Notícias do Mercado

-

22:23

EUR/GBP Price Analysis: Climbs towards weekly highs above 0.8500, but finishes around 0.8480s

- EUR/GBP prepares to finish the week almost flat, compared to last week’s marginally down 0.06%.

- The cross-currency pair is range-bound in the 0.8400-0.8490 area, though risks are skewed to the upside.

- A EUR/GBP break of 0.8500 could put a re-test of the YTD high into play.

The EUR/GBP advances to fresh weekly highs, above the 100-DMA, erasing Thursday’s losses as Wall Street finishes the week in the green, falling between 3% and 4.10%, on Fed’s Chair Powell’s remarks, on Friday. At the time of writing, the EUR/GBP is trading at 0.8481.

EUR/GBP Price Analysis: Technical outlook

During the week, the cross-currency pair dropped towards its weekly low at 0.0407, below the 20-day EMA on Tuesday, though it achieved a comeback, and the pair reclaimed the 200-day EMA. Friday’s price action, broad euro strength, lifted the pair towards its weekly highs above the 0.8500 figure, but lack of impetus sent the cross towards the 50-day EMA at 0.8481.

The EUR/GBP bias is neutral-to-upwards. Through August, the pair achieved a successive series of higher highs/lows and might be closing with gains in the monthly chart, but unless the EUR/GBP breaks the 0.8500 mark, the pair will remain trading in the 0.8400 handle for a foreseeable period.

If the EUR/GBP clears the 0.8500 psychological level, their next resistance would be the July 21 high at 0.8584. Once cleared, the psychological 0.8600 will be the next supply zone, ahead of a test of the YTD high at 0.8721.

On the flip side, the EUR/GBP first support would be the 0.8400 figure. Break below will expose essential demand zones, like the August 17 daily low at 0.8386, followed by the MTD lows at 0.8339.

EUR/GBP Key Technical Levels

-

21:09

Silver price tanks below $19.00 on Powell’s remarks, sour sentiment

- Silver price prepares to finish the week with losses of 0.64%.

- Fed’s Chair Powell reiterated the US central bank goal of bringing inflation down, even if it generates “pain to households and businesses.”

- Upbeat US economic data weighed on the white metal prices, plummeting more than $0.30.

Silver price tumbles from around weekly highs around $19.42, back below the $19.00 figure after Fed’s hawkish rhetoric finally takes its toll on the market’s erroneous perception of a Fed pivot. That, alongside positive US economic data, underpinned the greenback, a headwind for the white metal price. Therefore, XAG/USD is trading at $18.86 a troy ounce at the time of writing.

US equities are plunging after Jerome Powell’s saying that the Fed’s primary goal is bringing inflation to its 2% goal even if it spurs slow growth and “pain to households and businesses.” He added that “without price stability, the economy does not work for anyone.”

The US Dollar Index, a gauge of the buck’s performance against a basket of six currencies, gains more than 0.30%, set to finish the week above the 108.800 figure, while US Treasury bond yields are climbing, led by the short-end of the curve, with 2s up two and a half bps, at 3.398%. In the meantime, the US 10-year benchmark note sits at 3.039%, almost flat.

Fed’s favorite gauge of inflation edges lower, as well as American inflation expectations

In the meantime, the US Bureau of Economic Analysis reported that inflation in the US measured by the PCE slid to 6.3% YoY, less than estimates of 7.4%. Excluding volatile items like food and energy, the so-called Core PCE slowed to 4.6% YoY, lower than expectations of 4.7%.

Later, the University of Michigan’s Consumer Sentiment final release for August arrived at 58.2, upward revised from 55,1 preliminary reported, up from estimations of 55.2. Even though it’s a good reading, inflation expectations were the main spotlight. Americans expect inflation to top around 4,8% in the one-year horizon vs. 5% preliminary. Inflation is estimated to peak within five years at around 2.9% vs. 3% preliminary.

What to watch

In the next week, the US economic calendar will feature US CB Consumer Confidence, ISM Manufacturing PMI, the ADP Employment report and the Nonfarm Payrolls.

Silver (XAG/USD) Daily chart

-

20:44

Japan CFTC JPY NC Net Positions dipped from previous ¥-28.9K to ¥-38.8K

-

20:43

United States CFTC Oil NC Net Positions up to 246.2K from previous 214.9K

-

20:42

Australia CFTC AUD NC Net Positions down to $-60K from previous $-59.2K

-

20:42

United States CFTC S&P 500 NC Net Positions: $-262.3K vs $-288K

-

20:41

European Monetary Union CFTC EUR NC Net Positions down to €-44.1K from previous €-42.8K

-

20:41

United Kingdom CFTC GBP NC Net Positions climbed from previous £-33.1K to £-28K

-

20:41

United States CFTC Gold NC Net Positions fell from previous $141.2K to $125.8K

-

19:16

USD/CHF Price Analysis: Hovering around the top of the 0.9600-0.9660 range, eyeing 0.9700

- USD/CHF bounces from weekly lows, set to finish the week with gains of 0.73%.

- From a daily chart perspective, the USD/CHF has nowhere to go; it would likely remain in consolidation.

- Near-term, a symmetrical triangle in the USD/CHF 4-hour chart targets 0.9767.

The USD/CHF stages a comeback after hitting weekly lows around 0.9577 earlier in the day and is about to erase Thursday’s losses as the USD/CHF aims towards the 100-DMA, following hawkish remarks by the US Federal Reserve Chief, Jerome Powell. The USD/CHF is trading at 0.9659, up by almost 0.20%.

USD/CHF Price Analysis: Technical outlook

Consolidation in the daily chart will keep the USD/CHF trading within the 0.9600-0.9690 range, as shown by this week’s price action. Worth noting that the support/resistance levels are the 100 and 50-day EMAs, each at 0.9657 and 0.9614, respectively. Therefore, unless the exchange rate decisively breaks above/below the range, the USD/CHF might remain subdued.

Short term, the USD/CHF 4-hour scale depicts the formation of a symmetrical triangle on an uptrend, which was “false” broken to the downside, on the remarks of Fed’s Powell, though it closed within the top-bottom of the trendlines. Additionally, the USD/CHF bias is neutral-to-upwards biased, confirmed by the moving averages residing below the spot price, while the Relative Strength Index (RSI) turned the coroner and began to aim higher in positive territory.

Hence, the USD/CHF first resistance would be the top-trendline of the symmetrical triangle. Break above will expose the confluence of the R2 pivot point and the 0.9700 figure. Once cleared, the next supply zone would be the height of the symmetrical triangle, which targets 0.9767, followed by the psychological 0.9800 mark.

USD/CHF Key Technical Levels

-

18:03

NZD/USD plummets to six-week lows, post-Powell’s remarks, shiting sentiment sour

- NZD/USD plunges more than 1% on Friday, in a risk-off mood.

- Powell said it would “bring some pain to households and businesses” in achieving the Fed’s 2% goal.

- US inflation readings show signs of peaking while US consumer sentiment improves.

The NZD/USD dropped to fresh weekly lows of 0.8150 on Friday, following hawkish remarks by US Federal Reserve Chair Jerome Powell, reiterating the Fed’s job of restoring price stability towards the bank’s 2% target. Furthermore, he acknowledged that it will “require a sustained period of below-trend growth.” Consequently, sentiment shifted sour, with US equities falling off the cliff.

NZD/USD falls on Powell’s hawkish remarks and upbeat US economic data

In the Asian session, the NZD/USD opened above the 0.6220 figure, fluctuating within the 0.6180-0.6220 range ahead of US economic data releases and Powell’s remarks on Jackson Hole. Nevertheless, once Powell took the stand, the NZD/USD seesawed as volatility increased, sending the major to week’s lows. At the time of writing, the NZD/USD exchanges hands at 0.6148, well below its opening price.

Summarizing Powell’s remarks, he said that reducing inflation will “bring some pain to households and businesses” amidst a period of higher interest rates, softening labor market conditions, and sluggish economic growth. The Fed Chair reiterated that the Fed would “bring inflation back down to our 2% goal,” commenting that the central bank is taking rapid steps to curtail demand, so it better aligns to supply.

Jay Powell welcomed the July inflation figures but quickly added that a “single month improvement falls far short of what the Committee needs to see” regarding the direction of inflation. Powell noted that being around a neutral stance “was not a place to stop or pause,” pushing against the market’s perceptions of a Fed pivot that triggered a 15% rally ons US equities from June’s lows.

Aside from this, the US economic calendar unveiled the University of Michigan Consumer sentiment for August on its final release. American citizens’ sentiment improved to 58.2 vs. 55.2 estimates, while inflation expectations for a one-year horizon fell to 4.8% from 5.2% last month.

Earlier on Friday, the Fed’s favorite inflation gauge, headline, and core Personal Consumption Expenditures (PCE) price Indices for July. Headline PCE rose by 6.3% YoY, higher than the 6.2% estimated, while core PCE, which excludes volatile items, decelerates to 4.6% YoY vs. 4.7% forecast.

NZD/USD Key Technical Levels

-

18:01

United States Baker Hughes US Oil Rig Count climbed from previous 601 to 605

-

17:15

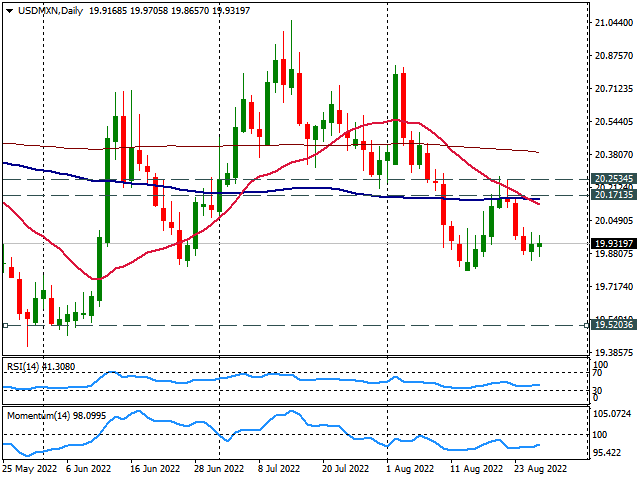

USD/MXN Price Analysis: Bearish bias while under 20.20

- USD/MXN remains above 19.90 but faces pressure

- More losses seem likely while under 20.20.

