Notícias do Mercado

-

16:47

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the U.S. economic data

The U.S. dollar traded mixed against the most major currencies after the U.S. economic data. The Labor Department released initial U.S. jobless claims. Initial U.S. jobless claims dropped by 2,000 people to 312,000 last week. That is a sign of an improving labour market.

The previous week's figure was revised upward by 2,000 to 314,000. Analysts had expected an increase by 2,000 to 314,000.

Personal incomes in the U.S. increased by 0.4% in May, missing expectations for a 0.5% gain, after a 0.3% rise in April.

Personal spending in the U.S. rose 0.2% in June, missing forecasts of a 0.4% increase, after a 0.1% decline in May.

The core PCE (prices paid for consumer goods excluding food and energy), Fed's preferred measure of inflation, climbed at annual rate by 1.5% in May, missing expectations for a 1.7% gain, after a 1.4% rise in April.

On a monthly basis, core PCE increased 0.2% in May, in line with expectations.

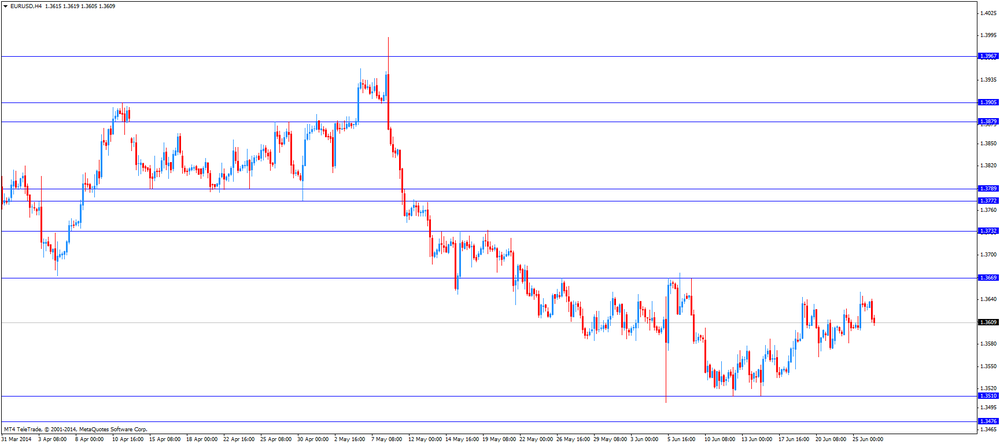

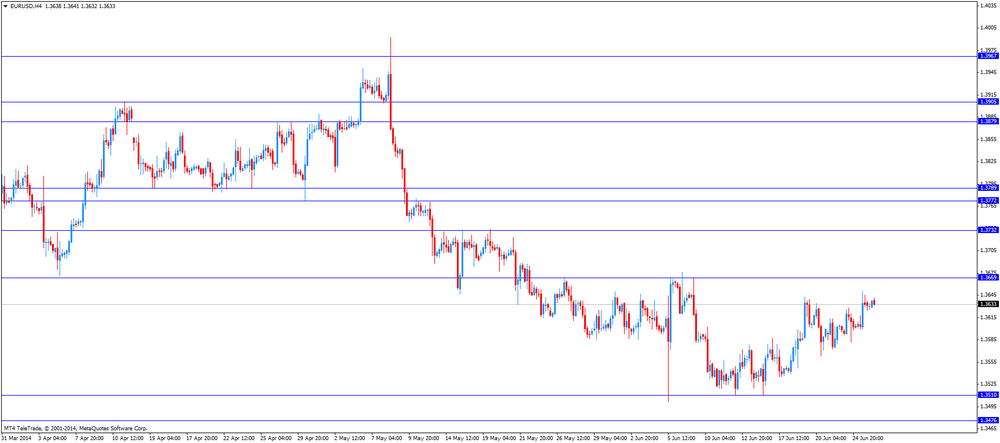

The euro declined against the U.S. dollar in the absence of any major economic reports.

