Notícias do Mercado

-

16:35

Foreign exchange market. American session: the U.S. dollar t traded slightly lower against the most major currencies after the better-than-expected Reuters/Michigan consumer sentiment

The U.S. dollar traded slightly lower against the most major currencies after the better-than-expected Reuters/Michigan consumer sentiment. Reuters/Michigan consumer sentiment index rose to 82.5 in June from 81.2 in May, exceeding expectations for an increase to 82.2.

The euro traded higher against the U.S. dollar after the German and French economic data. The German preliminary consumer price index (CPI) climbed 0.3% in June, beating forecasts of a 0.2% gain, after a 0.1% decline in May. On a yearly basis, German preliminary CPI rose 1.0% in June, after a 0.9% rise in May.

The consumer spending in France increased 1.0% in May, exceeding expectations for a 0.3% gain, after a 0.3% decline in April.

On a yearly basis, the consumer spending in France declined 0.6% in May, after a 0.5% drop in April.

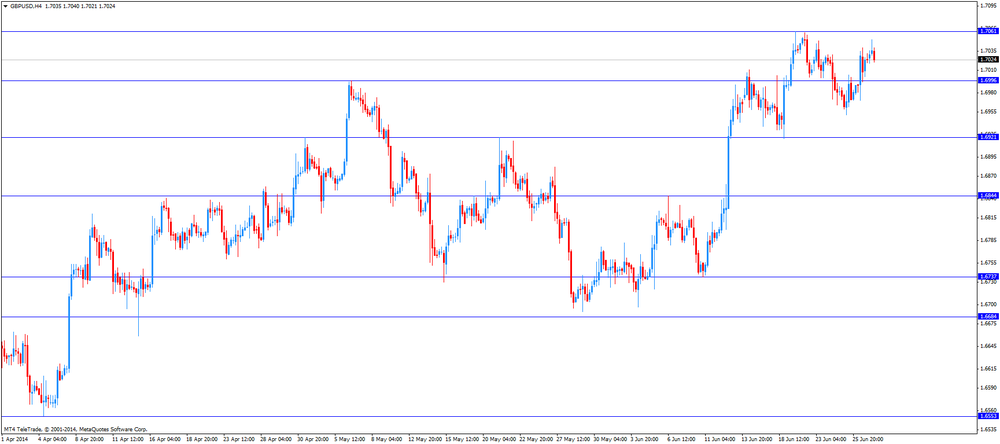

The British pound traded slightly higher against the U.S. dollar after the U.K. economic data. The gross domestic product in the U.K. rose 0.8% in the first quarter, in line with expectations, after a 0.8% gain the previous quarter. On a yearly basis, the U.K. GDP increased 3.0% in the first quarter, missing forecasts of a 3.1% rise, after a 3.1% gain the previous quarter.

The U.K. current account deficit declined to £18.5 billion in the first quarter, from £23.5 billion in the fourth quarter of 2013. The fourth quarter's figure was revised down from a deficit of £22.4 billion. Analysts had expected the current account deficit to decrease to £17.1 billion.

Business Investment in the U.K. rose 5.0% in first quarter, exceeding expectations for a 2.7% gain, after a 2.7% rise the previous quarter. On a yearly basis, business Investment in the U.K. surged 10.6% in first quarter, beating expectations for a 8.7% rise, after a 2.7% increase the previous quarter.

The Swiss franc increased against the U.S. dollar after the release of KOF leading indicator. The KOF leading indicator for Switzerland increased to 100.4 in June from 99.8 in May, beating expectations for a decline to 99.1.

The Canadian dollar climbed against the U.S. dollar. The raw material price index in Canada declined 0.4% in May, missing expectations for a 1.3% increase, after a 0.1% gain in April.

The industrial product prices in Canada decreased 0.5% in May, missing expectations for a 0.4% rise, after a 0.2% decline in April.

The New Zealand dollar traded slightly higher against the U.S dollar. New Zealand's trade balance declined to NZ$285 million in May from NZ$498 million in April, beating expectations for a drop to NZ$250 million. April's figure was revised down from NZ$534 million.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic data in Australia.

