Notícias do Mercado

-

20:00

Dow -143.38 14,803.08 -0.96% Nasdaq -71.71 3,585.86 -1.96% S&P -23.09 1,633.69 -1.39%

-

19:20

American focus: the dollar fell sharply against the euro

The dollar fell sharply against the euro, while losing all previously earned the position, even though the output of better-than-expected U.S. data. According to most experts, this dynamic trade related, primarily, to the fact that the Syrian conflict continues to trouble markets.

With regard to economic releases, it is to provide a report on the S & P / Case-Shiller and from the Conference Board, noted that the U.S. housing prices continued to rise in June, but the pace may slow in the future, showed published on Tuesday, the report S & P / Case-Shiller .

Housing prices in 10 major U.S. cities rose by 11.9% in the year ended in June, according to S & P / Case-Shiller. Housing prices in 20 major cities rose by 12.1% compared with a year earlier, which is close to the expectations of economists 11.9%. On the basis of an off-season prices for 10 and for 20 cities rose 2.2% in June compared with May. The seasonally adjusted price index for 10 cities rose 1.1%, while for the 20 cities rose 0.9%.

Meanwhile, it became known that the index of U.S. consumer confidence rose unexpectedly in August, which was primarily reflected in the improvement of short-term expectations. In the Conference Board reported that its consumer confidence index rose this month to a level of 81.5, compared to the upwardly revised index for July at around 81.0. We add that even a slight increase came as a surprise to economists, as they had expected decrease in this indicator to the level of 78.0 from 80.3, which was originally reported in the previous month.

The yen rose against all major currencies against the falling value of the Asian and European shares, which increased demand for safe-haven assets. This decrease is due to the stock indices growing tensions in Syria. On Monday, U.S. Secretary of State, John Kerry said that the U.S. intelligence there is conclusive evidence that chemical weapons were used near Damascus Syrian government forces, and that should not go unpunished. According to him, President Barack Obama prepares to take a decision on this issue, as only in the Syrian army had missiles capable by chemical attack.

-

18:20

European stock close

European stocks slid the most in nine weeks after U.S. Secretary of State John Kerry said the Obama administration will hold Syria accountable for using chemical weapons against its own people.

The Stoxx 600 slid 1.6 percent to 299.51 at 4:30 p.m. in London. The equity benchmark has still rallied 8.6 percent from this year’s low on June 24 as the European Central Bank said that interest rates will remain low for an extended period. The Stoxx 600 fell yesterday after Silvio Berlusconi’s People of Liberty party threatened to withdraw its support from Italy’s coalition government if the country’s Senate votes to remove the billionaire former prime minister. The senators will discuss Berlusconi’s case from Sept. 9.

The Federal Reserve holds its next meeting on Sept. 17-18. The central bank will decide to reduce its $85 billion of monthly asset purchases at the meeting, according to the median estimate of economists surveyed by Bloomberg on Aug. 9-13. Secretary of State Kerry denounced an attack on a suburb of Damascus last week, saying it required a response against Syrian President Bashar al-Assad’s regime.

National benchmark indexes declined in every western-European market today.

FTSE 100 6,440.97 -51.13 -0.79% CAC 40 3,968.73 -98.40 -2.42% DAX 8,242.56 -192.59 -2.28%

Renault and Porsche fell 4.7 percent to 56.45 euros and 4.1 percent to 64.68 euros, respectively. The preferred shares of Volkswagen AG, Europe’s largest carmaker, slid 3.2 percent to 176.35 euros. Daimler AG, the third-biggest maker of luxury vehicles, slipped 4.8 percent to 52.89 euros. Bayerische Motoren Werke AG, the biggest, decreased 3.2 percent to 73 euros.

UniCredit SpA (UCG) and Intesa Sanpaolo SpA, Italy’s two largest lenders, dropped 4.2 percent to 4.23 euros and 4.4 percent to 1.45 euros, respectively. The yield on benchmark 10-year Italian bonds climbed seven basis points to 4.45 percent. Banco Santander SA and Banco Bilbao Vizcaya Argentaria SA, Spain’s two biggest banks, slid 3.7 percent to 5.41 euros and 3.7 percent to 7.25 euros, respectively. The yield on 10-year Spanish debt rose four basis points to 4.50 percent.

