Notícias do Mercado

-

23:51

Japan: Industrial Production (YoY), September +0.6% (forecast -2.6%)

-

23:50

Japan: Industrial Production (MoM) , September +2.7% (forecast +2.3%)

-

23:33

Commodities. Daily history for Oct 28'2014:

(raw materials / closing price /% change)

Light Crude 81.50 +0.10%

Gold 1,227.90 -0.12%

-

23:31

Stocks. Daily history for Oct 28'2014:

(index / closing price / change items /% change)

Nikkei 225 15,329.91 -58.81 -0.38%

Hang Seng 23,520.36 +377.13 +1.63%

Shanghai Composite 2,337.87 +47.43 +2.07%

FTSE 100 6,402.17 +38.71 +0.61%

CAC 40 4,112.67 +15.93 +0.39%

Xetra DAX 9,068.19 +165.58 +1.86%

S&P 500 1,985.05 +23.42 +1.19%

NASDAQ Composite 4,564.29 +78.36 +1.75%

Dow Jones 17,005.75 +187.81 +1.12%

-

23:19

Currencies. Daily history for Oct 28'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2732 +0,28%

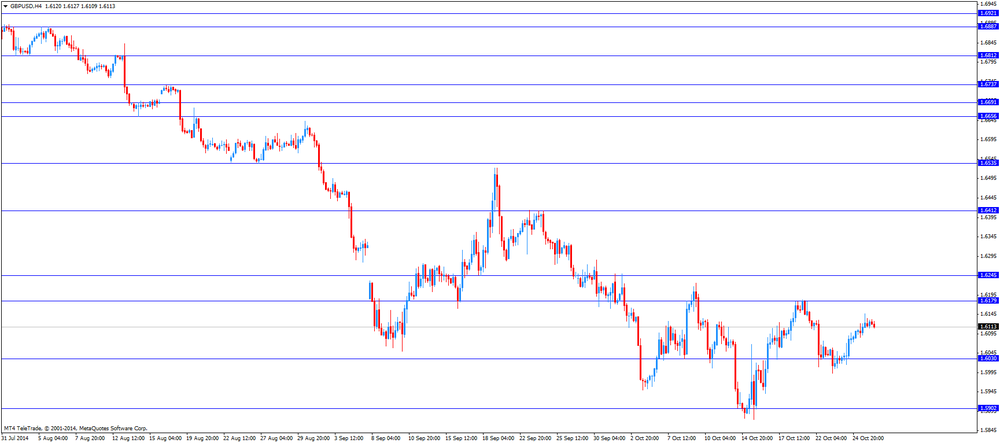

GBP/USD $1,6129 +0,09%

USD/CHF Chf0,9470 -0,25%

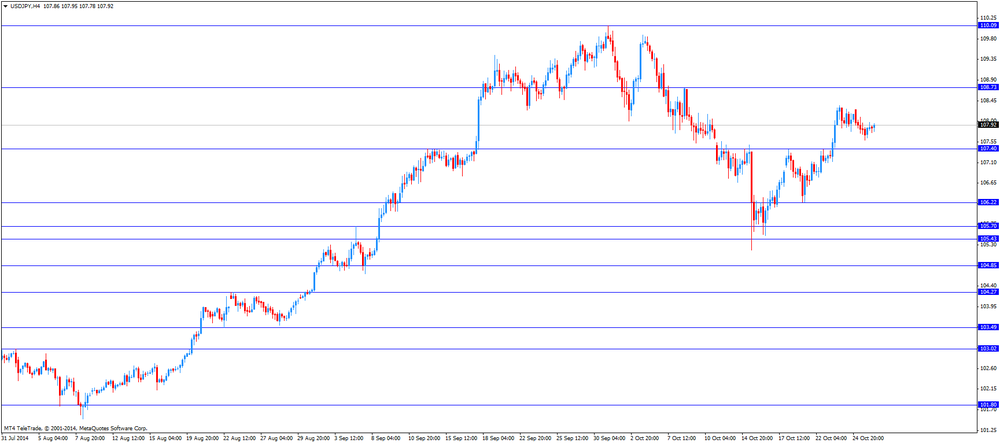

USD/JPY Y108,13 +0,26%

EUR/JPY Y137,68 +0,54%

GBP/JPY Y174,4 +0,35%

AUD/USD $0,8850 +0,56%

NZD/USD $0,7920 +0,40%

USD/CAD C$1,1167 -0,73%

-

23:00

Schedule for today, Wednesday, Oct 29’2014:

