Notícias do Mercado

-

23:42

Commodities. Daily history for Sep 24'2014:

(raw materials / closing price /% change)

Light Crude 92.92 +0.13%

Gold 1,217.50 -0.16%

-

23:32

Stocks. Daily history for Sep 24'2014:

(index / closing price / change items /% change)

Nikkei 225 16,167.45 -38.45 -0.24%

Hang Seng 23,921.61 +84.54 +0.35%

Shanghai Composite 2,343.57 +33.86 +1.47%

FTSE 100 6,706.27 +30.19 +0.45%

CAC 40 4,413.72 +54.37 +1.25%

Xetra DAX 9,661.97 +66.94 +0.70%

S&P 500 1,998.3 +15.53 +0.78%

NASDAQ Composite 4,555.22 +46.53 +1.03%

Dow Jones 17,210.06 +154.19 +0.90% 80.53m

-

23:23

Currencies. Daily history for Sep 24'2014:

(pare/closed(GMT +2)/change, %)

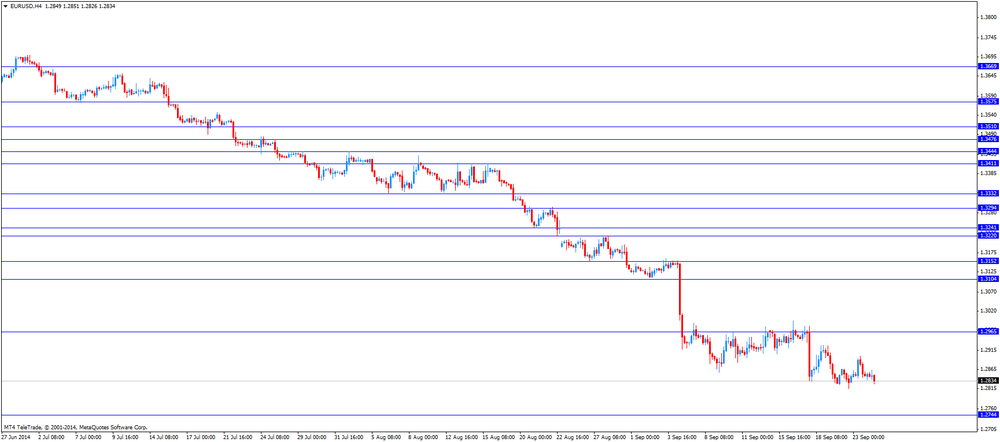

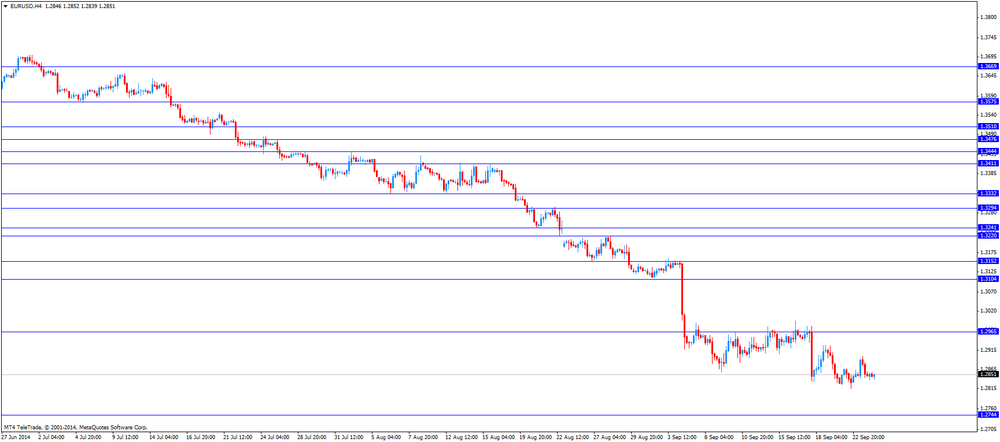

EUR/USD $1,2777 -0,55%

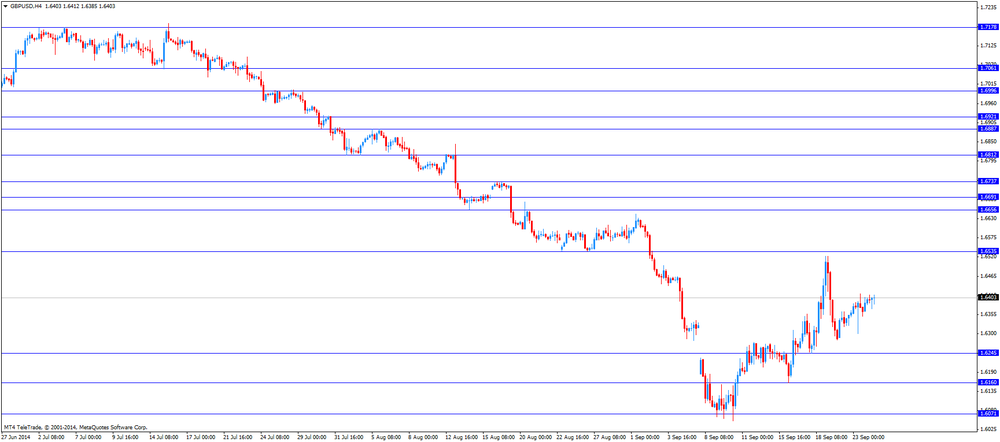

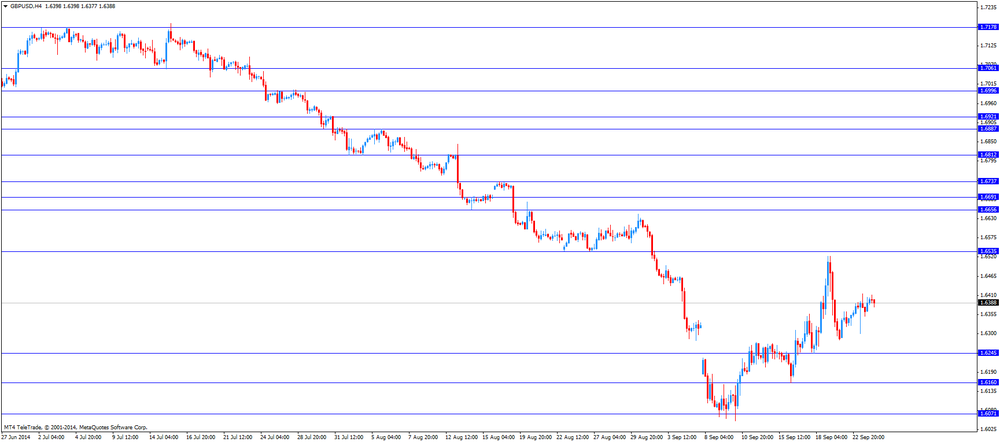

GBP/USD $1,6335 -0,32%

USD/CHF Chf0,9455 +0,62%

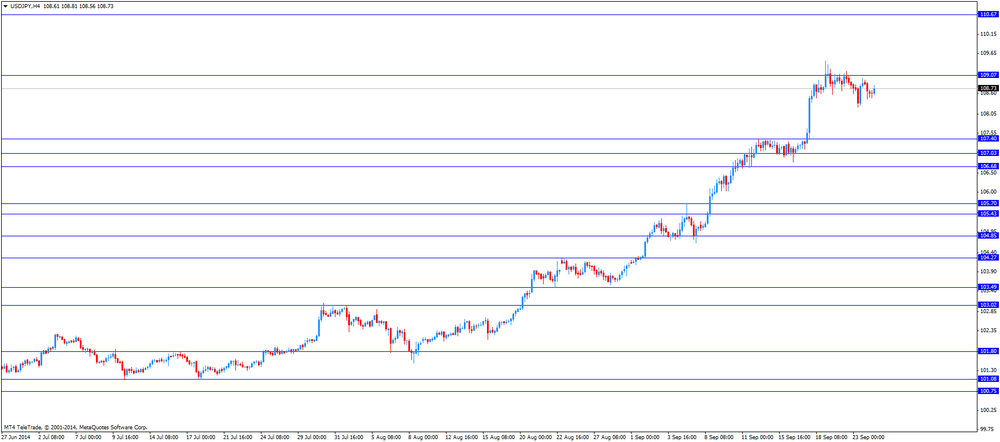

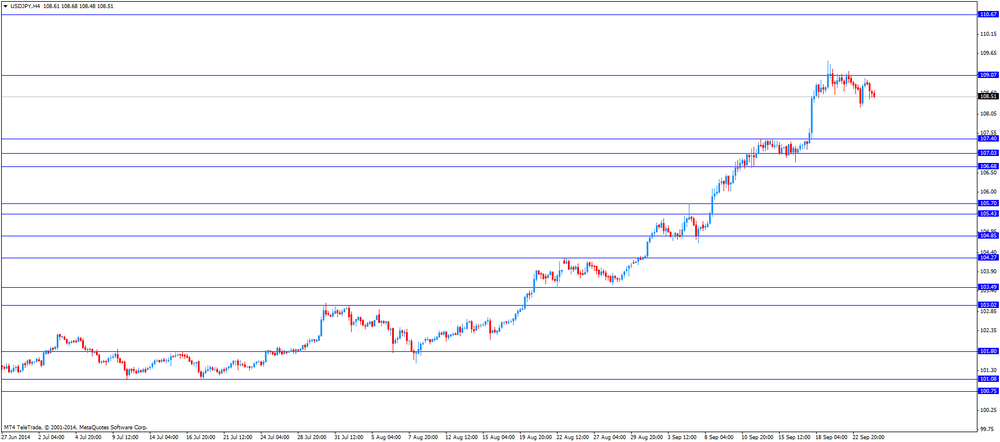

USD/JPY Y109,06 +0,19%

EUR/JPY Y139,36 -0,36%

GBP/JPY Y178,15 -0,13%

AUD/USD $0,8877 +0,37%

NZD/USD $0,8074 +0,11%

USD/CAD C$1,1059 -0,14%

-

23:00

Schedule for today, Thursday, Sep 25’2014:

(time / country / index / period / previous value / forecast)

