Notícias do Mercado

-

23:50

Japan: Retail sales, y/y, September +2.3% (forecast +0.9%)

-

23:36

Commodities. Daily history for Oct 27'2014:

(raw materials / closing price /% change)

Light Crude 80.68 -0.40%

Gold 1,225.70 -0.29%

-

23:31

Stocks. Daily history for Oct 27'2014:

(index / closing price / change items /% change)

Nikkei 225 15,388.72 +97.08 +0.63%

Hang Seng 23,143.23 -158.97 -0.68%

Shanghai Composite 2,290.44 -11.84 -0.51%

FTSE 100 6,363.46 -25.27 -0.40%

CAC 40 4,096.74 -32.16 -0.78%

Xetra DAX 8,902.61 -85.19 -0.95%

S&P 500 1,961.63 -2.95 -0.15%

NASDAQ Composite 4,485.93 +2.22 +0.05%

Dow Jones 16,817.94 +12.53 +0.07%

-

23:20

Currencies. Daily history for Oct 27'2014:

(pare/closed(GMT +2)/change, %)

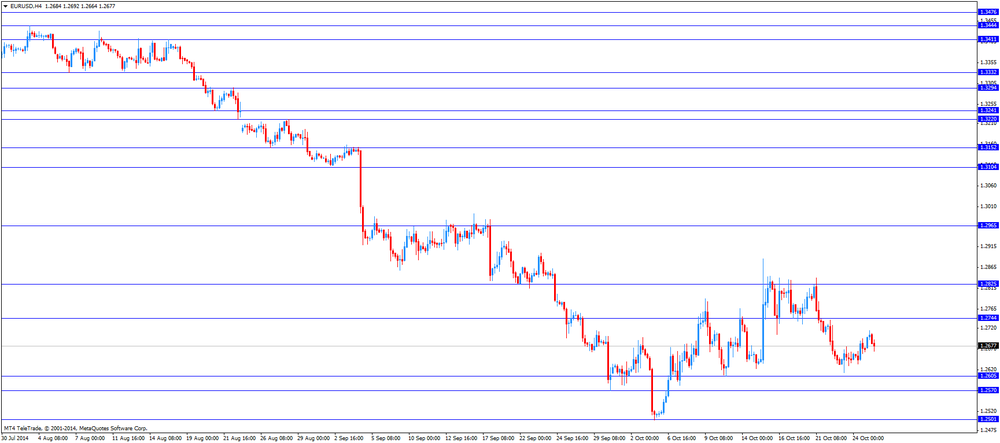

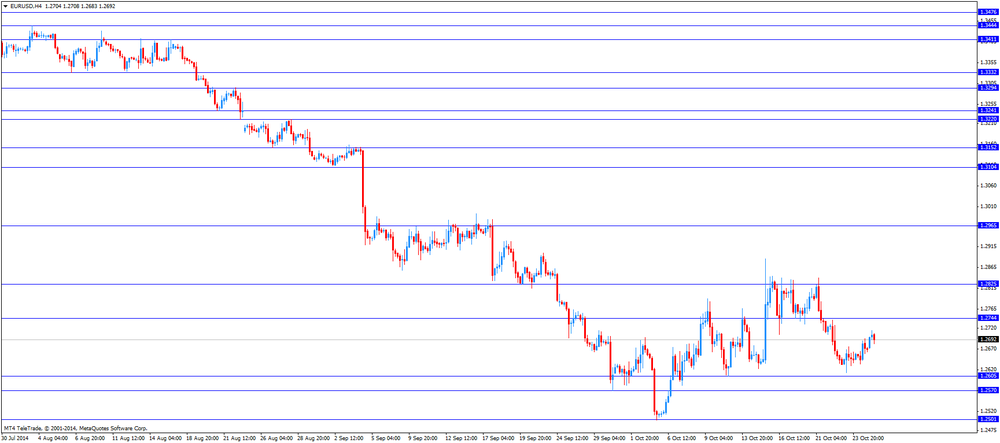

EUR/USD $1,2696 +0,21%

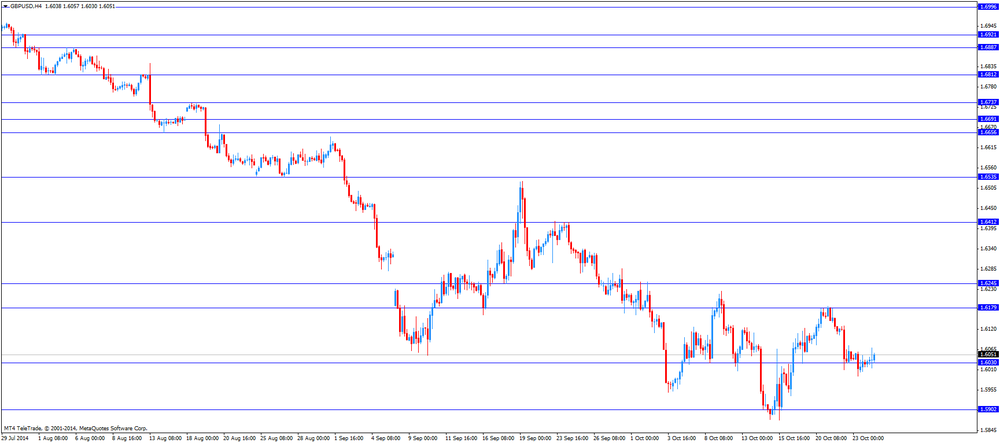

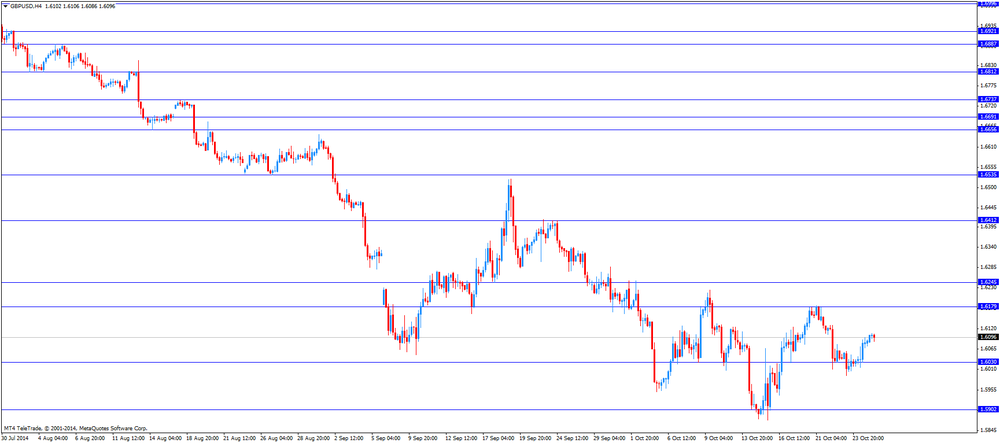

GBP/USD $1,6115 +0,17%

USD/CHF Chf0,9494 -0,25%

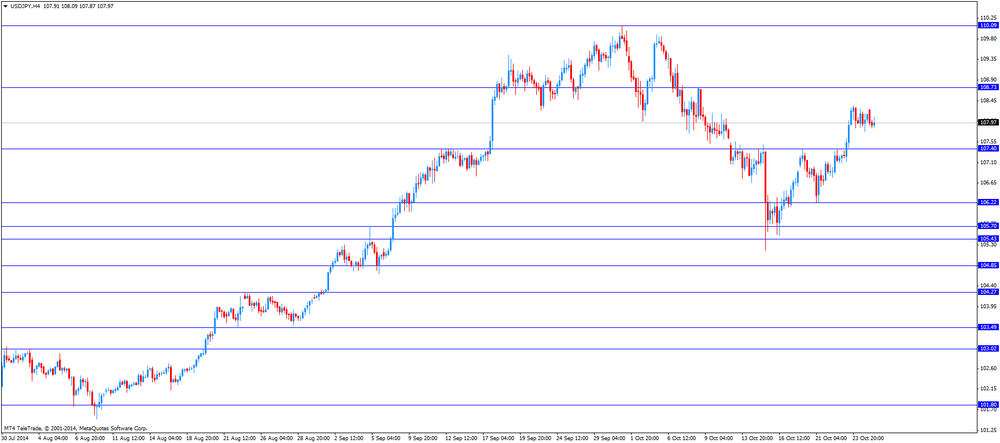

USD/JPY Y107,85 -0,29%

EUR/JPY Y136,93 -0,07%

GBP/JPY Y173,79 -0,12%

AUD/USD $0,8800 +0,13%

NZD/USD $0,7888 +0,44%

USD/CAD C$1,1249 +0,18%

-

23:00

Schedule for today, Tuesday, Oct 28’2014:

(time / country / index / period / previous value / forecast)

12:30 U.S. Durable Goods Orders September -18.4% Revised From -18.2% +0.4%

12:30 U.S. Durable Goods Orders ex Transportation September +0.4% Revised From +0.7% +0.5%

12:30 U.S. Durable goods orders ex defense September -19.0%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August +6.7% +5.7%

