Notícias do Mercado

-

23:23

Currencies. Daily history for Sep 24'2014:

(pare/closed(GMT +2)/change, %)

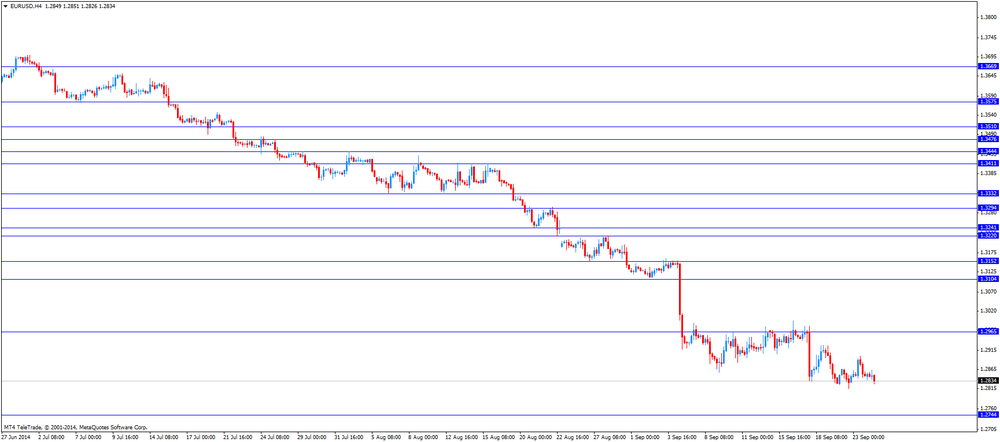

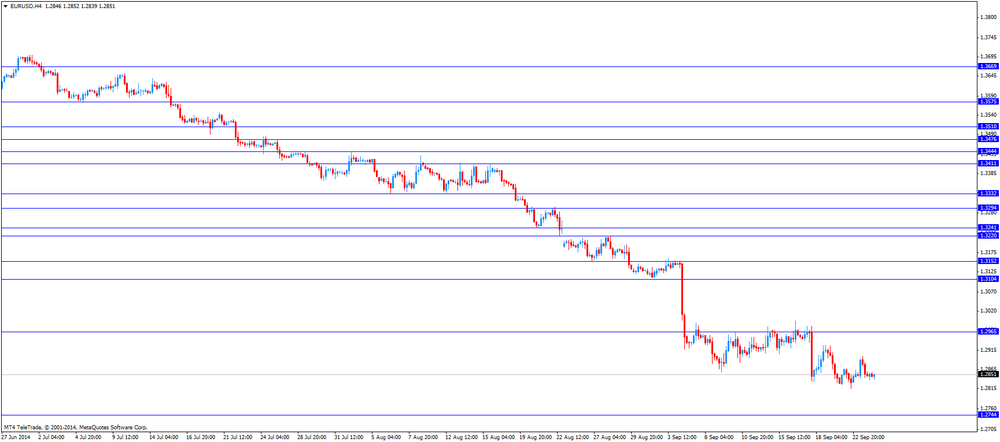

EUR/USD $1,2777 -0,55%

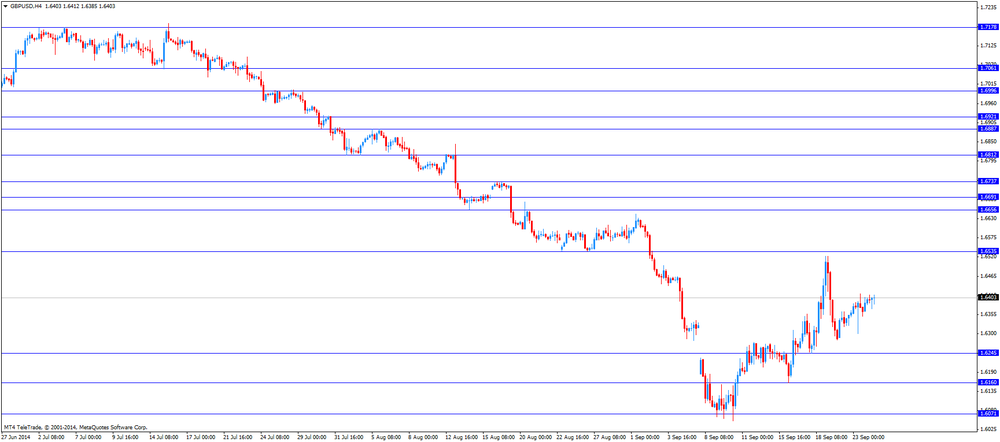

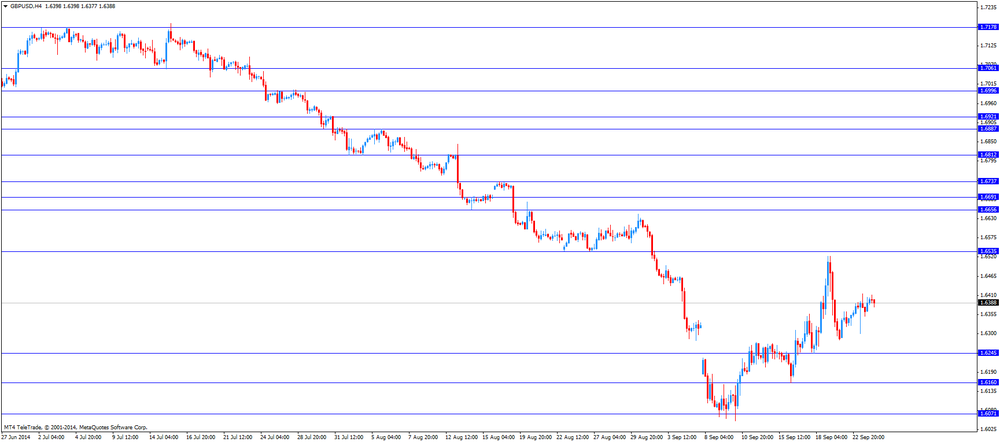

GBP/USD $1,6335 -0,32%

USD/CHF Chf0,9455 +0,62%

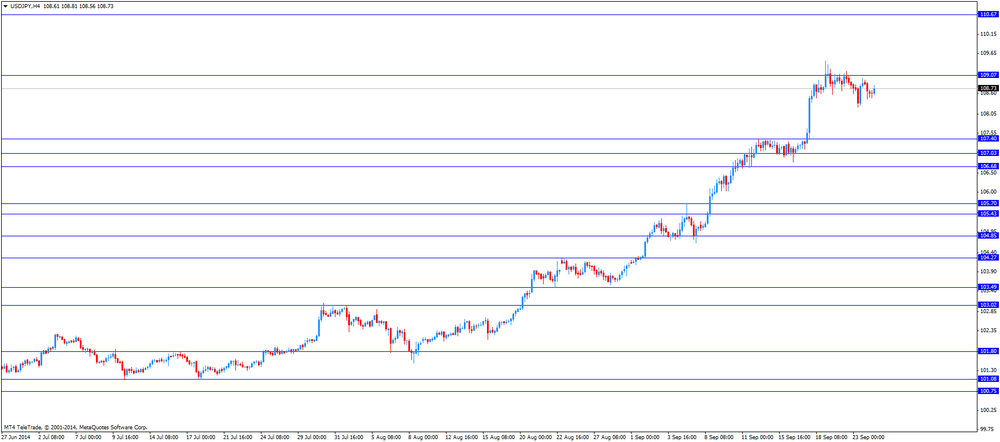

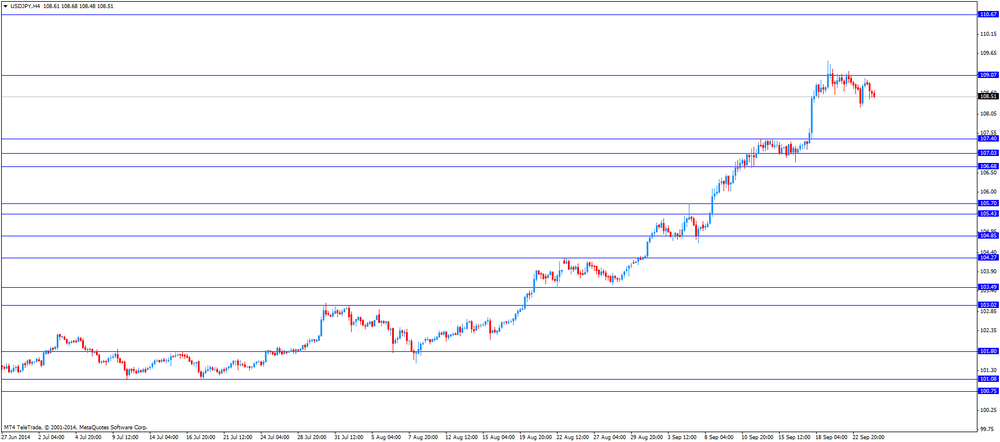

USD/JPY Y109,06 +0,19%

EUR/JPY Y139,36 -0,36%

GBP/JPY Y178,15 -0,13%

AUD/USD $0,8877 +0,37%

NZD/USD $0,8074 +0,11%

USD/CAD C$1,1059 -0,14%

-

23:00

Schedule for today, Thursday, Sep 25’2014:

(time / country / index / period / previous value / forecast)

02:30 Australia RBA's Governor Glenn Stevens Speech

06:00 United Kingdom Nationwide house price index September +0.8%

06:00 United Kingdom Nationwide house price index, y/y September +11.0%

08:00 Eurozone M3 money supply, adjusted y/y August +1.8% +1.9%

08:00 Eurozone Private Loans, Y/Y August -1.6% -1.5%

10:00 United Kingdom CBI retail sales volume balance September 37 34

12:30 U.S. Durable Goods Orders August +22.6% -17.7%

12:30 U.S. Durable Goods Orders ex Transportation August -0.7% Revised From -0.8% +0.7%

12:30 U.S. Durable goods orders ex defense August +24.9%

12:30 U.S. Initial Jobless Claims September 280 294

13:45 U.S. Services PMI (Preliminary) September 59.5 59.4

