Notícias do Mercado

-

16:41

Foreign exchange market. American session: the U.S. dollar increased against the most major currencies due to the strong U.S. economic data

The U.S. dollar increased against the most major currencies due to the strong U.S. economic data. The Conference Board released its consumer confidence index. The index climbed to 85.2 in June from a reading of 82.2 in May. That was the highest level since January 2008. May's figure was revised down from 83.0. Analysts expected an increase to 83.6.

New home sales in the U.S. jumped 18.6% in May to a seasonally adjusted annual rate of 504,000 units. That was the highest level since May 2008.

Analysts had expected new home sales to rise to 442,000 units. April's figure was revised down to 425,000 units from 433,000 units.

S&P/Case-Shiller home price index climbed 10.8% in April, missing expectations for a gain of 11.6%, after a 12.4% rise in March.

Richmond Fed manufacturing index declined to 3 in June from 7 in May, missing expectations for a fall to 6. Figures above zero indicate expansion.

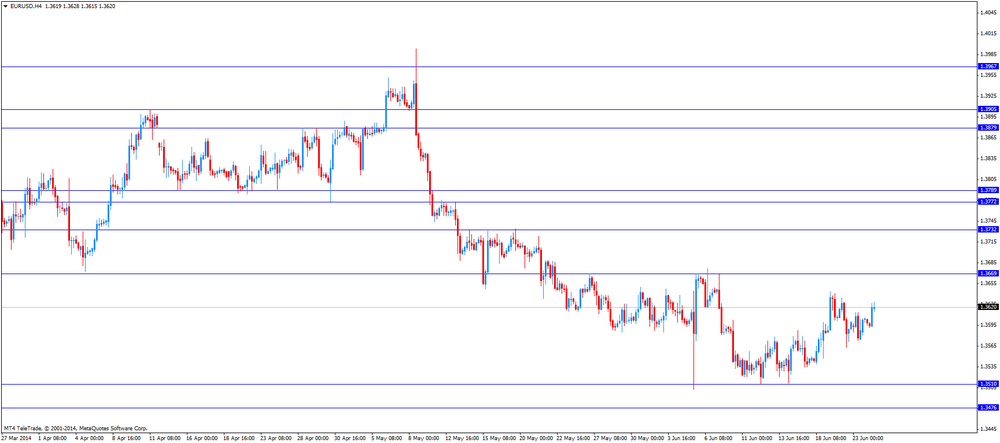

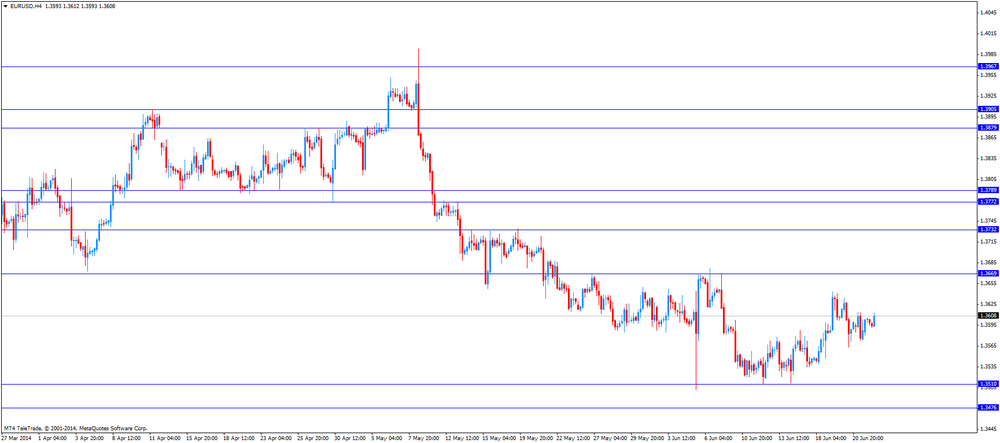

The euro declined against the U.S. dollar after the release of the better-than-expected U.S. economic data. The German Ifo business climate index declined to 109.7 in June from 110.4 in May. That was the lowest level this year. Analysts had expected a fall to 110.3.

The German Ifo expectations index fell to 104.8 in June from 106.2 in May.

