Notícias do Mercado

-

16:41

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the U.S. final gross domestic product

The U.S. dollar traded higher against the most major currencies after the U.S. final gross domestic product (GDP). The U.S. GDP rose at an annual rate of 4.6% in the second quarter, in line with expectations, after a 2.1% decline in the first quarter. A previous reading was a 4.2% gain.

The final Reuters/Michigan consumer sentiment index remained unchanged at 84.6 in September, missing expectations for a rise to 85.1.

The greenback remained supported on speculation the Fed will start to hike its interest rates sooner than expected. The Dallas Federal Reserve President Richard Fisher said yesterday that the Fed may start hiking its interest rates around the spring of 2015.

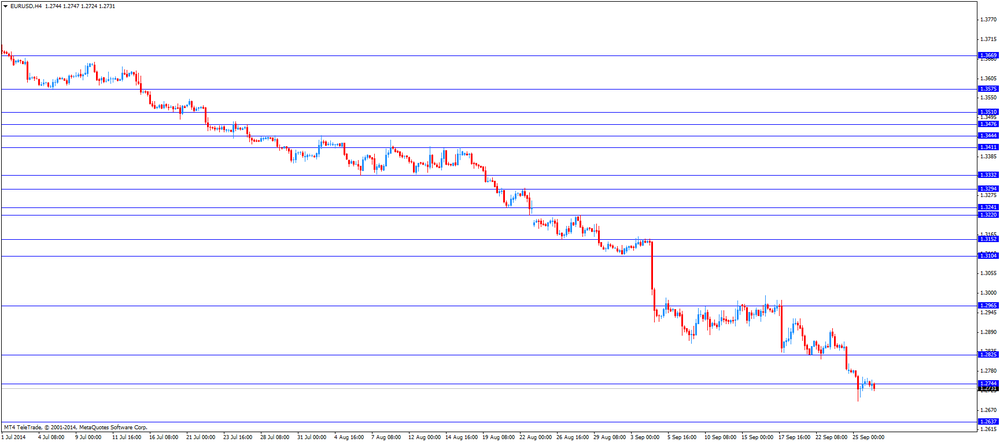

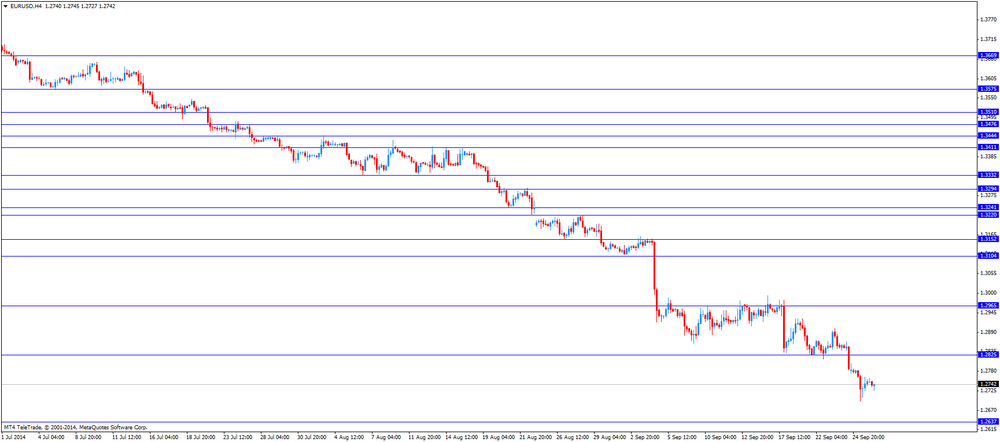

The euro traded lower against the U.S. dollar after the weaker-than-expected economic data from Germany. The Gfk consumer confidence index for Germany fell to 8.3 in October from 8.6 in September. Analysts had expected the index to decline to 8.5.

