Notícias do Mercado

-

23:52

Japan: Industrial Production (YoY), January +10.6% (forecast +8.8%)

-

23:51

Japan: Retail sales, y/y, January +4.4% (forecast +3.9%)

-

23:50

Japan: Industrial Production (MoM) , January +4.0% (forecast +3.1%)

-

23:35

Japan: National CPI Ex-Fresh Food, y/y, January +1.3% (forecast +1.3%)

-

23:35

Japan: Tokyo CPI ex Fresh Food, y/y, February +0.7% (forecast +0.8%)

-

23:34

Japan: Tokyo Consumer Price Index, y/y, February +1.1% (forecast +1.0%)

-

23:33

Japan: National Consumer Price Index, y/y, January +1.4% (forecast +1.4%)

-

23:32

Japan: Household spending Y/Y, January +1.1% (forecast +0.5%)

-

23:30

Japan: Unemployment Rate, January 3.7% (forecast 3.7%)

-

23:14

Japan: Manufacturing PMI, February 55.5

-

23:14

Currencies. Daily history for Feb 27'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3709 +0,18%

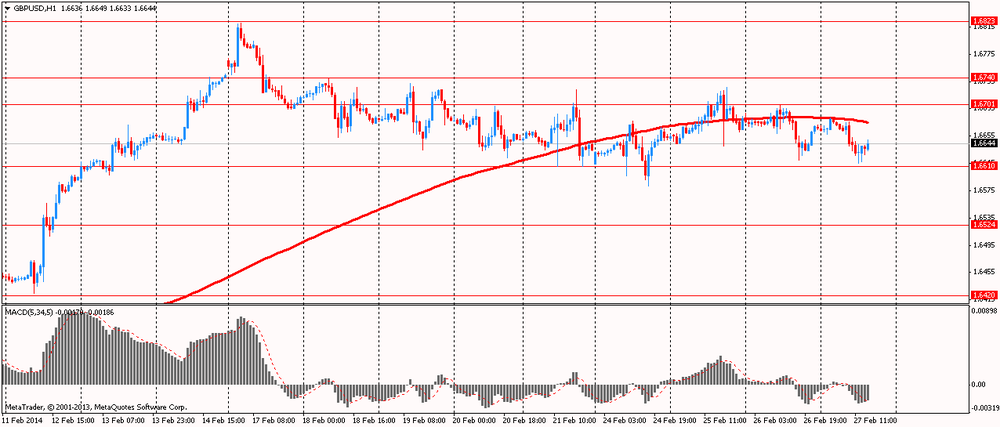

GBP/USD $1,6687 +0,12%

USD/CHF Chf0,8981+0,85%

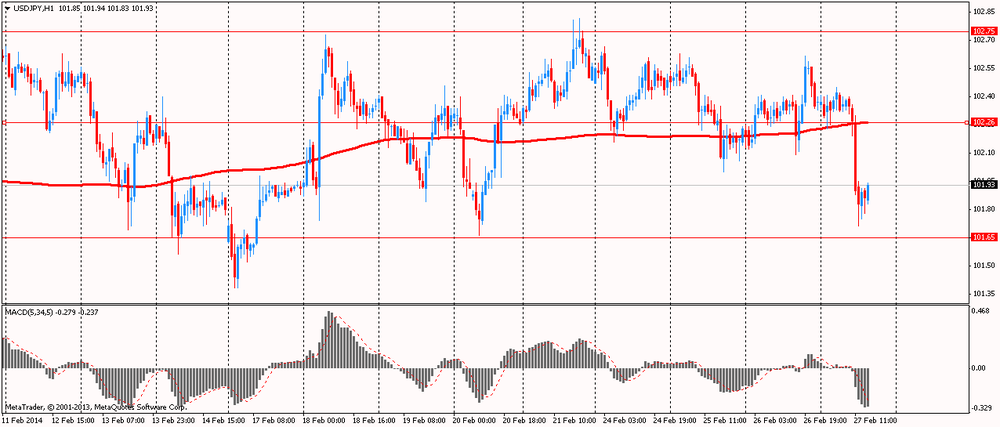

USD/JPY Y102,11 -0,25%

EUR/JPY Y139,99 +0,26%

GBP/JPY Y170,39 -0,13%

AUD/USD $0,8963 -0,03%

NZD/USD $0,8367 +0,66%

USD/CAD C$1,1119 -0,06%

-

23:00

Schedule for today, Friday, Feb 28’2014:

