Notícias do Mercado

-

23:34

Commodities. Daily history for Oct 23'2014:

(raw materials / closing price /% change)

Light Crude 81.79 -0.37%

Gold 1,233.50 +0.36%

-

23:31

Stocks. Daily history for Oct 23'2014:

(index / closing price / change items /% change)

Nikkei 225 15,138.96 -56.81 -0.37%

Hang Seng 23,333.18 -70.79 -0.30%

S&P/ASX 200 5,383.14 -2.73 -0.05%

Shanghai Composite 2,302.42 -24.14 -1.04%

FTSE 100 6,419.15 +19.42 +0.30%

CAC 40 4,157.68 +52.59 +1.28%

Xetra DAX 9,047.31 +107.17 +1.20%

S&P 500 1,950.82 +23.71 +1.23%

NASDAQ Composit 4,452.79 +69.95 +1.60%

Dow Jones 16,677.9 +216.58 +1.32%

-

23:20

Currencies. Daily history for Oct 23'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2644 0,00%

GBP/USD $ 1,6027 -0,09%

USD/CHF Chf0,9540 +0,02%

USD/JPY Y108,30 +1,02%

EUR/JPY Y136,94 +1,02%

GBP/JPY Y173,56 +0,92%

AUD/USD $0,8757 -0,05%

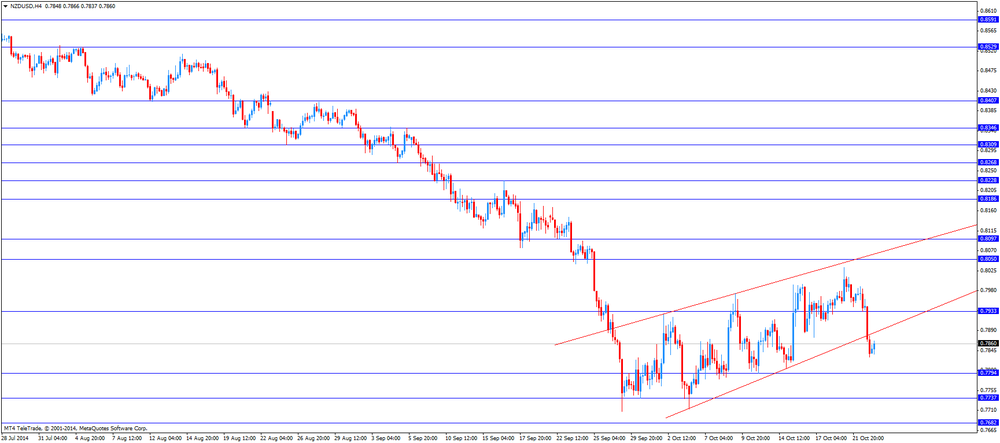

NZD/USD $0,7812 -0,73%

USD/CAD C$1,1230 -0,08%

-

23:00

Schedule for today, Friday, Oct 24’2014:

(time / country / index / period / previous value / forecast)

06:00 Germany Gfk Consumer Confidence Survey September 8.3 8.1

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III +0.9% +0.7%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III +3.2% +3.0%

09:00 Eurozone EU Economic Summit

13:00 Belgium Business Climate October -7.2 -7.8

14:00 U.S. New Home Sales September 504 473

-

22:45

New Zealand: Trade Balance, mln, September -1350 (forecast -620)

-

20:00

Dow +246.67 16,707.99 +1.50% Nasdaq +73.06 4,455.91 +1.67% S&P +26.29 1,953.40 +1.36%

-

17:00

European stocks close: FTSE 100 6,419.15 +19.42 +0.30% CAC 40 4,157.68 +52.59 +1.28% DAX 9,047.31 +107.17 +1.20%

-

17:00

European stocks close: stocks closed higher on positive PMI reports from the Eurozone

Stock indices closed higher on positive PMI reports from the Eurozone. Eurozone's preliminary manufacturing purchasing managers' index (PMI) rose to 50.7 in October from 50.3 in September, beating expectations for a decline to 50.0.

Eurozone's preliminary services PMI remained unchanged at 52.4 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary manufacturing PMI climbed to 51.8 in October from 49.9 in September, beating forecasts of a fall to 49.6.

Germany's preliminary services PMI fell to 54.8 in October from 55.7 in August, missing forecasts of a decline to 55.0.

France's preliminary manufacturing PMI declined to 47.3 in October from 48.8 in September, missing expectations for a decrease to 48.6.

Germany's preliminary services PMI decreased to 48.1 in October from 48.4 in August, missing forecasts of a fall to 48.2.

Retail sales in the U.K. fell 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% gain in August.