(time / country / index / period / previous value / forecast)

00:00 New Zealand ANZ Business Confidence October 13.4

09:30 United Kingdom Net Lending to Individuals, bln September 3.2 2.8

09:30 United Kingdom Mortgage Approvals September 64 63

12:30 Canada Industrial Product Prices, m/m September +0.2% +0.3%

12:30 Canada Raw Material Price Index September -2.2% +1.5%

14:30 U.S. Crude Oil Inventories October +7.1

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 15 0

18:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

-

19:00

Dow 16,938.54 +120.60 +0.72%, Nasdaq 4,546.55 +60.62 +1.35%, S&P 500 1,976.84 +15.21 +0.78%

-

17:00

European stocks closed in plus: FTSE 100 6,406.45 +42.99 +0.68%, CAC 40 4,117.75 +21.01 +0.51%, DAX 9,071.88 +169.27 +1.90%

-

17:00

European stocks close: stocks closed higher due to the better-than-expected corporate earnings

Stock indices closed higher due to the better-than-expected corporate earnings.

Investors are awaiting the Fed' interest rate decision on Wednesday. They expect that the Fed will end its bond-buying program. Investors are awaiting new signs for further monetary policy in the U.S. The slowdown of the global growth and recent weaker-than-expected U.S. economic data could lead that the Fed will keep its low interest rate for a longer period.

Sanofi shares dropped 10% after the company reported that sales of its diabetes products may not grow next year due to price competition.

Standard Chartered Plc shares fell 9% after reporting a 16% decline in third-quarter profit before taxes.

UBS AG shares rose 5.8% despite the weaker-than-estimated third-quarter profit.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,402.17 +38.71 +0.61%

DAX 9,068.19 +165.58 +1.86%

CAC 40 4,112.67 +15.93 +0.39%

-

16:40

WTI crude steady near 28-month low as supply seen rising

West Texas Intermediate was little changed near a 28-month low amid speculation that U.S. crude stockpiles increased last week. Brent oil was steady in London.

A government report tomorrow will probably show that crude supplies rose 3.8 million barrels last week, according to a Bloomberg survey of analysts. U.S. orders for durable goods dropped unexpectedly in September, a report showed today. Prices have slipped 11 percent this month on signs that global oil production is growing faster than demand for fuel.

"We're waiting for tomorrow's storage report," Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York, said by phone. "The consensus is for a gain of 3-to-4 million barrels, but we were looking for a 3 million-barrel gain last week and got 7 million. If something similar happens this week, WTI will come under pressure."

WTI for December delivery rose 21 cents to $81.21 a barrel at 10:37 a.m. on the New York Mercantile Exchange. Futures touched $79.44 yesterday, the lowest intraday level since June 29, 2012. The volume of all futures traded was 18 percent below the 100-day average for the time of day. Prices have declined 18 percent this year.

Brent for December settlement gained 7 cents to $85.90 a barrel on the London-based ICE Futures Europe exchange. The volume of all futures traded was 35 percent lower than the 100-day average. The European benchmark crude traded at a $4.69 premium to WTI, down from $4.83 at yesterday's close.

