Notícias do Mercado

-

20:00

Dow +108.82 16,786.72 +0.65% Nasdaq +18.68 4,471.47 +0.42% S&P +10.66 1,961.48 +0.55%

-

17:00

European stocks close: FTSE 100 6,388.73 -30.42 -0.47% CAC 40 4,128.9 -28.78 -0.69% DAX 8,987.8 -59.51 -0.66%

-

17:00

European stocks close: stocks closed lower, fears about the spread of the Ebola virus in the U.S. still weighed on markets

Stock indices closed lower, fears about the spread of the Ebola virus in the U.S. still weighed on markets. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

The European Central Bank will announce the results of stress tests on Sunday.

The Gfk German consumer confidence index increased to 8.5 in November from 8.4 in October, beating forecasts for a decline to 8.1. October's figure was revised up from 8.3.

Belgium's business climate index rose to -6.8 in October from -7.2 in September, beating expectations for a decline to -7.8.

The U.K. gross domestic product (GDP) climbed 0.7% in the third quarter, in line with expectations, after a 0.9% rise in the second quarter.

On a yearly basis, the U.K. GDP increased 3.0% in the third quarter, in line with expectations, after a 3.2% rise in the second quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,388.73 -30.42 -0.47%

DAX 8,991.91 -55.40 -0.61%

CAC 40 4,128.9 -28.78 -0.69%

-

16:41

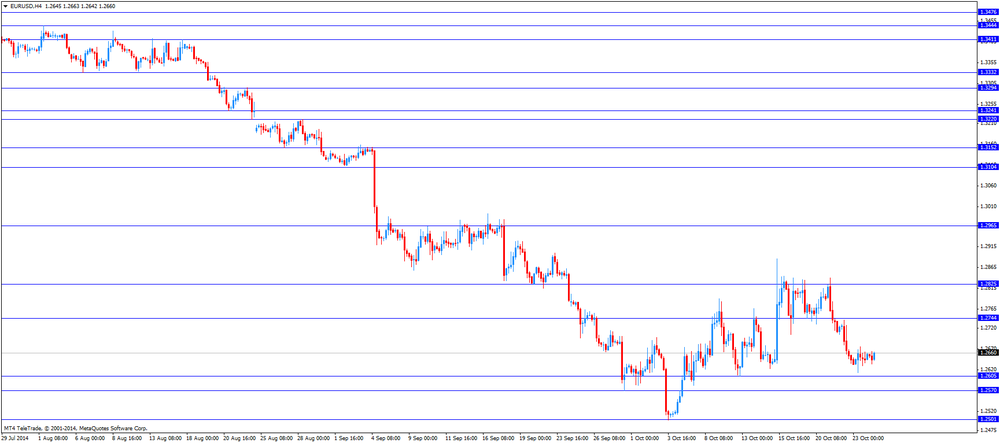

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the disappointing U.S. new home sales

The U.S. dollar traded mixed to lower against the most major currencies after the disappointing U.S. new home sales. New home sales in the U.S. climbed 0.2% to a seasonally adjusted annual rate of 467,000 units in September from 466,000 units in August. That was the highest since July 2008.

August's figure was revised down from 504,000 units. The Commerce Department also revised the sales figures for July and June.

Analysts had expected new home sales to reach 473,000 units.

Trade was cautious due to fears about the spread of the Ebola virus in the U.S. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

The euro traded higher against the U.S. dollar. The Gfk German consumer confidence index increased to 8.5 in November from 8.4 in October, beating forecasts for a decline to 8.1. October's figure was revised up from 8.3.

Belgium's business climate index rose to -6.8 in October from -7.2 in September, beating expectations for a decline to -7.8.

Market participants are awaiting the results of stress tests. The European Central Bank will announce the results of stress tests on Sunday.

