Notícias do Mercado

-

20:00

Dow +18.37 15,028.88 +0.12% Nasdaq +19.59 3,677.38 +0.54% S&P +2.14 1,665.64 +0.13%

-

19:20

American focus: the dollar rose slightly against the euro

The dollar rose modestly against the euro, returning with all previously lost ground, even though the publication of weak U.S. data.

It is learned that orders for manufactured durable goods fell sharply in July as demand for aircraft and reduced business costs were weak.

Total orders for durable goods - big-ticket items lasting three years or more - to a seasonally adjusted fell 7.3% to $ 226.6 billion in July compared with the previous month, the Commerce Department said Monday. Economists had forecast a 3% fall. Businesses and consumers usually make such purchases when they are confident in the economy and reduced orders showing possible signs of weakness at the time, as the economy struggles to grow. The decrease came largely from the category of civilian aircraft, which fell by 52.3% for the month. The company Boeing (BA), for example, reported only 90 aircraft orders in July, compared with 287 in June. Orders aircraft represent a small group of producers and their production takes several years, but their high prices can have a significant impact on the total orders. Without the volatile transportation category of durable goods were also relatively weak for the month and fell 0.6%. But the annual figures, which smoothes the data showed that the total orders for durable goods rose by 3.3%, while orders excluding transportation rose 2.5%. A key indicator of business spending - orders for non-defense capital goods excluding aircraft - fell 3.3% after rising in the previous five months.

Value of the pound was little changed against the dollar, with the absence of publication of economic data for the UK, as well as the official day off. However, it is worth noting that a partial influence on the bidding had data for the U.S., as well as the comments of the Bank of England Deputy Governor Charlie Bean. He said that officials hints about keeping rates unchanged in the near future, recognizing the surprise of the market, when offered the so-called "policy of further intentions"

"What we're trying to do is to explain as clearly what are the factors that determine the policy in the future," - said in an interview with Charlie Bean, while attending the annual meeting of the Federal Reserve Bank of Kansas City in Jackson Hole, Wyoming.

"The question of what the market is justified and what is not, depends on your point of view and answer the question when inflationary pressures will begin to manifest itself." The new head of the Bank of England, Mark Carney, said earlier this month that the bank will not consider raising rates before unemployment reaches 7%. The UK economy grew by 0.7% in the second quarter, and Mr. Bean said that if the economy is experiencing a "significant slowdown" that politicians can introduce further quantitative easing.

-

18:20

European stock close

European stocks fell for the first time in three days amid political wrangling in Italy and as orders for U.S. durable goods declined more than forecast.

The Stoxx Europe 600 Index lost 0.1 percent to 304.42 at 4:32 p.m. London, as two shares declined for each one that advanced. The volume of shares changing hands was 54 percent lower than the 30-day average as markets in London were closed for a holiday. The gauge has dropped 2 percent since May 22 amid speculation the Federal Reserve will start paring its bond-buying program as soon as next month.

Orders for U.S. durable goods fell more than forecast in July after three months of increases. Bookings for goods meant to last at least three years decreased 7.3 percent, the most since August 2012, after a 3.9 percent gain in June, the Commerce Department said today in Washington. The median forecast of economists called for a 3 percent drop.

European Central Bank policy makers can’t rule out lowering the benchmark interest rate from the record low of 0.5 percent even amid signs the euro-area economy is improving, Governing Council Member Panicos Demetriades said in an Aug. 24 interview. By contrast, Bank of Austria Governor Ewald Nowotny said Aug. 22 that he doesn’t see “many arguments now for a rate cut” after the recent “stream of good news.”

National benchmark indexes declined in 13 of the 17 western European markets open today.

FTSE 100 6,492.1 +45.23 +0.70% CAC 40 4,067.13 -2.34 -0.06% DAX 8,435.15 +18.16 +0.22%

Italy’s FTSE MIB Index (FTSEMIB) lost 2.1 percent as UniCredit retreated 3.5 percent to 4.42 euros and Intesa Sanpaolo SpA, the nation’s second-biggest bank, dropped 3.3 percent to 1.51 euros. Mediaset SpA, the broadcaster controlled by Berlusconi, tumbled 6.3 percent to 3.15 euros.

Fiat Industrial SpA, the maker of commercial and agriculture vehicles spun off from Fiat SpA in 2011, slipped 1.7 percent to 9.49 euros after saying Chief Financial Officer Pablo Di Si resigned to pursue other interests.