-

16:40

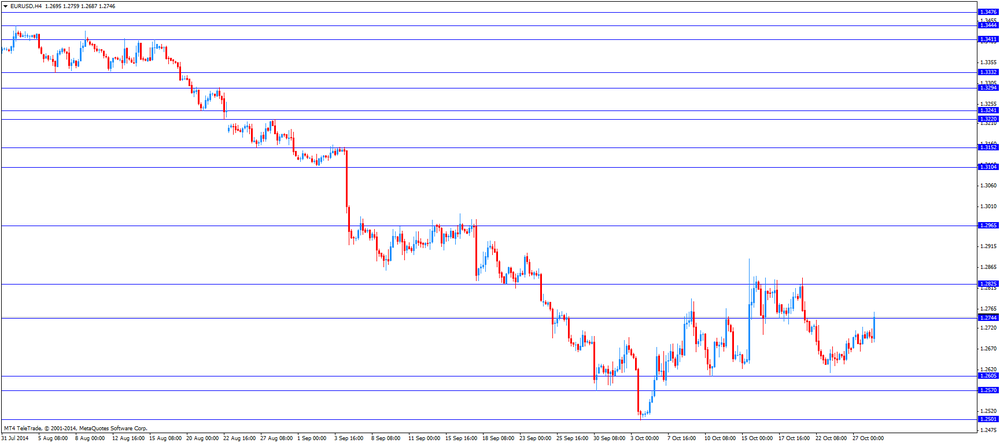

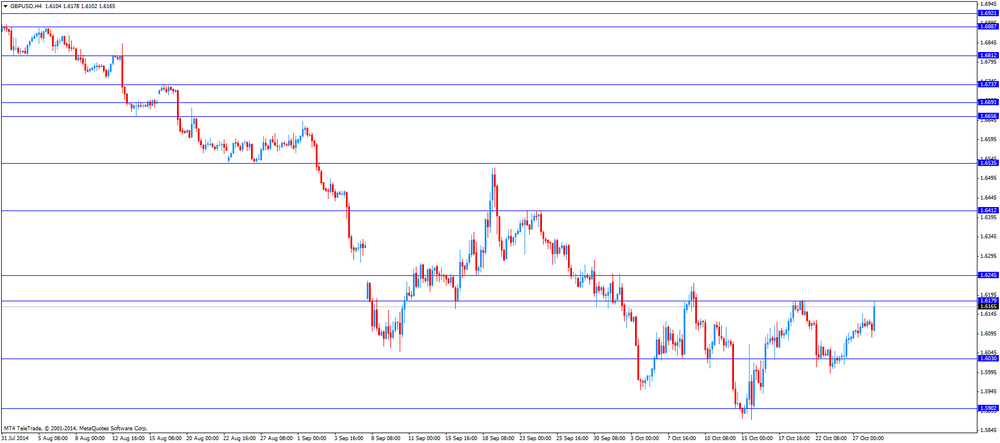

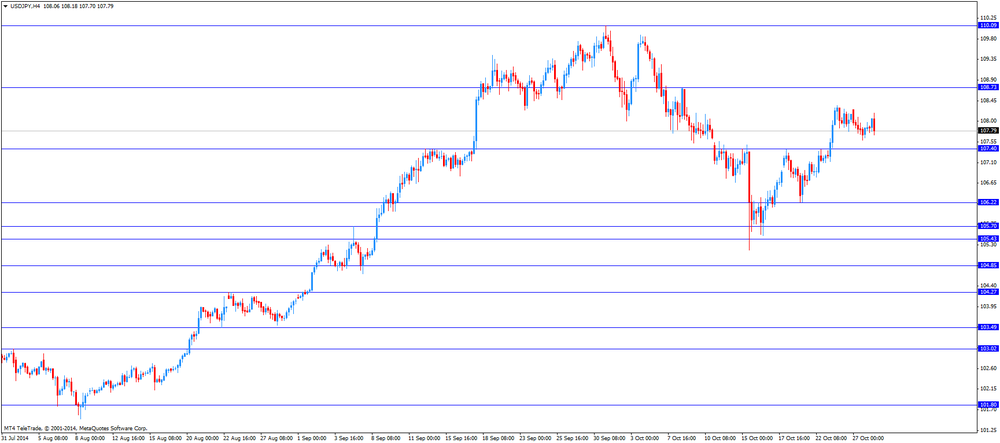

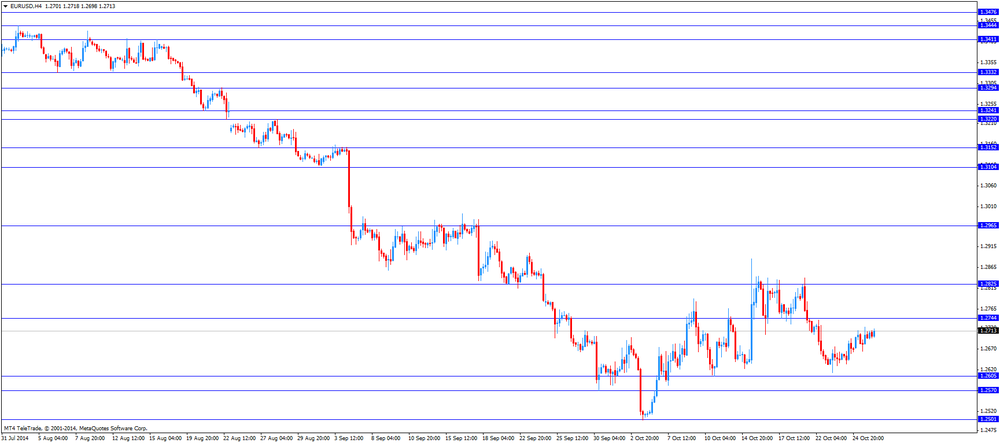

Foreign exchange market. American session: the U.S. dollar rebounded after the better-than-expected U.S. consumer confidence

The U.S. dollar declined against the most major currencies after the weaker-than-expected U.S. durable goods orders, but rebounded after the better-than-expected U.S. consumer confidence. The U.S. durable goods orders declined 1.3% in September, missing expectations for a 0.4% increase, after a 18.3% drop in August. August's figure was revised down from a 0.7% increase.

The U.S. durable goods orders excluding transportation fell 0.2% in September, missing expectations for a 0.5% gain, after a 0.4% rise in August. August's figure was revised up from a 18.4% decrease.

The U.S. durable goods orders excluding defence decreased 1.5% in September, after a revised 19.1% fall in August.

The U.S. consumer confidence index jumped to 94.5 in October from 89.0 in September; exceeding expectations for an increase to 87.4. That was the highest level since October 2007.

The S&P/Case-Shiller home price index increased by 5.6% in August, missing expectations for a 5.7% rise, after a 6.7% gain in July.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The New Zealand dollar traded slightly higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

Market participants are awaiting the Reserve Bank of New Zealand's and Fed' interest rate decision on Wednesday. They expect that the Reserve Bank of New Zealand will keep its interest rate unchanged at 3.50%, and the Fed will end its bond-buying program.

Investors also expects new signs for further monetary policy.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic reports from Australia.

Market participants are awaiting the Fed' interest rate decision on Wednesday.

The Japanese yen fell against the U.S. dollar. Retail sales in Japan jumped 2.3% in September, exceeding expectations for a 0.9% increase, after a 1.2% gain in August.

-

16:20

Gold rose after the release of US data

