Notícias do Mercado

-

16:55

Foreign exchange market. American session: the Canadian dollar traded higher against the U.S. dollar after the release of the Canadian consumer price index

The U.S. dollar traded higher against the most major currencies after the release of the U.S. housing market data. The U.S. new home sales increased 6.4% in April to a seasonally adjusted annual rate of 433,000 units. March's figure was revised up to 407,000 from 384,000. Analysts had expected a gain to 425,000.

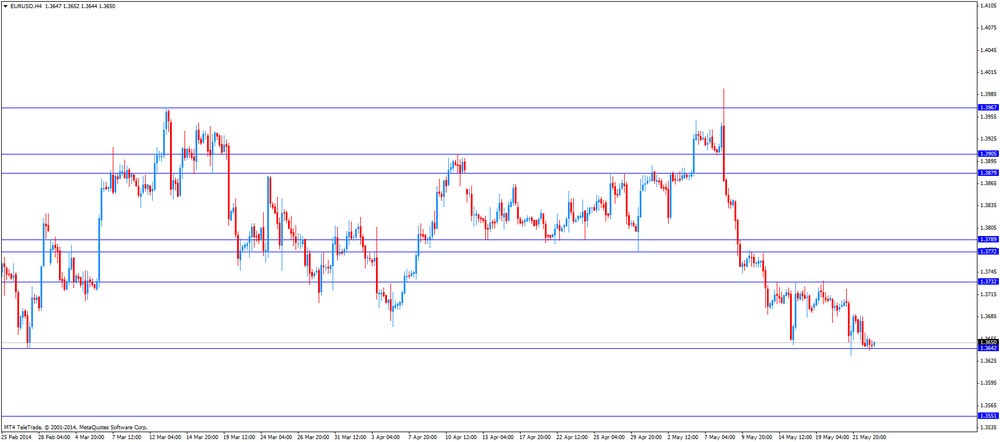

The euro traded lower against the U.S. dollar. The IFO - Business Climate index for Germany dropped to a 5-month low of 110.4 in May, from 111.2 in March. Analysts had expected the index to decline to 111.0. Market participants hope the further stimulus measures by the European Central Bank will be introduced in June due to recently released weak economic data in the Eurozone.

German gross domestic product climbed 0.8% in the first quarter (Q4 2013: +0.8%), meeting analysts’ expectations.

On a yearly basis, German gross domestic product rose 2.3% in the first quarter (Q4 2013: +2.2%), exceeding analysts’ expectations of a 2.2% gain.

The business climate index in Belgium decreased to -6.8 in March, from -4.6 in February. Analysts had expected -4.7.

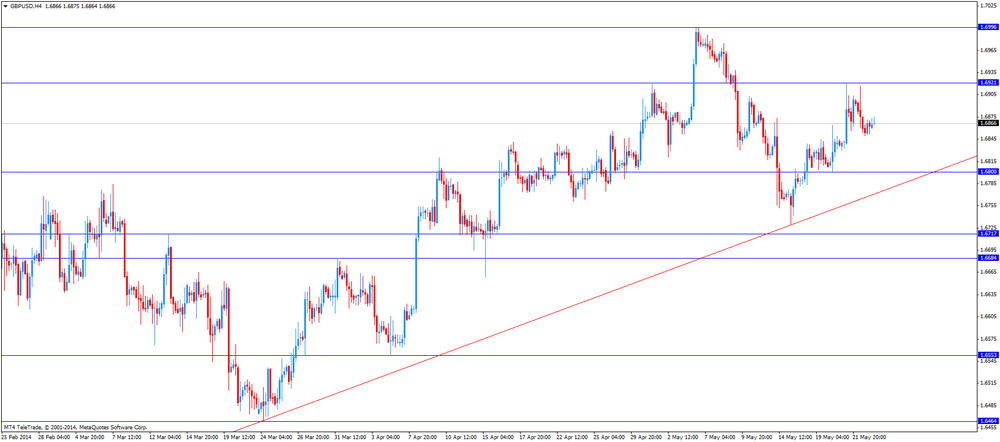

The British pound traded lower against the U.S. dollar after the release of the U.S. housing market data and in the absence of any major economic reports in the U.K.

