Notícias do Mercado

-

16:30

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the better-than-expected U.S. manufacturing purchasing managers' index and existing home sales

The U.S. dollar traded mixed against the most major currencies after the U.S. manufacturing purchasing managers' index and existing home sales. The existing home sales rose 4.9% to 4.89 million units in May from 4.66 million in April. That was the highest monthly increase since August 2011.

April's figures were revised up to a rate of 4.66 million from 4.65 million. Analysts had expected an increase to 4.74 million units.

The U.S. manufacturing purchasing managers' index climbed to 57.5 in June from 56.4 in May, beating expectations for a decline to 56.1.

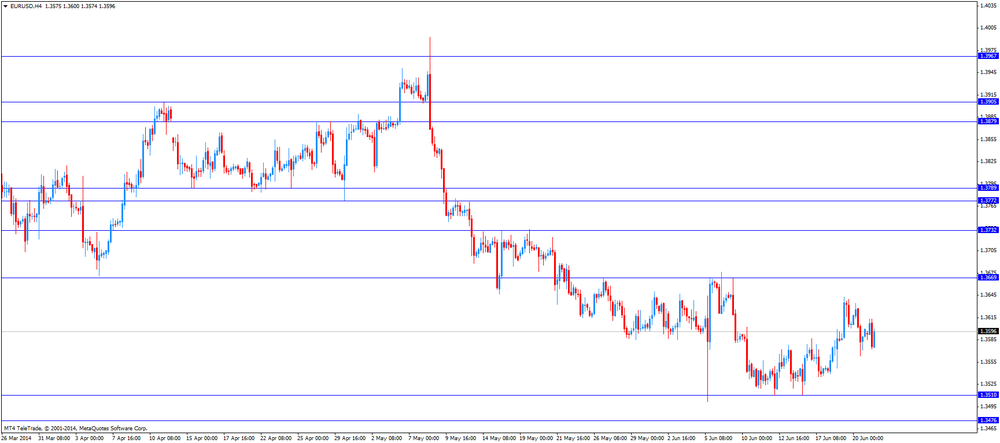

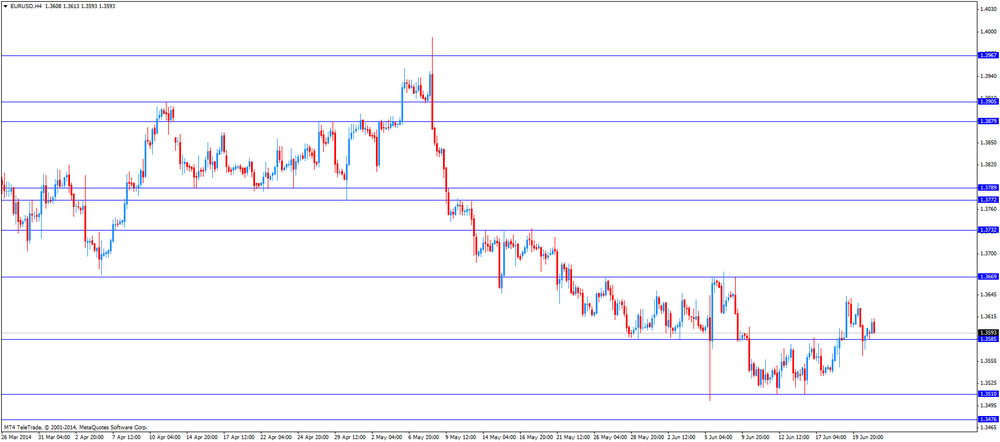

The euro traded slightly lower against the U.S. dollar after the weaker-than-expected data from the Eurozone. Eurozone's manufacturing purchasing managers' index dropped to 51.9 in June from 52.2 in May. Analysts had expected the index to remain unchanged.

Eurozone's services PMI fell to 52.8 in June from 53.2 in May, missing expectations for an increase to 53.4.

Germany's manufacturing PMI climbed to 52.4 in June to from 52.3 in May, but missing expectations for a gain to 52.7.

Germany's services PMI declined to 54.8 in June from 56.0 in May. Analysts had forecasted a decrease to 55.8.

The French manufacturing PMI fell to 47.8 in June from 49.6 in May. Analysts had expected the index to remain unchanged.

The French services PMI decreased to 48.2 in June from 49.1 in May, missing expectation for an increase to 49.5.

