Notícias do Mercado

-

16:39

Foreign exchange market. American session: the U.S. dollar declined against the most major currencies after the weaker-than-expected U.S. durable goods orders and gross domestic product

The U.S. dollar declined against the most major currencies after the weaker-than-expected U.S. durable goods orders and gross domestic product (GDP). The U.S. durable goods orders declined 1.0% in May, missing expectations for a 0.1% fall, after a 0.6% fall in April. The U.S. core durable goods orders (excluding transportation) decreased 0.1% in May, missing expectations for a 0.3% gain, after 0.3% rise in April.

The U.S. durable goods orders excluding defence increased 0.6% May, after a 0.8% decline in April.

The U.S. GDP dropped 2.9% in the first quarter, missing expectations for a 1.7% decline, after a 1.0% decline the previous quarter.

The euro increased against the U.S. dollar. The Gfk consumer climate index is expected to increase to 8.9 in July from 8.6 in June. June's figure was revised up from 8.5. Analysts had expected the index to rise to 8.6.

The British pound traded higher against the U.S. dollar. The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance dropped to +4 in June from +16 in May. That was the lowest level since November 2013. Analysts had expected an increase to +25.

The Swiss franc traded higher against the U.S. dollar. The UBS consumption indicator for Switzerland climbed to 1.77 points in May from a revised 1.68 points in April.

The New Zealand dollar surged against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar rose against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded higher against the U.S. dollar. The corporate service price index (CSPI) in Japan increased 3.6% in May, exceeding expectations for a 3.2% gain, after a 3.4% rise in April.

-

15:30

U.S.: Crude Oil Inventories, June +1.7

-

14:45

U.S.: Services PMI, June 61.2 (forecast 58.6)

-

14:43

Option expiries for today's 1400GMT cut

EUR/USD $1.3530-40, $1.3550, $1.3560, $1.3600, $1.3620, $1.3625, $1.3630, $1.3650, E1.3655

USD/JPY Y101.50, Y101.70, Y102.00, Y102.10-20

GBP/USD $1.6975, $1.7030

USD/CHF Chf0.8945

EUR/CHF Chf1.2200

AUD/USD $0.9400

-

13:32

U.S.: Durable Goods Orders ex Transportation , May -0.1% (forecast +0.3%)

-

13:30

U.S.: GDP, q/q, Quarter I -2.9% (forecast -1.7%)

-

13:30

U.S.: Durable Goods Orders , May -1.0% (forecast -0.1%)

-

13:30

U.S.: PCE price index, q/q, Quarter I +1.3% (forecast +1.3%)

-

13:30

U.S.: Durable goods orders ex defense, May +0.6%

-

13:04

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies ahead of the U.S. durable goods orders and gross domestic product

Economic calendar (GMT0):

03:00 Australia RBA Assist Gov Lowe Speaks

06:00 Germany Gfk Consumer Confidence Survey July 8.5 8.6 8.9

06:00 Switzerland UBS Consumption Indicator May 1.72 1.77

10:00 United Kingdom CBI retail sales volume balance June 16 25 4

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. durable goods orders and gross domestic product (GDP). The U.S. durable goods orders should decline 0.1% in May, after a 0.6% fall in April.

The U.S. GDP should drop 1.7% in the first quarter, after a 1.0% decline the previous quarter.

The euro traded mixed against the U.S. dollar. The Gfk consumer climate index is expected to increase to 8.9 in July from 8.6 in June. June's figure was revised up from 8.5. Analysts had expected the index to rise to 8.6.

The British pound traded lower against the U.S. dollar due to yesterday's Bank of England Governor Mark Carney comments. He said that the interest rate hike will be driven by the U.K. economic data. He also said that wages in the U.K. are softer than expected by the BoE. These comments by Mark Carney could mean there is no need to hike interest rate.

The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance dropped to +4 in June from +16 in May. That was the lowest level since November 2013. Analysts had expected an increase to +25.

The Swiss franc traded mixed against the U.S. dollar. The UBS consumption indicator for Switzerland climbed to 1.77 points in May from a revised 1.68 points in April.