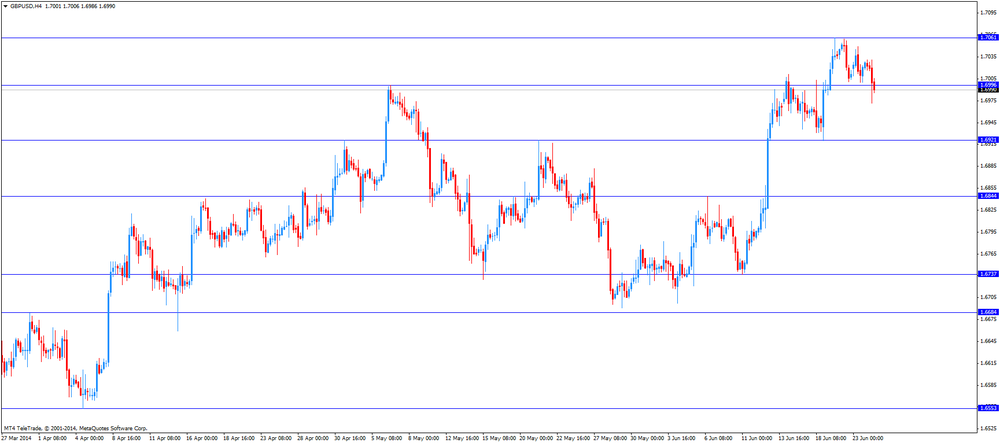

The British pound declined against the U.S. dollar due to the speech of the Bank of England (BoE) Governor Mark Carney and the better-than-expected U.S. economic data. Mark Carney testified before parliament's Treasury committee today. He said that the interest rate hike will be driven by the U.K. economic data. He also said that wages in the U.K. are softer than expected by the BoE.

These comment by Mark Carney means there is no need to hike interest rate.

The British Bankers Association release the mortgage approvals. The U.K. mortgage approvals climbed by £41,800 in May, exceeding expectations for a rise of £41,300, after an increase of £41,900 in April.

The New Zealand dollar fell against the U.S dollar due to the better-than-expected U.S. economic data. No economic reports were released in New Zealand.

The Australian dollar declined against the U.S. dollar due to the better-than-expected U.S. economic data. No economic reports were released in Australia.

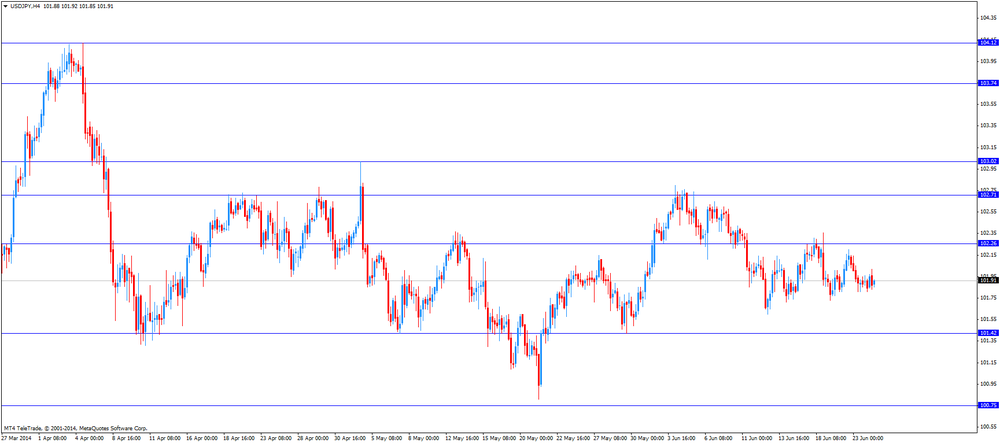

The Japanese yen traded lower against the U.S. dollar due to the better-than-expected U.S. economic data. No economic reports were released in Japan.

Japan's Prime Minister Shinzo Abe unveiled the reform plans of his "third arrow" strategy today. His reform plan focuses to encourage Japanese companies to invest more and create more jobs. The government plans to cut the corporate tax rate and to boost the role of working women due to the shrinking workforce in Japan.

-

15:57

U.S. new home sales rose 18.6% in May

The Commerce Department released new home sales in the U.S. New home sales jumped 18.6% in May to a seasonally adjusted annual rate of 504,000 units. That was the highest level since May 2008.

