Notícias do Mercado

-

20:00

Dow +25.94 15,535.15 +0.17% Nasdaq +10.76 3,939.72 +0.27% S&P +4.49 1,756.56 +0.26%

-

19:20

American focus : the pound declined significantly against the dollar

The dollar recovered slightly against the euro, while returning to the levels of the opening of today's session. Note that the growth of the U.S. currency have helped the data , which showed that in September orders for expensive U.S. goods rose by 3.7% , mainly due to the increasing demand for jets , but business investment outside the transport sector declined.

Economists had expected an increase in orders to a seasonally adjusted total 1.7 % , helped by a sharp increase in the number of signed contracts for orders Boeing Inc. Airline, which soared 57.5% after rising by only 5.4 % in the previous month. Orders for durable goods excluding transportation fell by 0.1 %. Orders for core capital goods fell by 1.1 %. This is the second drop in three months. Deliveries of major means of production , a figure that used to help determine how fast the economy is growing every quarter , fell 0.2 % in September. Orders for durable goods in August was revised upward to 0.2 %. For the first nine months of 2013 , orders for durable goods rose 3 % compared with the same period a year earlier.

The pound fell markedly against the dollar, losing the all the items received in anticipation of the report by Britain's GDP . In its preliminary assessment of the Office of National Statistics said gross domestic product grew by 0.8 % in July - September compared with the second quarter, when it increased by 0.7 %, showing the strongest growth since the second quarter of 2010 , when the economy expanded by 1.0 %. Production volume rose by 1.5 % compared to the third quarter of 2012. The figures in line with forecasts of economists. Year- on-year GDP growth this year could reach 3.2%. But despite the rapid growth , the data show that the UK economy is still below the levels of five years ago, when the financial crisis hit .

According to Trevor Graham , an analyst Fidelity Worldwide Investment, " Britain's GDP is restored, and in the 4th quarter , he may be even higher , according to the outgoing data. Recovery takes place against the background of the housing market , however, any growth is better than none , as it can lower the deficit , as well as to encourage companies to invest in new equipment . "

-

18:20

European stock close

European stocks were little changed, with the Stoxx Europe 600 Index heading for a third weekly advance, as companies from Kering (KER) SA to Renault SA reported sales that missed projections, offsetting gains in BASF SE.

The Stoxx 600 slipped 0.1 percent to 320 at 4:30 p.m. in London. The gauge has still climbed 0.5 percent this week as companies from Daimler AG to Royal Philips NV posted results that beat analysts’ estimates. The benchmark has gained 14 percent in 2013 as central banks around the world pledged to leave interest rates low for a prolonged period.

Data from the U.S. Commerce Department today showed orders for durable goods increased 3.7 percent in September after a revised 0.2 percent advance in the prior month, as stronger demand for commercial and military aircraft outweighed a drop in business equipment. The median estimate was for a 2.3 percent gain.

National benchmark indexes fell in 12 of the 18 Western-European markets.

FTSE 100 6,719.54 +6.36 +0.09% CAC 40 4,272.47 -3.22 -0.08% DAX 8,989.62 +8.99 +0.10%

Kering retreated 2.8 percent to 167.75 euros after the luxury-goods maker said third-quarter sales from continuing operations fell to 2.52 billion euros. Analysts predicted 2.55 billion euros, according to the median estimate. Gucci’s sales rose 0.6 percent, less than projections for 2.1 percent growth, and the weakest performance since the third quarter of 2009.

Renault (RNO) declined 3.1 percent to 66.19 euros. Sales fell 3.2 percent to 8 billion euros from a restated 8.26 billion euros a year earlier, the French company said late yesterday. Revenue was less than the 8.5 billion-euro average of analyst estimates.

Volvo AB (VOLVB), the world’s second-largest truckmaker, dropped 6.7 percent to 88 kronor, its biggest decline in a year, after saying that the strength of the krona and new-vehicle investments ate into profit. Earnings before interest and taxes decreased 18 percent to 2.4 billion kronor ($379 million) from 2.92 billion kronor a year earlier, missing the 3.15 billion-krona average estimate.