02:30 Australia RBA's Governor Glenn Stevens Speech

06:00 United Kingdom Nationwide house price index September +0.8%

06:00 United Kingdom Nationwide house price index, y/y September +11.0%

08:00 Eurozone M3 money supply, adjusted y/y August +1.8% +1.9%

08:00 Eurozone Private Loans, Y/Y August -1.6% -1.5%

10:00 United Kingdom CBI retail sales volume balance September 37 34

12:30 U.S. Durable Goods Orders August +22.6% -17.7%

12:30 U.S. Durable Goods Orders ex Transportation August -0.7% Revised From -0.8% +0.7%

12:30 U.S. Durable goods orders ex defense August +24.9%

12:30 U.S. Initial Jobless Claims September 280 294

13:45 U.S. Services PMI (Preliminary) September 59.5 59.4

23:30 Japan Tokyo Consumer Price Index, y/y September +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September +2.7% +2.7%

23:30 Japan National Consumer Price Index, y/y August +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y August +3.3% +3.2%

-

20:00

Dow +156.95 17,212.82 +0.92% Nasdaq +41.55 4,550.24 +0.92% S&P +15.17 1,997.94 +0.77%

-

17:00

European stocks close: FTSE 100 6,706.27 +30.19 +0.45% CAC 40 4,413.72 +54.37 +1.25% DAX 9,661.97 +66.94 +0.70%

-

17:00

European stocks close: stocks closed higher on speculation the European Central Bank will add further stimulus measures

Stock indices closed higher on speculation the European Central Bank will add further stimulus measures. The reason for the speculation was the weaker-than-expected Ifo business climate index for Germany. The Ifo business climate index for Germany declined to 104.7 in September from 106.3 in August. That was the fifth successive in five months and the lowest level since April 2013.

Analysts had expected the Ifo business climate index to fall to 105.9.

The European Central Bank (ECB) President Mario Draghi said in a French radio interview on Wednesday that the ECB will keep its monetary policy accommodative for as long as needed to bring inflation to 2% inflation target.

TNT Express NV dropped 9.4% after the company cut its 2015 profit forecast.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,706.27 +30.19 +0.45%

DAX 9,661.97 +66.94 +0.70%

CAC 40 4,413.72 +54.37 +1.25%

-

16:40

Oil: an overview of the market situation

Oil prices declined moderately today, reaching its lowest level in the last two years, as rising supplies from Africa and Iraq offset concerns about the situation in the Middle East. Add this quarter the price of oil has fallen by about 14 percent, which is the largest decline since the second quarter of 2012.