That data could mean that the economy in the U.K. is losing momentum, and the Bank of England may delay its interest rate hike.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,419.15 +19.42 +0.30%

DAX 9,047.31 +107.17 +1.20%

CAC 40 4,157.68 +52.59 +1.28%

-

16:40

Oil: an overview of the market situation

The price of oil has increased significantly today, departing from the two-year low, which helped to reduce the production of reports of Saudi Arabia. Support prices also have macroeconomic indicators from Europe and China.

According to informed sources, the supply from Saudi Arabia decreased by 328 thousand. Barrels per day to 9.36 million barrels a day last month from 9.69 million in August this year. At the same time, oil production in Saudi Arabia increased from 9.6 million barrels per day in August to 9.7 million in September.

"All of a sudden Saudi Arabia reduces supply, and that should be enough, at least, to provide some support and stabilize the market" - said an analyst and broker Tradition Energy Gene Makdzhillian.

As for the data, they showed that the activity indicator in the manufacturing sector in China in October rose to 50.4 after September remained at a three-month low of 50.2. Value was higher than had been expected 50.2. This result can ease concerns about the pace of economic growth in China.

Meanwhile, a report on the euro area indicated that the composite index from Markit manufacturing rose to 52.2 in October from 10-month low of 52 in September. Projected to fall to 51.5. The index of purchasing managers in the services sector remained unchanged at 52.4 in October, when expected to decline to 52 Manufacturing PMI increased to 50.7 from 50.3 in September. Economists expected the index to decline to 50.

The course of trading yesterday also continue to influence the data on stocks. Recall US crude stocks rose 7.1 million barrels last week, the forecast of 2.7 million.

"Of course, a lot of oil, so the rapid growth of shale oil extraction. But if the upcoming winter will be cold in the United States, production may be reduced because it will become harder to extract oil, "- said an analyst at National Australia Bank Fin Zibell.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) rose to $ 81.94 a barrel on the New York Mercantile Exchange (NYMEX).

The price of December futures for North Sea Brent crude oil mixture rose $ 1.95 to $ 86.52 a barrel on the London exchange ICE Futures Europe.

-

16:35

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies despite the weaker-than-expected number of initial jobless claims and the U.S. preliminary manufacturing purchasing managers' index

The U.S. dollar traded higher against the most major currencies despite the weaker-than-expected number of initial jobless claims and the U.S. preliminary manufacturing purchasing managers' index (PMI).

The number of initial jobless claims in the week ending October 18 in the U.S. rose by 17,000 to 283,000. The previous week's figure was revised to 266,000 from 264.000. Analysts had expected an increase to 269.000.

The U.S. preliminary manufacturing purchasing managers' index declined to 56.2 in October from 57.5 in September, missing expectations for a decline to 57.2.

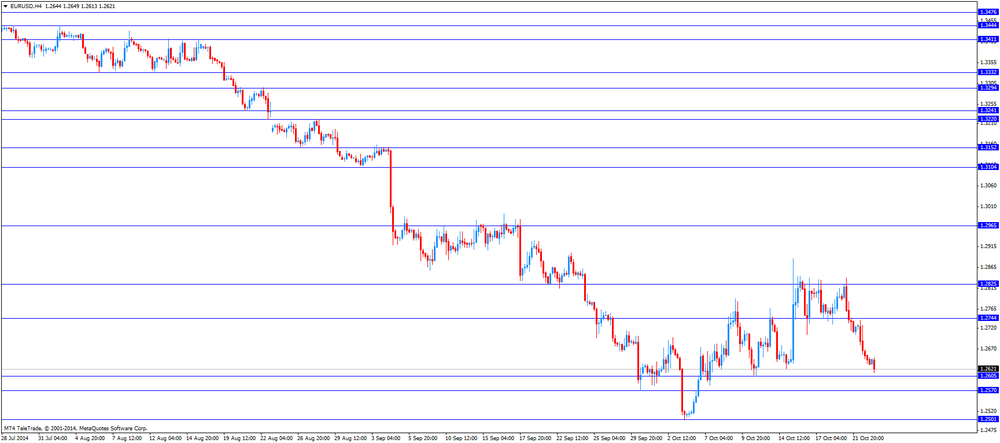

The euro traded lower against the U.S. dollar. Eurozone's consumer confidence fell to -11.1 in October from -11.4 in September, beating forecasts for a decrease to -12.

Eurozone's preliminary manufacturing purchasing managers' index (PMI) rose to 50.7 in October from 50.3 in September, beating expectations for a decline to 50.0.

Eurozone's preliminary services PMI remained unchanged at 52.4 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary manufacturing PMI climbed to 51.8 in October from 49.9 in September, beating forecasts of a fall to 49.6.

Germany's preliminary services PMI fell to 54.8 in October from 55.7 in August, missing forecasts of a decline to 55.0.