(time / country / index / period / previous value / forecast)

00:00 New Zealand ANZ Business Confidence February 64.1

00:05 United Kingdom Gfk Consumer Confidence February -7 -6

00:30 Australia Private Sector Credit, m/m January +0.5% +0.5%

00:30 Australia Private Sector Credit, y/y January +3.9%

05:00 Japan Housing Starts, y/y January +18.0% +15.3%

07:00 United Kingdom Nationwide house price index February +0.7% +0.6%

07:00 United Kingdom Nationwide house price index, y/y February +8.8% +9.0%

07:00 Germany Retail sales, real adjusted January -2.5% +1.2%

07:00 Germany Retail sales, real unadjusted, y/y January -2.4% +0.1%

07:45 France Consumer spending January -0.1% -0.8%

07:45 France Consumer spending, y/y January +1.4% +1.4%

09:00 Switzerland KOF Leading Indicator February 1.98 2.03

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) February

10:00 Eurozone Unemployment Rate January 12.0% 12.0%

10:00 U.S. FOMC Member Richard Fisher Speaks

13:30 United Kingdom BOE Gov Mark Carney Speaks

13:30 Canada GDP (m/m) December +0.2% -0.2%

13:30 U.S. PCE price index, q/q Quarter IV +3.3% +2.9%

13:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.1%

13:30 U.S. GDP, q/q (Revised) Quarter IV +3.2% +2.6%

14:45 U.S. Chicago Purchasing Managers' Index February 59.6 57.9

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 81.2 81.4

15:00 U.S. Pending Home Sales (MoM) January -8.7% +2.9%

15:15 U.S. FOMC Member Narayana Kocherlakota

15:15 U.S. FOMC Member Jeremy Stein Speaks

15:15 U.S. FOMC Member Charles Plosser Speaks

-

19:20

American focus : the euro rose against the dollar significantly

The euro exchange rate has risen sharply against the U.S. dollar , which was associated with the release of weak U.S. data and Fed chief comments . It is learned that orders for durable goods (products designed for the life of three years or more ) fell to a seasonally adjusted 1% from December . This is the second consecutive decline after orders fell 4.2 % in December. But excluding the volatile transportation category , orders rose by 1.1 % last month , showing the strongest growth since May. Economists forecast that overall orders for durable goods fell 0.7% in January.

Meanwhile, another report showed that the number of initial claims for unemployment benefits rose by 14,000 and amounted to a seasonally adjusted 348,000 in the week ended February 22. The figure for the previous week was revised down to 334,000 from 336,000 . Economists had predicted that jobless drop to 333,000 . The four-week moving average of claims remained unchanged last week at 338,250 . Analyst Department of Labor said that there were no special factors that could affect the data last week.

As for the speech of the Chairman of the Federal Reserve Janet Yellen , she noted : the Fed will continue to reduce the amount of quantitative easing (QE), despite the fact that the recovery of the U.S. labor market is still far from complete. Yellen also reiterated statements made on February 11 at the House of Representatives . Initially, her performance in the Senate Banking Committee to be held on February 13 , but was postponed due to inclement weather .

Furthermore Yellen confirmed that the base rate is likely to be maintained at the current level ( 0-0.25 %) for a long time after the U.S. unemployment rate falls below 6.5% , while maintaining the inflation forecast is not above the level of 2.5 %. She noted that the decision on the rate of reduction of volumes of quantitative easing are not predefined and the FOMC will be taken depending on the assessment of the situation on the labor market and inflation.