But, in spite of the fall in prices, the World Bank analysts said that, according to forecasts, the average price of oil on the world market will not fall below $ 100 per barrel in 2014-2015. "We expect the recent trends in the oil market and forecast the average price of oil at $ 103 per barrel in 2014 and $ 100 per barrel in 2015," - the report says the World Bank. In the long term, according to experts of the international organization, it is expected a decline in oil prices in real terms due to the increase in the supply of crude oil produced in unconventional ways, and the use of alternative fuels. The World Bank also expects that in 2014 global oil demand will increase by 1.1 million barrels per day, reaching 92.7 million barrels per day in 2014 and 94 million barrels per day in 2015. On the supply side is expected to increase the volume of oil production in Iraq and Libya.

The fall in prices has also been associated with weak European data. Recall yesterday's report showed that the composite PMI index of euro zone, which combines service sector activity and production fell to a nine-month high of 52.3 from 52.5 in August. PMI for the services sector of the currency bloc deteriorated to three-month low of 52.8 from 53.1 in August, while the expected value of 53.0. Meanwhile, today's data showed in September business climate indicator from Germany IFO worsened for the fifth month in a row. Business Climate Index fell to 104.7 from 106.3 in August. Economists had expected a decline to 105.9.

Also today, it became known that commercial oil stocks in the United States last week fell to 4,273,000. Barrels - up to 357,998 million barrels. This was stated by the Ministry of Energy. Gasoline inventories decreased by 414 thousand. Barrels and reached 210,324 million barrels. Commercial distillate stocks rose by 823 thousand. Barrels, reaching 128,595 million barrels. Economists had expected an increase of oil reserves by 750 thousand. Barrels, gasoline inventories immutability and distillate stocks increase by 500 thousand. Barrels.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 91.38 a barrel on the New York Mercantile Exchange (NYMEX).

November futures price for North Sea Brent crude oil mixture fell $ 0.70 to $ 96.06 a barrel on the London exchange ICE Futures Europe.

-

16:30

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies as the U.S. new home sales surged 18.0% in August

The U.S. dollar traded mixed to against the most major currencies after the U.S. new home sales. New home sales in the U.S. rose 18.0% to a seasonally adjusted annual rate of 504,000 units in August, up from 427,000 units in July. That was the highest level since May 2008.

July's sales were revised from 412,000 units.

Analysts had expected an increase to 432,000.

The euro fell against the U.S. dollar due to the weaker-than-expected Germany's Ifo business climate index and comments by the European Central Bank President Mario Draghi. The Ifo business climate index for Germany declined to 104.7 in September from 106.3 in August. That was the fifth successive in five months and the lowest level since April 2013.

Analysts had expected the Ifo business climate index to fall to 105.9.

The European Central Bank (ECB) President Mario Draghi said in a French radio interview on Wednesday that the ECB will keep its monetary policy accommodative for as long as needed to bring inflation to 2% inflation target.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. Switzerland's UBS consumption indicator declined to 1.35 points in August from 1.67 points in July. July's figure was revised up from 1.66 points.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the better-than-expected trade data. New Zealand's trade deficit fell to NZ$472 million in August from a deficit of NZ$692 million in July, beating forecasts for an increase to NZ$1,125 million in August.

Fonterra Cooperative Group lowered its forecast payout to farmers. The company cut the 2015 forecast payout to $5.30 per kilogram of milk solids from $6/kgMS.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie increased against the U.S. dollar due to solid leading index from Australia. The Conference Board released its leading index for Australia. The index increase 0.5% in July, after a 0.2% gain in June. June's figure revised down from a 0.4% rise.

The Japanese yen fell against the U.S. dollar. In the overnight trading session, the yen gained against the greenback after comments by Japanese Prime Minister Shinzo Abe. Abe said he would carefully watch the impact of yen weakness on Japanese regional economies.

Japan's preliminary purchasing managers' index declined to 51.7 in September from 52.2 in August, missing expectations for an increase to 52.5.

-

16:20

Gold: an overview of the market situation

Gold futures fell slightly, closer to the lowest level since January this year, as the strengthening of the American currency has led to a drop in demand for the precious metal as an alternative investment. The dollar is still maintained after the data, which showed that the manufacturing sector in September, the United States has shown the maximum growth over the past 4 years.

"The downward trend in gold is maintained. The dollar is very strong and will continue to put pressure on the precious metals, and the physical demand is insufficient to support prices ", - said economist Wing Fung Precious Metals Peter Fung. Traders relying on technical analysis, suggest that gold prices fall below the psychological level of $ 1,200 per ounce.

Little support gold receives from the geopolitical factor - fighting in Ukraine, Iraq and Syria. Gold is traditionally seen as a safe haven for investment in times of global economic instability. However, attempts to climb up the gold look on the background of the coming end of the program to promote and enhance the Fed rate limited and used for sale.