France's preliminary manufacturing PMI declined to 47.3 in October from 48.8 in September, missing expectations for a decrease to 48.6.

Germany's preliminary services PMI decreased to 48.1 in October from 48.4 in August, missing forecasts of a fall to 48.2.

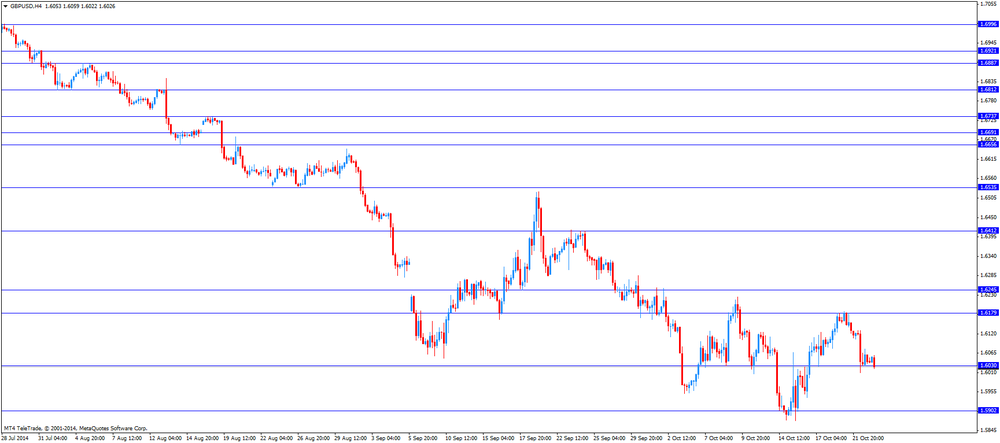

The British pound traded slightly higher against the U.S. dollar. In the morning trading session, the pound declined against the greenback after the disappointing retail sales from the U.K. Retail sales in the U.K. fell 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% gain in August.

That data could mean that the economy in the U.K. is losing momentum, and the Bank of England may delay its interest rate hike.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance fell to -6% in October from -4% in September, missing expectations for an increase to -3%. That was the lowest level since July 2013.

The New Zealand dollar fell against the U.S. dollar. In the overnight trading session, the kiwi dropped against the greenback after the consumer price inflation from New Zealand. New Zealand's consumer price inflation climbed 0.3% in the third quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the second quarter.

On a yearly basis, the consumer price index in New Zealand rose 1.0% in the third quarter, after a 1.6% increase in the second quarter.

That could mean that the Reserve Bank of New Zealand may delay its interest rate hike.

The Australian dollar declined against the U.S. dollar. The National Bank of Australia's business confidence index remained unchanged at 6 points in the third quarter.

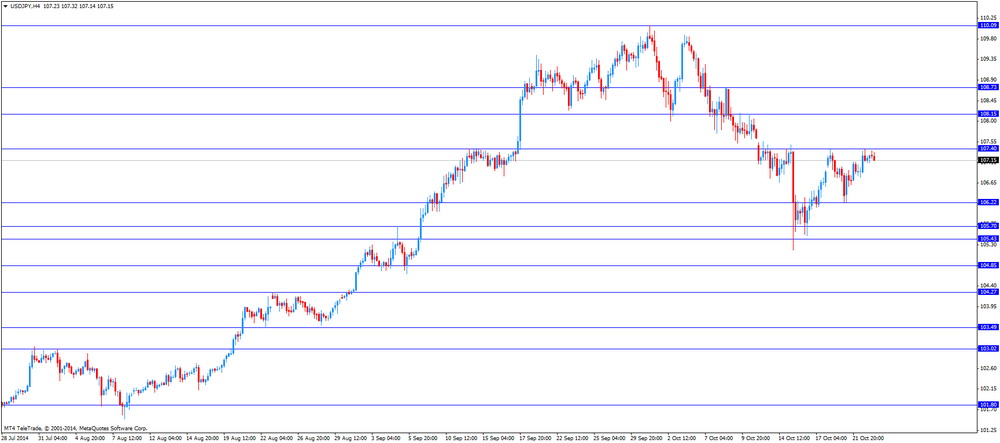

The Japanese yen dropped against the U.S. dollar. Japan's preliminary manufacturing purchasing managers' index increased to 52.8 in October from 51.7 in September, exceeding expectations for a rise to 52.1.

-

16:20

Gold: an overview of the market situation

Gold prices fell sharply today, approaching at the same time to a weekly minimum, because the stronger-than-expected economic data and upbeat earnings reports led to a rebound from the critical technical levels.

