Notícias do Mercado

-

16:41

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the disappointing U.S. new home sales

The U.S. dollar traded mixed to lower against the most major currencies after the disappointing U.S. new home sales. New home sales in the U.S. climbed 0.2% to a seasonally adjusted annual rate of 467,000 units in September from 466,000 units in August. That was the highest since July 2008.

August's figure was revised down from 504,000 units. The Commerce Department also revised the sales figures for July and June.

Analysts had expected new home sales to reach 473,000 units.

Trade was cautious due to fears about the spread of the Ebola virus in the U.S. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

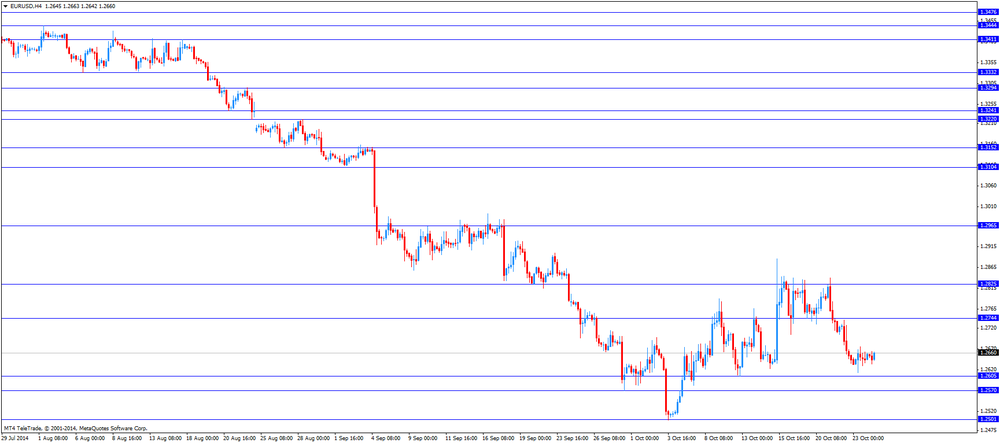

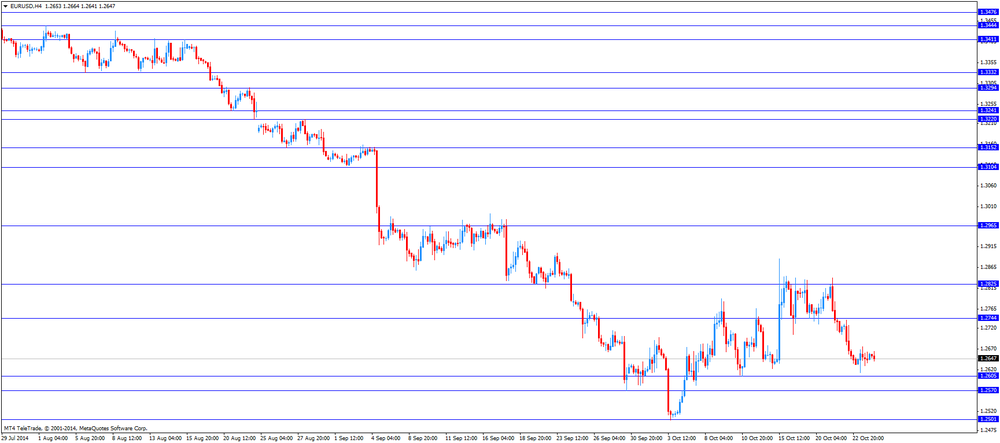

The euro traded higher against the U.S. dollar. The Gfk German consumer confidence index increased to 8.5 in November from 8.4 in October, beating forecasts for a decline to 8.1. October's figure was revised up from 8.3.

Belgium's business climate index rose to -6.8 in October from -7.2 in September, beating expectations for a decline to -7.8.

Market participants are awaiting the results of stress tests. The European Central Bank will announce the results of stress tests on Sunday.