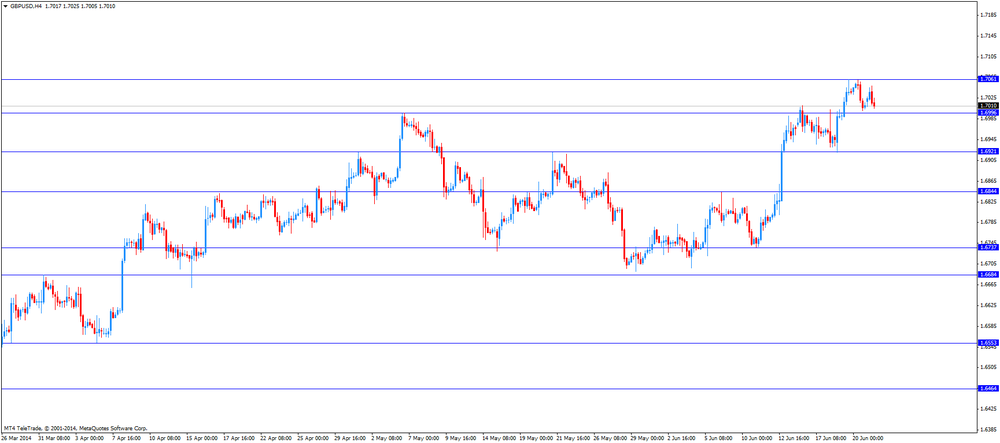

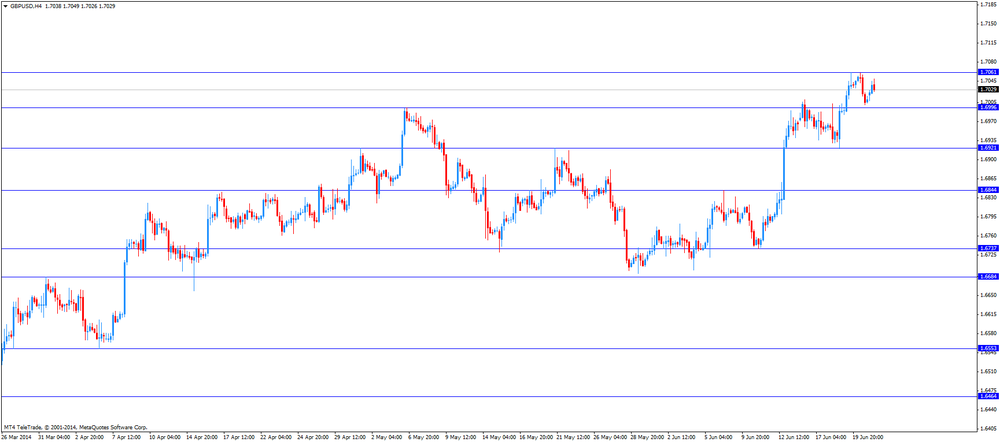

The British pound traded lower against the U.S. dollar. The Bank of England (BoE) released its latest Credit Conditions Survey on Monday. The BoE said that the demand for secured lending for house purchases and demand for corporate credit rose significantly in the second quarter. The BoE also said the demand for secured lending from household and corporates should rise in the third quarter. The BoE added that banks expect mortgage approvals to decrease significantly in the third quarter.

The New Zealand dollar increased against the U.S dollar due to the better-than-expected economic data from China, but later lost its gains. China's HSBC manufacturing purchasing managers' index rose to 50.8 in June from 49.4 in May. Analysts had expected an increase to 49.7.

The credit card spending in New Zealand rose 7.5% in May, after a 3.2% gain in April.

Westpac consumer sentiment for New Zealand declined to 121.2 in the second quarter from 121.7 the previous quarter.

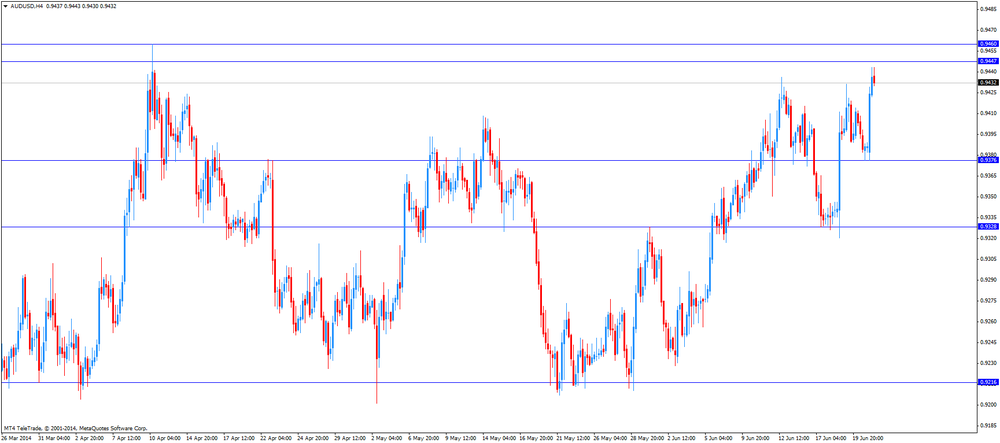

The Australian dollar climbed against the U.S. dollar due to the better-than-expected HSBC manufacturing purchasing managers' index from China, but later lost its gains. No economic reports were released in Australia.

