 54.7 54.8 56.4

07:58 Eurozone Manufacturing PMI (Preliminary) May 53.4 53.2 52.5

07:58 Eurozone Services PMI (Preliminary) May 53.1 53.0 53.5

08:30 United Kingdom Business Investment, q/q Quarter I +2.4% +2.3% +2.7%

08:30 United Kingdom Business Investment, y/y Quarter I +8.7% +8.7%

08:30 United Kingdom PSNB, bln April 4.9 3.6 9.63

08:30 United Kingdom GDP, q/q Quarter I +0.8% +0.8% +0.8%

08:30 United Kingdom GDP, y/y Quarter I +3.1% +3.1% +3.1%

The U.S. dollar declined against the most major currencies after the release of Federal Reserve's meeting minutes on Wednesday. The Fed see the slow improvement in the economy and doesn’t see inflation pressure. It means that the U.S. central bank could left interest rates unchanged at record lows for some time after its asset purchase program ends.

The New Zealand dollar traded higher against the U.S. dollar. The Reserve Bank of New Zealand reported its annual inflation expectations increased to 2.4% in the first quarter, from 2.3% in the previous quarter.

The kiwi was also supported by the better-than-expected Chinese economic data. China’s HSBC manufacturing index (preliminary) climbed to 49.7 in May, up from 48.1 in April. Analysts had expected an increase to 48.4.

The Australian dollar increased against the U.S. dollar after the release of inflation expectations in Australia and Chinese manufacturing data. The inflation expectation for the next 12 months rose to 4.4% in April, from 4.2% in March. March’s figure was revised up from +2.4%.

The Japanese yen declined against the U.S. dollar after the after the release of the better-than-expected Chinese manufacturing data. The decreasing demand for safe-haven currency had a negative impact on the yen. No economic data was published in Japan.

EUR/USD: the currency pair declined to $1.3670

GBP/USD: the currency pair decreased to $1.6885

USD/JPY: the currency pair climbed to Y101.70

The most important news that are expected (GMT0):

09:00 Eurozone European Parliamentary Elections

10:00 United Kingdom CBI industrial order books balance May -1 4

12:30 Canada Retail Sales, m/m March +0.5% +0.2%

12:30 Canada Retail Sales ex Autos, m/m March +0.6% +0.5%

12:30 U.S. Initial Jobless Claims May 297 312

13:43 U.S. Manufacturing PMI (Preliminary) May 55.4 55.6

14:00 U.S. Existing Home Sales April 4.59 4.71

-

09:33

United Kingdom: Business Investment, y/y, Quarter I +8.7%

-

09:32

United Kingdom: Business Investment, q/q, Quarter I +2.7% (forecast +2.3%)

-

09:31

United Kingdom: PSNB, bln, April 9.63 (forecast 3.6)

-

09:30

United Kingdom: GDP, q/q, Quarter I +0.8% (forecast +0.8%)

-

09:30

United Kingdom: GDP, y/y, Quarter I +3.1% (forecast +3.1%)

-

09:00

Eurozone: Manufacturing PMI, May 52.5 (forecast 53.2)

-

09:00

Eurozone: Services PMI, May 53.5 (forecast 53.0)

-

08:31

Germany: Services PMI, May 56.4 (forecast 54.8)

-

08:30

Germany: Manufacturing PMI, May 52.9 (forecast 54.0)

-

08:00

France: Manufacturing PMI, May 49.3 (forecast 51.1)

-

08:00

France: Services PMI, May 49.2 (forecast 50.3)

-

06:32

Options levels on thursday, May 22, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3794 (2550)

$1.3764 (3694)

$1.3723 (517)

Price at time of writing this review: $ 1.3672

Support levels (open interest**, contracts):

$1.3634 (2917)

$1.3614 (6641)

$1.3587 (2950)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 54071 contracts, with the maximum number of contracts with strike price $1,3850 (5148);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 70251 contracts, with the maximum number of contractswith strike price $1,3700 (6641);

- The ratio of PUT/CALL was 1.29 versus 1.47 from the previous trading day according to data from May, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.7200 (1750)

$1.7101 (1855)

$1.7003 (2745)

Price at time of writing this review: $1.6890

Support levels (open interest**, contracts):

$1.6797 (1565)

$1.6699 (2499)

$1.6599 (1555)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 23079 contracts, with the maximum number of contracts with strike price $1,7000 (2745);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 24225 contracts, with the maximum number of contracts with strike price $1,6700 (2499);

- The ratio of PUT/CALL was 1.05 versus 0.97 from the previous trading day according to data from May, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:01

New Zealand: Expected Annual Inflation 2y from now, Quarter II +2.4%

-

02:47

China: HSBC Manufacturing PMI, May 49.7 (forecast 48.4)

-

02:02

Australia: Consumer Inflation Expectation, May +4.4%

-

00:20

Currencies. Daily history for May 21'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3685 -0,09%

GBP/USD $1,6898 +0,36%

USD/CHF Chf0,8932 +0,15%

USD/JPY Y101,42 +0,11%

EUR/JPY Y138,80 +0,02%

GBP/JPY Y171,37 +0,47%

AUD/USD $0,9245 +0,05%

NZD/USD $0,8571 0,00%

USD/CAD C$1,0913 +0,07%

-

00:00

Schedule for today, Thursday, May 22’2014:

(time / country / index / period / previous value / forecast)01:00 Australia Consumer Inflation Expectation May +2.4%

01:45 China HSBC Manufacturing PMI (Preliminary) May 48.1 48.4

03:00 New Zealand Expected Annual Inflation 2y from now Quarter II +2.3%

06:58 France Manufacturing PMI (Preliminary) May 51.2 51.1

06:58 France Services PMI (Preliminary) May 50.4 50.3

07:28 Germany Manufacturing PMI (Preliminary) May 54.1 54.0

07:28 Germany Services PMI (Preliminary) May 54.7 54.8

07:58 Eurozone Manufacturing PMI (Preliminary) May 53.4 53.2

07:58 Eurozone Services PMI (Preliminary) May 53.1 53.0

08:30 United Kingdom Business Investment, q/q Quarter I +2.4% +2.3%

08:30 United Kingdom Business Investment, y/y Quarter I +8.7%

08:30 United Kingdom PSNB, bln April 4.9 3.6

08:30 United Kingdom GDP, q/q (Revised) Quarter I +0.8% +0.8%

08:30 United Kingdom GDP, y/y (Revised) Quarter I +3.1% +3.1%

09:00 Eurozone European Parliamentary Elections

10:00 United Kingdom CBI industrial order books balance May -1 4

12:30 Canada Retail Sales, m/m March +0.5% +0.2%

12:30 Canada Retail Sales ex Autos, m/m March +0.6% +0.5%

12:30 U.S. Initial Jobless Claims May 297 312

13:43 U.S. Manufacturing PMI (Preliminary) May 55.4 55.6

14:00 U.S. Leading Indicators April +0.8% +0.4%

14:00 U.S. Existing Home Sales April 4.59 4.71

-