Telecom Italia tumbled 6.3 percent to 67.3 euro cents. The phone company may propose the 1.5 billion euros to 2 billion euros capital increase at its Nov. 7 board meeting, according to three people with knowledge of the matter, who asked not to be identified because the deliberations are private.

Schneider Electric SA slipped 1.5 percent to 62.32 euros. The world’s biggest maker of low- and medium-voltage equipment cut its 2013 profit and revenue forecasts because of the strength of the euro. The decline of emerging-market currencies will crimp its ">BASF, the world’s largest chemical maker, rose 1.6 percent to 75.34 euros. Third-quarter Ebit excluding one-time items jumped 15 percent to 1.69 billion euros, beating the average analyst estimate of 1.62 billion euros, according to a statement today.

-

17:00

European stock close: FTSE 100 6,719.54 +6.36 +0.09% CAC 40 4,272.47 -3.22 -0.08% DAX 8,989.62 +8.99 +0.10%

-

16:41

Oil: an overview of the market situation

Oil prices fell , dropping below $ 107 per barrel (brand Brent), which was due to fears of growing supply and demand discontinuity , despite signs of economic growth in the second largest oil consumer in the world - China.

Recall that the increased tension in Syria, which could disrupt the supply of Middle East oil brand Brent, pushed prices to a six-month high in August - above $ 117. But since then, prices have dropped by more than $ 10 a barrel . However , some analysts say that a further decline is still to come .

As the price of crude oil WTI, they were under pressure from the seasonal drop in demand and an increase in domestic oil production , which led to an increase in inventories , especially on the U.S. Gulf Coast.

Meanwhile , we add that oil markets continue to be supported by the data presented yesterday by the Chinese , who pointed to the acceleration of economic growth.

In addition, we note that a small effect on the bidding had a report on the United States, which showed that orders for durable goods rose 3.7 % in September compared with August . It was the second consecutive monthly increase and the strongest increase since June. Analysts had expected new orders rise by 1.7 % in September. The growth was driven by double-digit percentage increase in orders for transportation equipment , namely, non-defense aircraft .

Excluding transportation equipment orders for durable goods fell 0.1 % last month - the third consecutive month of decline in orders.

The report showed that demand fell for commodities such as machinery and equipment, electrical equipment, hardware , and automobiles and auto parts .

" As the price of oil , they are close to the minimum . Demand for oil has reached a low point , and the onset of winter when it will grow," - said the risk manager Mitsubishi Corp Tony Noonan .

Moderating influence on prices have U.S. talks with Iran on Tehran's nuclear program . On Thursday, the White House hosted a meeting of leaders of the Senate Committees advisers to persuade Congress to postpone the adoption of tough new sanctions against Iran.

The cost of the December futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 97.52 a barrel on the New York Mercantile Exchange.

December futures price for North Sea Brent crude oil mixture fell $ 0.36 to $ 106.59 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices recovered from session lows , stabilized with near one-month high , completing the current week increase. Note that the rise in price of the precious metal this week has been associated with the publication of weak data , which pushed even further opportunities to reduce the stimulus from the Fed .

Recall that yesterday, the U.S. Labor Department reported that the number of Americans filing initial applications for unemployment benefits fell last week - a sign that the majority of employers in the private sector left jobs for the period of interruption of the government. The number of initial claims for unemployment benefits fell by 12,000 adjusted for seasonal variations to 350,000 .

Report on Thursday pointed to a cooling in the labor market . On Tuesday , the government reported that the economy added only 148,000 jobs in September , based on data collected before October 1. This compared with an average of more than 200,000 jobs a month in the first half of the year .

Signs of softening of the labor market and the U.S. economy , combined with the weakening of other economic reports posing a new challenge for the Federal Reserve and puts the start date to reduce incentives. Recall that the issue would be discussed at a meeting of the Fed, which will take place on the already next week.