23:30 Japan Tokyo Consumer Price Index, y/y September +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September +2.7% +2.7%

23:30 Japan National Consumer Price Index, y/y August +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y August +3.3% +3.2%

-

16:30

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies as the U.S. new home sales surged 18.0% in August

The U.S. dollar traded mixed to against the most major currencies after the U.S. new home sales. New home sales in the U.S. rose 18.0% to a seasonally adjusted annual rate of 504,000 units in August, up from 427,000 units in July. That was the highest level since May 2008.

July's sales were revised from 412,000 units.

Analysts had expected an increase to 432,000.

The euro fell against the U.S. dollar due to the weaker-than-expected Germany's Ifo business climate index and comments by the European Central Bank President Mario Draghi. The Ifo business climate index for Germany declined to 104.7 in September from 106.3 in August. That was the fifth successive in five months and the lowest level since April 2013.

Analysts had expected the Ifo business climate index to fall to 105.9.

The European Central Bank (ECB) President Mario Draghi said in a French radio interview on Wednesday that the ECB will keep its monetary policy accommodative for as long as needed to bring inflation to 2% inflation target.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. Switzerland's UBS consumption indicator declined to 1.35 points in August from 1.67 points in July. July's figure was revised up from 1.66 points.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the better-than-expected trade data. New Zealand's trade deficit fell to NZ$472 million in August from a deficit of NZ$692 million in July, beating forecasts for an increase to NZ$1,125 million in August.

Fonterra Cooperative Group lowered its forecast payout to farmers. The company cut the 2015 forecast payout to $5.30 per kilogram of milk solids from $6/kgMS.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie increased against the U.S. dollar due to solid leading index from Australia. The Conference Board released its leading index for Australia. The index increase 0.5% in July, after a 0.2% gain in June. June's figure revised down from a 0.4% rise.

The Japanese yen fell against the U.S. dollar. In the overnight trading session, the yen gained against the greenback after comments by Japanese Prime Minister Shinzo Abe. Abe said he would carefully watch the impact of yen weakness on Japanese regional economies.

Japan's preliminary purchasing managers' index declined to 51.7 in September from 52.2 in August, missing expectations for an increase to 52.5.

