Notícias do Mercado

-

19:20

American focus: the dollar fell sharply against the euro

The dollar fell sharply against the euro, while losing all previously earned the position, even though the output of better-than-expected U.S. data. According to most experts, this dynamic trade related, primarily, to the fact that the Syrian conflict continues to trouble markets.

With regard to economic releases, it is to provide a report on the S & P / Case-Shiller and from the Conference Board, noted that the U.S. housing prices continued to rise in June, but the pace may slow in the future, showed published on Tuesday, the report S & P / Case-Shiller .

Housing prices in 10 major U.S. cities rose by 11.9% in the year ended in June, according to S & P / Case-Shiller. Housing prices in 20 major cities rose by 12.1% compared with a year earlier, which is close to the expectations of economists 11.9%. On the basis of an off-season prices for 10 and for 20 cities rose 2.2% in June compared with May. The seasonally adjusted price index for 10 cities rose 1.1%, while for the 20 cities rose 0.9%.

Meanwhile, it became known that the index of U.S. consumer confidence rose unexpectedly in August, which was primarily reflected in the improvement of short-term expectations. In the Conference Board reported that its consumer confidence index rose this month to a level of 81.5, compared to the upwardly revised index for July at around 81.0. We add that even a slight increase came as a surprise to economists, as they had expected decrease in this indicator to the level of 78.0 from 80.3, which was originally reported in the previous month.

The yen rose against all major currencies against the falling value of the Asian and European shares, which increased demand for safe-haven assets. This decrease is due to the stock indices growing tensions in Syria. On Monday, U.S. Secretary of State, John Kerry said that the U.S. intelligence there is conclusive evidence that chemical weapons were used near Damascus Syrian government forces, and that should not go unpunished. According to him, President Barack Obama prepares to take a decision on this issue, as only in the Syrian army had missiles capable by chemical attack.

-

15:00

U.S.: Richmond Fed Manufacturing Index, August 14 (forecast -7)

-

15:00

U.S.: Consumer confidence , August 81.5 (forecast 79.6)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3250, $1.3260, $1.3275, $1.3280, $1.3300, $1.3350, $1.3400, $1.3420, $1.3450

USD/JPY Y97.00, Y97.50, Y98.00, Y98.25, Y98.30, Y98.50, Y99.00, Y99.45/50

GBP/USD $1.5550, $1.5590

USD/CHF Chf0.9250

AUD/USD $0.8925, $0.8950, $0.9000, $0.9025, $0.9070, $0.9130

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, June +12.1% (forecast +11.9%)

-

13:18

European session: risk currencies under pressure of the situation in Syria

08:00 Germany IFO - Business Climate August 106.2 107.1 107.5

08:00 Germany IFO - Current Assessment August 110.1 111.0 112.0

08:00 Germany IFO - Expectations August 102.4 103.1 103.3

The euro rose against the dollar after the release of data from the German Ifo, which exceeded expectations. However, the EUR / USD fell immediately turned around and updating the session lows.

The mood in German business confidence strengthened in August amid improved prospects for exports, thus confirming that Europe's largest economy is gaining momentum after a weak start to the year. This was reported today institute Ifo. According to published data, the index of business sentiment in Germany Ifo in August rose for the fourth consecutive time: its value was 107.5 against 106.2 in July, while the projected increase to 107.1.

Previously was also published positive results of a survey of purchasing managers in Germany, according to which business activity grew at the fastest pace in seven months.

The index of business sentiment in the manufacturing sector increased significantly and reached its highest level since April 2012, as companies anticipate growth in exports.

The yen rose against all major currencies against the falling value of the Asian and European shares, which increased demand for safe-haven assets. This decrease is due to the stock indices growing tensions in Syria. On Monday, U.S. Secretary of State, John Kerry said that the U.S. intelligence there is conclusive evidence that chemical weapons were used near Damascus Syrian government forces, and that should not go unpunished. According to him, President Barack Obama prepares to take a decision on this issue, as only in the Syrian army had missiles capable by chemical attack.

The dollar index is trading near three-week high, as many investors are of the view that the U.S. economy has recovered in order to the Federal Reserve began reducing monetary stimulus in September. Additional impact on the U.S. dollar exchange rate can have a release housing price index from the S & P / Case-Shiller. According to the median forecast of economists, the cost of housing in 20 large U.S. cities is likely to rise in June, up 12.1% against the same values in the previous month. Recall that the growth of 12.2% was the largest since March 2006.