Data presented today also showed that stocks of the world's largest exchange-traded fund backed by gold SPDR Gold Shares on Thursday fell by 0.2 percent or 1.8 tons. Recall that on Monday the fund holdings declined by more than 10 tonnes, but increased by 6 tonnes on Tuesday .

Note also that the increase in spot prices further deter physical demand in most Asian countries. Premiums on the Shanghai Stock Exchange on gold fell to multi-month lows at $ 2 an ounce. This compares with a high of $ 30, which was recorded in April and May.

The cost of the December gold futures on COMEX today dropped to $ 1347.00 per ounce.

-

15:00

U.S.: Wholesale Inventories, August +0.5%

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, October 73.2 (forecast 75.3)

-

14:46

Option expiries for today's 1400GMT cut

EUR/USD $1.3680, $1.3700, $1.3725, $1.3750, $1.3800, $1.3820, $1.3850

USD/JPY Y96.80, Y96.90, Y97.00, Y97.50, Y97.85, Y98.00, Y98.20, Y98.25, Y98.30/35, Y98.45/50

EUR/JPY Y135.00

AUD/JPY Y93.30, Y95.00

GBP/USD $1.6050, $1.6185, $1.6275, $1.6300

EUR/GBP stg0.8425

USD/CHF Chf0.8875, Chf0.8995, Chf0.9025

EUR/CHF Chf1.2300

AUD/USD $0.9590, $0.9600, $0.9675

USD/CAD C$1.0325, C$1.0360, C$1.0415, C$1.0485, C$1.0535

-

14:37

U.S. Stocks open: Dow 15,519.99 +10.78 +0.07%, Nasdaq 3,953.25 +24.29 +0.62%, S&P 1,755.35 +3.28 +0.19%

-

14:15

Italy retail sales stagnate in August

Retail sales in Italy during August remained unchanged from the previous month as spending on food held steady, while non-food consumption shrunk, data released by the statistical office ISTAT showed on Friday.

The seasonally adjusted retail trade index remained unchanged from July, when sales declined a revised 0.2 percent. This was in line with economists' expectations and came after a 0.2 percent decreases in the previous two months.

Sales of food were stable in August, following a 0.1 percent gain in the previous month. Non-food sales declined for the fourth straight month, down 0.1 percent.

On an annual basis, non-adjusted retail sales rose 0.2 percent in August, after declining 0.8 percent in the previous month. The increase came in contrast to economists' expectations for a 2.3 percent fall.

It was the first annual increase since June last year. Food sales grew 1 percent, while non-food sales shrunk 0.4 percent.

-

13:30

U.S.: Durable Goods Orders , September +3.7% (forecast +1.7%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , September -0.1% (forecast +0.6%)

-

13:30

U.S.: Durable goods orders ex defense, October +3.2%

-

13:16

European session: the euro fell

08:00 Eurozone Private Loans, Y/Y September -2.0% -1.9% -1.9%

08:00 Eurozone M3 money supply, adjusted y/y September +2.3% +2.3% +2.2%

08:00 Germany IFO - Business Climate October 107.7 108.2 107.4

08:00 Germany IFO - Current Assessment October 111.4 111.4 111.3

08:00 Germany IFO - Expectations October 104.2 104.5 103.6

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III +0.7% +0.8% +0.8%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III +1.3% +1.5% +1.5%