Experts note that the strong performance of China's PMI and Germany have reduced the metal's appeal as a safe asset and labor market data the United States put additional pressure on gold. Previously submitted report showed that the number of new applications for unemployment benefits in the United States rose last week but remained near a fourteen-year lows, this is another sign of a healthy labor market conditions. The number of initial claims for unemployment benefits rose by 17,000 and amounted to a seasonally adjusted 283,000 in the week ended Oct. 18, the Labor Department said Thursday. It was above 269,000 applications for Economists. Treatment for the previous week were revised higher by 2,000 to 266000. This was the lowest level since April 2000. The Labor Department said that there were no special factors influencing the data. Moving average for the four weeks of initial claims, which smooths weekly volatility, fell by 3,000 to 281,000, the lowest level since May 2000. The report also showed the number of people continuing to receive unemployment benefits fell by 38,000 to 2.35 million in the week ended Oct. 11. These figures are a one week lag.

Also today it was announced that the world's largest reserves of the Fund ETF SPDR Gold Trust on Wednesday declined by 0.3% to 749.87 tonnes - at least since the end of 2008.

Little support have expectations rising demand in the physical market of India on the eve of the two parties, when increasing the purchase of gold jewelry. Demand in China is also the largest consumer increased, and the margin to the reference spot price is about $ 2 per ounce.

The cost of the December gold futures on the COMEX today dropped to 1227.20 dollars per ounce.

-

15:01

U.S.: Leading Indicators , September +0.8% (forecast +0.8%)

-

15:00

Eurozone: Consumer Confidence, October -11.1 (forecast -12)

-

14:45

U.S.: Manufacturing PMI, October 56.2 (forecast 57.2)

-

14:37

U.S. Stocks open: Dow 16,636.90 +175.58 +1.07%, Nasdaq 4,424.48 +41.63 +0.95%, S&P 1,945.53 +18.42 +0.96%

-

14:28

Before the bell: S&P futures +0.74%, Nasdaq futures +0.77%

U.S. stock futures advanced as higher profit forecasts from companies including Caterpillar Inc. and a surprise gain in euro-area manufacturing boosted confidence in the global economy.

Global markets:

Nikkei 15,138.96 -56.81 -0.37%

Hang Seng 23,333.18 -70.79 -0.30%

Shanghai Composite 2,302.42 -24.14 -1.04%

FTSE 6,398.99 -0.74 -0.01%

CAC 4,135.3 +30.21 +0.74%

DAX 8,985.2 +45.06 +0.50%

Crude oil $80.81 (+0.55%)

Gold $1234.90 (-0.85%)

-

14:11

DOW components before the bell

(company / ticker / price / change, % / volume)

Procter & Gamble Co

PG

84.34

+0.13%

1.2K

Boeing Co

BA

121.91

+0.38%

26.8K

Verizon Communications Inc

VZ

48.50

+0.39%

0.2K

Nike

NKE

90.25

+0.43%

2.6K

McDonald's Corp

MCD

91.43

+0.54%

3.9K

The Coca-Cola Co

KO

40.85

+0.57%

1.3K

International Business Machines Co...

IBM

162.80

+0.62%

3.5K

Wal-Mart Stores Inc

WMT

76.50

+0.62%

3.9K

American Express Co

AXP

84.50

+0.64%

1.2K

Johnson & Johnson

JNJ

101.92

+0.69%

4.5K

Microsoft Corp

MSFT

44.73

+0.79%

0.1K

Cisco Systems Inc

CSCO

23.46

+0.86%

5.1K

Merck & Co Inc

MRK

56.00

+0.88%

0.2K

Walt Disney Co

DIS

87.89

+0.91%

0.6K

Goldman Sachs

GS

178.50

+0.94%

3.4K

Pfizer Inc

PFE

28.58

+0.99%

11.3K

Home Depot Inc

HD

94.27

+1.00%

8.6K

E. I. du Pont de Nemours and Co

DD

69.35

+1.02%

5.4K

Intel Corp

INTC

32.61

+1.05%

1.1K

JPMorgan Chase and Co

JPM

58.07

+1.08%

0.1K

Chevron Corp

CVX

115.25

+1.10%

0.9K

General Electric Co

GE

25.47

+1.11%

18.1K

United Technologies Corp

UTX

102.50

+1.30%

0.8K

Exxon Mobil Corp

XOM

94.35

+1.31%

9.0K

3M Co

MMM

141.95

+2.16%

4.6K

Caterpillar Inc

CAT

98.10

+3.73%

219.0K

AT&T Inc

T

34.08

-1.22%

172.5K

-

14:07

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Boeing (BA) downgraded from Outperform to Neutral at Credit Suisse, target lowered from $162 to $133

Other:

