Notícias do Mercado

-

23:19

Currencies. Daily history for Feb 24'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3733 -0,03%

GBP/USD $1,6653 +0,10%

USD/CHF Chf0,8887 +0,14%

USD/JPY Y102,49 -0,06%

EUR/JPY Y140,77 -0,07%

GBP/JPY Y170,68 +0,05%

AUD/USD $0,9035 +0,77%

NZD/USD $0,8328 +0,61%

USD/CAD C$1,1059 -0,63%

-

22:59

Schedule for today, Tuesday, Feb 25’2014:

(time / country / index / period / previous value / forecast)

02:00 China Leading Index January +0.4%

02:00 New Zealand Expected Annual Inflation 2y from now Quarter I +2.3%

05:00 Japan Small Business Confidence February 51.3

07:00 Germany GDP (QoQ) (Finally) Quarter IV +0.4% +0.4%

07:00 Germany GDP (YoY) (Finally) Quarter IV +1.3% +1.3%

09:30 United Kingdom BBA Mortgage Approvals January 46.5 47.9

11:00 United Kingdom CBI retail sales volume balance February 14 15

12:45 Eurozone European Commission Economic Growth Forecasts February

14:00 U.S. Housing Price Index, m/m December +0.1% +0.4%

14:00 U.S. Housing Price Index, y/y December +7.6%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y December +13.7% +13.4%

15:00 U.S. Richmond Fed Manufacturing Index February 12 13

15:00 U.S. Consumer confidence February 80.7 80.2

15:10 U.S. FOMC Member Tarullo Speaks

21:30 U.S. API Crude Oil Inventories February -0.5

-

19:20

American focus : the euro rebounded against the dollar

Rate of the euro regained some lost ground earlier against the dollar, while returning to the opening level . Support Eurocurrency had weak U.S. data . As it became known , a preliminary index of business activity in the service sector fell to 52.7 in February from 56.7 in January. This shows that the increase in activity has slowed, but continues. Preliminary data based on approximately 85 % of total respondents. Values above 50 indicate growth in activity compared with the previous month , lower than 50 - reducing activity

We also learned that improving conditions for business from producers in the Dallas Fed region this month almost was not. The index of overall economic activity from the Dallas Fed declined from February to 0.3 against 3.8 in January. Index forecast companies dropped from 15.9 to 3.4 .

Values below 0 indicate contraction in activity , and above - its expansion. Despite the slowdown in total, sub-indices show that the improvement continues .

Pound is trading slightly higher against the dollar , which is associated with the comments and the Bank of England published data . Recall that the head of the Bank of England Governor Mark Carney said the new phase of policy intentions should give further assurance that officials will support the economic recovery . Carney said that the revised policy system further intentions reflects the need for more complex set of judgments than was necessary in the first stage , when the link was only on unemployment . Bank changed its approach after unemployment fell faster than expected officials to the 7 percent threshold for considering an increase in the interest rate.

As for the data , they showed that sentiment among UK service sector companies have improved to all-time high in the three months to February, while the sector recorded growth of the third quarter in a row . These are the results of a survey published by the Confederation of British Industry (CBI). The latest survey of the services sector of the CBI showed that confidence among service providers in the consumer sector , as well as the professional services sector grew at the fastest pace since the management of records about fifteen years ago . Optimistic attitude reflects a remarkable recovery in business volumes , which rose the most since 2005, which resulted in the first ever recorded growth of profitability since 2007.

Also forecast business volumes grew strongest pace in a decade , with the majority of the surveyed firms stated that they intend to raise the number of staff in the next quarter .

-

15:00

Belgium: Business Climate, February -4.0 (forecast -5.4)

-

13:40

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.20, Y102.50

EUR/USD $1.3675, $1.3800

AUD/USD $0.8900, $0.8935, $0.9125, $0.9150

EUR/GBP stg0.8200, stg0.8225

USD/CAD Cad1.1100

GBP/USD $1.6600, $1.6675

USD/CHF Chf0.8965

NZD/USD NZ$0.8250, NZ$0.8300

EUR/CHF Chf1.2175, Chf1.2200, Chf1.2260

-

13:20

European session: the euro fell

09:00 Germany IFO - Business Climate February 110.6 110.7 111.3

09:00 Germany IFO - Current Assessment February 112.4 112.8 114.4

09:00 Germany IFO - Expectations February 108.9 108.1 108.3

10:00 Eurozone Harmonized CPI January +0.3% -1.1% -1.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) January +0.7% +0.7% +0.8%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y January +0.7% +0.8% +0.8%