KPN added 3 percent to 2.33 euros after Telefonica Deutschland said billionaire Carlos Slim’s America Movil has committed to vote in favor of the sale of the German mobile business, called E-Plus. The stake in Telefonica Deutschland that KPN (KPN) will retain after completion will be increased to 20.5 percent from 17.6 percent, KPN said.

Sanofi (SAN) rose 2.4 percent to 76.74 euros, for the biggest gain in the Stoxx 600 by index points. France’s largest drugmaker said tests showed superior benefits of its Fluzone High-Dose influenza vaccine relative to the standard dose of Fluzone treatment in preventing flu.

K+S AG, Europe’s biggest potash producer, advanced 4.3 percent to 19.27 euros as Vladislav Baumgertner, chief executive officer of rival OAO Uralkali, was arrested in Belarus. Baumgertner was charged with abusing his office as chairman of Belarusian Potash Co., the trading venture known as BPC that Russia’s Uralkali and Belaruskali set up in 2005.

-

17:00

European stock close: FTSE 100 6,492.1 +45.23 +0.70% CAC 40 4,067.13 -2.34 -0.06% DAX 8,435.15 +18.16 +0.22%

-

16:42

Oil: an overview of the market situation

The cost of oil futures fell slightly, the first decline recorded over the past three days, as the data in the U.S. were much worse than expected by many experts.

It is learned that orders for durable goods in the U.S. fell more than forecast in July, after three months of growth, indicating a slow strengthening of production. Orders for durable goods, their life span at least three years, fell by 7.3 percent, the most since August 2012, after a 3.9% rise in June. Economists drop should not exceed 3%. Orders fell sharply on the aircraft and capital goods such as computers and electronic equipment.

Today's figures showed a decrease in orders for commercial aircraft by 52.3% after rising 33.8% in June. Chicago-based company Boeing (BA) said it received 90 aircraft orders in July, compared with 287 the previous month. Demand for non-military capital goods excluding aircraft, a leading indicator for future business investment in computers, electronics and other equipment fell by 3.3% in July after rising 1.3% the previous month.

We also add that the conflict in Syria and the unrest in Egypt raised concern that tensions could spread to big oil exporters in the Middle East, which together account for 34 percent of the world's supply of oil. In addition, it was reported that Libya has resumed exports from the port of Brega, one of the four ports, which had been closed since the end of July against the protests.

The cost of the October futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $106.10 per barrel on the New York Mercantile Exchange.

October futures price for North Sea Brent crude oil mixture fell to $ 110.78 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

The value of gold has not changed, remaining near its 11-week high just below $ 1,400, because of the uncertainty about the prospects for monetary policy in the United States.

Note that Friday's weak U.S. data, and news about the biggest influx of gold in the world's largest exchange-traded fund contributed to a sharp rise in prices to $ 1,406.01, the highest level since June 7. However, market participants were not able to keep the price of gold in and around these levels, against which they had fallen below $ 1,400.

Meanwhile, it was reported that hedge funds and other speculators expect a rise in gold prices, as there are signs of an economic slowdown in the United States. As of August 20, the number of net long positions increased by 29 percent to 73,216 futures and options - data showed US Commodity Futures Trading Commission. Short contracts reduced the second week in a row, reaching the lowest level since Feb. 12. Net bullish stance on U.S. 18 traded goods grew by 34 percent, the maximum increase since July 2010.

Gold rose 18 percent compared with a 34-month low in June. Asian jewelry demand rose as prices fell. Sales of new U.S. homes fell more than 13 percent in July, while consumer confidence fell for the week ending August 18, amid growing speculation over whether the Fed will reduce the incentive program, which is weakening the dollar.

We note that the stocks in the SPDR Gold Trust rose by 6.61 tonnes to 920.13 tonnes on Friday, showing the most significant one-day inflow since October 8.

The cost of the October gold futures on COMEX today rose to $ 1396.40 per ounce.

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3315, $1.3335, $1.3350, $1.3360, $1.3420

USD/JPY Y97.00, Y98.00, Y98.50, Y100.00

EUR/GBP stg0.8555

USD/CHF Chf0.9350

AUD/USD $0.8925, $0.9000, $0.9150

USD/CAD C$1.0400, C$1.0450, C$1.0460, C$1.0465, C$1.0570

-

14:34

U.S. Stocks open: Dow 15,016.85 +6.34 +0.04%, Nasdaq 3,662.47 +4.68 +0.13%, S&P 1,664.92 +1.42 +0.09%

-

14:30

Before the bell: S&P futures +0.06%, Nasdaq futures +0.14%

U.S. stock-index futures were little changed after a report showing durable-goods orders fell more than forecast in July may ease concern the Federal Reserve will reduce stimulus efforts next month.