AT&T (T) target lowered from $36 to $35 at RBC Capital Mkts

AT&T (T) target lowered from $42 to $38 at Oppenheimer

-

14:03

U.S.: Housing Price Index, y/y, August +4.8%

-

14:02

U.S.: Housing Price Index, m/m, August +0.5% (forecast +0.4%)

-

13:30

U.S.: Initial Jobless Claims, October 283 (forecast 269)

-

13:00

Orders

EUR/USD

Offers

Bids $1.2605/00, $1.2585/80

GBP/USD

Offers $1.6200, $1.6080

Bids $1.5985, $1.5900

AUD/USD

Offers $0.8900, $0.8840/50, $0.8800

Bids $0.8720/00, $0.8650

EUR/JPY

Offers Y137.50, Y137.20, Y136.80/00, Y136.45/50

Bids Y135.60/50, Y135.00, Y134.50, Y134.00

USD/JPY

Offers Y109.00, Y108.50, Y107.80/00

Bids Y107.25/20, Y107.00, Y106.50, Y106.10/00

EUR/GBP

Offers stg0.8066

Bids stg0.7870/65, stg0.7850, stg0.7800

-

13:00

Foreign exchange market. European session: the British pound fell against the U.S. dollar after the disappointing retail sales from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia NAB Quarterly Business Confidence Quarter III 6 6

01:35 Japan Manufacturing PMI (Preliminary) October 51.7 52.1 52.8

01:45 China HSBC Manufacturing PMI (Preliminary) October 50.2 50.2 50.4

06:58 France Manufacturing PMI (Preliminary) October 48.8 48.6 47.3

06:58 France Services PMI (Preliminary) October 48.4 48.2 48.1

07:28 Germany Manufacturing PMI (Preliminary) October 49.9 49.6 51.8

07:28 Germany Services PMI (Preliminary) October 55.7 55.0 54.8

07:58 Eurozone Services PMI (Preliminary) October 52.4 52.0 52.4

07:58 Eurozone Manufacturing PMI (Preliminary) October 50.3 50.0 50.7

08:30 United Kingdom Retail Sales (MoM) September +0.4% -0.1% -0.3%

08:30 United Kingdom Retail Sales (YoY) September +3.9% +2.8% +2.7%

08:30 United Kingdom BBA Mortgage Approvals September 41.6 41.5 39.3

09:00 Eurozone EU Economic Summit

10:00 United Kingdom CBI industrial order books balance October -4 -3

The U.S. dollar traded mixed against the most major currencies ahead the number of initial jobless claims and the U.S. preliminary manufacturing purchasing managers' index (PMI).

The number of initial jobless claims in the U.S. is expected to rise by 5,000 to 269,000.

The U.S. preliminary manufacturing purchasing managers' index is expected to decline to 57.2 in October from 57.5 in September.

The greenback remained supported by yesterday's better-than-expected U.S. consumer price inflation. The U.S. consumer price inflation rose 0.1% in September, exceeding expectations for a flat reading, after a 0.2% decrease in August.

The euro traded higher against the U.S. dollar after PMI reports from the Eurozone. Eurozone's preliminary manufacturing purchasing managers' index (PMI) rose to 50.7 in October from 50.3 in September, beating expectations for a decline to 50.0.

Eurozone's preliminary services PMI remained unchanged at 52.4 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary manufacturing PMI climbed to 51.8 in October from 49.9 in September, beating forecasts of a fall to 49.6.

Germany's preliminary services PMI fell to 54.8 in October from 55.7 in August, missing forecasts of a decline to 55.0.

France's preliminary manufacturing PMI declined to 47.3 in October from 48.8 in September, missing expectations for a decrease to 48.6.

Germany's preliminary services PMI decreased to 48.1 in October from 48.4 in August, missing forecasts of a fall to 48.2.

Eurozone's consumer confidence is expected to fall to -12 in October from -11 in September.

The British pound fell against the U.S. dollar after the disappointing retail sales from the U.K. Retail sales in the U.K. fell 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% gain in August.

That data could mean that the economy in the U.K. is losing momentum, and the Bank of England may delay its interest rate hike.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance fell to -6% in October from -4% in September, missing expectations for an increase to -3%. That was the lowest level since July 2013.