Euro fell against the dollar after rising data on the business climate in Germany. German business climate indicator unexpectedly strengthened in February to the highest level since July 2011 , despite the drop in expectations. These results are presented on Monday institute IFO. Business climate index rose to 111.3 from 110.6 in January. According to the average expectations index was slightly rise to the level of 110.7 . In addition, the current conditions index improved to 114.4 in February from 112.4 a month ago. Result was higher than expected level of 112.8 . On the other hand , the expectations index fell to 108.3 in February from 108.9 in January. The result was predicted to drop to 108.1 .

Also today published the final data on inflation in the eurozone. Consumer prices in the euro area grew at a faster pace in January than previously thought , but inflation remained unchanged compared to December showed the revised data published by Eurostat on Monday . Harmonized index of consumer prices (HICP) rose by 0.8 percent year on year in January. The result was unchanged compared with the growth rate in December. Preliminary estimates were at the level of growth of 0.7 percent in January .

At the same time , core inflation, which excludes energy , food, alcohol and tobacco, rose to 0.8 percent from 0.7 percent in December , according to initial estimates . Inflation has remained below the target level of the European Central Bank " below but close to 2 percent," the twelfth consecutive month.

In January, prices for foodstuffs , alcohol and tobacco rose 1.7 percent, while energy prices fell 1.2 percent. The cost of non-energy industrial goods increased by 0.2 percent, and prices of services expanded by 1.2 percent. On a monthly basis, consumer prices recorded a decline of 1.1 percent in January .

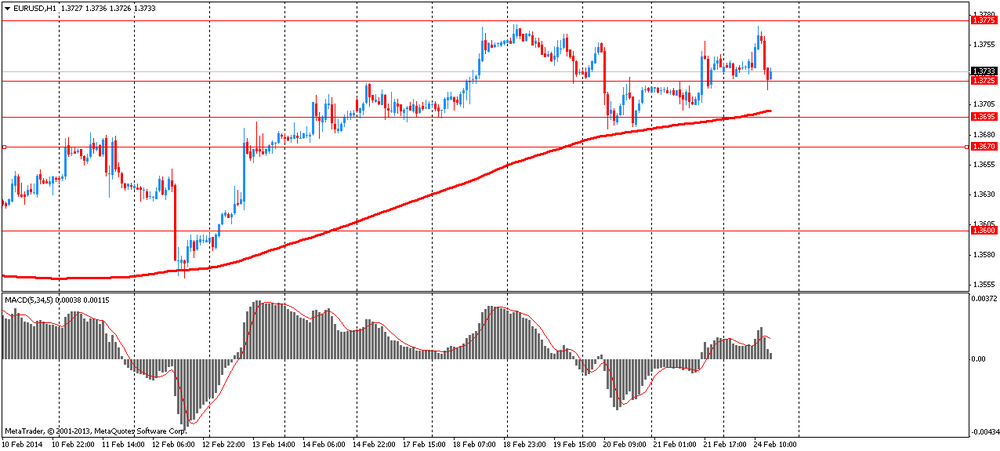

EUR / USD: during the European session, the pair rose to $ 1.3771 , and then fell to $ 1.3718