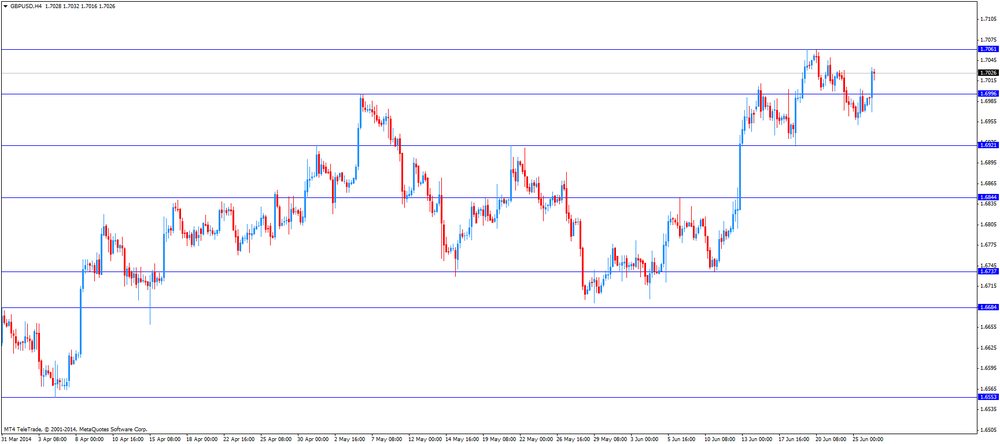

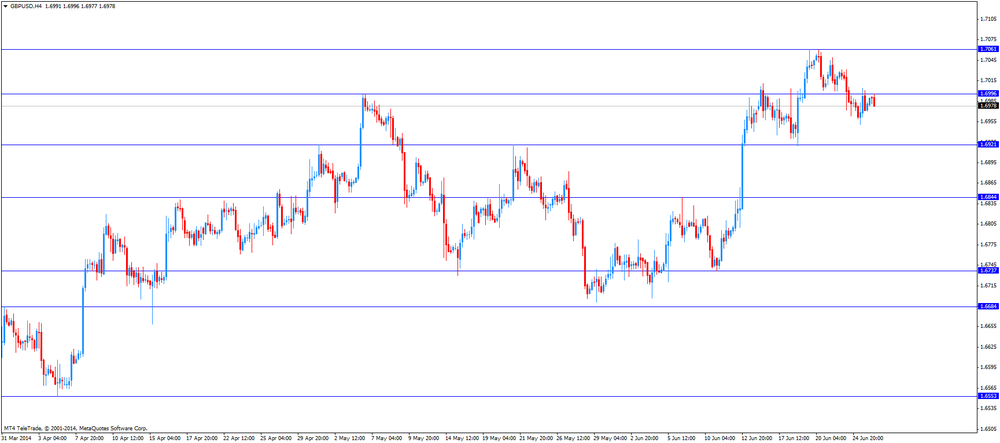

The British pound traded lower against the U.S. dollar. The BoE plans to cap mortgages beginning from October. Lenders must limit the proportion of mortgages at 4.5 times income to no more than 15% of their new home loans.

The Bank of England Governor Mark Carney said the recovery in the U.K. economy is strengthening. But he added the housing market is the main risk to financial stability.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded lower against the U.S. dollar. The number of job vacancies in Australia increased 2.5% in March-May, after a 2.8% gain in December-February.