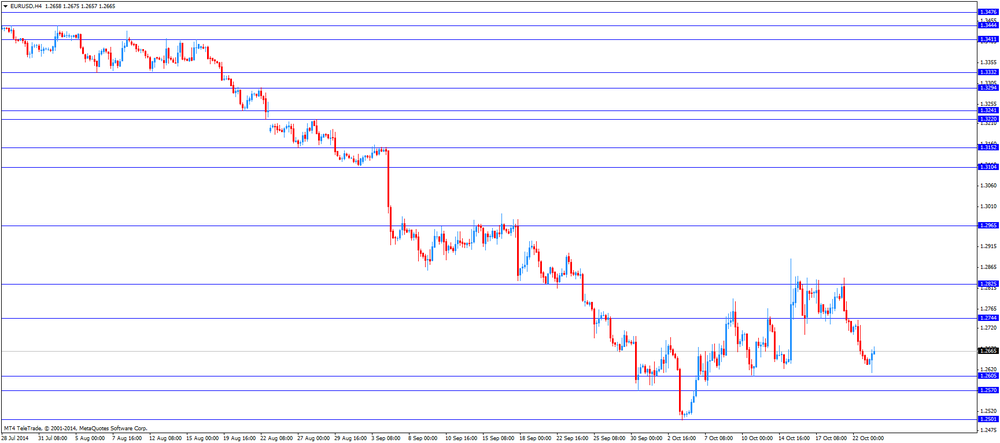

EUR/USD: the currency pair rose to 1.2675

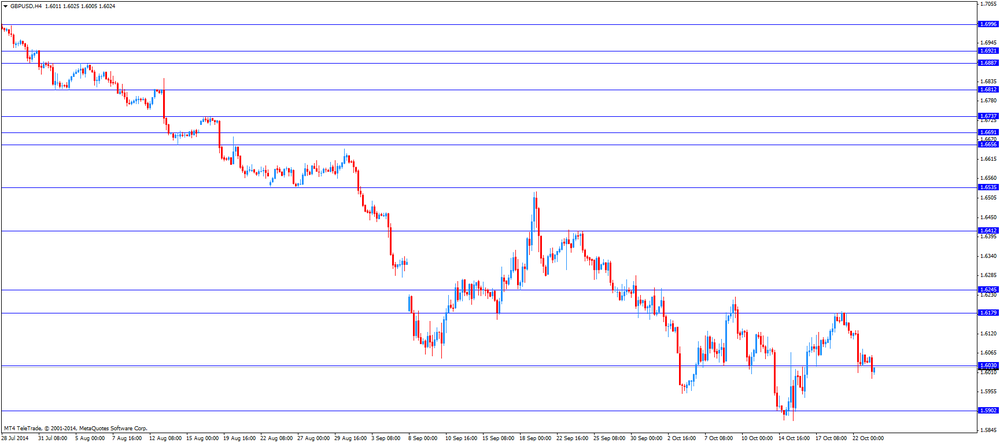

GBP/USD: the currency pair fell to $1.5993

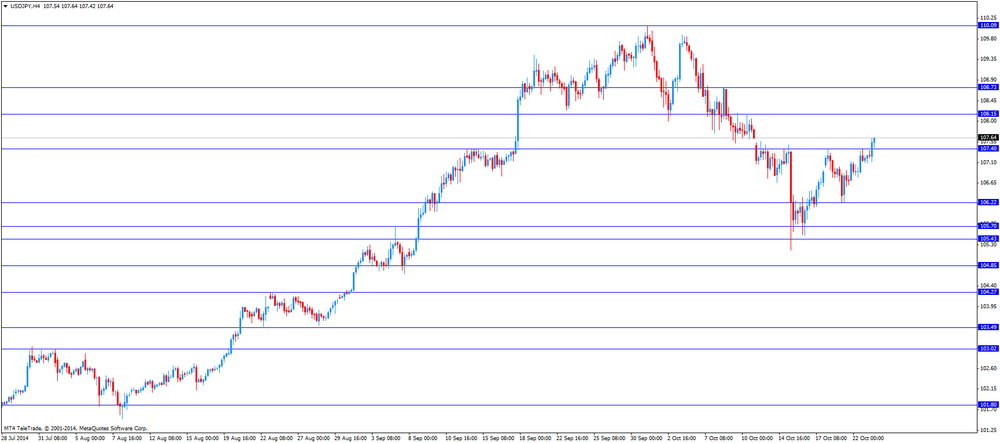

USD/JPY: the currency pair climbed to Y107.64

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims October 264 269

13:45 U.S. Manufacturing PMI (Preliminary) October 57.5 57.2

14:00 Eurozone Consumer Confidence October -11 -12

21:45 New Zealand Trade Balance, mln September -472 -620

-

12:02

European stock markets mid session: stocks traded little changed after PMI reports from the Eurozone

Stock indices traded little changed traded little changed after PMI reports from the Eurozone. Eurozone's preliminary manufacturing purchasing managers' index (PMI) rose to 50.7 in October from 50.3 in September, beating expectations for a decline to 50.0.

Eurozone's preliminary services PMI remained unchanged at 52.4 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary manufacturing PMI climbed to 51.8 in October from 49.9 in September, beating forecasts of a fall to 49.6.