14:00 U.S. Richmond Fed Manufacturing Index October 14 11

14:00 U.S. Consumer confidence October 86.0 87.4

20:30 U.S. API Crude Oil Inventories October +1.2

23:50 Japan Industrial Production (MoM) (Preliminary) September -1.9% +2.3%

23:50 Japan Industrial Production (YoY) (Preliminary) September -3.3% -2.6%

-

19:00

Dow -15.38 16,790.03 -0.09% Nasdaq -6.94 4,476.78 -0.15% S&P -6.18 1,958.40 -0.31%

-

17:01

European stocks close: stocks closed lower, German Ifo business climate index and the results from the European Central Bank's stress tests weighed on markets

Stock indices traded lower after the weaker-than-expected economic data from Germany. German Ifo business climate index fell to 103.2 in October from 104.7 in September, missing expectations for a decline to 104.6. That was the lowest level since December 2012.

Eurozone's adjusted M3 money supply climbed 2.1% in September, exceeding expectations for a 2.2% increase, after a 2.1% gain in August. August's figure was revised up from a 2.0% rise.

Eurozone's private loans fell 1.2% in September, beating forecasts of a 1.3% decrease, after a 1.5% drop in August.

The European Central Bank said on Sunday that 25 banks failed due to a capital shortfall and 13 banks have to raise an additional €10 billion in capital. Most banks have already taken steps to solve their problems.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,363.46 -25.27 -0.40%

DAX 8,902.61 -85.19 -0.95%

CAC 40 4,096.74 -32.16 -0.78%

-

17:00

European stocks close: FTSE 100 6,363.46 -25.27 -0.40% CAC 40 4,096.74 -32.16 -0.78% DAX 8,902.61 -85.19 -0.95%

-

16:40