Antofagasta Plc retreated 3.3 percent to 884.5 pence. The copper producer controlled by Chile’s Luksic family said in a statement that net income declined to $395 million from $646.1 million a year earlier. Sales (ANTO) slipped 12 percent to $2.78 billion in the six months through June as metal prices declined.

ThyssenKrupp AG fell 3.1 percent to 15.82 euros. Nomura Holdings Inc. downgraded Germany’s largest steelmaker to neutral from buy. The brokerage said that the shares will probably not rally because the Brazilian real has weakened against the euro. ThyssenKrupp’s Steel Americas unit owns a steel mill in the Brazilian state of Rio de Janeiro.

Fresnillo Plc, a producer of gold and silver, surged 7.1 percent to 1,310 pence, its highest price since April, as precious metals rose. Randgold Resources Ltd. gained 4.1 percent to 5,335 pence.

-

17:00

European stock close: FTSE 100 6,440.97 -51.13 -0.79% CAC 40 3,968.73 -98.40 -2.42% DAX 8,242.56 -192.59 -2.28%

-

16:41

Oil: an overview of the market situation

Oil prices rose sharply today, rising with up to five-week high, which is due to speculation that the tensions in Syria disrupt supplies from the Middle East.

Prices jumped by as much as 3%, which was associated with the application Syrian Foreign Minister Walid al-Muallem. During the press conference, he confirmed that Syria has all the evidence that it is gangs used chemical weapons in the Damascus suburb of East Huta. As he pointed out, who blames the Syrian armed forces, should provide the public with their arguments. Al-Moallem also said that he and U.S. Secretary of State John Kerry on August 22 held a telephone conversation, during which the Foreign Minister of Syria confirmed the country's interest in uncovering the truth about what really happened in Guta August 21.

According to Al-Muallem, all statements by the United States on the use of chemical weapons by the Syrian authorities are "entirely false."

Syrian Foreign Minister also said he believes that the United States is not going to take forceful action against Damascus.

We also add that President Barack Obama is currently not decided on a military strike on Syria in connection with an alleged himatakoy near Damascus. Earlier it was reported that air strikes on Syria may be applied as early as Thursday, September 29. As noted in the report, attacks can be applied for three days and will point. On Tuesday, the Western countries have notified the Syrian opposition about the possibility of attacking Syria in the coming days.

Meanwhile, it is worth noting that in the course of trade is also affected yield data on the United States. As it became known, in U.S. home prices continued to rise in June, but the pace may slow in the future, showed a report published on Tuesday S & P / Case-Shiller. Housing prices in 10 major U.S. cities rose by 11.9% in the year ended in June, according to S & P / Case-Shiller. Housing prices in 20 major cities rose by 12.1% compared with a year earlier, which is close to the expectations of economists 11.9%.

The cost of the October futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 108.94 a barrel on the New York Mercantile Exchange.

October futures price for North Sea Brent crude oil mixture fell to $ 113.97 a barrel on the London exchange ICE Futures Europe.

-

16:21

Gold: an overview of the market situation

Gold prices rose sharply today, reaching thus the highest level since June, as the political tensions around Syria contributes to increased demand for the precious metal as a store of value. We also add that this concern is also reflected in the cost of platinum, the price of which has reached four-month high.

Note that the U.S. secretary of state John Kerry made an extraordinary statement in which he called the information on the use of chemical weapons in Syria convincing and based on facts. He blamed the use of chemicals in the Assad regime, adding that the authorities destroyed evidence. Barack Obama considers the sheer power of action in Syria. Also, John Kerry, in a special statement promised that the United States and its partners will manifest evidence of the use of chemical weapons in Syria.

He assured that U.S. authorities already have some additional information in the near future it will be presented to the international community.

We add that the price of gold has soared by 18%, retreating from 34-month low of $ 1,179.40 an ounce, which was recorded in June, as lower prices boosted demand for jewelry, coins and bullion.

Analysts say that the fact that investment demand rose several times in recent years, and in conjunction with the escalation of the Syrian conflict, we can expect further price rises in the future.