The Canadian dollar traded higher against the U.S. dollar after the release of the Canadian consumer price index. The consumer price index in Canada increase 0.3% in April (March: +0.6%), meeting analysts’ expectations. On a year-over-year rate, the consumer price index in Canada climbed 2.0% in April, from 1.5% in March.

The Canadian core consumer price index rose 0.2% in April (March: +0.3%), meeting analysts’ expectations. On a yearly basis, the Canadian core consumer price index climbed 1.4% in April, from a 1.3% increase in March.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports in New Zealand. The Conference Board released its April leading economic index for China. The index increased 0.9% in April, from a 1.2 gain in March. Market participants remained unimpressed by this release. China is New Zealand’s second-largest trading partner.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic reports in Australia.

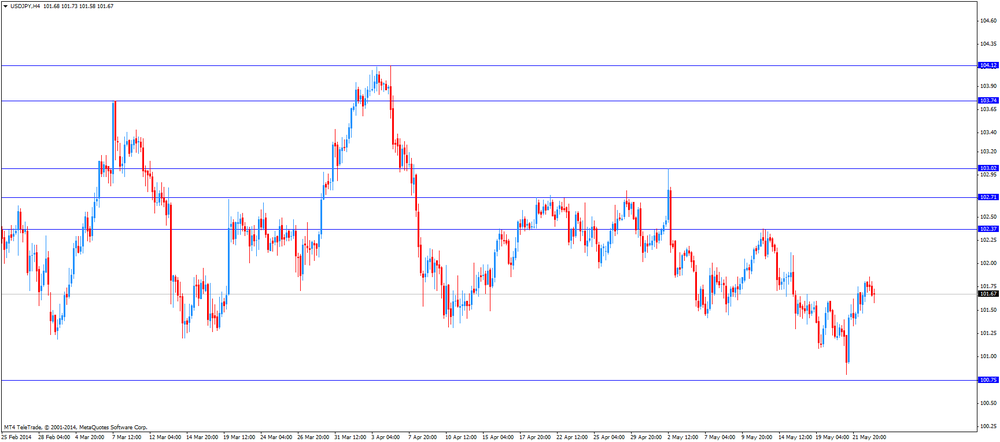

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports in Japan.

-

15:34

U.S. new home sales surged better than expected

The U.S. Census Bureau released the new home sales figures on Friday. The U.S. new home sales increased 6.4% in April to a seasonally adjusted annual rate of 433,000 units. March's figure was revised up to 407,000 from 384,000. Analysts had expected a gain to 425,000.

Sales of new homes declined 4.2% over the past 12 months.

The median sales price declined 2.1% during the past month to $275,800.

These figures could be a sign that the U.S. housing market gained strength.

-

15:00

U.S.: New Home Sales, April 433 (forecast 426)

-

14:46

Option expiries for today's 1400GMT cut

EUR/USD $1.3675

USD/JPY Y100.70, Y101.20, Y101.50, Y101.75, Y102.00/10

GBP/USD $1.6775

EUR/GBP stg0.8100, stg0.8125, stg0.8175

AUD/USD $0.9225, $0.9240, $0.9300, $0.9325, $0.9340

USD/CAD C$1.0825, C$1.0970-75

-

14:00

Belgium: Business Climate, March -6.8 (forecast -4.7)

-

13:30

Canada: Consumer Price Index m / m, April +0.3% (forecast +0.3%)

-

13:30

Canada: Consumer price index, y/y, April +2.0%

-

13:30

Canada: Bank of Canada Consumer Price Index Core, m/m, April +0.2% (forecast +0.2%)

-

13:30

Canada: Bank of Canada Consumer Price Index Core, y/y, April +1.4%

-

13:07

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. housing market data

Economic calendar (GMT0):

02:00 China Leading Index April +1.2% +0.9%

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.8% +0.8% +0.8%

06:00 Germany GDP (YoY) (Finally) Quarter I +2.2% +2.2% +2.3%

08:00 Germany IFO - Business Climate May 111.2 111.0 110.4

08:00 Germany IFO - Current Assessment March 115.3 115.6 114.8

08:00 Germany IFO - Expectations March 107.3 106.9 106.2

09:00 Eurozone European Parliamentary Elections

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. housing market data. The U.S. new home sales should rise to 426,000 units in April, from 384,000 units in March.