The USD/MXN is modestly higher on Friday, but it remains under 20.00. The pair found support above 19.80 and rebounded. The move higher so far shows lack of strength keeping the bias in favor of the Mexican peso.

A consolidation under 19.90 should clear the way for a test of the 19.80 area. A break lower would expose 19.70 an even stronger support area that protects 19.50.

A recovery above 20.00 could point to more gains and a test of 2017, the convergence of the 20 and 100-day Simple Moving Average. A daily close above 20.25 should trigger more gains, shifting the short-term outlook from bearish to neutral/bullish.

On a wider perspective, USD/MXN continues to trade in the 19.50/21.50 range as is has been the case since November 2020. A weekly close above 21.00 could suggest a test of 21.50.

USD/MXN Daily chart

-

16:54

Fed's Mester: Need to be cautious in thinking that inflation has peaked

Cleveland Federal Reserve President Loretta Mester said on Friday that the July inflation report was welcome news but added that she needed to see more convincing data to conclude inflation was coming down, as reported by Reuters.

Additional takeaways

"I think FOMC Chairman Jerome Powell delivered a very strong message."

"We're all in and we're going to be resolute about getting inflation to goal."

"Market is between 50 and 75 for September and that's where my head is, need to see more data though."

"We really have an imbalance in supply and demand, Fed tools really work on demand side."

"European situation may indicate that gasoline prices do not keep retreating."

"Need to be cautious in thinking that inflation has peaked."

"Would need to see convincing evidence of inflation coming down before we stop rate hikes."

"We're still in negative real rates, haven't even gotten to a neutral fed funds rate."

"I think will need to take rates above 4% and leave them there."

"Not predicting recession but expect below-trend growth this year and next."

"Will likely see weakening in labor market."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen losing 0.1% on the day at 108.30.

-

16:39

S&P 500 bleeds to fresh lows on the day back of hawkish Fed Powell

- Wall Street continues to bleed out on the back of hawkish Fed's Powell.

- S&P 500 is making fresh lows for the day.

Stocks on Wall Street are bleeding out into the midday New York trade following Federal Reserve Chief Jerome Powell's comments made in a speech to the Jackson Hole central banking conference in Wyoming. He suggested the central bank will keep raising interest rates to tame inflation. The US economy will need tight monetary policy "for some time" before inflation is under control, he said.

The Fed is very clearly dependent on data and Powell said that while the US economy is slowing, he argues that it still has strong underlying momentum. For instance, and crucially, Powell explained that while ''July's lower inflation readings are ‘welcome’,'' they are ''short of what will be needed before we are confident inflation is moving down.''

Investors were looking for clues as to whether the Fed was content with the less inflationary results in the data of late, but the speech from Powell shows little concrete evidence of that. In fact, he focused on not loosening policy too early but he didn't mention going any further on a hawkish side.

He did say that ''as policy tightens further, it will be fitting to halt the pace of rate rises at some time,'' however, that is somewhere over the horizon. Instead, he argues that ''restoring price stability will likely require maintaining a restrictive policy stance for 'some time.''' As a consequence, the Fed funds futures are showing odds of a 75bps hike in September now 56.5% vs 46.5% before Powell's speech.

From the moments just before the release of Powell's remarks at 1000 EDT, until now, the S&P 500 had fallen around 1.5%. It was roughly flat before the chairman's remarks. The index is now down 1.9% and has printed a fresh low for the day of 4,106.45.

meanwhile, data earlier showed US consumer spending barely rose in July, but inflation eased considerably, which is yet another data input that could give the Fed room to scale back its aggressive interest rate increases.

-

16:37

USD/JPY reclaims the 137.00 figure after Powell’s speech strengthens the US dollar

- USD/JPY edges higher by 0.56% on Friday amidst a downbeat market mood.

- Fed’s Powell: “Restoring price stability will likely require maintaining a restrictive policy stance for some time.”

- Money Market Futures odds of a 75 bps Fed rate hike ie at 56.5%.

The USD/JPY advances In the North American session, following hawkish remarks of Fed Chair Jerome Powell in the Jackson Hole Simposium, after the Fed’s favorite inflation gauge showed signs that prices are getting lower, meaning rate hikes are working.

The USD/JPY began trading near the day’s lows around 136.19, but in the last hour, the major seesawed around 136.20 – 137.34, past Powell’s remarks. At the time of writing, the USD/JPY is trading at 137.25, above its opening price, in a volatile session.

Summary of Powell’s remarks

The so-awaited Jerome Powell speech pointed out that the central bank will use its tools “forcefully” to bring supply and demand in balance. Powell welcomed July’s lower inflation readings but disregarded one month’s data and said they needed to see compelling evidence of slowing inflation.

The Fed Chair added that restoring price stability will take some time while emphasizing that the Fed needs to get to restrictive levels, to return inflation to the 2% target.

Worth noting that Powell’s speech did not give any forward guidance for the September meeting when Powell said that the bank would be data-dependant.

Powell added that the Federal funds rate at a long-run neutral estimate of 2.25% - 2.50% is “not a place to stop or pause.” Albeit mentioning that the Fed will slow the pace of rate hikes, he emphasized that restoring price stability would require keeping a restrictive policy for “some time.”

Elsewhere, money market futures expect the US Federal Reserve odds of going 75 bps, at 56.5% higher than 46.5% before Powell took the stand. Meanwhile, the greenback stages a comeback, as shown by the US Dollar Index, up by 0.18%, at 108.606.

US inflation lowered, while UoM Consumer Sentiment improved

Data-wise, the US economic docket featured the Fed’s favorite inflation gauge, headline, and core Personal Consumption Expenditures (PCE) price Indices for July. Headline PCE rose by 6.3% YoY, higher than the 6.2% estimated, while core PCE, which excludes volatile items, decelerates to 4.6% YoY vs. 4.7% forecast.

Meanwhile, the University of Michigan Consumer Sentiment for August’s final reading rose to 58.3, topping estimates of 55.2. Inflation expectation for a one-year horizon dropped to 4.8%

USD/JPY Key Technical Levels

-

16:34

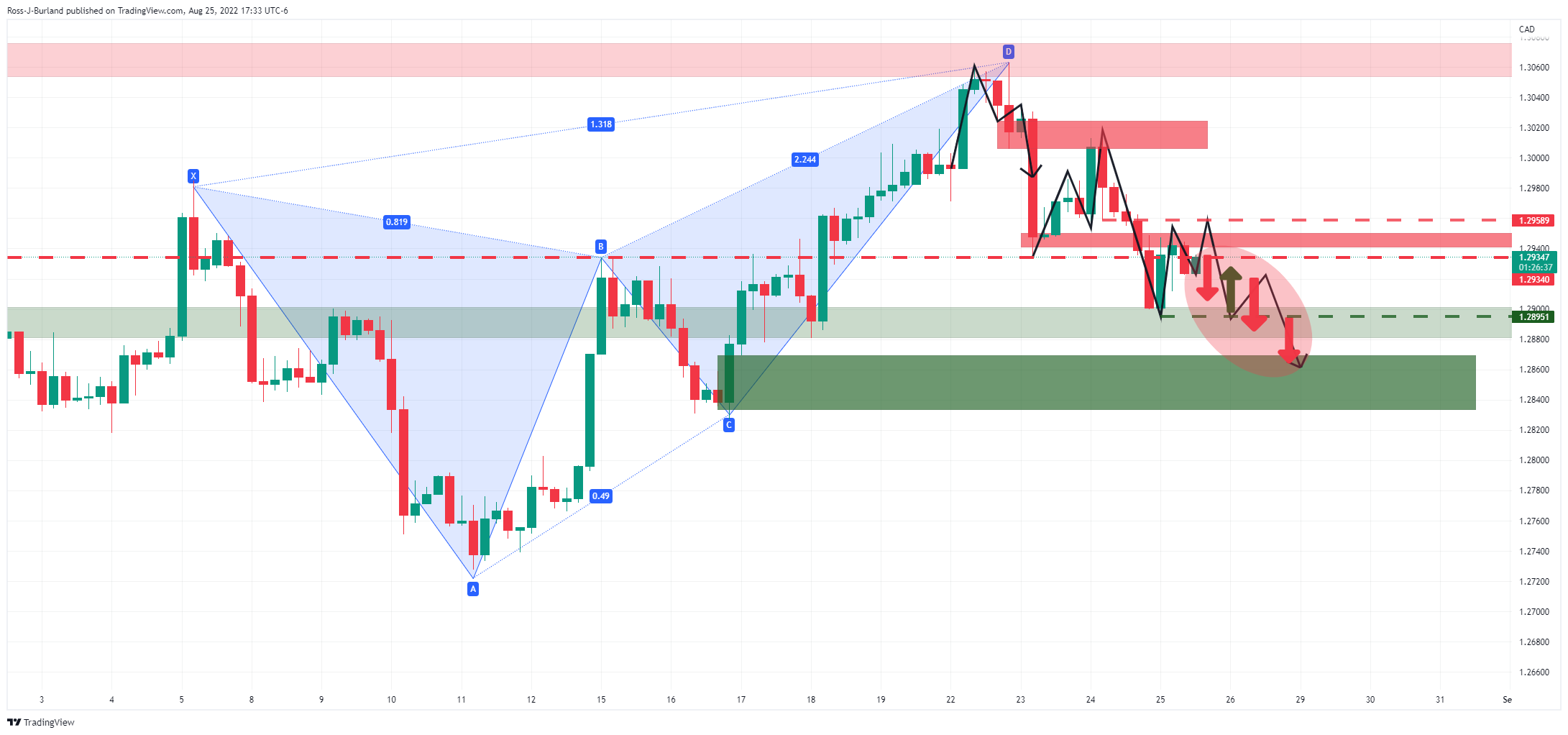

USD/CAD jumps to 1.3000 after Powell as Wall Street tumbles

- Risk aversion boosts the US dollar across the board.