Demand for gold in the physical markets of Asia generally increased in the fourth quarter due to holidays in China and India, but some customers to delay purchases, waiting for further price reductions. With regard to investment demand, it is also low: the world's largest reserves of the gold-traded exchange-traded fund SPDR Gold Trust Tuesday fell by 1.2 tonnes to 773.45 tonnes - the minimum volume since December 2008. Over the last week the outflow of SPDR Gold Trust was 1.4%. In general, investors are amplified "bearish" sentiment.

The cost of the October gold futures on the COMEX today dropped to 1220.00 dollars per ounce.

-

15:50

U.S. new home sales increased 18% in August

The U.S. Commerce Department released new home sales figures today. New home sales rose 18.0% to a seasonally adjusted annual rate of 504,000 units in August, up from 427,000 units in July. That was the highest level since May 2008.

July's sales were revised from 412,000 units.

Analysts had expected an increase to 432,000.

-

15:30

U.S.: Crude Oil Inventories, September -4.3

-

15:00

U.S.: New Home Sales, August 504 (forecast 432)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2850(E500mn), $1.2915(E308mn), $1.2850 E2.4bn

USD/JPY: Y107.60($300mn), Y108.00($201mn), Y108.50($130mn), Y109.25-50 $1.4bn

GBP/USD: $1.6325(stg156mn), $1.6450(stg240mn)

EUR/GBP: Stg0.7800(E200mn), Stg0.7840(E340mn)

USD/CHF: Chf0.9300($325mn), Chf0.9500($300mn)

AUD/USD: $0.8800(A$227mn), $0.8900(A$200mn), $0.9000-10(A$275mn)

EUR/AUD: A$1.4160(E199mn)

NZD/USD: $0.8250(NZ$282mn)

AUD/NZD: NZ$1.1125(A$297mn)

USD/CAD: C$1.1000($259mn), C$1.1090-95($545mn)

-

14:36

U.S. Stocks open: Dow 17,075.37 +19.50 +0.11%, Nasdaq 4,521.12 +12.43 +0.28%, S&P 1,984.22 +1.45 +0.07%

-

14:28

Before the bell: S&P futures +0.20%, Nasdaq futures +0.22%

U.S. stock futures advanced as investors awaited data estimated to show new-home sales rebounded for the first time in three months.

Global markets:

Nikkei 16,167.45 -38.45 -0.24%

Hang Seng 23,921.61 +84.54 +0.35%

Shanghai Composite 2,343.57 +33.86 +1.47%

FTSE 6,676.88 +0.80 +0.01%

CAC 4,383 +23.65 +0.54%

DAX 9,604.52 +9.49 +0.10%

Crude oil $91.65 (+0.09%)

Gold $1221.80 (-0.02%)

-

14:12

DOW components before the bell

(company / ticker / price / change, % / volume)

Exxon Mobil Corp

XOM

96.05

+0.02%

1K

Verizon Communications Inc

VZ

49.94

+0.06%

4.5K

General Electric Co

GE

26.04

+0.08%

6.1K

Boeing Co

BA

127.50

+0.09%

25.4K

Merck & Co Inc

MRK

60.36

+0.13%

17.8K

Intel Corp

INTC

34.47

+0.15%

14.8K

Johnson & Johnson

JNJ

107.66

+0.19%

0.9K

Microsoft Corp

MSFT

46.65

+0.19%

2.9K

Cisco Systems Inc

CSCO

24.75

+0.20%

2.2M

Home Depot Inc

HD

91.70

+0.23%

1K

Visa

V

213.00

+0.25%

22.9K

Goldman Sachs

GS

185.70

+0.33%

0.2K

AT&T Inc

T

35.38

+0.34%

0.5K

Wal-Mart Stores Inc

WMT

75.89

+0.38%

0.2K

Walt Disney Co

DIS

88.65

+0.39%

0.3K

E. I. du Pont de Nemours and Co

DD

71.04

0.00%

1.0K

Pfizer Inc

PFE

30.05

0.00%

167.6K

McDonald's Corp

MCD

93.49

-0.02%

34.3K

JPMorgan Chase and Co

JPM

60.90

-0.07%

14.2K

Procter & Gamble Co

PG

84.28

-0.19%

1.2K

Chevron Corp

CVX

122.74

-0.26%

439.7K

International Business Machines Co...

