Notícias do Mercado

-

23:25

Currencies. Daily history for Sep 25'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2751 -0,20%

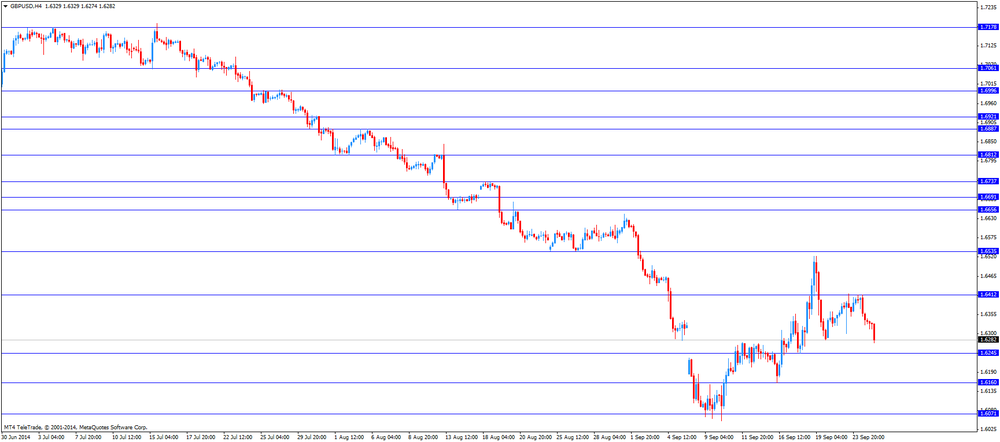

GBP/USD $1,6316 -0,12%

USD/CHF Chf0,9467 +0,13%

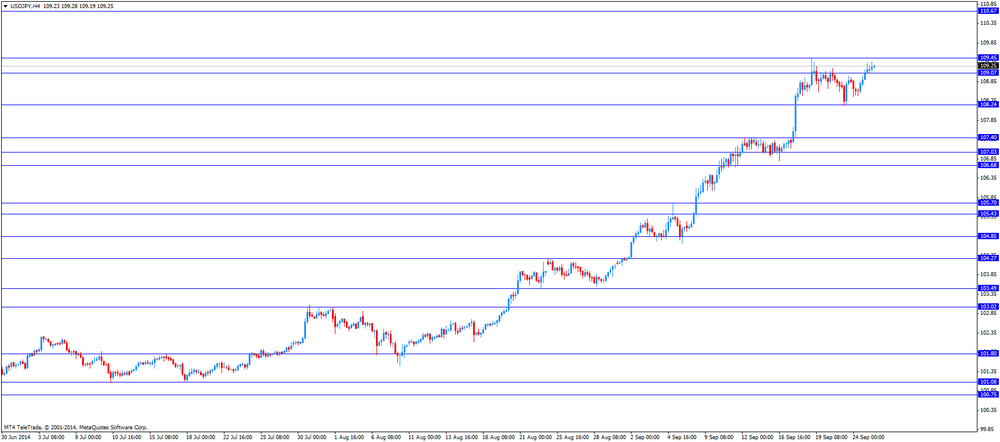

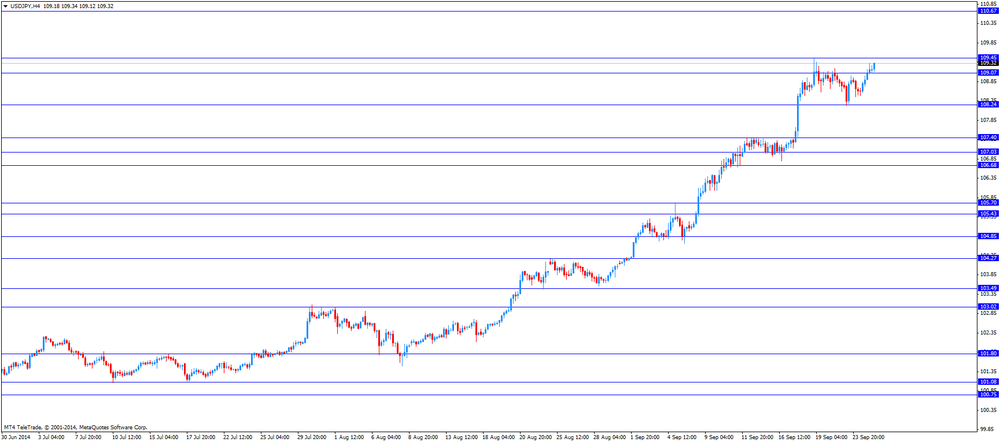

USD/JPY Y108,74 -0,29%

EUR/JPY Y138,66 -0,50%

GBP/JPY Y177,42 -0,41%

AUD/USD $0,8789 -1,00%

NZD/USD $0,7930 -1,82%

USD/CAD C$1,1112 +0,48%

-

23:00

Schedule for today, Friday, Sep 26’2014:

(time / country / index / period / previous value / forecast)

02:00 China Leading Index August +1.3%

06:00 Germany Gfk Consumer Confidence Survey October 8.6 8.5

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. GDP, q/q (Finally) Quarter II +4.2% +4.6%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 84.6 85.1

-

16:35

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies as U.S. durable goods orders dropped 18.2% in August

The U.S. dollar traded mixed against the most major currencies after the U.S. durable goods orders and the number of initial jobless claims. U.S. durable goods orders declined 18.2% in August, missing expectations for a 17.7% drop, after a 22.5% rise in July. July's figure was revised down from a 22.6% increase. That was the largest drop since 1992.

U.S. durable goods orders excluding transportation increased 0.7% last month, in line with expectations, after a 0.5% fall in July. July's figure was revised up from a 0.7% decline.

U.S. durable goods orders excluding defence goods fell 19% last month, after a 24.9% gain in July.

The number of initial jobless claims in the week ending September 20 climbed by 12,000 to 293,000 from 281,000 in the previous week. The previous week's figure was revised from 280,000. Analysts had expected the number of initial jobless claims to increase to 294,000.

The euro traded mixed against the U.S. dollar. The euro remained under pressure after comments by the European Central Bank President Mario Draghi. He said in an interview with Lithuanian business daily Verslo Zinios that the ECB bank is ready to use additional unconventional instruments to counter deflationary risks.

The volume of private loans in the Eurozone fell by 1.5% in August, in line with expectations, after a 1.6% drop in July.

M3 money supply in the Eurozone rose 2% in August, exceeding expectations for a 1.9% increase, after a 1.8% growth in July.

The British pound traded mixed against the U.S. dollar. The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance fell to +31 in August from +37 in July. Analysts had expected a decline to +34.

