Notícias do Mercado

-

19:20

American focus : the pound declined significantly against the dollar

The dollar recovered slightly against the euro, while returning to the levels of the opening of today's session. Note that the growth of the U.S. currency have helped the data , which showed that in September orders for expensive U.S. goods rose by 3.7% , mainly due to the increasing demand for jets , but business investment outside the transport sector declined.

Economists had expected an increase in orders to a seasonally adjusted total 1.7 % , helped by a sharp increase in the number of signed contracts for orders Boeing Inc. Airline, which soared 57.5% after rising by only 5.4 % in the previous month. Orders for durable goods excluding transportation fell by 0.1 %. Orders for core capital goods fell by 1.1 %. This is the second drop in three months. Deliveries of major means of production , a figure that used to help determine how fast the economy is growing every quarter , fell 0.2 % in September. Orders for durable goods in August was revised upward to 0.2 %. For the first nine months of 2013 , orders for durable goods rose 3 % compared with the same period a year earlier.

The pound fell markedly against the dollar, losing the all the items received in anticipation of the report by Britain's GDP . In its preliminary assessment of the Office of National Statistics said gross domestic product grew by 0.8 % in July - September compared with the second quarter, when it increased by 0.7 %, showing the strongest growth since the second quarter of 2010 , when the economy expanded by 1.0 %. Production volume rose by 1.5 % compared to the third quarter of 2012. The figures in line with forecasts of economists. Year- on-year GDP growth this year could reach 3.2%. But despite the rapid growth , the data show that the UK economy is still below the levels of five years ago, when the financial crisis hit .

According to Trevor Graham , an analyst Fidelity Worldwide Investment, " Britain's GDP is restored, and in the 4th quarter , he may be even higher , according to the outgoing data. Recovery takes place against the background of the housing market , however, any growth is better than none , as it can lower the deficit , as well as to encourage companies to invest in new equipment . "

-

15:00

U.S.: Wholesale Inventories, August +0.5%

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, October 73.2 (forecast 75.3)

-

14:46

Option expiries for today's 1400GMT cut

EUR/USD $1.3680, $1.3700, $1.3725, $1.3750, $1.3800, $1.3820, $1.3850

USD/JPY Y96.80, Y96.90, Y97.00, Y97.50, Y97.85, Y98.00, Y98.20, Y98.25, Y98.30/35, Y98.45/50

EUR/JPY Y135.00

AUD/JPY Y93.30, Y95.00

GBP/USD $1.6050, $1.6185, $1.6275, $1.6300

EUR/GBP stg0.8425

USD/CHF Chf0.8875, Chf0.8995, Chf0.9025

EUR/CHF Chf1.2300

AUD/USD $0.9590, $0.9600, $0.9675

USD/CAD C$1.0325, C$1.0360, C$1.0415, C$1.0485, C$1.0535

-

14:15

Italy retail sales stagnate in August

Retail sales in Italy during August remained unchanged from the previous month as spending on food held steady, while non-food consumption shrunk, data released by the statistical office ISTAT showed on Friday.

The seasonally adjusted retail trade index remained unchanged from July, when sales declined a revised 0.2 percent. This was in line with economists' expectations and came after a 0.2 percent decreases in the previous two months.

Sales of food were stable in August, following a 0.1 percent gain in the previous month. Non-food sales declined for the fourth straight month, down 0.1 percent.

On an annual basis, non-adjusted retail sales rose 0.2 percent in August, after declining 0.8 percent in the previous month. The increase came in contrast to economists' expectations for a 2.3 percent fall.

It was the first annual increase since June last year. Food sales grew 1 percent, while non-food sales shrunk 0.4 percent.