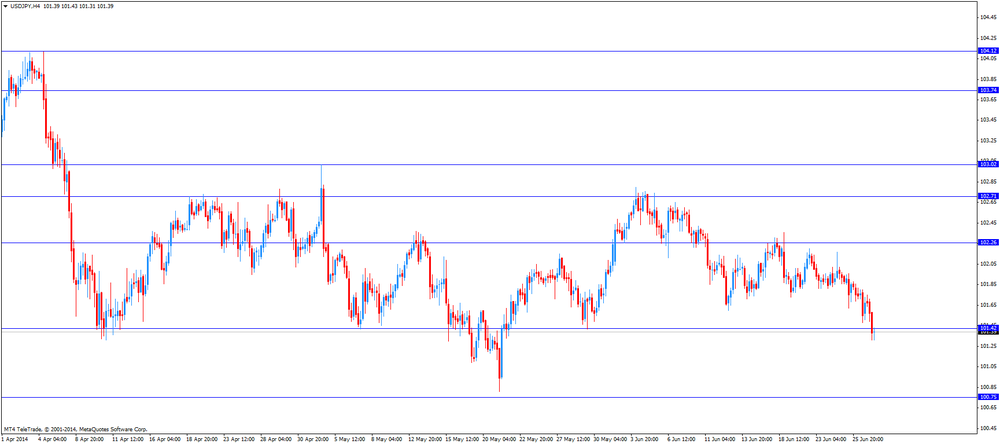

The Japanese yen traded mixed against the U.S. dollar. Japan's national CPI excluding fresh food increased 3.4% in May, in line with expectations, after a 3.2% gain.

Japan's national CPI rose 3.4% in May, after a 3.4% gain.

The Japanese unemployment rate declined to 3.4% in May, exceeding expectations for 3.6%, after 3.6% in April.

Household spending in Japan dropped 8%, missing expectations for a 1.9% decline in May, after a 4.6% decrease in April.

Retail sales in Japan decreased 0.4% in May, after a 4.3% decline in April. Analysts had expected a 1.9% decline.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, June 82.5 (forecast 82.2)

-

14:36

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3570-75, $1.3600, $1.3650

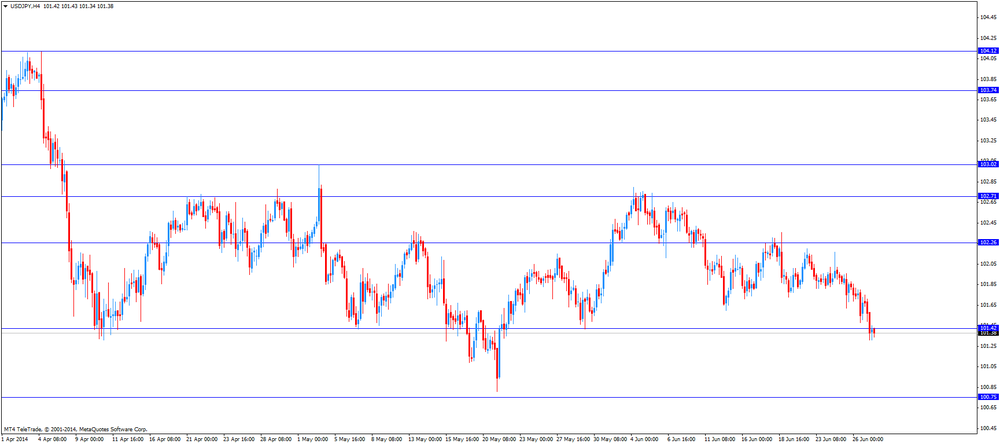

USD/JPY Y101.45, Y102.15, Y102.25, Y102.50

GBP/USD $1.6900, $1.7000, $1.7050-60

EUR/GBP stg0.7965

AUD/USD $0.9350, $0.9450

USD/CAD C$1.0700, C$1.0750

-

13:30

Canada: Raw Material Price Index, May -0.4% (forecast +1.3%)

-

13:30

Canada: Industrial Product Prices, m/m, May -0.5% (forecast +0.4%)

-

13:00

Germany: CPI, m/m, June +0.3% (forecast +0.2%)

-

13:00

Germany: CPI, y/y , June +1.0%

-

13:00

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the U.K. economic data

Economic calendar (GMT0):