Gold prices jumped to a three-day highs after weak US data on durable goods undermined optimism about the strength of the economy and caused a decline in the dollar.

Index USD, which tracks the greenback against a basket of six other major currencies, was down 0.25% to 85.40.

The US Commerce Department reported that the total level of orders for durable goods, taking into account the transport equipment fell last month to a seasonally adjusted 1.3%, disappointing expectations for a gain of 0.4%.

The volume of orders for durable goods excluding transportation equipment fell in September to a seasonally adjusted 0.2%, while the projected rise of 0.5%.

The volume of new orders for non-defense capital goods in the industry excluding aircraft, a key barometer of business investment by the private sector fell last month by 1.7%, confounding expectations for a 0.6% rise.

The volume of new orders for non-defense capital goods in the industry excluding aircraft, a category that is used for the calculation of the quarterly economic growth fell in September by 0.2%, although it is expected to rise by 0.7%.

Today, investors expect the beginning of a long-awaited meeting of the Fed.

The Fed is likely to announce on Wednesday the completion of its enabling asset purchases, known as quantitative easing, but it is also expected that the bank will calm the markets that interest rates will remain at current levels for some time.

Investors will closely examine the Fed statement to find in it further hints on the timing of rising interest rates and get an idea about the state of the global economy.

Another sign of the economic slowdown in Europe and China could force the US central bank to stick to a restrained monetary policy and to postpone a possible rate increase.

The cost of December gold futures on the COMEX today rose to 1235.50 dollars per ounce.

-

15:11

U.S. consumer confidence index climbed to 94.5 in October

The Conference Board released its U.S. consumer confidence index today. The U.S. consumer confidence index jumped to 94.5 in October from 89.0 in September; exceeding expectations for an increase to 87.4. That was the highest level since October 2007.

Job gains and falling gasoline prices helped to increase consumers' purchasing power.