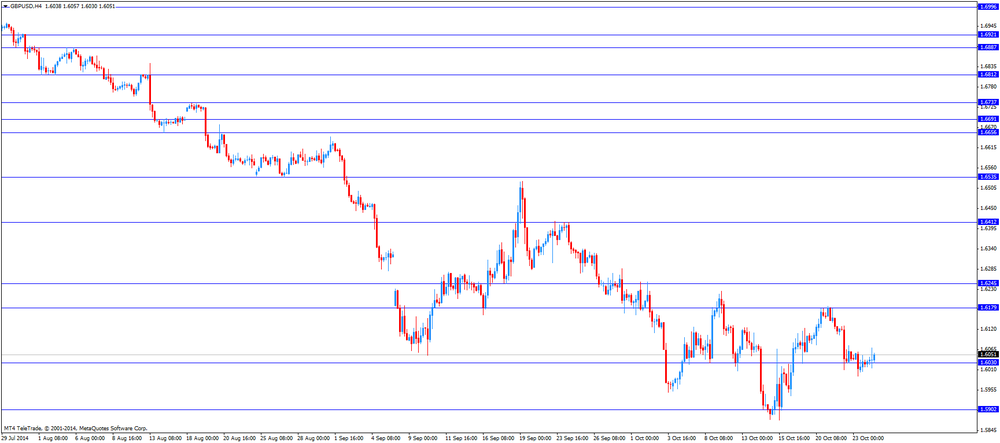

The British pound higher against the U.S. dollar after the U.K. gross domestic product. The U.K. gross domestic product (GDP) climbed 0.7% in the third quarter, in line with expectations, after a 0.9% rise in the second quarter.

On a yearly basis, the U.K. GDP increased 3.0% in the third quarter, in line with expectations, after a 3.2% rise in the second quarter.

The New Zealand dollar traded slightly higher against the U.S. dollar. In the overnight trading session, the kiwi dropped against the greenback despite the weaker-than-expected trade deficit from New Zealand. New Zealand' trade deficit widened to NZ$1,350 million in September from NZ$472 million in August. Analysts had expected the trade deficit to rise to NZ$620 million.

Exports dropped at annual rate of 5.3% in September, while imports surged at annual rate of 23.0%.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback due to increasing demand for safe-haven assets on fears about the spread of the Ebola virus in the U.S. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

No major economic reports were released in Japan.

-

16:40

Oil: an overview of the market situation

Oil prices fell markedly, offsetting earlier rise, as markets got some certainty oil policy of Saudi Arabia. The course of trade affect the assumptions of investors that the decline in exports of oil from Saudi Arabia is not a signal to reduce oil production in the country. Some analysts believe that the decline in oil supplies from Saudi Arabia due to increased volume of oil remaining in the country, due to increased domestic demand. Recall yesterday it became known to reduce the supply of oil from the country in September to 328,000 barrels a day - up to 9.36 million barrels per day.

"Saudi Arabia does not reduce production. Volumes supplied to the oil market are great, and the price of oil will have a tendency to decrease, "- said the manager Tyche Capital Advisors Tariq Zahir.

Pressure on prices also had reports that a New York physician was confirmed Ebola after his return from West Africa, where he provided medical care to patients. The first confirmed case of the disease in the largest city in the United States called the recent concerns about the spread of the virus, putting pressure mainly on risky assets.

Concerns about the weakening global demand, as well as signs that the Organization of Petroleum Exporting Countries will not cut production to support oil quotations, also pressured in recent weeks. Oil production in the OPEC reached in September two-year high of 31 million barrels per day, due to the increase in production in Iraq and Libya. Some market analysts believe that only a reduction in the volume of production in the oil cartel will be able to stop the decline in prices.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 80.98 a barrel on the New York Mercantile Exchange (NYMEX).

The price of December futures for North Sea Brent crude oil mixture has dropped to $ 86.45 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

The price of gold rose slightly today, which was associated with a reduction in the European stock market and the depreciation of the dollar. Nevertheless, at the end of the week the precious metal has lost about 0.5 percent.