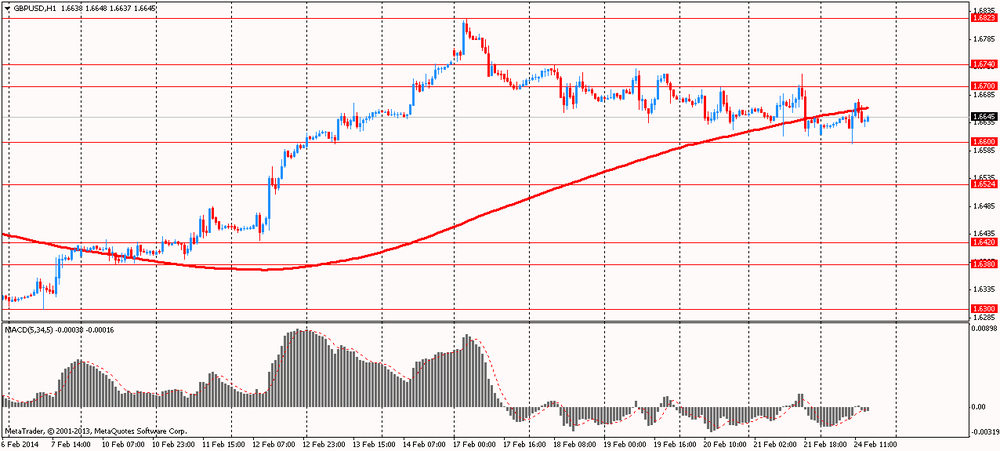

GBP / USD: during the European session, the pair fell to $ 1.6597 , but then rose to $ 1.6677

USD / JPY: during the European session, the pair rose to Y102.51

At 14:00 GMT in Belgium will index business sentiment for February.

-

13:00

Orders

EUR/USD

Offers $1.3850/60, $1.3820, $1.3770/75

Bids $1.3705/00, $1.3660/50

GBP/USD

Offers $1.6795/800, $1.6770/80, $1.6720/25, $1.6700

Bids $1.6580, $1.6555/50

AUD/USD

Offers $0.9100, $0.9045/50, $0.9015/20, $0.8995/00

Bids $0.8925/20, $0.8910/00, $0.8850

EUR/GBP

Offers stg0.8370/80, stg0.8300/05

Bids stg0.8205/195, stg0.8180, stg0.8150

EUR/JPY

Offers Y142.45/50, Y142.00, Y141.50

Bids Y140.55/50, Y140.20, Y140.00, Y139.60/50

USD/JPY

Offers Y103.50, Y102.80/00, Y102.65/70

Bids Y102.00, Y101.80, Y101.50

-

10:25

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.20, Y102.50

EUR/USD $1.3675, $1.3800

AUD/USD $0.8900, $0.8935, $0.9125, $0.9150

EUR/GBP stg0.8200, stg0.8225

USD/CAD Cad1.1100

GBP/USD $1.6600, $1.6675

USD/CHF Chf0.8965

NZD/USD NZ$0.8250, NZ$0.8300

EUR/CHF Chf1.2175, Chf1.2200, Chf1.2260

-

10:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, January +0.8% (forecast +0.8%)

-

10:00

Eurozone: Harmonized CPI, January -1.1% (forecast -1.1%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, January +0.8% (forecast +0.7%)

-

09:00

Germany: IFO - Business Climate, February 111.3 (forecast 110.7)

-

09:00

Germany: IFO - Current Assessment , February 114.4 (forecast 112.8)

-

09:00

Germany: IFO - Expectations , February 108.3 (forecast 108.1)

-

06:24

Asian session: The euro slid

The euro slid from a one-month high against the yen after European Central Bank President Mario Draghi reiterated a willingness to act if the outlook for inflation deteriorates. Data due for release today and on Feb. 28 are estimated to show consumer-price gains in Europe held at less than half the ECB’s target of 2 percent. Consumer prices rose an annual 0.7 percent in January after a 0.8 percent gain the previous month, the European Union’s statistics office will confirm today, according to the median estimate in a Bloomberg News survey of economists. A Feb. 28 initial estimate will probably show prices gained 0.7 percent again in February, signaling the fifth consecutive reading of less than 1 percent.

In the U.S., data today may show the Chicago Fed national index, a weighted average of 85 economic indicators, fell to minus 0.2 in January from 0.16 a month earlier, according to a Bloomberg survey. A reading below zero indicates below-trend growth in the national economy.

The Japanese currency strengthened against all 16 major counterparts as Chinese stocks led declines in Asian shares, boosting haven demand.

Australia’s dollar fell after iron-ore prices touched a week-low and amid reports of property-lending curbs in China. Iron ore declined to $122.40 a metric ton on Feb. 21, the lowest since Feb. 13, according to data from The Steel Index Ltd. Total inventory of the steelmaking material at Chinese ports monitored by Shanghai Steelhome Information Technology Co. climbed to 100.9 million tons in the week ended Feb. 21, the highest since at least March 2010.

EUR / USD: during the Asian session the pair fell to $ 1.3725

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6625-45

USD / JPY: on Asian session the pair fell to Y102.15

A light domestic calendar for the UK with focus expected to be on Germany Ifo (0900GMT) and EZ CPI (1000GMT).

-