- Fed Chair Powell warrants more rate hikes and a tight policy until inflation is under control.

- USD/CAD erases weekly losses after rising almost a hundred pips.

The USD/CAD bounced sharply on Friday after Powell’s speech and amid a sharp decline in equity prices in Wall Street. The pair climbed from 1.2920 to 1.3010, hitting a two-day high.

A reversal of the US dollar across the board followed by the deterioration in market sentiment boosted USD/CAD. The pair is hovering around 1.3000 and could test Wednesday’s high at 1.3018. The loonie erased weekly gains.

No surprises, but volatility

Fed Chair Powell mentioned the central bank needs to keep raising rates that will persist at higher levels for some time. “We still expect the Fed to raise key interest rates from the current 2.50% to as high as 4% by year-end. Powell's statements also signal that he supports a front-loading of rate hikes. The sharp tightening of monetary policy, however, is likely to trigger a recession next year”, said Dr. Christoph Balz, Senior Economist at Commerzbank.

Powell’s comments triggered volatility despite offering no major surprises. The US 2-year bond yield stands at 3.42% (up 1.45%), and the 10-year at 3.03% (up just 0.23% and below the level it had before).

In Wall Street, the Dow Jones is falling by 1.60% and the Nasdaq by 2.45%. The risk-off mode boosted the dollar. The DXY bottomed at 107.60 and as of writing, it is back at the 108.50, area.

The USD/CAD is about to end the week practically flat. It still faces resistance at the 200-week Simple Moving Average at 1.3025 while it is being supported by the 1.2890/1.2900 zone that contains the 20-day SMA.

Technical levels

-

16:02

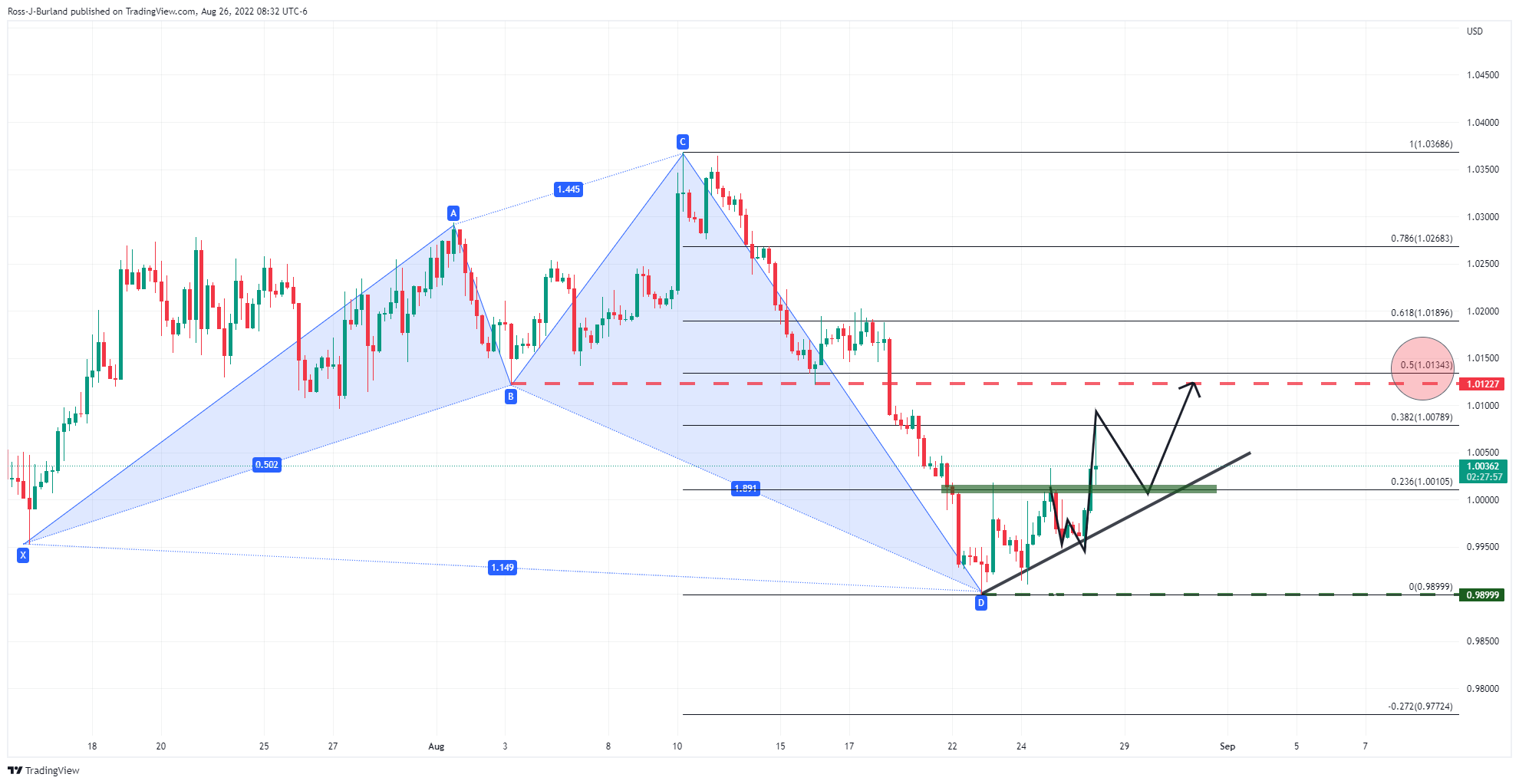

EUR/USD Price Analysis: Powell fails to bend markets out of shape, status quo points to 1.0120/50

- EUR/USD bulls remain in play despite hawkish Powell.

- Bulls can target 1.0120/50 so long as 1.0000/0.9980 holds.

Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole created some volatility, but nothing out of the daily ranges as he did not say something significantly different to what Fed speakers have already been talking about. He was just as hawkish as any other speaker which leaves the status quo in place.

The euro was shaken up initially on the knee-jerk but has not been bent out of shape technically on the 4-hour charts. EUR/USD remains above a key support area of 1.0000. The following illustrates the upside bias so long as this support remains intact for days ahead with a focus on 1.0120 on a breach of 1.0080.

EUR/USD H4 charts

The bullish harmonic pattern leaves an upside bias on the charts so long as D holds around 0.9900. For the near term, for positive conviction, bulls will be more encouraged should the area between 1.0000/0.9980 hold, as per the W-formation's support zone. The neckline of the pattern is a 50% mean reversion of the range between points C-D.

Zooming down, we can see there is resistance between the highs of the day and 1.0080. This is a high volume area that guards the target and 1.0145 higher up.

-

15:40

GBP/USD remains volatile after Powell’s speech in Jackson Hole, stays above 1.1800

- GBP/USD seesawed in a 1.1820-1.1900 range on Fed’s Powell speech.

- Fed’s Powell speech tone was hawkish but cautious, trying not to derail the markets.

- GBP/USD Price Analysis: Rallied towards 1.1900 as Powell’s ended its speech but has erased those gains.

The GBP/USD seesaws as Fed Chair Powell takes the stand at the Jackson Hole Symposium. During the day, the GBP/USD bounced off a daily low at 1.1775 and rallied sharply to a fresh daily high at 1.1900. However, as Powell finished his speech, the GBP/USD retraced from highs of the days towards the 1.1820s area. At the time of writing, the GBP/USD trades volatile, around the 1.1800-1.1810 area.

Fed’s Powell remarks

In his speech, Jerome Powell said that the central bank is moving “purposefully” to a sufficiently restrictive to return inflation to 2% while adding that restoring price stability will take some time, requiring a “forcefully” use of the central bank’s tools.

Powell added that the Federal funds rate at a long-run neutral estimate of 2.25% - 2.50% is “not a place to stop or pause.” He noted that the US central bank would be data-dependent for the September meeting. Even though he mentioned that the Fed will slow the pace of rate hikes, he emphasized that restoring price stability would require keeping a restrictive policy for “some time.”

After Jerome Powell’s remarks, money market futures odds of a Fed 75 bps rate hike diminished to 56.5%, vs. 46.5% before the speech. Meanwhile, the US Dollar Index recovered some ground after hitting a low at 107.588, recovering the 108.000 figure, but it is stills below its opening price.

At the same time, on its final reading, the University of Michigan Consumer Sentiment came in at 58.2 vs. forecasts of 55.2. Earlier on Friday, the Fed’s favorite measure for inflation rose 0.1% MoM, vs. 0.3% foreseen, while annually based, core PCE decelerated to 4.6% from 4.7%.

GBP/USD Key Technical Levels

-

15:30

Gold Price Forecast: XAUUSD remains under pressure after Powell speech, unable to recover $1750

- Volatility soars after US data and following Powell’s speech.

- Fed Chair keeps hawkish tone, says high interest rates will persist for some time.

- Gold under pressure, after short-lived rebound above 1750$.

Gold is having a volatile session, still showing a negative bias after being unable to break key short-term resistance levels. It bottomed at the begging of Powell’s speech and then rebounded.

The yellow metal bottomed at $1741, the lowest in three days and then rebounded, to as high as $1755. Again, the price failed to break the critical area and then pulled back under $1750.

It remains in negative territory for the day and the odd of another test of the $1740 support remains in place, particularly while under $1750. If gold managed to break firmly above $1755, the intraday outlook could change. Above the next strong barrier is seen at $1770.

Critical for gold price action, US yields are moving without a clear direction. The 2-year yield jumped to 3.45% and then pulled back toward 3.40% while the 10-year hovered around 3.04%, below the level it had prior to Powell’s speech.

Fed Chair mentioned that higher interest rates will persist for some time and added the “historical record cautions strongly against prematurely loosening policy”. The tone of Powell was seen as “hawkish”.

The latest report on Friday showed a better than expected reading in the University of Michigan’s Consumer Sentiment Index for August which came in at 58.2 against the market consensus of 55.2.

Earlier on Friday, a report showed the Core Personal Consumption Expenditure Price Index dropped in July by 0.1% unexpectedly, the annual rate declined from 6.8% in June to 6.3% against expectations of 7.4%.