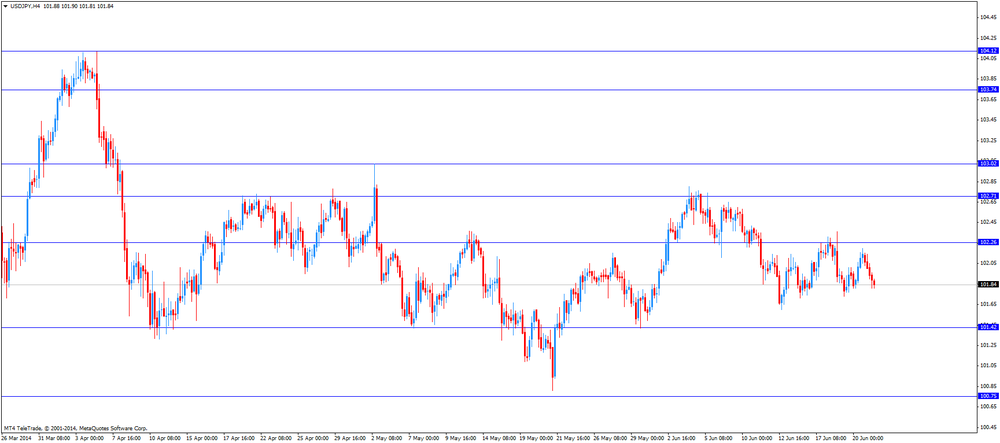

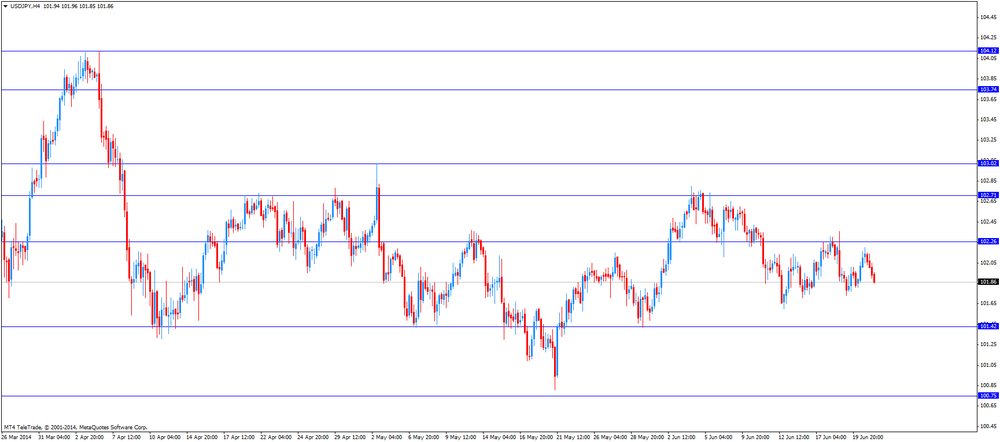

The Japanese yen traded higher against the U.S. dollar after the manufacturing purchasing managers' index. The manufacturing purchasing managers' index in Japan climbed to 51.1 in June from 49.9 in May.

-

15:55

Existing home sales in the U.S. increased 4.9% in May

The National Association of Realtors released the existing home sales in the U.S. The existing home sales rose 4.9% to 4.89 million units in May from 4.66 million in April. That was the highest monthly increase since August 2011.

April's figures were revised up to a rate of 4.66 million from 4.65 million. Analysts had expected an increase to 4.74 million units.

Despite an improving trend, existing home sales were down 5% from the year-earlier level.

