Notícias do Mercado

-

23:19

Currencies. Daily history for Feb 25'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3742 +0,07%

GBP/USD $1,6681 +0,17%

USD/CHF Chf0,8867 -0,23%

USD/JPY Y102,23 -0,25%

EUR/JPY Y140,47 -0,21%

GBP/JPY Y170,51 -0,10%

AUD/USD $0,9018 -0,19%

NZD/USD $0,8328 0,00%

USD/CAD C$1,1083 +0,22% -

22:59

Schedule for today, Wednesday, Feb 26’2014:

(time / country / index / period / previous value / forecast)00:30 Australia Construction Work Done Quarter IV +2.7% +0.4%

07:00 Germany Gfk Consumer Confidence Survey March 8.2 8.3

07:00 Switzerland UBS Consumption Indicator January 1.81

09:25 United Kingdom MPC Member Dr Ben Broadbent Speaks

09:30 United Kingdom Business Investment, q/q Quarter IV +2.0% +2.6%

09:30 United Kingdom GDP, q/q (Revised) Quarter IV +0.7% +0.7%

09:30 United Kingdom GDP, y/y (Revised) Quarter IV +2.8% +2.8%

15:00 U.S. New Home Sales January 414 406

15:15 United Kingdom BOE Deputy Governor Andrew Bailey Speaks

15:30 U.S. Crude Oil Inventories February +1.0

21:45 New Zealand Trade Balance, mln January 523 230

-

19:20

American focus : the euro rebounded against the dollar

Euro regained most of the lost ground against the dollar, and is now trading on the rise. Previously declined against the dollar on risk aversion , which increased to U.S. data and the prevention of the formation of bubbles Tarullo . Report of the Federal Reserve Bank of Richmond showed that in February the production conditions in the region have deteriorated compared to the previous month . Corresponding index of manufacturing activity fell to 6 points in February compared to 12 in January. Economists had expected the index to rise to 13 points .

Meanwhile, a report from the Conference Board showed that the consumer sentiment index fell to 78.1 from 79.4 in January ( revised from 80.7 ) . Economists had expected a decline to 80.2 . Assess the current situation index rose from 77.3 to 81.7 . This component of the index rose to its highest in nearly six years level . The expectations index fell sharply - from 80.8 to 75.7 .

As for the performances of Daniel Tarullo ( Fed governor in charge of financial regulation ) , he said a small increase in risk in the credit markets , but this does not mean that in response to the central bank should raise interest rates . According Tarullo , the Fed should not exclude raising rates to combat potential "bubble " in asset markets , but it should first try to use and hone their regulatory tools to identify these threats to financial stability. Nevertheless , he added , raising interest rates in response to every little sign of the "bubble " will have significant negative consequences for the economy.

British pound shows growth against the dollar, despite a significant decline earlier. Influenced the course of trading data on the number of approved applications for mortgage loans and the index of retail sales , as well as the representative of the Bank of England comments McCafferty . McCafferty said in an interview with Reuters, that the term of the first rate hike Bank of England will strongly depend on the state of inflation. In the case of acceleration of growth previously possible increase. Yet he stressed that projections suggest the first increase in Q2 . 2015 , and it is quite reasonable. Moreover, McCafferty said: the current growth of the pound does not harm British exports, but if it continues , the Bank of England will be forced to react.

With regard to the published statistics, the number of mortgage approvals in the UK rose more than expected and reached its highest level since September 2007 , the report showed the British Bankers Association (BBA). Number of loans for house purchase rose to 49,972 in January. This is the highest since September 2007 , from 47,086 in December. The expected level was 47,150 .

Another report showed : UK retail sales rose at the fastest pace since June 2012 . These are data from a study of the Confederation of British Industry (CBI). About 45 percent of respondents reported that sales rose compared with the previous year , while 8 percent said they were down . This gave the balance 37 per cent. Retailers expect sales growth at a steady pace in the next month - 43 percent expect growth, 15 percent expect a recession. The balance was 28 percent. Investment intentions for the year ahead given the balance of 17 percent. This is the strongest level since November 2010.