Technical levels

-

15:26

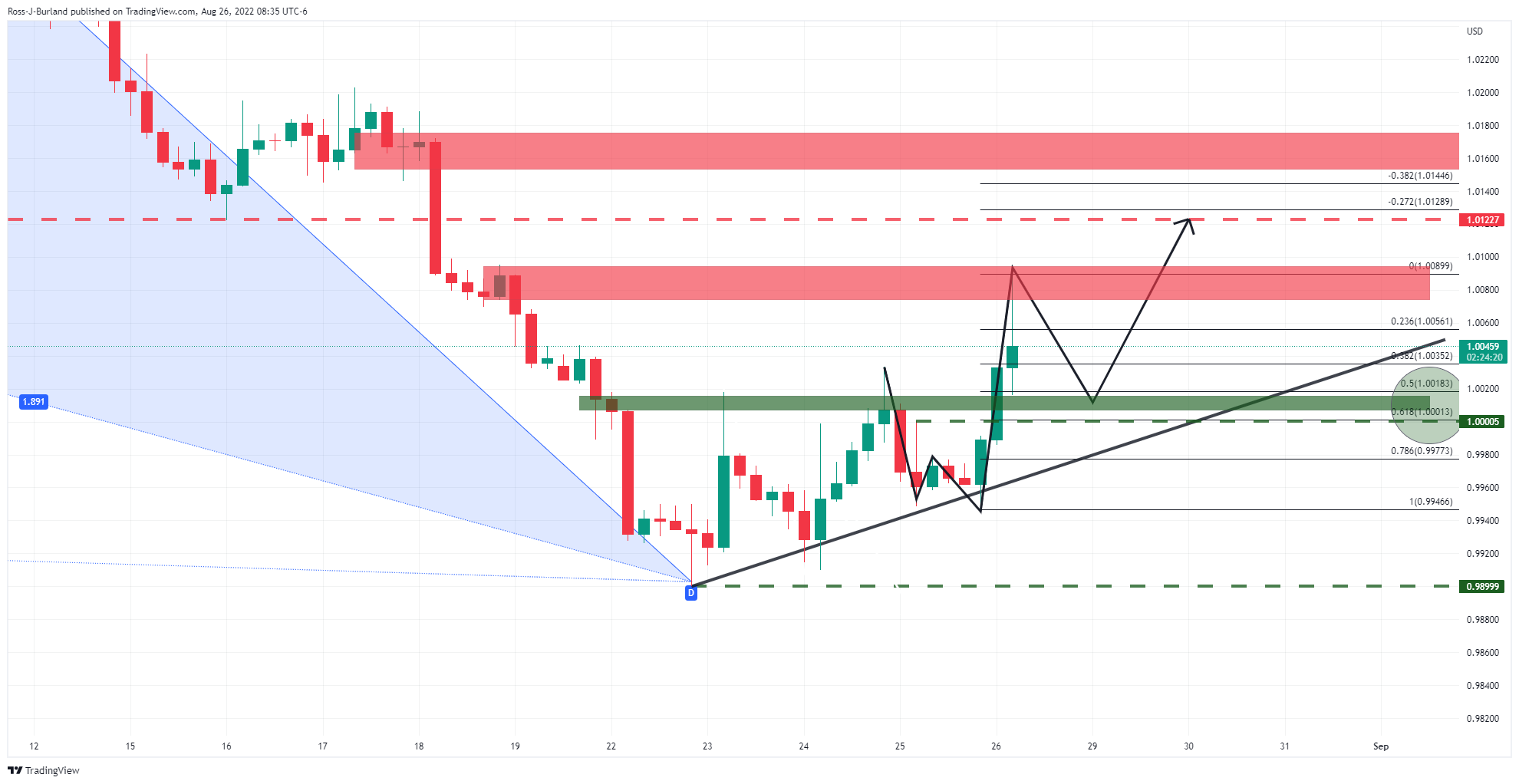

AUD/USD is volatile around the Powell speech, but focus is on downside while below 0.7000

- AUD/USD dumped and pumped around the Powell speech.

- The hourly harmonic pattern is bearish and the focus is on the downside while below 0.7000.

Federal Reserve's Jerome Powell's hawkish speech has sent a bid on the US dollar and has rocked financial markets with stocks down and bond yields up. Given its high beta status, the Aussie dropped heavily, losing around 35 pips on the knee jerk. At the time of writing, AUD/USD is back trading at 0.699, recovering all of the losses some 15 minutes after the speech hit the wires, but it fell to a low of 0.6951. It is back trading towards the high of the day, 0.7005.

The Fed is dependent on data and Powell said that while the US economy is clearly slowing, he argues that it still has strong underlying momentum. For instance, and crucially, Powell explained that while ''July's lower inflation readings are ‘welcome’,'' they are ''short of what will be needed before we are confident inflation is moving down.''

Markets were looking for clues as to whether the Fed was content with the less inflationary results in the data of late, but the speech from Powell shows no evidence of that. He did say that ''as policy tightens further, it will be fitting to halt the pace of rate rises at some time,'' however, that is somewhere over the horizon. Instead, he argues that ''restoring price stability will likely require maintaining a restrictive policy stance for 'some time.''' As a consequence, the Fed funds futures are showing odds of a 75bps hike in September now 56.5% vs 46.5% before Powell's speech.

Meanwhile, the US dollar is consolidating the move around the lows. DXY, an index that measures the greenback vs. a basket of currencies is down 0.6%, losing territories from 108.753, printing a low of 107.588 so far on the day. Should the bears remain in play, AUD should struggle to move much higher and remain pressured below 0.70 the figure.

AUD/USD technical analysis

The hourly harmonic pattern is bearish with the price being met by resistance in a supply zone around the 78.6% Fibonacci area of the XA range. Meanwhile, support is seen at 0.6970 guards 0.6950. A waterfall sell-off could be expected below there towards 0.69 the figure.

-

15:15

US UoM Final Consumer Sentiment Index arrives at 58.2 in August vs. 55.2 expected

The University of Michigan Surveys of Consumers Sentiment was revised upwards in August, with the final print arriving at 58.2 vs. the preliminary reading of 55.1 and 55.2 expected.

Additional takeaways

University of Michigan Surveys of Consumers Current Conditions Index Final Aug 58.6 vs. Prelim Aug 55.5 and Final July 58.1.

University of Michigan Surveys of Consumers Expectations Index Final Aug 58.0 vs. Prelim Aug 54.9 and Final July 47.3.

University of Michigan Surveys of Consumers 1-Year Inflation Outlook Final August 4.8 Pct vs. Prelim 5.0% and Final July 5.2%.

University of Michigan Surveys of Consumers 5-Year Inflation Outlook Final August 2.9 Pct vs. Prelim 3.0% and Final July 2.9%.

Market reaction

The US dollar index is rebounding firmly above 108.00, as investors assess the upward revision to the consumer sentiment data and Powell’s comments.

-

15:02

Breaking: Fed's Powell says restoring price stability to require a restrictive policy stance for 'some time'

US Federal Reserve (Fed) President Jerome Powell is delivering opening remarks and speaking about the policy outlook at the central bank’s annual Jackson Hole Economic Symposium, in Wyoming.

Key quotes

Central bank is moving policy 'purposefully' to a level sufficiently restrictive to return inflation to 2%.

Restoring price stability will take some time, require using central bank's tools 'forcefully'.

Reducing inflation likely to require sustained period of below-trend growth.

There will very likely be some softening of labor conditions, some pain to households.

These are the unfortunate costs of reducing inflation, but failing to restore price stability would mean far greater pain.

Benchmark overnight interest rate at long-run neutral estimate of 2.25%-2.50% 'not a place to stop or pause'.

Overarching focus is to bring inflation back down to 2% goal.

Decision on September rate hike will depend on totality of data since July meeting.

At some point, as policy stance tightens further, it will be appropriate to slow pace of rate increases.

Restoring price stabilty will likely require maintaining a restrictive policy stance for 'some time'.

Fed must keep at it until the job is done.

Historical record cautions strongly against loosening policy prematurely.

US economy clearly slowing, but has strong underlying momentum.

Labor market is particularly strong, but out of balance; high inflation has continued to spread.

July's lower inflation readings welcome, but short of what will be needed before central bank is confident inflation is moving down.

Central bank committed to moderating demand to better align with supply.

The longer high inflation continues, the greater the chance it will become entrenched.

Market reaction

In an immediate reaction to Powell’s comments, the US dollar index was largely unchanged, keeping its range near-daily lows of 107.71. The gauge is shedding 0.62% on the day.

-

15:01

United States Michigan Consumer Sentiment Index came in at 58.2, above forecasts (55.2) in August

-

14:52

Fed’s Bostic: I'd like to see our policy get to a 'marginally' restrictive

Speaking in a Bloomberg TV interview on the sidelines of the Jackson Hole Symposium, Atlanta Fed President Raphael Bostic said that “I'd like to see our policy get to a 'marginally' restrictive.”

Additional quotes

The economy's been producing a lot of jobs each month, we want to see that start to slow.

Levels inflation are now were unimaginable 18 months ago, we have to get inflation down.

I'd be comfortable with some weakness in labor markets, but we're far away from that.

Would like to get another 100-125 basis points higher than we are now, and sooner than later.

We still need to move in an orderly way.

I think we should stay there (at high rates) 'for a long time'.

Inflation is often the last data to respond.

I would be willing to see unemployment numbers moderate to get us back to target.

Asked if we're looking at a 'sea change' in global inflation, says it's an open question.

Reduction in balance sheet will have a restrictive impact on how the economy evolves.

Market reaction

The US dollar index is licking its wounds around 107.80, losing 0.61% on the day, awaiting Powell’s speech for fresh trading impetus.

-

14:47

EUR/USD climbs to fresh weekly highs, though pares some gains ahead of Powell’s speech

- EUR/USD hits a daily high at 1.0075, post sources reporting ECB members looking for a 75 bps rate hike.

- Fed’s favorite gauge of inflation shows that it’s slowing down.

