Notícias do Mercado

-

23:50

Japan: Retail sales, y/y, September +2.3% (forecast +0.9%)

-

23:20

Currencies. Daily history for Oct 27'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2696 +0,21%

GBP/USD $1,6115 +0,17%

USD/CHF Chf0,9494 -0,25%

USD/JPY Y107,85 -0,29%

EUR/JPY Y136,93 -0,07%

GBP/JPY Y173,79 -0,12%

AUD/USD $0,8800 +0,13%

NZD/USD $0,7888 +0,44%

USD/CAD C$1,1249 +0,18%

-

23:00

Schedule for today, Tuesday, Oct 28’2014:

(time / country / index / period / previous value / forecast)

12:30 U.S. Durable Goods Orders September -18.4% Revised From -18.2% +0.4%

12:30 U.S. Durable Goods Orders ex Transportation September +0.4% Revised From +0.7% +0.5%

12:30 U.S. Durable goods orders ex defense September -19.0%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August +6.7% +5.7%

14:00 U.S. Richmond Fed Manufacturing Index October 14 11

14:00 U.S. Consumer confidence October 86.0 87.4

20:30 U.S. API Crude Oil Inventories October +1.2

23:50 Japan Industrial Production (MoM) (Preliminary) September -1.9% +2.3%

23:50 Japan Industrial Production (YoY) (Preliminary) September -3.3% -2.6%

-

16:35

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. pending home sales and services purchasing managers' index

The U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. pending home sales and services purchasing managers' index. Pending home sales in the U.S. rose 0.3% in September, missing expectations for a 1.1% increase, after a 1.0% drop in August.

The U.S. preliminary services purchasing managers' index declined to 57.3 in September from 58.9 in August, missing expectations for a decrease to 58.7.

The euro increased against the U.S. dollar. German Ifo business climate index fell to 103.2 in October from 104.7 in September, missing expectations for a decline to 104.6. That was the lowest level since December 2012.

Eurozone's adjusted M3 money supply climbed 2.1% in September, exceeding expectations for a 2.2% increase, after a 2.1% gain in August. August's figure was revised up from a 2.0% rise.

Eurozone's private loans fell 1.2% in September, beating forecasts of a 1.3% decrease, after a 1.5% drop in August.

The British pound rose against the U.S. dollar. The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance remained unchanged at 31% in October, missing expectations for an increase to 35%.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded slightly higher against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:52

25 banks failed the ECB’s stress test

The European Central Bank (ECB) released its stress tests results on Sunday. 25 banks failed due to a capital shortfall and 13 banks have to raise an additional €10 billion in capital. Most banks have already taken steps to solve their problems.

Banks that failed the stress tests were from Italy (9 banks), Greece (3 banks), Cyprus (3 banks), Belgium (2 banks), Slovenia (2 banks), Portugal (1 bank), Germany (1 bank), Ireland (1 bank), France (1 bank), Ireland (1 bank), Spain (1 bank) and Austria (1 bank).

Italian bank Monte dei Paschi di Siena had the biggest capital shortfall. The bank had a €2.1bn shortfall.

-

15:01

U.S. pending home sales rose 0.3% in September

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. Pending home sales in the U.S. rose 0.3% in September, missing expectations for a 1.1% increase, after a 1.0% drop in August.

The NAR's chief economist Lawrence Yun said that the current low mortgage rates "should help more buyers reach the market".

-

14:00

U.S.: Pending Home Sales (MoM) , September +0.3% (forecast +1.1%)

-

13:54

Option expiries for today's 1400GMT cut

USDJPY 107.20 (USD 505m) 107.50 (USD 454m) 108.00 (USD 885m) 108.25

EURUSD 1.2600 (EUR 452m) 1.2650 (EUR 1bln) 1.2680-90 (EUR 2.2bln) 1.2700 (EUR 1.3bln) 1.2720 (1.8bln) 1.2730 (EUR 650m) 1.2745-50 (EUR 758m)

AUDUSD 0.8770 (AUD 663m) 0.8850 ( AUD 300m)

USDCAD 1.1225

NZDUSD 0.7800 (NZD 746m) 0.8050 (NZD 422m)

EURJPY 137.00 (EUR 312m)

-

13:45

U.S.: Services PMI, October 57.3 (forecast 58.7)

-

13:13

Foreign exchange market. European session: the euro fell against the U.S. dollar after the weaker-than-expected economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

09:00 Eurozone M3 money supply, adjusted y/y September +2.1% +2.2% 2.5%

09:00 Eurozone Private Loans, Y/Y September -1.5% -1.3% 1.2%

09:00 Germany IFO - Business Climate October 104.7 104.6 103.2

09:00 Germany IFO - Current Assessment October 110.5 109.5 108.4

09:00 Germany IFO - Expectations October 99.3 98.7 98.3

11:00 United Kingdom CBI retail sales balance October 31 35 31

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. pending home sales and services purchasing managers' index. Pending home sales in the U.S. are expected to climb 1.1% in September, after a 1.0% in August.