Little impact on the course of trading have today's data on the housing market the United States. It is learned that new home sales rose 0.2% in September compared with the previous month - to an annual rate of 467 000 Sales rose by 15.3% in August to 466,000 units, which have been revised downward from the initial assessment of 504 000 sales in June and July were revised downward. Economists had expected sales to fall in September by 6.7% to 473 000 The September sales of 467,000 was still the highest since July 2008. According to estimates of the Ministry of Commerce data on new home sales can be volatile from month to month. 0.2% increase in September were calculated with an accuracy of 15.7 percentage points. Sales in September rose 17% from a year earlier. For the first nine months of this year, sales rose by 1.7% compared to the same period in 2013. In the newly built homes accounted for about 10% of purchases of homes in the United States. Sales of existing homes rose 2.4% in September to a seasonally adjusted annual rate of 5.17 million, it is the fastest pace of the year, said on Tuesday the National Association of Realtors. But sales of existing homes were less than 1.7% last month compared with a year earlier.

Meanwhile, we add that market participants are cautious in anticipation of the Fed meeting, scheduled for next Wednesday. Many experts believe that the central bank of the USA completes asset purchase program as part of its third round of quantitative easing, as well as provide clues as to the timing of interest rate hikes.

The cost of the December gold futures on the COMEX today rose to 1229.80 dollars per ounce.

-

15:45

New home sales rose 0.2% in September

The U.S. Commerce Department released new home sales data today. New home sales climbed 0.2% to a seasonally adjusted annual rate of 467,000 units in September from 466,000 units in August. That was the highest since July 2008.

August's figure was revised down from 504,000 units. The Commerce Department also revised the sales figures for July and June.

Analysts had expected new home sales to reach 473,000 units.

The median home sales price in September was $259,000, the lowest level since August 2013.

-

15:00

U.S.: New Home Sales, September 467 (forecast 473)

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E582mn), $1.2630(E1.1bn), $1.2650(E500mn), $1.2700(E350mn), $1.2710(E629mn), $1.2730(E375mn), $1.2790(E530mn)

USD/JPY: Y107.85($950mn), Y108.00($445mn)

GBP/USD: $1.6100(stg250mn)

EUR/GBP: Stg0.7960-70(E300mn)

USD/CHF: Chf0.9340($240mn), Chf0.9440($343mn)

AUD/USD: $0.8780-85(A$380mn), $0.8800(A$1.1bn), $0.8850(A$1.5bn)

NZD/USD: $0.7800(NZ$250mn), $0.7865(NZ$169mn), 0.7975(NZ$250mn)

USD/CAD: C$1.1200($225mn), C$1.1300($160mn)

-

14:37

U.S. Stocks open: Dow 16,699.19 +21.29 +0.13%, Nasdaq 4,457.18 +4.39 +0.10%, S&P 1,951.61 +0.79 +0.04%

-

14:28

Before the bell: S&P futures -0.15%, Nasdaq futures -0.20%

U.S. stock futures fell after a doctor in New York tested positive for Ebola and investors weighed earnings from companies including Amazon.com Inc. and Microsoft.

Global markets:

Nikkei 15,291.64 +152.68 +1.01%

Hang Seng 23,302.2 -30.98 -0.13%

Shanghai Composite 2,302.28 -0.14 -0.01%

FTSE 6,383.27 -35.88 -0.56%

CAC 4,122.53 -35.15 -0.85%

DAX 8,998.27 -49.04 -0.54%

Crude oil $81.22 (-1.06%)

Gold $1233.60 (+0.38%)

-

14:15

DOW components before the bell

(company / ticker / price / change, % / volume)

