Notícias do Mercado

-

23:21

Currencies. Daily history for Feb 26'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3685 -0,42%

GBP/USD $1,6667 -0,08%

USD/CHF Chf0,8905 +0,43%

USD/JPY Y102,37 +0,14%

EUR/JPY Y139,63 -0,60%

GBP/JPY Y170,61 +0,06%

AUD/USD $0,8966 -0,58%

NZD/USD $0,8312 -0,19%

USD/CAD C$1,1126 +0,39% -

23:04

Schedule for today, Thursday, Feb 27’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Private Capital Expenditure Quarter IV +3.6% -1.0%

00:30 U.S. FOMC Member Pianalto Speaks

06:45 Switzerland Gross Domestic Product (QoQ) Quarter IV +0.5% +0.4%

06:45 Switzerland Gross Domestic Product (YoY) Quarter IV +1.9% +2.0%

07:45 France Consumer confidence February 86 86

08:15 Switzerland Employment Level Quarter IV 4.20 4.22

08:55 Germany Unemployment Change February -28 -10

08:55 Germany Unemployment Rate s.a. February 6.8% 6.8%

09:00 Eurozone M3 money supply, adjusted y/y January +1.0%

10:00 Eurozone Business climate indicator February 0.19 0.24

10:00 Eurozone Economic sentiment index February 100.9 101.0

10:00 Eurozone Industrial confidence February -3.9 -4.0

13:00 Germany CPI, m/m (Preliminary) February -0.6% +0.6%

13:00 Germany CPI, y/y (Preliminary) February +1.3% +1.3%

13:30 Canada Current Account, bln Quarter IV -15.5 -16.5

13:30 U.S. Durable Goods Orders January -4.3% -0.7%

13:30 U.S. Durable Goods Orders ex Transportation January -1.6% -0.1%

13:30 U.S. Durable goods orders ex defense January -3.7% -1.2%

13:30 U.S. Initial Jobless Claims February 336 333

15:30 U.S. Federal Reserve Chair Janet Yellen Testifies

18:30 Eurozone ECB President Mario Draghi Speaks

18:30 United Kingdom MPC Member Miles Speaks

21:45 New Zealand Building Permits, m/m January +7.6% -15.0%

23:15 Japan Manufacturing PMI February 56.6

23:30 Japan Unemployment Rate January 3.7% 3.7%

23:30 Japan Household spending Y/Y January +0.7% +0.5%

23:30 Japan Tokyo Consumer Price Index, y/y February +0.7% +1.0%

23:30 Japan Tokyo CPI ex Fresh Food, y/y February +0.7% +0.8%

23:30 Japan National Consumer Price Index, y/y January +1.6% +1.4%

23:30 Japan National CPI Ex-Fresh Food, y/y January +1.3% +1.3%

23:50 Japan Industrial Production (MoM) (Preliminary) January +0.9% +3.1%

23:50 Japan Industrial Production (YoY) (Preliminary) January +7.1% +8.8%

23:50 Japan Retail sales, y/y January +2.6% +3.9%

-

19:20

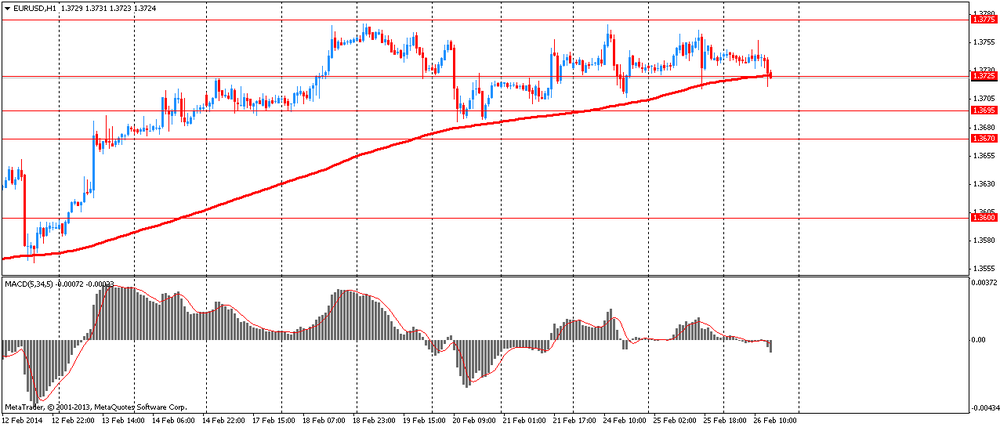

American focus : the euro weakened significantly against the dollar

Rate of the euro fell sharply against the U.S. dollar on risk aversion caused by the political crisis . Experts note that the calm, to mark to market the last session disappears , as Ukraine has captured everyone's attention again . Fears that Russia can make forceful intervention against Ukraine , grow , and the EU , meanwhile, argues that he is ready to act if necessary.

Also, the euro's failure was due to the upbeat U.S. data . Note that sales of newly built homes rose in January, which was an unexpected sign of strength after a long period of weakness in the housing sector . Sales of new single-family homes rose 9.6% to a seasonally adjusted annual rate of 468,000 compared with the previous month , reaching the highest level since July 2008. Result December was revised up to 427,000 . Economists had expected home sales in January to fall to an annual rate of 406,000 . Increase last month was due to sales growth in the Northeast , where they rose by 73.7 % to compensate for the decline of the previous month . The South and West was also recorded growth , but new home sales fell in the Midwest.