The Canadian dollar fell slightly against the U.S. dollar , which was associated with the release of data on the balance of payments . As it became known , the current account deficit widened in Canada in the fourth quarter of 2013 and the fourth largest in history, mainly due to a higher deficit in trade in goods . The current account deficit rose to a seasonally adjusted 16.01 billion Canadian dollars ( $ 14.39 billion ) , compared with a revised deficit in the third quarter at 14.80 billion Canadian dollars . Deficit in the previous quarter originally estimated at 15.47 billion Canadian dollars . Economists had expected a deficit of $ 16.5 billion Canadian dollars .

BMO Capital Markets experts believe that the recent period of large current account deficits provides evidence that the Canadian dollar was overvalued in recent years. The recent weakening of the currency is expected to gradually lead to a smaller current account deficit in 2014.

-

13:48

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y101.85, Y102.10, Y102.40/45, Y102.60, Y102.70, Y103.50, Y104.00

EUR/USD $1.3550, $1.3580, $1.3615, $1.3625, $1.3650, $1.3700, $1.3790

GBP/USD $1.6550, $1.6660, $1.6675/80, $1.6725, $1.6750, $1.6775, $1.6800, $1.6900

EUR/GBP stg0.8150, stg0.8220, stg0.8330

AUD/USD $0.8850, $0.8895, $0.8900, $0.8950, $0.9050, $0.9085, $0.9100

NZD/USD $0.8250

USD/CAD C$1.1005, C$1.1015, C$1.1075, C$1.1090, C$1.1100, C$1.1110, C$1.1125, C$1.1135, C$1.1150, C$1.1170-75-85, C$1.1200, C$1.1240, C$1.1250

-

13:33

U.S.: Durable goods orders ex defense, January -1,8% (forecast -1.2%)

-

13:32

Canada: Current Account, bln, Quarter IV -16 (forecast -16.5)

-

13:30

U.S.: Initial Jobless Claims, February 348 (forecast 333)

-

13:30

U.S.: Durable Goods Orders , January -1.0% (forecast -0.7%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , January +1.1% (forecast -0.1%)

-

13:18

European session: the euro fell

06:45 Switzerland Gross Domestic Product (QoQ) Quarter IV +0.5% +0.4% +0.2%

06:45 Switzerland Gross Domestic Product (YoY) Quarter IV +2.1% Revised From +1.9% +2.0% +1.7%

07:45 France Consumer confidence February 86 86 85

08:15 Switzerland Employment Level Quarter IV 4.20 4.22 1.18

08:55 Germany Unemployment Change February -28 -10 -14

08:55 Germany Unemployment Rate s.a. February 6.8% 6.8% 6.8%

09:00 Eurozone M3 money supply, adjusted y/y January +1.0% +1.2%

10:00 Eurozone Business climate indicator February 0.25 Revised From 0.19 0.24 0.37

10:00 Eurozone Economic sentiment index February 101.0 Revised From 100.9 101.0 101.2

10:00 Eurozone Industrial confidence February -3.8 Revised From -3.9 -4.0 -3.4

13:00 Germany CPI, m/m (Preliminary) February -0.6% +0.6% +0.5%

13:00 Germany CPI, y/y (Preliminary) February +1.3% +1.3% +1.2%

The euro has decreased moderately against the dollar , despite exceeding the forecast of labor market data in Germany. Euro has not responded to report that the German unemployment fell more than expected , but the unemployment rate remained stable in February , data showed on Thursday , Federal Agency of Labour . Number of people out of work fell by 14,000 to 2.914 million in February. Unemployment is projected to drop by was 10,000 . At the same time , the unemployment rate to a seasonally adjusted remained stable at 6.8 percent in February .

In turn , the French consumer confidence index fell slightly in February , offset by the gain recorded in the previous month , as concerns over rising unemployment continue to plague the country , reducing the economic expectations . The consumer confidence index fell to 85 points on January 86, showed a survey conducted by the statistical office INSEE. Economists had expected the index to remain unchanged at 86.

Views of households on the general economic situation in the next 12 months deteriorated sharply in February. Corresponding index decreased by 5 points. Score consumers their financial situation over the next 12 months a little weakened. Households also expect that prices will fall in the coming months , and the corresponding sub-index reached its lowest level since March 2010 , remaining well below the long term average . Rating unemployment situation worsened a second consecutive month in February. The corresponding sub-index rose 3 points, after a gain of 4 points in January . The sub-index remained above its long-term average.