Oil: an overview of the market situation

Oil prices have dropped significantly today, while reaching its lowest level in nearly 28 months after analysts Goldman Sachs Group Inc. downgraded the outlook on prices for 2015, citing the growth of the world's supply.

According to new estimates from Goldman Sachs, in the first quarter of 2015. Brent crude oil will cost $ 85 per barrel (previously expected $ 100 per barrel) and WTI - $ 75 per barrel from $ 90 previously.

The experts believe that OPEC will lose its position of producer, able to influence the dynamics of oil prices, and this position will take the US to increase the production of shale oil. "Our forecasts oil prices reflect, including expectations and the loss of key OPEC ability to affect the pricing in the market," - said in a statement.

It is worth emphasizing, Goldman Sachs forecast the most pessimistic of all US financial institutions made in recent concerns about the pace of growth and excess supply. Forecast Goldman goes against estimates Standard Chartered Bank, which analysts have estimated that a barrel of Brent in 2015 will cost $ 105

Add that concern about the weakening global demand, as well as signs that the Organization of Petroleum Exporting Countries will not cut production to support oil quotations, also exert pressure in recent weeks. Oil production in the OPEC reached in September two-year high of 31 million barrels per day, due to the increase in production in Iraq and Libya. Some market analysts believe that only a reduction in the volume of production in the oil cartel will be able to stop the decline in prices.