-

15:50

U.S. new home sales increased 18% in August

The U.S. Commerce Department released new home sales figures today. New home sales rose 18.0% to a seasonally adjusted annual rate of 504,000 units in August, up from 427,000 units in July. That was the highest level since May 2008.

July's sales were revised from 412,000 units.

Analysts had expected an increase to 432,000.

-

15:30

U.S.: Crude Oil Inventories, September -4.3

-

15:00

U.S.: New Home Sales, August 504 (forecast 432)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2850(E500mn), $1.2915(E308mn), $1.2850 E2.4bn

USD/JPY: Y107.60($300mn), Y108.00($201mn), Y108.50($130mn), Y109.25-50 $1.4bn

GBP/USD: $1.6325(stg156mn), $1.6450(stg240mn)

EUR/GBP: Stg0.7800(E200mn), Stg0.7840(E340mn)

USD/CHF: Chf0.9300($325mn), Chf0.9500($300mn)

AUD/USD: $0.8800(A$227mn), $0.8900(A$200mn), $0.9000-10(A$275mn)

EUR/AUD: A$1.4160(E199mn)

NZD/USD: $0.8250(NZ$282mn)

AUD/NZD: NZ$1.1125(A$297mn)

USD/CAD: C$1.1000($259mn), C$1.1090-95($545mn)

-

14:00

Belgium: Business Climate, September -7.2 (forecast -7.1)

-

13:00

Orders

EUR/USD

Offers $1.2950, $1.2930/35

Bids $1.2800, $1.2788

GBP/USD

Offers 1.6480/85, 1.6430/35

Bids 1.6300

AUD/USD

Offers $0.9020, $0.9000, $0.8940/60, $0.8900

Bids $0.8825/20, $0.8800, $0.8778/77, $0.8750/57, $0.8700

EUR/JPY

Offers Y141.00, Y140.00

Bids Y139.20, Y138.80, Y138.20

USD/JPY

Offers Y110.00, Y109.50, Y109.00

Bids Y108.40, Y107.48

EUR/GBP

Offers stg0.7900

Bids stg0.7800

-

13:00

Foreign exchange market. European session: the euro traded lower against the U.S. dollar due to the weaker-than-expected Germany’s Ifo business climate index and comments by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index July +0.2% +0.5%

01:30 Australia RBA Financial Stability Review

01:35 Japan Manufacturing PMI (Preliminary) September 52.2 52.5 51.7

06:00 Switzerland UBS Consumption Indicator August 1.66 1.35

08:00 Germany IFO - Business Climate September 106.3 105.9 104.7

08:00 Germany IFO - Current Assessment September 111.1 110.6 110.5

08:00 Germany IFO - Expectations September 101.7 101.3 99.3

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. new home sales. New home sales in the U.S. are expected to increase to 432,000 units in August from 412 units in July.

The euro traded lower against the U.S. dollar due to the weaker-than-expected Germany's Ifo business climate index and comments by the European Central Bank President Mario Draghi. The Ifo business climate index for Germany declined to 104.7 in September from 106.3 in August. That was the fifth successive in five months and the lowest level since April 2013.

Analysts had expected the Ifo business climate index to fall to 105.9.

The European Central Bank (ECB) President Mario Draghi said in a French radio interview on Wednesday that the ECB will keep its monetary policy accommodative for as long as needed to bring inflation to 2% inflation target.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. Switzerland's UBS consumption indicator declined to 1.35 points in August from 1.67 points in July. July's figure was revised up from 1.66 points.