-

15:00

U.S.: Richmond Fed Manufacturing Index, February -6 (forecast 13)

-

15:00

U.S.: Consumer confidence , February 78.1 (forecast 80.2)

-

14:01

U.S.: Housing Price Index, y/y, December +7.7%

-

14:00

U.S.: Housing Price Index, m/m, December +0.8% (forecast +0.4%)

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, December +13.4% (forecast +13.4%)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y102.00/10, Y102.50, Y102.90/95, Y103.00, Y103.30, Y103.45, Y103.60

EUR/USD $1.3600, $1.3660, $1.3675/80, $1.3700, $1.3775, $1.3795, $1.3820

AUD/USD $0.8865, $0.8945, $0.9000

EUR/GBP stg0.8200, stg0.8260

USD/CAD Cad1.1125, Cad1.1155, Cad1.1200

GBP/USD $1.6600, $1.6650

EUR/CHF Chf1.2250

EUR/SEK Sek8.9795

AUD/JPY Y93.35

-

13:16

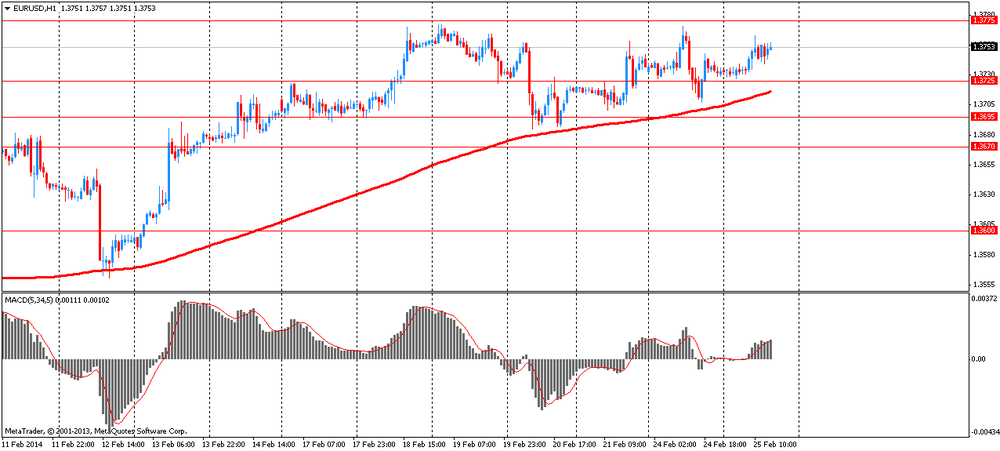

European session: the euro rose

07:00 Germany GDP (QoQ) (Finally) Quarter IV +0.4% +0.4% +0.4%

07:00 Germany GDP (YoY) (Finally) Quarter IV +1.3% +1.3% +1.4%

09:30 United Kingdom BBA Mortgage Approvals January 46.5 47.9 49.9

11:00 United Kingdom CBI retail sales volume balance February 14 15 37

12:45 Eurozone European Commission Economic Growth Forecasts February

The euro rose against the dollar on GDP data in Germany. The German economy grew moderately in late 2013 as originally anticipated at the beginning of this month , final data showed Destatis. Gross domestic product increased by 0.4 percent compared with the previous quarter , which is slightly faster than the expansion of 0.3 percent , which is seen in the third quarter . This was in accordance with the calculation results , published on February 14.

The expenditure breakdown of GDP showed that exports of goods and services grew by 2.6 percent compared with the third quarter . At the same time , imports increased by no more than 0.6 percent. As a result , the balance of exports and imports contributed to the growth by 1.1 percentage points of GDP and is a key economic engine in the fourth quarter . Investments grew by 1.4 percent in quarterly terms. Nevertheless , stocks declined significantly , leading to slower economic growth by 0.8 percentage points. While government spending remained unchanged from the previous quarter, household spending on final consumption decreased slightly by 0.1 percent .

In annual terms with the calendar adjusted GDP grew more than doubled to 1.4 percent from 0.6 percent in the third quarter. In addition, the price-adjusted GDP grew by 1.3 percent compared with 1.1 percent in the previous period . Results in the fourth quarter correspond to preliminary estimates .