Market participants are waiting for a meeting of oil ministers of the OPEC countries, scheduled for November 27, during which intend to consider the advisability of adjusting the current production at the level of 30 mln. Barrels per day at the beginning of 2015.

Today, as it became known that Iran plans to increase oil production. This was stated by Deputy Oil Minister of Iran Mansour Moazzam. The Islamic Republic plans to increase refining capacity from the current 1.8 million barrels per day to 3 million barrels. According to OPEC daily oil production in Iran in September was 2.675 million barrels. According to the calculations of Iranian experts, Iran's oil reserves will last for 60 years.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to $ 80.61 a barrel on the New York Mercantile Exchange (NYMEX).

December futures price for North Sea petroleum mix of mark Brent fell $ 0.42 to $ 85.71 a barrel on the London exchange ICE Futures Europe.

-

16:35

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. pending home sales and services purchasing managers' index

The U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. pending home sales and services purchasing managers' index. Pending home sales in the U.S. rose 0.3% in September, missing expectations for a 1.1% increase, after a 1.0% drop in August.

The U.S. preliminary services purchasing managers' index declined to 57.3 in September from 58.9 in August, missing expectations for a decrease to 58.7.

The euro increased against the U.S. dollar. German Ifo business climate index fell to 103.2 in October from 104.7 in September, missing expectations for a decline to 104.6. That was the lowest level since December 2012.

Eurozone's adjusted M3 money supply climbed 2.1% in September, exceeding expectations for a 2.2% increase, after a 2.1% gain in August. August's figure was revised up from a 2.0% rise.

Eurozone's private loans fell 1.2% in September, beating forecasts of a 1.3% decrease, after a 1.5% drop in August.

The British pound rose against the U.S. dollar. The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance remained unchanged at 31% in October, missing expectations for an increase to 35%.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded slightly higher against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports from Japan.

-

16:20

Gold: an overview of the market situation

Gold prices fell slightly today, due to the expectations of the Fed meeting, scheduled for this week. According to experts, the central bank said the continuation of folding bond purchase program, and such a decision is likely to have an upward pressure on the dollar, which again weaken the demand for gold as a safe haven. Investors are also closely examine the Fed statement to find in it further hints on the timing of interest rate increases. Recall, rising interest rates generally negative for gold, as it increases the relative cost containment metal.

Little impact on the bidding had stress test results of the largest banks in Europe have shown that the majority of the region's leading lenders have enough capital to survive another financial crisis. On Sunday, the ECB announced the results of tests of 150 banks. In all, 25 banks had discovered the lack of capital, but most of them have already taken action. A total of 13 banks still need to save $ 9.5 billion. Euro debt capital.

The value of precious metals also affect the data on the US housing market. As it became known, the number of pending home sales rose slightly in September and is now higher compared to the same period of the previous year for the first time in 11 months. The index of pending home sales (PHSI) - forecast indicator based on signed contracts - rose slightly by 0.3 percent to 105.0 in September from 104.7 in August, and is now 1.0 per cent higher than in September 2013 (104.0). The index is above 100 for the fifth month in a row, and is the second highest level since last September.

Also today it was announced that the world's largest reserves of the Fund ETF SPDR Gold Trust fell on Friday to 4.5 tonnes - up to 745.39 tons, reaching a six-year low. According to the results of last week, stocks fell by 15.5 tons, fixing the maximum weekly drop since July last year.

The cost of December gold futures on the COMEX today dropped to 1228.80 dollars per ounce.

-

15:52

25 banks failed the ECB’s stress test

The European Central Bank (ECB) released its stress tests results on Sunday. 25 banks failed due to a capital shortfall and 13 banks have to raise an additional €10 billion in capital. Most banks have already taken steps to solve their problems.

Banks that failed the stress tests were from Italy (9 banks), Greece (3 banks), Cyprus (3 banks), Belgium (2 banks), Slovenia (2 banks), Portugal (1 bank), Germany (1 bank), Ireland (1 bank), France (1 bank), Ireland (1 bank), Spain (1 bank) and Austria (1 bank).