-

13:30

U.S.: Durable Goods Orders , September +3.7% (forecast +1.7%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , September -0.1% (forecast +0.6%)

-

13:30

U.S.: Durable goods orders ex defense, October +3.2%

-

13:16

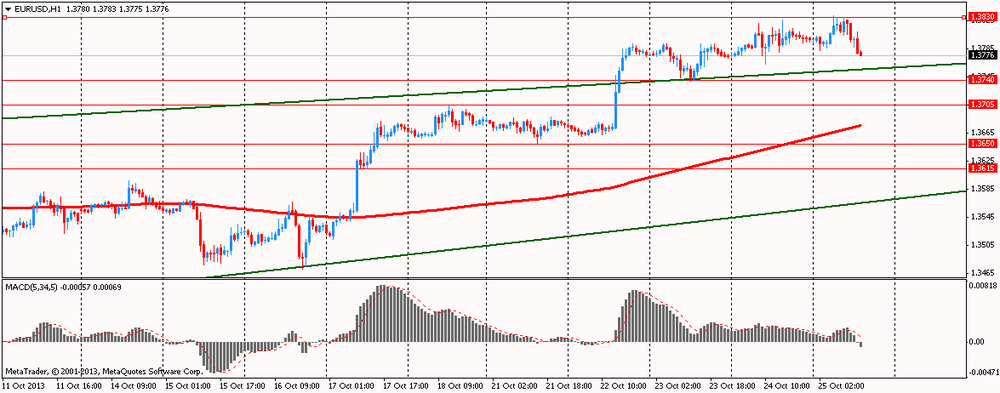

European session: the euro fell

08:00 Eurozone Private Loans, Y/Y September -2.0% -1.9% -1.9%

08:00 Eurozone M3 money supply, adjusted y/y September +2.3% +2.3% +2.2%

08:00 Germany IFO - Business Climate October 107.7 108.2 107.4

08:00 Germany IFO - Current Assessment October 111.4 111.4 111.3

08:00 Germany IFO - Expectations October 104.2 104.5 103.6

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III +0.7% +0.8% +0.8%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III +1.3% +1.5% +1.5%

The euro fell against the dollar after data showed that the mood of German business confidence unexpectedly deteriorated in October , as expectations of sales declined in most industries, including manufacturing . The business confidence index according to the Ifo Institute fell for the first time in six months to 107.4 in October from 107.7 in September , below the projected growth to 108.2 . But in general, the mood in the business community are still strong and the economic recovery continues , economists say.

The euro rose by 8 % in relation to the U.S. dollar from July to two-year high , just above 1.38 dollars this week, it could undermine German exports . Ifo said that about 7,000 companies participating in the monthly survey reported some deterioration in business prospects. Indicator of business expectations fell to 103.6 in October from 104.2 in September. In addition, the Company assesses the current business situation is less favorable . The corresponding Ifo index fell to 111.3 from 111.4 in September.

Another report showed that the euro zone money supply growth slowed unexpectedly in September, and loans to the private sector declined slightly slower pace . M3 money supply grew by 2.2 percent year on year in September, slower than the 2.3 percent growth rate , which was in August , according to the European Central Bank . According to forecasts , the growth rate were to remain at the August level.

The data showed that the reduction of total lending , which is available to residents eurozone deepened to 0.7 percent from 0.5 percent the previous month . Meanwhile, the government loans rose 0.7 percent in September , compared with 2.1 percent in August. Loans to the private sector fell by 1.1 percent in September , compared with a 1.2 percent fall in the previous month .

The pound rose against the dollar at the beginning of the European session after the release of the preliminary GDP data for the UK . The UK economy expanded at the fastest pace since the second quarter of 2010. Gross domestic product grew by 0.8 percent sequentially in the third quarter, slightly faster than the 0.7 percent expansion recorded in the previous three months. The growth rate in line with economists' expectations . Growth in the third quarter was the biggest since the second quarter of 2010, when GDP grew by 1 percent.

Compared to the third quarter of 2012 the economy grew by 1.5 percent. ONS, however, noted that the Olympic and Paralympic Games , which were held during the third quarter of 2012, increased the level of GDP in the quarter . The data showed that the volume of production increased by 1.4 per cent in agriculture, 0.5 percent in industry and 2.5 percent in construction. The dominant services sector grew by 0.7 percent.