Meanwhile, experts say that in view of the approaching meeting of the ECB talk about lowering rates again resumed, putting pressure on the euro. Underway speculation that the ECB is ready to act and considering several options , including lowering interest rates on deposits , which is currently zero.

Pound fell moderately against the dollar , as after GDP data release , investors' attention shifted to the publication of a report on potrebdoveriyu Gfk, house prices Nationwide, and the speech of the Central Bank of Carney .

Recall , the British economy grew in line with preliminary estimates for the fourth quarter and for the full growth in 2013 was weaker preliminary calculations. Such data are the Office for National Statistics (ONS ) . Gross domestic product expanded 0.7 percent in the quarter , measured according to a preliminary estimate published on 28 January. Growth rate slowed down slightly from the 0.8 percent increase in the third quarter . In annual terms, the economy grew by 2.7 percent - growth has been revised downwards to 2.8 percent. In general, the 2013 GDP growth was revised down slightly to 1.8 percent from 1.9 percent.

The yen weakened significantly against the U.S. dollar , approaching to yesterday's lows , due to expectations of output data packet in Japan . The market expects that the national consumer price index ( excluding food prices ) will rise by 1.3 % per annum after the same increase in January, and industrial production - by 3.1 % per annum. Also tomorrow, will report on household spending and retail sales for January. It is expected that spending rose by 0.5 percent , while sales increased by 3.9 percent.

Also influenced the course of trading words board member Koji Ishida BOJ . He noted that because of the tax increase in April economic data in the first half can be very confusing and the Bank of Japan should be very careful when evaluating the economy. " In the first place should not hurry with the expansion of incentive programs " - said Ishida .

Comments Ishida , broadly in line with estimates of the Bank of Japan and may reduce the rumors of further stimulation by the Central Bank this year because of doubts about the economy after the increase in the sales tax .

-

15:30

U.S.: Crude Oil Inventories, February +0.1

-

15:00

U.S.: New Home Sales, January 468 (forecast 406)

-

13:15

European session: the euro fell

07:00 Germany Gfk Consumer Confidence Survey March 8.3 Revised From 8.2 8.3 8.5

07:00 Switzerland UBS Consumption Indicator January 1.81 1.44

09:25 United Kingdom MPC Member Dr Ben Broadbent Speaks

09:30 United Kingdom Business Investment, q/q Quarter IV +2.0% +2.6% +2.4%

09:30 United Kingdom GDP, q/q (Revised) Quarter IV +0.7% +0.7% +0.7%

09:30 United Kingdom GDP, y/y (Revised) Quarter IV +2.8% +2.8% +2.7%

Euro fell against the dollar retreated from highs reached on data potrebdoveriyu in Germany. According to a survey by GfK consumer confidence index in Germany reflected the improvement in March. Consumer confidence index rose to 8.5 points from 8.3 points in February. The index is projected to grow only had 8.3 points from February's initial value of 8.2.