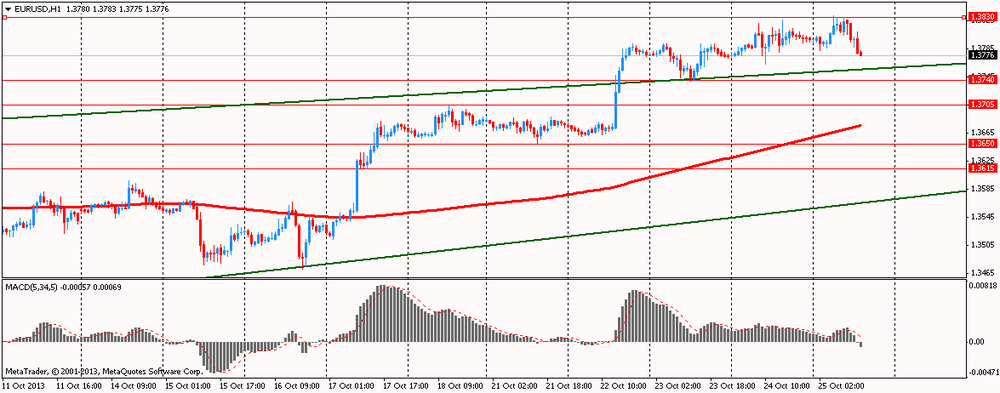

The euro fell against the dollar after data showed that the mood of German business confidence unexpectedly deteriorated in October , as expectations of sales declined in most industries, including manufacturing . The business confidence index according to the Ifo Institute fell for the first time in six months to 107.4 in October from 107.7 in September , below the projected growth to 108.2 . But in general, the mood in the business community are still strong and the economic recovery continues , economists say.

The euro rose by 8 % in relation to the U.S. dollar from July to two-year high , just above 1.38 dollars this week, it could undermine German exports . Ifo said that about 7,000 companies participating in the monthly survey reported some deterioration in business prospects. Indicator of business expectations fell to 103.6 in October from 104.2 in September. In addition, the Company assesses the current business situation is less favorable . The corresponding Ifo index fell to 111.3 from 111.4 in September.

Another report showed that the euro zone money supply growth slowed unexpectedly in September, and loans to the private sector declined slightly slower pace . M3 money supply grew by 2.2 percent year on year in September, slower than the 2.3 percent growth rate , which was in August , according to the European Central Bank . According to forecasts , the growth rate were to remain at the August level.

The data showed that the reduction of total lending , which is available to residents eurozone deepened to 0.7 percent from 0.5 percent the previous month . Meanwhile, the government loans rose 0.7 percent in September , compared with 2.1 percent in August. Loans to the private sector fell by 1.1 percent in September , compared with a 1.2 percent fall in the previous month .

The pound rose against the dollar at the beginning of the European session after the release of the preliminary GDP data for the UK . The UK economy expanded at the fastest pace since the second quarter of 2010. Gross domestic product grew by 0.8 percent sequentially in the third quarter, slightly faster than the 0.7 percent expansion recorded in the previous three months. The growth rate in line with economists' expectations . Growth in the third quarter was the biggest since the second quarter of 2010, when GDP grew by 1 percent.

Compared to the third quarter of 2012 the economy grew by 1.5 percent. ONS, however, noted that the Olympic and Paralympic Games , which were held during the third quarter of 2012, increased the level of GDP in the quarter . The data showed that the volume of production increased by 1.4 per cent in agriculture, 0.5 percent in industry and 2.5 percent in construction. The dominant services sector grew by 0.7 percent.

EUR / USD: during the European session, the pair fell to $ 1.3775

GBP / USD: during the European session, the pair rose to $ 1.6238 , and then fell to $ 1.6166