The New Zealand dollar declined against the U.S. dollar. The comments by the Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler weighed on the kiwi. He said that the kiwi was still "unjustifiably high".

Wheeler warned the strength of the New Zealand dollar was "unjustified and unsustainable".

The RBNZ governor noted when the kiwi declines from an unjustified and unsustainable level, the downward adjustment can be large.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie followed the New Zealand dollar and decreased.

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said at an economic forum in Melbourne that he was open to restrictions on home lending to investors, but he said he didn't consider macroprudential tools.

Stevens supported more economy risk taking.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:37

Reserve Bank of Australia Governor Glenn Stevens: risk-taking is essential for the economy

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said at an economic forum in Melbourne that he was concerned about double-digit rates in home finance. Stevens also said that he was open to restrictions on home lending to investors, but he said he didn't consider macroprudential tools.

Stevens noted that risk-taking was still essential for the economy.

-

15:25

Reserve Bank of New Zealand Governor Graeme Wheeler: New Zealand’s currency was still "unjustifiably high"

The Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler said today:

- The kiwi was still "unjustifiably high";

- The strength of the New Zealand dollar was "unjustified and unsustainable";

- When the kiwi declines from an unjustified and unsustainable level, the downward adjustment can be large;

- The real exchange rate has not adjusted to the recent fall in commodity prices;

- "Unjustified and unsustainable are important considerations in assessing whether exchange rate intervention is feasible".

- The kiwi was still "unjustifiably high";

-

14:59

U.S. durable goods orders plunged 18.2% in August

The U.S. Commerce Department released durable goods orders today. U.S. durable goods orders declined 18.2% in August, missing expectations for a 17.7% drop, after a 22.5% rise in July. July's figure was revised down from a 22.6% increase. That was the largest drop since 1992.

The significant decline was no surprise.

Orders for the transportation decreased 42% in August, while civilian aircraft orders fall 74.3%.