Another report from the European Commission showed that the euro zone economic confidence improved tenth consecutive month in February. Economic sentiment index rose to 101.2 in February from 101 in January. Economists had expected the index was 101 in February compared with the originally voiced 100.9 in January. Eurozone economic confidence slight increase was due to increased confidence in the construction and , to a lesser extent , services , retail and industry. At the same time , the confidence of customers in February deteriorated .

Pressure on the Swiss franc had data on slowing economic growth. Economic growth in Switzerland slowed more than expected in the fourth quarter as exports declined amid weak global demand for chemical and pharmaceutical products. This was announced on Thursday, the State Secretariat for Economic Affairs (SECO). Real GDP growth slowed more than expected to 0.2 percent from 0.5 percent in the third quarter . Projected growth should have been reduced to 0.4 per cent . Economic growth has slowed down the second consecutive quarter .

On the expenditure side , a positive contribution to GDP growth came from consumption and gross fixed capital investment . Final consumption expenditure rose by 0.7 percent, faster than the 0.4 percent expansion posted nazad.Krome quarter , the growth of gross fixed capital investment accelerated to 1.5 percent in the fourth quarter from 0.5 percent in the previous three months.

Exports of goods decreased by 1.7 percent in the fourth quarter due to falling supplies of chemical and pharmaceutical products. On the other hand , imports of goods increased by 1.4 percent. The main growth factors were chemical and pharmaceutical products and equipment .

In annual terms, GDP grew by 1.7 per cent , it is slower than the 2.1 percent expansion registered in the third quarter. Economists had forecast a slight slowdown to 2 percent .

First estimates for the full year , based on quarterly data showed that economic growth accelerated in 2013 against the backdrop of private consumption and investment . GDP grew by 2 percent in 2013 after expanding by 1 percent in 2012 . SECO expects that growth will accelerate to 2.3 percent in 2014.

EUR / USD: during the European session, the pair fell to $ 1.3642

GBP / USD: during the European session, the pair fell to $ 1.6615

USD / JPY: during the European session, the pair dropped to Y101.71

At 13:30 GMT , Canada will release the balance of current account balance of payments for the 4th quarter . At 13:30 GMT the U.S. will release the change in orders for durable goods , including excluding transport equipment in January . At 21:45 GMT New Zealand is to publish the change in volume of building permits issued in January . At 23:30 GMT Japan will change the volume level of household spending , CPI , consumer price index excluding prices for fresh food , the consumer price index excluding prices for food and energy in January , Tokyo CPI , CPI Tokyo prices excluding prices for fresh food , Tokyo CPI excluding prices for food and energy in February. At 23:50 GMT , Japan will release preliminary data on industrial production , changes in retail sales in January .

-

13:00

Germany: CPI, m/m, February +0.5% (forecast +0.6%)

-

13:00

Germany: CPI, y/y , February +1.2% (forecast +1.3%)

-

10:20

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y101.85, Y102.10, Y102.40/45, Y102.60, Y102.70, Y103.50, Y104.00

EUR/USD $1.3550, $1.3580, $1.3615, $1.3625, $1.3650, $1.3700, $1.3790

GBP/USD $1.6550, $1.6660, $1.6675/80, $1.6725, $1.6750, $1.6775, $1.6800, $1.6900

EUR/GBP stg0.8150, stg0.8220, stg0.8330

AUD/USD $0.8850, $0.8895, $0.8900, $0.8950, $0.9050, $0.9085, $0.9100

NZD/USD $0.8250

USD/CAD C$1.1005, C$1.1015, C$1.1075, C$1.1090, C$1.1100, C$1.1110, C$1.1125, C$1.1135, C$1.1150, C$1.1170-75-85, C$1.1200, C$1.1240, C$1.1250

-

10:01

Eurozone: Business climate indicator , February 0.37 (forecast 0.24)

-

10:01

Eurozone: Industrial confidence, February -3.4 (forecast -4.0)

-

10:01

Eurozone: Economic sentiment index , February 101.2 (forecast 101.0)