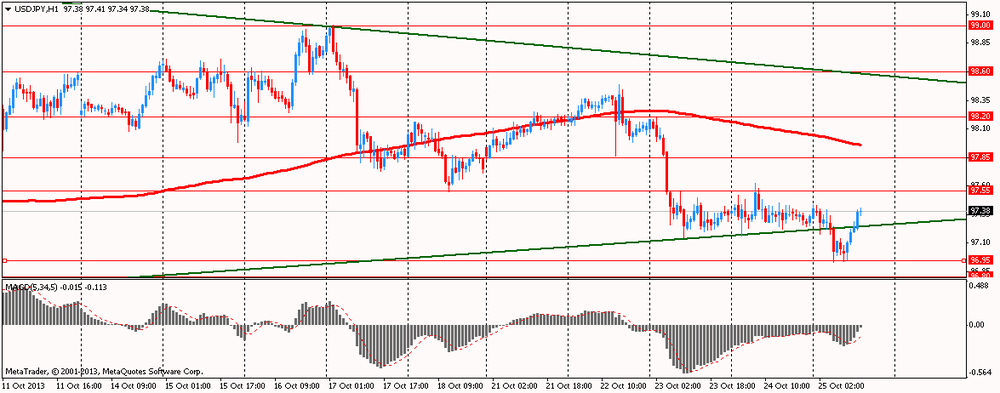

USD / JPY: during the European session, the pair rose to Y97.41

In the U.S., at 12:30 GMT will change in orders for durable goods , a change in orders for durable goods excluding transportation equipment in September , in the 13:55 GMT - an indicator of consumer confidence from the University of Michigan in October.

-

13:06

European stock markets mid-session: European indices stronger, DAX leading the way

European indices extend highs in today's trading session. The FTSE 100 index is currently trading higher 0.12% at 6,737.53 points, France's CAC 40 is up +0.62% currently quoted at 4,395.37 points and Germany's DAX 30 booked the biggest gains trading +1.03% at 9,885.97 points. The DAX successfully breached the 9825 resistance level and is heading for the highest close since July, after its rebound from a one-year low in October. Data on German GDP was in line with expectations reading +0.1% on a yearly and +1.2% on a quarterly basis.

-

13:00

Orders

EUR/USD

Offers $1.3870/80, $1.3850, $1.3830/35

Bids $1.3785, $1.3765/60, $1.3750/40, $1.3720, $1.3710/00

GBP/USD

Offers $1.6320/30, $1.6300, $1.6280, $1.6250/60

Bids $1.6165/60, $1.6115/00, $1.6080

AUD/USD

Offers $0.9720/25, $0.9690/00, $0.9670/75, $0.9645/50, $0.9620/25

Bids $0.9585/80, $0.9560/50, $0.9500, $0.9480

EUR/GBP

Offers stg0.8650, stg0.8600, stg0.8555/65, stg0.8535

Bids stg0.8505/00, stg0.8470, stg0.8450/40, stg0.8425/15, stg0.8400

EUR/JPY

Offers Y135.50, Y135.25/30, Y135.00, Y134.80, Y134.50

Bids Y133.55/50, Y133.00

USD/JPY

Offers Y98.20, Y98.00, Y97.75/80, Y97.50

Bids Y96.80, Y96.50, Y96.20, Y96.00

-

11:30

European stocks were little changed

European stocks were little changed, with the Stoxx Europe 600 Index heading for a weekly advance, as companies from Kering SA to Renault SA reported quarterly sales that missed projections, offsetting gains in BASF SE. U.S. index futures were little changed, while Asian shares fell.

U.S. data today may show orders for durable goods increased 2.3 percent in September after a 0.1 percent gain in the prior month, according to the median estimate before a Commerce Department report at 8:30 a.m. in Washington.

Kering dropped 2.1 percent to 169 euros after the luxury-goods maker said third-quarter sales from continuing operations fell to 2.52 billion euros ($3.48 billion). Analysts predicted 2.55 billion euros, according to the median estimate compiled by Bloomberg. Gucci’s sales rose 0.6 percent, less than projections for 2.1 percent growth, and the weakest performance since the third quarter of 2009.

Renault declined 2.7 percent to 66.40 euros. Sales fell 3.2 percent to 8 billion euros from a restated 8.26 billion euros a year earlier, the Boulogne-Billancourt, France-based company said late yesterday. Revenue was less than the 8.5 billion-euro average of six analyst estimates.

BASF, the world’s largest chemical maker, rose 1.6 percent to 75.39 euros. Third-quarter Ebit excluding one-time items jumped 15 percent to 1.69 billion euros, beating the average analyst estimate of 1.62 billion euros, according to a statement today.

FTSE 100 6,720.51 +7.33 +0.11%

CAC 40 4,270.87 -4.82 -0.11%

DAX 8,980.01 -0.62 -0.01%

-

11:15

Eurozone september money supply growth slows unexpectedly

Eurozone money supply growth slowed unexpectedly in September, while loans provided to the private sector decreased at a slightly slower pace, data showed Friday.