Analysts had expected new home sales to rise to 442,000 units. April's figure was revised down to 425,000 units from 433,000 units.

That could be a sign for the housing recovery in the U.S.

-

15:44

Japan’s Prime Minister Shinzo Abe unveiled the reform plans of his "third arrow" strategy

Japan's Prime Minister Shinzo Abe unveiled the reform plans of his "third arrow" strategy today. His reform plan focuses to encourage Japanese companies to invest more and create more jobs. The government plans to cut the corporate tax rate below 30% from the current 34%. This process should start next year.

The government wants to boost the role of working women due to the shrinking workforce in Japan. Japan's population is one of the world's most rapidly ageing populations.

-

15:07

Bank of England Governor Mark Carney: wages in the U.K. softer than expected by the BoE

The Bank of England Governor Mark Carney testified before the Treasury Select Committee (TSC) today. He said:

- Wages in the U.K. softer than expected by the BoE;

- There has been more spare capacity in the labour market that can be absorbed before the interest rate hike;

- Timing of any interest increases is not as important as the fact any interest rise will be "limited and gradual";

- The interest rate hike will be driven by the U.K. economic data.

- Wages in the U.K. softer than expected by the BoE;

-

15:00

U.S.: Richmond Fed Manufacturing Index, June 3 (forecast 6)

-

15:00

U.S.: Consumer confidence , June 85.2 (forecast 83.6)

-

15:00

U.S.: New Home Sales, May 504 (forecast 442)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3530, $1.3545, $1.3600, $1.3635

USD/JPY Y102.05, Y102.75, Y103.00

EUR/JPY Y138.50, Y139.55

AUD/USD $0.9350/60

NZD/USD NZ$0.8655

USD/CHF Chf0.8900, Chf0.9005

-

14:04

U.S.: Housing Price Index, y/y, April +5.9%

-

14:02

U.S.: Housing Price Index, m/m, April +0.0% (forecast +0.6%)

-

14:00

Belgium: Business Climate, June -6.2 (forecast -4.1)

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, April +10.8% (forecast +11.7%)

-

13:05

Foreign exchange market. European session: the euro increased against the U.S. dollar despite the weaker-than-expected German Ifo business climate index

Economic calendar (GMT0):

02:00 China Leading Index May +0.9% +0.7%

06:00 Switzerland Trade Balance May 2.45 2.77 2.77

08:00 Germany IFO - Business Climate June 110.4 110.3 109.7

08:00 Germany IFO - Current Assessment June 114.8 114.8

08:00 Germany IFO - Expectations June 106.2 104.8

08:30 United Kingdom BBA Mortgage Approvals May 42.2 41.3 41.8

08:30 United Kingdom BOE Gov Mark Carney Speaks

08:30 United Kingdom Inflation Report Hearings

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. S&P/Case-Shiller home price index should climb 11.7% in April, after a 12.4% rise in March.

The consumer confidence in the U.S. should rise to 83.6 in June from 83.0 in May.

The euro increased against the U.S. dollar despite the weaker-than-expected German Ifo business climate index. The German Ifo business climate index declined to 109.7 in June from 110.4 in May. That was the lowest level this year. Analysts had expected a fall to 110.3.

The German Ifo expectations index fell to 104.8 in June from 106.2 in May.

The British pound declined against the U.S. dollar after the speech of the Bank of England (BoE) Governor Mark Carney. Mark Carney testified before parliament's Treasury committee today. He said that the interest rate hike will be driven by the U.K. economic data. He also said that wages in the U.K. are softer than expected by the BoE.

These comment by Mark Carney means there is no need to hike interest rate.

The British Bankers Association release the mortgage approvals. The U.K. mortgage approvals climbed by £41,800 in May, exceeding expectations for a rise of £41,300, after an increase of £41,900 in April.