The Director of Economic Indicators at the Conference Board Lynn Franco said that "current job market and business conditions contributed to the improvement in consumers' view of the present situation"

-

14:00

U.S.: Richmond Fed Manufacturing Index, October 20 (forecast 11)

-

14:00

U.S.: Consumer confidence , October 94.5 (forecast 87.4)

-

13:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2650(E750mn), $1.2700(E437mn)

USD/JPY: Y107.30($600mn), Y107.40-50($432mn), Y108.00($1.27bn)

NZD/USD: $0.7900(NZ$400mn)

USD/CAD: C$1.1200($575mn), C$1.1215-20($500mn), C$1.1350($450mn)

-

13:34

U.S. Stocks: Dow 16,817.94 +12.53 +0.07%, Nasdaq 4,507.95 +22.02 +0.49%, S&P 1,969.44 +7.81 +0.40%

-

13:29

Before the bell: S&P futures +0.29%, Nasdaq futures +0.39%

U.S. stock futures rose as investors assessed corporate earnings and an unexpected drop in durables goods orders as the Federal Reserve prepares to end bond purchases.

Global markets:

Nikkei 15,329.91 -58.81 -0.38%

Hang Seng 23,520.36 +377.13 +1.63%

Shanghai Composite 2,337.87 +47.43 +2.07%

FTSE 6,395.65 +32.19 +0.51%

CAC 4,109.47 +12.73 +0.31%

DAX 9,017.06 +114.45 +1.29%

Crude oil $81.48 (+0.60%)

Gold $1232.60 (+0.27%)

-

13:15

U.S. durable goods orders declined 1.3% in September

The U.S. Commerce Department released durable goods orders data today. The U.S. durable goods orders declined 1.3% in September, missing expectations for a 0.4% increase, after a 18.3% drop in August. August's figure was revised down from a 0.7% increase.

The U.S. durable goods orders excluding transportation fell 0.2% in September, missing expectations for a 0.5% gain, after a 0.4% rise in August. August's figure was revised up from a 18.4% decrease.

The U.S. durable goods orders excluding defence decreased 1.5% in September, after a revised 19.1% fall in August.

These figures could mean that worries over slowing global growth could have a negative impact on business confidence in the U.S.

-

13:14

DOW components before the bell

(company / ticker / price / change, % / volume)

Intel Corp

INTC

33.26

+0.18%

4.3K

Boeing Co

BA

122.35

+0.19%

1.0K

Nike

NKE

91.86

+0.24%

0.8K

E. I. du Pont de Nemours and Co

DD

68.05

+0.25%

3.5K

The Coca-Cola Co

KO

40.86

+0.25%

0.3K

Walt Disney Co

DIS

88.69

+0.27%

4.3K

3M Co

MMM

149.98

+0.28%

8.6K

Visa

V

214.00

+0.28%

0.5K

General Electric Co

GE

25.60

+0.31%

6.6K

McDonald's Corp

MCD

92.30

+0.32%

0.1K

Travelers Companies Inc

TRV

99.19

+0.32%

0.2K

International Business Machines Co...

IBM

162.40

+0.33%

4.1K

Chevron Corp

CVX

115.42

+0.35%

5.1K

Verizon Communications Inc

VZ

49.60

+0.36%

3.7K

Wal-Mart Stores Inc

WMT

76.88

+0.38%

0.3K

Johnson & Johnson

JNJ

104.50

+0.41%

3.4K

Microsoft Corp

MSFT

46.10

+0.41%

5.6K

American Express Co

AXP

87.00

+0.43%

0.4K

AT&T Inc

T

34.26

+0.44%

11.2K

Goldman Sachs

GS

184.75

+0.46%

1.4K

Exxon Mobil Corp

XOM

94.15

+0.47%

0.4K

Procter & Gamble Co

PG

86.40

+0.52%

0.6K

Cisco Systems Inc

CSCO

23.89

+0.55%

5.3K

JPMorgan Chase and Co

JPM

59.00

+0.61%

0.4K

United Technologies Corp

UTX

105.00

+0.78%

0.5K

Caterpillar Inc

CAT

99.38

+0.85%

0.5K

Pfizer Inc

PFE

29.37

+1.17%

40.1K

Merck & Co Inc

MRK

56.45

0.00%

1.4K

UnitedHealth Group Inc

UNH

91.24

-0.97%

1.1K

-

13:04

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Twitter (TWTR) downgraded to Sell from Hold at Stifel

