Notícias do Mercado

-

20:00

Dow +57.18 16,600.26 +0.35% Nasdaq +28.06 4,182.40 +0.68% S&P +7.41 1,899.90 +0.39%

-

17:08

European stocks close: stocks traded mixed after the better-than-expected U.S. housing market data

The stock indices stocks traded mixed amid the better-than-expected U.S. housing market data. Investors were cautious ahead of this weekend’s European Parliament elections.

The IFO - Business Climate index for Germany dropped to a 5-month low of 110.4 in May, from 111.2 in March. Analysts had expected the index to decline to 111.0. Market participants hope the further stimulus measures by the European Central Bank will be introduced in June due to recently released weak economic data in the Eurozone.

German gross domestic product climbed 0.8% in the first quarter (Q4 2013: +0.8%), meeting analysts’ expectations.

On a yearly basis, German gross domestic product rose 2.3% in the first quarter (Q4 2013: +2.2%), exceeding analysts’ expectations of a 2.2% gain.

The business climate index in Belgium decreased to -6.8 in March, from -4.6 in February. Analysts had expected -4.7.

Pandora A/S declined 4.2% as some shareholders sold a stake of about 10%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,815.75 -4.81 -0.07%

DAX 9,768.01 +47.10 +0.48%

CAC 40 4,493.15 +14.94 +0.33%

-

17:00

European stock close: FTSE 100 6,835.37 +4.81 +0.07% CAC 40 4,493.15 +14.94 +0.33% DAX 9,768.01 +47.10 +0.48%

-

16:55

Foreign exchange market. American session: the Canadian dollar traded higher against the U.S. dollar after the release of the Canadian consumer price index

The U.S. dollar traded higher against the most major currencies after the release of the U.S. housing market data. The U.S. new home sales increased 6.4% in April to a seasonally adjusted annual rate of 433,000 units. March's figure was revised up to 407,000 from 384,000. Analysts had expected a gain to 425,000.

The euro traded lower against the U.S. dollar. The IFO - Business Climate index for Germany dropped to a 5-month low of 110.4 in May, from 111.2 in March. Analysts had expected the index to decline to 111.0. Market participants hope the further stimulus measures by the European Central Bank will be introduced in June due to recently released weak economic data in the Eurozone.

German gross domestic product climbed 0.8% in the first quarter (Q4 2013: +0.8%), meeting analysts’ expectations.

On a yearly basis, German gross domestic product rose 2.3% in the first quarter (Q4 2013: +2.2%), exceeding analysts’ expectations of a 2.2% gain.

The business climate index in Belgium decreased to -6.8 in March, from -4.6 in February. Analysts had expected -4.7.

The British pound traded lower against the U.S. dollar after the release of the U.S. housing market data and in the absence of any major economic reports in the U.K.

The Canadian dollar traded higher against the U.S. dollar after the release of the Canadian consumer price index. The consumer price index in Canada increase 0.3% in April (March: +0.6%), meeting analysts’ expectations. On a year-over-year rate, the consumer price index in Canada climbed 2.0% in April, from 1.5% in March.

The Canadian core consumer price index rose 0.2% in April (March: +0.3%), meeting analysts’ expectations. On a yearly basis, the Canadian core consumer price index climbed 1.4% in April, from a 1.3% increase in March.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports in New Zealand. The Conference Board released its April leading economic index for China. The index increased 0.9% in April, from a 1.2 gain in March. Market participants remained unimpressed by this release. China is New Zealand’s second-largest trading partner.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports in Japan.

-

16:40

Oil: an overview of the market situation

The price of oil rose moderately today , which was due to the tense situation in Ukraine before the presidential elections scheduled for May 25.

As it became known , the Ukrainian army on Thursday lost more than a dozen soldiers in battle with pro-Russian separatists.

We also add that the oil market continues today technical correction waiting for news that could give the market movement . Little influenced by the U.S. data , which showed that sales of newly built homes rose in April , becoming the latest sign of the revival of the housing market after the winter stagnation. New home sales rose 6.4% from March to a seasonally adjusted annual rate of 433,000 . Value for March was revised to increase to 407,000 . Economists forecast that monthly sales will grow by 426,000 in April.

However, today is characterized by low trading activity of market participants , which is partly due to the strengthening of the U.S. dollar on the FOREX. Low activity on the oil futures market today is also due to the upcoming three-day weekend in the U.S. and the lack of trading on the NYMEX April 26 in connection with a federal holiday on Memorial Day.