The cost of the October gold futures on COMEX today rose to $ 1418.70 per ounce.

-

15:00

U.S.: Richmond Fed Manufacturing Index, August 14 (forecast -7)

-

15:00

U.S.: Consumer confidence , August 81.5 (forecast 79.6)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3250, $1.3260, $1.3275, $1.3280, $1.3300, $1.3350, $1.3400, $1.3420, $1.3450

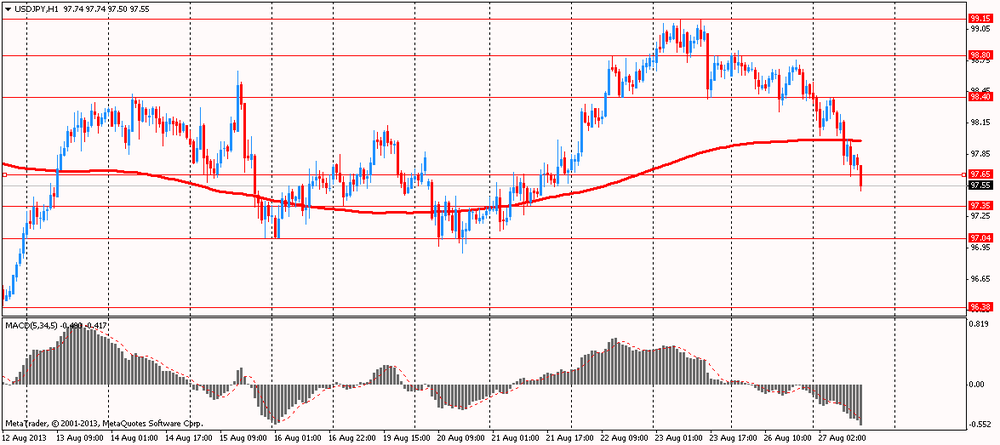

USD/JPY Y97.00, Y97.50, Y98.00, Y98.25, Y98.30, Y98.50, Y99.00, Y99.45/50

GBP/USD $1.5550, $1.5590

USD/CHF Chf0.9250

AUD/USD $0.8925, $0.8950, $0.9000, $0.9025, $0.9070, $0.9130

-

14:35

U.S. Stocks open: Dow 14,887.49 -58.97 -0.39%, Nasdaq 3,617.43 -40.14 -1.10%, S&P 1,645.81 -10.97 -0.66%

-

14:25

Before the bell: S&P futures -0.98%, Nasdaq futures -1.09%

U.S. stock-index futures fell as tension grew over possible military action in Syria and investors awaited data that may show consumer confidence fell.

Global Stock:

Nikkei 13,542.37 -93.91 -0.69%

Hang Seng 21,874.77 -130.55 -0.59%

Shanghai Composite 2,103.57 +7.09 +0.34%

FTSE 6,437.41 -54.69 -0.84%

CAC 3,982.76 -84.37 -2.07%

DAX 8,259.94 -175.21 -2.08%

Crude Oil $108.12 +2.08%

Gold $1418.10 +1.79%

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, June +12.1% (forecast +11.9%)