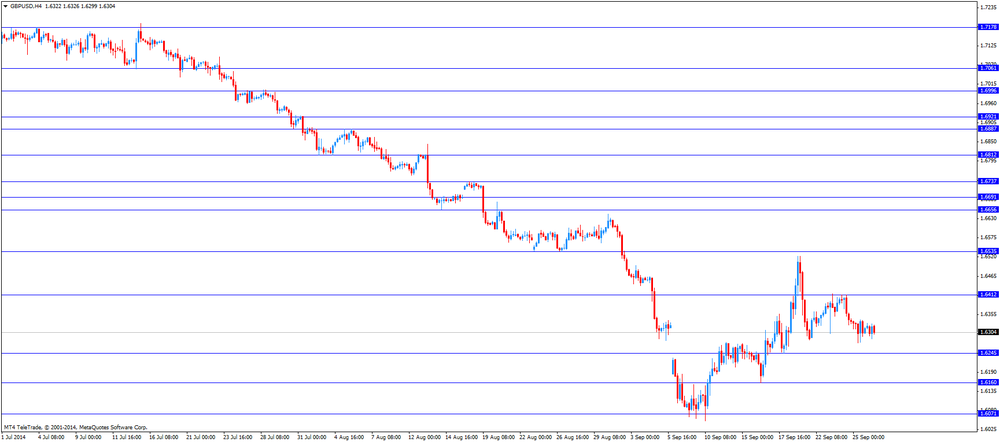

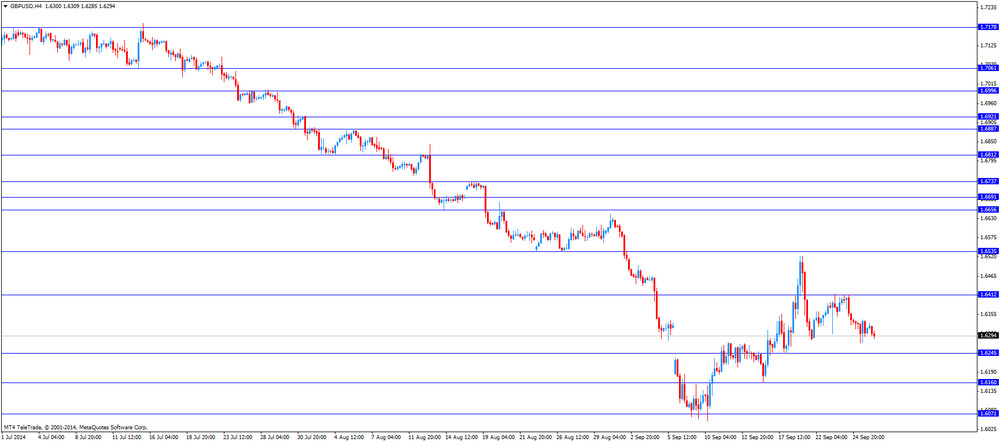

The British pound dropped against the U.S. dollar in the absence of any major economic reports from the U.K.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

Yesterday's comments by the Reserve Bank of New Zealand Governor Graeme Wheeler still weighed on the kiwi. He said the strength of the New Zealand dollar was "unjustified and unsustainable".

The Australian dollar traded slightly lower against the U.S. dollar in the absence of any major economic reports from Australia.