Dynamics is also dictated by the situation in Libya . Note that the protesters in Libya occupied the head office of the company, managing the oil port of Brega - the only one of the ports on the east of the country , which continued to work during the nine-month opposition factions vying for power . On Wednesday, the country's oil production was about 230,000 barrels , compared with 1.4 million barrels per day last year.

Support for WTI crude oil continues to have a decrease in energy reserves in the United States . U.S. crude inventories declined for the last week to 391.3 million barrels - the lowest level in six months.

The cost of the July futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 104.36 per barrel on the New York Mercantile Exchange (NYMEX).

July futures price for North Sea Brent crude oil mixture rose 6 cents to $ 110.42 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices retreated from session lows , but still remain below the opening level . Initially, the pressure exerted on the precious metal standby output data on the U.S. housing market , but the publication itself helped restore prices . As it became known , sales of newly built homes rose in April , becoming the latest sign of the revival of the housing market after the winter stagnation. New home sales rose 6.4% from March to a seasonally adjusted annual rate of 433,000 , said Friday the Ministry of Commerce . Value for March was revised to increase to 407,000 . Economists forecast that monthly sales will grow by 426,000 in April. Compared with a year earlier , sales of new homes fell 4.2% . The average home price remained elevated at $ 275,800 . It is slightly smaller than in March , when it reached the highest level in history.

Negative price dynamics is also called a technical correction and weakening interest in buying . On the eve of the official price of gold on COMEX rose by $ 6.9 and reached a maximum value for the three sessions , providing a small premium for sales.

However, weak investment demand for gold bullion today continues to put pressure on futures prices on COMEX. The assets of the world's largest holder of gold investment institutions ETFs SPDR Gold Trust as of 20 May 2014. remain at the level of 780.19 tonnes - the lowest level since December 2008.

Market participants are also watching the events in Ukraine, where this Sunday should be a presidential election . U.S. and European officials have warned over the weekend that against Russia will be additional sanctions if Moscow disrupt the forthcoming elections in Ukraine.

If you evaluate a technical point of view , it is likely that in the coming days will be a range of quotations of gold capped at $ 1280.0 support and resistance level $ 1305.0 .

The cost of the June gold futures on the COMEX today dropped to $ 1293.80 .

-

15:34

U.S. new home sales surged better than expected

The U.S. Census Bureau released the new home sales figures on Friday. The U.S. new home sales increased 6.4% in April to a seasonally adjusted annual rate of 433,000 units. March's figure was revised up to 407,000 from 384,000. Analysts had expected a gain to 425,000.

Sales of new homes declined 4.2% over the past 12 months.

The median sales price declined 2.1% during the past month to $275,800.

These figures could be a sign that the U.S. housing market gained strength.

-

15:00

U.S.: New Home Sales, April 433 (forecast 426)

-

14:46

Option expiries for today's 1400GMT cut

EUR/USD $1.3675

USD/JPY Y100.70, Y101.20, Y101.50, Y101.75, Y102.00/10

GBP/USD $1.6775

EUR/GBP stg0.8100, stg0.8125, stg0.8175

AUD/USD $0.9225, $0.9240, $0.9300, $0.9325, $0.9340

USD/CAD C$1.0825, C$1.0970-75

-

14:34

U.S. Stocks open: Dow 16,549.30 +6.22 +0.04%, Nasdaq 4,160.37 +6.03 +0.15%, S&P 1,893.58 +1.09 +0.06%

-

14:28

Before the bell: S&P futures +0.06%, Nasdaq futures +0.14%

U.S. stock-index futures were little changed before data that may show a rebound in housing activity in the world’s largest economy.

Global markets:

Nikkei 14,462.17 +124.38 +0.87%

Hang Seng 22,965.86 +12.10 +0.05%

Shanghai Composite 2,034.57 +13.28 +0.66%

FTSE 6,800.24 -20.32 -0.30%

CAC 4,481.95 +3.74 +0.08%

DAX 9,740.13 +19.22 +0.20%

Crude oil $104.12 (+0.37%)

Gold $1290.10 (-0.73%)

-

14:04

DOW components before the bell

(company / ticker / price / change, % / volume)

Boeing Co

BA

131.86

+0.02%

5.8K

International Business Machines Co...