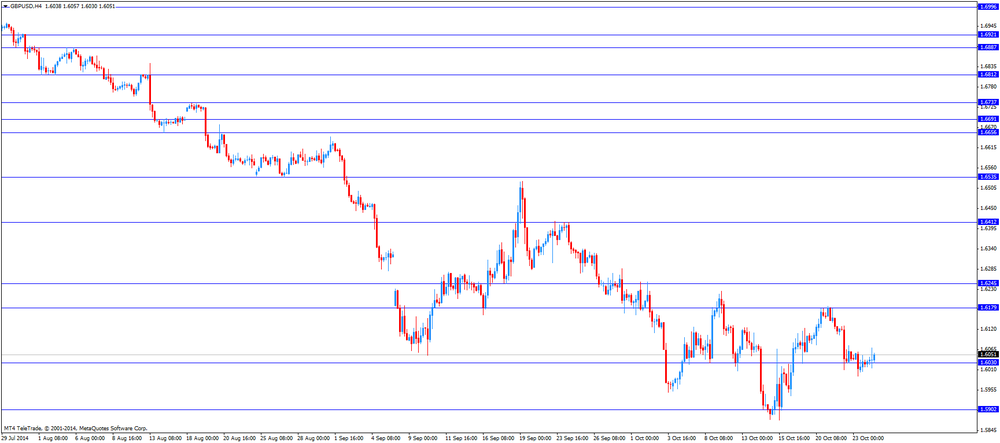

The British pound higher against the U.S. dollar after the U.K. gross domestic product. The U.K. gross domestic product (GDP) climbed 0.7% in the third quarter, in line with expectations, after a 0.9% rise in the second quarter.

On a yearly basis, the U.K. GDP increased 3.0% in the third quarter, in line with expectations, after a 3.2% rise in the second quarter.

The New Zealand dollar traded slightly higher against the U.S. dollar. In the overnight trading session, the kiwi dropped against the greenback despite the weaker-than-expected trade deficit from New Zealand. New Zealand' trade deficit widened to NZ$1,350 million in September from NZ$472 million in August. Analysts had expected the trade deficit to rise to NZ$620 million.

Exports dropped at annual rate of 5.3% in September, while imports surged at annual rate of 23.0%.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

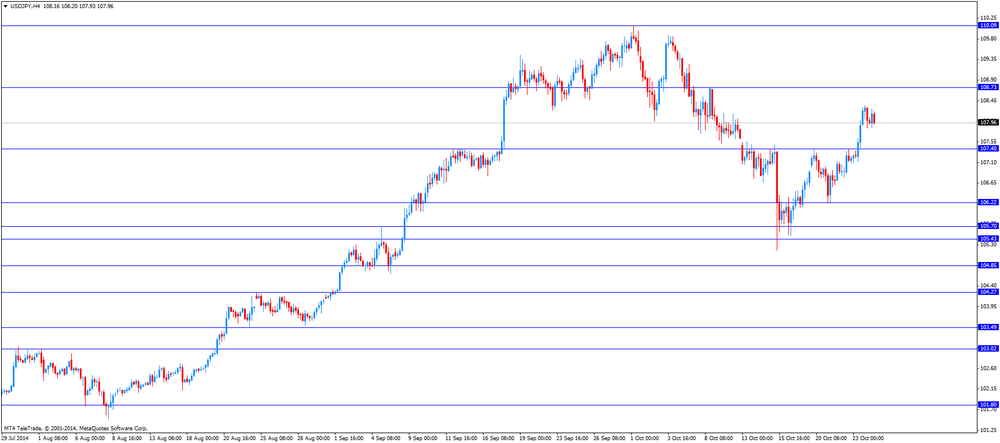

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback due to increasing demand for safe-haven assets on fears about the spread of the Ebola virus in the U.S. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

No major economic reports were released in Japan.

-

15:45

New home sales rose 0.2% in September

The U.S. Commerce Department released new home sales data today. New home sales climbed 0.2% to a seasonally adjusted annual rate of 467,000 units in September from 466,000 units in August. That was the highest since July 2008.

August's figure was revised down from 504,000 units. The Commerce Department also revised the sales figures for July and June.

Analysts had expected new home sales to reach 473,000 units.

The median home sales price in September was $259,000, the lowest level since August 2013.

-

15:00

U.S.: New Home Sales, September 467 (forecast 473)

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E582mn), $1.2630(E1.1bn), $1.2650(E500mn), $1.2700(E350mn), $1.2710(E629mn), $1.2730(E375mn), $1.2790(E530mn)

USD/JPY: Y107.85($950mn), Y108.00($445mn)

GBP/USD: $1.6100(stg250mn)

EUR/GBP: Stg0.7960-70(E300mn)

USD/CHF: Chf0.9340($240mn), Chf0.9440($343mn)

AUD/USD: $0.8780-85(A$380mn), $0.8800(A$1.1bn), $0.8850(A$1.5bn)

NZD/USD: $0.7800(NZ$250mn), $0.7865(NZ$169mn), 0.7975(NZ$250mn)

USD/CAD: C$1.1200($225mn), C$1.1300($160mn)

-

14:00

Belgium: Business Climate, October -6.8 (forecast -7.8)

-

13:01

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the better-than-expected Gfk German consumer confidence index

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Gfk Consumer Confidence Survey November 8.4 Revised From 8.3 8.1 8.5

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III +0.9% +0.7% +0.7%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III +3.2% +3.0% +3.0%

09:00 Eurozone EU Economic Summit

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. new home sales. New home sales in the U.S. are expected to decline to 437,000 units in September from 504,000 units in August.

