Notícias do Mercado

-

19:00

American focus : the Japanese yen has strengthened considerably against the dollar

Rate of the euro traded higher against the dollar, although it lost some of the previously -earned positions. Note that support for the euro initially had information that pointed to the improved sentiment in the euro-zone economy . As it became known to consumers and businesses in 17 countries of the euro area September were less pessimistic than in the past two years. This indicates that economic growth in the eurozone is likely to continue in the coming months . On Friday, the European Commission reported that the leading index of economic sentiment in the euro area in September rose to 96.9 from 95.3 in August , its highest level since August 2011 . This index is calculated on the basis of surveys of companies and consumers in the region . Along with recent surveys of purchasing managers , the index indicates that economic growth in the euro area continued in the 3rd quarter. If the growth will be sustained confidence , it will increase the cost of consumers and companies. However, the index of sentiment in the economy remains below the average for the period since 1990, which is 100 .

Also contributed to the strengthening of the euro comments Fed's Evans. who said that plans to raise interest rates helped lift growth in the United States . Speaking at a conference of central banks in Oslo , Norway , Evans said the better-than -expected U.S. economic growth in the period from 2009 to 2013 is associated with messages about the Fed's future policy. Headwinds that have influenced the growth between 2011 and 2013 without the promise from the Federal Reserve to keep interest rates low for an extended period of time, would worsen the situation. In addition , Evans said that monetary policy is used as a weapon against financial instability will lead to inflation below 2 % , the Fed's second goal . Evans also said that the central bank was not quite ready to cut purchases at the last meeting in September , and he sees that the U.S. unemployment rate should fall below 6.5 % before raising the federal funds rate .

The pound rose significantly against the dollar, which was associated with the statements of the Bank of England's Mark Carney . He said that the UK economy " continues to recovery" against the background of accelerating growth in Europe and the United States. "The last time the countries with developed economies began to feel better," - said Carney . - "Europe and the United States as the major importers of products from the UK, providing support to our economy ."

Carney said that at the moment the UK is at the head of the developed economies on the back of higher household incomes , lower unemployment and the real estate market recovery .

"Business and household confidence in the fact that the Bank of England will not raise interest rates as long as the economy does not show signs of steady growth . We have introduced a threshold in the unemployment rate of 7% as a guide, that may soon start tightening our policy , "- said Carney .

"The Bank of England also may consider easing of monetary policy , in case the recovery stop. But I see the restoration and strengthening of the economy , I do not base to expand quantitative easing "- said the head of the Bank of England.

The yen rose significantly against the dollar, helped by the comments of Finance Minister Taro Aso that Japan can not reduce corporate taxes . In an interview with Aso said that if the tax cuts will require funding.

Comments helped support the yen moderately as a haven amid concerns over the debt ceiling. Today, the U.S. Senate will vote on the bill for the costs . And in mid-October, the United States is estimated to have once again reach the debt ceiling. The debate on this issue once again at an impasse , because the Republicans want to prevent its increase , reducing the federal budget, and the Democrats want to protect spending.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, September 77.5 (forecast 78.2)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3300, $1.3350, $1.3400, $1.3450, $1.3500, $1.3550

GBP/USD $1.6000

USD/JPY Y98.00, Y98.50, Y98.75, Y99.20, Y99.25, Y99.50, Y100.00, Y100.50

AUD/USD $0.9275, $0.9350, $0.9400, $0.9425, $0.9500

USD/CAD Cad1.0200, Cad1.0230, Cad1.0250, Cad1.0325

EUR/CHF Chf1.2300

EUR/GBP stg0.8380, stg0.8400

AUD/JPY Y91.50, Y93.00

-

13:30

U.S.: Personal Income, m/m, August +0.4% (forecast +0.5%)

-

13:30

U.S.: PCE price index ex food, energy, m/m, August +0.2% (forecast +0.1%)

-

13:30

U.S.: PCE price index ex food, energy, Y/Y, August +1.2% (forecast +1.2%)

-

13:30

U.S.: Personal spending , August +0.3% (forecast +0.3%)

-

13:20

European session: the dollar fell

06:00 United Kingdom Nationwide house price index September +0.7% Revised From +0.6% +0.5% +0.9%

06:00 United Kingdom Nationwide house price index, y/y September +3.5% +4.4% +5.0%