IBM

185.76

+0.04%

0.2K

Johnson & Johnson

JNJ

101.00

+0.04%

0.4K

JPMorgan Chase and Co

JPM

54.59

+0.07%

0.4K

General Electric Co

GE

26.53

+0.08%

1.0K

Nike

NKE

75.01

+0.17%

0.9K

Walt Disney Co

DIS

82.51

+0.19%

12.2K

Verizon Communications Inc

VZ

49.56

+0.22%

10.4K

3M Co

MMM

140.31

0.00%

1.1K

Intel Corp

INTC

26.15

0.00%

0.1K

Cisco Systems Inc

CSCO

24.35

-0.12%

5.7K

Exxon Mobil Corp

XOM

101.33

-0.17%

0.1K

AT&T Inc

T

35.30

-0.23%

2.5K

Pfizer Inc

PFE

29.58

-0.27%

10.0K

-

14:00

Belgium: Business Climate, March -6.8 (forecast -4.7)

-

13:30

Canada: Consumer Price Index m / m, April +0.3% (forecast +0.3%)

-

13:30

Canada: Consumer price index, y/y, April +2.0%

-

13:30

Canada: Bank of Canada Consumer Price Index Core, m/m, April +0.2% (forecast +0.2%)

-

13:30

Canada: Bank of Canada Consumer Price Index Core, y/y, April +1.4%

-

13:07

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. housing market data

Economic calendar (GMT0):

02:00 China Leading Index April +1.2% +0.9%

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.8% +0.8% +0.8%

06:00 Germany GDP (YoY) (Finally) Quarter I +2.2% +2.2% +2.3%

08:00 Germany IFO - Business Climate May 111.2 111.0 110.4

08:00 Germany IFO - Current Assessment March 115.3 115.6 114.8

08:00 Germany IFO - Expectations March 107.3 106.9 106.2

09:00 Eurozone European Parliamentary Elections

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. housing market data. The U.S. new home sales should rise to 426,000 units in April, from 384,000 units in March.

The euro traded lower against the U.S. dollar due to the weaker-than-expected IFO-Business Climate index for Germany. The index dropped to a 5-month low of 110.4 in May, from 111.2 in March. Analysts had expected the index to decline to 111.0. Market participants hope the further stimulus measures by the European Central Bank will be introduced in June due to recently released weak economic data in the Eurozone.

German gross domestic product climbed 0.8% in the first quarter (Q4 2013: +0.8%), meeting analysts’ expectations.

On a yearly basis, German gross domestic product rose 2.3% in the first quarter (Q4 2013: +2.2%), exceeding analysts’ expectations of a 2.2% gain.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports in the U.K.

The Canadian dollar traded slightly higher against the U.S. dollar ahead of the release of the Canadian consumer price index. The consumer price index in Canada should increase 0.3% in April, from a 0.6% rise in April. The Canadian core consumer price index should climb 0.2% in April, from a 0.3% increase in March.