The U.S. preliminary services purchasing managers' index is expected to decline to 58.7 in September from 58.9 in August.

The euro fell against the U.S. dollar after the weaker-than-expected economic data from Germany. German Ifo business climate index fell to 103.2 in October from 104.7 in September, missing expectations for a decline to 104.6. That was the lowest level since December 2012.

Eurozone's adjusted M3 money supply climbed 2.1% in September, exceeding expectations for a 2.2% increase, after a 2.1% gain in August. August's figure was revised up from a 2.0% rise.

Eurozone's private loans fell 1.2% in September, beating forecasts of a 1.3% decrease, after a 1.5% drop in August.

The British pound traded higher against the U.S. dollar after the U.K. retailer index. The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance remained unchanged at 31% in October, missing expectations for an increase to 35%.

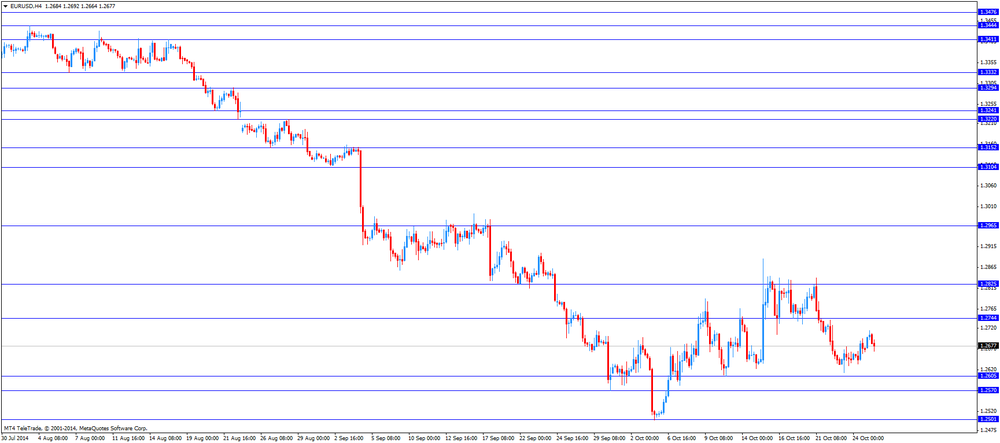

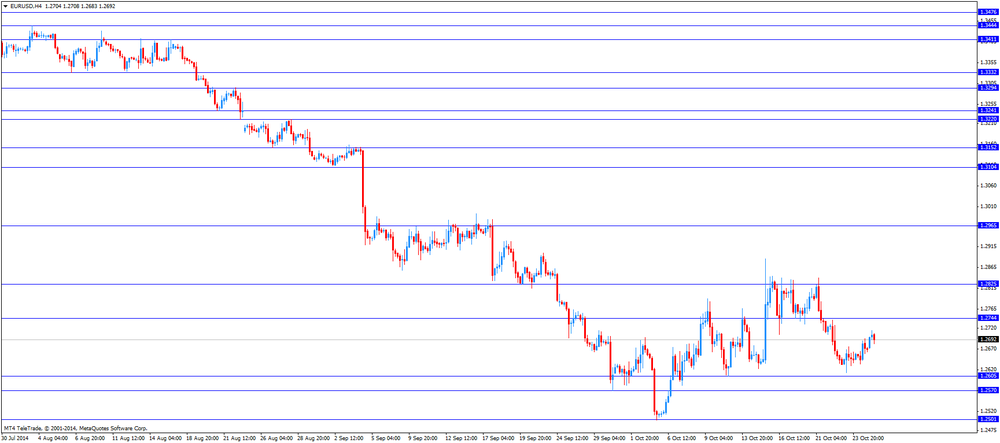

EUR/USD: the currency pair fell to $1.2664

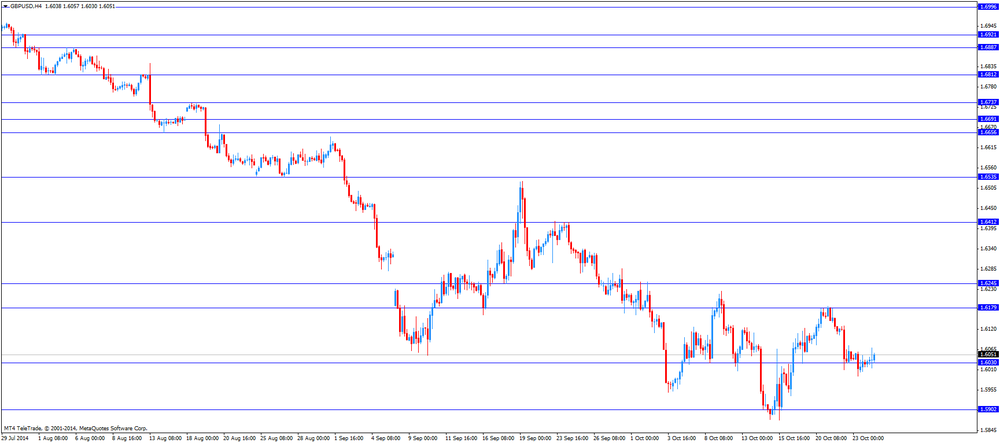

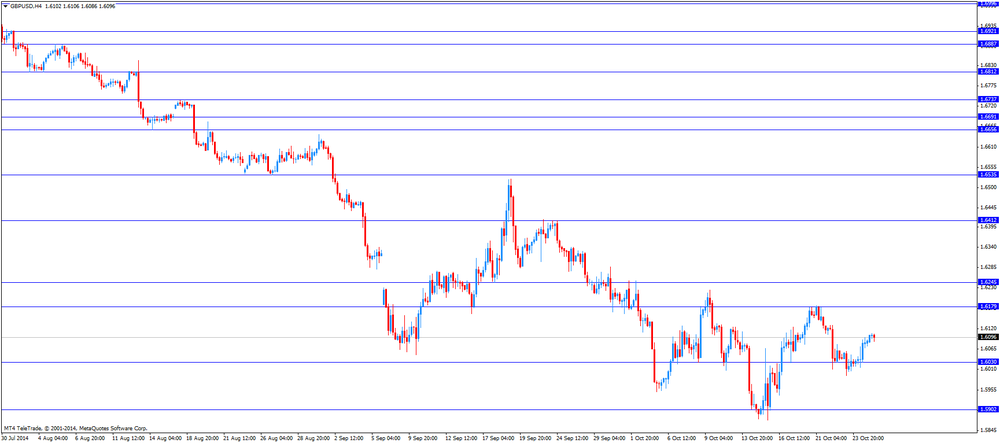

GBP/USD: the currency pair rose to $1.6121

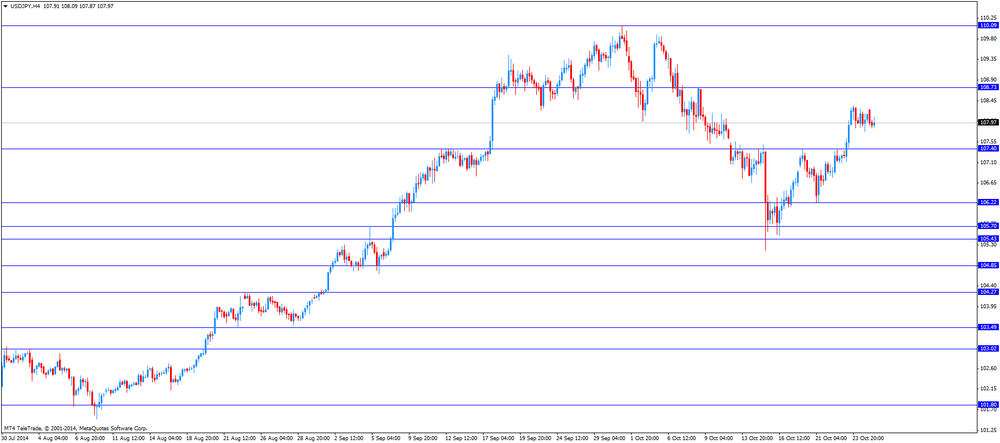

USD/JPY: the currency pair declined to Y107.71

The most important news that are expected (GMT0):