EUR / USD: during the European session, the pair fell to $ 1.3775

GBP / USD: during the European session, the pair rose to $ 1.6238 , and then fell to $ 1.6166

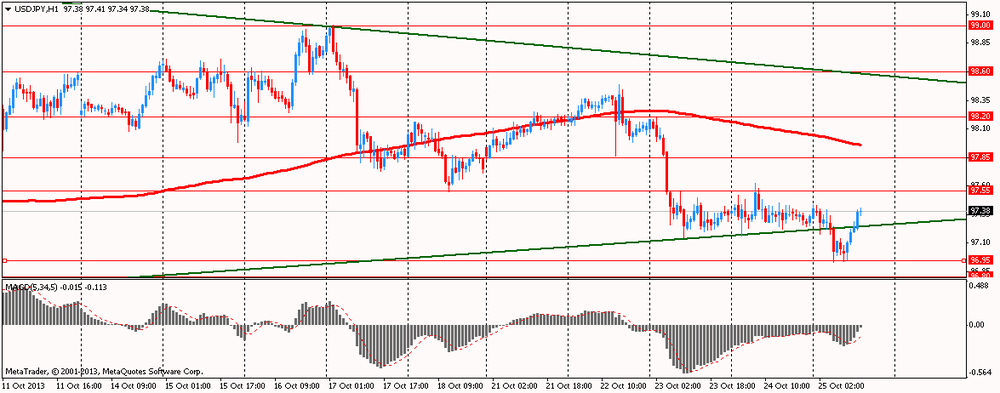

USD / JPY: during the European session, the pair rose to Y97.41

In the U.S., at 12:30 GMT will change in orders for durable goods , a change in orders for durable goods excluding transportation equipment in September , in the 13:55 GMT - an indicator of consumer confidence from the University of Michigan in October.

-

13:00

Orders

EUR/USD

Offers $1.3870/80, $1.3850, $1.3830/35

Bids $1.3785, $1.3765/60, $1.3750/40, $1.3720, $1.3710/00

GBP/USD

Offers $1.6320/30, $1.6300, $1.6280, $1.6250/60

Bids $1.6165/60, $1.6115/00, $1.6080

AUD/USD

Offers $0.9720/25, $0.9690/00, $0.9670/75, $0.9645/50, $0.9620/25

Bids $0.9585/80, $0.9560/50, $0.9500, $0.9480

EUR/GBP

Offers stg0.8650, stg0.8600, stg0.8555/65, stg0.8535

Bids stg0.8505/00, stg0.8470, stg0.8450/40, stg0.8425/15, stg0.8400

EUR/JPY

Offers Y135.50, Y135.25/30, Y135.00, Y134.80, Y134.50

Bids Y133.55/50, Y133.00

USD/JPY

Offers Y98.20, Y98.00, Y97.75/80, Y97.50

Bids Y96.80, Y96.50, Y96.20, Y96.00

-

11:15

Eurozone september money supply growth slows unexpectedly

Eurozone money supply growth slowed unexpectedly in September, while loans provided to the private sector decreased at a slightly slower pace, data showed Friday.

M3 money supply advanced 2.1 percent year-on-year in September, slower than the 2.3 percent rise seen in August, the European Central Bank said. The rate was forecast to rise to 2.4 percent.

Data showed that the decline in total credit granted to euro area residents deepened to 0.7 percent from 0.5 percent. Meanwhile, credit to general government grew 0.7 percent in September, but down from 2.1 percent in August.

The credit provided to the private sector was down by 1.1 percent in September, compared to a 1.2 percent drop in the previous month.

-

11:00

U.K. Q3 GDP expands at fastest pace since 2010

The U.K. economy expanded at the fastest rate since the second quarter of 2010, preliminary data from the Office for National Statistics showed Friday.

Gross domestic product grew 0.8 percent sequentially in the third quarter, slightly faster than the 0.7 percent expansion logged in the preceding three months. The rate matched economists' expectations.

The third quarter increase was the biggest since the second quarter of 2010, when it grew 1 percent.

Compared with the third quarter of 2012, the economy grew 1.5 percent. The ONS, however, said that the Olympics and Paralympics took place during the third quarter of 2012, raising the level of GDP in this quarter.

Data showed that output increased by 1.4 percent in agriculture, 0.5 percent in production and 2.5 percent in construction. The dominant service sector advanced 0.7 percent.