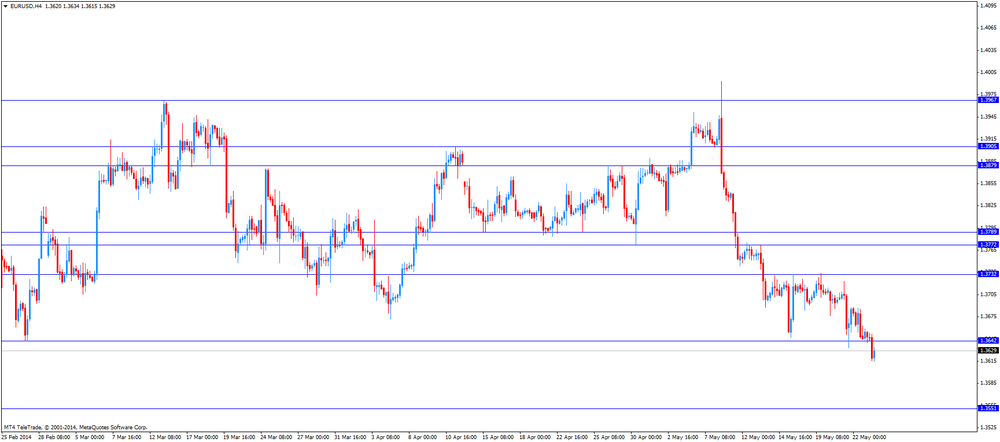

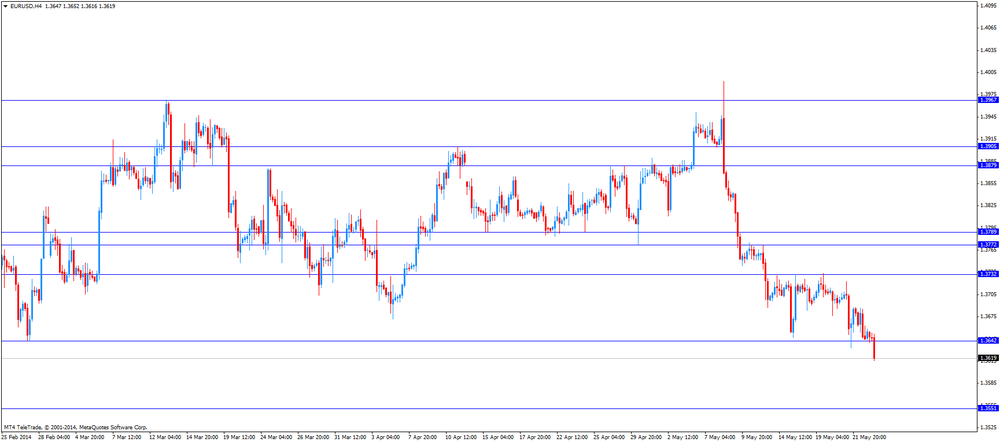

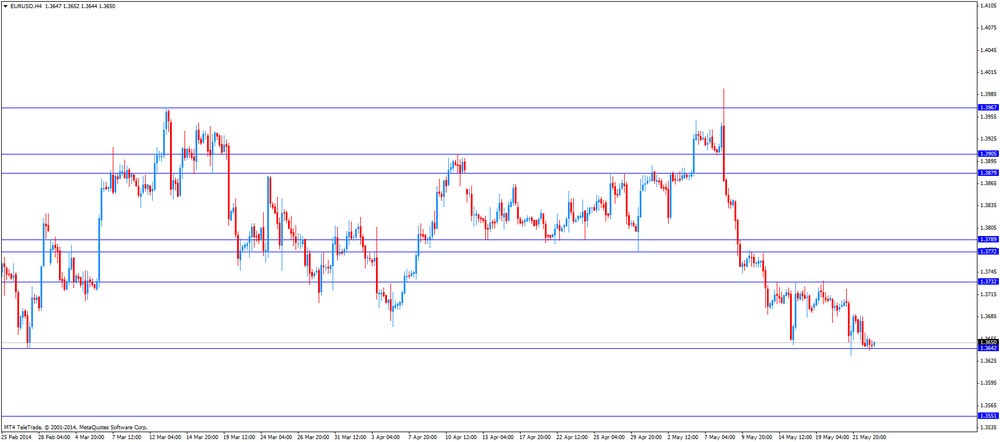

EUR/USD: the currency pair dropped to $1.3615

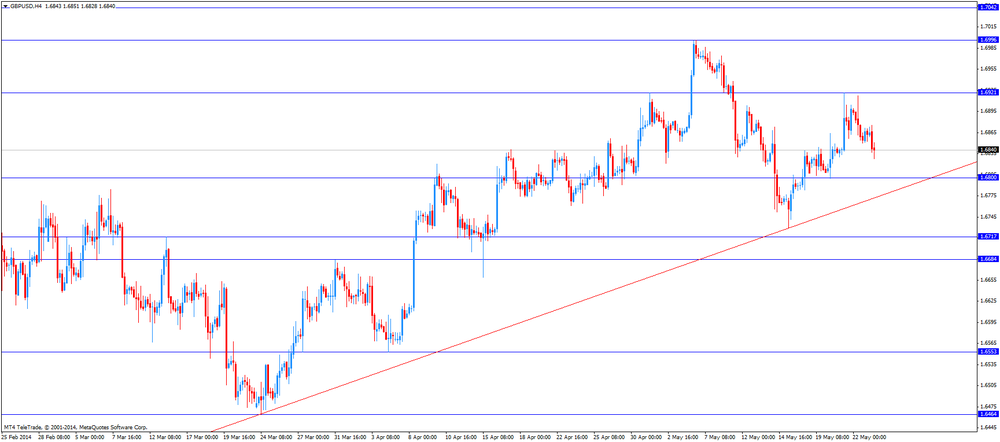

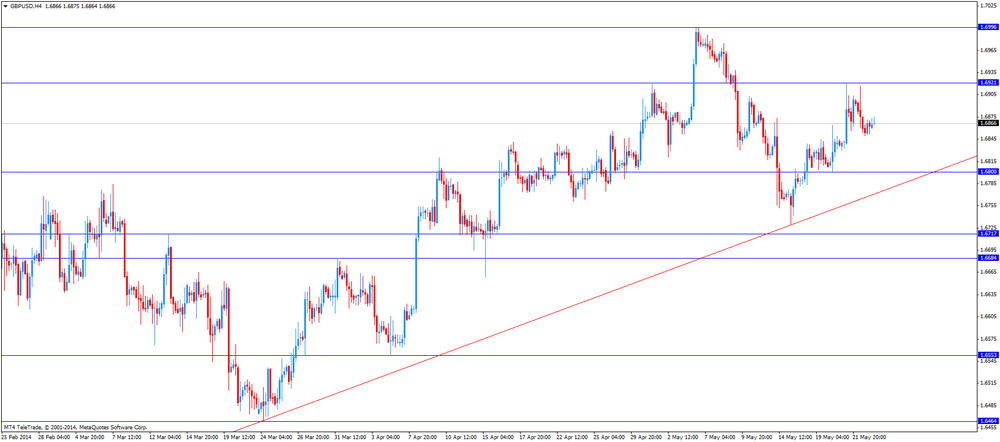

GBP/USD: the currency pair declined to $1.6828

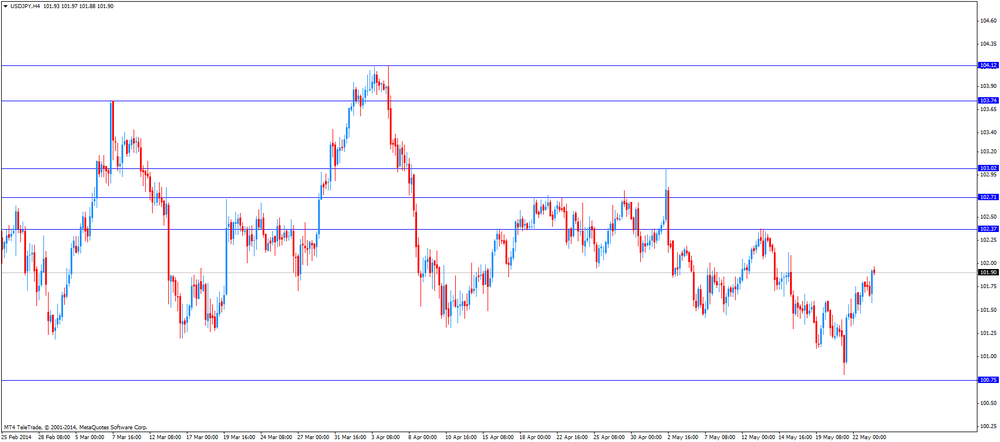