AT&T Inc

T

33.67

+0.03%

12.1K

Caterpillar Inc

CAT

99.31

+0.04%

2.2K

United Technologies Corp

UTX

103.30

+0.12%

0.1K

McDonald's Corp

MCD

91.16

+0.15%

0.1K

Johnson & Johnson

JNJ

102.80

+0.17%

5.1K

JPMorgan Chase and Co

JPM

58.20

+0.24%

7.0K

Pfizer Inc

PFE

29.02

+1.47%

27.7K

Procter & Gamble Co

PG

85.00

+2.13%

135.1K

Microsoft Corp

MSFT

47.12

+4.66%

259.9K

General Electric Co

GE

25.44

0.00%

9.8K

UnitedHealth Group Inc

UNH

90.66

0.00%

0.2K

The Coca-Cola Co

KO

40.86

0.00%

0.6K

Boeing Co

BA

122.00

-0.02%

1.6K

Goldman Sachs

GS

180.00

-0.03%

0.1K

Travelers Companies Inc

TRV

96.67

-0.10%

0.1K

Chevron Corp

CVX

116.05

-0.12%

8.0K

Exxon Mobil Corp

XOM

94.00

-0.12%

1.7K

American Express Co

AXP

85.50

-0.13%

2.1K

E. I. du Pont de Nemours and Co

DD

68.50

-0.13%

0.9K

Walt Disney Co

DIS

87.88

-0.13%

0.7K

Verizon Communications Inc

VZ

48.14

-0.17%

2.8K

Cisco Systems Inc

CSCO

23.52

-0.19%

0.6K

Wal-Mart Stores Inc

WMT

76.10

-0.20%

1.5K

3M Co

MMM

144.75

-0.21%

0.1K

Merck & Co Inc

MRK

56.50

-0.23%

0.1K

Intel Corp

INTC

32.61

-0.24%

3.0K

Visa

V

213.49

-0.37%

0.7K

Nike

NKE

90.03

-0.38%

0.2K

International Business Machines Co...

IBM

161.40

-0.48%

1.8K

-

14:00

Belgium: Business Climate, October -6.8 (forecast -7.8)

-

13:58

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Microsoft (MSFT) target raised to $55 from $50 at Credit Suisse, to $53 from $51 at FBR Capital

Visa (V) target lowered to $250 from $270 at Oppenheimer

Amazon.com (AMZN) target lowered to $372 from $415 at Oppenheimer, to $420 from $435 at RBC Capital Mkts, to $350 from $395 at Topeka Capital Markets

-

13:01

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the better-than-expected Gfk German consumer confidence index

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Gfk Consumer Confidence Survey November 8.4 Revised From 8.3 8.1 8.5

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III +0.9% +0.7% +0.7%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III +3.2% +3.0% +3.0%

09:00 Eurozone EU Economic Summit

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. new home sales. New home sales in the U.S. are expected to decline to 437,000 units in September from 504,000 units in August.

Trade was cautious due to fears about the spread of the Ebola virus in the U.S. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

The euro traded mixed against the U.S. dollar after the better-than-expected Gfk German consumer confidence index. The Gfk German consumer confidence index increased to 8.5 in November from 8.4 in October, beating forecasts for a decline to 8.1. October's figure was revised up from 8.3.

Belgium's business climate index is expected to fall to -7.8 in October from -7.2 in September.

Market participants are awaiting the results of stress tests. The European Central Bank will announce the results of stress tests on Sunday.

The British pound slightly higher against the U.S. dollar after the U.K. gross domestic product. The U.K. gross domestic product (GDP) climbed 0.7% in the third quarter, in line with expectations, after a 0.9% rise in the second quarter.

On a yearly basis, the U.K. GDP increased 3.0% in the third quarter, in line with expectations, after a 3.2% rise in the second quarter.