Global Stocks:

Nikkei 13,636.28 -24.27 -0.18%

Hang Seng 22,005.32 +141.81 +0.65%

Shanghai Composite 2,096.47 +39.02 +1.90%

CAC 4,056.2 -13.27 -0.33%

DAX 8,416.47 -0.52 -0.01%

Crude oil$106.21 -0.20%

Gold $1396.40 +0.04%

-

13:59

Upgrades and downgrades before the market open:

Upgrades:

Downgrades:

Other:

Microsoft (MSFT) target raised to $37 from $34 at BMO Capital Mkts

-

13:30

U.S.: Durable Goods Orders , July -7.3% (forecast -3.0%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , July -0.6% (forecast +0.6%)

-

13:30

U.S.: Durable goods orders ex defense, July -6.7%

-

13:17

European session: Dollar recovers losses

08:00 Eurozone ECB's Jens Weidmann Speaks

Dollar index recovers losses incurred last Friday, trading near session highs around 81.40/45.

For the dollar this week promises to be interesting, and today we know the results of the report on orders for durable goods in the United States. Markets expect a reduction of orders by 3.0% in July, while the index excluding the transport sector is projected at 0.6%. Investor sentiment continues to control the talk about the prospects for reducing the Fed asset purchases, which are amplified as we approach the September meeting of the FOMC. "Our economists still expect the Fed to announce the beginning of tightening at the next meeting, but as yet no figures and dates will not be made public. However, the decision itself will signal the movement of the Central Bank to normalize. We believe that QE could be completed in the middle of next year ", - noted Mr. Barry and J. Yu, strategists at UBS.

Euro traded near-month high against the yen in anticipation of tomorrow's data IFO business climate index in Germany. It is expected that the figure will continue to further recovery of the fourth month in a row. According to the median forecast of economists, the level of business confidence in Europe's largest economy is likely to grow this month to 107 from 106.2 in July. In this case, the German unemployment rate for August is likely to be 6.8%. This is the lowest level since May 2012.

Today in Japan, Chief Cabinet Secretary Suga said that before the start of an extraordinary session of parliament, which will be held this fall, Prime Minister Shinzo Abe will take the decision to raise the sales tax in the country.