M3 money supply advanced 2.1 percent year-on-year in September, slower than the 2.3 percent rise seen in August, the European Central Bank said. The rate was forecast to rise to 2.4 percent.

Data showed that the decline in total credit granted to euro area residents deepened to 0.7 percent from 0.5 percent. Meanwhile, credit to general government grew 0.7 percent in September, but down from 2.1 percent in August.

The credit provided to the private sector was down by 1.1 percent in September, compared to a 1.2 percent drop in the previous month.

-

11:00

U.K. Q3 GDP expands at fastest pace since 2010

The U.K. economy expanded at the fastest rate since the second quarter of 2010, preliminary data from the Office for National Statistics showed Friday.

Gross domestic product grew 0.8 percent sequentially in the third quarter, slightly faster than the 0.7 percent expansion logged in the preceding three months. The rate matched economists' expectations.

The third quarter increase was the biggest since the second quarter of 2010, when it grew 1 percent.

Compared with the third quarter of 2012, the economy grew 1.5 percent. The ONS, however, said that the Olympics and Paralympics took place during the third quarter of 2012, raising the level of GDP in this quarter.

Data showed that output increased by 1.4 percent in agriculture, 0.5 percent in production and 2.5 percent in construction. The dominant service sector advanced 0.7 percent.

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD $1.3680, $1.3700, $1.3725, $1.3750, $1.3800, $1.3820, $1.3850

USD/JPY Y96.80, Y96.90, Y97.00, Y97.50, Y97.85, Y98.00, Y98.20, Y98.25, Y98.30/35, Y98.45/50

EUR/JPY Y135.00

AUD/JPY Y93.30, Y95.00

GBP/USD $1.6050, $1.6185, $1.6275, $1.6300

EUR/GBP stg0.8425

USD/CHF Chf0.8875, Chf0.8995, Chf0.9025

EUR/CHF Chf1.2300

AUD/USD $0.9590, $0.9600, $0.9675

USD/CAD C$1.0325, C$1.0360, C$1.0415, C$1.0485, C$1.0535

-

10:00

Asia Pacific stocks close

Asian stocks fell, extending the regional gauge’s biggest weekly decline since August, as forecasts from Canon Inc. to Posco disappointed investors.

Nikkei 225 14,088.19 -398.22 -2.75%

Hang Seng 22,691.15 -144.67 -0.63%

S&P/ASX 200 5,386.35 +13.46 +0.25%

Shanghai Composite 2,132.96 -31.37 -1.45%

Canon retreated 1.6 percent in Tokyo as the camera maker trimmed its earnings outlook.

Posco, South Korea’s biggest steelmaker, sank 0.5 percent in Seoul after cutting its 2013 sales forecast.

LG Electronics Inc. lost 3.4 percent after its third-quarter operating profit and sales missed estimates.

AMP Ltd. tumbled 2.8 percent in Sydney after Australia’s largest life insurer and pension manager said fourth-quarter operating profit will fall by as much as A$65 million ($62.5 million).

-

09:30

United Kingdom: GDP, y/y, Quarter III +1.5% (forecast +1.5%)

-

09:30

United Kingdom: GDP, q/q, Quarter III +0.8% (forecast +0.8%)

-

09:02

Germany: IFO - Expectations , October 103.6 (forecast 104.5)

-

09:01

Eurozone: Private Loans, Y/Y, September -1.9% (forecast -1.9%)

-

09:01

Eurozone: M3 money supply, adjusted y/y, September +2.2% (forecast +2.3%)

-

09:00

Germany: IFO - Business Climate, October 107.4 (forecast 108.2)

-

09:00

Germany: IFO - Current Assessment , October 111.3 (forecast 111.4)

-

08:40

FTSE 100 6,711.63 -1.55 -0.02%, CAC 40 4,251.94 -23.75 -0.56%, Xetra DAX 8,958.66 -21.97 -0.24%

-

07:20

European bourses are initially seen trading narrowly mixed Friday: the FTSE up 12, but both the DAX and CAC down 4.