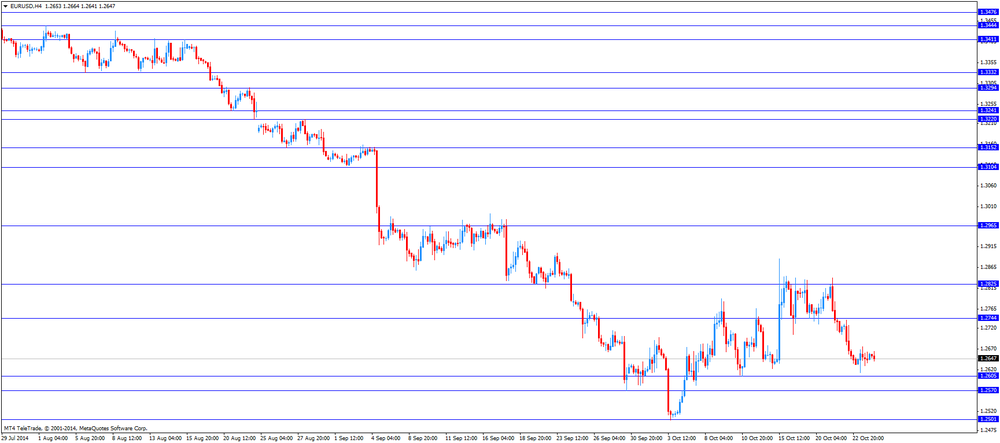

EUR/USD: the currency pair traded mixed

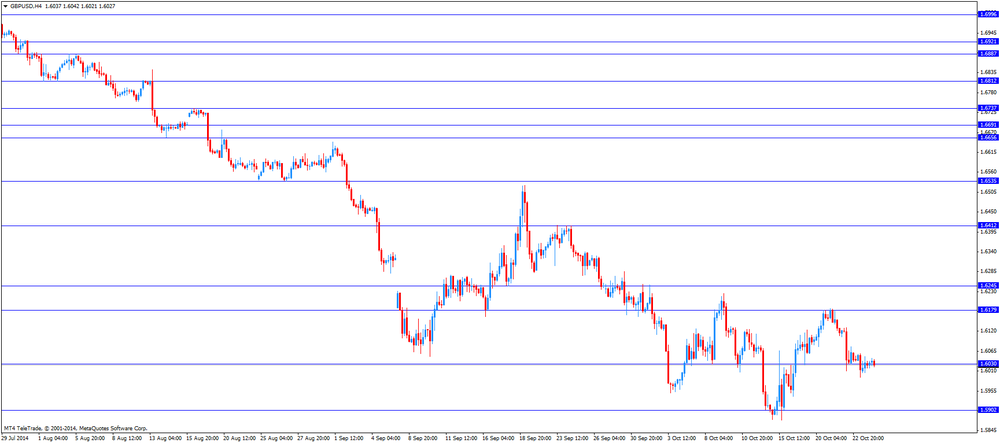

GBP/USD: the currency pair rose to $1.6071

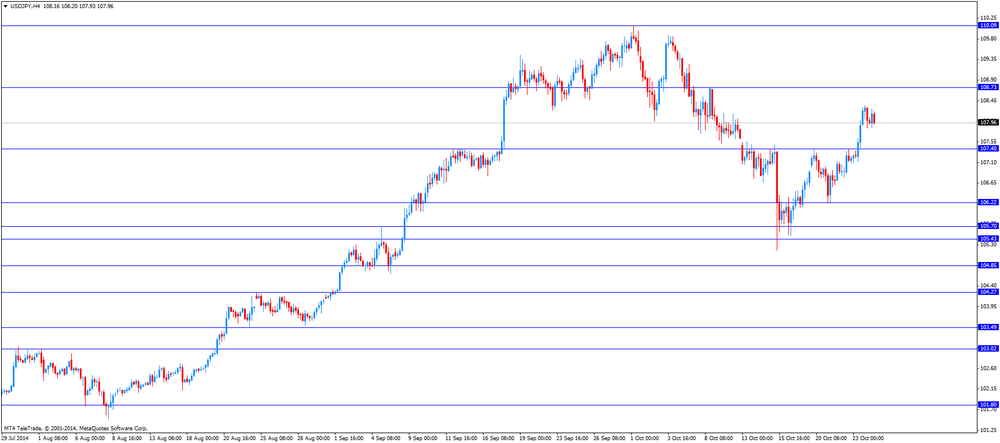

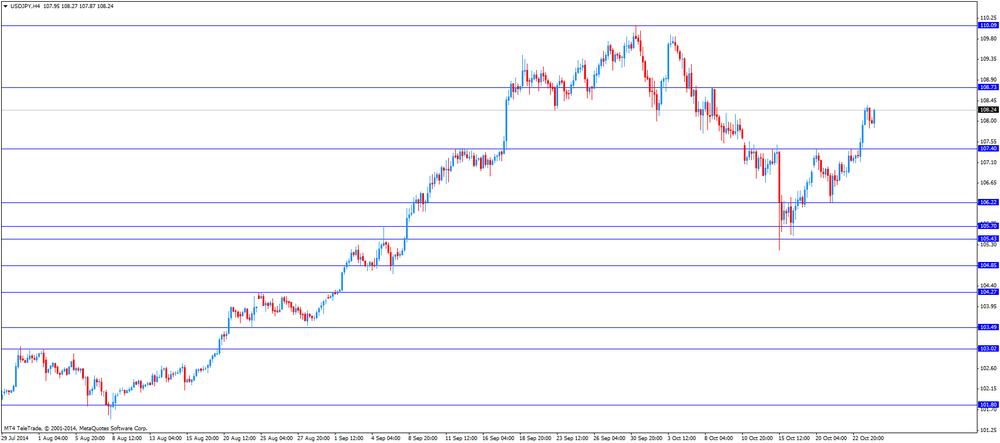

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:00 Belgium Business Climate October -7.2 -7.8

14:00 U.S. New Home Sales September 504 473

-

13:00

Orders

EUR/USD

Offers $1.2720, $1.2700/05

Bids $1.2614, $1.2605/00, $1.2585/80

GBP/USD

Offers $1.6200, $1.6080

Bids $1.6000, $1.5900

AUD/USD

Offers $0.8840/50, $0.8800

Bids $0.8750, $0.8700/10, $0.8650, $0.8640/20

EUR/JPY

Offers Y137.80, Y137.50, Y137.20, Y136.90/00

Bids Y136.50, Y136.10/00, Y135.80, Y135.55/50

USD/JPY

Offers Y109.00, Y108.50

Bids Y107.85/80, Y107.55/50, Y107.20, Y107.00

EUR/GBP

Offers

Bids stg0.7870/65, stg0.7850, stg0.7800

-

12:04

European stock markets mid session: stocks traded lower on fears about the spread of the Ebola virus in the U.S.

Stock indices traded lower on fears about the spread of the Ebola virus in the U.S. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

The European Central Bank will announce the results of stress tests on Sunday.

The Gfk German consumer confidence index increased to 8.5 in November from 8.4 in October, beating forecasts for a decline to 8.1. October's figure was revised up from 8.3.

The U.K. gross domestic product (GDP) climbed 0.7% in the third quarter, in line with expectations, after a 0.9% rise in the second quarter.

On a yearly basis, the U.K. GDP increased 3.0% in the third quarter, in line with expectations, after a 3.2% rise in the second quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,396.92 -22.23 -0.35%

