Notícias do Mercado

-

23:44

Commodities. Daily history for Feb 24’2014:

(raw materials / closing price /% change)Gold $1,337.6 +14.90 +1.13%

ICE Brent Crude Oil $109.69 +0.84 +0.76%

NYMEX Crude Oil $102.85 +0.35 +0.34%

-

23:25

Stocks. Daily history for Feb 24’2014:

(index / closing price / change items /% change)

Nikkei 14,837.68 -27.99 -0.19%

Hang Seng 22,388.56 -179.68 -0.80%

Shanghai Composite 2,076.69 -37.01 -1.75%

S&P 500 1,847.61 +11.36 +0.62%

NASDAQ 4,292.97 +29.56 +0.69%

Dow 16,207.14 +103.84 +0.64%

FTSE 6,865.86 +27.80 +0.41%

CAC 4,419.13 +38.07 +0.87%

DAX 9,708.94 +51.99 +0.54%

-

23:19

Currencies. Daily history for Feb 24'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3733 -0,03%

GBP/USD $1,6653 +0,10%

USD/CHF Chf0,8887 +0,14%

USD/JPY Y102,49 -0,06%

EUR/JPY Y140,77 -0,07%

GBP/JPY Y170,68 +0,05%

AUD/USD $0,9035 +0,77%

NZD/USD $0,8328 +0,61%

USD/CAD C$1,1059 -0,63%

-

22:59

Schedule for today, Tuesday, Feb 25’2014:

(time / country / index / period / previous value / forecast)

02:00 China Leading Index January +0.4%

02:00 New Zealand Expected Annual Inflation 2y from now Quarter I +2.3%

05:00 Japan Small Business Confidence February 51.3

07:00 Germany GDP (QoQ) (Finally) Quarter IV +0.4% +0.4%

07:00 Germany GDP (YoY) (Finally) Quarter IV +1.3% +1.3%

09:30 United Kingdom BBA Mortgage Approvals January 46.5 47.9

11:00 United Kingdom CBI retail sales volume balance February 14 15

12:45 Eurozone European Commission Economic Growth Forecasts February

14:00 U.S. Housing Price Index, m/m December +0.1% +0.4%

14:00 U.S. Housing Price Index, y/y December +7.6%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y December +13.7% +13.4%

15:00 U.S. Richmond Fed Manufacturing Index February 12 13

15:00 U.S. Consumer confidence February 80.7 80.2

15:10 U.S. FOMC Member Tarullo Speaks

21:30 U.S. API Crude Oil Inventories February -0.5

-

20:00

Dow +175.02 16,278.32 +1.09% Nasdaq +45.85 4,309.26 +1.08% S&P +19.7 1,855.95 +1.07%

-

19:20

American focus : the euro rebounded against the dollar

Rate of the euro regained some lost ground earlier against the dollar, while returning to the opening level . Support Eurocurrency had weak U.S. data . As it became known , a preliminary index of business activity in the service sector fell to 52.7 in February from 56.7 in January. This shows that the increase in activity has slowed, but continues. Preliminary data based on approximately 85 % of total respondents. Values above 50 indicate growth in activity compared with the previous month , lower than 50 - reducing activity

We also learned that improving conditions for business from producers in the Dallas Fed region this month almost was not. The index of overall economic activity from the Dallas Fed declined from February to 0.3 against 3.8 in January. Index forecast companies dropped from 15.9 to 3.4 .

Values below 0 indicate contraction in activity , and above - its expansion. Despite the slowdown in total, sub-indices show that the improvement continues .