-

13:18

European session: risk currencies under pressure of the situation in Syria

08:00 Germany IFO - Business Climate August 106.2 107.1 107.5

08:00 Germany IFO - Current Assessment August 110.1 111.0 112.0

08:00 Germany IFO - Expectations August 102.4 103.1 103.3

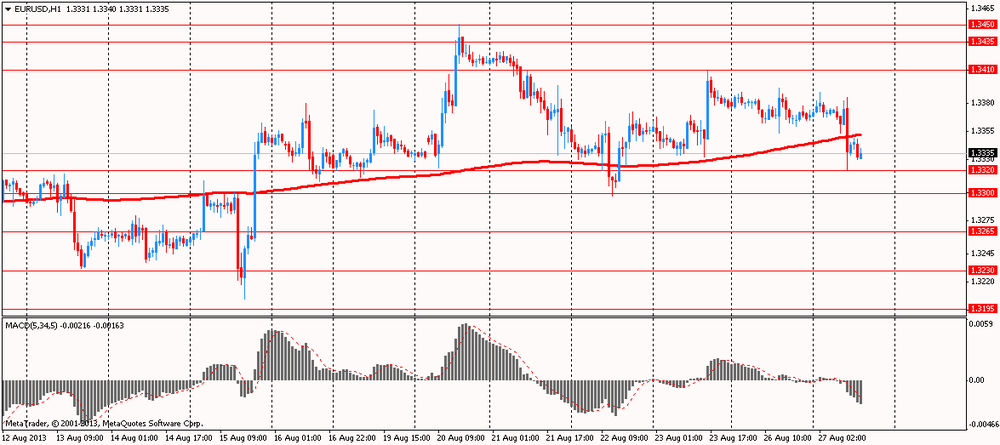

The euro rose against the dollar after the release of data from the German Ifo, which exceeded expectations. However, the EUR / USD fell immediately turned around and updating the session lows.

The mood in German business confidence strengthened in August amid improved prospects for exports, thus confirming that Europe's largest economy is gaining momentum after a weak start to the year. This was reported today institute Ifo. According to published data, the index of business sentiment in Germany Ifo in August rose for the fourth consecutive time: its value was 107.5 against 106.2 in July, while the projected increase to 107.1.

Previously was also published positive results of a survey of purchasing managers in Germany, according to which business activity grew at the fastest pace in seven months.

The index of business sentiment in the manufacturing sector increased significantly and reached its highest level since April 2012, as companies anticipate growth in exports.

The yen rose against all major currencies against the falling value of the Asian and European shares, which increased demand for safe-haven assets. This decrease is due to the stock indices growing tensions in Syria. On Monday, U.S. Secretary of State, John Kerry said that the U.S. intelligence there is conclusive evidence that chemical weapons were used near Damascus Syrian government forces, and that should not go unpunished. According to him, President Barack Obama prepares to take a decision on this issue, as only in the Syrian army had missiles capable by chemical attack.

The dollar index is trading near three-week high, as many investors are of the view that the U.S. economy has recovered in order to the Federal Reserve began reducing monetary stimulus in September. Additional impact on the U.S. dollar exchange rate can have a release housing price index from the S & P / Case-Shiller. According to the median forecast of economists, the cost of housing in 20 large U.S. cities is likely to rise in June, up 12.1% against the same values in the previous month. Recall that the growth of 12.2% was the largest since March 2006.

EUR / USD: during the European session, the pair rose to $ 1.3386, and then fell to $ 1.3321

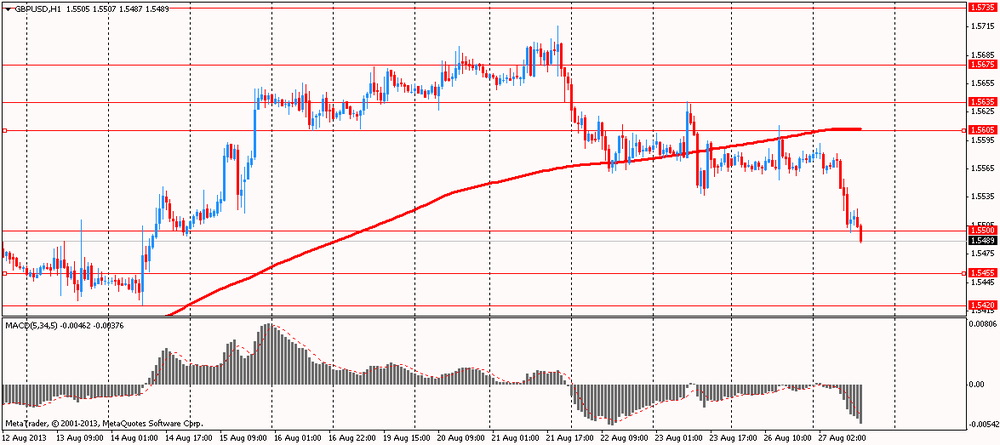

GBP / USD: during the European session, the pair fell to $ 1.5487

USD / JPY: during the European session, the pair fell to Y97.50

In the U.S. will be released at 13:00 GMT the index of housing prices in 20 major cities S & P / Case-Shiller, a national composite house price index S & P / CaseShiller for June, to 14:00 GMT - an indicator of consumer confidence for August.