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD $1.3680, $1.3700, $1.3725, $1.3750, $1.3800, $1.3820, $1.3850

USD/JPY Y96.80, Y96.90, Y97.00, Y97.50, Y97.85, Y98.00, Y98.20, Y98.25, Y98.30/35, Y98.45/50

EUR/JPY Y135.00

AUD/JPY Y93.30, Y95.00

GBP/USD $1.6050, $1.6185, $1.6275, $1.6300

EUR/GBP stg0.8425

USD/CHF Chf0.8875, Chf0.8995, Chf0.9025

EUR/CHF Chf1.2300

AUD/USD $0.9590, $0.9600, $0.9675

USD/CAD C$1.0325, C$1.0360, C$1.0415, C$1.0485, C$1.0535

-

09:30

United Kingdom: GDP, y/y, Quarter III +1.5% (forecast +1.5%)

-

09:30

United Kingdom: GDP, q/q, Quarter III +0.8% (forecast +0.8%)

-

09:02

Germany: IFO - Expectations , October 103.6 (forecast 104.5)

-

09:01

Eurozone: Private Loans, Y/Y, September -1.9% (forecast -1.9%)

-

09:01

Eurozone: M3 money supply, adjusted y/y, September +2.2% (forecast +2.3%)

-

09:00

Germany: IFO - Business Climate, October 107.4 (forecast 108.2)

-

09:00

Germany: IFO - Current Assessment , October 111.3 (forecast 111.4)

-

07:00

Asian session: The dollar traded 0.2 percent from the weakest in almost two years

The dollar traded 0.2 percent from the weakest in almost two years versus the euro before reports today forecast to show diverging confidence in the U.S. and in Europe’s largest economy. The Thomson Reuters/University of Michigan consumer sentiment index probably fell to 75 this month, the lowest since January, and compared with 77.5 in September, according to the median economist estimate in a Bloomberg News survey before today’s data. A preliminary reading for October was 75.2. Separate reports yesterday showed more Americans than forecast filed jobless-benefit claims and manufacturing growth slowed.

In Germany, Europe’s biggest economy, the Ifo institute’s business climate index probably climbed to 108 this month, the highest since April 2012, and compared with 107.7 in September, a separate survey showed before the figures today.

New Zealand’s dollar weakened against all its major peers after the nation’s central bank signaled hesitation to raise borrowing costs.

EUR / USD: during the Asian session the pair rose to $ 1.3830

GBP / USD: during the Asian session, the pair rose to $ 1.6245

USD / JPY: during the Asian session the pair fell to Y96.90

There is a full calendar on both sides of the Atlantic Friday, with Germany's Ifo and the UK GDP data set to dominate the morning session. Early data sees the release of the German August construction orders at 0600GMT. At 0700GMT, Spain's September PPI data will cross the wires. There is a raft of data set for release at 0800GMT, including EMU M3 numbers, Italian August retail sales data and Germany's October IFO business climate index. At 1730GMT, ECB Governing Council member Luis Maria Linde will give a speech on Spain's Economic Crisis" in Granada, while ECB Executive Board member Joerg Asmussen delivers a speech at awards ceremony in Milan from 1930GMT. The UK's Q3 GDP data will be released at 0830GMT, along with the August Index of Services data.

-

06:20

Currencies. Daily history for Oct 24'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3799 +0,18%

GBP/USD $1,6201 +0,23%

USD/CHF Chf0,8923 +0,01%

USD/JPY Y97,32 -0,03%

EUR/JPY Y134,29 +0,14%

GBP/JPY Y157,65 +0,18%

AUD/USD $0,9614 0,00%

NZD/USD $0,8341 -0,70%

USD/CAD C$1,0420 +0,36%

-

05:59

Schedule for today, Friday, Oct 25’2013:

08:00 Eurozone Private Loans, Y/Y September -2.0% -1.9%

08:00 Eurozone M3 money supply, adjusted y/y September +2.3% +2.3%

08:00 Germany IFO - Business Climate October 107.7 108.2

08:00 Germany IFO - Current Assessment October 111.4 111.4

08:00 Germany IFO - Expectations October 104.2 104.5

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III +0.7% +0.8%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III +1.3% +1.5%

12:30 U.S. Durable Goods Orders September +0.1% +1.7%

12:30 U.S. Durable Goods Orders ex Transportation September -0.1% +0.6%

12:30 U.S. Durable goods orders ex defense October +0.5%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 75.2 75.3

-