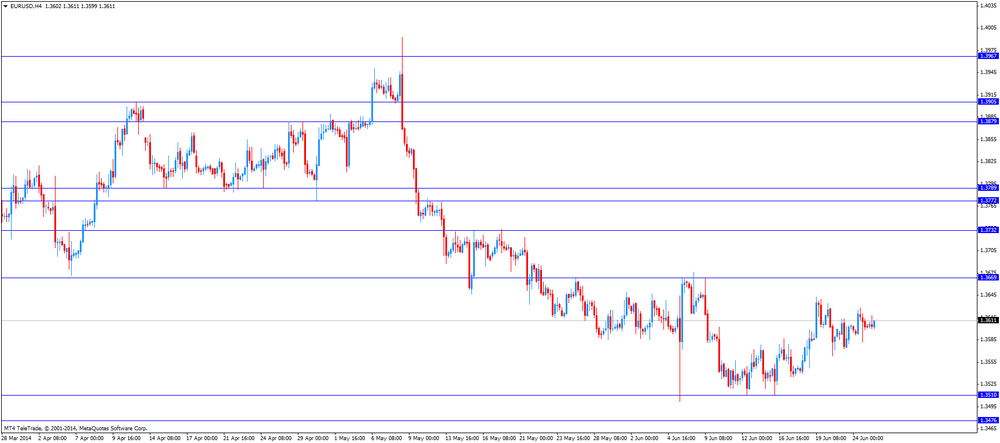

EUR/USD: the currency pair traded mixed

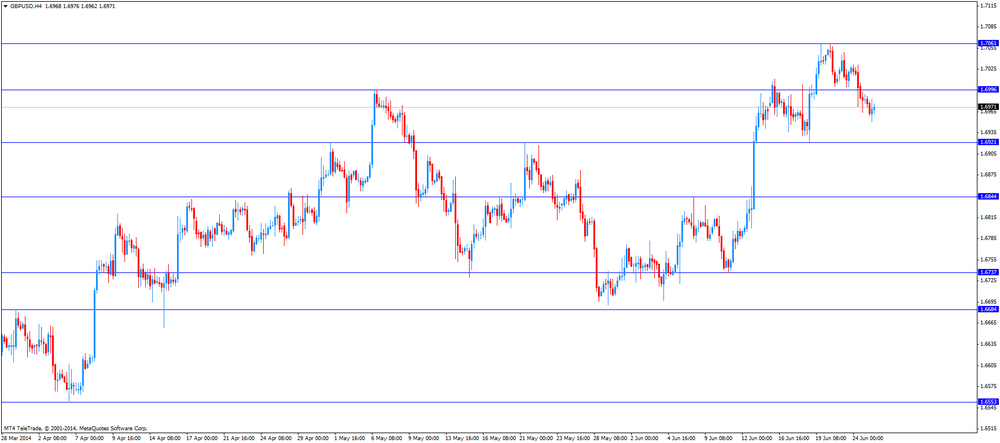

GBP/USD: the currency pair decreased to $1.6951

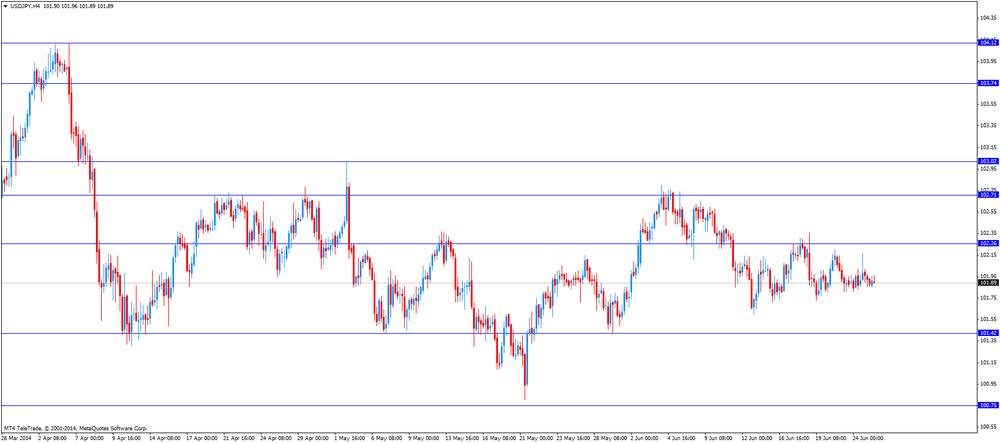

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders May -0.6% -0.1%

12:30 U.S. Durable Goods Orders ex Transportation May +0.3% +0.3%

12:30 U.S. Durable goods orders ex defense May -0.8%

12:30 U.S. PCE price index, q/q (Finally) Quarter I +1.3% +1.3%

12:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter I +3.1% +3.1%

12:30 U.S. GDP, q/q (Finally) Quarter I -1.0% -1.7%

-

13:00

Orders

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3645

Bids $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85, $1.7062

Bids $1.6950, $1.6920, $1.6910/00, $1.6845

AUD/USD

Offers $0.9545, $0.9500, $0.9460, $0.9450, $0.9430

Bids $0.9320, $0.9300, $0.9255, $0.9230

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.40, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.40, Y102.20

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900

-

11:00

United Kingdom: CBI retail sales volume balance, June 4 (forecast 25)

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3530-40, $1.3550, $1.3560, $1.3600, $1.3620, $1.3625, $1.3630, $1.3650, E1.3655