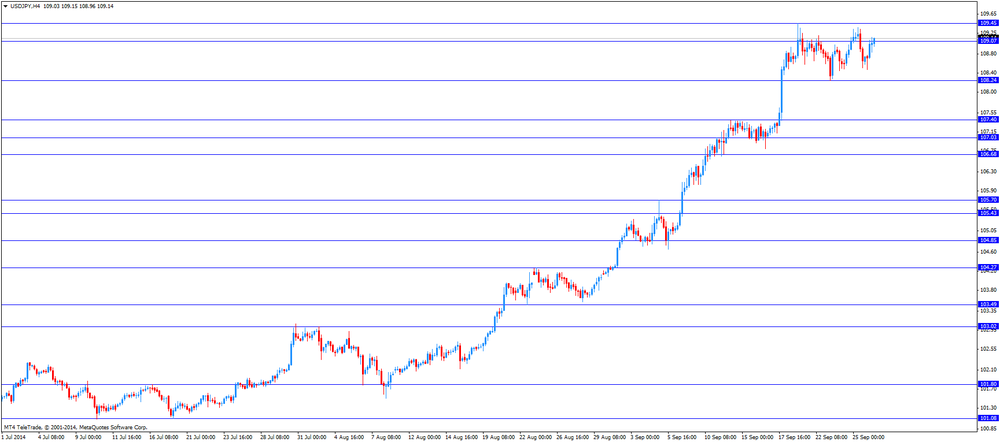

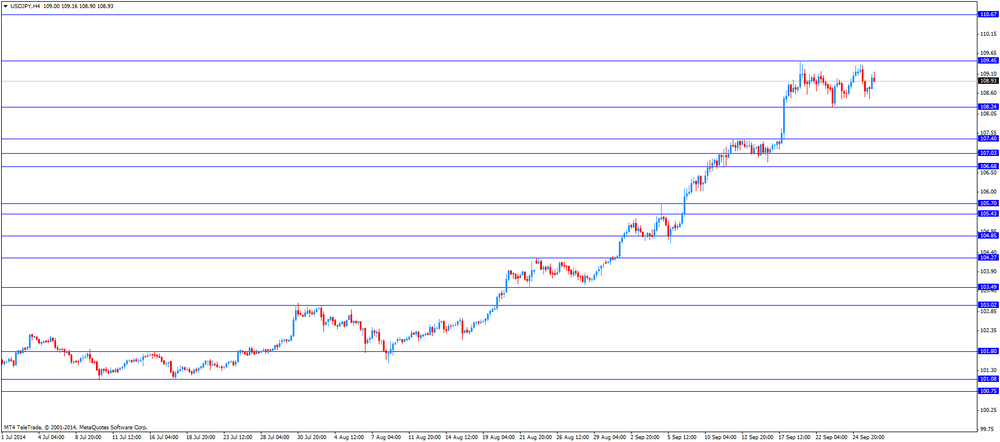

The Japanese yen traded lower against the U.S. dollar. Japan's nationwide core consumer price index increased 3.1% in August, missing expectations for a 3.2% rise, after a 3.3% gain in July.

Japan's nationwide consumer price index rose 3.3% in August, after a 3.4% increase in July.

Comments by Japan's Welfare Minister Yasuhisa Shiozaki also weighed on the yen. He said reforms for Government Pension Investment Fund (GPIF) would continue as planned.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, September 84.6 (forecast 85.1)

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD: $1.2695(E512mn), $1.2730(E204mn), $1.2750(E3.04bn), $1.2800/05(E650mn)

USD/JPY: Y108.30($500mn), Y108.50-55($435mn), Y109.50($250mn)

GBP/USD: $1.6305-10(stg300mn), $1.6465-70(stg460mn), $1.6500(stg600mn)

EUR/GBP: Stg0.7750(E150mn), Stg0.7870(E240mn)

AUD/USD: $0.8750(A$301mn), $0.8900(A$136mn)

USD/CAD: C$1.1045/50($281mn), C$1.1100($100mn), C$1.1165-75($276mn)

-

13:31

U.S.: PCE price index, q/q, Quarter II +2.3%

-

13:31

U.S.: PCE price index ex food, energy, q/q, Quarter II +2.0%

-

13:30

U.S.: GDP, q/q, Quarter II +4.6% (forecast +4.6%)

-

13:20

Foreign exchange market. European session: the euro declined against the U.S. dollar after the weaker-than-expected economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Leading Index August +1.3% +0.7%

06:00 Germany Gfk Consumer Confidence Survey October 8.6 8.5 8.3

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. final gross domestic product (GDP). Analysts expect U.S. GDP to increase 4.6% in the second quarter, up from a previous reading of a 4.2% gain.

The final Reuters/Michigan consumer sentiment index is expected to climbs to 85.1 in September, up from a previous reading of 84.6.

The greenback remained supported on speculation the Fed will start to hike its interest rates sooner than expected. The Dallas Federal Reserve President Richard Fisher said yesterday that the Fed may start hiking its interest rates around the spring of 2015.