-

13:00

Orders

EUR/USD

Offers $1.3500, $1.3475/85, $1.3450/60, $1.3400/20

Bids $1.3320, $1.3300, $1.3285/80

GBP/USD

Offers $1.5780/85, $1.5750/55, $1.5720/25, $1.5680/85, $1.5640/50, $1.5615/20

Bids $1.5500, $1.5495/90, $1.5450, $1.5435/25

AUD/USD

Offers $0.9090/00, $0.9075/80, $0.9045/50, $0.9020/25, $0.8985/90

Bids $0.8935/30, $0.8920, $0.8900, $0.8880/75, $0.8800

EUR/JPY

Offers Y132.20, Y132.00, Y131.55/60, Y131.30/35, Y130.80

Bids Y130.20/15, Y130.00, Y129.80, Y129.50

USD/JPY

Offers Y99.20, Y98.90/00, Y98.30/40

Bids Y97.50, Y97.20/00, Y96.90, Y96.50

EUR/GBP

Offers stg0.8665/75, stg0.8640/45, stg0.8620/30

Bids stg0.8560, stg0.8545/35, stg0.8520-10, stg0.8485/75

-

11:30

European stocks slid the most in a week

European stocks slid the most in a week after U.S. Secretary of State John Kerry said the Obama administration will hold Syria accountable for using chemical weapons. U.S. index futures and Asian shares also fell.

Kerry denounced an attack on a suburb of Damascus last week, saying it required a response against Syrian President Bashar al-Assad’s regime.

In Germany, a report from showed that business confidence rose for a fourth month in August. The Ifo institute’s business-climate index, based on a survey of 7,000 executives, climbed to 107.5 from 106.2 in July. That exceeded the median estimate of 107 in a survey of economists.

Aker Solutions lost 1.4 percent to 89.35 kroner. The oil-services group controlled by billionaire Kjell Inge Roekke posted quarterly earnings of 0.44 kroner per share, missing the average analyst estimate of 0.728 kroner apiece.

ThyssenKrupp fell 3.2 percent to 15.81 euros. Nomura downgraded Germany’s largest steelmaker to neutral from buy. The brokerage said that the shares will probably not rally because the Brazilian real has depreciated against the euro. ThyssenKrupp’s Steel Americas unit owns a steel mill in the Brazilian state of Rio de Janeiro.

Peugeot gained 2.7 percent to 11.66 euros. UBS upgraded the shares to buy from neutral, citing stabilizing volume in Europe and faster-than-expected restructuring.

FTSE 100 6,455.91 -36.19 -0.56%

CAC 40 4,013.48 -53.65 -1.32%

DAX 8,318.32 -116.83 -1.39%

-

11:15

ITALY BTPEI AUCTION RESULTS:

Sold E1.001bln vs target E500mln-E1.0bln

- E736mln of 1.70% Sep 2018 BTPei; avg yield 2.30%, cover 2.30

- E265mln of 3.10% Sep 2026 BTPei; avg yield 3.30%, cover 3.23.

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD $1.3250, $1.3260, $1.3275, $1.3280, $1.3400, $1.3420, $1.3450

USD/JPY Y97.00, Y97.50, Y98.00, Y98.25, Y98.30, Y98.50, Y99.00, Y99.45/50

GBP/USD $1.5550, $1.5590

USD/CHF Chf0.9250

AUD/USD $0.8925, $0.8950, $0.9000, $0.9025, $0.9070, $0.9130

-

10:01

Asia Pacific stocks close

Asian stocks fell, with the regional benchmark index poised to snap a two-day gain, as the U.S. vows to hold Syria’s government liable for deadly chemical weapons attacks on its people, damping investors’ risk appetite.

Nikkei 225 13,542.37 -93.91 -0.69%

Hang Seng 21,927.89 -77.43 -0.35%

S&P/ASX 200 5,141.22 +5.81 +0.11%

Shanghai Composite 2,103.57 +7.09 +0.34%

Billabong International Ltd., an Australian surfwear company, slumped 5.3 percent after it posted a loss more than three times its market value and said its core brand was worthless.