06:45 France Consumer spending July -0.8% +0.3% +0.5%

06:45 France Consumer spending, y/y July -0.5% -0.2% +0.4%

06:45 France GDP, q/q (Finally) Quarter II +0.5% +0.5% +0.5%

06:45 France GDP, Y/Y (Finally) Quarter II +0.3% +0.3% +0.4%

07:00 Switzerland KOF Leading Indicator September 1.37 Revised From 1.36 1.46 1.53

09:00 Eurozone ECB President Mario Draghi Speaks

09:00 Eurozone Business climate indicator September -0.21 -0.09 -0.2

09:00 Eurozone Economic sentiment index September 95.2 95.9 96.9

09:00 Eurozone Industrial confidence September -7.8 Revised From -7.9 -7.0 -6.7

09:45 U.S. FOMC Member Charles Evans Speaks

12:00 Germany CPI, m/m (Preliminary) September 0.0% 0.0% 0.0%

12:00 Germany CPI, y/y (Preliminary) September +1.5% +1.5% +1.4%

Тhe euro rose against the dollar amid evidence of improving sentiment in the euro-zone economy . Consumers and companies from 17 countries in the euro area September less pessimistic than in the past two years. This indicates that economic growth in the eurozone is likely to continue in the coming months . On Friday, the European Commission reported that the leading index of economic sentiment in the euro area in September rose to 96.9 from 95.3 in August , its highest level since August 2011 . This index is calculated on the basis of surveys of companies and consumers in the region . Along with recent surveys of purchasing managers , the index indicates that economic growth in the euro area continued in the 3rd quarter. If the growth will be sustained confidence , it will increase the cost of consumers and companies. However, the index of sentiment in the economy remains below the average for the period since 1990, which is 100 .

Also contributed to the strengthening of the euro Fed's Evans' comments that the current level of economic activity is not justified folding , is necessary to increase confidence. The head of the Chicago Fed and FOMC voting member Charles Evans said that "the policy of transparency ," the Fed helped to stimulate economic growth.

The British pound rose against the dollar after the Bank of England Governor Mark Carney said in an interview Yorkshire Post, that he does not consider it necessary to further stimulate the British economy, as the recovery is clearly gaining momentum. The Bank of England has pumped into the economy 375 billion pounds, and Carney believes that in the current situation it is enough. Recovery of the British economy is supported by the improvement of the euro area and the global economy, and the best way will be to maintain further stimulate job growth, said the head of the Central Bank, adding that " at the moment Britain is probably the leader among the major developed economies." Carney also pointed to the recently introduced policy of transparent communication , stating that " it is the policy for the country as a whole, companies and households understand that we are not going to raise rates as long as the economy begins to show real growth ."

The yen strengthened against all major currencies as investors buy safe-haven assets amid ongoing talks in Washington on the upper limit of public debt. Congress must reach an agreement on the federal budget for the following Monday , otherwise the government will stop working . A separate agreement to raise the national debt ceiling has to be taken to the middle of October , or the Ministry of Finance may be faced with the necessity of defaulting on the national debt .

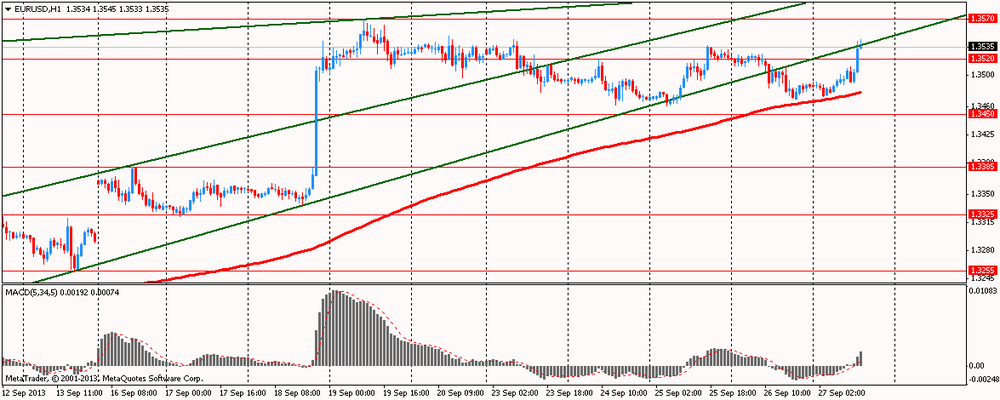

EUR / USD: during the European session, the pair rose to $ 1.3545

GBP / USD: during the European session, the pair rose to $ 1.6132

USD / JPY: during the European session, the pair fell to Y98.38

U.S. at 12:30 GMT will publish the main index for personal consumption expenditures , changes in the level of spending, deflator of personal consumption expenditures for August, at 13:55 GMT - an indicator of consumer confidence from the University of Michigan in September.