IBM

191.10

-0.27%

1K

-

14:00

Belgium: Business Climate, September -7.2 (forecast -7.1)

-

13:00

Orders

EUR/USD

Offers $1.2950, $1.2930/35

Bids $1.2800, $1.2788

GBP/USD

Offers 1.6480/85, 1.6430/35

Bids 1.6300

AUD/USD

Offers $0.9020, $0.9000, $0.8940/60, $0.8900

Bids $0.8825/20, $0.8800, $0.8778/77, $0.8750/57, $0.8700

EUR/JPY

Offers Y141.00, Y140.00

Bids Y139.20, Y138.80, Y138.20

USD/JPY

Offers Y110.00, Y109.50, Y109.00

Bids Y108.40, Y107.48

EUR/GBP

Offers stg0.7900

Bids stg0.7800

-

13:00

Foreign exchange market. European session: the euro traded lower against the U.S. dollar due to the weaker-than-expected Germany’s Ifo business climate index and comments by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index July +0.2% +0.5%

01:30 Australia RBA Financial Stability Review

01:35 Japan Manufacturing PMI (Preliminary) September 52.2 52.5 51.7

06:00 Switzerland UBS Consumption Indicator August 1.66 1.35

08:00 Germany IFO - Business Climate September 106.3 105.9 104.7

08:00 Germany IFO - Current Assessment September 111.1 110.6 110.5

08:00 Germany IFO - Expectations September 101.7 101.3 99.3

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. new home sales. New home sales in the U.S. are expected to increase to 432,000 units in August from 412 units in July.

The euro traded lower against the U.S. dollar due to the weaker-than-expected Germany's Ifo business climate index and comments by the European Central Bank President Mario Draghi. The Ifo business climate index for Germany declined to 104.7 in September from 106.3 in August. That was the fifth successive in five months and the lowest level since April 2013.

Analysts had expected the Ifo business climate index to fall to 105.9.

The European Central Bank (ECB) President Mario Draghi said in a French radio interview on Wednesday that the ECB will keep its monetary policy accommodative for as long as needed to bring inflation to 2% inflation target.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. Switzerland's UBS consumption indicator declined to 1.35 points in August from 1.67 points in July. July's figure was revised up from 1.66 points.

EUR/USD: the currency pair fell to $1.2826

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:00 Belgium Business Climate September -7.3 -7.1

14:00 U.S. New Home Sales August 412 432

16:05 U.S. FOMC Member Narayana Kocherlakota

-

12:05

European stock markets mid session: stocks traded mixed due to weaker-than-expected economic data from Germany

Stock indices traded mixed due to weaker-than-expected economic data from Germany. The Ifo business climate index for Germany declined to 104.7 in September from 106.3 in August. That was the fifth successive in five months and the lowest level since April 2013.

Analysts had expected the Ifo business climate index to fall to 105.9.

The European Central Bank (ECB) President Mario Draghi said in a French radio interview on Wednesday that the ECB will keep its monetary policy accommodative for as long as needed to bring inflation to 2% inflation target.

TNT Express NV dropped 11.5% after the company cut its 2015 profit forecast.

Current figures:

Name Price Change Change %

FTSE 6,674.45 -1.63 -0.02%

DAX 9,604.91 +9.88 +0.10%

CAC 40 4,381.37 +22.02 +0.51%

-

10:47

Asian Stocks close: stocks closed mixed on geopolitical concerns

Asian stock closed mixed on geopolitical concerns. Market participants monitor escalating conflict in the Middle East.

Japanese stocks fell due to stronger yen. The yen rose against the U.S. dollar after comments by Japanese Prime Minister Shinzo Abe. Abe said he would carefully watch the impact of yen weakness on Japanese regional economies.

Japan's preliminary purchasing managers' index declined to 51.7 in September from 52.2 in August, missing expectations for an increase to 52.5.