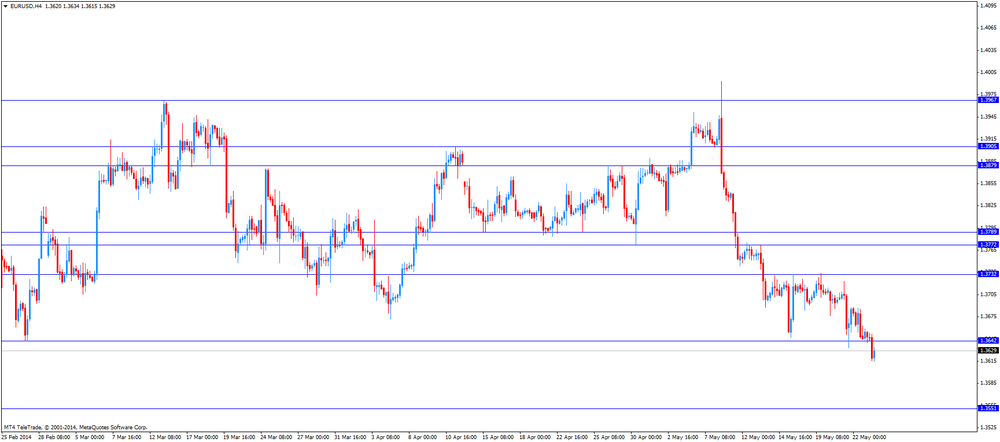

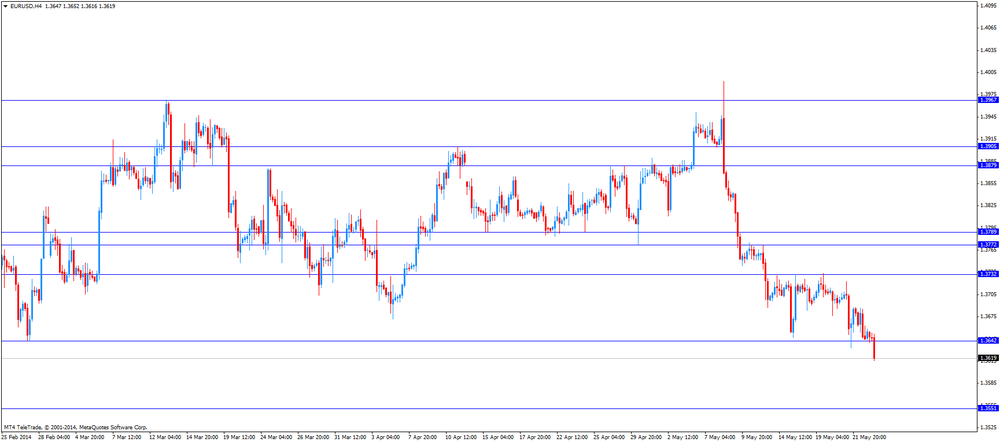

The euro traded lower against the U.S. dollar due to the weaker-than-expected IFO-Business Climate index for Germany. The index dropped to a 5-month low of 110.4 in May, from 111.2 in March. Analysts had expected the index to decline to 111.0. Market participants hope the further stimulus measures by the European Central Bank will be introduced in June due to recently released weak economic data in the Eurozone.

German gross domestic product climbed 0.8% in the first quarter (Q4 2013: +0.8%), meeting analysts’ expectations.

On a yearly basis, German gross domestic product rose 2.3% in the first quarter (Q4 2013: +2.2%), exceeding analysts’ expectations of a 2.2% gain.