EUR/USD: the currency pair fell to $1.2826

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:00 Belgium Business Climate September -7.3 -7.1

14:00 U.S. New Home Sales August 412 432

16:05 U.S. FOMC Member Narayana Kocherlakota

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD: $1.2850(E500mn), $1.2915(E308mn), $1.2850 E2.4bn

USD/JPY: Y107.60($300mn), Y108.00($201mn), Y108.50($130mn), Y109.25-50 $1.4bn

GBP/USD: $1.6325(stg156mn), $1.6450(stg240mn)

EUR/GBP: Stg0.7800(E200mn), Stg0.7840(E340mn)

USD/CHF: Chf0.9300($325mn), Chf0.9500($300mn)

AUD/USD: $0.8800(A$227mn), $0.8900(A$200mn), $0.9000-10(A$275mn)

EUR/AUD: A$1.4160(E199mn)

NZD/USD: $0.8250(NZ$282mn)

AUD/NZD: NZ$1.1125(A$297mn)

USD/CAD: C$1.1000($259mn), C$1.1090-95($545mn)

-

10:11

Foreign exchange market. Asian session: the New Zealand dollar rose against the U.S. dollar after the better-than-expected trade data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index July +0.2% +0.5%

01:30 Australia RBA Financial Stability Review

01:35 Japan Manufacturing PMI (Preliminary) September 52.2 52.5 51.7

06:00 Switzerland UBS Consumption Indicator August 1.66 1.35

08:00 Germany IFO - Business Climate September 106.3 105.9 104.7

08:00 Germany IFO - Current Assessment September 111.1 110.6 110.5

08:00 Germany IFO - Expectations September 101.7 101.3 99.3

The U.S. dollar traded mixed to lower against the most major currencies. The greenback remained supported by yesterday's U.S. manufacturing purchasing managers' index. The preliminary U.S. manufacturing purchasing managers' index remained unchanged at 57.9 in September, missing expectations for an increase to 58.1.

The New Zealand dollar rose against the U.S. dollar after the better-than-expected trade data. New Zealand's trade deficit fell to NZ$472 million in August from a deficit of NZ$692 million in July, beating forecasts for an increase to NZ$1,125 million in August.

Fonterra Cooperative Group lowered its forecast payout to farmers. The company cut the 2015 forecast payout to $5.30 per kilogram of milk solids from $6/kgMS.

The Australian dollar rose against the U.S. dollar due to solid leading index from Australia. The Conference Board released its leading index for Australia. The index increase 0.5% in July, after a 0.2% gain in June. June's figure revised down from a 0.4% rise.

The Japanese yen traded higher against the U.S. dollar after comments by Japanese Prime Minister Shinzo Abe. Abe said he would carefully watch the impact of yen weakness on Japanese regional economies.

Japan's preliminary purchasing managers' index declined to 51.7 in September from 52.2 in August, missing expectations for an increase to 52.5.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.6412

USD/JPY: the currency pair fell to Y108.45

The most important news that are expected (GMT0):

13:00 Belgium Business Climate September -7.3 -7.1

14:00 U.S. New Home Sales August 412 432

16:05 U.S. FOMC Member Narayana Kocherlakota

-

09:01

Germany: IFO - Expectations , September 99.3 (forecast 101.3)

-

09:00

Germany: IFO - Business Climate, September 104.7 (forecast 105.9)

-

09:00

Germany: IFO - Current Assessment , September 110.5 (forecast 110.6)

-

07:01

Switzerland: UBS Consumption Indicator, August 1.35

-

06:27

Options levels on wednesday, September 24, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2979 (2758)

$1.2946 (2561)

$1.2901 (315)

Price at time of writing this review: $ 1.2851

Support levels (open interest**, contracts):

$1.2819 (3408)

$1.2794 (3140)

$1.2764 (6178)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 55334 contracts, with the maximum number of contracts with strike price $1,3000 (5117);

- Overall open interest on the PUT options with the expiration date October, 3 is 60686 contracts, with the maximum number of contracts with strike price $1,2800 (6178);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from September, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.6700 (3706)

$1.6601 (1414)

$1.6503 (2584)

Price at time of writing this review: $1.6402

Support levels (open interest**, contracts):

$1.6297 (4927)

$1.6198 (1964)

$1.6099 (3349)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 31914 contracts, with the maximum number of contracts with strike price $1,6700 (3706);

- Overall open interest on the PUT options with the expiration date October, 3 is 41020 contracts, with the maximum number of contracts with strike price $1,6300 (4927);

- The ratio of PUT/CALL was 1.29 versus 1.30 from the previous trading day according to data from September, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:35

Japan: Manufacturing PMI, September 51.7 (forecast 52.5)

-