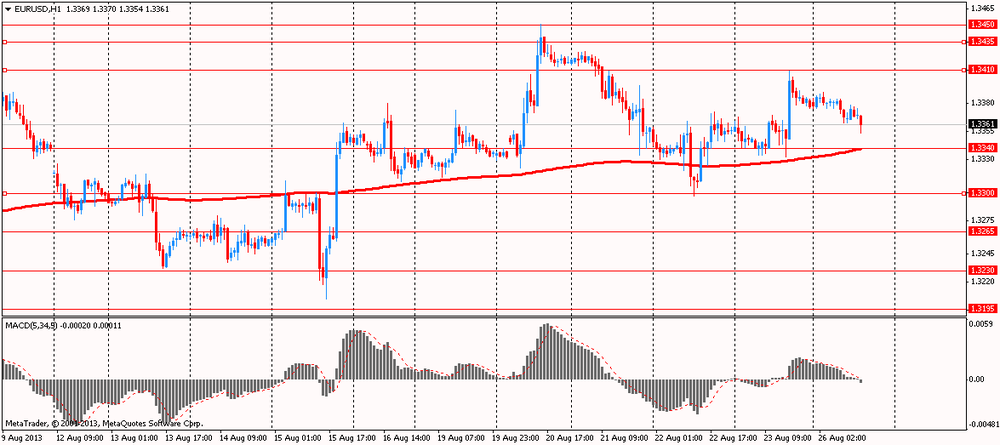

EUR / USD: during the European session, the pair fell to $ 1.3354

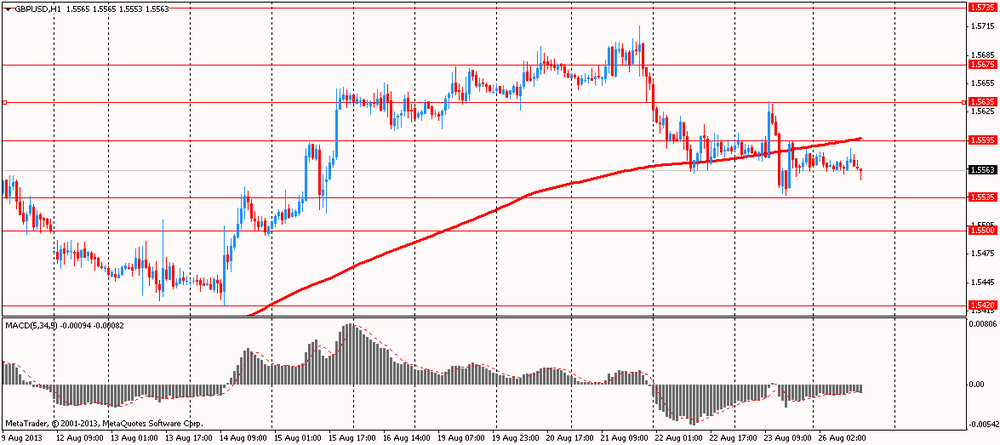

GBP / USD: during the European session, the pair fell to $ 1.5553

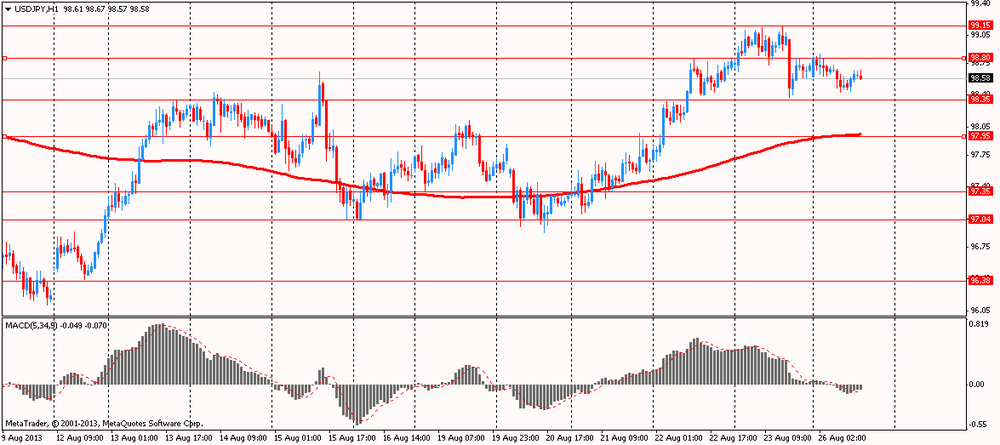

USD / JPY: during the European session, the pair consolidated in the Y98.43-Y98.67

At 12:30 GMT will be published data on the Consumer Price Index in Canada in July. At 13:00 GMT Belgium publish an index of business sentiment for August. At 14:00 GMT is expected to publish an indicator of consumer confidence for August for the euro area. Also this time, the U.S. will present data on the volume of sales in the primary market in July.

At 12:30 GMT the United States will change in orders for durable goods, including excluding transportation equipment in July.

In Britain, the summer bank holiday

-

13:02

Orders

EUR/USD

Offers $1.3500, $1.3475/85, $1.3450/60, $1.3410-20, $1.3400

Bids $1.3365/55, $1.3335/30, $1.3300, $1.3285/80

GBP/USD

Offers $1.5750/55, $1.5720/25, $1.5680/85, $1.5615/20, $1.5590/600

Bids $1.5555/50, $1.5525/15, $1.5505/00, $1.5495/90

AUD/USD

Offers $0.9150, $0.9120, $0.9090/00, $0.9075/80

Bids $0.8980/70, $0.8950, $0.8935/30, $0.8920, $0.8900, $0.8880/75

EUR/JPY

Offers Y133.50, Y133.20, Y133.00, Y132.40/50

Bids Y131.10/00, Y130.80, Y130.50, Y130.20/15

USD/JPY

Offers Y99.50, Y99.20

Bids Y98.10, Y98.00/7.90, Y97.85/80, Y97.50

EUR/GBP

Offers stg0.8675, stg0.8665, stg0.8640/45, stg0.8620/30, stg0.8600/10

Bids stg0.8560, stg0.8545/35, stg0.8520-10, stg0.8485/75

-

11:30

European stocks dropped

European stocks dropped for the first time in three days as investors awaited data on U.S. durable-good orders. U.S. index futures were little changed and Asian shares rose.