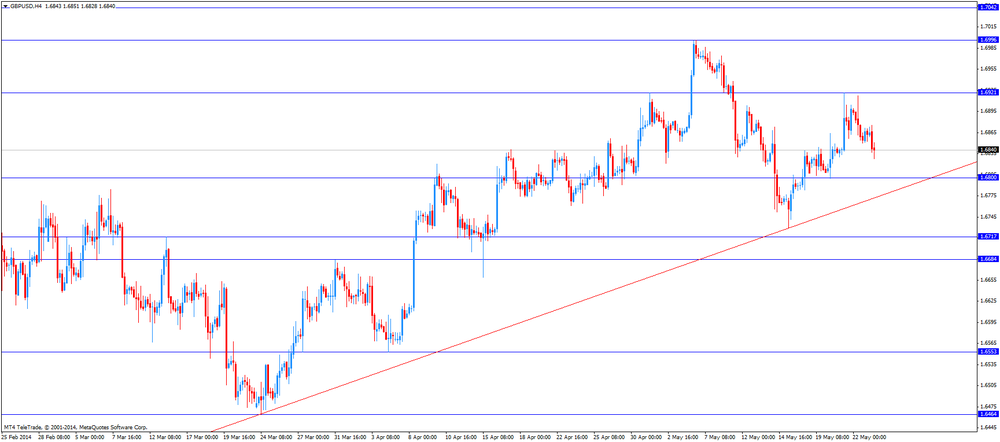

The British pound traded lower against the U.S. dollar in the absence of any major economic reports in the U.K.

The Canadian dollar traded slightly higher against the U.S. dollar ahead of the release of the Canadian consumer price index. The consumer price index in Canada should increase 0.3% in April, from a 0.6% rise in April. The Canadian core consumer price index should climb 0.2% in April, from a 0.3% increase in March.

EUR/USD: the currency pair dropped to $1.3615

GBP/USD: the currency pair declined to $1.6828

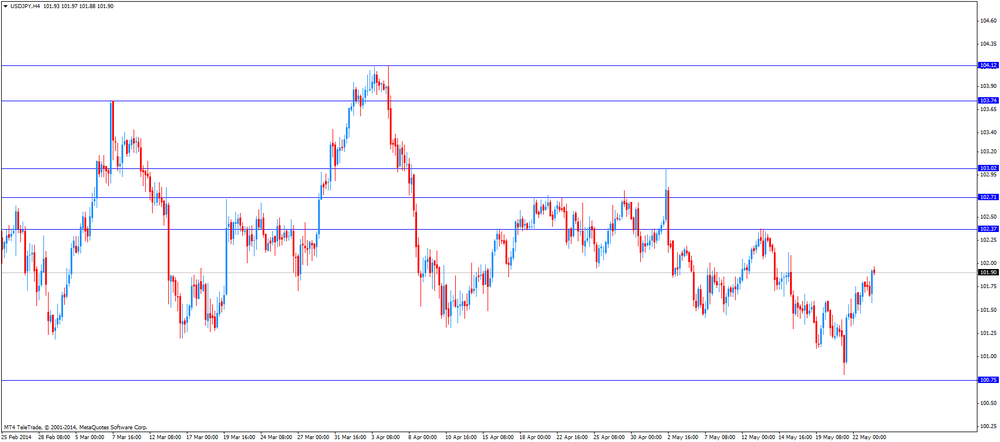

USD/JPY: the currency pair climbed to Y101.97

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m April +0.6% +0.3%

12:30 Canada Consumer price index, y/y April +1.5%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m April +0.3% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April +1.3%

13:00 Belgium Business Climate March -4.6 -4.7

14:00 U.S. New Home Sales April 384 426

-

13:00

Orders

EUR/USD

Offers $1.3695/700

Bids $1.3600, $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6950, $1.6930/35, $1.6900

Bids $1.6830, $1.6800

AUD/USD

Offers $0.9300, $0.9280, $0.9250

Bids $0.9200, $0.9150

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.50, Y139.20

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y102.50, Y102.00

Bids Y101.50, Y101.05/00, Y100.80

EUR/GBP

Offers stg0.8120, stg0.8110-15

Bids stg0.8050, stg0.8035/30, stg0.8005/000

-

10:40

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD $1.3675

USD/JPY Y100.70, Y101.20, Y101.50, Y101.75, Y102.00/10

GBP/USD $1.6775

EUR/GBP stg0.8100, stg0.8125, stg0.8175

AUD/USD $0.9225, $0.9240, $0.9300, $0.9325, $0.9340

USD/CAD C$1.0825, C$1.0970-75

-

09:47

Foreign exchange market. Asian session: currencies traded slightly changed in the any major economic reports

Economic calendar (GMT0):

02:00 China Leading Index April +1.2% +0.9%

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.8% +0.8% +0.8%

06:00 Germany GDP (YoY) (Finally) Quarter I +2.2% +2.2% +2.3%

08:00 Germany IFO - Business Climate May 111.2 111.0 110.4

08:00 Germany IFO - Current Assessment March 115.3 115.6 114.8

08:00 Germany IFO - Expectations March 107.3 106.9 106.2

The U.S. dollar traded mixed against the most major currencies. The U.S. currency was supported by the positive U.S. economic data, published on Thursday. U.S. flash manufacturing purchasing managers' index rose to 56.2 in May, from 55.4 in April. Analysts had forecasted a gain to 55.6.