-

15:00

U.S.: Existing Home Sales , May 4.89 (forecast 4.74)

-

14:45

U.S.: Manufacturing PMI, June 57.5 (forecast 56.1)

-

14:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3600, $1.3640, $1.3700

USD/JPY Y102.00, Y102.10, Y102.20, Y102.25/30, Y102.55, Y103.00, Y103.25, Y103.40

GBP/USD $1.6490

USD/CAD Cad1.0800, Cad1.0815, Cad1.0925, Cad1.0950

AUD/USD $0.9350, $0.9400

-

13:02

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of the U.S. manufacturing purchasing managers' index and existing home sales

Economic calendar (GMT0):

01:35 Japan Manufacturing PMI June 49.9 51.1

01:45 China HSBC Manufacturing PMI (Preliminary) June 49.4 49.7 50.8

03:00 New Zealand Credit Card Spending May +3.2% +7.5%

06:00 Japan BOJ Governor Haruhiko Kuroda Speaks

06:58 France Manufacturing PMI (Preliminary) June 49.6 49.6 47.8

06:58 France Services PMI (Preliminary) June 49.1 49.5 48.2

07:28 Germany Manufacturing PMI (Preliminary) June 52.3 52.7 52.4

07:28 Germany Services PMI (Preliminary) June 56.0 55.8 54.8

07:58 Eurozone Manufacturing PMI (Preliminary) June 52.2 52.2 51.9

07:58 Eurozone Services PMI (Preliminary) June 53.2 53.4 52.8

08:30 United Kingdom BOE Credit Conditions Survey

The U.S. dollar traded higher against the most major currencies ahead of the U.S. manufacturing purchasing managers' index and existing home sales. The U.S. manufacturing purchasing managers' index should decline to 56.1 in June from 56.4 in May.

The existing home sales in the U.S. should rise to 4.74 million units in May after 4.65 million units in April.

The euro traded lower against the U.S. dollar after the weaker-than-expected data from the Eurozone. Eurozone's manufacturing purchasing managers' index dropped to 51.9 in June from 52.2 in May. Analysts had expected the index to remain unchanged.

Eurozone's services PMI fell to 52.8 in June from 53.2 in May, missing expectations for an increase to 53.4.

Germany's manufacturing PMI climbed to 52.4 in June to from 52.3 in May, but missing expectations for a gain to 52.7.

Germany's services PMI declined to 54.8 in June from 56.0 in May. Analysts had forecasted a decrease to 55.8.

The French manufacturing PMI fell to 47.8 in June from 49.6 in May. Analysts had expected the index to remain unchanged.

The French services PMI decreased to 48.2 in June from 49.1 in May, missing expectation for an increase to 49.5.

The British pound traded lower against the U.S. dollar. The Bank of England (BoE) released its latest Credit Conditions Survey on Monday. The BoE said that the demand for secured lending for house purchases and demand for corporate credit rose significantly in the second quarter. The BoE also said the demand for secured lending from household and corporates should rise in the third quarter. The BoE added that banks expect mortgage approvals to decrease significantly in the third quarter.

EUR/USD: the currency pair declined to $1.3573

GBP/USD: the currency pair decreased to $1.7005

USD/JPY: the currency pair declined to Y101.81

The most important news that are expected (GMT0):

13:43 U.S. Manufacturing PMI (Preliminary) June 56.4 56.1

14:00 U.S. Existing Home Sales May 4.65 4.74

-

13:00

Orders

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3645

Bids $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85, $1.7062

Bids $1.6992, $1.6980, $1.6950, $1.6910/00

AUD/USD

Offers $0.9545, $0.9500, $0.9460, $0.9450

Bids $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.50, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.40, Y102.20

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900

-

10:22

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3600, $1.3640, $1.3700

USD/JPY Y102.00, Y102.10, Y102.20, Y102.25/30, Y102.55, Y103.00, Y103.25, Y103.40

GBP/USD $1.6490

USD/CAD Cad1.0800, Cad1.0815, Cad1.0925, Cad1.0950

AUD/USD $0.9350, $0.9400

-

09:53

Foreign exchange market. Asian session: the Australian and New Zealand dollar increased against the U.S dollar due to the better-than-expected economic data from China

Economic calendar (GMT0):

01:35 Japan Manufacturing PMI June 49.9 51.1

01:45 China HSBC Manufacturing PMI (Preliminary) June 49.4 49.7 50.8

03:00 New Zealand Credit Card Spending May +3.2% +7.5%

06:00 Japan BOJ Governor Haruhiko Kuroda Speaks

06:58 France Manufacturing PMI (Preliminary) June 49.6 49.6 47.8

06:58 France Services PMI (Preliminary) June 49.1 49.5 48.2

07:28 Germany Manufacturing PMI (Preliminary) June 52.3 52.7 52.4

07:28 Germany Services PMI (Preliminary) June 56.0 55.8 54.8

07:58 Eurozone Manufacturing PMI (Preliminary) June 52.2 52.2 51.9

07:58 Eurozone Services PMI (Preliminary) June 53.2 53.4 52.8

08:30 United Kingdom BOE Credit Conditions Survey

The U.S. dollar traded lower against the most major currencies. The U.S. currency remained under pressure due to Fed's comments that interest rates in the U.S. will remain unchanged for a considerable time after the Fed's asset purchase program ends.