Orders for automobiles declined 6.4%.

U.S. durable goods orders excluding transportation increased 0.7% last month, in line with expectations, after a 0.5% fall in July. July's figure was revised up from a 0.7% decline.

U.S. durable goods orders excluding defence goods fell 19% last month, after a 24.9% gain in July.

-

14:45

U.S.: Services PMI, September 58.5 (forecast 59.4)

-

14:30

Option expiries for today's 1400GMT cut

EUR/USD: $1.2800(E1.1bn), $1.2850(E2.8bn), $1.2860(E351mn), $1.2875(E407mn), $1.2900(E1.1bn)

USD/JPY: Y108.80($300mn), Y109.25($825mn), Y109.50($510mn)

GBP/USD: $1.6300(stg389mn), $1.6395-00(stg340mn), $1.6450(stg775mn), $1.6500(stg392mn), $1.6550(stg582mn)

EUR/GBP: Stg0.7870(E175mn), Stg0.7935(E150mn)

USD/CAD: C$1.1000($681mn), C$1.1060($1.16bn), C$1.1100($272mn), C$1.1200($618mn)

-

13:31

U.S.: Durable goods orders ex defense, August -19.0%

-

13:30

U.S.: Initial Jobless Claims, September 293 (forecast 294)

-

13:30

U.S.: Durable Goods Orders , August -18.2% (forecast -17.7%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , August +0.7% (forecast +0.7%)

-

13:02

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of the U.S. durable goods orders and the number of initial jobless claims

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:30 Australia RBA's Governor Glenn Stevens Speech

08:00 Eurozone M3 money supply, adjusted y/y August +1.8% +1.9% +2.0%

08:00 Eurozone Private Loans, Y/Y August -1.6% -1.5% -1.5%

10:00 United Kingdom CBI retail sales volume balance September 37 34 31

The U.S. dollar traded higher against the most major currencies ahead of the U.S. durable goods orders and the number of initial jobless claims. The U.S. durable goods orders are expected to drop 17.7% in August, after a 22.6% increase in July.

The number of initial jobless claims is expected to by 14,000 to 294,000.

The euro traded lower against the U.S. dollar after comments by the European Central Bank President Mario Draghi. He said in an interview with Lithuanian business daily Verslo Zinios that the ECB bank is ready to use additional unconventional instruments to counter deflationary risks.

The volume of private loans in the Eurozone fell by 1.5% in August, in line with expectations, after a 1.6% drop in July.

M3 money supply in the Eurozone rose 2% in August, exceeding expectations for a 1.9% increase, after a 1.8% growth in July.

The British pound traded lower against the U.S. dollar. The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance fell to +31 in August from +37 in July. Analysts had expected a decline to +34.