DAX 9,012.73 -34.58 -0.38%

CAC 40 4,134.01 -23.67 -0.57%

-

10:44

Asian Stocks close: most stocks closed lower despite gains on the Wall Street and the strong PMI from Eurozone

Asian stock indices closed lower despite gains on the Wall Street and the strong PMI from Eurozone.

The better-than-expected corporate earnings reports of the U.S. companies led to gains on the Wall Street.

Eurozone's preliminary manufacturing purchasing managers' index (PMI) rose to 50.7 in October from 50.3 in September, beating expectations for a decline to 50.0.

Eurozone's preliminary services PMI remained unchanged at 52.4 in October, beating forecasts of a decrease to 52.0.

Indexes on the close:

Nikkei 225 15,291.64 +152.68 +1.01%

Hang Seng 23,302.2 -30.98 -0.13%

Shanghai Composite 2,302.28 -0.14 -0.01%

-

10:22

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E582mn), $1.2630(E1.1bn), $1.2650(E500mn), $1.2700(E350mn), $1.2710(E629mn), $1.2730(E375mn), $1.2790(E530mn)

USD/JPY: Y107.85($950mn), Y108.00($445mn)

GBP/USD: $1.6100(stg250mn)

EUR/GBP: Stg0.7960-70(E300mn)

USD/CHF: Chf0.9340($240mn), Chf0.9440($343mn)

AUD/USD: $0.8780-85(A$380mn), $0.8800(A$1.1bn), $0.8850(A$1.5bn)

NZD/USD: $0.7800(NZ$250mn), $0.7865(NZ$169mn), 0.7975(NZ$250mn)

USD/CAD: C$1.1200($225mn), C$1.1300($160mn)

-

10:11

U.K. gross domestic product rose 0.7% in the third quarter

The Office for National Statistics released the gross domestic figures today. The U.K. gross domestic product (GDP) climbed 0.7% in the third quarter, in line with expectations, after a 0.9% rise in the second quarter.