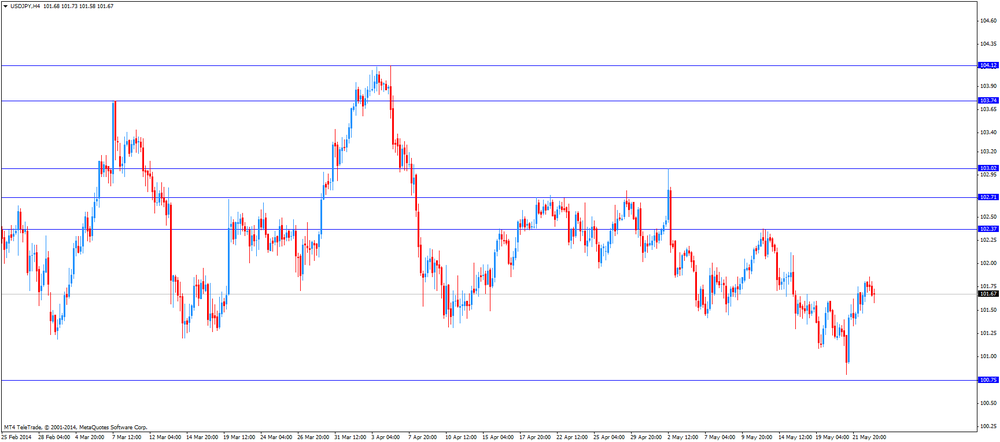

USD/JPY: the currency pair climbed to Y101.97

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m April +0.6% +0.3%

12:30 Canada Consumer price index, y/y April +1.5%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m April +0.3% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April +1.3%