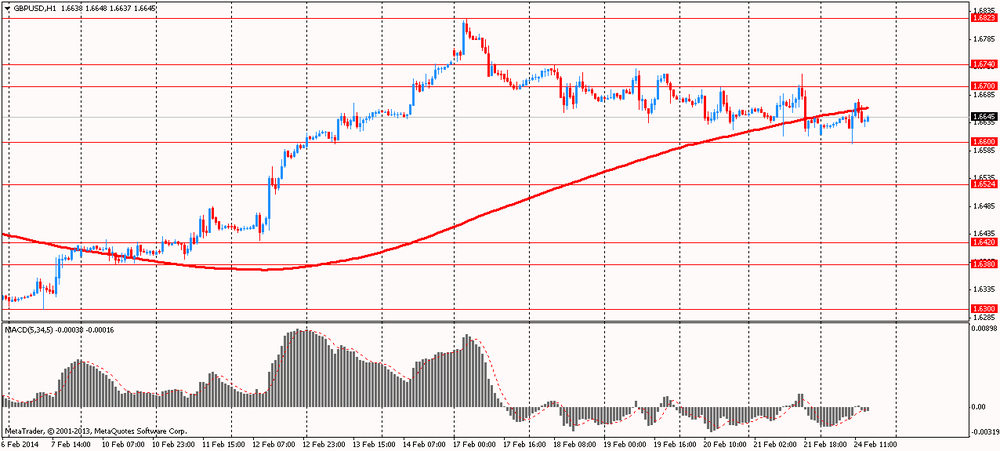

Pound is trading slightly higher against the dollar , which is associated with the comments and the Bank of England published data . Recall that the head of the Bank of England Governor Mark Carney said the new phase of policy intentions should give further assurance that officials will support the economic recovery . Carney said that the revised policy system further intentions reflects the need for more complex set of judgments than was necessary in the first stage , when the link was only on unemployment . Bank changed its approach after unemployment fell faster than expected officials to the 7 percent threshold for considering an increase in the interest rate.

As for the data , they showed that sentiment among UK service sector companies have improved to all-time high in the three months to February, while the sector recorded growth of the third quarter in a row . These are the results of a survey published by the Confederation of British Industry (CBI). The latest survey of the services sector of the CBI showed that confidence among service providers in the consumer sector , as well as the professional services sector grew at the fastest pace since the management of records about fifteen years ago . Optimistic attitude reflects a remarkable recovery in business volumes , which rose the most since 2005, which resulted in the first ever recorded growth of profitability since 2007.

Also forecast business volumes grew strongest pace in a decade , with the majority of the surveyed firms stated that they intend to raise the number of staff in the next quarter .

-

18:20

European stock close

European stocks advanced to a six-year high as companies from Scania AB to Dixons Retail Plc rallied amid heightened mergers-and-acquisitions activity, outweighing a drop in HSBC (HSBA) Holdings Plc which posted worse-than-estimated profit.

The Stoxx Europe 600 Index rose 0.6 percent to 338.19 at the close of trading, its highest level since Jan. 14, 2008. The benchmark climbed 0.8 percent last week to its highest level since January 2008 as companies from Meda AB to Valeo SA posted better-than-forecast earnings.

In Germany, a report showed the Ifo Institute’s business climate index, based on a survey of 7,000 executives, unexpectedly rose to 111.3 in February from 110.6 a month earlier. Economists had predicted a drop to 110.5 this month.

National benchmark indexes climbed in 16 of the 18 western European markets.

FTSE 100 6,865.86 +27.80 +0.41% CAC 40 4,419.13 +38.07 +0.87% DAX 9,708.94 +51.99 +0.54%

Scania surged 32 percent to 194.5 kronor. Volkswagen, which controls a majority of Scania’s shares and 89.2 percent of voting rights, said late Feb. 21 that it is offering 200 kronor per share for the remaining stock. Preferred shares of Volkswagen fell 6.5 percent to 187.90 euros, its biggest drop in a year. Europe’s largest automaker also reported fourth-quarter earnings that missed estimates.

Dixons rose 6.7 percent to 50.3 pence and Carphone Warehouse climbed 8.8 percent to 333 pence. The two companies said in a joint statement they are in preliminary talks for a merger. Betaville blog reported earlier, without citing sources, that they are discussing an all-share merger.

Bunzl Plc jumped 6.9 percent to 1,585 pence, its highest price since at least 1988, after saying full-year earnings excluding currency swings rose 15 percent to 82.4 pence per share. That beat analysts’ projections for 78.5 pence a share.

HSBC fell 2.8 percent to 635.7 pence. Europe’s largest bank reported 2013 pretax profit of $22.6 billion, trailing the $24.6 billion median estimate.

PostNL NV tumbled 20 percent to 3.44 euros, its biggest drop in 13 months, after the Dutch mail service reported a full-year net loss of 170 million euros. Analysts on average had projected a loss of 156 million euros.