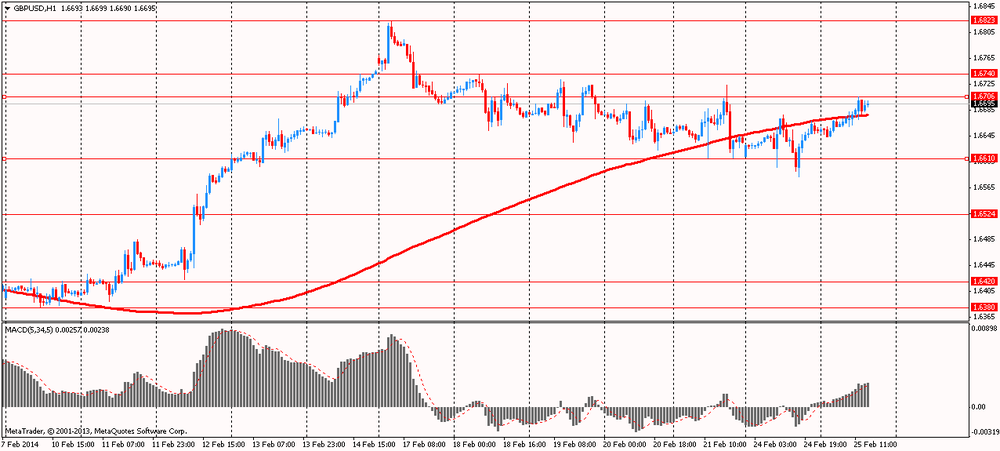

The British pound rose against the U.S. dollar , supported by data and comments of the Bank of England McCafferty . McCafferty said in an interview with Reuters on Tuesday that the first term of the Bank of England rate hike will depend greatly on the state of inflation. In the case of acceleration of its growth may increase more than previously . Yet he stressed that the projections assume the first increase in Q2 . 2015 , and it is quite reasonable. Moreover, McCafferty said that the current growth of the pound does not harm British exports, but if it continues , the Bank of England will be forced to react.

With regard to the published statistics, the number of mortgage approvals in the UK rose by more than expected , and reached its highest level since September 2007 , data showed the British Bankers Association (BBA). Number of loans for house purchase rose to 49,972 in January , the highest level since September 2007 , from 47,086 in December. The expected level was 47,150 . Including re- mortgages , general statements made 82,151 compared to 78,584 a month ago.

Another report showed that UK retail sales rose at the fastest pace since June 2012 . These are the findings of research trends distributive trade from the Confederation of British Industry (CBI). About 45 percent of respondents reported that sales rose compared with the previous year , while 8 percent said they were down . This gave the balance 37 per cent. Retailers expect sales to grow at a steady pace in the next month - 43 percent expect growth, 15 percent expect a recession. The balance was 28 percent. Investment intentions for the year ahead given the balance of 17 percent, which is the strongest level since November 2010 . Retailers also expect that their overall business situation will improve over the next three months.

EUR / USD: during the European session, the pair rose to $ 1.3763

GBP / USD: during the European session, the pair rose to $ 1.6706

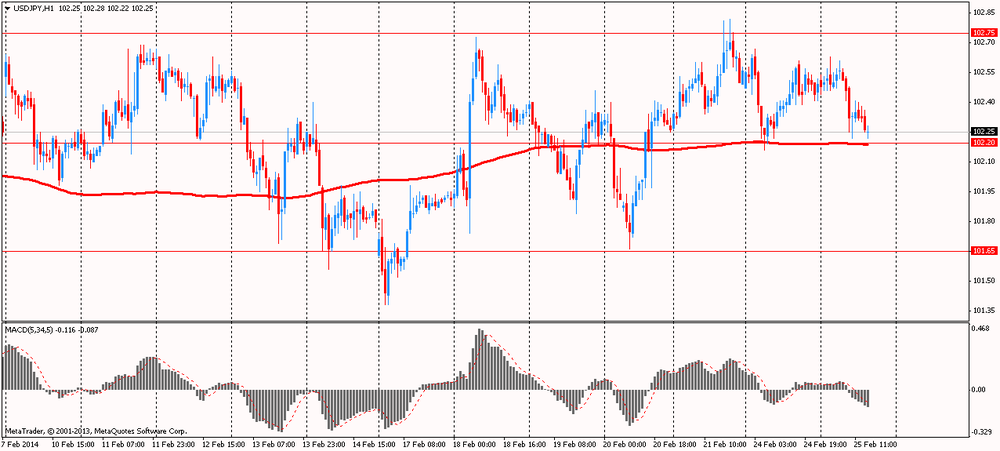

USD / JPY: during the European session, the pair fell to Y102.22

In the U.S. at 14:00 GMT will index of home prices in 20 major cities of S & P / Case-Shiller, national composite house price index S & P / CaseShiller December to 15:00 GMT - indicator of consumer confidence for February at 21:30 GMT - the change in volume of crude oil , according to the API. Chairman of the Board of Governors Federal Reserve Janet Yellen suggests .