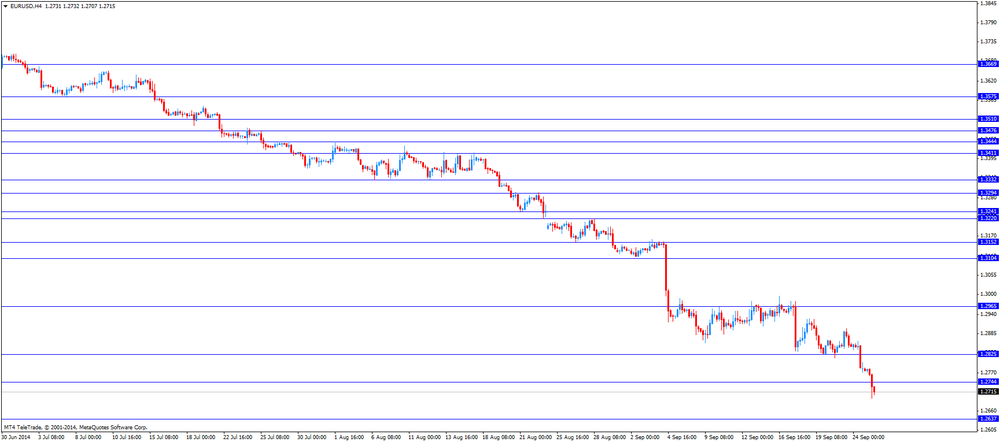

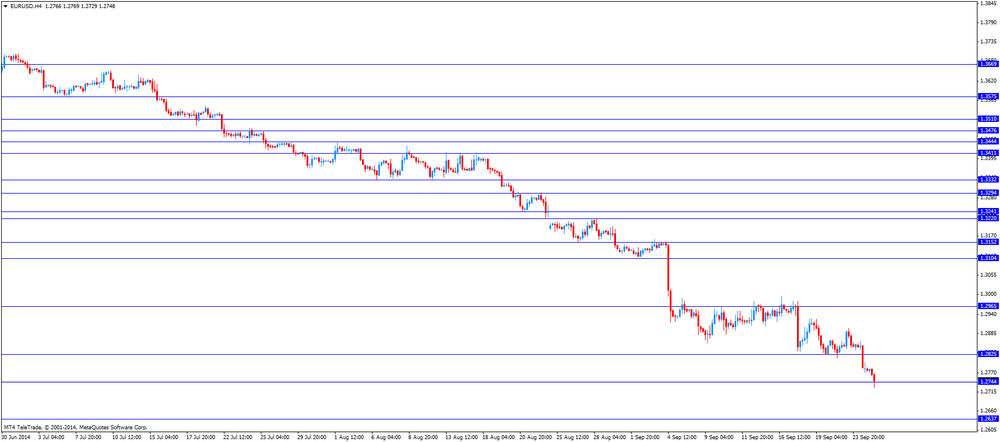

EUR/USD: the currency pair fell to $1.2696

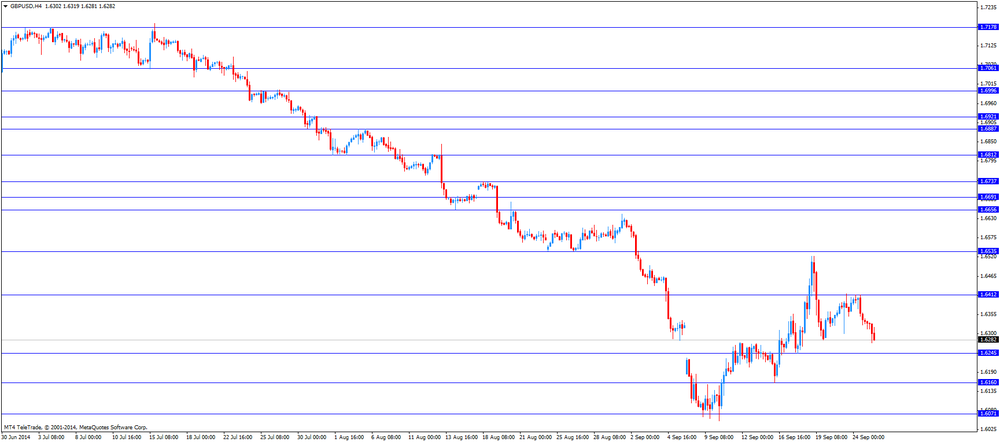

GBP/USD: the currency pair declined to $1.6274

USD/JPY: the currency pair rose to Y109.37

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders August +22.6% -17.7%

12:30 U.S. Durable Goods Orders ex Transportation August -0.7% Revised From -0.8% +0.7%

12:30 U.S. Durable goods orders ex defense August +24.9%

12:30 U.S. Initial Jobless Claims September 280 294

13:45 U.S. Services PMI (Preliminary) September 59.5 59.4

23:30 Japan Tokyo Consumer Price Index, y/y September +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September +2.7% +2.7%

23:30 Japan National Consumer Price Index, y/y August +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y August +3.3% +3.2%

-

13:00

Orders

EUR/USD

Offers $1.2820-30, $1.2800, $1.2750/60

Bids $1.2660/50, $1.2600

GBP/USD

Offers

Bids 1.6210/00, 1.6180

AUD/USD

Offers $0.8980, $0.8940/60, $0.8900, $0.8835/40

Bids $0.8780, $0.8750, $0.8700

EUR/JPY

Offers Y140.50, Y140.20, Y140.00, Y139.40/50

Bids Y138.80, Y138.20, Y138.00

USD/JPY

Offers Y110.50, Y110.00, Y109.50, Y109.40

Bids Y109.00, Y108.60/50, Y108.40

EUR/GBP

Offers stg0.7900

Bids stg0.7800

-

11:00

United Kingdom: CBI retail sales volume balance, September 31 (forecast 34)