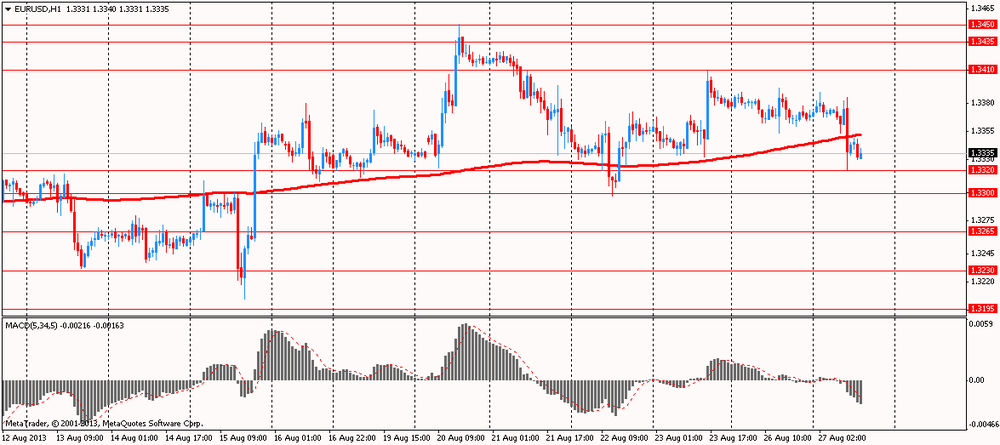

EUR / USD: during the European session, the pair rose to $ 1.3386, and then fell to $ 1.3321

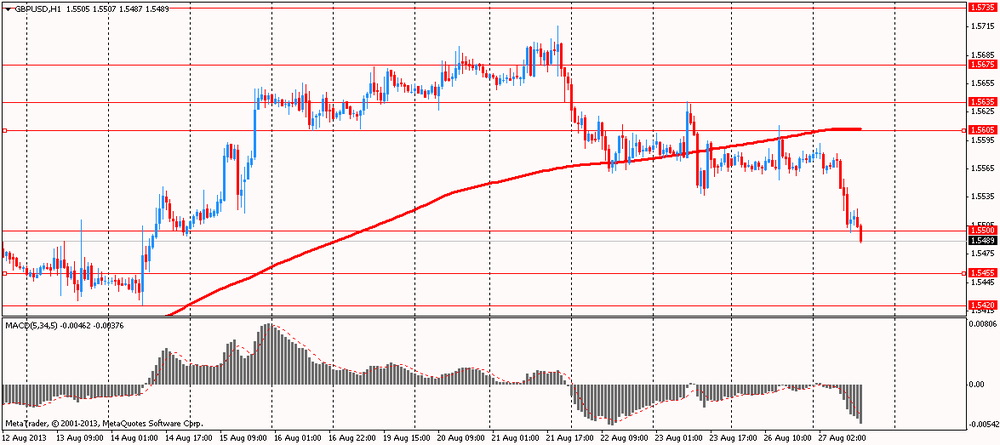

GBP / USD: during the European session, the pair fell to $ 1.5487

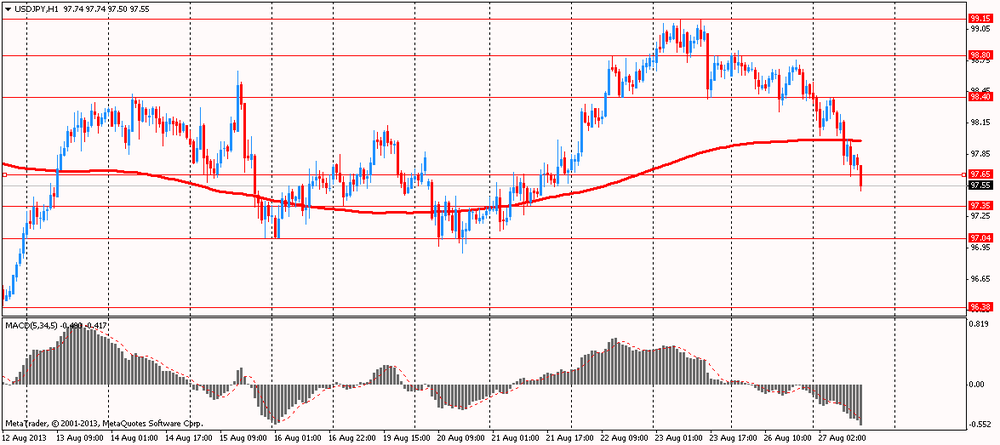

USD / JPY: during the European session, the pair fell to Y97.50

In the U.S. will be released at 13:00 GMT the index of housing prices in 20 major cities S & P / Case-Shiller, a national composite house price index S & P / CaseShiller for June, to 14:00 GMT - an indicator of consumer confidence for August.