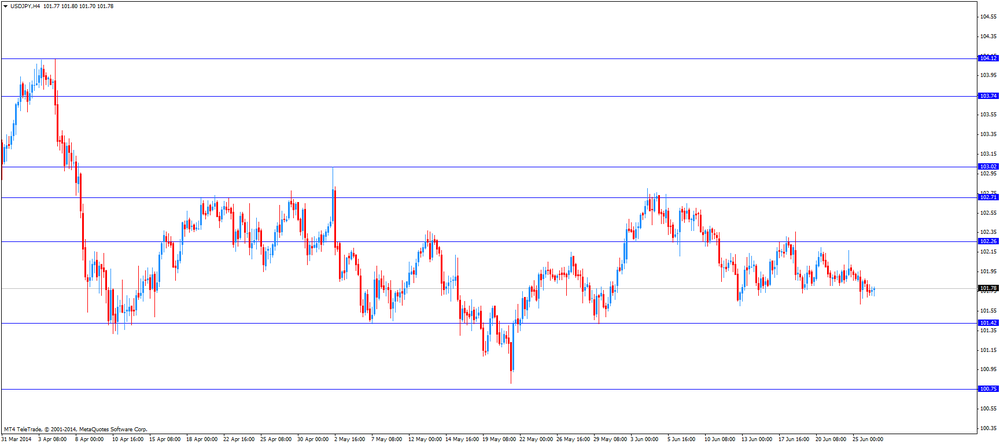

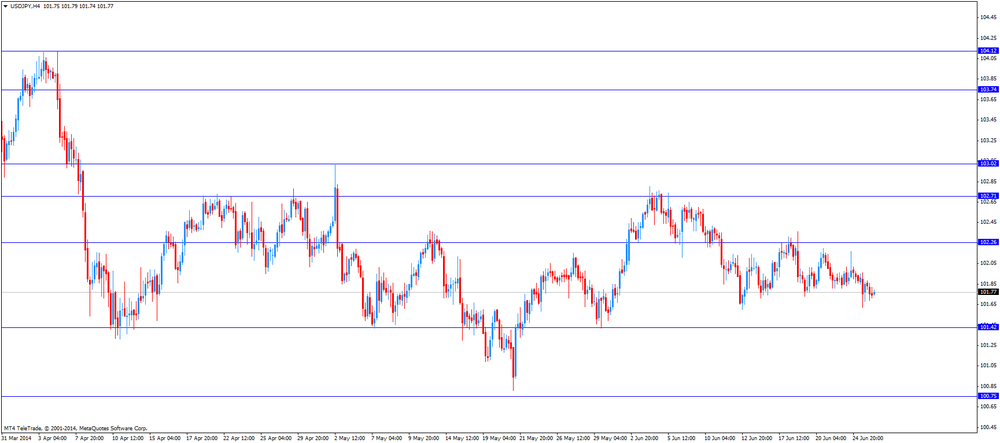

The Japanese yen rose against the U.S. dollar in the absence of any major economic reports in Japan.

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3570-75, $1.3585-89, $1.3600, $1.3610-20, $1.3640-50

USD/JPY Y101.00, Y101.50, Y101.65, Y101.95, Y102.00, Y102.20-25, Y102.30

EUR/JPY Y138.00, Y138.20

GBP/USD $1.6900, $1.7000

EUR/GBP stg0.7970, stg0.8030

AUD/USD $0.9400

-

14:31

Bank of England plans to cap mortgages beginning from October

The Bank of England released its financial stability report:

- BoE plans to cap mortgages beginning from October;

- 85% of mortgage approvals would need to be below 4.5 times of the borrowers' income;

- BoE plans to test banks, whereby borrowers could repay the mortgage even if interest rates rise to 3%;

- No new mortgages around the limit of 4.5 would be allowed.

The Bank of England Governor Mark Carney said at the press conference today:

- The recovery in the U.K. economy is strengthening;

- The housing market is the main risk to the U.K. economy's stability.