U.S. data today may show orders for durable goods fell 4 percent in July, according to the median estimate in a Bloomberg survey of 64 economists. The Commerce Department report is due for release at 8:30 a.m. in Washington.

European Central Bank policy makers can’t rule out lowering the benchmark interest rate from the record low of 0.5 percent even amid signs the euro-area economy is improving, Governing Council Member Panicos Demetriades said in an Aug. 24 interview. By contrast, Bank of Austria Governor Ewald Nowotny said Aug. 22 that he doesn’t see “many arguments now for a rate cut” after the recent “stream of good news.”

UniCredit SpA led banks lower, retreating 2.7 percent.

Royal KPN NV advanced 2.9 percent after winning the support of minority shareholder America Movil SAB for the sale of its German business to Telefonica Deutschland Holding AG. Telefonica Deutschland rallied 3.9 percent.

FTSE 100 Closed

CAC 40 4,043.51 -25.96 -0.64%

DAX 8,392.23 -24.76 -0.29%

-

10:26

Option expiries for today's 1400GMT cut

EUR/USD $1.3315, $1.3335, $1.3350, $1.3360, $1.3420

USD/JPY Y97.00, Y98.00, Y98.50, Y100.00

EUR/GBP stg0.8555

USD/CHF Chf0.9350

AUD/USD $0.8925, $0.9000, $0.9150

USD/CAD C$1.0400, C$1.0450, C$1.0460, C$1.0465, C$1.0570

-

10:21

Asia Pacific stocks close

Asian stocks rose for a second day after a slump in U.S. home sales eased speculation the Federal Reserve will reduce economic stimulus next month.

Nikkei 225 13,636.28 -24.27 -0.18%

Hang Seng 22,005.32 +141.81 +0.65%

S&P/ASX 200 5,135.4 +12.04 +0.24%

Shanghai Composite 2,096.47 +39.02 +1.90%

Belle International Holdings Ltd., a retailer of woman’s footwear, advanced 6.1 percent in Hong Kong after reporting first half-net income.

Newcrest Mining Ltd. jumped 4.9 percent, leading a surge in Australian gold producers after the price of the precious metal rose above $1,400 an ounce last week.

Tokyo Electric Power Co. slumped 6.9 percent in Tokyo after saying one of two irradiated water filters at its wrecked nuclear plant in Fukushima will be shut until at least September..

-

09:01

CAC 40 4,069.59 +0.12 0.00%, Xetra DAX 8,426.94 +9.95 +0.12%

-

07:00

Asian session: The U.S. Dollar Index was little changed

---

The U.S. Dollar Index was little changed before a report forecast to show durable goods orders fell for the first time in four months. Orders placed with U.S. factories for goods meant to last at least three years probably fell 4 percent in July from the previous month, when they gained 3.9 percent, according to the median estimate of economists polled by Bloomberg News before the Commerce Department data today.Fed officials last week rebuffed calls to take the threat of fallout in emerging markets into account when tapering quantitative easing.

The euro was near the highest in a month against the yen before data tomorrow forecast to show continued improvement in Germany’s business climate. In Germany, Europe’s biggest economy, business confidence probably rose for a fourth month in August. The Ifo institute’s business climate index, based on a survey of 7,000 executives, rose to 107 from 106.2 in July, economists predicted ahead of tomorrow’s report. The German unemployment rate likely held at 6.8 percent in August, according to a separate poll before the Aug. 29 data. The jobless rate hasn’t been lower than that since May 2012

In Japan, Chief Cabinet Secretary Yoshihide Suga said today that Prime Minister Shinzo Abe will make a decision on whether to raise the country’s sales tax before the start of the extraordinary Diet session set for the autumn.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3375-90

GBP / USD: during the Asian session the pair traded in the range of $ 1.5560-80

USD / JPY: during the Asian session the pair fell below Y99.50

The approaching long weekend (UK closed today Aug26) prompted a paring back of long sterling positions ahead of this week's BOE Governor Carney speech (Wednesday, and expected to be dovish) as well as expected end month demand for euro-sterling.

-

06:00

Schedule for today, Monday, Aug 26’2013:

06:00 United Kingdom Bank holiday

08:00 Eurozone ECB's Jens Weidmann Speaks

12:30 U.S. Durable Goods Orders July +4.2% -3.0%

12:30 U.S. Durable Goods Orders ex Transportation July 0.0% +0.6%

12:30 U.S. Durable goods orders ex defense July +3.0%

-