After five successive increases in economic expectations recorded a moderate decline of 3.4 points to 31.9 in February. In contrast to economic expectations , income expectations continued to rise in February to 48.6 from 46.2 . They once again improved slightly from a 13-year high reached in the previous month .

Willingness to buy remained at a high level, and only slightly decreased to 48.9 from 50.0 in January. Propensity to save has not registered any significant changes . Research group GfK predicted real growth of total private consumption by 1.5 percent in 2014.

Later, the pair EUR / USD down at the end of the European session , a fresh daily low. However , the pair remains within the range this week , unable to determine the direction of movement. "The lack of economic data , interest and momentum - that's the motto under which were the last days in the currency markets - analysts TD Securities. - EUR / USD stuck at around 1.37 , and intraday ranges are getting smaller and smaller. EUR looks quite " happy ", in our opinion, and despite the fact that the price is not too eager to test the peaks of the recent range , at the moment there is no obvious catalysts its downward movement . "

The British pound rose moderately against the U.S. dollar after the release of the revised GDP data . The UK economy grew in line with preliminary estimates for the fourth quarter and for the full growth in 2013 was weaker preliminary calculations. Such data are the Office for National Statistics (ONS ) .

Gross domestic product expanded 0.7 percent in the quarterly measurement , according to a preliminary estimate published on 28 January. Growth rate slowed down slightly from the 0.8 percent increase in the third quarter . In annual terms, the economy grew by 2.7 percent - growth has been revised downwards to 2.8 percent. In general, the 2013 GDP growth was revised down slightly to 1.8 percent from 1.9 percent.

With regard to production , mining , including oil and gas production fell by 1.9 percent in the fourth quarter . Total production gained 0.5 percent, compared with a preliminary estimate of 0.7 percent. Construction volumes rose 0.2 percent instead of 0.3 percent fall estimated initially.

Increase in the dominant services sector confirmed at 0.8 percent. Meanwhile , production in agriculture , forestry and fishing fell by a revised 0.1 percent.

Another report from the ONS showed that production in the services sector grew by 3.2 percent in December compared with the previous year . Compared with November services index rose 0.2 percent .

According to preliminary results of the ONS , only gross fixed capital formation increased by £ 1.3 billion or 2.4 percent in the fourth quarter compared with the previous quarter .

At the same time , business investment grew by an estimated 0.8 billion pounds or 2.4 percent compared to the previous quarter and were 8.5 percent higher compared to the fourth quarter of 2012 .

EUR / USD: during the European session, the pair rose to $ 1.3745 , and then fell to $ 1.3716

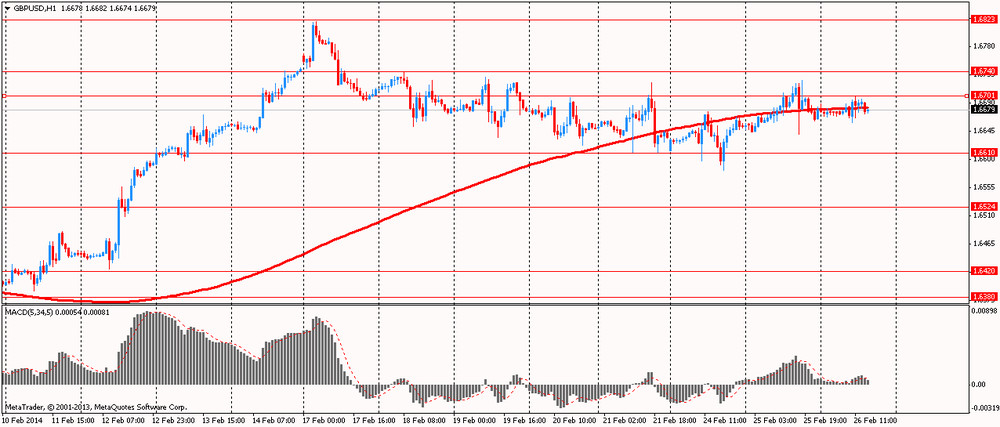

GBP / USD: during the European session, the pair rose to $ 1.6701

USD / JPY: during the European session, the pair rose to Y102.40

At 15:00 GMT the United States will sales in the primary market in January . At 21:45 GMT New Zealand will release the trade balance (for 12 months , from the beginning of the year ) and the trade balance for January.