- BoE plans to cap mortgages beginning from October;

-

13:30

U.S.: Initial Jobless Claims, June 312 (forecast 314)

-

13:30

U.S.: Personal Income, m/m, May +0.4% (forecast +0.5%)

-

13:30

U.S.: Personal spending , June +0.2% (forecast +0.4%)

-

13:30

U.S.: PCE price index ex food, energy, m/m, May +0.2% (forecast +0.2%)

-

13:30

U.S.: PCE price index ex food, energy, Y/Y, May +1.5% (forecast +1.7%)

-

13:09

Foreign exchange market. European session: the euro declined against the U.S. dollar

Economic calendar (GMT0):

07:30 Switzerland SNB Quarterly Bulletin Quarter II

09:00 Eurozone EU Economic Summit

09:30 United Kingdom BOE Financial Stability Report

09:30 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. Initial jobless claims in the U.S. should increase by 2,000 to 314,000.

The personal income should climb 0.5% in May, after a 0.3% gain. The personal spending in the U.S. should rise 0.5% in June, after a 0.1% decline.

Yesterday's weak U.S. GDP weighed on the U.S. currency. U.S. GDP dropped 2.9% in the first quarter, missing expectations for a 1.7% decline, after a 1.0% decline the previous quarter.

The euro declined against the U.S. dollar in the absence of any major economic reports.

The British pound increased against the U.S. dollar after the Bank of England report and the Bank of England Governor Mark Carney's speech. The BoE plans to cap mortgages beginning from October. Borrowers limited to 4.5 times income.

The Bank of England Governor Mark Carney said the recovery in the U.K. economy is strengthening. But he added the housing market is the main risk to financial stability.

EUR/USD: the currency pair declined to $1.3605

GBP/USD: the currency pair increased to $1.7035

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims June 312 314

12:30 U.S. Personal Income, m/m May +0.3% +0.5%

12:30 U.S. Personal spending June -0.1% +0.4%

12:30 U.S. PCE price index ex food, energy, m/m May +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y May +1.4% +1.7%

22:45 New Zealand Trade Balance, mln May 534 250

23:05 United Kingdom Gfk Consumer Confidence June 0 2

23:30 Japan Unemployment Rate May 3.6% 3.6%

23:30 Japan Household spending Y/Y May -4.6% -1.9%

23:30 Japan Tokyo Consumer Price Index, y/y June +3.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June +2.8% +2.8%

23:30 Japan National Consumer Price Index, y/y May +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y May +3.2% +3.4%

23:50 Japan Retail sales, y/y May -4.3% -1.9%

-

13:00

Orders

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3650

Bids $1.3605, $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85, $1.7062

Bids $1.6920, $1.6910/00, $1.6845

AUD/USD

Offers $0.9545, $0.9500, $0.9460, $0.9450, $0.9430

Bids $0.9350, $0.9320, $0.9300, $0.9255, $0.9230

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.40, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.40, Y102.20

Bids Y101.60, Y101.50/40, Y101.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8040

Bids stg0.8000, stg0.7950, stg0.7900

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD $1.3570-75, $1.3585-89, $1.3600, $1.3610-20, $1.3640-50

USD/JPY Y101.00, Y101.50, Y101.65, Y101.95, Y102.00, Y102.20-25, Y102.30

EUR/JPY Y138.00, Y138.20

GBP/USD $1.6900, $1.7000

EUR/GBP stg0.7970, stg0.8030

AUD/USD $0.9400

-

09:37

Foreign exchange market. Asian session: the Australian and New Zealand dollar traded higher against the U.S dollar, supported by yesterday’s weak U.S. economic data

Economic calendar (GMT0):

07:30 Switzerland SNB Quarterly Bulletin Quarter II

The U.S. dollar traded lower against the most major currencies due to yesterday's weaker-than-expected U.S. GDP. The U.S. GDP dropped 2.9% in the first quarter, missing expectations for a 1.7% decline, after a 1.0% decline the previous quarter. That was the worst performance in five years.

The New Zealand dollar traded higher against the U.S dollar in the absence of any major economic reports in New Zealand. The kiwi was supported by yesterday's weak U.S. economic data.

The Australian dollar traded higher against the U.S. dollar. The Aussie was supported by yesterday's weak U.S. economic data.