-

10:00

Eurozone: Economic sentiment index , February 101.2 (forecast 101.0)

-

08:55

Germany: Unemployment Change, February -14 (forecast -10)

-

08:55

Germany: Unemployment Rate s.a. , February 6.8% (forecast 6.8%)

-

08:17

Switzerland: Employment Level, Quarter IV 1.18 (forecast 4.22)

-

07:45

France: Consumer confidence , February 85 (forecast 86)

-

06:46

Switzerland: Gross Domestic Product (QoQ) , Quarter IV +0.2% (forecast +0.4%)

-

06:45

Switzerland: Gross Domestic Product (YoY), Quarter IV +1.7% (forecast +2.0%)

-

06:28

Asian session: The dollar was near a two-week high

00:30 Australia Private Capital Expenditure Quarter IV +3.6% -1.0% -5.2%

The dollar was near a two-week high against a basket of its major peers before Federal Reserve Chair Janet Yellen speaks today amid prospects the central bank will continue to scale down its bond purchases. Yellen said this month the economy has strengthened enough to withstand cuts to monetary stimulus, adding that only a notable change to the outlook would prompt the Fed to slow the pace of tapering its bond purchases. She is scheduled to testify before the Senate Banking Committee today after it was postponed on Feb. 13 owing to a snow storm.

In the U.S., purchases of new homes gained 9.6 percent last month, exceeding the highest estimate of economists surveyed by Bloomberg, figures from the Commerce Department showed. Data due today may show jobless claims fell last week by 1,000 while a decline in durable goods orders eased to 1.7 percent in January from 4.2 percent the prior month, economists forecast.

Australia’s currency dropped after business investment fell the most in four years. Capital spending decreased 5.2 percent in the fourth quarter, the most since September 2009, the Bureau of Statistics said in Sydney today.

EUR / USD: during the Asian session, the pair rose to $ 1.3695

GBP / USD: during the Asian session, the pair rose to $ 1.6680

USD / JPY: on Asian session the pair traded in the range of Y102.25-45

German Chancellor Merkel is set to visit the UK, with a keynote speech to both Houses of Parliament expected. Merkel will also hold a press conference with UK Prime Minister David Cameron. The European data calendar kicks off at 0700GMT, with the release of the German January ILO employment data and the January import price index. French consumer confidence data will be released at 0745GMT. That will be followed at 0800GMT with the release of the Spanish fourth quarter GDP data. Further German data will be released at 0855GMT, when the national February unemployment data will be released. The ECB will release EMU January M3 data at 0900GMT. Further EMU data will cross the wire at 1000GMT, with the release of the February business and consumer survey, along with the economic sentiment and business climate indices.

The first of a series of central bank appearances gets underway at 1230GMT, when ECB Governing Council member Ewald Nowotny is slated to give a speech in Vienna. At 1300GMT, ECB Governing Council member Jens Weidmann will give an address in Frankfurt.More central bank speakers appear from 1630GMT, when Bundesbank Board member Andreas Dombret delivers a speech, in Frankfurt. ECB President Mario Draghi will also deliver a speech in Frankfurt from 1830GMT. At 2015GMT, Atlanta Fed President Dennis Lockhart and Kansas City Fed President Esther George will both speak, in Atlanta.

The US calendar will start at 1300GMT, with the release of the revised January building permits numbers. At 1330GMT, the Jobless claims data for the Feb 22 week will be released, along with the January durable goods data. The IMF will hold a regular press briefing in Washington at 1430GMT. Federal Reserve Chair Janet Yellen testifies to the Senate Banking Committee in Washington from 1500GMT. At 1530GMT, the EIA Natural Gas stock data for the Feb 22 week will cross the wires. The February Kansas City Fed Production survey data will be published at 1600GMT. At 2015GMT, Atlanta Fed President Dennis Lockhart and Kansas City Fed President Esther George will both speak, in Atlanta. Late data sees the release of the US M2 money supply data at 2030GMT. Later, the US will sell $29 billion in 7-year paper.

-

00:30

Australia: Private Capital Expenditure, Quarter IV -5.2% (forecast -1.0%)

-