-

10:30

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y101.75, Y102.00, Y102.25, Y102.35-40-50-55, Y103.00, Y103.20-35

EUR/USD $1.3650, $1.3660, $1.3675, $1.3690, $1.3750, $1.3765, $1.3800, $1.3825-35

GBP/USD $1.6600, $1.6650, $1.6700, $1.6785, $1.6800, $1.6830-50, $1.6905

EUR/GBP stg0.8150, stg0.8200, stg0.8235, stg0.8250, stg0.8300

USD/CHF Chf0.8955

AUD/USD $0.8900, $0.8935, $0.8950-55-65, $0.9000, $0.9050, $0.9100, $0.9120

AUD/JPY Y93.50

NZD/USD $0.8250

USD/CAD C$1.0970, C$1.1025, C$1.1075, C$1.1080, C$1.1100, C$1.1140, C$1.1170, C$1.1200

-

09:32

United Kingdom: GDP, q/q, Quarter IV +0.7% (forecast +0.7%)

-

09:32

United Kingdom: GDP, y/y, Quarter IV +2.7% (forecast +2.8%)

-

07:01

Switzerland: UBS Consumption Indicator, January 1.44

-

07:00

Germany: Gfk Consumer Confidence Survey, March 8.5 (forecast 8.3)

-

06:23

Asian session: Australia’s dollar slid

00:30 Australia Construction Work Done Quarter IV +3.0% Revised From +2.7% +0.4% -1.0%

Australia’s dollar slid against its major peers after iron-ore prices touched a seven-month low while the yuan was near the weakest since July as the People’s Bank of China brought down its reference rate. Iron ore prices for Chinese imports declined for a fifth day to $119.10 a metric ton yesterday, the lowest since July 1, according to data from The Steel Index Ltd. Australia’s statistics bureau said today construction work done in the nation in the fourth quarter fell 1 percent, compared with economist forecasts for a 0.2 percent increase.

A gauge of trader expectations of future currency swings dropped to the lowest in more than a year before Federal Reserve Chair Janet Yellen speaks tomorrow, with investors looking for the central bank’s view on the economic impact of winter weather. Yellen said this month that the economy has strengthened enough to withstand cuts to monetary stimulus, adding that only a notable change to the outlook would prompt the central bank to slow the pace of tapering its bond purchases.

Bookings for durable goods meant to last at least three years are estimated to have decreased for a second straight month in January, a separate Bloomberg survey shows ahead of a Commerce Department report due tomorrow.

EUR / USD: during the Asian session, the pair traded in the range of $1.3735-45

GBP / USD: during the Asian session, the pair traded in the range of $1.6670-90

USD / JPY: during the Asian session, the pair rose to Y102.40

The European calendar gets underway at 0710GMT, with the release of the German March GfK consumer confidence data. Back on the Continent, at 1300GMT, ECB Executive Board member Yves Mersch is scheduled to give a keynote speech at the Luxembourg Renminbi Forum, in Luxembourg. Further European data is set for release at 1600GMT, when the French January registered job seekers data will hit the screens. Across the Atlantic, the US calendar gets underway at 1200GMT, with the release of the MBA Mortgage Index for the Feb 21 week. At 1500GMT, the US January New Home Sales data will cross the wires. The EIA Crude Oil Stocks for the Feb 22 week will be published at 1530GMT. Late appearances from Fed speakers will see Boston Federal Reserve Bank President Eric Rosengren deliver a speech on the economic outlook, in Boston. Just after midnight UK time, Cleveland Federal Reserve Bank President Sandra Pianalto delivers a speech on the history of the Fed, in Wooster, Ohio.

-

01:54

Australia: Construction Work Done, Quarter IV -1.0% (forecast +0.4%)

-

00:34

Australia: Construction Work Done, Quarter IV -1.0% (forecast +0.4%)

-