Twitter (TWTR) downgraded to Sector Perform from Outperform at RBC Capital Mkts, target lowered to $47 from $65

Twitter (TWTR) downgraded to Neutral from Buy at BofA/Merrill, target $50

Twitter (TWTR) downgraded to Neutral from Buy at Nomura, target lowered to $45 from $55

Other:

-

13:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, August +5.6% (forecast +5.7%)

-

13:00

Foreign exchange market. European session: the U.S. dollar declined against the most major currencies after the weaker-than-expected U.S. durable goods orders

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

12:30 U.S. Durable Goods Orders September -18.3% Revised From -18.4% +0.4% -1.3%

12:30 U.S. Durable Goods Orders ex Transportation September +0.4% Revised From +0.7% +0.5% -0.2%

12:30 U.S. Durable goods orders ex defense September -19.1% -1.5%

The U.S. dollar declined against the most major currencies after the weaker-than-expected U.S. durable goods orders. The U.S. durable goods orders declined 1.3% in September, missing expectations for a 0.4% increase, after a 18.3% drop in August. August's figure was revised down from a 0.7% increase.

The U.S. durable goods orders excluding transportation fell 0.2% in September, missing expectations for a 0.5% gain, after a 0.4% rise in August. August's figure was revised up from a 18.4% decrease.

The U.S. durable goods orders excluding defence decreased 1.5% in September, after a revised 19.1% fall in August.

The consumer confidence in the U.S. is expected to rise to 87.4 in October from 86.00 in September.

The euro increased against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound rose against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair increased to $1.2759

GBP/USD: the currency pair rose to $1.6178

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August +6.7% +5.7%

14:00 U.S. Consumer confidence October 86.0 87.4

23:50 Japan Industrial Production (MoM) (Preliminary) September -1.9% +2.3%

23:50 Japan Industrial Production (YoY) (Preliminary) September -3.3% -2.6%

-

12:46

Orders

EUR/USD

Offers $1.2845, $1.2800, $1.2740

Bids $1.2665, $1.2610, $1.2580

GBP/USD

Offers $1.6225, $1.6200, $1.6185

Bids $1.6070, $1.6000, $1.5940

AUD/USD

Offers $0.8950, $0.8900, $0.8840/50

Bids $0.8785/80, $0.8755/50, $0.8710/00

EUR/JPY

Offers Y138.00, Y137.80, Y137.45/50

Bids Y136.55/50, Y136.10/00, Y135.80, Y135.50

USD/JPY

Offers Y109.00, Y108.50

Bids Y107.55/50, Y107.20, Y107.00

EUR/GBP

Ордера на продажу $0.8000, $0.7940

Bids stg0.7850, $0.6070

-

12:31

U.S.: Durable Goods Orders , September -1.3% (forecast +0.4%)

-

12:31

U.S.: Durable goods orders ex defense, September -1.5%

-

12:30

U.S.: Durable Goods Orders ex Transportation , September -0.2% (forecast +0.5%)

-

12:00

European stock markets mid session: stocks traded higher as investors focussed on corporate earnings

Stock indices traded higher as investors focussed on corporate earnings.

Investors are awaiting the Fed' interest rate decision on Wednesday. They expect that the Fed will end its bond-buying program. Investors are awaiting new signs for further monetary policy in the U.S. The slowdown of the global growth and recent weaker-than-expected U.S. economic data could lead that the Fed will keep its low interest rate for a longer period.

Sanofi shares dropped 8.3% after the company reported that sales of its diabetes products may not grow next year due to price competition.

Standard Chartered Plc shares fell 8.2% after reporting a 16% decline in third-quarter profit before taxes.

UBS AG shares rose 3.6% despite the weaker-than-estimated third-quarter profit.

Current figures:

Name Price Change Change %

FTSE 100 6,398.96 +35.50 +0.56%

DAX 9,039.04 +136.43 +1.53%

CAC 40 4,117.83 +21.09 +0.51%

-

10:35

Asian Stocks close: most stocks closed higher ahead of the Fed’s interest rate decision on Wednesday

Most Asian stock indices closed higher ahead of the Fed's interest rate decision on Wednesday. Market participants are awaiting the Fed will end its bond-buying program.