- FOMC Chairman Jerome Powell speaks at Jackson Hole Symposium – live stream

The shared currency reclaimed parity, back above the 1.0020 area on Friday, as the US Fed’s preferred inflation gauge shows that interest rate increases keep working, consequently weakening the greenback, ahead of Fed’s Powell speech at Jackson Hole.

The EUR/USD struck the day’s lows during the European session, at 0.9946, before the common currency stayed a comeback, reaching a daily high at 1.0040, as investors await further hawkish guidance from Fed officials. At the time of writing, the EUR/USD is trading at 1.0065, above its opening price.

Before Wall Street opened, the US Department of Commerce reported that the Personal Consumption Expenditures (PCE) price index for July decreased by 0.1% MoM, less than estimates of a 0.3% increase. Excluding volatile items like food and energy, the so-called core PCE, the Fed’s favorite measure for inflation, rose 0.1% MoM, vs. 0.3% foreseen. On an annual basis, headline PCE uptick to 6.3% vs. 6.2% expected, while core PCE decelerated to 4.6% from 4.7%

EUR/USD and DXY’s reaction to US data

The EUR/USD jumped from around 1.0000 to 1.0020, once the headlines nit traders’ screens, and so far has reached the 1.0040 mark. At the same time, the greenback weakened, as shown by the US Dollar Index, dropping from around 108.350 to 107.920, so far down 0.43%.

In the meantime, Europe’s financial narrative hasn’t changed. The extreme energy crisis hitting the bloc, alongside recession fears augmenting particularly in Germany, the biggest economy in the area, kept euro buyers cautions from opening fresh long bets vs. the buck.

Lately, sources cited by Reuters reported that some ECB policymakers wanted to discuss a 75 bps hike for September due to further deterioration in the inflation outlook. The EUR/USD rallied sharply, from around 1.0040 to fresh daily highs around 1.0075, at 13:34 GMT.

What to watch

At 14:00, Federal Reserve Chairman Jerome Powell will hit the stand at Jackson Hole. You can follow the live stream here!

EUR/USD 5-minute chart

EUR/USD Key Technical Levels

-

14:43

USD/CAD Price Analysis: Struggles near 1.2900 confluence support, Powell’s speech awaited

- USD/CAD slides back closer to a one-week low amid a fresh wave of USD selling.

- Retreating crude oil prices undermine the loonie and seem to help limit the downside.

- Sustained weakness below the 1.2900 confluence will set the stage for further losses.

The USD/CAD pair witnessed an intraday turnaround from the 1.2955-1.2960 area and turns lower for the second straight day on Friday. The downward trajectory drags spot prices back closer to the one-week low touched the previous day, with bearish now awaiting sustained weakness below the 1.2900 mark.

The US dollar dives to a fresh weekly low in reaction to the softer US PCE report, which seems to have dashed expectations for more aggressive rate hikes by the Fed. This, in turn, is seen exerting some downward pressure on the USD/CAD pair. That said, a fresh leg down in crude oil prices could undermine the commodity-linked loonie and help limit the downside ahead of Fed Chair Jerome Powell's highly-anticipated speech at the Jackson Hole Symposium.

From a technical perspective, the 1.2900-1.2895 region marks confluence support comprising the 50% Fibonacci retracement level of the 1.2728-1.3063 rally and the 100-period SMA on the 4-hour chart. A convincing break below will be seen as a fresh trigger for bearish traders and make the USD/CAD pair vulnerable. The next relevant support is pegged near the 61.8% Fibo. level, around the 1.2855 region, which if broken will set the stage for further losses.

On the flip side, the 38.2% Fibo. level, around the 1.2935 area now seems to act as an immediate hurdle ahead of the daily swing high, around the 1.2955-1.2960 region. Some follow-through buying should allow bulls to aim back to reclaim the 1.3000 psychological mark. The latter coincides with the 23.6% Fibo. level, above which the momentum could further get extended towards the weekly swing high, around the 1.3060 region, en route to the 1.3100 round-figure mark.

USD/CAD 4-hour chart

-637971180935110040.png)

Key levels to watch

-

14:31

Some ECB policymakers want to discuss a 75 bps hike next month – Reuters

Citing sources familiar with the matter, Reuters reported on Friday that some European Central Bank (ECB) policymakers want to discuss a 75 basis points (bps) rate hike next month due to a deterioration in the inflation outlook.

The looming eurozone recession should not slow or halt the ECB's policy normalisation, sources further told Reuters.

Market reaction

This headline seems to be providing a boost to the shared currency. As of writing, the EUR/USD pair was up 0.95% on a daily basis at 1.0067.

-

14:22

FOMC Chairman Jerome Powell speaks at Jackson Hole Symposium – live stream

FOMC Chairman Jerome Powell will deliver his opening remarks at the annual Jackson Hole Symposium titled "Reassessing Constraints on the Economy and Policy" on Friday, August 26, at 1400 GMT.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

-

14:19

Gold Price Forecast: XAU/USD bounces off daily low on softer US PCE data, ahead of Powell

- Gold stalls the intraday decline following the release of softer US PCE data.

- The USD refreshes the weekly low and offers some support to the commodity.

- Elevated US bond yields to cap the upside ahead of Fed Chair Powell’s speech.

Gold continues losing ground through the early North American session, albeit rebounds from the daily low in reaction to softer US economic data. The XAU/USD is currently trading just above the $1,750 level, still down nearly 0.50% for the day.

The US dollar turns lower for the second straight day on Friday and drops to a fresh weekly low, which, in turn, offers support to the dollar-denominated gold. The USD witnessed some selling in the last hour after the US Bureau of Economic Analysis reported that the US Personal Consumption Expenditures (PCE) Price Index declined to 6.3% in July from 6.8% in June.

Excluding volatile food and energy prices, the Core PCE Price Index, which is Fed's preferred inflation gauge, eased further from the 40-year high and fell to 4.6%, missing the 4.7% print estimated. The data points to signs of easing inflation in the US and dampens the prospects for more aggressive Fed rate hikes, which, in turn, exert pressure on the greenback.

The US central bank, however, is still expected to hike interest rates by at least 50 bps at the next policy meeting in September. The bets were reaffirmed by hawkish comments by Atlanta Fed President Raphael Bostic and Philadelphia Fed President Patrick Harker, stressing the need for further policy tightening to get inflation under control.

This remains supportive of elevated US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond manages to hold above the 3.0% threshold, which might keep a lid on any meaningful upside for the non-yielding gold. Traders might also refrain from placing aggressive bets ahead of Fed Chair Jerome Powell's highly-anticipated speech.

Technical levels to watch

-

14:07

Fed's Harker: Need to move methodically toward a clearly restrictive stance

Philadelphia Fed President Patrick Harker said on Friday that they need to methodically toward a "clearly restrictive stance," on Friday. "We will do what it takes to get inflation under control," Harker added, as reported by Reuters.

Additional takeaways

"Restrictive is clearly above 3%, how much more than that we'll have to see."

"If there is a recession, it would be shallow in my view."

"Possible Fed could risk recession to control inflation."

Market reaction

The greenback is having a difficult time finding demand after these comments. As of writing, the US Dollar Index was testing 108.00, where it was down 0.4% on a daily basis.

-

13:52

Fed's Bostic: I am leaning toward 50 bps in September

Atlanta Fed President Raphael Bostic told CNBC on Friday that he is leaning toward a 50 basis points (bps) rate hike in September, as reported by Reuters.

Additional takeaways

"This is a sign economy is responding to policy."

"Need to bring policy closer to restrictive range."

"We are not there yet, restrictive is 3.5% -3.75% hopeful to get there by year-end."

"We need to get policy to restrictive to bring inflation down - that's most important."

"We need to make sure we don't overreact."

"We have to narrow the demand-supply imbalance and supply side can do some of the work."

"If we see the economy continue to slow, we could stay at 3.5%-3.75%."

"It's premature to think about cutting."

"There's a lot of uncertainty about where economy was, don't think we were that behind the curve."

"Still have data to watch before September meeting."

"The goal is to get to stable more restrictive stance as soon as possible and stay there."

Market reaction

The dollar came under renewed bearish pressure on these comments and the US Dollar Index was last seen losing 0.3% on the day at 108.08.

-

13:42

GBP/USD holds steady below mid-1.1800 post-US PCE, focus remains on Fed’s Powell

- GBP/USD attracts some dip-buying on Friday amid a fresh leg down in the greenback.

- The softer US PCE report keeps the USD bulls on the defensive and acts as a tailwind.

- Traders seem reluctant ahead of Fed Chair Jerome Powell’s highly-anticipated speech.

The GBP/USD pair reverses an intraday slide to the 1.1775 region and refreshes the daily peak heading into the North American session, though lacks follow-through buying. Spot prices hold steady around the 1.1825-1.1830 region and move little in reaction to the US macro data.

The US Bureau of Economic Analysis reported that the headline Personal Consumption Expenditures (PCE) Index unexpectedly declined by 0.1% MoM in July as compared to the 1% increase in the previous month. Adding to this, The yearly rate drops to 6.3% during the reported month from 6.8% in June, missing estimates for a rise to 7.4%. Furthermore, the Core PCE Price Index - the Fed's preferred inflation gauge - also missed expectations and falls to a 4.6% YoY rate in July from the 4.9% previous.

The data points to signs of easing inflationary pressures in the US and exerts some pressure on the US dollar, offering support to the GBP/USD pair. That said, investors still seem convinced that the Fed will stick to its policy tightening path and hike interest rates further. The expectations remain supportive of elevated US Treasury bond yields, which seem to act as a tailwind for the greenback amid expectations for a hawkish message from Fed Chair Jerome Powell at the Jackson Hole Symposium.

Apart from this, a bleak outlook for the UK economy continues to undermine the sentiment surrounding the British pound. This further seems to contribute towards capping the upside for the GBP/USD pair, at least for the time being. Hence, it will be prudent to wait for strong follow-through buying before confirming that spot prices have bottomed out in the near term and positioning for any meaningful upside.