The euro declined against the U.S. dollar after the weaker-than-expected economic data from Germany. The Gfk consumer confidence index for Germany fell to 8.3 in October from 8.6 in September. Analysts had expected the index to decline to 8.5.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair fell to $1.2724

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y109.16

The most important news that are expected (GMT0):

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. GDP, q/q (Finally) Quarter II +4.2% +4.6%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 84.6 85.1

-

12:50

Orders

EUR/USD

Offers $1.2820-30, $1.2800, $1.2780/85, $1.2765

Bids $1.2660/50

GBP/USD

Offers $1.6430/35, $1.6400

Bids $1.6210/00, $1.6180

AUD/USD

Offers $0.8900, $0.8850, $0.8795/00

Bids $0.8700, $0.8650

EUR/JPY

Offers Y140.00, Y139.50, Y139.15/20

Bids Y138.55/50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y110.00, Y109.50, Y109.40, Y109.20

Bids Y108.40

EUR/GBP

Offers stg0.7829-31

Bids stg0.7755/45

-

09:51

Foreign exchange market. Asian session: the Japanese yen traded lower against the U.S. dollar after the consumer inflation data from Japan

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Leading Index August +1.3% +0.7%

06:00 Germany Gfk Consumer Confidence Survey October 8.6 8.5 8.3

The U.S. dollar traded higher against the most major currencies on speculation the Fed will start to hike its interest rates sooner than expected. The Dallas Federal Reserve President Richard Fisher said yesterday that the Fed may start hiking its interest rates around the spring of 2015.

The New Zealand dollar fell against the U.S. dollar in the absence of any major economic reports from New Zealand.

Yesterday's comments by the Reserve Bank of New Zealand Governor Graeme Wheeler still weighed on the kiwi. He said the strength of the New Zealand dollar was "unjustified and unsustainable".

The Australian dollar declined against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar after the consumer inflation data from Japan. Japan's nationwide core consumer price index increased 3.1% in August, missing expectations for a 3.2% rise, after a 3.3% gain in July.

Japan's nationwide consumer price index rose 3.3% in August, after a 3.4% increase in July.

Comments by Japan's Welfare Minister Yasuhisa Shiozaki also weighed on the yen. He said reforms for Government Pension Investment Fund (GPIF) would continue as planned.

EUR/USD: the currency pair fell to $1.2737

GBP/USD: the currency pair decreased to $1.6294

USD/JPY: the currency pair rose to Y109.10

The most important news that are expected (GMT0):

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. GDP, q/q (Finally) Quarter II +4.2% +4.6%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 84.6 85.1

-

07:00

Germany: Gfk Consumer Confidence Survey, October 8.3 (forecast 8.5)

-

06:35

Options levels on friday, September 26, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2877 (1657)

$1.2844 (2315)

$1.2797 (259)

Price at time of writing this review: $ 1.2743

Support levels (open interest**, contracts):

$1.2687 (3291)

$1.2658 (3895)

$1.2622 (2380)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 59604 contracts, with the maximum number of contracts with strike price $1,3000 (5054);

- Overall open interest on the PUT options with the expiration date October, 3 is 61664 contracts, with the maximum number of contracts with strike price $1,2800 (6025);

- The ratio of PUT/CALL was 1.03 versus 1.07 from the previous trading day according to data from September, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.6600 (1337)

$1.6501 (2523)

$1.6403 (1603)

Price at time of writing this review: $1.6299

Support levels (open interest**, contracts):

$1.6197 (2136)

$1.6099 (3351)

$1.6000 (2017)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 31587 contracts, with the maximum number of contracts with strike price $1,6700 (3699);

- Overall open interest on the PUT options with the expiration date October, 3 is 41401 contracts, with the maximum number of contracts with strike price $1,6300 (4690);

- The ratio of PUT/CALL was 1.31 versus 1.31 from the previous trading day according to data from September, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:00

China: Leading Index , August +0.7%

-

00:31

Japan: Tokyo CPI ex Fresh Food, y/y, September +2.6% (forecast +2.7%)

-

00:31

Japan: National CPI Ex-Fresh Food, y/y, August +3.1% (forecast +3.2%)

-

00:30

Japan: Tokyo Consumer Price Index, y/y, September +2.9%

-

00:30

Japan: National Consumer Price Index, y/y, August +3.3%

-