Investors also expects new signs for further monetary policy.

Chinese stocks rose as industrial profits in China increased and China's President Xi Jinping urged to create more free-trade zones in China. Profits of Chinese industrial firms rose 0.4% in September from a year earlier, after a 0.6% fall in August.

Retail sales in Japan jumped 2.3% in September, exceeding expectations for a 0.9% increase, after a 1.2% gain in August.

Indexes on the close:

Nikkei 225 15,329.91 -58.81 -0.38%

Hang Seng 23,520.36 +377.13 +1.63%

Shanghai Composite 2,337.87 +47.43 +2.07%

-

10:18

Option expiries for today's 10:00am NY cut

EUR/USD: $1.2650(E750mn), $1.2700(E437mn)

USD/JPY: Y107.30($600mn), Y107.40-50($432mn), Y108.00($1.27bn)

NZD/USD: $0.7900(NZ$400mn)

USD/CAD: C$1.1200($575mn), C$1.1215-20($500mn), C$1.1350($450mn)

-

09:54

Foreign exchange market. Asian session: the yen traded mixed against the U.S. dollar after the better-than-expected retail sales from Japan

The U.S. dollar traded mixed against the most major currencies. The weaker-than-expected U.S. economic data weighed on the greenback. Pending home sales in the U.S. rose 0.3% in September, missing expectations for a 1.1% increase, after a 1.0% drop in August.

The U.S. preliminary services purchasing managers' index declined to 57.3 in September from 58.9 in August, missing expectations for a decrease to 58.7.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

Market participants are awaiting the Reserve Bank of New Zealand's and Fed' interest rate decision on Wednesday. They expect that the Reserve Bank of New Zealand will keep its interest rate unchanged at 3.50%, and the Fed will end its bond-buying program.

Investors also expects new signs for further monetary policy.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

Market participants are awaiting the Fed' interest rate decision on Wednesday.

The Japanese yen traded mixed against the U.S. dollar after the better-than-expected retail sales from Japan. Retail sales in Japan jumped 2.3% in September, exceeding expectations for a 0.9% increase, after a 1.2% gain in August.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders September -18.4% Revised From -18.2% +0.4%

12:30 U.S. Durable Goods Orders ex Transportation September +0.4% Revised From +0.7% +0.5%

12:30 U.S. Durable goods orders ex defense September -19.0%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August +6.7% +5.7%

14:00 U.S. Consumer confidence October 86.0 87.4

23:50 Japan Industrial Production (MoM) (Preliminary) September -1.9% +2.3%

23:50 Japan Industrial Production (YoY) (Preliminary) September -3.3% -2.6%

-

06:27

Options levels on tuesday, October 28, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2838 (3301)

$1.2806 (3526)

$1.2760 (1666)

Price at time of writing this review: $ 1.2702

Support levels (open interest**, contracts):

$1.2656 (2173)

$1.2602 (2380)

$1.2528 (4487)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 58051 contracts, with the maximum number of contracts with strike pric $1,2900 (7038);

- Overall open interest on the PUT options with the expiration date November, 7 is 59566 contracts, with the maximum number of contracts with strike price $1,2500 (6621);

- The ratio of PUT/CALL was 1.03 versus 1.04 from the previous trading day according to data from October, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.6401 (1510)

$1.6302 (1779)

$1.6204 (2359)

Price at time of writing this review: $1.6124

Support levels (open interest**, contracts):

$1.6093 (1293)

$1.5997 (2001)

$1.5898 (1950)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 27623 contracts, with the maximum number of contracts with strike price $1,6200 (2359);

- Overall open interest on the PUT options with the expiration date November, 7 is 32621 contracts, with the maximum number of contracts with strike price $1,5400 (2350);

- The ratio of PUT/CALL was 1.18 versus 1.19 from the previous trading day according to data from October, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:00

Nikkei 225 15,357.62 -31.10 -0.20%, Hang Seng 23,248.22 +104.99 +0.45%, S&P/ASX 200 5,438.1 -20.85 -0.38%, Shanghai Composite 2,294.01 +3.58 +0.16%

-