Technical levels to watch

-

13:32

Breaking: US annual PCE inflation declines to 6.3% in July vs. 7.4% expected

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, declined to 6.3% in July from 6.8% in June, the US Bureau of Economic Analysis reported on Friday. This reading came in much lower than the market expectation of 7.4%.

The Core PCE Price Index, which excludes volatile food and energy prices, edged lower to 4.6% from 4.8% in the same period, compared to the market expectation of 4.7%.

Market reaction

With the initial reaction, the US Dollar Index came in under modest bearish pressure and the US Dollar Index was last seen losing 0.22% on the day at 108.18.

-

13:32

Brazil Current Account below expectations ($-1.082B) in April: Actual ($-3.506B)

-

13:31

United States Core Personal Consumption Expenditures - Price Index (YoY) registered at 4.6%, below expectations (4.7%) in July

-

13:31

United States Personal Income (MoM) came in at 0.2% below forecasts (0.6%) in July

-

13:31

United States Wholesale Inventories fell from previous 1.8% to 0.8% in July

-

13:31

United States Personal Consumption Expenditures - Price Index (YoY) registered at 6.3%, below expectations (7.4%) in July

-

13:31

United States Personal Consumption Expenditures - Price Index (MoM) came in at -0.1% below forecasts (0.6%) in July

-

13:30

United States Core Personal Consumption Expenditures - Price Index (MoM) below forecasts (0.3%) in July: Actual (0.1%)

-

13:30

United States Personal Spending came in at 0.1% below forecasts (0.4%) in July

-

13:30

United States Goods Trade Balance increased to $-89.1B in July from previous $-99.5B

-

13:26

Oil prices to climb further as Saudi Arabia considers cutting oil production – Commerzbank

The oil price has risen sharply this week following Saudi Arabia’s verbal intervention. Economists at Commerzbank believe that the price recovery will continue.

Saudi Arabia lends verbal support to oil

“The energy minister of the largest OPEC producer described cutting oil production as one possible way to bring oil prices back into alignment with fundamentals, talking in this context of a disconnect.”

“The impression remains that Saudi Arabia is not willing to tolerate any price slide below $90. Speculators could view this as an invitation to bet on further price rises without the need to fear any more pronounced price declines.”

“The production surveys due to be published next week are likely to show that OPEC again produced noticeably less oil than agreed in August.”

-

13:23

Powell to support the dollar but without providing a catalyst for any notable gains – MUFG

The US dollar was mostly weaker yesterday versus G10. Today, it is hard to see a big jump in FX vol on FOMC Chairman Jerome Powell's speech at the annual Jackson Hole Symposium, in the view of economists at MUFG Bank.

Fed officials set the tone for Powell

“It feels like there’s certainly a consensus for at least another 125 bps of tightening this year. Fed President Bullard also spoke and cited frontloading and getting the fed funds to 3.75%-4.00%.”

“We can’t see Fed Chair Powell providing the grounds for a big move in rates. He is unlikely to commit to a size of move for the September FOMC and is more likely than not to imply implicitly that current market pricing seems reasonable.”

“We’d expect Powell to have a hawkish bias similar to other speakers this week which will help support the dollar without providing a catalyst for any notable gains from current levels.”

-

13:17

Gold Price Forecast: XAU/USD to fall if a 75 bps rate hike by the Fed is considered more likely – Commerzbank

Gold witnesses some selling on Friday and snaps a three-day winning streak. All eyes are at Jackson Hole Symposium, as if markets believe that a 75 basis points rate hike next month is likely, XAU/USD would slump, economists at Commerzbank report.

Jackson Hole Symposium to drive gold price action in the short-term

“Though the gold price has recovered somewhat of late, there is no sign of any prolonged upswing. This is being thwarted by persistent ETF outflows, a still firm US dollar and the Fed rate hike expectations.”

“The short-term performance of the gold price will probably depend on the remarks made at the Fed symposium that is currently underway in Jackson Hole. If a 75 bps rate hike by the Fed next month is considered more likely, a renewed price fall would be on the cards.”

-

13:09

EUR/USD to have trouble making much headway above 1.00 – BBH

EUR/USD has tested parity but has failed to break sustainably that key level. Economists at BBH believe that the pair is still on track to test the September 2002 low near 0.9615.

Minutes of the European Central Bank underline its new approach to normalisation

“EUR/USD should continue to have trouble making much headway above 1.00. We believe the pair remains on track to test the September 2002 low near 0.9615.”

“The account of the ECB’s July meeting is worth discussing. The bottom line is that the ECB will continue to hike rates and simply hope that the market doesn’t test its resolve to keep peripheral spreads lower.”

“We believe the account reflects ongoing reluctance of the creditor nation to unconditionally support the debtor nations. This is a dangerous stance to take as the September elections in Italy approach.”

-

13:01

GBP/USD needs to clear strong resistance at 1.1870 to gather bullish momentum

GBP/USD has managed to recover above 1.1800 on Friday ahead of FOMC Chairman Jerome Powell’s remarks at the Jackson Hole Symposium. The pair will reveal a buildup of bullish momentum on a break past 1.1870, FXStreet’s Eren Sengezer reports.

Pound struggles to turn bullish ahead of Powell

“In case the chairman's comments suggest that the bank could opt for another 75 basis points in September, GBP/USD could turn south amid a stronger dollar. On the other hand, an optimistic tone inflation outlook should hurt the greenback and help GBP/USD gain traction.”

“On the upside, cable faces key resistance at 1.1870, where the Fibonacci 23.6% retracement level of the latest downtrend is located. Above that level, the 50-period SMA forms interim resistance at 1.1900 ahead of 1.1940 (Fibonacci 38.2% retracement).”

“1.1800 (psychological level, 20-period SMA) aligns as initial support before 1.1750 (static level, end-point of the downtrend) and 1.1720 (Aug. 23 low).”

-

13:00

Gold Price Forecast: XAU/USD to see modest weakness for the remainder of 2022, before recovering – ABN Amro

Gold prices have declined by 3.6% year-to-date. Strategists at ABN Amro have downgraded their gold price outlook, expecting modest weakness for the remainder of 2022, before prices recover in 2023.

New year-end forecasts are $1,700 in 2022 and $1,900 in 2023

“We expect modestly lower gold prices for the remainder of this year. There is a crucial support area layered at $1,680-$1,700. We expect these levels to be tested again and prices could move below these, albeit only temporary. Our new forecast for the end of 2022 is $1,700.”

“For 2023, the gold price outlook is more positive. Not only do we expect the US dollar to weaken, but we also expect the Fed to start cutting rates in the second half of 2023. On top of that, we expect lower US real yields. As a result, gold prices are likely to rebound next year. Having said that, we do not believe that gold prices will set a new high though.”

“Our new year-end 2023 forecast is $1,900.”

-

12:31

India Bank Loan Growth above expectations (14.3%) in August 8: Actual (15.3%)

-

12:00

Mexico Trade Balance s/a, $ came in at $-4.401B, above expectations ($-5.588B) in July

-

12:00

Mexico Trade Balance, $ registered at $-5.959B, below expectations ($-5.2B) in July

-

11:56

When is the US July PCE Price Index and how could it affect EUR/USD?

US PCE Price Index Overview

Friday's US economic docket highlights the release of the Core Personal Consumption Expenditure (PCE) Price Index for July, scheduled later during the early North American session at 12:30 GMT. The gauge is expected to rise by 0.6% MoM during the reported month as compared to the 1% increase in June. The yearly rate, however, is anticipated to accelerate to 7.4% in July from the 6.8% previous. Meanwhile, the Core PCE Price Index - the Fed's preferred inflation measure - is anticipated to ease to a 4.7% YoY rate from 4.8% in June.

How Could it Affect EUR/USD?

A stronger-than-expected report will cement expectations that the Fed will continue to hike interest rates to tame inflation. This should result in higher US Treasury bond yields and a stronger USD, which, in turn, should exert fresh downward pressure on the EUR/USD pair.

A weaker reading could prompt some US dollar selling and provide a modest lift to the EUR/USD pair. That said, concerns about an extreme energy crisis in Europe should continue to act as a headwind for the shared currency and keep a lid on any meaningful upside for the major.

That said, the immediate market reaction is more likely to be short-lived as investors might prefer to move on the sidelines ahead of Fed Chair Jerome Powell's speech at the Jackson Hole Symposium.

Eren Sengezer, Editor at FXStreet, offers a brief technical overview of the major and writes: “EUR/USD continues to fluctuate between key technical levels for the third straight day on Friday. The Relative Strength Index (RSI) indicator on the four-hour chart moves sideways near 50, reflecting the pair's indecisiveness.”

Eren also outlines important technical levels to trade EUR/USD: “On the upside, 1.0000 (psychological level, static level) aligns as key hurdle. Above that level, 1.0020 (Fibonacci 23.6% retracement of the latest downtrend) could act as interim resistance before 1.0040 (50-period SMA) and 1.0080 (Fibonacci 38.2% retracement).”

“Immediate support is located at 0.9960 (20-period SMA). If that level is confirmed as resistance, additional losses toward 0.9920 (end-point of the downtrend) and 0.9900 (psychological level, multi-year lows) could be witnessed,” Eren adds further.

Key Notes

• US PCE Inflation Preview: Powell to steal the limelight

• EUR/USD Forecast: Euro defines key levels for the next breakout

• EUR/USD to tumble towards 0.97 by year-end – Nordea

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While Personal spending stimulates inflationary pressures, it could lead to raise interest rates. A high reading is positive (or Bullish) for the USD.

-

11:14

EUR/USD ticks higher to parity, lacks follow-through as traders await Fed’s Powell

- EUR/USD edges higher on Friday and climbs to the parity mark amid modest USD weakness.

- Worries about an energy crisis in Europe should act as a headwind for the euro and cap gains.

- Hawkish Fed expectations might help limit the USD losses ahead of Fed Chair Powell’s speech.

The EUR/USD pair edges higher on the last day of the week and moves back above the parity mark during the first half of the European session. The intraday uptick was sponsored by the emergence of some US dollar selling, though lacks bullish conviction amid worries about a deeper economic downturn in the Eurozone.