Trade was cautious due to fears about the spread of the Ebola virus in the U.S. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

The euro traded mixed against the U.S. dollar after the better-than-expected Gfk German consumer confidence index. The Gfk German consumer confidence index increased to 8.5 in November from 8.4 in October, beating forecasts for a decline to 8.1. October's figure was revised up from 8.3.

Belgium's business climate index is expected to fall to -7.8 in October from -7.2 in September.

Market participants are awaiting the results of stress tests. The European Central Bank will announce the results of stress tests on Sunday.

The British pound slightly higher against the U.S. dollar after the U.K. gross domestic product. The U.K. gross domestic product (GDP) climbed 0.7% in the third quarter, in line with expectations, after a 0.9% rise in the second quarter.

On a yearly basis, the U.K. GDP increased 3.0% in the third quarter, in line with expectations, after a 3.2% rise in the second quarter.

EUR/USD: the currency pair traded mixed

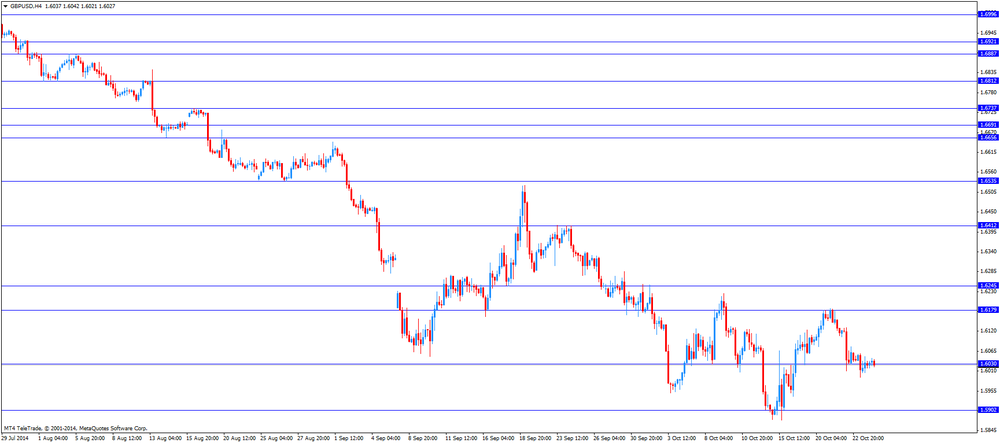

GBP/USD: the currency pair rose to $1.6071

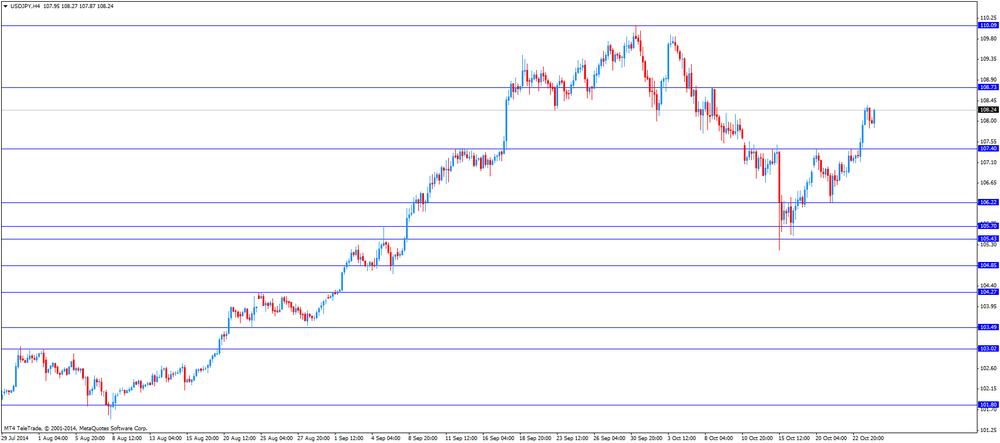

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:00 Belgium Business Climate October -7.2 -7.8

14:00 U.S. New Home Sales September 504 473

-

13:00

Orders

EUR/USD

Offers $1.2720, $1.2700/05

Bids $1.2614, $1.2605/00, $1.2585/80

GBP/USD

Offers $1.6200, $1.6080

Bids $1.6000, $1.5900

AUD/USD

Offers $0.8840/50, $0.8800

Bids $0.8750, $0.8700/10, $0.8650, $0.8640/20

EUR/JPY

Offers Y137.80, Y137.50, Y137.20, Y136.90/00

Bids Y136.50, Y136.10/00, Y135.80, Y135.55/50

USD/JPY

Offers Y109.00, Y108.50

Bids Y107.85/80, Y107.55/50, Y107.20, Y107.00

EUR/GBP

Offers

Bids stg0.7870/65, stg0.7850, stg0.7800

-

10:22

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E582mn), $1.2630(E1.1bn), $1.2650(E500mn), $1.2700(E350mn), $1.2710(E629mn), $1.2730(E375mn), $1.2790(E530mn)