USD/JPY Y101.50, Y101.70, Y102.00, Y102.10-20

GBP/USD $1.6975, $1.7030

USD/CHF Chf0.8945

EUR/CHF Chf1.2200

AUD/USD $0.9400

-

09:37

Foreign exchange market. Asian session: the U.S. dollar traded mixed against the most major currencies, yesterday’s strong U.S. economic data still weighed on markets

Economic calendar (GMT0):

03:00 Australia RBA Assist Gov Lowe Speaks

06:00 Germany Gfk Consumer Confidence Survey July 8.5 8.6 8.9

06:00 Switzerland UBS Consumption Indicator May 1.72 1.77

The U.S. dollar traded mixed against the most major currencies. The U.S. currency was supported by the yesterday's strong U.S. economic data. The CBI consumer confidence index climbed to 85.2 in June from a reading of 82.2 in May. That was the highest level since January 2008.

New home sales in the U.S. jumped 18.6% in May to a seasonally adjusted annual rate of 504,000 units. That was the highest level since May 2008.

The New Zealand dollar traded slightly higher against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports in Australia. The U.S. currency was supported by the yesterday's strong U.S. economic data.

The Japanese yen traded mixed against the U.S. dollar. The corporate service price index (CSPI) in Japan increased 3.6% in May, exceeding expectations for a 3.2% gain, after a 3.4% rise in April.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.6959

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

10:00 United Kingdom CBI retail sales volume balance June 16 25

12:30 U.S. Durable Goods Orders May -0.6% -0.1%

12:30 U.S. Durable Goods Orders ex Transportation May +0.3% +0.3%

12:30 U.S. Durable goods orders ex defense May -0.8%

12:30 U.S. PCE price index, q/q (Finally) Quarter I +1.3% +1.3%

12:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter I +3.1% +3.1%

12:30 U.S. GDP, q/q (Finally) Quarter I -1.0% -1.7%

-

07:01

Switzerland: UBS Consumption Indicator, May 1.77

-

07:00

Germany: Gfk Consumer Confidence Survey, July 8.9 (forecast 8.6)

-

06:22

Options levels on wednesday, June 25, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3679 (2115)

$1.3652 (3464)

$1.3633 (1836)

Price at time of writing this review: $ 1.3607

Support levels (open interest**, contracts):

$1.3577 (1009)

$1.3554 (3746)

$1.3523 (5109)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 30694 contracts, with the maximum number of contracts with strike price $1,3700 (3999);

- Overall open interest on the PUT options with the expiration date July, 3 is 41549 contracts, with the maximum number of contracts with strike price $1,3500 (5341);

- The ratio of PUT/CALL was 1.35 versus 1.38 from the previous trading day according to data from June, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.7200 (2064)

$1.7101 (2242)

$1.7004 (2353)

Price at time of writing this review: $1.6972

Support levels (open interest**, contracts):

$1.6897 (1996)

$1.6799 (1698)

$1.6700 (2412)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 20180 contracts, with the maximum number of contracts with strike price $1,7100 (2353);

- Overall open interest on the PUT options with the expiration date July, 3 is 26082 contracts, with the maximum number of contracts with strike price $1,6700 (2412);

- The ratio of PUT/CALL was 1.28 versus 1.27 from the previous trading day according to data from June, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:51

Japan: CSPI, y/y, May +3.6% (forecast +3.2%)

-

00:20

Currencies. Daily history for June 24'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3602 -0,01%

GBP/USD $1,6982 -0,26%

USD/CHF Chf0,8939 -0,03%

USD/JPY Y101,96 +0,06%

EUR/JPY Y138,69 +0,05%

GBP/JPY Y173,14 -0,20%

AUD/USD $0,9366 -0,60%

NZD/USD $0,8669 -0,58%

USD/CAD C$1,0745 +0,16%

-

00:00

Schedule for today, Wednesday, June 25’2014:

(time / country / index / period / previous value / forecast)03:00 Australia RBA Assist Gov Lowe Speaks

06:00 United Kingdom Nationwide house price index June +0.7% +0.7%

06:00 United Kingdom Nationwide house price index, y/y June +11.1%

06:00 Germany Gfk Consumer Confidence Survey July 8.5 8.6

06:00 Switzerland UBS Consumption Indicator May 1.72

10:00 United Kingdom CBI retail sales volume balance June 16 25

12:30 U.S. Durable Goods Orders May -0.6% -0.1%

12:30 U.S. Durable Goods Orders ex Transportation May +0.3% +0.3%

12:30 U.S. Durable goods orders ex defense May -0.8%

12:30 U.S. PCE price index, q/q (Finally) Quarter I +1.3% +1.3%

12:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter I +3.1% +3.1%

12:30 U.S. GDP, q/q (Finally) Quarter I -1.0% -1.7%

13:45 U.S. Services PMI (Preliminary) June 58.1 58.6

14:30 U.S. Crude Oil Inventories June -0.6

-