-

13:01

Germany: CPI, y/y , September +1.4% (forecast +1.5%)

-

13:00

Germany: CPI, m/m, September 0.0% (forecast 0.0%)

-

12:57

Orders

EUR/USD

Offers $1.3600, $1.3575/80, $1.3545/50, $1.3520

Bids $1.3475/70, $1.3455/50, $1.3420/10, $1.3400

GBP/USD

Offers $1.6220, $1.6200, $1.6170/80, $1.6145/50

Bids $1.6060/50, $1.6000, $1.5985/80, $1.5960/50

AUD/USD

Offers $0.9480, $0.9450, $0.9420, $0.9400, $0.9365/70, $0.9335/40

Bids $0.9300, $0.9280, $0.9250, $0.9200

EUR/GBP

Offers stg0.8500, stg0.8480, stg0.8460/65, stg0.8450, stg0.8420

Bids stg0.8355/50, stg0.8320, stg0.8300, stg0.8280, stg0.8250

EUR/JPY

Offers Y134.20, Y134.00, Y133.70/80, Y133.45/50

Bids Y132.85/80, Y132.60/50, Y132.20, Y132.00

USD/JPY

Offers Y99.60, Y99.50, Y99.15/20, Y98.85/90

Bids Y98.50, Y98.25/20, Y98.00, Y97.80

-

11:15

Eurozone economic confidence rises more than forecast

Eurozone economic confidence rose more than expected in September with markedly improved confidence across all business sectors, the European Commission said Friday.

The economic sentiment index climbed to 96.9 in September from 95.3 in August. It stayed above consensus of 96. Among components, improvements in construction and retail trade were particularly pronounced.

Retailers' confidence rose to -7 from -10.6 a month ago. Managers were particularly more positive about the present business situation. Also their assessments of the future business situation and the volume of stocks improved.

The construction sector registered the sharpest confidence increase of all surveyed sectors. Confidence in construction came in -28.8 in September, up from -33.2 in August.

Consumer confidence continued the upward trend persisting since December 2012. Sentiment rose to -14.9 from -15.6, thanks to more optimistic views on the future general economic situation, unemployment expectations and the future financial situation of household.

At the same time, industrial confidence increased 1.1 points to -6.7 in September driven by managers' much more positive assessment of production expectations and, less pronounced, the current level of overall order books and the stocks of finished products.

Services confidence rose to -3.3 from -5.2, resulting from managers' sharply improving appraisals of demand expectations, the past business situation and, to a lesser extent, past demand.

Elsewhere, the commission said business confidence rose marginally to -0.20 in September from -0.22 in August.

-

10:28

Option expiries for today's 1400GMT cut

EUR/USD $1.3300, $1.3350, $1.3400, $1.3450, $1.3500, $1.3550

GBP/USD $1.6000

USD/JPY Y98.00, Y98.50, Y98.75, Y99.25, Y99.50, Y100.00, Y100.50

AUD/USD $0.9275, $0.9350, $0.9400, $0.9425, $0.9500

USD/CAD Cad1.0200, Cad1.0230, Cad1.0250, Cad1.0325

EUR/CHF Chf1.2300

EUR/GBP stg0.8380, stg0.8400

AUD/JPY Y91.50, Y93.00

-

10:02

Eurozone: Business climate indicator , September -0.2 (forecast -0.09)

-

10:01

Eurozone: Industrial confidence, September -6.7 (forecast -7.0)

-

10:01

Eurozone: Economic sentiment index , September 96.9 (forecast 95.9)

-

08:01

Switzerland: KOF Leading Indicator, September 1.53 (forecast 1.46)

-

07:50

France: GDP, Y/Y, Quarter II +0.4% (forecast +0.3%)

-

07:49

France: GDP, q/q, Quarter II +0.5% (forecast +0.5%)

-

07:46

France: Consumer spending, y/y, July -0.4% (forecast -0.2%)

-

07:46

France: Consumer spending , July +0.4% (forecast +0.3%)

-

07:20

Asian session: The yen strengthened

01:15 U.S. FOMC Member Esther George Speaks

The yen strengthened versus all of its 16 major counterparts as investors sought safety amid concern a budget deadlock among U.S. lawmakers will send the nation to the brink of a federal government shutdown. The U.S. Senate plans to vote today on a spending bill, three days before federal spending authority runs out and a few weeks until the country hits its borrowing limit.