-

10:30

Option expiries for today's 1400GMT cut

EUR/USD: $1.2800(E1.1bn), $1.2850(E2.8bn), $1.2860(E351mn), $1.2875(E407mn), $1.2900(E1.1bn)

USD/JPY: Y108.80($300mn), Y109.25($825mn), Y109.50($510mn)

GBP/USD: $1.6300(stg389mn), $1.6395-00(stg340mn), $1.6450(stg775mn), $1.6500(stg392mn), $1.6550(stg582mn)

EUR/GBP: Stg0.7870(E175mn), Stg0.7935(E150mn)

USD/CAD: C$1.1000($681mn), C$1.1060($1.16bn), C$1.1100($272mn), C$1.1200($618mn)

-

10:04

Foreign exchange market. Asian session: the New Zealand dollar dropped against the U.S. dollar after comments by after Reserve Bank of New Zealand Governor Graeme Wheeler

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:30 Australia RBA's Governor Glenn Stevens Speech

08:00 Eurozone M3 money supply, adjusted y/y August +1.8% +1.9% +2.0%

08:00 Eurozone Private Loans, Y/Y August -1.6% -1.5% -1.5%

The U.S. dollar traded higher against the most major currencies. The greenback remained supported by yesterday's U.S. new home sales. New home sales in the U.S. rose 18.0% to a seasonally adjusted annual rate of 504,000 units in August, up from 427,000 units in July. That was the highest level since May 2008.

The New Zealand dollar dropped against the U.S. dollar after comments by the Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler. He said that the kiwi was still "unjustifiably high".

Wheeler warned the strength of the New Zealand dollar was "unjustified and unsustainable".

The RBNZ governor noted when the kiwi declines from an unjustified and unsustainable level, the downward adjustment can be large.

The Australian dollar fell against the U.S. dollar, following the New Zealand dollar.

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said at an economic forum in Melbourne that he was open to restrictions on home lending to investors, but he said he didn't consider macroprudential tools.

Stevens supported more economy risk taking.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair fell to $1.2762

GBP/USD: the currency pair decreased to $1.6314

USD/JPY: the currency pair rose to Y109.33

The most important news that are expected (GMT0):

10:00 United Kingdom CBI retail sales volume balance September 37 34

12:30 U.S. Durable Goods Orders August +22.6% -17.7%

12:30 U.S. Durable Goods Orders ex Transportation August -0.7% Revised From -0.8% +0.7%

12:30 U.S. Durable goods orders ex defense August +24.9%

12:30 U.S. Initial Jobless Claims September 280 294

13:45 U.S. Services PMI (Preliminary) September 59.5 59.4

23:30 Japan Tokyo Consumer Price Index, y/y September +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September +2.7% +2.7%

23:30 Japan National Consumer Price Index, y/y August +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y August +3.3% +3.2%

-

09:01

Eurozone: Private Loans, Y/Y, August -1.5% (forecast -1.5%)

-

09:00

Eurozone: M3 money supply, adjusted y/y, August +2.0% (forecast +1.9%)

-

06:28

Options levels on thursday, September 25, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2887 (2758)

$1.2857 (914)

$1.2805 (96)

Price at time of writing this review: $ 1.2765

Support levels (open interest**, contracts):

$1.2730 (6046)

$1.2703 (3091)

$1.2670 (3142)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 56219 contracts, with the maximum number of contracts with strike price $1,3000 (5111);

- Overall open interest on the PUT options with the expiration date October, 3 is 60357 contracts, with the maximum number of contracts with strike price $1,2800 (6046);

- The ratio of PUT/CALL was 1.07 versus 1.10 from the previous trading day according to data from September, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.6600 (1387)

$1.6501 (2594)

$1.6403 (1632)

Price at time of writing this review: $1.6323

Support levels (open interest**, contracts):

$1.6295 (4981)

$1.6198 (2052)

$1.6099 (3349)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 31721 contracts, with the maximum number of contracts with strike price $1,6700 (3699);

- Overall open interest on the PUT options with the expiration date October, 3 is 41658 contracts, with the maximum number of contracts with strike price $1,6300 (4981);

- The ratio of PUT/CALL was 1.31 versus 1.29 from the previous trading day according to data from September, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-