13:00 Belgium Business Climate March -4.6 -4.7

14:00 U.S. New Home Sales April 384 426

-

13:00

Orders

EUR/USD

Offers $1.3695/700

Bids $1.3600, $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6950, $1.6930/35, $1.6900

Bids $1.6830, $1.6800

AUD/USD

Offers $0.9300, $0.9280, $0.9250

Bids $0.9200, $0.9150

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.50, Y139.20

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y102.50, Y102.00

Bids Y101.50, Y101.05/00, Y100.80

EUR/GBP

Offers stg0.8120, stg0.8110-15

Bids stg0.8050, stg0.8035/30, stg0.8005/000

-

12:05

European stock markets mid session: stocks traded mixed amid the U.S. housing market data

The stock indices stocks traded mixed amid the U.S. housing market data.

The IFO - Business Climate index for Germany dropped to a 5-month low of 110.4 in May, from 111.2 in March. Analysts had expected the index to decline to 111.0. Market participants hope the further stimulus measures by the European Central Bank will be introduced in June due to recently released weak economic data in the Eurozone.

German gross domestic product climbed 0.8% in the first quarter (Q4 2013: +0.8%), meeting analysts’ expectations.

On a yearly basis, German gross domestic product rose 2.3% in the first quarter (Q4 2013: +2.2%), exceeding analysts’ expectations of a 2.2% gain.

Pandora A/S declined 3.7% as some shareholders sold a stake of about 10%.

Current figures:

Name Price Change Change %

FTSE 100 6,800.3 -20.26 -0.30%

DAX 9,740.83 +19.92 +0.20%

CAC 40 4,477.34 -0.87 -0.02%

-

10:40

-

10:32

Asian Stocks close: stocks rose due to the positive U.S. economic data

Asian stock indices rose due to the positive U.S. economic data, following the U.S. markets. U.S. flash manufacturing purchasing managers' index rose to 56.2 in May, from 55.4 in April. Analysts had forecasted a gain to 55.6.

Sales of existing homes in the U.S. climbed to 1.3% in April to an annual rate of 4.65 million units, missing expectations of a 2.2% gain to 4.68 million. That was the first increase in 2014.

The Conference Board released its April leading economic index for China. The index increased 0.9% in April, from a 1.2 gain in March.

Indexes on the close:

Nikkei 225 14,462.17 +124.38 +0.78%

Hang Seng 22,965.86 +12.10 +0.05%

Shanghai Composite 2,034.57 +13.28 +0.66%

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD $1.3675

USD/JPY Y100.70, Y101.20, Y101.50, Y101.75, Y102.00/10

GBP/USD $1.6775

EUR/GBP stg0.8100, stg0.8125, stg0.8175

AUD/USD $0.9225, $0.9240, $0.9300, $0.9325, $0.9340

USD/CAD C$1.0825, C$1.0970-75

-

09:47

Foreign exchange market. Asian session: currencies traded slightly changed in the any major economic reports

Economic calendar (GMT0):

02:00 China Leading Index April +1.2% +0.9%

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.8% +0.8% +0.8%

06:00 Germany GDP (YoY) (Finally) Quarter I +2.2% +2.2% +2.3%

08:00 Germany IFO - Business Climate May 111.2 111.0 110.4

08:00 Germany IFO - Current Assessment March 115.3 115.6 114.8

08:00 Germany IFO - Expectations March 107.3 106.9 106.2

The U.S. dollar traded mixed against the most major currencies. The U.S. currency was supported by the positive U.S. economic data, published on Thursday. U.S. flash manufacturing purchasing managers' index rose to 56.2 in May, from 55.4 in April. Analysts had forecasted a gain to 55.6.

Sales of existing homes in the U.S. climbed to 1.3% in April to an annual rate of 4.65 million units, missing expectations of a 2.2% gain to 4.68 million. That was the first increase in 2014.