-

13:00

Orders

EUR/USD

Offers $1.3500, $1.3475/85, $1.3450/60, $1.3400/20

Bids $1.3320, $1.3300, $1.3285/80

GBP/USD

Offers $1.5780/85, $1.5750/55, $1.5720/25, $1.5680/85, $1.5640/50, $1.5615/20

Bids $1.5500, $1.5495/90, $1.5450, $1.5435/25

AUD/USD

Offers $0.9090/00, $0.9075/80, $0.9045/50, $0.9020/25, $0.8985/90

Bids $0.8935/30, $0.8920, $0.8900, $0.8880/75, $0.8800

EUR/JPY

Offers Y132.20, Y132.00, Y131.55/60, Y131.30/35, Y130.80

Bids Y130.20/15, Y130.00, Y129.80, Y129.50

USD/JPY

Offers Y99.20, Y98.90/00, Y98.30/40

Bids Y97.50, Y97.20/00, Y96.90, Y96.50

EUR/GBP

Offers stg0.8665/75, stg0.8640/45, stg0.8620/30

Bids stg0.8560, stg0.8545/35, stg0.8520-10, stg0.8485/75

-

11:15

ITALY BTPEI AUCTION RESULTS:

Sold E1.001bln vs target E500mln-E1.0bln

- E736mln of 1.70% Sep 2018 BTPei; avg yield 2.30%, cover 2.30

- E265mln of 3.10% Sep 2026 BTPei; avg yield 3.30%, cover 3.23.

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD $1.3250, $1.3260, $1.3275, $1.3280, $1.3400, $1.3420, $1.3450

USD/JPY Y97.00, Y97.50, Y98.00, Y98.25, Y98.30, Y98.50, Y99.00, Y99.45/50

GBP/USD $1.5550, $1.5590

USD/CHF Chf0.9250

AUD/USD $0.8925, $0.8950, $0.9000, $0.9025, $0.9070, $0.9130

-

09:01

Germany: IFO - Current Assessment , August 112 (forecast 111.0)

-

09:01

Germany: IFO - Expectations , August 103.3 (forecast 103.1)

-

09:00

Germany: IFO - Business Climate, August 107.5 (forecast 107.1)

-

07:02

Asian session: The yen climbed

---

The yen climbed against all of its 16 major counterparts as a selloff in emerging markets boosted demand for haven assets. Asian shares fell amid a freefall in the currencies of India and Indonesia, and as tensions in Syria escalated.

The euro was supported ahead of data forecast to show continued improvement in Germany’s business climate. In Germany, Europe’s biggest economy, business confidence probably rose for a fourth month in August. The Ifo institute’s business climate index, based on a survey of 7,000 executives, rose to 107.0 from 106.2 in July, economists predicted ahead of today’s report. The German unemployment rate probably held at 6.8 percent in August, a separate poll before the Aug. 29 data showed. The jobless rate hasn’t been lower than that since May 2012.

The Bloomberg U.S. Dollar Index traded near the highest in three weeks as traders stuck to the view that the American economy is strong enough for the Federal Reserve to begin reducing monetary stimulus in September. In the U.S., the S&P/Case-Shiller index of home prices in 20 cities probably climbed 12.1 percent in June from the same month last year, according to the median forecast in a Bloomberg News survey of economists before the data today. That would follow a 12.2 percent advance in the 12 months ended May that was the biggest since March 2006.

The Australian dollar slid versus all 16 major counterparts as volatility headed for the highest close in six weeks, damping demand for the currency.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3365-90

GBP / USD: during the Asian session the pair traded in the range of $ 1.5560-90

USD / JPY: during the Asian session the pair fell to Y98.00

A light domestic calendar in the UK today with focus on Germany Ifo. BOE Carney speech Wednesday the next domestic interest.

-

06:20

Currencies. Daily history for Aug 26'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3370 +0,10%

GBP/USD $1,5579 -0,03%

USD/CHF Chf0,9225 -0,11%

USD/JPY Y98,43 -0,33%

EUR/JPY Y131,60 -0,23%

GBP/JPY Y153,32 -0,38%

AUD/USD $0,9026 +0,14%

NZD/USD $0,7853 +0,22%

USD/CAD C$1,0498 -0,20%

-

06:00

Schedule for today, Tuesday, Aug 27’2013:

08:00 Germany IFO - Business Climate August 106.2 107.1

08:00 Germany IFO - Current Assessment August 110.1 111.0

08:00 Germany IFO - Expectations August 102.4 103.1

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y June +12.2% +11.9%

14:00 U.S. Richmond Fed Manufacturing Index August -11 -7

14:00 U.S. Consumer confidence August 80.3 79.6

16:45 Canada Gov Council Member Murray Speaks

20:30 U.S. API Crude Oil Inventories August -1.2

-