USD/JPY: Y107.85($950mn), Y108.00($445mn)

GBP/USD: $1.6100(stg250mn)

EUR/GBP: Stg0.7960-70(E300mn)

USD/CHF: Chf0.9340($240mn), Chf0.9440($343mn)

AUD/USD: $0.8780-85(A$380mn), $0.8800(A$1.1bn), $0.8850(A$1.5bn)

NZD/USD: $0.7800(NZ$250mn), $0.7865(NZ$169mn), 0.7975(NZ$250mn)

USD/CAD: C$1.1200($225mn), C$1.1300($160mn)

-

10:11

U.K. gross domestic product rose 0.7% in the third quarter

The Office for National Statistics released the gross domestic figures today. The U.K. gross domestic product (GDP) climbed 0.7% in the third quarter, in line with expectations, after a 0.9% rise in the second quarter.

On a yearly basis, the U.K. GDP increased 3.0% in the third quarter, in line with expectations, after a 3.2% rise in the second quarter.

The service sector rose 0.7% in the third quarter, while the production and construction sector increased 0.5% and 0.8%.

-

09:59

Foreign exchange market. Asian session: the New Zealand dollar dropped against the U.S. dollar despite the weaker-than-expected trade deficit from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Gfk Consumer Confidence Survey November 8.4 Revised From 8.3 8.1 8.5

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III +0.9% +0.7% +0.7%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III +3.2% +3.0% +3.0%

The U.S. dollar traded lower against the most major currencies. The better-than-expected corporate earnings reports of some U.S. companies supported the demand for the greenback.

The New Zealand dollar dropped against the U.S. dollar despite the weaker-than-expected trade deficit from New Zealand. New Zealand' trade deficit widened to NZ$1,350 million in September from NZ$472 million in August. Analysts had expected the trade deficit to rise to NZ$620 million.

Exports dropped at annual rate of 5.3% in September, while imports surged at annual rate of 23.0%.

The Australian dollar traded slightly higher against the U.S. dollar in the absence of any major economic reports from Australia.

Strong U.S. economic data and Wednesday's weak consumer price inflation in New Zealand weighed on the Aussie.

The Japanese yen rose against the U.S. dollar due to increasing demand for safe-haven assets on fears about the spread of the Ebola virus in the U.S. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

No major economic reports were released in Japan.

EUR/USD: the currency pair rose to $1.2661

GBP/USD: the currency pair increased to $1.6045

USD/JPY: the currency pair fell to Y107.85

The most important news that are expected (GMT0):

09:00 Eurozone EU Economic Summit

13:00 Belgium Business Climate October -7.2 -7.8

14:00 U.S. New Home Sales September 504 473

-

09:30

United Kingdom: GDP, q/q, Quarter III +0.7% (forecast +0.7%)

-

09:30

United Kingdom: GDP, y/y, Quarter III +3.0% (forecast +3.0%)

-

07:00

Germany: Gfk Consumer Confidence Survey, September 8.5 (forecast 8.1)

-

06:26

Options levels on friday, October 24, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2795 (3406)

$1.2737 (1677)

$1.2698 (1664)

Price at time of writing this review: $ 1.2656

Support levels (open interest**, contracts):

$1.2590 (2946)

$1.2538 (6322)

$1.2505 (4483)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 57109 contracts, with the maximum number of contracts with strike pric $1,2900 (6994);

- Overall open interest on the PUT options with the expiration date November, 7 is 59634 contracts, with the maximum number of contracts with strike price $1,2500 (6624);

- The ratio of PUT/CALL was 1.04 versus 1.05 from the previous trading day according to data from October, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.6301 (1701)

$1.6203 (2091)

$1.6106 (1492)

Price at time of writing this review: $1.6041

Support levels (open interest**, contracts):

$1.5992 (2057)

$1.5895 (1771)

$1.5798 (1543)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 27031 contracts, with the maximum number of contracts with strike price $1,6200 (2091);

- Overall open interest on the PUT options with the expiration date November, 7 is 32203 contracts, with the maximum number of contracts with strike price $1,5400 (2350);

- The ratio of PUT/CALL was 1.19 versus 1.21 from the previous trading day according to data from October, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-