The New Zealand dollar traded little changed against the U.S. dollar in the absence of any major economic reports in New Zealand. The Conference Board released its April leading economic index for China. The index increased 0.9% in April, from a 1.2 gain in March. Market participants remained unimpressed by this release. China is New Zealand’s second-largest trading partner.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded slightly higher against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair declined to $1.3640

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y101.65

The most important news that are expected (GMT0):

09:00 Eurozone European Parliamentary Elections

12:30 Canada Consumer Price Index m / m April +0.6% +0.3%

12:30 Canada Consumer price index, y/y April +1.5%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m April +0.3% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April +1.3%

13:00 Belgium Business Climate March -4.6 -4.7

14:00 U.S. New Home Sales April 384 426

-

09:00

Germany: IFO - Business Climate, May 110.4 (forecast 111.0)

-

09:00

Germany: IFO - Current Assessment , March 114.8 (forecast 115.6)

-

09:00

Germany: IFO - Expectations , March 106.2 (forecast 106.9)

-

08:46

FTSE 100 6,802.79 -17.77 -0.26%, CAC 40 4,473.68 -4.53 -0.10%, Xetra DAX 9,717.97 -2.94 -0.03%

-

07:01

Germany: GDP (QoQ), Quarter I +0.8% (forecast +0.8%)

-

07:01

Germany: GDP (YoY), Quarter I +2.3% (forecast +2.2%)

-

06:41

European bourses are seen flat to modestly higher Friday: the FTSE and DAX seen 0.1% higher and the CAC flat

-

06:27

Options levels on friday, May 23, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3785 (3157)

$1.3753 (4171)

$1.3704 (537)

Price at time of writing this review: $ 1.3650

Support levels (open interest**, contracts):

$1.3615 (2917)

$1.3597 (6292)

$1.3574 (3395)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56557 contracts, with the maximum number of contracts with strike price $1,3850 (6253);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 71516 contracts, with the maximum number of contractswith strike price $1,3700 (6292);

- The ratio of PUT/CALL was 1.26 versus 1.29 from the previous trading day according to data from May, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.7101 (1855)

$1.7002 (2838)

$1.6905 (1948)

Price at time of writing this review: $1.6869

Support levels (open interest**, contracts):

$1.6796 (1669)

$1.6698 (2394)

$1.6599 (1605)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 23478 contracts, with the maximum number of contracts with strike price $1,7000 (2838);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 24754 contracts, with the maximum number of contracts with strike price $1,6700 (2394);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from May, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:00

China: Leading Index , April +0.9%

-

00:30

Commodities. Daily history for May 22’2014:

(raw materials / closing price /% change)Gold $1,294.90 +6.90 +0.54%

ICE Brent Crude Oil $110.39 -0.16 -0.14%

NYMEX Crude Oil $103.69 -0.30 -0.29%

-

00:25

Stocks. Daily history for May 22’2014:

(index / closing price / change items /% change)Nikkei 14,337.79 +295.62 +2.11%

Hang Seng 22,953.76 +117.24 +0.51%

Shanghai Composite 2,021.29 -3.67 -0.18%

S&P 1,892.49 +4.46 +0.24%

NASDAQ 4,154.34 +22.80 +0.55%

Dow 16,543.08 +10.02 +0.06%

FTSE 1,366.29 +1.53 +0.11%

CAC 4,478.21 +9.18 +0.21%

DAX 9,720.91 +23.04 +0.24%

-

00:20

Currencies. Daily history for May 22'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3655 -0,22%

GBP/USD $1,6866 -0,19%

USD/CHF Chf0,8941 +0,10%

USD/JPY Y101,75 +0,32%

EUR/JPY Y138,94 +0,10%

GBP/JPY Y171,60 +0,13%

AUD/USD $0,9222 -0,25%

NZD/USD $0,8563 -0,09%

USD/CAD C$1,0891 -0,20%

-

00:00

Schedule for today, Friday, May 23’2014:

(time / country / index / period / previous value / forecast)02:00 China Leading Index April +1.2%

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.8% +0.8%

06:00 Germany GDP (YoY) (Finally) Quarter I +2.2% +2.2%

08:00 Germany IFO - Business Climate May 111.2 111.0

08:00 Germany IFO - Current Assessment March 115.3 115.6

08:00 Germany IFO - Expectations March 107.3 106.9

09:00 Eurozone European Parliamentary Elections

12:30 Canada Consumer Price Index m/m April +0.6% +0.3%

12:30 Canada Consumer price index, y/y April +1.5%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m April +0.3% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April +1.3%

13:00 Belgium Business Climate March -4.6 -4.7

14:00 U.S. New Home Sales April 384 426

-