Italian bank Monte dei Paschi di Siena had the biggest capital shortfall. The bank had a €2.1bn shortfall.

-

15:01

U.S. pending home sales rose 0.3% in September

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. Pending home sales in the U.S. rose 0.3% in September, missing expectations for a 1.1% increase, after a 1.0% drop in August.

The NAR's chief economist Lawrence Yun said that the current low mortgage rates "should help more buyers reach the market".

-

14:00

U.S.: Pending Home Sales (MoM) , September +0.3% (forecast +1.1%)

-

13:54

Option expiries for today's 1400GMT cut

USDJPY 107.20 (USD 505m) 107.50 (USD 454m) 108.00 (USD 885m) 108.25

EURUSD 1.2600 (EUR 452m) 1.2650 (EUR 1bln) 1.2680-90 (EUR 2.2bln) 1.2700 (EUR 1.3bln) 1.2720 (1.8bln) 1.2730 (EUR 650m) 1.2745-50 (EUR 758m)

AUDUSD 0.8770 (AUD 663m) 0.8850 ( AUD 300m)

USDCAD 1.1225

NZDUSD 0.7800 (NZD 746m) 0.8050 (NZD 422m)

EURJPY 137.00 (EUR 312m)

-

13:45

U.S.: Services PMI, October 57.3 (forecast 58.7)

-

13:34

U.S. Stocks open: Dow 16,761.78 -43.63 -0.26%, Nasdaq 4,468.93 -14.79 -0.33%, S&P 1,959.43 -5.15 -0.26%

-

13:29

Before the bell: S&P futures -0.45%, Nasdaq futures -0.24%

U.S. stock-index futures fell as investors weighed earnings to gauge how well the economy is coping with the cut in Federal Reserve stimulus.

Global markets:

Nikkei 15,388.72 +97.08 +0.63%

Hang Seng 23,143.23 -158.97 -0.68%

Shanghai Composite 2,290.44 -11.84 -0.51%

FTSE 6,349.3 -39.43 -0.62%

CAC 4,074.32 -54.58 -1.32%

DAX 8,870.31 -117.49 -1.31%

Crude oil $80.00 (-1.28%)

Gold $1231.40 (-0.04%)

-

13:16

DOW components before the bell

(company / ticker / price / change, % / volume)

Walt Disney Co

DIS

88.62

+0.01%

1.5K

UnitedHealth Group Inc

UNH

91.75

+0.12%

0.9K

AT&T Inc

T

33.87

0.00%

2.3K

Visa

V

213.48

0.00%

0.4K

Boeing Co

BA

122.23

-0.01%

0.1K

Verizon Communications Inc

VZ

48.76

-0.02%

2.0K

Pfizer Inc

PFE

29.10

-0.03%

5.5K

E. I. du Pont de Nemours and Co

DD

68.90

-0.14%

0.2K

Merck & Co Inc

MRK

57.50

-0.19%

23.6K

General Electric Co

GE

25.58

-0.23%

16.4K

Intel Corp

INTC

33.10

-0.24%

1.1K

Caterpillar Inc

CAT

99.19

-0.25%

1K

Procter & Gamble Co

PG

84.94

-0.26%

0.2K

McDonald's Corp

MCD

91.40

-0.29%

4.6K

International Business Machines Co...

IBM

161.60

-0.30%

4.8K

Goldman Sachs

GS

182.75

-0.33%

5.6K

Johnson & Johnson

JNJ

102.79

-0.33%

5.8K

Microsoft Corp

MSFT

45.97

-0.35%

30.6K

JPMorgan Chase and Co

JPM

58.46

-0.48%

0.6K

Cisco Systems Inc

CSCO

23.65

-0.55%

0.3K

Exxon Mobil Corp

XOM

93.90

-0.62%

2.7K

The Coca-Cola Co

KO

40.68

-0.85%

12.8K

Nike

NKE

90.09

-0.89%

0.8K

Chevron Corp

CVX

114.84

-0.92%

0.3K

American Express Co

AXP

85.46

-1.09%

0.2K

-

13:13

Foreign exchange market. European session: the euro fell against the U.S. dollar after the weaker-than-expected economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