The New Zealand dollar increased against the U.S dollar due to the better-than-expected economic data from China. China's HSBC manufacturing purchasing managers' index rose to 50.8 in June from 49.4 in May. Analysts had expected an increase to 49.7.

The credit card spending in New Zealand rose 7.5% in May, after a 3.2% gain in April.

Westpac consumer sentiment for New Zealand declined to 121.2 in the second quarter from 121.7 the previous quarter.

The Australian dollar climbed against the U.S. dollar due to the better-than-expected HSBC manufacturing purchasing managers' index from China. No economic reports were released in Australia.

The Japanese yen gained against the U.S. dollar after the manufacturing purchasing managers' index. The manufacturing purchasing managers' index in Japan climbed to 51.1 in June from 49.9 in May.

EUR/USD: the currency pair increased to $1.3610

GBP/USD: the currency pair climbed to $1.7045

USD/JPY: the currency pair declined to Y101.90

AUD/USD: the currency pair climbed to $0.9443

NZD/USD: the currency pair increased to $0.8748

The most important news that are expected (GMT0):

13:43 U.S. Manufacturing PMI (Preliminary) June 56.4 56.1

14:00 U.S. Existing Home Sales May 4.65 4.74

-

09:01

Eurozone: Services PMI, June 52.8 (forecast 53.4)

-

09:00

Eurozone: Manufacturing PMI, June 51.9 (forecast 52.2)

-

08:30

Germany: Manufacturing PMI, June 52.4 (forecast 52.7)

-

08:30

Germany: Services PMI, June 54.8 (forecast 55.8)

-

07:59

France: Manufacturing PMI, June 47.8 (forecast 49.6)

-

07:59

France: Services PMI, June 48.2 (forecast 49.5)

-

06:10

Options levels on monday, June 23, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3682 (2388)

$1.3654 (3542)

$1.3633 (1814)

Price at time of writing this review: $ 1.3607

Support levels (open interest**, contracts):

$1.3579 (1572)

$1.3542 (3966)

$1.3513 (5089)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 30803 contracts, with the maximum number of contracts with strike price $1,3700 (3836);

- Overall open interest on the PUT options with the expiration date July, 3 is 42275 contracts, with the maximum number of contracts with strike price $1,3500 (5304);

- The ratio of PUT/CALL was 1.37 versus 1.39 from the previous trading day according to data from June, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (385)

$1.7201 (2145)

$1.7102 (2195)

Price at time of writing this review: $1.7042

Support levels (open interest**, contracts):

$1.6897 (1332)

$1.6799 (1689)

$1.6700 (2252)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 119645 contracts, with the maximum number of contracts with strike price $1,7100 (2195);

- Overall open interest on the PUT options with the expiration date July, 3 is 23528 contracts, with the maximum number of contracts with strike price $1,6750 (2279);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from June, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:00

New Zealand: Credit Card Spending, May +7.5%

-

02:45

China: HSBC Manufacturing PMI, June 50.8 (forecast 49.7)

-

02:35

Japan: Manufacturing PMI, June 51.1

-

00:20

Currencies. Daily history for June 20'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3599 -0,05%

GBP/USD $1,7011 -0,15%

USD/CHF Chf0,8948 +0,09%

USD/JPY Y102,06 +0,13%

EUR/JPY Y138,79 +0,07%

GBP/JPY Y173,62 -0,02%

AUD/USD $0,9386 -0,10%

NZD/USD $0,8695 -0,18%

USD/CAD C$1,0756 -0,58%

-

00:00

Schedule for today, Monday, June 23’2014:

(time / country / index / period / previous value / forecast)01:35 Japan Manufacturing PMI June 49.9

01:45 China HSBC Manufacturing PMI (Preliminary) June 49.4 49.7

03:00 New Zealand Credit Card Spending May +3.2%

06:00 Japan BOJ Governor Haruhiko Kuroda Speaks

06:58 France Manufacturing PMI (Preliminary) June 49.6 49.6

06:58 France Services PMI (Preliminary) June 49.1 49.5

07:28 Germany Manufacturing PMI (Preliminary) June 52.3 52.7

07:28 Germany Services PMI (Preliminary) June 56.0 55.8

07:58 Eurozone Manufacturing PMI (Preliminary) June 52.2 52.2

07:58 Eurozone Services PMI (Preliminary) June 53.2 53.4

08:30 United Kingdom BOE Credit Conditions Survey

13:43 U.S. Manufacturing PMI (Preliminary) June 56.4 56.1

14:00 U.S. Existing Home Sales May 4.65 4.74

-