A gauge of the greenback was poised for its first five-day gain in four weeks after Federal Reserve Bank of Kansas City President Esther George said labor-market gains warrant tapering the U.S. central bank’s bond purchases, which tend to debase the currency. George of the Kansas City Fed signaled support for a reduction in U.S. central bank stimulus.

U.S. consumer purchases increased 0.3 percent in August after a 0.1 percent advance in July, according to the median forecast in a Bloomberg News survey of economists before today’s report. The data will also show personal income rose 0.4 percent in August, the biggest gain since February, after a 0.1 percent gain a month earlier, according to the poll.

The Thomson Reuters/University of Michigan index of sentiment this month was at 78 compared to a preliminary reading of 76.8, economists projected in a separate survey. It was at 82.1 in August.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3470-90

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6025-45

USD / JPY: during the Asian session the pair fell to Y98.60

No respite ahead of the weekend, as Friday sees a full calendar on both sides of the Atlantic, with another day loaded with central bank speakers. German flash HICP numbers are also expected, although there is no fixed release time. CPI m/m is expected at 0.0% y/y is expected at 1.5%. Monthly HICP is expected at 0.0% and y/y at 1.6%. French data is due at 06456GMT, with the release of the revised second quarter GDP data and the Aug consumer spending data. France GDP Q/Q is expected at 0.5%, unrevised. France GDP Y/Y is also to be released and is expected to be unrevised at 0.3%. Spanish data expected at 0700GMT when Spain's September flash HICP and the August retail sales index will be published. Switzerland's September KOF economic barometer will also be released at 0700GMT. Italian data set for release at 0800GMT includes the Sep ISTAT business survey. EMU data will be released at 0900GMT, when September economic sentiment survey and the September business climate index numbers are published. Economic confidence data for the Eurozone is expected to increase to 96.6 compared with 95.2 last. ECB President Mario Draghi and Governing Council member Inacio Visco are due to speak at an event in Milan, from 0900GMT.

-

07:01

United Kingdom: Nationwide house price index , September +0.9% (forecast +0.5%)

-

07:00

United Kingdom: Nationwide house price index, y/y, September +5.0% (forecast +4.4%)

-

06:20

Currencies. Daily history for Sep 26'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3486 -0,27%

GBP/USD $1,6037 -0,25%

USD/CHF Chf0,9102 +0,07%

USD/JPY Y98,97 +0,53%

EUR/JPY Y133,48 +0,26%

GBP/JPY Y158,71 +0,29%

AUD/USD $0,9363 +0,03%

NZD/USD $0,8288 +0,57%

USD/CAD C$1,0311 -0,05%

-

06:00

Schedule for today, Friday, Sep 27’2013:

01:00 New Zealand ANZ Business Confidence September 48.1

01:15 U.S. FOMC Member Esther George Speaks

01:45 China Leading Index August 100.2

06:00 United Kingdom Nationwide house price index September +0.6% +0.5%

06:00 United Kingdom Nationwide house price index, y/y September +3.5% +4.4%

06:30 France Consumer spending, y/y July -0.5% -0.2%

06:45 France Consumer spending July -0.8% +0.3%

06:45 France GDP, q/q (Finally) Quarter II +0.5% +0.5%

06:45 France GDP, Y/Y (Finally) Quarter II +0.3% +0.3%

07:00 Switzerland KOF Leading Indicator September 1.36 1.46

09:00 Eurozone ECB President Mario Draghi Speaks

09:00 Eurozone Business climate indicator September -0.21 -0.09

09:00 Eurozone Economic sentiment index September 95.2 95.9

09:00 Eurozone Industrial confidence September -7.9 -7.0

09:45 U.S. FOMC Member Charles Evans Speaks

12:00 Germany CPI, m/m (Preliminary) September 0.0% 0.0%

12:00 Germany CPI, y/y (Preliminary) September +1.5% +1.5%

12:30 U.S. FOMC Member Rosengren Speaks

12:30 U.S. Personal Income, m/m August +0.1% +0.5%

12:30 U.S. Personal spending August +0.1% +0.3%

12:30 U.S. PCE price index ex food, energy, m/m August +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y August +1.2% +1.2%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 76.8 78.2

14:45 U.S. FOMC Member Charles Evans Speaks

18:00 U.S. FOMC Member Dudley Speak

-