Germany's preliminary services PMI fell to 54.8 in October from 55.7 in August, missing forecasts of a decline to 55.0.

France's preliminary manufacturing PMI declined to 47.3 in October from 48.8 in September, missing expectations for a decrease to 48.6.

Germany's preliminary services PMI decreased to 48.1 in October from 48.4 in August, missing forecasts of a fall to 48.2.

Retail sales in the U.K. fell 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% gain in August.

That data could mean that the economy in the U.K. is losing momentum, and the Bank of England may delay its interest rate hike.

Corporate earnings reports also weighed on markets.

Current figures:

Name Price Change Change %

FTSE 100 6,350.7 -49.03 -0.77%

DAX 8,926.54 -13.60 -0.15%

CAC 40 4,092.28 -12.81 -0.31%

-

11:27

UK retail sales declined 0.3% in September

The Office for National Statistics released the retail sales data for the U.K. Retail sales in the U.K. fell 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% gain in August.

On a yearly basis, retail sales in the U.K. climbed 2.7% in September, missing expectations for a 2.8% rise, after a 3.7% increase in August. August's figure was revised down from a 3.9% rise.

The decline was driven by a weak clothing demand. Clothing and footwear sales dropped by 7.8% in September, the biggest monthly decline since April 2012.

That data could mean that the economy in the U.K. is losing momentum, and the Bank of England may delay its interest rate hike.

-

10:40

Asian Stocks close: most stocks closed lower, following losses on Wall Street

Asian stock indices closed lower, following losses on Wall Street. Concerns over the slowdown of the global growth still weighed on markets.

The better-than-expected Chinese economic data has not impressed investors. China's HSBC manufacturing purchasing managers' index rose to 50.4 in October from 50.2 in September. Analysts had expected the index to remain unchanged at 50.2.

Japan's preliminary manufacturing purchasing managers' index increased to 52.8 in October from 51.7 in September, exceeding expectations for a rise to 52.1.

Indexes on the close:

Nikkei 225 15,138.96 -56.81 -0.37%

Hang Seng 23,333.18 -70.79 -0.30%

Shanghai Composite 2,302.42 -24.14 -1.04%

-

10:21

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600(E1.1bn), $1.2650(E1.9bn), $1.2695-00(E600mn), $1.2720-25(E668mn), $1.2750(E803mn)

USD/JPY: Y106.75($590mn), Y107.00($1.745bn), Y107.35($585mn)

EUR/GBP: Stg0.7800(E391mn)

USD/CHF: Chf0.9375($786mn), Chf0.9475($278mn), Chf0.9700($500mn)

AUD/USD: $0.8700(A$1.0bn), $0.8800(A$350mn), $0.8835(A$507mn)

-

10:02

Foreign exchange market. Asian session: the New Zealand dollar dropped against the U.S. dollar after the consumer price inflation from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia NAB Quarterly Business Confidence Quarter III 6 6

01:35 Japan Manufacturing PMI (Preliminary) October 51.7 52.1 52.8

01:45 China HSBC Manufacturing PMI (Preliminary) October 50.2 50.2 50.4

06:58 France Manufacturing PMI (Preliminary) October 48.8 48.6 47.3

06:58 France Services PMI (Preliminary) October 48.4 48.2 48.1

07:28 Germany Manufacturing PMI (Preliminary) October 49.9 49.6 51.8

07:28 Germany Services PMI (Preliminary) October 55.7 55.0 54.8

07:58 Eurozone Services PMI (Preliminary) October 52.4 52.0 52.4

07:58 Eurozone Manufacturing PMI (Preliminary) October 50.3 50.0 50.7

08:30 United Kingdom Retail Sales (MoM) September +0.4% -0.1% -0.3%

08:30 United Kingdom Retail Sales (YoY) September +3.9% +2.8% +2.7%

08:30 United Kingdom BBA Mortgage Approvals September 41.6 41.5 39.3

09:00 Eurozone EU Economic Summit

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by yesterday's better-than-expected U.S. consumer price inflation. The U.S. consumer price inflation rose 0.1% in September, exceeding expectations for a flat reading, after a 0.2% decrease in August.

The New Zealand dollar dropped against the U.S. dollar after the consumer price inflation from New Zealand. New Zealand's consumer price inflation climbed 0.3% in the third quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the second quarter.

On a yearly basis, the consumer price index in New Zealand rose 1.0% in the third quarter, after a 1.6% increase in the second quarter.

That could mean that the Reserve Bank of New Zealand may delay its interest rate hike.

The Australian dollar traded slightly lower against the U.S. dollar despite the better-than-expected preliminary Chinese HSBC manufacturing purchasing managers' index. China's HSBC manufacturing purchasing managers' index rose to 50.4 in October from 50.2 in September. Analysts had expected the index to remain unchanged at 50.2.