ENN Energy Holdings Ltd., an operator of gas pipelines, slumped 5.8 percent in Hong Kong after its first-half net income missed estimates.

Tokyo Electric Power Co. jumped 12 percent after the government said it would take over the handling of radioactive water spills at the Fukushima Dai-Ichi nuclear plant.

-

09:01

Germany: IFO - Current Assessment , August 112 (forecast 111.0)

-

09:01

Germany: IFO - Expectations , August 103.3 (forecast 103.1)

-

09:00

Germany: IFO - Business Climate, August 107.5 (forecast 107.1)

-

08:40

FTSE 100 6,471.32 -20.78 -0.32%, CAC 40 4,050.81 -16.32 -0.40%, Xetra DAX 8,400.43 -34.72 -0.41%

-

07:02

Asian session: The yen climbed

---

The yen climbed against all of its 16 major counterparts as a selloff in emerging markets boosted demand for haven assets. Asian shares fell amid a freefall in the currencies of India and Indonesia, and as tensions in Syria escalated.

The euro was supported ahead of data forecast to show continued improvement in Germany’s business climate. In Germany, Europe’s biggest economy, business confidence probably rose for a fourth month in August. The Ifo institute’s business climate index, based on a survey of 7,000 executives, rose to 107.0 from 106.2 in July, economists predicted ahead of today’s report. The German unemployment rate probably held at 6.8 percent in August, a separate poll before the Aug. 29 data showed. The jobless rate hasn’t been lower than that since May 2012.

The Bloomberg U.S. Dollar Index traded near the highest in three weeks as traders stuck to the view that the American economy is strong enough for the Federal Reserve to begin reducing monetary stimulus in September. In the U.S., the S&P/Case-Shiller index of home prices in 20 cities probably climbed 12.1 percent in June from the same month last year, according to the median forecast in a Bloomberg News survey of economists before the data today. That would follow a 12.2 percent advance in the 12 months ended May that was the biggest since March 2006.

The Australian dollar slid versus all 16 major counterparts as volatility headed for the highest close in six weeks, damping demand for the currency.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3365-90

GBP / USD: during the Asian session the pair traded in the range of $ 1.5560-90

USD / JPY: during the Asian session the pair fell to Y98.00

A light domestic calendar in the UK today with focus on Germany Ifo. BOE Carney speech Wednesday the next domestic interest.

-

06:21

Commodities. Daily history for Aug 26’2013:

Change % Change Last

GOLD 1,402.80 7.10 0.51%

OIL (WTI) 106.19 -0.23 -0.22%

-

06:20

Stocks. Daily history for Aug 26’2013:

Nikkei 225 -0,18 -24,27 13,636.28%

Hang Seng 22,005.32 141,81 0,65%

S & P / ASX 200 5,135.4 12,04 0,24%

Shanghai Composite 2,096.47 +39.02 +1.90%

FTSE 100 6,492.1 +45.23 +0.70%

CAC 40 4,067.13 -2.34 -0.06%

DAX 8,435.15 +18.16 +0.22%

Dow -60.67 14,949.84 -0.40%

Nasdaq -0.43 3,657.36 -0.01%

S&P -6.33 1,657.17 -0.38%

-

06:20

Currencies. Daily history for Aug 26'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3370 +0,10%

GBP/USD $1,5579 -0,03%

USD/CHF Chf0,9225 -0,11%

USD/JPY Y98,43 -0,33%

EUR/JPY Y131,60 -0,23%

GBP/JPY Y153,32 -0,38%

AUD/USD $0,9026 +0,14%

NZD/USD $0,7853 +0,22%

USD/CAD C$1,0498 -0,20%

-

06:00

Schedule for today, Tuesday, Aug 27’2013:

08:00 Germany IFO - Business Climate August 106.2 107.1

08:00 Germany IFO - Current Assessment August 110.1 111.0

08:00 Germany IFO - Expectations August 102.4 103.1

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y June +12.2% +11.9%

14:00 U.S. Richmond Fed Manufacturing Index August -11 -7

14:00 U.S. Consumer confidence August 80.3 79.6

16:45 Canada Gov Council Member Murray Speaks

20:30 U.S. API Crude Oil Inventories August -1.2

-