EUR/USD: the currency pair increased to $1.3628

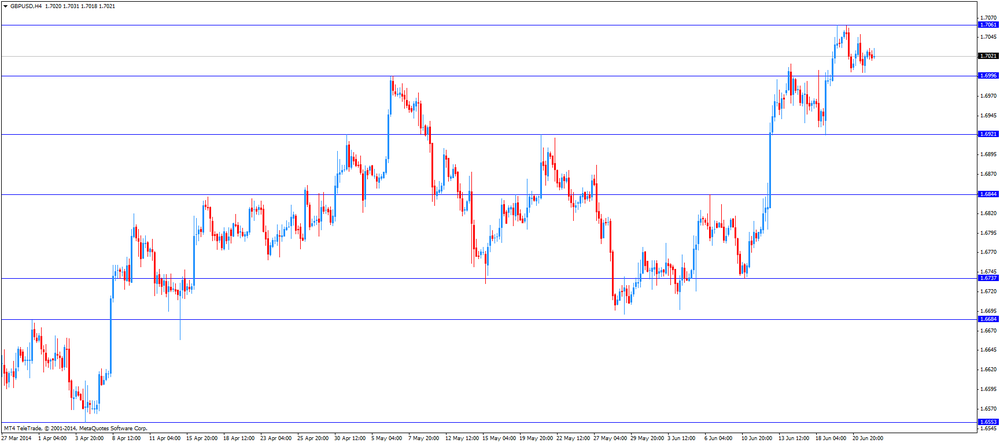

GBP/USD: the currency pair decreased to $1.6972

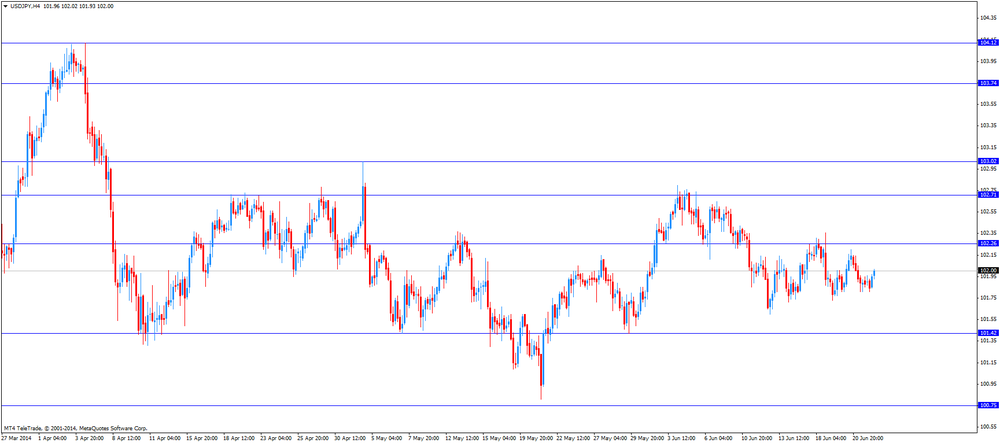

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:05 U.S. FOMC Member Charles Plosser Speaks

13:00 Belgium Business Climate June -6.8 -4.1

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April +12.4% +11.7%

14:00 U.S. Consumer confidence June 83.0 83.6

14:00 U.S. New Home Sales May 433 442

14:00 U.S. Treasury Sec Lew Speaks

-

13:00

Orders

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3645

Bids $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85, $1.7062

Bids $1.6992, $1.6980, $1.6950, $1.6910/00

AUD/USD

Offers $0.9545, $0.9500, $0.9460, $0.9450

Bids $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.40, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.40, Y102.20

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900

-

10:28

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3530, $1.3545, $1.3600, $1.3635

USD/JPY Y102.05, Y102.75, Y103.00

EUR/JPY Y138.50, Y139.55

AUD/USD $0.9350/60

NZD/USD NZ$0.8655

USD/CHF Chf0.8900, Chf0.9005

-

09:35

Foreign exchange market. Asian session: New Zealand dollar traded mixed against the U.S dollar, still supported by yesterday’s Chinese economic data

Economic calendar (GMT0):

02:00 China Leading Index May +0.9% +0.7%

06:00 Switzerland Trade Balance May 2.45 2.77 2.77

08:00 Germany IFO - Business Climate June 110.4 110.3 109.7

08:00 Germany IFO - Current Assessment June 114.8 114.8

08:00 Germany IFO - Expectations June 106.2 104.8

08:30 United Kingdom BBA Mortgage Approvals May 42.2 41.3 41.8

08:30 United Kingdom BOE Gov Mark Carney Speaks

08:30 United Kingdom Inflation Report Hearings

The U.S. dollar traded mixed against the most major currencies. The U.S. currency was supported by the better-than-expected he U.S. manufacturing purchasing managers' index. The U.S. manufacturing purchasing managers' index climbed to 57.5 in June from 56.4 in May, beating expectations for a decline to 56.1.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand. The kiwi was still supported by yesterday's Chinese economic data. China's HSBC manufacturing purchasing managers' index rose to 50.8 in June from 49.4 in May. Analysts had expected an increase to 49.7.