The greenback struggles to preserve its modest intraday gains and turns lower for the second successive day on Friday, which turns out to be a key factor lending support to the EUR/USD pair. The USD downtick could be solely attributed to some repositioning trade ahead of Fed Chair Jerome Powell's speech at the Jackson Hole Symposium, due later during the early North American session. That said, a softer risk tone, along with hawkish Fed expectations, could act as a tailwind for the buck.

The overnight optimism led by China's latest stimulus measures fizzles out rather quickly amid growing recession fears. Furthermore, economic headwinds stemming from the recent COVID-19 lockdowns in China temper investors' appetite for riskier assets, which is evident from a weaker sentiment around the equity markets. Apart from this, growing acceptance that the US central bank will stick to its policy tightening path should continue to limit any deeper USD downfall ahead of the key event risk.

The overnight hawkish comments by Fed officials reaffirmed bets for further interest rate hikes by the Fed. Policymakers, however, reserved their judgment on the size of the rate increase at the September FOMC policy meeting. Hence, investors will closely scrutinize Powell's remarks for clues about a 75 bps Fed rate hike move in September. This, in turn, will play a key role in influencing the USD price dynamics and help determine the next leg of a directional move for the EUR/USD pair.

In the meantime, concerns about an extreme energy crisis in Europe, which could drag the region's economy faster and deeper into recession, could act as a headwind for the shared currency. This suggests that the path of least resistance for the EUR/USD pair is to the downside. Hence, it will be prudent to wait for strong follow-through buying before confirming that spot prices have formed a bottom near the 0.9900 mark, or a two-decade low touched earlier this week.

Technical levels to watch

-

10:35

AUD/USD bounces off daily low, remains below 0.7000 mark ahead of US PCE/Fed’s Powell

- AUD/USD reverses a modest intraday dip amid the emergence of some USD selling.

- Hawkish Fed expectations, elevated US bond yields should limit losses for the buck.

- A softer risk tone further contributes to capping the gains for risk-sensitive aussie.

- Traders eye the US PCE data for some impetus ahead of Fed Chair Powell’s speech.

The AUD/USD pair edges lower on Friday and erodes a part of the previous day's strong gains to the 0.7000 neighbourhood, or over a one-week high. The pair remains on the defensive through the first half of the European session, though manages to find some support near mid-0.6900s and recovers a few pips from the daily low.

The US dollar surrenders its modest intraday gains and turns lower for the second successive day amid some repositioning trade ahead of Fed Chair Jerome Powell's appearance at the Jackson Hole Symposium. This is seen as a key factor that helps limit the downside for the AUD/USD pair, though any meaningful upside still seems elusive ahead of the key event risk.

The overnight hawkish comments by Fed officials reaffirmed market expectations that the US central bank will stick to its policy tightening path. Policymakers, however, reserved their judgment on the size of the rate increase at the September FOMC meeting. Hence, Powell's remarks will be scrutinized for clues about a 75 bps hike, which will drive the USD demand.

In the meantime, elevated US Treasury bond yields should continue to act as a tailwind for the buck. Apart from the prevalent cautious market mood - amid growing worries about a deeper global economic downturn, should continue to lend support to the safe-haven greenback. This, in turn, should keep a lid on any meaningful intraday positive move for the AUD/USD pair.

Heading into the key event risk, traders on Friday will also take cues from the release of the US Core PCE Price Index, due later during the early North American session. This, along with the US bond yields and the broader risk sentiment, could influence the USD and provide some impetus to the AUD/USD pair, though the immediate market reaction is likely to be short-lived.

Technical levels to watch

-

10:00

USD/CAD sticks to gains around mid-1.2900s ahead of US PCE data, Fed’s Powell

- USD/CAD catches fresh bids on Friday and reverses the overnight slide to the weekly low.

- Subdued oil prices undermine the loonie and offer support amid a modest USD strength.

- The market focus remains on Fed Chair Jerome Powell’s appearance at the Jackson Hole.

The USD/CAD pair regains positive traction on Friday and reverses a major part of the previous day's slide to sub-1.2900 levels, or a fresh weekly low. The pair maintains its bid tone through the first half of the European session and is currently placed near the daily high, just above mid-1.2900s.

Crude oil prices consolidate the overnight sharp retracement slide from a three-week low, which seem to undermine the commodity-linked loonie. This turns out to be a key factor lending support to the USD/CAD pair amid the emergence of some US dollar buying, bolstered by hawkish Fed expectations.

The progress in renewing Iran's nuclear deal raises hopes for the return of sanctioned Iranian oil to the markets. Apart from this, concerns that a deeper global economic downturn will dent fuel demand overshadow the prospects of production cuts by major oil producers and weighs on the black liquid.

The greenback, on the other hand, moves away from the weekly low touched the previous day and continues to draw support from growing acceptance for a further policy tightening by the Fed. The bets were reaffirmed by the upbeat US macro data and hawkish remarks by Fed officials on Thursday.

In fact, St. Louis Fed chief James Bullard noted that rates now are not yet high enough to begin curtailing price pressures. Furthermore, Kansas City Fed President Esther George said the Fed hasn’t yet raised rates to levels that weigh on the economy and may have to take them above 4% for a time.

Policymakers, however, reserved their judgment on the size of the rate increase at the September FOMC policy meeting. Hence, the focus remains on Fed Chair Jerome Powell's speech at the Jackson Hole Symposium, which might provide clues about the possibility of a 75 bps rate hike in September.

Heading into the key event risk, traders on Friday might take cues from the US Core PCE Price Index, due for release later during the early North American session. In the meantime, the cautious mood might continue to benefit the safe-haven USD and offer some support to the USD/CAD pair.

Technical levels to watch

-

09:21

GBP/USD weakens further below 1.1800 amid modest USD strength, ahead of Fed’s Powell

- GBP/USD meets with a fresh supply on Friday and slides back below the 1.1800 mark.

- The USD regains traction amid hawkish Fed expectations and exerts downward pressure.

- Recession fears continue to undermine sterling and contribute to the intraday decline.

- Traders now eye the US PCE data for some impetus ahead of Fed Chair Powell’s speech.

The GBP/USD pair comes under some renewed selling pressure on Friday and extends the overnight pullback from the vicinity of the weekly high. Spot prices continue losing ground through the early European session and weaken further below the 1.1800 mark, hitting a fresh daily low in the last hour.

The steady intraday descent is exclusively sponsored by the emergence of fresh buying around the US dollar, bolstered by hawkish Fed expectations. The overnight hawkish remarks by Fed officials reaffirm market expectations for a further policy tightening by the US central bank. In fact, the markets are pricing in a greater chance of a supersized 75 bps rate hike move at the September FOMC meeting.

The British pound, on the other hand, is undermined by worries about a deeper economic downturn, amid the recent absurd surge in energy prices and the persistent rise in inflationary pressures. The Bank of England had predicted earlier this month that the country will enter a prolonged recession from the fourth quarter of 2022 and warned that the UK faces a very big inflation shock.

Apart from the aforementioned fundamental factors, sustained weakness below the 1.1800 mark seems to have aggravated the bearish pressure surrounding the GBP/USD pair. This might have already set the stage for additional losses. Hence, a subsequent slide towards retesting the YTD low, around the 1.1720-1.1715 area touched earlier this week, looks like a distinct possibility.

Traders, however, might prefer to wait for a more hawkish message by Fed Chair Jerome Powell at the Jackson Hole Symposium amid the uncertainty over the size of the next rate hike. In the meantime, traders on Friday will further take cues from the US Core PCE Price Index. The data might influence the USD price dynamics and produce short-term trading opportunities around the GBP/USD pair.

Technical levels to watch

-

09:01

European Monetary Union M3 Money Supply (3m) down to 5.7% in July from previous 5.9%

-

09:00

European Monetary Union Private Loans (YoY) came in at 4.5%, below expectations (4.7%) in July

-

09:00

European Monetary Union M3 Money Supply (YoY) came in at 5.5% below forecasts (5.6%) in July

-

09:00

Italy Business Confidence came in at 104.3, below expectations (104.4) in August

-

09:00

Italy Consumer Confidence above expectations (92.5) in August: Actual (98.3)

-

08:41

EUR/USD to tumble towards 0.97 by year-end – Nordea

EUR/USD has fallen to trade more convincingly below parity. Economists at Nordea expect the pair to sink towards 0.97 by end-2022.

A recession in the euro area increasingly likely over the winter

“We see more downside ahead and continue to target 0.97 by the end of the year.”

“A recession in the euro area and especially the German economy looks increasingly likely over the winter.”

-

08:41

Gold Price Forecast: XAU/USD slips below $1,755, awaits Powell's speech at Jackson Hole

- Gold witnesses some selling on Friday and snaps a three-day winning streak to a one-week high.

- Hawkish Fed expectations help revive the USD demand and exerted pressure on the commodity.

- Investors now eye the US PCE data for some impetus ahead of Fed Chair Powell’s appearance.

Gold comes under some selling pressure on Friday and snaps a three-day winning streak to the $1,765 area, or a one-week high touched the previous day. The XAU/USD remains depressed through the early European session and is currently placed near the daily low, just below the $1,755 level.

The US dollar regains some positive traction and recovers further from the weekly low, which turns out to be a key factor exerting

downward pressure on the dollar-denominated gold. The resilient USD continues to draw support from growing acceptance that the US central bank will stick to its policy-tightening path. The bets were reaffirmed by better-than-expected US macro data and hawkish remarks by Fed officials on Thursday.In fact, St. Louis Fed chief James Bullard stressed the need to keep raising interest rates. Adding to this, Kansas City Fed President Esther George said the Fed hasn’t yet raised rates to levels that weigh on the economy and may have to take them above 4% for a time. This, in turn, lifted bets for a supersized 75 bps rate hike, which remains supportive of elevated US bond yields and offers additional support to the greenback.

Policymakers, however, reserved their judgment on the size of the rate increase at the next FOMC policy meeting in September. Hence, the focus remains glued to Fed Chair Jerome Powell's appearance at the Jackson Hole Symposium. Investors will look for clues about the possibility of more aggressive rate hikes, which will drive the USD demand and help determine the next leg of a directional move for the non-yielding gold.