RSA Insurance Group Plc retreated 3.7 percent to 97.5 pence after the insurer said it is considering a share sale as a way of replenishing capital. The company may say this week, when it reports full-year results, that it will raise as much as 800 million pounds, the Sunday Times reported yesterday.

-

17:00

European stock close: FTSE 100 6,865.86 +27.80 +0.41% CAC 40 4,419.13 +38.07 +0.87% DAX 9,708.94 +51.99 +0.54%

-

16:40

Oil: an overview of the market situation

Oil prices rose modestly today , resisting the sharp decline in prices for some other risk assets on news of further production cuts in Africa and expectations revival of growth in demand for oil.

The data showed that Libyan oil production fell even more over the weekend , falling to 230,000 barrels per day after a new protest that forced the mine to close El Shararah . Before the start of the protests across the country in the middle of last year, Libyan oil production was at 1.4 million barrels per day .

"While the situation in Libya remains volatile , world oil prices will rise ," said

The oil market was also supported by a fairly optimistic G20 meeting of heads in Sydney. Finance ministers from the G20 agreed to implement policies that will increase global GDP by more than $ 2 trillion in the next five years. This amount is equivalent to the increase in global GDP by 2% compared with an expected growth in the next five years . Such a policy should also create tens of millions of jobs.

Also, higher prices helped German data , which showed that the business climate indicator unexpectedly strengthened in February to the highest level since July 2011 , despite the drop in expectations. These results are presented on Monday institute IFO. Business climate index rose to 111.3 from 110.6 in January. According to the average expectations index was slightly rise to the level of 110.7 . In addition, the current conditions index improved to 114.4 in February from 112.4 a month ago. The result was higher than expected level of 112.8 . On the other hand , the expectations index fell to 108.3 in February from 108.9 in January ( forecast he had to go down to 108.1 ) .

Investors also watched the global political tensions and the potential for further disruptions in oil exports . At the same time, investors remained concerned about the overall economic situation in China, which , according to experts , this year will be the largest consumer of raw materials . According to the newspaper Shanghai Securities News, China Industrial Bank and some other banks have restricted lending to the real estate sector and related industries , such as steel and cement .

April futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 102.81 per barrel on the New York Mercantile Exchange (NYMEX).

April futures price for North Sea Brent crude oil mixture rose 24 cents to $ 110.43 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices have risen markedly today , approaching to four-month high , which was due to the increasing concern among investors about the pace of the U.S. economic recovery and growth in China .

Weak U.S. data on industrial production and employment, and the slowdown in residential property prices in China last month that recorded for the first time in 14 months , increased concerns about the growth in the major economies of the world , which is reflected in the price of gold, which is often seen as insurance in difficult times .

Recall that the price of the precious metal rose more than 9 percent this year , after a 28 percent drop in 2013 , thus ending the 12-year growth.

"Short-term sentiment for gold is quite positive, but to provide additional momentum to overcome worth $ 1,340 per ounce ," said the head of Sharps Pixley Ross Norman.

Hedge funds and money managers increased their net long positions in gold futures and options in the week that ended on February 18 , after prices broke important resistance level at $ 1,300 per ounce.

Margins on gold bars in Hong Kong remained at last week's $ 1.30-1.70 per ounce to the spot price in London.

Political tensions in Thailand has not yet led to the growth of purchases. Prime Minister Yingluck Shinawatra left Bangkok and is located 150 kilometers from the capital , reported in its administration , without specifying its location . Margins in Singapore , gold trading center in Southeast Asia, also remained at the level of last week, $ 1.20-1.50 per ounce to the price in London.

Stocks of the world's largest exchange-traded fund backed by gold ETF SPDR Gold Trust rose on Friday by 0.34 percent .

The cost of the April gold futures on the COMEX today rose to $ 1336.70 per ounce.

-

15:00

Belgium: Business Climate, February -4.0 (forecast -5.4)

-

14:36

U.S. Stocks open:Dow 16,135.89 +32.59 +0.20%, Nasdaq 4,275.10 +11.69 +0.27%, S&P 1,840.48 +4.23 +0.23%

-

14:27

Before the bell: S&P futures +0.20%, Nasdaq futures +0.25%

U.S. stock-index futures gained as investors bet that the economy can withstand the slowing down of the Federal Reserve’s bond-buying program.