The National Bank of Australia's business confidence index remained unchanged at 6 points in the third quarter.

The Japanese yen traded mixed against the U.S. dollar. Japan's preliminary manufacturing purchasing managers' index increased to 52.8 in October from 51.7 in September, exceeding expectations for a rise to 52.1.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.6056

USD/JPY: the currency pair traded mixed

NZD/USD: the currency pair fell to $0.7830

The most important news that are expected (GMT0):

10:00 United Kingdom CBI industrial order books balance October -4 -3

12:30 U.S. Initial Jobless Claims October 264 269

13:45 U.S. Manufacturing PMI (Preliminary) October 57.5 57.2

14:00 Eurozone Consumer Confidence October -11 -12

21:45 New Zealand Trade Balance, mln September -472 -620

-

09:30

United Kingdom: Retail Sales (MoM), September -0.3% (forecast -0.1%)

-

09:30

United Kingdom: Retail Sales (YoY) , September +2.7% (forecast +2.8%)

-

09:30

United Kingdom: BBA Mortgage Approvals, September 39.3 (forecast 41.5)

-

09:00

Eurozone: Manufacturing PMI, October 50.7 (forecast 50.0)

-

09:00

Eurozone: Services PMI, October 52.4 (forecast 52.0)

-

08:30

Germany: Manufacturing PMI, October 51.8 (forecast 49.6)

-

08:30

Germany: Services PMI, October 54.8 (forecast 55.0)

-

08:00

France: Manufacturing PMI, October 47.3 (forecast 48.6)

-

08:00

France: Services PMI, October 48.1 (forecast 48.2)

-

06:26

Options levels on thursday, October 23, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2797 (3435)

$1.2739 (1668)

$1.2699 (1664)

Price at time of writing this review: $ 1.2637

Support levels (open interest**, contracts):

$1.2582 (3127)

$1.2531 (6357)

$1.2499 (4454)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 56529 contracts, with the maximum number of contracts with strike pric $1,2900 (6995);

- Overall open interest on the PUT options with the expiration date November, 7 is 59170 contracts, with the maximum number of contracts with strike price $1,2500 (6596);

- The ratio of PUT/CALL was 1.05 versus 1.02 from the previous trading day according to data from October, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.6302 (1700)

$1.6204 (2041)

$1.6107 (1492)

Price at time of writing this review: $1.6051

Support levels (open interest**, contracts):

$1.5992 (2339)

$1.5895 (1768)

$1.5797 (1532)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 27029 contracts, with the maximum number of contracts with strike price $1,6200 (2041);

- Overall open interest on the PUT options with the expiration date November, 7 is 32742 contracts, with the maximum number of contracts with strike price $1,5400 (2398);

- The ratio of PUT/CALL was 1.21 versus 1.20 from the previous trading day according to data from October, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:00

Nikkei 225 15,089.92 -105.85 -0.70%, Hang Seng 23,363.1 -40.87 -0.17%, S&P/ASX 200 5,380.1 -5.77 -0.11%, Shanghai Composite 2,322.51 -4.04 -0.17%

-

02:45

China: HSBC Manufacturing PMI, October 50.4 (forecast 50.2)

-

02:35

Japan: Manufacturing PMI, October 52.8 (forecast 52.1)

-

01:30

Australia: NAB Quarterly Business Confidence, Quarter II 6

-

00:08

Commodities. Daily history for Oct 22'2014:

(raw materials / closing price /% change)

Light Crude 80.47 -0.06%

Gold 1,242.10 -0.27%

-

00:06

Stocks. Daily history for Oct 22'2014:

(index / closing price / change items /% change)

Nikkei 225 15,195.77 +391.49 +2.64%

Hang Seng 23,403.97 +315.39 +1.37%

Shanghai Composite 2,326.55 -13.10 -0.56%

FTSE 100 6,399.73 +27.40 +0.43%

CAC 40 4,105.09 +23.85 +0.58%

Xetra DAX 8,940.14 +53.18 +0.60%

S&P 500 1,927.11 -14.17 -0.73%

NASDAQ Composite 4,382.85 -36.63 -0.83%

Dow Jones 16,461.32 -153.49 -0.92%

-

00:01

Currencies. Daily history for Oct 22'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2644 -0,53%

GBP/USD $1,6041 -0,46%

USD/CHF Chf0,9538 +0,49%

USD/JPY Y107,20 +0,12%

EUR/JPY Y135,55 -0,41%

GBP/JPY Y171,96 -0,34%

AUD/USD $0,8761 -0,18%

NZD/USD $0,7869 -1,12%

USD/CAD C$1,1239 +0,13%

-