-

13:00

Orders

EUR/USD

Offers $1.3900, $1.3850/60, $1.3790/800, $1.3770/75

Bids $1.3705/695, $1.3660/50

GBP/USD

Offers $1.6795/800, $1.6770/80, $1.6720/25

Bids $1.6605/00, $1.6580, $1.6555/50

AUD/USD

Offers $0.9150, $0.9100, $0.9045/50

Bids $0.9000, $0.8950, $0.8925/20, $0.8910/00

EUR/GBP

Offers stg0.8300/05

Bids stg0.8225/20, stg0.8205/195, stg0.8180, stg0.8150

EUR/JPY

Offers Y142.45/50, Y142.00, Y141.50, Y141.00

Bids Y140.55/50, Y140.20, Y140.00, Y139.55/50

USD/JPY

Offers Y103.50, Y102.90/00, Y102.65/70

Bids Y102.00, Y101.80, Y101.50

-

11:00

United Kingdom: CBI retail sales volume balance, February 37 (forecast 15)

-

10:33

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y102.00/10, Y102.50, Y102.90/95, Y103.00, Y103.30, Y103.45, Y103.60

EUR/USD $1.3600, $1.3660, $1.3675/80, $1.3700, $1.3775, $1.3795, $1.3820

AUD/USD $0.8865, $0.8945, $0.9000

EUR/GBP stg0.8200, stg0.8260

USD/CAD Cad1.1125, Cad1.1155, Cad1.1200

GBP/USD $1.6600, $1.6650

EUR/CHF Chf1.2250

EUR/SEK Sek8.9795

AUD/JPY Y93.35

-

10:00

Asia Pacific stocks close

Asian stocks rose, with the regional benchmark index on course for the highest close in a month, as telecommunication and health-care companies led gains. Chinese shares tumbled, led by property firms.

Nikkei 225 15,051.6 +213.92 +1.44%

S&P/ASX 200 5,433.84 -6.38 -0.12%

Shanghai Composite 2,034.22 -42.47 -2.04%

Naver Corp. surged 7.5 percent in Seoul as people with knowledge of the matter said a stake in the company’s Line Corp. mobile-messaging service is being sought by SoftBank Corp., which jumped 4.1 percent in Tokyo.

Ramsay Health Care Ltd. rose 6.7 percent in Sydney after raising its profit forecast.

HSBC Holdings Plc fell 2.4 percent in Hong Kong after profit at Europe’s largest bank missed estimates as a cost-cutting drive fell short of targets and revenue shrank.

-

09:30

United Kingdom: BBA Mortgage Approvals, January 49.9 (forecast 47.9)

-

07:00

Germany: GDP (QoQ), Quarter IV +0.4% (forecast +0.4%)

-

07:00

Germany: GDP (YoY), Quarter IV +1.4% (forecast +1.3%)

-

06:27

Asian session: The euro remained lower

02:00 China Leading Index January +0.4% +1.2%

02:00 New Zealand Expected Annual Inflation 2y from now Quarter I +2.3% +2.3%

05:00 Japan Small Business Confidence February 51.3 50.6

The euro remained lower against most of its major peers from yesterday on bets the European Central Bank may add to monetary stimulus next week.

ECB Executive Board member Peter Praet signaled policy makers have tools ready to maintain price stability. Praet, the central bank’s chief economist, said in an interview with Portugal’s Expresso published on the central bank’s website that “weakness in price development is extending to the medium term.”

Council member Jens Weidmann, who heads Germany’s Bundesbank, signaled more openness to pausing sterilization of the ECB’s now-defunct bond-purchase Securities Markets Program, saying in a Feb. 23 interview that he “wouldn’t rule out” such a move.

In the U.S., the S&P/Case-Shiller index of property prices probably climbed 13.4 percent in December from a year ago after a 13.7 percent increase in the year ended November, according to the median estimate of economists surveyed by Bloomberg before the data today.

Norway’s krone and the Australian and New Zealand dollars led monthly gains amid higher commodity prices.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3725-40

GBP / USD: during the Asian session, the pair rose to $ 1.6670

USD / JPY: on Asian session the pair traded in the range of Y102.45-65

The European calendar gets underway at 0700GMT, with the release of the German Maastricht debt data and the Q4 GDP numbers. The final GDP data is seen unchanged on the quarter at 0.4%. There is a raft of French data at 0745GMT, when the February business climate index is released, along with the February manufacturing and services sentiment surveys. At the same time, the French January housing starts numbers will cross the wires. At 0800GMT, Spain's January PPI data will be published. Italian data due at 0900GMT, with the release of the December retail sales data and the February ISTAT consumer confidence numbers. The sovereign issuance calendar sees auction on both sides of the Atlantic Tuesday. -

02:02

China: Leading Index , January +1.2%

-

02:02

New Zealand: Expected Annual Inflation 2y from now, Quarter I +2.3%

-