On a yearly basis, the U.K. GDP increased 3.0% in the third quarter, in line with expectations, after a 3.2% rise in the second quarter.

The service sector rose 0.7% in the third quarter, while the production and construction sector increased 0.5% and 0.8%.

-

09:59

Foreign exchange market. Asian session: the New Zealand dollar dropped against the U.S. dollar despite the weaker-than-expected trade deficit from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Gfk Consumer Confidence Survey November 8.4 Revised From 8.3 8.1 8.5

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III +0.9% +0.7% +0.7%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III +3.2% +3.0% +3.0%

The U.S. dollar traded lower against the most major currencies. The better-than-expected corporate earnings reports of some U.S. companies supported the demand for the greenback.

The New Zealand dollar dropped against the U.S. dollar despite the weaker-than-expected trade deficit from New Zealand. New Zealand' trade deficit widened to NZ$1,350 million in September from NZ$472 million in August. Analysts had expected the trade deficit to rise to NZ$620 million.

Exports dropped at annual rate of 5.3% in September, while imports surged at annual rate of 23.0%.

The Australian dollar traded slightly higher against the U.S. dollar in the absence of any major economic reports from Australia.

Strong U.S. economic data and Wednesday's weak consumer price inflation in New Zealand weighed on the Aussie.

The Japanese yen rose against the U.S. dollar due to increasing demand for safe-haven assets on fears about the spread of the Ebola virus in the U.S. News said that a doctor who had worked in Africa had tested positive for the Ebola virus in New York City.

No major economic reports were released in Japan.

EUR/USD: the currency pair rose to $1.2661

GBP/USD: the currency pair increased to $1.6045

USD/JPY: the currency pair fell to Y107.85

The most important news that are expected (GMT0):

09:00 Eurozone EU Economic Summit

13:00 Belgium Business Climate October -7.2 -7.8

14:00 U.S. New Home Sales September 504 473

-

09:30

United Kingdom: GDP, q/q, Quarter III +0.7% (forecast +0.7%)

-

09:30

United Kingdom: GDP, y/y, Quarter III +3.0% (forecast +3.0%)

-

07:00

Germany: Gfk Consumer Confidence Survey, September 8.5 (forecast 8.1)

-

06:26

Options levels on friday, October 24, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2795 (3406)

$1.2737 (1677)

$1.2698 (1664)

Price at time of writing this review: $ 1.2656

Support levels (open interest**, contracts):

$1.2590 (2946)

$1.2538 (6322)

$1.2505 (4483)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 57109 contracts, with the maximum number of contracts with strike pric $1,2900 (6994);

- Overall open interest on the PUT options with the expiration date November, 7 is 59634 contracts, with the maximum number of contracts with strike price $1,2500 (6624);

- The ratio of PUT/CALL was 1.04 versus 1.05 from the previous trading day according to data from October, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.6301 (1701)

$1.6203 (2091)

$1.6106 (1492)

Price at time of writing this review: $1.6041

Support levels (open interest**, contracts):

$1.5992 (2057)

$1.5895 (1771)

$1.5798 (1543)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 27031 contracts, with the maximum number of contracts with strike price $1,6200 (2091);

- Overall open interest on the PUT options with the expiration date November, 7 is 32203 contracts, with the maximum number of contracts with strike price $1,5400 (2350);

- The ratio of PUT/CALL was 1.19 versus 1.21 from the previous trading day according to data from October, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:05

Nikkei 225 15,266.95 +127.99 +0.85%, Hang Seng 23,257.13 -76.05 -0.33%, S&P/ASX 200 5,405.9 +22.77 +0.42%, Shanghai Composite 2,307.32 +4.91 +0.21%

-