06:45 France Consumer spending May -0.3% +0.3% +1.0%

06:45 France Consumer spending, y/y May -0.5% -0.6%

07:00 Switzerland KOF Leading Indicator June 99.8 99.1 100.4

08:30 United Kingdom Current account, bln Quarter I -22.4 -17.1 -18.5

08:30 United Kingdom Business Investment, q/q Quarter I +2.7% +2.7% +5.0%

08:30 United Kingdom Business Investment, y/y Quarter I +8.7% +8.7% +10.6%

08:30 United Kingdom GDP, q/q (Finally) Quarter I +0.8% +0.8% +0.8%

08:30 United Kingdom GDP, y/y (Finally) Quarter I +3.1% +3.1% +3.0%

09:00 Eurozone EU Economic Summit

The U.S. dollar traded mixed against the most major currencies due to yesterday's weak U.S. economic data. Personal incomes in the U.S. increased by 0.4% in May, missing expectations for a 0.5% gain, after a 0.3% rise in April.

Personal spending in the U.S. rose 0.2% in June, missing forecasts of a 0.4% increase, after a 0.1% decline in May.

The euro traded mixed against the U.S. dollar. The consumer spending in France increased 1.0% in May, exceeding expectations for a 0.3% gain, after a 0.3% decline in April.

On a yearly basis, the consumer spending in France declined 0.6% in May, after a 0.5% drop in April.

The British pound traded lower against the U.S. dollar after the U.K. economic data. The gross domestic product in the U.K. rose 0.8% in the first quarter, in line with expectations, after a 0.8% gain the previous quarter. On a yearly basis, the U.K. GDP increased 3.0% in the first quarter, missing forecasts of a 3.1% rise, after a 3.1% gain the previous quarter.

The U.K. current account deficit declined to £18.5 billion in the first quarter, from £23.5 billion in the fourth quarter of 2013. The fourth quarter's figure was revised down from a deficit of £22.4 billion. Analysts had expected the current account deficit to decrease to £17.1 billion.

Business Investment in the U.K. rose 5.0% in first quarter, exceeding expectations for a 2.7% gain, after a 2.7% rise the previous quarter. On a yearly basis, business Investment in the U.K. surged 10.6% in first quarter, beating expectations for a 8.7% rise, after a 2.7% increase the previous quarter.

The Swiss franc traded mixed against the U.S. dollar after the release of KOF leading indicator. The KOF leading indicator for Switzerland increased to 100.4 in June from 99.8 in May, beating expectations for a decline to 99.1.