Sales of existing homes in the U.S. climbed to 1.3% in April to an annual rate of 4.65 million units, missing expectations of a 2.2% gain to 4.68 million. That was the first increase in 2014.

The New Zealand dollar traded little changed against the U.S. dollar in the absence of any major economic reports in New Zealand. The Conference Board released its April leading economic index for China. The index increased 0.9% in April, from a 1.2 gain in March. Market participants remained unimpressed by this release. China is New Zealand’s second-largest trading partner.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded slightly higher against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair declined to $1.3640

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y101.65

The most important news that are expected (GMT0):

09:00 Eurozone European Parliamentary Elections

12:30 Canada Consumer Price Index m / m April +0.6% +0.3%

12:30 Canada Consumer price index, y/y April +1.5%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m April +0.3% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April +1.3%

13:00 Belgium Business Climate March -4.6 -4.7

14:00 U.S. New Home Sales April 384 426

-

09:00

Germany: IFO - Business Climate, May 110.4 (forecast 111.0)

-

09:00

Germany: IFO - Current Assessment , March 114.8 (forecast 115.6)

-

09:00

Germany: IFO - Expectations , March 106.2 (forecast 106.9)

-

07:01

Germany: GDP (QoQ), Quarter I +0.8% (forecast +0.8%)

-

07:01

Germany: GDP (YoY), Quarter I +2.3% (forecast +2.2%)

-

06:27

Options levels on friday, May 23, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3785 (3157)

$1.3753 (4171)

$1.3704 (537)

Price at time of writing this review: $ 1.3650

Support levels (open interest**, contracts):

$1.3615 (2917)

$1.3597 (6292)

$1.3574 (3395)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56557 contracts, with the maximum number of contracts with strike price $1,3850 (6253);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 71516 contracts, with the maximum number of contractswith strike price $1,3700 (6292);

- The ratio of PUT/CALL was 1.26 versus 1.29 from the previous trading day according to data from May, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.7101 (1855)

$1.7002 (2838)

$1.6905 (1948)

Price at time of writing this review: $1.6869

Support levels (open interest**, contracts):

$1.6796 (1669)

$1.6698 (2394)

$1.6599 (1605)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 23478 contracts, with the maximum number of contracts with strike price $1,7000 (2838);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 24754 contracts, with the maximum number of contracts with strike price $1,6700 (2394);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from May, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:00

China: Leading Index , April +0.9%

-

00:20

Currencies. Daily history for May 22'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3655 -0,22%

GBP/USD $1,6866 -0,19%

USD/CHF Chf0,8941 +0,10%

USD/JPY Y101,75 +0,32%

EUR/JPY Y138,94 +0,10%

GBP/JPY Y171,60 +0,13%

AUD/USD $0,9222 -0,25%

NZD/USD $0,8563 -0,09%

USD/CAD C$1,0891 -0,20%

-

00:00

Schedule for today, Friday, May 23’2014:

(time / country / index / period / previous value / forecast)02:00 China Leading Index April +1.2%

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.8% +0.8%

06:00 Germany GDP (YoY) (Finally) Quarter I +2.2% +2.2%

08:00 Germany IFO - Business Climate May 111.2 111.0

08:00 Germany IFO - Current Assessment March 115.3 115.6

08:00 Germany IFO - Expectations March 107.3 106.9

09:00 Eurozone European Parliamentary Elections

12:30 Canada Consumer Price Index m/m April +0.6% +0.3%

12:30 Canada Consumer price index, y/y April +1.5%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m April +0.3% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April +1.3%

13:00 Belgium Business Climate March -4.6 -4.7

14:00 U.S. New Home Sales April 384 426

-