09:00 Eurozone M3 money supply, adjusted y/y September +2.1% +2.2% 2.5%

09:00 Eurozone Private Loans, Y/Y September -1.5% -1.3% 1.2%

09:00 Germany IFO - Business Climate October 104.7 104.6 103.2

09:00 Germany IFO - Current Assessment October 110.5 109.5 108.4

09:00 Germany IFO - Expectations October 99.3 98.7 98.3

11:00 United Kingdom CBI retail sales balance October 31 35 31

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. pending home sales and services purchasing managers' index. Pending home sales in the U.S. are expected to climb 1.1% in September, after a 1.0% in August.

The U.S. preliminary services purchasing managers' index is expected to decline to 58.7 in September from 58.9 in August.

The euro fell against the U.S. dollar after the weaker-than-expected economic data from Germany. German Ifo business climate index fell to 103.2 in October from 104.7 in September, missing expectations for a decline to 104.6. That was the lowest level since December 2012.

Eurozone's adjusted M3 money supply climbed 2.1% in September, exceeding expectations for a 2.2% increase, after a 2.1% gain in August. August's figure was revised up from a 2.0% rise.

Eurozone's private loans fell 1.2% in September, beating forecasts of a 1.3% decrease, after a 1.5% drop in August.

The British pound traded higher against the U.S. dollar after the U.K. retailer index. The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance remained unchanged at 31% in October, missing expectations for an increase to 35%.

EUR/USD: the currency pair fell to $1.2664

GBP/USD: the currency pair rose to $1.6121

USD/JPY: the currency pair declined to Y107.71

The most important news that are expected (GMT0):

13:45 U.S. Services PMI (Preliminary) October 58.9 58.7

14:00 U.S. Pending Home Sales (MoM) September -1.0% +1.1%

23:50 Japan Retail sales, y/y September +1.2% +0.9%

-

13:00

Orders

EUR/USD

Offers $1.2720

Bids $1.2614, $1.2605/00

GBP/USD

Offers $1.6250, $1.6200

Bids $1.6025/20, $1.6000

AUD/USD

Offers $0.8950, $0.8900, $0.8840/50

Bids $0.8785/80, $0.8755/50, $0.8710/00

EUR/JPY

Offers Y138.00, Y137.80, Y137.45/50, Y137.00

Bids Y136.55/50, Y136.10/00, Y135.80, Y135.50

USD/JPY

Offers Y109.00, Y108.50, Y108.05/10

Bids Y107.55/50, Y107.20, Y107.00

EUR/GBP

Offers

Bids stg0.7850, stg0.7800

-

12:01

European stock markets mid session: stocks traded lower after the weaker-than-expected economic data from Germany

Stock indices traded lower after the weaker-than-expected economic data from Germany. German Ifo business climate index fell to 103.2 in October from 104.7 in September, missing expectations for a decline to 104.6. That was the lowest level since December 2012.

Eurozone's adjusted M3 money supply climbed 2.1% in September, exceeding expectations for a 2.2% increase, after a 2.1% gain in August. August's figure was revised up from a 2.0% rise.

Eurozone's private loans fell 1.2% in September, beating forecasts of a 1.3% decrease, after a 1.5% drop in August.

Current figures:

Name Price Change Change %

FTSE 100 6,382.23 -6.50 -0.10%

DAX 8,952.74 -35.06 -0.39%

CAC 40 4,115.57 -13.33 -0.32%

-

11:01

United Kingdom: CBI industrial order books balance, October 31 (forecast 35)

-

10:45

Asian Stocks close: most stocks closed lower due to delay to the link between the Hong Kong’s and Shanghai’s stock exchange

Most Asian stock indices closed lower due to the delay to the link between the Hong Kong's and Shanghai's stock exchange. The link between both stock exchanges still hadn't received regulatory approval.