Heading into the key event risk, traders on Friday might take cues from the release of the US Core PCE Price Index, due later during the early North American session. The data could influence gold, which is traditionally seen as a hedge against inflation. The immediate market reaction, however, is more likely to remain short-lived. In the meantime, the prevalent cautious mood could lend support to the safe-haven precious metal.

Technical levels to watch

-

08:11

EUR/PLN to reverse back towards the 4.770 area – ING

The Polish zloty is testing stronger levels. Nevertheless, economists at ING expect the EUR/PLN pair to revert back to the 4.770 mark.

Interest rate differential unlikely to be supportive of the zloty

“Zloty was supported yesterday by a rise in market expectations for a rate hike and could thus benefit from a rising interest rate differential for the first time in a while. However, this is not enough and if bets on rate hikes do not increase further, the zloty will revert back to 4.770 EUR/PLN.”

“Markets are already expecting more than a 50 bps rate hike at the September National Bank of Poland meeting at this point, which we already think is a very aggressive expectation. Therefore, we do not expect the interest rate differential to be supportive of the zloty.”

-

08:08

A consolidation of the hawkish pricing can help the US dollar – ING

Friday's speech by Fed Chair Jerome Powell in Jackson Hole has been regarded as a pivotal event for markets. However, Powell may not want to shock the markets (in either direction), economists at ING report.

Fireworks not guaranteed

“We see a quite elevated risk that Powell may end up broadly matching the generally hawkish market expectations and avert any significant market shock.”

“We think that markets may find enough reason to push their peak rate pricing a bit closer to the 4.0% mark today and stir away from pricing back more than the current 1-2 rate cuts in 2023, which should ultimately offer some support to the dollar into next weeks’ payrolls release.”

“We think DXY may touch 110.00 in the coming days, if not today.”

“Despite not being our baseline case, the downside risks to the dollar are non-negligible today. A more alarming tone on recession and any hints that the Fed will be more considerate when it comes to tightening to avert a major dampening impact on the economy would likely trigger an asymmetric negative reaction on the dollar.”

-

08:04

EUR/USD may retest the 0.9900 support – ING

EUR/USD trades in a tight range above 0.9950. In the opinion of economists at ING, the pair could retest the 0.99 level following FOMC Chairman Jerome Powell’s remarks at the annual Jackson Hole Symposium.

Fair value converging to spot?

“Today’s price action in EUR/USD should be entirely driven by the dollar reaction to Powell’s speech unless some further developments on the gas crisis story come to the fore.”

“As we expect a moderately dollar-positive impact from Powell, we think EUR/USD may retest the 0.9900 support.”

“The ongoing short-term undervaluation in EUR/USD is quite significant (around 5%), but a shrinking of the risk premium seems unlikely given the major threats to the eurozone’s economic outlook and may instead be triggered by a re-widening of the Fed-ECB rate expectations differential – i.e. with the fair value converging to spot and not the other way around.”

-

08:00

GBP/USD: Break below 1.1730 on the cards on the back of USD strengthening – ING

After having registered small daily gains on Thursday, GBP/USD has reversed its direction. A break under 1.1730 is a distinct possibility if the dollar strengthens following today's speech by Jerome Powell in Jackson Hole.

All eyes on Powell's speech at Jackson Hole Symposium

“Cable should move mostly in line with the dollar reaction to Jackson Hole. A break below the 1.1730 lows from earlier this week may well be on the cards on the back of USD strengthening, as 1.1500 (the 2020 flash crash bottom) is no longer looking like a remote possibility.”

“It will be interesting to see EUR/GBP reaction to today’s speech by Powell. We could see a small recovery in the pair in a hawkish scenario where risk sentiment is hit, considering GBP is normally more sensitive to global risk moves, but the low appetite for EUR longs should keep a cap on the pair for now.”

-

08:00

USD/JPY steadily climbs back above 137.00 mark amid renewed USD buying interest

- USD/JPY regains positive traction on Friday and is supported by a combination of factors.

- Hawkish Fed expectations help revive the USD demand and offer support to the major.

- The Fed-BoJ policy divergence and a positive risk tone undermine the safe-haven JPY.

- Traders now eye the US PCE data for some impetus ahead of Fed Chair Powell’s speech.

The USD/JPY pair attracts fresh buying on Friday and climbs back to the 137.00 mark during the early European session, reversing the previous day's losses.

The US dollar builds on the overnight bounce from the weekly low and gains some traction on the last day of the week, which, in turn, is seen lending some support to the USD/JPY pair. Firming expectations that the Fed will tighten its policy further to tame inflation continues to underpin the buck. The bets were reaffirmed by upbeat US macro data and hawkish remarks by Fed officials on Thursday.

In fact, St. Louis Fed chief James Bullard stressed the need to keep raising interest rates. Adding to this, Kansas City Fed President Esther George said the Fed hasn’t yet raised rates to levels that weigh on the economy and may have to take them above 4% for a time. Policymakers, however, reserved their judgment on the size of the rate increase at the next FOMC policy meeting in September.

Nevertheless, the markets are still pricing in a greater chance of a supersized 75 bps rate hike. In contrast, the Bank of Japan is expected to retain its ultra-easy policy stance, marking a big divergence in comparison to a more hawkish Fed. This, along with a generally positive tone around the equity markets, undermines the safe-haven Japanese yen and contributes to the USD/JPY pair's move up.

The fundamental backdrop supports prospects for a further near-term appreciating move. That said, bulls might refrain from placing aggressive bets and prefer to wait for a more hawkish message from Fed Chair Jerome Powell at the Jackson Hole Symposium. Ahead of the key event risk, traders might take cues from the release of the US PCE data, due later during the early North American session.

Technical levels to watch

-

07:56

EUR/GBP Price Analysis: Stays firmer on the way to 0.8485 hurdle

- EUR/GBP picks up bids to refresh intraday high, pares the first weekly loss in four.

- Repeated bounces off three-week-old ascending support, steady RSI challenge bearish bias.

- 50-DMA acts as the key resistance, 61.8% Fibonacci retracement level adds to the upside filters.

EUR/GBP renews intraday high around 0.8445 to consolidate the weekly loss, the first in four, amid the early Friday morning in Europe. In doing so, the cross-currency pair defends the bounce off a three-week-old support line. Also keeping the EUR/GBP buyers hopeful is the steady RSI (14).

That said, the pair currently aims for the 50% Fibonacci retracement level of March-June rise, around 0.8465, before challenging the 50-DMA level near 0.8465.

In a case where the EUR/GBP prices remain firmer past 0.8485, the monthly high of 0.8511 appears the last defense of the bears before directing the quote toward the 0.8600 round figure.

On the flip side, the aforementioned support line, close to 0.8420 at the latest, restricts the EUR/GBP pair’s immediate downside.

Following that, the 61.8% Fibonacci retracement level near 0.8400 and the monthly low of 0.8340 could entertain the EUR/GBP bears.

It’s worth noting that the EUR/GBP pair’s weakness past 0.8340 could make it vulnerable to refreshing the yearly low, presently around 0.8200. Though, April’s bottom of 0.8250 may offer an intermediate halt.

EUR/GBP: Daily chart

Trend: Further recovery expected

-

07:53

FX option expiries for August 26 NY cut

FX option expiries for August 26 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 0.9850 536m

- 1.0000-10 2.0b

- 1.0050-55 1.08b

- 1.0150 1.75b

- USD/JPY: USD amounts

- 135.00 360m

- 137.00-10 1.3b

- USD/CHF: USD amounts

- 0.9755 250m

- USD/CAD: USD amounts

- 1.2870 226m

- 1.2875-85 524m

- 1.2900 210m

- 1.3000 350m

-

07:50

USD to be the main beneficiary of a hawkish message from Powell – Crédit Agricole

Markets stay relatively quiet waiting for FOMC Chairman Jerome Powell to deliver his opening remarks at the annual Jackson Hole Symposium. A hawkish message should see the dollar strengthening, in the view of economists at Crédit Agricole CIB Research.

High bar for a hawkish surprise from Fed Chair Powell

“We continue to think that the recent price action is raising the bar for a hawkish surprise from the speech of Fed Chair Powell in particular. Indeed, the US rates market current pricing of policy tightening seems consistent with that signalled by the June Fed dot plot.”

“With many positives related to the Fed already in the price of the USD, we continue to think that the currency’s main support could be a potential further deterioration of risk sentiment. Indeed, should a hawkish message from Powell undermine global risk sentiment, the USD could be the main beneficiary.”

-

07:47

Forex Today: All eyes on Powell's speech at Jackson Hole Symposium

Here is what you need to know on Friday, August 26:

Markets stay relatively quiet early Friday as investors stay on the sidelines while waiting for FOMC Chairman Jerome Powell to deliver his opening remarks at the annual Jackson Hole Symposium. On Thursday, the improving market mood made it difficult for the dollar to find demand and the US Dollar Index (DXY) closed the day in negative territory near 108.50. The DXY posts modest gains in the European morning amid a negative shift witnessed in risk mood early Friday. The US Bureau of Economic Analysis (BEA) will release the Personal Consumption Expenditures (PCE) Price Index alongside Personal Income and Personal Spending data for July.

Jackson Hole Symposium Preview: Will Powell power dollar bulls?

The data from the US revealed on Thursday that the BEA revised the Q2 GDP growth higher to -0.6% from -0.9% in its flash estimate. Additionally, the weekly Initial Jobless Claims declined to 243K, coming in better than the market expectation of 253K.

While speaking on the sidelines of the Jackson Hole Symposium, several Fed policymakers repeated that it was too soon to decide on the size of the next rate hike. Philadelphia Fed President Patrick Harker, however, said that even a 50 basis points rate hike in September would still be a "substantial move" and this comment helped Wall Street's main indexes gain traction.

For the third straight day on Thursday, EUR/USD tested parity but failed to break that key level. In the early European morning, the pair trades in a tight range above 0.9950.