Global markets:

Nikkei 14,837.68 -27.99 -0.19%

Hang Seng 22,388.56 -179.68 -0.80%

Shanghai Composite 2,076.69 -37.01 -1.75%

FTSE 6,824.2 -13.86 -0.20%

CAC 4,387.09 +6.03 +0.14%

DAX 9,643.32 -13.63 -0.14%

Crude oil $102.44 (+0.23%)

Gold $1331.90 (+0.63%).

-

13:40

Option expiries for today's 1400GMT cut

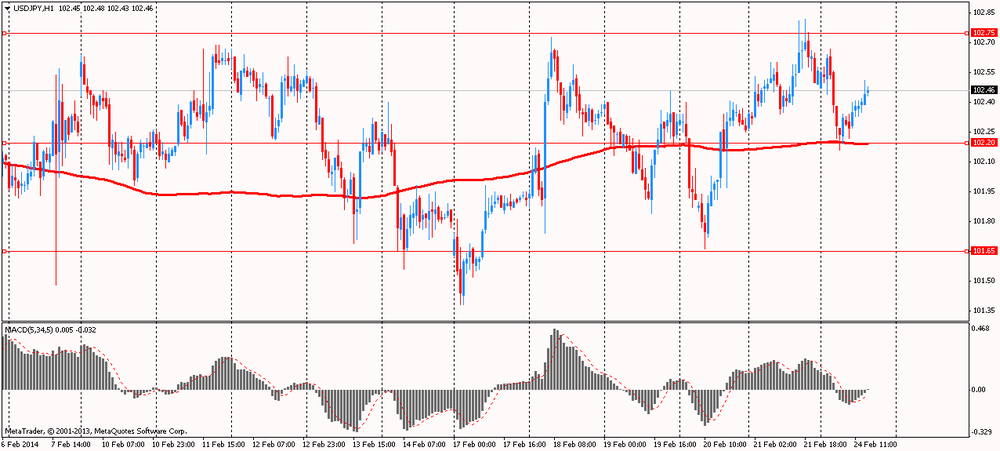

USD/JPY Y102.00, Y102.20, Y102.50

EUR/USD $1.3675, $1.3800

AUD/USD $0.8900, $0.8935, $0.9125, $0.9150

EUR/GBP stg0.8200, stg0.8225

USD/CAD Cad1.1100

GBP/USD $1.6600, $1.6675

USD/CHF Chf0.8965

NZD/USD NZ$0.8250, NZ$0.8300

EUR/CHF Chf1.2175, Chf1.2200, Chf1.2260

-

13:20

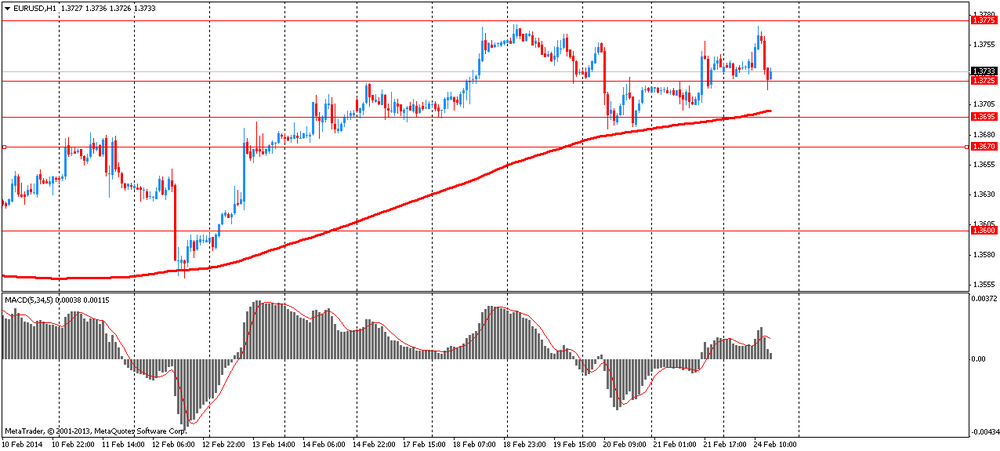

European session: the euro fell

09:00 Germany IFO - Business Climate February 110.6 110.7 111.3

09:00 Germany IFO - Current Assessment February 112.4 112.8 114.4

09:00 Germany IFO - Expectations February 108.9 108.1 108.3

10:00 Eurozone Harmonized CPI January +0.3% -1.1% -1.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) January +0.7% +0.7% +0.8%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y January +0.7% +0.8% +0.8%