The Australian dollar declined against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded slightly lower against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair declined to $1.3590

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y101.97

The most important news that are expected (GMT0):

12:05 U.S. FOMC Member Charles Plosser Speaks

13:00 Belgium Business Climate June -6.8 -4.1

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April +12.4% +11.7%

14:00 U.S. Consumer confidence June 83.0 83.6

14:00 U.S. New Home Sales May 433 442

14:00 U.S. Treasury Sec Lew Speaks

-

09:30

United Kingdom: BBA Mortgage Approvals, May 41.8 (forecast 41.3)

-

09:00

Germany: IFO - Business Climate, June 109.7 (forecast 110.3)

-

09:00

Germany: IFO - Current Assessment , June 114.8

-

09:00

Germany: IFO - Expectations , June 104.8

-

07:00

Switzerland: Trade Balance, May 2.77 (forecast 2.77)

-

06:24

Options levels on tuesday, June 24, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3682 (2410)

$1.3655 (3467)

$1.3624 (388)

Price at time of writing this review: $ 1.3595

Support levels (open interest**, contracts):

$1.3575 (1032)

$1.3552 (4096)

$1.3521 (5037)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 30740 contracts, with the maximum number of contracts with strike price $1,3700 (3845);

- Overall open interest on the PUT options with the expiration date July, 3 is 42368 contracts, with the maximum number of contracts with strike price $1,3500 (5359);

- The ratio of PUT/CALL was 1.38 versus 1.37 from the previous trading day according to data from June, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (385)

$1.7201 (2081)

$1.7103 (2286)

Price at time of writing this review: $1.7024

Support levels (open interest**, contracts):

$1.6995 (1194)

$1.6898 (1641)

$1.6799 (1720)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 19786 contracts, with the maximum number of contracts with strike price $1,7100 (2353);

- Overall open interest on the PUT options with the expiration date July, 3 is 25038 contracts, with the maximum number of contracts with strike price $1,6750 (2267);

- The ratio of PUT/CALL was 1.27 versus 1.20 from the previous trading day according to data from June, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:02

China: Leading Index , May +0.7%

-

00:20

Currencies. Daily history for June 23'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3604 +0,04%

GBP/USD $1,7027 +0,09%

USD/CHF Chf0,8942 -0,07%

USD/JPY Y101,90 -0,16%

EUR/JPY Y138,62 -0,12%

GBP/JPY Y173,49 -0,07%

AUD/USD $0,9422 +0,38%

NZD/USD $0,8719 +0,28%

USD/CAD C$1,0728 -0,26%

-

00:00

Schedule for today, Tuesday, June 24’2014:

(time / country / index / period / previous value / forecast)02:00 China Leading Index May +0.9%

06:00 Switzerland Trade Balance May 2.45 2.77

08:00 Germany IFO - Business Climate June 110.4 110.3

08:00 Germany IFO - Current Assessment June 114.8

08:00 Germany IFO - Expectations June 106.2

08:30 United Kingdom BBA Mortgage Approvals May 42.2 41.3

08:30 United Kingdom BOE Gov Mark Carney Speaks

08:30 United Kingdom Inflation Report Hearings

12:05 U.S. FOMC Member Charles Plosser Speaks

13:00 Belgium Business Climate June -6.8 -4.1

13:00 U.S. Housing Price Index, m/m April +0.7% +0.6%

13:00 U.S. Housing Price Index, y/y April +6.5%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April +12.4% +11.7%

14:00 U.S. Richmond Fed Manufacturing Index June 7 6

14:00 U.S. Consumer confidence June 83.0 83.6

14:00 U.S. New Home Sales May 433 442

14:00 U.S. Treasury Sec Lew Speaks

20:30 U.S. API Crude Oil Inventories June -5.7

23:50 Japan CSPI, y/y May +3.4% +3.2%

-