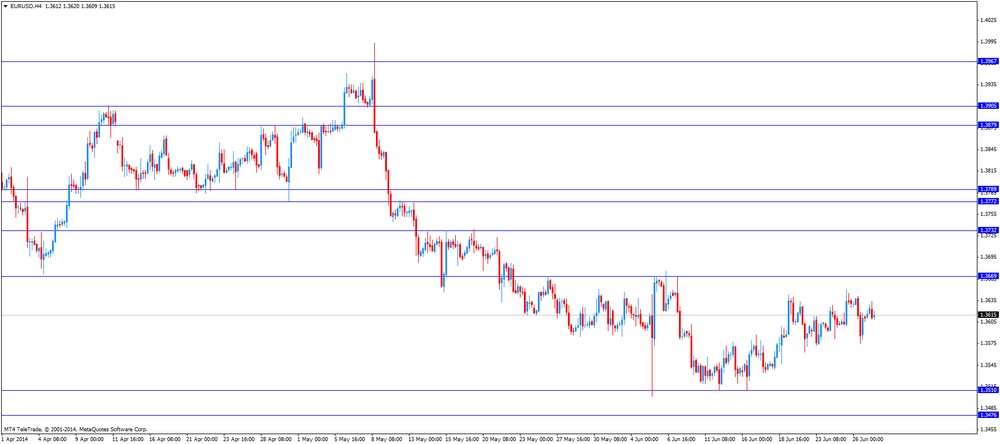

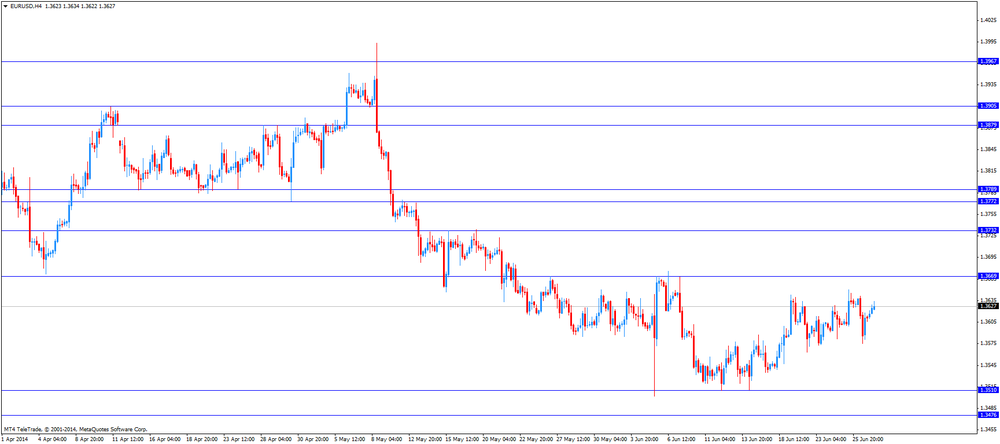

EUR/USD: the currency pair traded mixed

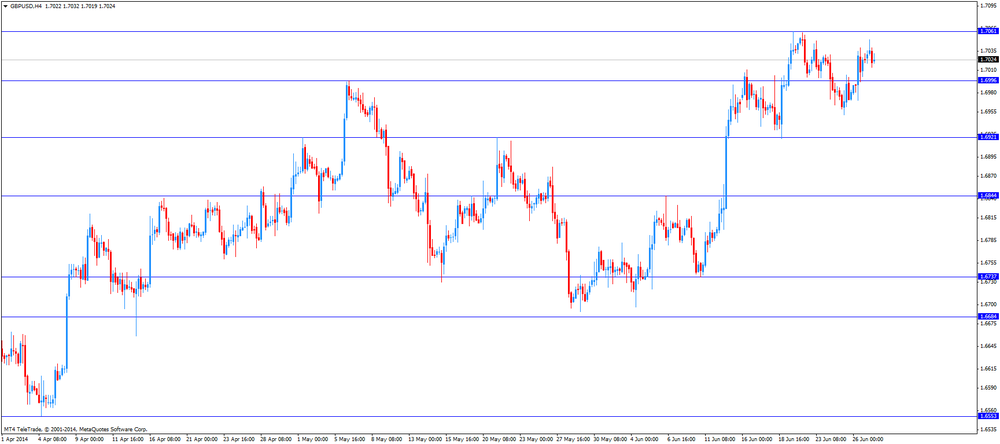

GBP/USD: the currency pair declined to $1.7014

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:00 Germany CPI, m/m (Preliminary) June -0.1% +0.2%

12:00 Germany CPI, y/y (Preliminary) June +0.9%

12:30 Canada Raw Material Price Index May +0.1% +1.3%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) June 81.2 82.2

-

12:45

Orders

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3650

Bids $1.3595, $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85, $1.7062

Bids $1.6950, $1.6920, $1.6910/00, $1.6845

AUD/USD

Offers $0.9545, $0.9500, $0.9460, $0.9450

Bids $0.9400, $0.9350, $0.9320, $0.9300, $0.9255, $0.9230

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00, Y138.55

Bids Y137.90, Y137.70, Y137.00

USD/JPY

Offers Y102.80, Y102.65, Y102.40, Y102.20, Y101.90

Bids Y101.00, Y100.80, Y100.45, Y100.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8040

Bids stg0.7980, stg0.7950, stg0.7900

-

10:05

Foreign exchange market. Asian session: the Japanese yen rose against the U.S. dollar after the economic data from Japan

Economic calendar (GMT0):

06:45 France Consumer spending May -0.3% +0.3% +1.0%

06:45 France Consumer spending, y/y May -0.5% -0.6%

07:00 Switzerland KOF Leading Indicator June 99.8 99.1 100.4

08:30 United Kingdom Current account, bln Quarter I -22.4 -17.1 -18.5

08:30 United Kingdom Business Investment, q/q Quarter I +2.7% +2.7% +5.0%

08:30 United Kingdom Business Investment, y/y Quarter I +8.7% +8.7% +10.6%

08:30 United Kingdom GDP, q/q (Finally) Quarter I +0.8% +0.8% +0.8%

08:30 United Kingdom GDP, y/y (Finally) Quarter I +3.1% +3.1% +3.0%

09:00 Eurozone EU Economic Summit

The U.S. dollar traded lower against the most major currencies after comments by St. Louis Fed President James Bullard. He told Fox Business Network that the Fed' interest rate hike by the end of the first quarter in 2015 will be appropriate, if the U.S. economy grows 3% in the next four quarters.