-

07:00

Asian session: The dollar traded 0.2 percent from the weakest in almost two years

The dollar traded 0.2 percent from the weakest in almost two years versus the euro before reports today forecast to show diverging confidence in the U.S. and in Europe’s largest economy. The Thomson Reuters/University of Michigan consumer sentiment index probably fell to 75 this month, the lowest since January, and compared with 77.5 in September, according to the median economist estimate in a Bloomberg News survey before today’s data. A preliminary reading for October was 75.2. Separate reports yesterday showed more Americans than forecast filed jobless-benefit claims and manufacturing growth slowed.

In Germany, Europe’s biggest economy, the Ifo institute’s business climate index probably climbed to 108 this month, the highest since April 2012, and compared with 107.7 in September, a separate survey showed before the figures today.

New Zealand’s dollar weakened against all its major peers after the nation’s central bank signaled hesitation to raise borrowing costs.

EUR / USD: during the Asian session the pair rose to $ 1.3830

GBP / USD: during the Asian session, the pair rose to $ 1.6245

USD / JPY: during the Asian session the pair fell to Y96.90

There is a full calendar on both sides of the Atlantic Friday, with Germany's Ifo and the UK GDP data set to dominate the morning session. Early data sees the release of the German August construction orders at 0600GMT. At 0700GMT, Spain's September PPI data will cross the wires. There is a raft of data set for release at 0800GMT, including EMU M3 numbers, Italian August retail sales data and Germany's October IFO business climate index. At 1730GMT, ECB Governing Council member Luis Maria Linde will give a speech on Spain's Economic Crisis" in Granada, while ECB Executive Board member Joerg Asmussen delivers a speech at awards ceremony in Milan from 1930GMT. The UK's Q3 GDP data will be released at 0830GMT, along with the August Index of Services data.

-

06:21

Commodities. Daily history for Oct 24’2013:

GOLD 1,350.20 16.30 1.22%

OIL (WTI) 97.10 0.24 0.25%

-

06:20

Stocks. Daily history for Oct 24’2013:

Nikkei 225 14,486.41 60,36 0,42%

Hang Seng 22,809.53 -190,42 -0,83%

S & P / ASX 200 5,372.9 16,80 0,31%

Shanghai Composite 2,164.32 -18.78 -0.86%

FTSE 100 6,713.18 +38.70 +0.58%

CAC 40 4,275.69 +15.03 +0.35%

DAX 8,980.63 +60.77 +0.68%

Dow +93.56 15,506.89 +0.61%

Nasdaq +21.89 3,928.96 +0.56%

S&P +5.61 1,751.99 +0.32%

-

06:20

Currencies. Daily history for Oct 24'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3799 +0,18%

GBP/USD $1,6201 +0,23%

USD/CHF Chf0,8923 +0,01%

USD/JPY Y97,32 -0,03%

EUR/JPY Y134,29 +0,14%

GBP/JPY Y157,65 +0,18%

AUD/USD $0,9614 0,00%

NZD/USD $0,8341 -0,70%

USD/CAD C$1,0420 +0,36%

-

05:59

Schedule for today, Friday, Oct 25’2013:

08:00 Eurozone Private Loans, Y/Y September -2.0% -1.9%

08:00 Eurozone M3 money supply, adjusted y/y September +2.3% +2.3%

08:00 Germany IFO - Business Climate October 107.7 108.2

08:00 Germany IFO - Current Assessment October 111.4 111.4

08:00 Germany IFO - Expectations October 104.2 104.5

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III +0.7% +0.8%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III +1.3% +1.5%

12:30 U.S. Durable Goods Orders September +0.1% +1.7%

12:30 U.S. Durable Goods Orders ex Transportation September -0.1% +0.6%

12:30 U.S. Durable goods orders ex defense October +0.5%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 75.2 75.3

-