The number of job vacancies in Australia increased 2.5% in March-May, after a 2.8% gain in December-February.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

09:00 Eurozone EU Economic Summit

09:30 United Kingdom BOE Financial Stability Report

09:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Initial Jobless Claims June 312 314

12:30 U.S. Personal Income, m/m May +0.3% +0.5%

12:30 U.S. Personal spending June -0.1% +0.4%

12:30 U.S. PCE price index ex food, energy, m/m May +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y May +1.4% +1.7%

22:45 New Zealand Trade Balance, mln May 534 250

23:05 United Kingdom Gfk Consumer Confidence June 0 2

23:30 Japan Unemployment Rate May 3.6% 3.6%

23:30 Japan Household spending Y/Y May -4.6% -1.9%

23:30 Japan Tokyo Consumer Price Index, y/y June +3.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June +2.8% +2.8%

23:30 Japan National Consumer Price Index, y/y May +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y May +3.2% +3.4%

23:50 Japan Retail sales, y/y May -4.3% -1.9%

-

06:23

Options levels on thursday, June 26, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3685 (2301)

$1.3662 (3441)

$1.3648 (1835)

Price at time of writing this review: $ 1.3632

Support levels (open interest**, contracts):

$1.3614 (1569)

$1.3596 (1063)

$1.3569 (3709)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 32233 contracts, with the maximum number of contracts with strike price $1,3700 (5354);

- Overall open interest on the PUT options with the expiration date July, 3 is 41120 contracts, with the maximum number of contracts with strike price $1,3500 (5294);

- The ratio of PUT/CALL was 1.28 versus 1.35 from the previous trading day according to data from June, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (383)

$1.7200 (2065)

$1.7101 (2210)

Price at time of writing this review: $1.6986

Support levels (open interest**, contracts):

$1.6897 (2204)

$1.6799 (1769)

$1.6700 (2412)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 21370 contracts, with the maximum number of contracts with strike price $1,7000 (3108);

- Overall open interest on the PUT options with the expiration date July, 3 is 26458 contracts, with the maximum number of contracts with strike price $1,6700 (2412);

- The ratio of PUT/CALL was 1.24 versus 1.29 from the previous trading day according to data from June, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:20

Currencies. Daily history for June 25'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3631 +0,21%

GBP/USD $1,6981 -0,01%

USD/CHF Chf0,8928 -0,12%

USD/JPY Y101,83 -0,13%

EUR/JPY Y138,79 +0,07%

GBP/JPY Y172,90 -0,14%

AUD/USD $0,9401 +0,37%

NZD/USD $0,8730 +0,70%

USD/CAD C$1,0719 -0,24% -

00:00

Schedule for today, Thursday, June 26’2014:

(time / country / index / period / previous value / forecast)06:00 United Kingdom Nationwide house price index June +0.7% +0.7%

06:00 United Kingdom Nationwide house price index, y/y June +11.1%

07:30 Switzerland SNB Quarterly Bulletin Quarter II

09:00 Eurozone EU Economic Summit

09:30 United Kingdom BOE Financial Stability Report

09:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Initial Jobless Claims June 312 314

12:30 U.S. Personal Income, m/m May +0.3% +0.5%

12:30 U.S. Personal spending June -0.1% +0.4%

12:30 U.S. PCE price index ex food, energy, m/m May +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y May +1.4%

22:45 New Zealand Trade Balance, mln May 534 250

23:05 United Kingdom Gfk Consumer Confidence June 0 2

23:30 Japan Unemployment Rate May 3.6% 3.6%

23:30 Japan Household spending Y/Y May -4.6% -1.9%

23:30 Japan Tokyo Consumer Price Index, y/y June +3.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June +2.8% +2.8%

23:30 Japan National Consumer Price Index, y/y May +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y May +3.2% +3.4%

23:50 Japan Retail sales, y/y May -4.3% -1.9%

-