The New Zealand dollar traded higher against the U.S dollar after New Zealand's better-than-expected trade balance surplus. New Zealand's trade balance declined to NZ$285 million in May from NZ$498 million in April, beating expectations for a drop to NZ$250 million. April's figure was revised down from NZ$534 million.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic data in Australia. The Aussie was supported by the weak U.S. economic data.

The Japanese yen rose against the U.S. dollar after the economic data from Japan. Japan's national CPI excluding fresh food increased 3.4% in May, in line with expectations, after a 3.2% gain in April.

Japan's national CPI rose 3.4% in May, after a 3.4% gain.

The Japanese unemployment rate declined to 3.4% in May, exceeding expectations for 3.6%, after 3.6% in April.

Household spending in Japan dropped 8%, missing expectations for a 1.9% decline in May, after a 4.6% decrease in April.

Retail sales in Japan decreased 0.4% in May, after a 4.3% decline in April. Analysts had expected a 1.9% decline.

EUR/USD: the currency pair increased to $1.3630

GBP/USD: the currency pair rose to $1.7050

USD/JPY: the currency pair declined Y101.30

The most important news that are expected (GMT0):

12:00 Germany CPI, m/m (Preliminary) June -0.1% +0.2%

12:00 Germany CPI, y/y (Preliminary) June +0.9%

12:30 Canada Raw Material Price Index May +0.1% +1.3%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) June 81.2 82.2

-

09:59

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3570-75, $1.3600, $1.3650

USD/JPY Y101.45, Y102.15, Y102.25, Y102.50

GBP/USD $1.6900, $1.7000, $1.7050-60

EUR/GBP stg0.7965

AUD/USD $0.9350, $0.9450

USD/CAD C$1.0700, C$1.0750

-

09:31

United Kingdom: Business Investment, q/q, Quarter I +5.0% (forecast +2.7%)

-

09:31

United Kingdom: Business Investment, y/y, Quarter I +10.6% (forecast +8.7%)

-

09:31

United Kingdom: Current account, bln , Quarter I -18.5 (forecast -17.1)

-

09:30

United Kingdom: GDP, q/q, Quarter I +0.8% (forecast +0.8%)

-

09:30

United Kingdom: GDP, y/y, Quarter I +3.0% (forecast +3.1%)

-

08:00

Switzerland: KOF Leading Indicator, June 100.4 (forecast 99.1)

-

07:45

France: Consumer spending , May +1.0% (forecast +0.3%)

-

06:32

Options levels on friday, June 27, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3712 (2737)

$1.3677 (2238)

$1.3650 (3721)

Price at time of writing this review: $ 1.3626

Support levels (open interest**, contracts):

$1.3599 (1569)

$1.3584 (1076)

$1.3561 (3836)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 31908 contracts, with the maximum number of contracts with strike price $1,3700 (5154);

- Overall open interest on the PUT options with the expiration date July, 3 is 41676 contracts, with the maximum number of contracts with strike price $1,3500 (5678);

- The ratio of PUT/CALL was 1.31 versus 1.28 from the previous trading day according to data from June, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (383)

$1.7201 (2018)

$1.7102 (2329)

Price at time of writing this review: $1.7039

Support levels (open interest**, contracts):

$1.6994 (1652)

$1.6899 (2214)

$1.6800 (1776)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 23148 contracts, with the maximum number of contracts with strike price $1,7005 (4173);

- Overall open interest on the PUT options with the expiration date July, 3 is 26827 contracts, with the maximum number of contracts with strike price $1,6700 (2412);

- The ratio of PUT/CALL was 1.16 versus 1.24 from the previous trading day according to data from June, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Japan: Unemployment Rate, May 3.4% (forecast 3.6%)

-