Markets were supported by the results from the European Central Bank's stress tests. The European Central Bank said on Sunday that 25 banks failed due to a capital shortfall and 13 banks have to raise an additional €10 billion in capital. Most banks have already taken steps to solve their problems.

Indexes on the close:

Nikkei 225 15,388.72 +97.08 +0.63%

Hang Seng 23,143.23 -158.97 -0.68%

Shanghai Composite 2,290.44 -11.84 -0.51%

-

10:10

Option expiries for today's 10:00am NY cut

USDJPY 107.20 (USD 505m) 107.50 (USD 454m) 108.00 (USD 885m) 108.25

EURUSD 1.2600 (EUR 452m) 1.2650 (EUR 1bln) 1.2680-90 (EUR 2.2bln) 1.2700 (EUR 1.3bln) 1.2720 (1.8bln) 1.2730 (EUR 650m) 1.2745-50 (EUR 758m)

AUDUSD 0.8770 (AUD 663m) 0.8850 ( AUD 300m)

USDCAD 1.1225

NZDUSD 0.7800 (NZD 746m) 0.8050 (NZD 422m)

EURJPY 137.00 (EUR 312m)

-

09:59

Foreign exchange market. Asian session: the U.S. dollar traded lower against the most major currencies after the results from the European Central Bank's stress tests

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

09:00 Eurozone M3 money supply, adjusted y/y September +2.1% +2.2% 2.5%

09:00 Eurozone Private Loans, Y/Y September -1.5% -1.3% 1.2%

09:00 Germany IFO - Business Climate October 104.7 104.6 103.2

09:00 Germany IFO - Current Assessment October 110.5 109.5 108.4

09:00 Germany IFO - Expectations October 99.3 98.7 98.3

The U.S. dollar traded lower against the most major currencies after the results from the European Central Bank's stress tests. The European Central Bank said on Sunday that 25 banks failed due to a capital shortfall and 13 banks have to raise an additional €10 billion in capital. Most banks have already taken steps to solve their problems.

The New Zealand dollar traded higher against the U.S. dollar after the results from the European Central Bank's stress tests. No major economic reports were released in New Zealand.

The Australian dollar traded higher against the U.S. dollar after the results from the European Central Bank's stress tests. No major economic reports were released in Australia.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair rose to $1.2714

GBP/USD: the currency pair increased to $1.6107

USD/JPY: the currency pair fell to Y107.85

The most important news that are expected (GMT0):

10:00 United Kingdom CBI retail sales balance October 31 35

13:45 U.S. Services PMI (Preliminary) October 58.9 58.7

14:00 U.S. Pending Home Sales (MoM) September -1.0% +1.1%

23:50 Japan Retail sales, y/y September +1.2% +0.9%

-

06:14

Options levels on monday, October 27, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2831 (3140)

$1.2796 (3442)

$1.2741 (1669)

Price at time of writing this review: $ 1.2707

Support levels (open interest**, contracts):

$1.2622 (2138)

$1.2577 (2384)

$1.2513 (4529)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 57070 contracts, with the maximum number of contracts with strike pric $1,2900 (7001);

- Overall open interest on the PUT options with the expiration date November, 7 is 59630 contracts, with the maximum number of contracts with strike price $1,2500 (6666);

- The ratio of PUT/CALL was 1.04 versus 1.04 from the previous trading day according to data from October, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.6301 (1759)

$1.6203 (2118)

$1.6107 (1490)

Price at time of writing this review: $1.6097

Support levels (open interest**, contracts):

$1.5995 (1985)

$1.5897 (1851)

$1.5799 (1577)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 27169 contracts, with the maximum number of contracts with strike price $1,6200 (2118);

- Overall open interest on the PUT options with the expiration date November, 7 is 32273 contracts, with the maximum number of contracts with strike price $1,5400 (2350);

- The ratio of PUT/CALL was 1.19 versus 1.19 from the previous trading day according to data from October, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:03

Nikkei 225 15,359.22 +67.58 +0.44%, Hang Seng 23,038.84 -263.36 -1.13%, S&P/ASX 200 5,446.9 +34.65 +0.64%, Shanghai Composite 2,290.81 -11.47 -0.50%

-