Indexes on the close:

Nikkei 225 16,167.45 -38.45 -0.24%

Hang Seng 23,921.61 +84.54 +0.35%

Shanghai Composite 2,343.57 +33.86 +1.47%

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD: $1.2850(E500mn), $1.2915(E308mn), $1.2850 E2.4bn

USD/JPY: Y107.60($300mn), Y108.00($201mn), Y108.50($130mn), Y109.25-50 $1.4bn

GBP/USD: $1.6325(stg156mn), $1.6450(stg240mn)

EUR/GBP: Stg0.7800(E200mn), Stg0.7840(E340mn)

USD/CHF: Chf0.9300($325mn), Chf0.9500($300mn)

AUD/USD: $0.8800(A$227mn), $0.8900(A$200mn), $0.9000-10(A$275mn)

EUR/AUD: A$1.4160(E199mn)

NZD/USD: $0.8250(NZ$282mn)

AUD/NZD: NZ$1.1125(A$297mn)

USD/CAD: C$1.1000($259mn), C$1.1090-95($545mn)

-

10:11

Foreign exchange market. Asian session: the New Zealand dollar rose against the U.S. dollar after the better-than-expected trade data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index July +0.2% +0.5%

01:30 Australia RBA Financial Stability Review

01:35 Japan Manufacturing PMI (Preliminary) September 52.2 52.5 51.7

06:00 Switzerland UBS Consumption Indicator August 1.66 1.35

08:00 Germany IFO - Business Climate September 106.3 105.9 104.7

08:00 Germany IFO - Current Assessment September 111.1 110.6 110.5

08:00 Germany IFO - Expectations September 101.7 101.3 99.3

The U.S. dollar traded mixed to lower against the most major currencies. The greenback remained supported by yesterday's U.S. manufacturing purchasing managers' index. The preliminary U.S. manufacturing purchasing managers' index remained unchanged at 57.9 in September, missing expectations for an increase to 58.1.

The New Zealand dollar rose against the U.S. dollar after the better-than-expected trade data. New Zealand's trade deficit fell to NZ$472 million in August from a deficit of NZ$692 million in July, beating forecasts for an increase to NZ$1,125 million in August.

Fonterra Cooperative Group lowered its forecast payout to farmers. The company cut the 2015 forecast payout to $5.30 per kilogram of milk solids from $6/kgMS.

The Australian dollar rose against the U.S. dollar due to solid leading index from Australia. The Conference Board released its leading index for Australia. The index increase 0.5% in July, after a 0.2% gain in June. June's figure revised down from a 0.4% rise.

The Japanese yen traded higher against the U.S. dollar after comments by Japanese Prime Minister Shinzo Abe. Abe said he would carefully watch the impact of yen weakness on Japanese regional economies.

Japan's preliminary purchasing managers' index declined to 51.7 in September from 52.2 in August, missing expectations for an increase to 52.5.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.6412

USD/JPY: the currency pair fell to Y108.45

The most important news that are expected (GMT0):

13:00 Belgium Business Climate September -7.3 -7.1

14:00 U.S. New Home Sales August 412 432

16:05 U.S. FOMC Member Narayana Kocherlakota

-

09:01

Germany: IFO - Expectations , September 99.3 (forecast 101.3)

-

09:00

Germany: IFO - Business Climate, September 104.7 (forecast 105.9)

-

09:00

Germany: IFO - Current Assessment , September 110.5 (forecast 110.6)

-

07:01

Switzerland: UBS Consumption Indicator, August 1.35

-

06:27

Options levels on wednesday, September 24, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2979 (2758)

$1.2946 (2561)

$1.2901 (315)

Price at time of writing this review: $ 1.2851

Support levels (open interest**, contracts):

$1.2819 (3408)

$1.2794 (3140)

$1.2764 (6178)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 55334 contracts, with the maximum number of contracts with strike price $1,3000 (5117);

- Overall open interest on the PUT options with the expiration date October, 3 is 60686 contracts, with the maximum number of contracts with strike price $1,2800 (6178);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from September, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.6700 (3706)

$1.6601 (1414)

$1.6503 (2584)

Price at time of writing this review: $1.6402

Support levels (open interest**, contracts):

$1.6297 (4927)

$1.6198 (1964)

$1.6099 (3349)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 31914 contracts, with the maximum number of contracts with strike price $1,6700 (3706);

- Overall open interest on the PUT options with the expiration date October, 3 is 41020 contracts, with the maximum number of contracts with strike price $1,6300 (4927);

- The ratio of PUT/CALL was 1.29 versus 1.30 from the previous trading day according to data from September, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:00

Nikkei 225 16,181.52 -24.38 -0.15%, Hang Seng 23,858.06 +20.99 +0.09%, Shanghai Composite 2,308.61 -1.11 -0.05%

-

02:35

Japan: Manufacturing PMI, September 51.7 (forecast 52.5)

-