13:45 U.S. Services PMI (Preliminary) October 58.9 58.7

14:00 U.S. Pending Home Sales (MoM) September -1.0% +1.1%

23:50 Japan Retail sales, y/y September +1.2% +0.9%

-

13:00

Orders

EUR/USD

Offers $1.2720

Bids $1.2614, $1.2605/00

GBP/USD

Offers $1.6250, $1.6200

Bids $1.6025/20, $1.6000

AUD/USD

Offers $0.8950, $0.8900, $0.8840/50

Bids $0.8785/80, $0.8755/50, $0.8710/00

EUR/JPY

Offers Y138.00, Y137.80, Y137.45/50, Y137.00

Bids Y136.55/50, Y136.10/00, Y135.80, Y135.50

USD/JPY

Offers Y109.00, Y108.50, Y108.05/10

Bids Y107.55/50, Y107.20, Y107.00

EUR/GBP

Offers

Bids stg0.7850, stg0.7800

-

11:01

United Kingdom: CBI industrial order books balance, October 31 (forecast 35)

-

10:10

Option expiries for today's 10:00am NY cut

USDJPY 107.20 (USD 505m) 107.50 (USD 454m) 108.00 (USD 885m) 108.25

EURUSD 1.2600 (EUR 452m) 1.2650 (EUR 1bln) 1.2680-90 (EUR 2.2bln) 1.2700 (EUR 1.3bln) 1.2720 (1.8bln) 1.2730 (EUR 650m) 1.2745-50 (EUR 758m)

AUDUSD 0.8770 (AUD 663m) 0.8850 ( AUD 300m)

USDCAD 1.1225

NZDUSD 0.7800 (NZD 746m) 0.8050 (NZD 422m)

EURJPY 137.00 (EUR 312m)

-

09:59

Foreign exchange market. Asian session: the U.S. dollar traded lower against the most major currencies after the results from the European Central Bank's stress tests

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

09:00 Eurozone M3 money supply, adjusted y/y September +2.1% +2.2% 2.5%

09:00 Eurozone Private Loans, Y/Y September -1.5% -1.3% 1.2%

09:00 Germany IFO - Business Climate October 104.7 104.6 103.2

09:00 Germany IFO - Current Assessment October 110.5 109.5 108.4

09:00 Germany IFO - Expectations October 99.3 98.7 98.3

The U.S. dollar traded lower against the most major currencies after the results from the European Central Bank's stress tests. The European Central Bank said on Sunday that 25 banks failed due to a capital shortfall and 13 banks have to raise an additional €10 billion in capital. Most banks have already taken steps to solve their problems.

The New Zealand dollar traded higher against the U.S. dollar after the results from the European Central Bank's stress tests. No major economic reports were released in New Zealand.

The Australian dollar traded higher against the U.S. dollar after the results from the European Central Bank's stress tests. No major economic reports were released in Australia.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair rose to $1.2714

GBP/USD: the currency pair increased to $1.6107

USD/JPY: the currency pair fell to Y107.85

The most important news that are expected (GMT0):

10:00 United Kingdom CBI retail sales balance October 31 35

13:45 U.S. Services PMI (Preliminary) October 58.9 58.7

14:00 U.S. Pending Home Sales (MoM) September -1.0% +1.1%

23:50 Japan Retail sales, y/y September +1.2% +0.9%

-

06:14

Options levels on monday, October 27, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2831 (3140)

$1.2796 (3442)

$1.2741 (1669)

Price at time of writing this review: $ 1.2707

Support levels (open interest**, contracts):

$1.2622 (2138)

$1.2577 (2384)

$1.2513 (4529)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 57070 contracts, with the maximum number of contracts with strike pric $1,2900 (7001);

- Overall open interest on the PUT options with the expiration date November, 7 is 59630 contracts, with the maximum number of contracts with strike price $1,2500 (6666);

- The ratio of PUT/CALL was 1.04 versus 1.04 from the previous trading day according to data from October, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.6301 (1759)

$1.6203 (2118)

$1.6107 (1490)

Price at time of writing this review: $1.6097

Support levels (open interest**, contracts):

$1.5995 (1985)

$1.5897 (1851)

$1.5799 (1577)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 27169 contracts, with the maximum number of contracts with strike price $1,6200 (2118);

- Overall open interest on the PUT options with the expiration date November, 7 is 32273 contracts, with the maximum number of contracts with strike price $1,5400 (2350);

- The ratio of PUT/CALL was 1.19 versus 1.19 from the previous trading day according to data from October, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-