Euro fell against the dollar after rising data on the business climate in Germany. German business climate indicator unexpectedly strengthened in February to the highest level since July 2011 , despite the drop in expectations. These results are presented on Monday institute IFO. Business climate index rose to 111.3 from 110.6 in January. According to the average expectations index was slightly rise to the level of 110.7 . In addition, the current conditions index improved to 114.4 in February from 112.4 a month ago. Result was higher than expected level of 112.8 . On the other hand , the expectations index fell to 108.3 in February from 108.9 in January. The result was predicted to drop to 108.1 .

Also today published the final data on inflation in the eurozone. Consumer prices in the euro area grew at a faster pace in January than previously thought , but inflation remained unchanged compared to December showed the revised data published by Eurostat on Monday . Harmonized index of consumer prices (HICP) rose by 0.8 percent year on year in January. The result was unchanged compared with the growth rate in December. Preliminary estimates were at the level of growth of 0.7 percent in January .

At the same time , core inflation, which excludes energy , food, alcohol and tobacco, rose to 0.8 percent from 0.7 percent in December , according to initial estimates . Inflation has remained below the target level of the European Central Bank " below but close to 2 percent," the twelfth consecutive month.

In January, prices for foodstuffs , alcohol and tobacco rose 1.7 percent, while energy prices fell 1.2 percent. The cost of non-energy industrial goods increased by 0.2 percent, and prices of services expanded by 1.2 percent. On a monthly basis, consumer prices recorded a decline of 1.1 percent in January .

EUR / USD: during the European session, the pair rose to $ 1.3771 , and then fell to $ 1.3718

GBP / USD: during the European session, the pair fell to $ 1.6597 , but then rose to $ 1.6677

USD / JPY: during the European session, the pair rose to Y102.51

At 14:00 GMT in Belgium will index business sentiment for February.

-

13:00

Orders

EUR/USD

Offers $1.3850/60, $1.3820, $1.3770/75

Bids $1.3705/00, $1.3660/50

GBP/USD

Offers $1.6795/800, $1.6770/80, $1.6720/25, $1.6700

Bids $1.6580, $1.6555/50

AUD/USD

Offers $0.9100, $0.9045/50, $0.9015/20, $0.8995/00

Bids $0.8925/20, $0.8910/00, $0.8850

EUR/GBP

Offers stg0.8370/80, stg0.8300/05

Bids stg0.8205/195, stg0.8180, stg0.8150

EUR/JPY

Offers Y142.45/50, Y142.00, Y141.50

Bids Y140.55/50, Y140.20, Y140.00, Y139.60/50

USD/JPY

Offers Y103.50, Y102.80/00, Y102.65/70

Bids Y102.00, Y101.80, Y101.50

-

11:30

European stocks were little changed

European stocks were little changed near a six-year high as HSBC Holdings Plc fell after reporting worse-than-estimated profit, offsetting a surge in Scania AB following a Volkswagen AG bid. U.S. index futures were little changed, while Asian shares slipped.

The Stoxx Europe 600 Index fell less than 0.1 percent to 335.79 at 9:12 a.m. in London. The benchmark gained 0.8 percent last week, reaching its highest level since January 2008, as companies from Meda AB to Valeo SA posted better-than-estimated earnings. The gauge has advanced 4.1 percent this month. Standard & Poor’s 500 Index futures added 0.1 percent today, while the MSCI Asia Pacific Index slid 0.2 percent.

In Germany, a report showed the Ifo Institute’s business climate index, based on a survey of 7,000 executives, unexpectedly rose to 111.3 in February from 110.6 a month earlier. Economists in a Bloomberg survey had predicted a drop to 110.5 this month.

Italian Prime Minister Matteo Renzi faces his first confidence vote in parliament today since taking office last week. Renzi will address the Senate at 2 p.m. in Rome to introduce his 16-member cabinet and outline his strategy for governance.

HSBC, Europe’s biggest lender, dropped the most in six months.

PostNL NV slid the most in 13 months after reporting a wider loss than analysts had projected.

Scania soared to its highest level since July 2007 after Volkswagen offered to buy the remaining stake in the Swedish truckmaker for 6.7 billion euros ($9.2 billion).

FTSE 100 6,814.16 -23.90 -0.35%

CAC 40 4,381.36 +0.30 +0.01%

DAX 9,639.87 -17.08 -0.18%

-

10:25

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.20, Y102.50

EUR/USD $1.3675, $1.3800

AUD/USD $0.8900, $0.8935, $0.9125, $0.9150

EUR/GBP stg0.8200, stg0.8225

USD/CAD Cad1.1100

GBP/USD $1.6600, $1.6675

USD/CHF Chf0.8965

NZD/USD NZ$0.8250, NZ$0.8300

EUR/CHF Chf1.2175, Chf1.2200, Chf1.2260

-

10:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, January +0.8% (forecast +0.8%)

-

10:00

Eurozone: Harmonized CPI, January -1.1% (forecast -1.1%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, January +0.8% (forecast +0.7%)

-

09:47

Asia Pacific stocks close

China’s stocks fell, sending the benchmark index to its biggest loss in seven weeks, amid speculation that reduced lending to the property industry will curb growth in the world’s second-largest economy.

Nikkei 225 14,837.68 -27.99 -0.19%

S&P/ASX 200 5,440.22 +1.52 +0.03%

Shanghai Composite 2,076.69 -37.01 -1.75%

China Vanke Co. and Poly Real Estate Group Co., the nation’s biggest developers, plunged more than 6 percent after the Shanghai Securities News reported Industrial Bank Co. and other banks have curbed lending to the property sector.

Industrial Bank led declines for lenders with a 3.7 percent loss.

China Petroleum & Chemical Corp., the refiner known as Sinopec, slid as much as 6.4 percent, erasing gains since it announced plans to sell a stake to private investors.

-

09:00

Germany: IFO - Business Climate, February 111.3 (forecast 110.7)

-

09:00

Germany: IFO - Current Assessment , February 114.4 (forecast 112.8)

-

09:00

Germany: IFO - Expectations , February 108.3 (forecast 108.1)

-

08:41

FTSE 100 6,818.75 -19.31 -0.28%, CAC 40 4,378.73 -2.33 -0.05%, Xetra DAX 9,615.79 -41.16 -0.43%

-

06:45

European stocks are seen opening flat to modestly lower Monday: the FTSE is down 0.1%, the DAX down 0.3% and the CAC down 0.2%.

-

06:24

Asian session: The euro slid

The euro slid from a one-month high against the yen after European Central Bank President Mario Draghi reiterated a willingness to act if the outlook for inflation deteriorates. Data due for release today and on Feb. 28 are estimated to show consumer-price gains in Europe held at less than half the ECB’s target of 2 percent. Consumer prices rose an annual 0.7 percent in January after a 0.8 percent gain the previous month, the European Union’s statistics office will confirm today, according to the median estimate in a Bloomberg News survey of economists. A Feb. 28 initial estimate will probably show prices gained 0.7 percent again in February, signaling the fifth consecutive reading of less than 1 percent.

In the U.S., data today may show the Chicago Fed national index, a weighted average of 85 economic indicators, fell to minus 0.2 in January from 0.16 a month earlier, according to a Bloomberg survey. A reading below zero indicates below-trend growth in the national economy.

The Japanese currency strengthened against all 16 major counterparts as Chinese stocks led declines in Asian shares, boosting haven demand.

Australia’s dollar fell after iron-ore prices touched a week-low and amid reports of property-lending curbs in China. Iron ore declined to $122.40 a metric ton on Feb. 21, the lowest since Feb. 13, according to data from The Steel Index Ltd. Total inventory of the steelmaking material at Chinese ports monitored by Shanghai Steelhome Information Technology Co. climbed to 100.9 million tons in the week ended Feb. 21, the highest since at least March 2010.

EUR / USD: during the Asian session the pair fell to $ 1.3725

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6625-45

USD / JPY: on Asian session the pair fell to Y102.15

A light domestic calendar for the UK with focus expected to be on Germany Ifo (0900GMT) and EZ CPI (1000GMT).

-